PDF Attached

US

employment report was better than expected. Grains and soybean complex traded higher on US weather concerns. The USD was slightly lower around 1 pm CT and WTI a little more than $2.00 higher. USDA export sales were poor. Not much has changed with the fundamentals.

Easing recession fears were again noted. We are getting a little concerned for the US demand side for ags. Other than the occasional US grain tenders, major importers have been absent from the US market. Last USDA 24-H announcement was June 17.

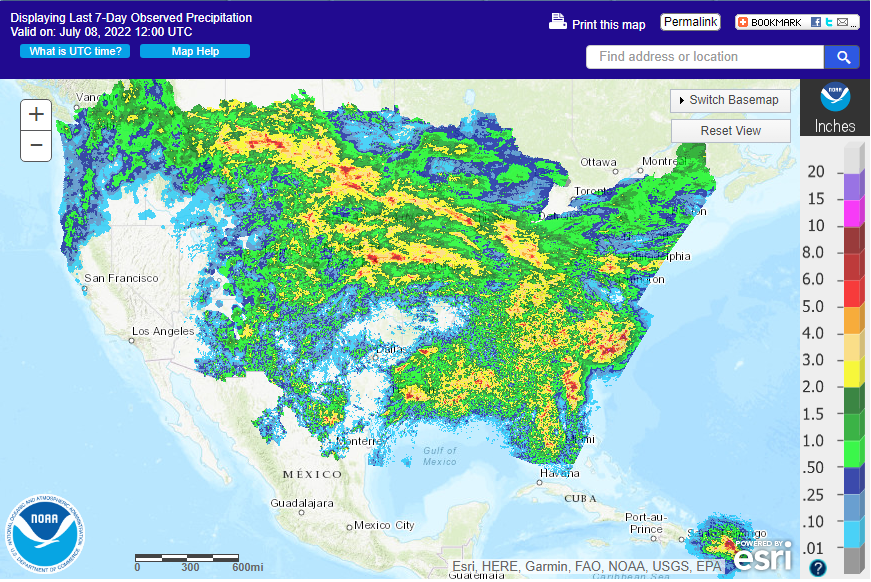

Last

7-days

WEATHER

TO WATCH AROUND THE WORLD

- Portions

of Thailand continue to receive lighter than usual rainfall, although no serious drought has evolved - Greater

rain is needed to improve rice and sugarcane as well as some corn production potential - Western

Europe continues to be threatened by dry and warm to hot weather that will evolve later this weekend and especially next week - Dry

or mostly dry weather is expected for ten days and possibly two weeks - Extreme

high temperatures in the 90s Fahrenheit will impact France, the U.K. and possibly a few areas as far north as southern England and Wales - A

few temperatures near and over 100 will occur in France during the middle to latter part of next week when the heat is most intense

- Spain

and Portugal will also be included in the heat wave along - Crop

stress is expected to evolve and become significant next week and on into the following weekend - Eastern

Europe will continue to experience pockets of dryness that threaten production potential of dryland corn, sunseed and soybeans - It

is still early enough in the summer that a weather change toward wetter weather could improve production potentials, but not much change is likely for a while - Temperatures

in eastern Europe will be milder than usual over the coming week and then hotter than usual in the following week - Russia’s

southern region is advertised to receive a few more showers in today’s forecast relative to that of previous days this week - Any

showers would be welcome due to parts of the region being notably dry - Recent

temperatures have been heating up into the 80s and lower 90s Fahrenheit and this trend will continue until rain begins to evolve later this weekend into early next week - Partial

relief from the heat and dryness is expected, but greater rain will be needed - Argentina’s

outlook has not changed today with a drier than usual bias continuing in western wheat areas through the next ten days; however the European operational model overnight suggested showers early next week and more significantly late next week into the following

weekend would provide some relief - The

European Ensemble and GFS model runs all disagree keeping showers limited to eastern wheat areas and most of that will occur early next week - U.S.

