PDF Attached

Daily

estimate of funds will be updated Wednesday morning.

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

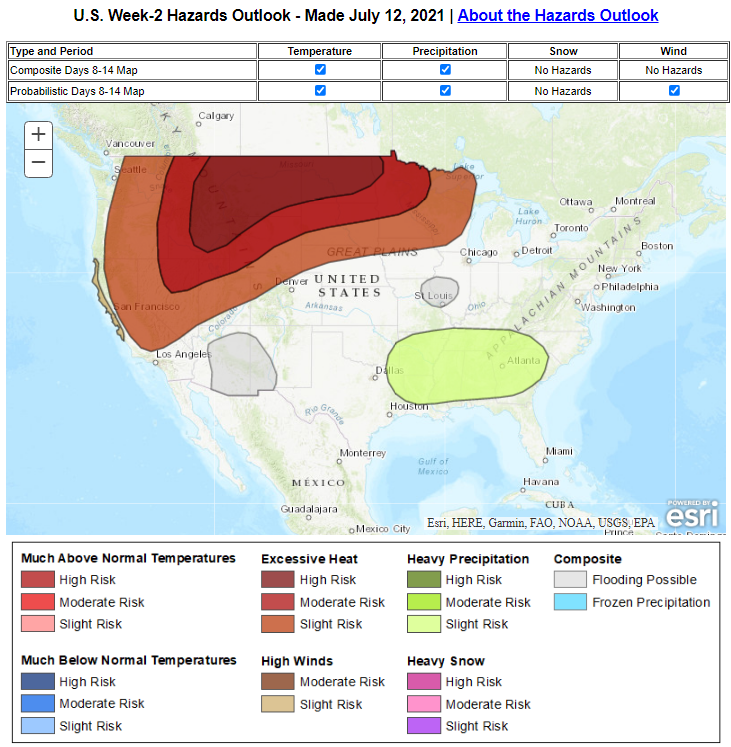

- Canada’s

Prairies, North Dakota, parts of Montana and northern Minnesota are facing ten days of very stressful conditions

o

Little to no rain and warm to eventually hot temperature are expected

o

Crop stress is already at serious levels and the lack of rain and continued very warm to hot temperatures will accelerate crop yield losses for spring, wheat, canola, barley, lentils, and all other unirrigated early season crops

- Stress

to corn, flax and soybeans is also expected to steadily raise - Rain

expected in South Dakota today into Wednesday will be welcome for a part of the state, but northern areas will not likely get much moisture

o

Crop moisture stress will begin to increase after this event and it will prevail for ten days

- Unsettled

weather will continue in the U.S. Midwest for the coming five days adding more rainfall to areas that have already been receiving some rain periodically

o

Crop conditions will remain very good from southeastern Iowa and eastern Missouri to Ohio, Michigan, and Kentucky

- North

America weather changes will begin this weekend and become pronounced during next week and on into late month.

o

Warmer temperatures will impact the Great Plains and much of the Midwest, although excessive heat is unlikely in the eastern Midwest

- The

warming will be most welcome to the wetter areas in the central and eastern Midwest and should stimulate additional aggressive crop development and good yield potentials

o

Warmer weather in the western Corn Belt and upper Midwest will slowly decrease soil moisture and raise stress in the driest areas

- The

greatest crop stress in the western Corn Belt is expected in the last ten days of July at which time soil moisture will be quickly depleted and concern over production will begin to rise - Western

U.S. Corn Belt and upper Midwest crop stress will peak in the last days of July and early August with the ridge of high pressure expected to retrograde to the west during mid- to late-August returning showers and somewhat cooler temperatures - Warmer

temperatures in the U.S. southern Plains next week will be ideal for cotton, sorghum and corn which have experienced some milder than usual conditions recently - U.S.

Delta and southeastern states will experience a good mix of weather for a while - U.S.