weather outlook has not changed greatly today relative to that of Thursday - Limited

rainfall after Saturday will lead to net drying in most of the Key Midwestern states and in a large part of the Great Plains - Some

showers and thunderstorms will occur briefly in the Delta tonight and again during mid- to late-week and in the following weekend offering a limited amount of relief from recent hot and dry weather - U.S.

southeastern states will see the best mix of rain and sunshine over the next ten days improving crop conditions - Temperatures

will trend milder than usual over the central and eastern Midwest this weekend and especially next week - Western

Corn and Soybean Belt will experience warm weather infrequently during the next week to ten days - Southern

Plains will stay too dry and warm to hot for crops, despite some sporadic showers - Crops

in West Texas, the Texas Blacklands and some areas in South Texas will experience significant moisture stress - Far

western states will continue quite dry and warm - Canada’s

Prairies will heat up and dry out for a while next week after weekend showers and thunderstorms end Monday - High

temperatures in the 90s to near 100 Fahrenheit are expected from southern Alberta through most of Saskatchewan and into a part of western Manitoba - Some

drying would be welcome in the wetter areas, but dryness in central and south-central Saskatchewan may worsen raising concern over crop conditions - Timely

rainfall must resume in the second week of the forecast to protect crop production potentials - Ontario

and Quebec Canada will get some timely rainfall and experience some milder than usual weather over the next ten days - Southwestern

Ontario has become quite dry and need a big boost in rainfall - Northern

China will continue to be abundantly to excessively wet - Crop

conditions vary widely across the region - Some

crops in the northeast need more sunshine - Central

parts of the Yellow River Basin and North China Plain crop have improved with greater rainfall noted earlier this season; however some central China locations have become much too wet recently and flooding has resulted - Rain

is expected to fall abundantly to excessively from the northern Yellow River Basin to Liaoning and the Korean Peninsula during the next ten days - China’s

Xinjiang province continues to experience relatively good weather - A

few showers and thunderstorms are expected, but most of the region will be dry with temperatures varying greatly over the week to ten days - Some

cooler biased conditions may briefly evolve in northern parts of the region - Southern

China will experience some drying over the next ten days and that will be a welcome change after recent weeks of excessive rain - India’s

monsoon will generate waves of rain across the central two-thirds of the nation during the next ten days to two weeks - The

region will be plenty wet - Additional

rain will reach into Gujarat and Rajasthan while being heavy at times in Madhya Pradesh and Maharashtra

- Flooding

is expected in some of these areas resulting in potential crop damage and a need for replanting - Personal

property damage will also result from excessive rainfall - Today’s

forecast is not quite as wet as that of Thursday - Brazil

periodic rainfall will be confined to Atlantic coastal areas and from Rio Grande do Sul to Parana and southern Paraguay during the next ten days - There

is no risk of crop threatening cold in Brazil grain, coffee, sugarcane or citrus areas for the next two weeks - Dry

weather in Safrinha corn and cotton areas of Brazil will be good for maturation and harvest progress - Southern

Australia weather will trend a little wetter in this coming week bringing back some welcome moisture to the region after a brief break - The

precipitation will be great for winter crop establishment - South

Korea rice areas are still dealing with a serious drought, despite some rain that fell recently.

- Some

rain is expected over the next couple of weeks, but the greatest rainfall may be held off for several more days - Significant

drought relief is forthcoming near mid-month - Mexico’s

monsoonal rainfall will be good in the west, south and north-central parts of the nation during the coming two weeks - Northeastern

Mexico drought relief may not occur without the help of a tropical cyclone - The

same may be true for far southern Texas - Southeast

Asia rainfall will continue abundant in many areas through the next two weeks - Local

flooding is possible in the Philippines, New Guinea and Myanmar - Some

western mainland areas of Southeast Asia will continue to get lighter than usual rainfall, but sufficient amounts will occur to support crops - There

is need for greater rain to improve water supply later in the year - Sumatra

rainfall and parts of peninsular Malaysia will experience lighter than usual precipitation in this coming week to ten days - East-central

Africa rainfall will be greatest in central and western Ethiopia and lightest in parts of Uganda.

- Tanzania

is normal dry at this time of year and it should be that way for the next few of weeks - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

greater rain would still be welcome in the drier areas of Ivory Coast - South

Africa’s crop moisture situation is favorable for winter crop emergence, although some additional rain might be welcome - Some

rain will fall in the southwestern crop areas periodically over the next couple of weeks maintaining good soil moisture for winter crop establishment - Central

America rainfall will continue to be abundant to excessive and drying is needed - Today’s

Southern Oscillation Index was +14.81 and it will lower during the coming week - New

Zealand weather will trend wetter with some flooding rainfall possible in North Island and the north half of South Island

Source:

World Weather INC

Friday,

July 8:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- FAO

world food price index, grains supply and demand outlook - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Monday,

July 11:

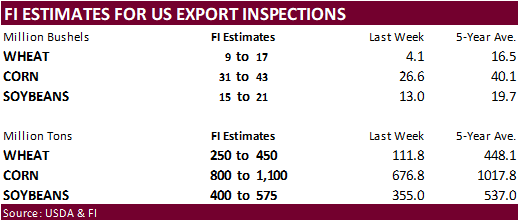

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop conditions for spring and winter wheat, corn, soybeans and cotton, 4pm - Brazil’s

Unica to release cane crushing and sugar output data (tentative) - HOLIDAY:

Singapore, Malaysia, Pakistan, Bangladesh

Tuesday,

July 12:

- USDA’s

monthly World Agricultural Supply and Demand Estimates (WASDE), 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - The

Malaysian Palm Oil Board releases palm oil stockpiles, output and export data for June - World

Coffee Producers Forum (virtual session) - France

agriculture ministry 2022 crop production estimates - EU

weekly grain, oilseed import and export data

Wednesday,

July 13:

- China’s

first batch of June trade data, incl. soybean, edible oil, rubber and meat imports - EIA

weekly U.S. ethanol inventories, production, 10:30am - France

AgriMer monthly grains outlook - New

Zealand food prices - HOLIDAY:

Thailand

Thursday,

July 14:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - HOLIDAY:

France

Friday,

July 15:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

1H pork output and hog inventory - Malaysia’s

July 1-15 palm oil export data - FranceAgriMer

weekly update on crop conditions - The

Cocoa Association of Asia releases 2Q cocoa grind data

Source:

Bloomberg and FI

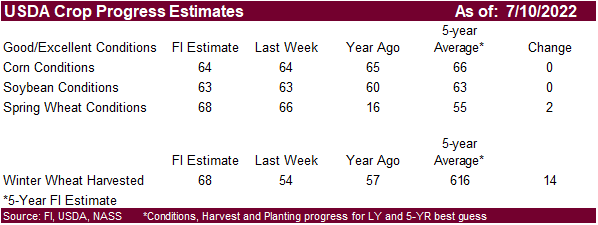

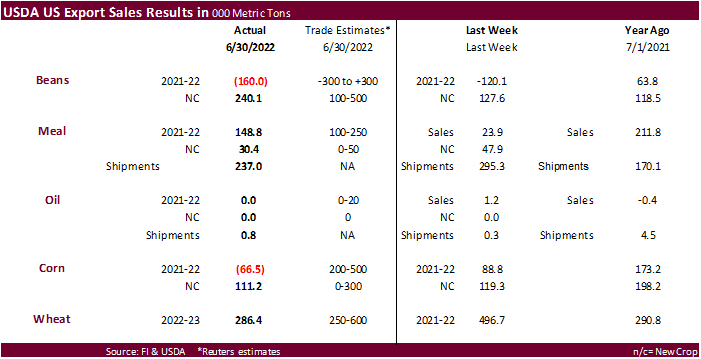

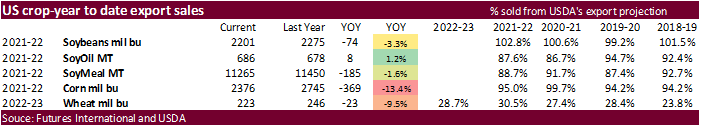

USDA

Export Sales

Another

poor week of sales for the books. We are under the impression both corn and soybean exports will fall short of USDA’s 2021-22 export projection, based on Census, inspection, and sales data.