Southwest monsoonal precipitation is expected to occur favorably in Arizona, New Mexico, and areas north into the central Rocky Mountain region during the next two weeks - California,

Nevada, and the Pacific Northwest will remain dry and very warm to hot over the next couple of weeks - Mexico

drought continues to slowly shrink with frequent rain expected in western and southern parts of the nation

o

Rain is needed in the northeast

- Western

Russia will dry down for a while, but rain is expected in the second week of the outlook bringing timely relief to the drier bias - Ukraine,

Belarus, and Baltic States weather will be very good for crops over the next two weeks - Welcome

rain is expected in the western Balkan Countries late this week into next week

o

The region has been too dry and warm in recent weeks stressing unirrigated crops from the eastern Adriatic Sea coast to Hungary and western Slovakia

- Too

much rain is expected in eastern France, parts of Germany, Belgium, and southeastern Netherlands over the next week

o

Rain totals of 2.00 to 6.00 inches with local totals over 7.00 inches will result in some flooding

- Net

drying is expected in western France, the U.S. and parts of Scandinavia during the coming ten days

o

Drying is also expected in Spain, Portugal, southern Italy and Greece, but these areas are typically dry during the summer

- China

received more heavy rainfall Monday in Hebei, parts of Shandong and in neighboring areas of Inner Mongolia where 2.00 to more than 4.00 inches resulted and at least one location getting over 10.00 inches of rain

o

Net drying occurred elsewhere in the nation

- Additional

heavy rain is expected in the North China Plain resulting in some potential for crop damage in low lying areas - Xinjiang

weather will continue good for the next ten days

o

Showers and thunderstorms will pop up near the mountains while most crop areas remain dry

o

Temperatures will be warm with highs in the 80s and lower 90s northeast and in the 90s to slightly over 100 elsewhere

- India’s

monsoon will distribute rainfall a little better across the nation, but resulting amounts will remain lighter than usual in many areas

o

Crop development should advance relatively well, but greater rain will be needed to ensure water supply has been restored and deep subsoil moisture is replenished for crop and human use during the long dry season

o

Sugarcane and other crops that are not irrigated could suffer from the lighter than usual precipitation if these conditions persist too long.

- West

Africa rainfall from Ivory Coast and Ghana to Cameroon and Nigeria will be lighter than usual during the coming ten days, but timely rainfall will maintain favorable crop conditions

o

Ivory Coast and Ghana will experience the least rainfall and have the greatest increase in rainfall needs over the next two weeks

- Erratic

rainfall has been and will continue to fall from Uganda and Kenya into parts of Ethiopia

o

A boost in precipitation is needed and is under way

- Ethiopia

rainfall is expected to continue gradually improving this week and then it will decrease next week

- East-central

Argentina rainfall will occur into mid-week benefiting some eastern and central wheat production areas, but dry weather will occur elsewhere through much of the next ten days - Brazil

will receive three waves of rain during the next ten days to two weeks. The precipitation will favor winter wheat, and be good for sugarcane, citrus and some coffee areas

o

Temperatures will trend cooler in the second week of the outlook and some frost or freezes will impact far southern grain areas this weekend and early next week

- Australia

weather will provide periodic rainfall and bouts of sunshine with seasonable temperatures through the next two weeks supporting winter crop establishment

o

South Australia and northwestern Victoria are driest and have the greatest need for rain

- Some

precipitation is expected, but more may be needed - Southeastern

Canada’s Ontario and Quebec crop areas have received some welcome rain recently improving soil moisture and supporting long term crop- development

o

A good mix of weather is expected over the next two weeks

- North

Africa has been and will continue to be mostly dry supporting late season winter crop harvesting

- Thailand,

Cambodia and Vietnam started to receive needed rain last week and it continued through the weekend and into Monday

o

A general improvement in crop conditions, soil moisture and eventually the water supply is expected

- Thailand,

corn, rice, sugarcane and other crops were becoming stressed because of dryness recently. The same may have been occurring in some Cambodia and Vietnam locations. These areas are now getting enough rain to begin seeing improving crop conditions - Indonesia

and Malaysia rainfall is expected to be sufficient to maintain or improve soil moisture for all crops - Philippines

rainfall will slowly increase during the next two weeks which should be welcome initially - South

Africa will experience additional showers in the far west periodically over the coming week

o

The moisture will be good for winter crops, but more moisture will be needed in Free State and other eastern wheat production areas

o

Summer crop harvesting has advanced well this year and the planting of winter grains has also gone well, but there is need for moisture in eastern winter crop areas

- Nicaragua

and Honduras have been and will continue receiving some welcome rain recently, but moisture deficits are continuing in some areas

o

Nicaragua received significant rain during the weekend, but Honduras was mostly dry

o

Additional improvement is needed and may come slowly

- Southern

Oscillation Index is mostly neutral at +9.24 and the index is expected to continue rising for a few more days - New

Zealand weather during the coming week will be abundantly wet and then drier weather is expected next week

o

Temperatures will be near to below average

Source:

World Weather Inc.