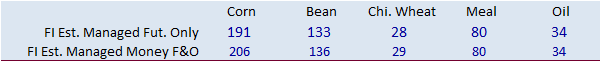

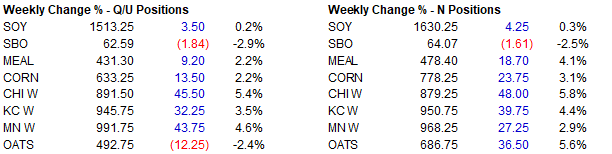

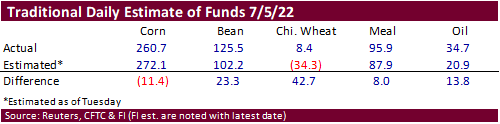

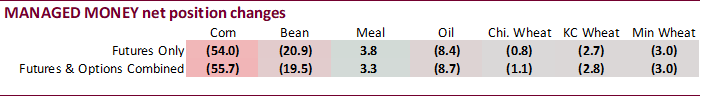

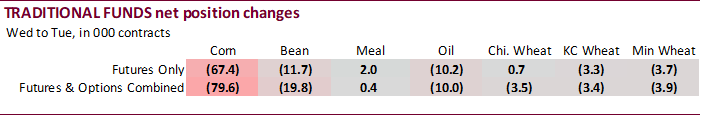

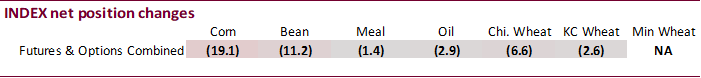

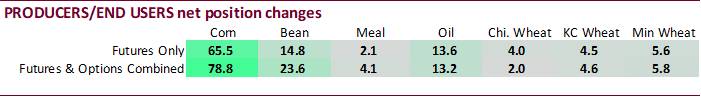

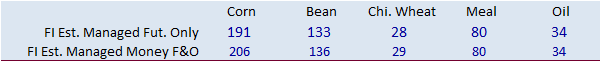

CFTC

Commitment of Traders

Funds

were heavy sellers for the week ending July 5 in corn, good sellers in soybeans, but were much lighter sellers for Chicago wheat. The funds position was less long for corn, but traders missed soybeans and to a much higher extent the Chicago wheat market. Indexes

continued to liquidate longs for the five major commodities. Meanwhile producers loaded up on positions in corn.