Bloomberg

Ag Calendar

Wednesday,

July 14:

- EIA

weekly U.S. ethanol inventories, production - Brazil

Unica cane crush, sugar production (tentative) - Malaysia

2Q cocoa grinding data (tentative) - HOLIDAY:

France

Thursday,

July 15:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China

2Q pork output and inventory levels - Malaysia

July 1-15 palm oil export data - Malaysia

crude palm oil export tax for August (tentative) - Port

of Rouen data on French grain exports - Barry

Callebaut 9-month key sales figures

Friday,

July 16:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Cocoa

Association of Asia releases 2Q cocoa grinding data

Source:

Bloomberg and FI

Selected

China commodity imports

China

Jan-June crude oil imports down 3% at 261 mln tons

China

Jan-June soybean imports up 8.7% at 48.96 mln tons

China

Jan-June natural gas imports up 23.8% at 59.82 mln tons

China

Jan-June iron ore imports up 2.6% at 561 mln tons

China

Jan-June wheat imports up 60.1% at 5.37 mln tons

China

Jan-June corn imports up 318.5% at 15.3 mln tons

China’s

June iron ore imports lowest since May 2020

US

CPI (Y/Y) Jun: 5.4% (est 4.9%; prev 5.0%)

US

CPI Ex-Food, Energy (Y/Y) Jun: 4.5% (est 4.0%; prev 3.8%)

US

CPI (M/M) Jun: 0.9% (est 0.5%; prev 0.6%)

US

CPI Ex- Food, Energy (M/M) Jun: 0.9% (est 0.4%; prev 0.7%)

US

Real Avg Weekly Earnings (Y/Y) Jun: -1.4% (prevR -2.6%; prev -2.2%)

US

Real Avg Hourly Earnings (Y/Y) Jun: -1.7% (prevR -2.9%; prev -2.8%)

73

Counterparties Take $798.267 Bln At Fed’s Fixed-Rate Reverse Repo (prev $776.472 Bln, 70 Bidders)

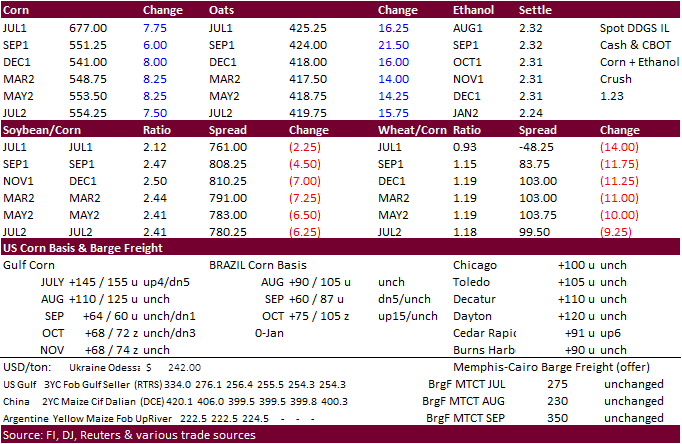

Corn

- US

corn

ended higher despite an improvement in the US national corn rating. But some states posted a good decline. IL was down 5, CO down 5, and NE off 5. IA was up 4. New was light.

- Open

interest headed into today for the July corn contract was 245 contracts and we saw a short squeeze in that position. At one point during the trade July was up about 80 cents before pairing gains.

- China

imported 15.3 million tons of corn during the January through June period, 318% increases from a year earlier.

- China

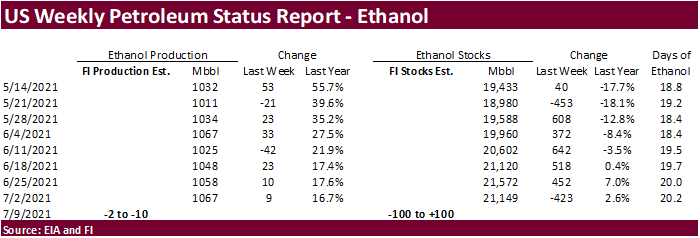

imported 743,000 tons of meat in June, down 17% from the same month a year earlier. January through June meat imports were 5.08 million tons. - A

Bloomberg poll looks for weekly US ethanol production to be down 8,000 barrels (1049-1075 range) from the previous week and stocks up 242,000 barrels to 21.391 million.

Export

developments.

- Jordan

seeks 120,000 tons of feed barley on July 28 for Nov/Dec shipment.