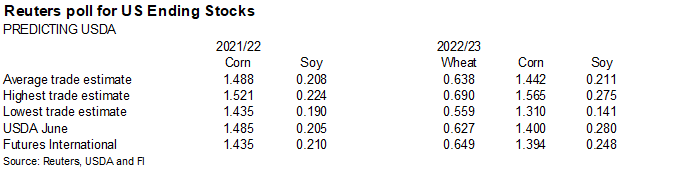

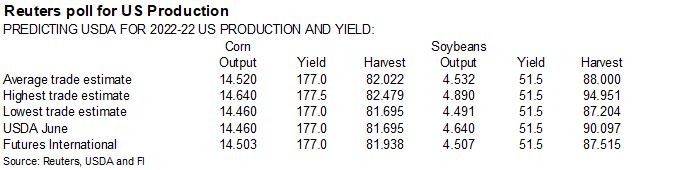

Reuters

Table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

73,449 -64,988 405,599 -19,113 -420,847 89,083

Soybeans

33,564 -12,567 170,183 -11,192 -165,614 27,720

Soyoil

6,306 -8,914 96,629 -2,908 -107,315 15,700

CBOT

wheat -47,436 295 129,439 -6,593 -73,524 9,273

KCBT

wheat -2,982 -2,215 52,763 -2,598 -46,569 5,264

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

172,867 -55,748 269,969 5,767 -428,714 78,788

Soybeans

105,048 -19,450 105,056 153 -168,327 23,589

Soymeal

65,777 3,321 82,129 150 -184,276 4,119

Soyoil

24,929 -8,677 80,173 623 -116,805 13,234

CBOT

wheat -42 -1,063 61,498 4,491 -58,738 2,017

KCBT

wheat 22,037 -2,819 25,778 -809 -39,527 4,614

MGEX

wheat 5,131 -2,955 665 283 -6,434 5,760

———- ———- ———- ———- ———- ———-

Total

wheat 27,126 -6,837 87,941 3,965 -104,699 12,391

Live

cattle 14,297 -9,968 61,290 -2,153 -91,910 8,544

Feeder

cattle -7,531 -2,211 3,645 -342 6,547 1,050

Lean

hogs 28,485 -2,155 52,545 -706 -69,029 2,659

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

44,078 -23,825 -58,201 -4,983 1,854,508 -1,463

Soybeans

-3,644 -331 -38,133 -3,960 805,841 5,375

Soymeal

17,694 -2,881 18,677 -4,709 435,036 4,221

Soyoil

7,324 -1,303 4,380 -3,878 414,025 9,387

CBOT

wheat 5,761 -2,471 -8,479 -2,976 387,076 11,528

KCBT

wheat -5,075 -535 -3,214 -450 170,838 -642

MGEX

wheat 2,157 -902 -1,518 -2,186 65,698 -1,651

———- ———- ———- ———- ———- ———-

Total

wheat 2,843 -3,908 -13,211 -5,612 623,612 9,235

Live

cattle 19,646 2,119 -3,324 1,458 341,485 -258

Feeder

cattle 1,168 872 -3,830 632 54,342 234

Lean

hogs -1,080 303 -10,921 -103 251,545 10,001

Macros

US

Change In Nonfarm Payrolls Jun: 372K (est 268K; prev 390K)

US

Unemployment Rate Jun: 3.6% (est 3.6%; prev 3.6%)

US

Average Hourly Earnings (M/M) Jun: 0.3% (est 0.3%; prev 0.3%)

US

Average Hourly Earnings (Y/Y) Jun: 5.1% (est 5.0%; prev 5.2%)

Revisions***

US Change In Nonfarm Payrolls Jun: 372K (est 268K; prevR 384K)

US

Unemployment Rate Jun: 3.6% (est 3.6%; prev 3.6%)

US

Average Hourly Earnings (M/M) Jun: 0.3% (est 0.3%; prevR 0.4%)

US

Average Hourly Earnings (Y/Y) Jun: 5.1% (est 5.0%; prevR 5.3%)

97

Counterparties Take $2.145 Tln At Fed Reverse Repo Op (prev $2.172 Tln, 102 Bids)

·

CBOT corn was higher on follow through technical buying and US wheat concerns. The midday weather forecast called for a strong high-pressure ridge for the heart of the US later this month. The 6–10-day weather outlook still has

very warm temperatures bias WCB and GP and net drying for the upper Midwest.

·

The central and southern Great Plains are currently seeing hot conditions.

·

USDA export sales were again poor, and slowing demand is leading us to think 2021-22 ending stocks will be higher than what the trade has penciled in. The USD is lower, WTI crude oil turned higher and equities lower.

·

Funds bought an estimated net 20,000 corn contracts.

·

South Korea’s FLC bought 65,000 tons of corn at an estimated $321.29/ton c&f for arrival around October 25.

USDA

Attaché

China

Grain and Feed Update

September

corn is seen in a $5.50 and $7.50 range

December

corn is seen in a wide $5.00-$8.00 range