September

corn is seen is a$4.75-$6.25 range (up 25, unchanged from precious).

December

corn is seen in a $4.25-$6.00 range.

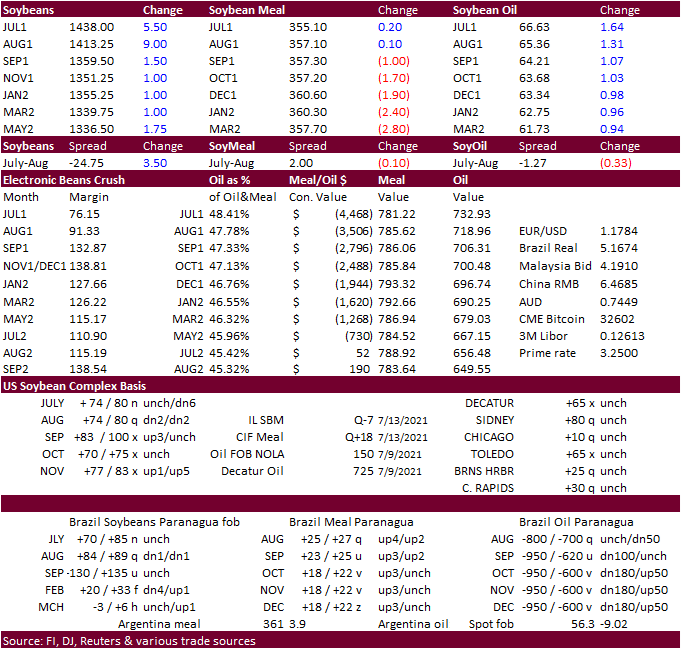

-

CBOT

soybeans rallied bias the August position (+10.50) to the upside. Back months were up 1.50-2.25 cents. There was talk China might be inquiring for soybeans off the PNW. We also heard China was active buying Argentina soybean cargoes, about 4 this week and

4 last week. US soybeans appear to be competitive with Argentina during the OND timeframe.

-

Soybean

oil traded sharply higher led by the August contract, appreciating 149 points and widening 32 points over the September position. Traders are still waiting for a mandate recommendation by the EPA. We thought this would have been released in June.

-

Soybean

meal was lower on product spreading. -

November

Canadian canola gapped higher this morning but paired some gains on overbought conditions. Limits contract to $45/ton.

-

India

imported 996,014 tons of vegetable oils during the month of June, down 20 percent from May and off 17 percent from June 2020. November through June imports are running 5 percent higher than the same period a year earlier. June palm oil imports were 587,467

tons, down from 769,602 tons during May. Palm imports since November were 5.149 million tons, up from 4.239 million during the same period year ago.

-

Brazil

increased their mandatory biodiesel blend requirement to 12% from 10%, below the 2021 target of 13%. About 70% of Brazil’s biodiesel is produced from soybean oil. Brazil dropped the blend rate from 13% to 10% on April 9 to help ease high fuel prices.

-

Argentine

producers sold 24.5 million tons of 2020-21 soybeans so far this season (up 831,300 tons from week earlier) through July 7, below 26.9 million tons year ago. BA Grains Exchange has a 43.5-million-ton production this year, down from 49 million tons for 2019-20. -

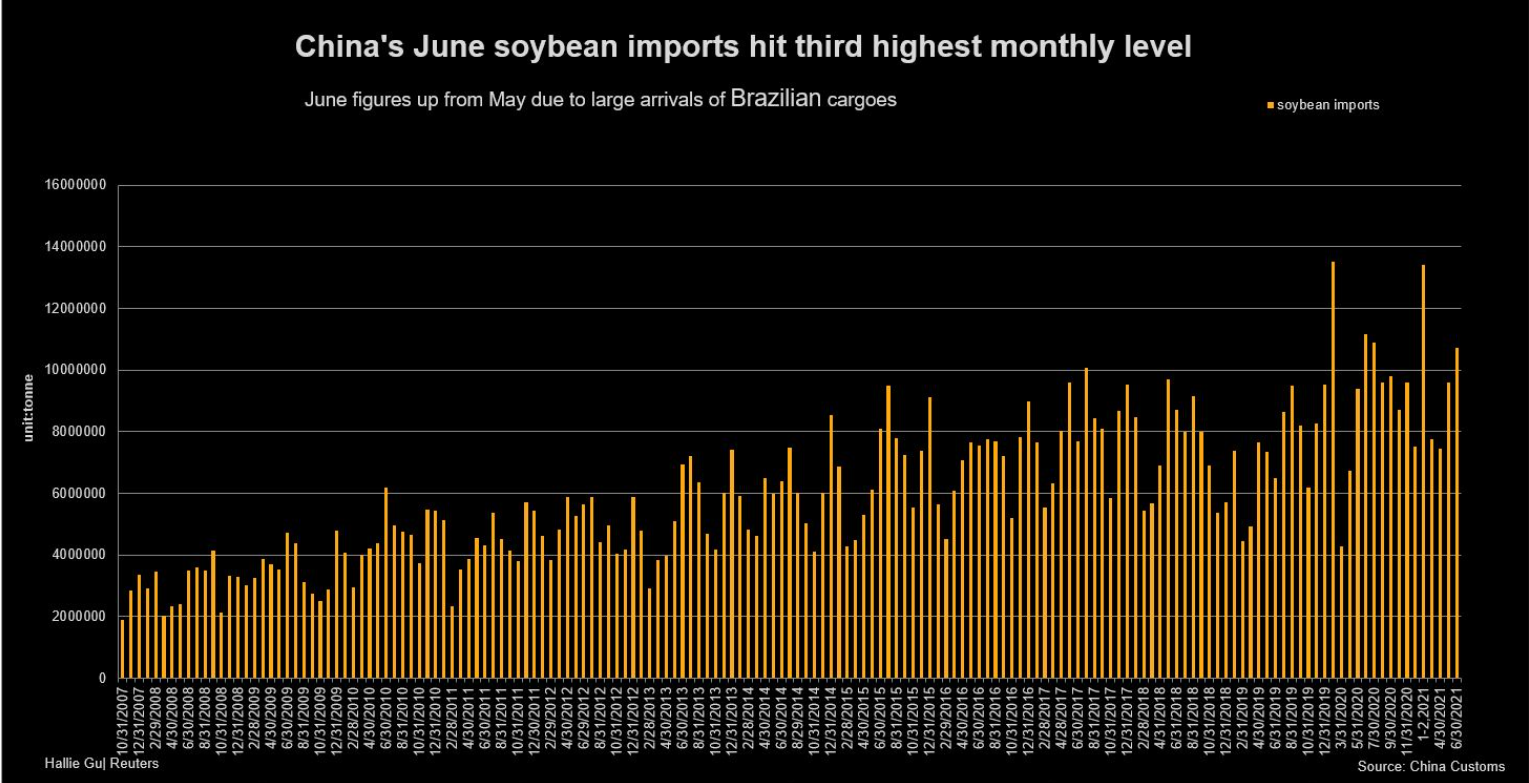

China

soybean imports in June rose 11.6% from May to 10.72 million tons, up from 9.61 million tons in May, third-highest on record, and were below 11.16 million tons year earlier. In the first six months of 2021 China imported 48.96 million tons, up 8.7% from the

same period a year earlier. -

We

are hearing Canadian canola production between 17 and 19.5 million tons. We are at 19.5MMT. USDA is at 20.2 million tons, up from 19 million in 2020-21.

-

European

Union soybean imports so far this season (July 1) reached 289,111 tons by July 11, down from 555,679 tons by the same week in 2020-21. EU rapeseed imports reached 120,692 tons, compared with 30,315 in 2020-21. Soymeal imports were 304,751 tons vs. 576,192.

Source:

Reuters

- South

Korea’s Agro-Fisheries & Food Trade Corp. seeks around 7,600 tons of GMO-free soybeans on July 21 for arrival in South Korea between Aug. 20 and Oct. 20.

Updated

7/13/21

August

soybeans are seen in a $13.25-$15.25 range (up 50, up 25); November $11.75-$15.00

August

soybean meal – $330-$410; December $320-$425

August

soybean oil – 62-67 (up 200);

December 46-67 cent range

- US

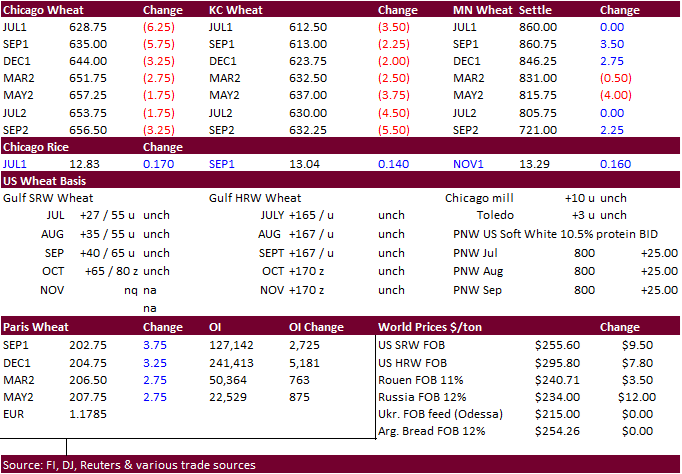

wheat ended

mixed with Chicago and KC lower on US harvesting pressure and MN higher on unfavorable US and Canadian spring wheat weather. After the close Egypt announced they seek wheat for September 11-20 shipment.

September

Minneapolis wheat hit a new contract high today. - September

Paris wheat was up 3.50 at 202.50 euros. - Russia

will harvest 124-126 million tons of grain this year according to the head of science at state weather forecaster Hydrometcentre. Winter wheat was expected between 55-57 million tons and spring wheat crop 22-24 million tons.

- Sovecon

lowered its estimate of the Russia 2021 wheat crop by 2.3 million tons to 82.3 million tons due to lower-than-expected yields.

- FranceAgriMer

looks for French soft wheat exports and stocks in the 2021-22 season to rebound from last year. Soft wheat exports outside the 27-country EU were forecast to reach 10.5 million tons in 2021-22, up 40% compared with 7.50 million in the previous season. Soft

wheat stocks were expected to reach 3.7 million tons, up nearly 39% from 2.7 million last season. - EU

soft wheat exports for the season that just started July 1 reached 199,274 tons by July 11, down from 485,459 tons by the same week in 2020-21. - USDA’s

344.6-million-bushel spring wheat estimate would be lowest since 1988, if realized.

- A

heat wave is sweeping across the far western US and parts of Canada this week, lasting through next week, further stressing crops. We expect spring wheat rating west of the Dakota’s to deteriorate this week and possibly next week.

- Egypt

seeks wheat for September 11-20 shipment. - Turkey’s

TMO bought about 395,000 tons of milling wheat.

|

Port |

|

Derince |

|

Derince |

|

Iskenderun |

|

Iskenderun |

|

Mersin |

|

Izmir |

|

Izmir |

|

Bandırma |

|

Bandırma |

|

Tekirdag |

|

Tekirdag |

|

Samsun |

|

Samsun |

|

Trabzon |

|

Karasu |

- Taiwan

Flour Millers’ Association seeks 55,000 tons of million wheat from the United States on July 16 for shipment from the U.S. Pacific Northwest coast between Aug. 31 and Sept. 14.

- The

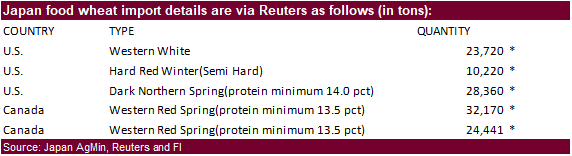

Philippines rejected all offers in a tender for up to 200,000 tons of animal feed wheat due to high prices. They were in for 150,000 tons of feed wheat and 50,000 tons of milling wheat with shipment from in September, October, and November. - Japan’s

AgMin seeks 118,911 tons of food-quality wheat from the United States and Canada.

- Japan

seeks 80,000 tons of feed wheat and 100,000 tons of barley on July 14 - Iran’s

GTC seeks 60,000 tons of milling wheat for August and September shipment on Wednesday, July 14. - Bangladesh’s

seeks 50,000 tons of milling wheat on July 15. - Bangladesh’s

seeks 50,000 tons of milling wheat on July 18.

- Ethiopia

seeks 400,000 tons of wheat on July 19.

- Pakistan’s

TCP seeks 500,000 tons of wheat on July 27. 200,000 tons are for August shipment, and 300,000 tons are for September shipment.

Rice/Other

- South

Korea seeks 91,216 tons of rice from China, the United States and Vietnam for arrival in South Korea between Oct. 31, 2021, and April 30, 2022.

- Bangladesh

seeks 50,000 tons of rice on July 18, not on the July. They delayed it.

Updated

7/12/21

September Chicago wheat is seen in a $5.90-$7.00 range

September KC wheat is seen in a $5.60-$6.70

September MN wheat is seen in a $7.75-$9.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.