PDF Attached

US

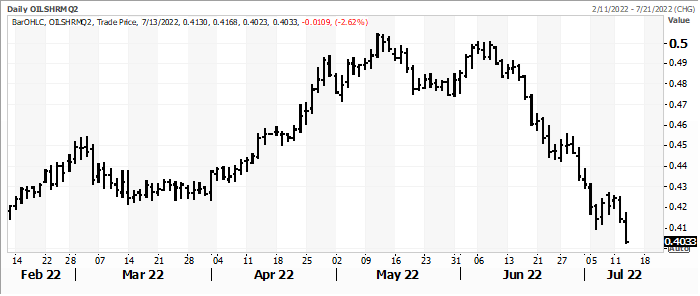

weather concerns underpinned some of the ags. Some traders were focused on outside markets today with US economic data yielding to volatile US equity and currency markets. US CPI (Y/Y) Jun: 9.1% (est 8.8%; prev 8.6%). Global vegetable oil markets were under

pressure today led by a more than 8 percent decline in palm oil futures (one year low). CBOT oil share is getting cheap.

![]()

August

CBOT soybean oil share

Source:

Reuters and FI

WEATHER

TO WATCH AROUND THE WORLD

- Not

many changes occurred overnight - The

U.S. Midwest is not as wet as it was at mid-day Tuesday on the model runs - Europe

rainfall was reduced for northwestern areas early next week - U.S.

weather theme remains mostly unchanged - Periodic

showers and thunderstorms are expected in the Midwest - Resulting

rainfall in the far western Corn Belt will be light and sporadic enough to result in net drying for many areas, despite some rainfall - Temperatures

will also be quite warm in the Missouri River Basin at times in the coming week to ten days resulting in accelerated drying and some livestock and crop stress at times - Production

potentials may be at risk of declining from Missouri to South Dakota and southwestern Iowa over time - Eastern

Midwest showers and thunderstorms may be a little more numerous and more frequent than that of the far western Corn Belt, but not all areas will be treated equally and pockets of dryness are expected - Temperatures

will be mild at times during the next couple of weeks, but there will be some warm periods as well.

- The

environment should be better for crops and livestock than that of the far western Corn Belt - Production

potentials should remain mostly good - U.S.

Delta rainfall potentials and relief from chronic dryness and heat is possible late this weekend into early next week, but it will only be temporary with more drying later next week - U.S.

southeastern states will experience the best mix of rain and sunshine and should support crops relatively well - U.S.

central and southern Plains will be frequently hot with restricted rainfall over the next ten days - Livestock

and crop stress will continue - Frequent

high temperatures in the 90s to 110 degrees Fahrenheit are expected over the next ten days to two weeks with only brief breaks possible for some areas - West

Texas rainfall will remain very limited and inadequate in countering evaporation because of hot temperatures - All

of Texas will experience the same fate as that of West Texas - U.S.

Pacific Northwest will be dry and very warm to hot at times over the next ten days - No

drought relief in most of the far western U.S. - Much

of Europe will be drying out over the next ten days and temperatures will be hot in much of the west through the weekend and eventually spreading into central parts of the continent next week

- Heat

and dryness will prevail next week - Extreme

highs this weekend into next week in the 80s and 90s will be common across the continent next week while western areas see some extremes of 96 to 108 across France and to 113 in Spain - Germany

could see a couple of extreme temperatures near 100 as well - Crop

and livestock stress will threaten production for grains, oilseeds, milk, fruits and vegetables and result in lower animal weight gains - Energy

demand will be quite strong - Far

northeastern Europe will receive most of the significant rainfall in the continent over the next ten days - Europe

weather Tuesday was mostly dry and heating up in the west - Highest

temperatures were in the 90s and lower 100s from southwestern France into Spain and Portugal with one Spain location reaching 111 degrees - Highest

in the remainder of France were in the upper 80s and lower 90s while the U.S reach into the upper 70s and 80s. Western Germany warmed to the upper 70s and lower 80s - Rain

fell mostly in easternmost parts of the continent - Russia’s

Southern Region will experience some periodic showers over the next ten days supporting some improvement for crop and field conditions after recent drying, but much more rain will be needed.

- Most

other areas in Russia, northern Ukraine, Belarus and the Baltic States will see rain routinely during the next couple of weeks resulting in moisture abundance - Canada’s

southern Prairies will experience net drying conditions during much of the coming week to ten days - Southern

Saskatchewan will be driest and have the greatest need for rain as time moves along - Most

of the Prairies except western and northern Alberta will experience net drying conditions for a while during the coming week with possibly better rainfall in parts of the region during the July 21-27 period - Parts

of Ontario, Canada need rain while Quebec crops continue to develop favorably - Drought

in northeastern Mexico and the southern U.S. Plains is unlikely to change in the next two weeks unless the tropical disturbance noted above in the north-central Gulf of Mexico moves to Texas in which there might be some relief from dryness in Texas, but confidence

is very low - Most

likely any rain from such an event as this will not seriously relief drought conditions - Mexico

rain will be most abundant in the west and southern parts of the nation - Argentina

rainfall will continue restricted during the next ten days except in east-central and northeastern parts of the nation where rain is expected periodically - Some

showers will occur in the west-central and southwest Friday into Saturday, but resulting rainfall is unlikely to seriously change the moisture profile - Greater

rain will still be needed throughout the wheat region, but especially in the west where it has been driest for the longest period of time - The

GFS model suggested some late July rainfall will be possible, but confidence is very low - South

America temperatures over the next two weeks will be near to below average in Argentina, Uruguay and far southern Brazil and near to above normal elsewhere in Brazil - Brazil

rainfall will be minimal except in Atlantic coastal areas and from the southwest half of Mato Grosso do Sul and southwestern Sao Paulo into Rio Grande do Sul and Paraguay during the next ten days - Some

of the advertised rain will be heavy from Uruguay into Rio Grande do Sul where 1.00 to 3.00 inches are expected

- Good

drying conditions are likely elsewhere supporting Safrinha crop maturation and harvest progress - India’s

monsoon will continue to perform more aggressively over the next two weeks with widespread rain of significance expected along the west coast and from Odisha and northeastern Andhra Pradesh to Maharashtra, Madhya Pradesh, Gujarat and Rajasthan - Only

far southern and some east-central India locations will receive lighter than usual precipitation - Summer

crop development will advance well, although flooding is expected to become a problem for a few production areas and replanting may be necessary - China

rainfall is expected to be frequent and often abundant in east-central China and the northeastern Provinces while the interior southeast drier biased - Excessive

rain events should not occur as often as they have been, but the nation will continue very wet and would benefit from some drying - Parts

of China need sunnier weather to induce better drying conditions after recent excessive rainfall. Crop damage has occurred in various areas in recent weeks because of too much moisture and serious flooding. - China’s

Xinjiang province continues to experience relatively good weather - A

few showers and thunderstorms are expected, but most of the region will be dry with temperatures varying greatly over the week to ten days - Sumatra,

Indonesia will continue receiving lighter than usual rainfall over the coming week, although there will be sufficient amounts to support most crop needs - Greater

rain is expected in the July 21-27 period - All

other Southeast Asian nations will experience an abundance of rainfall during the next few weeks resulting in some flooding

- Crop

damage potentials from flooding will be greatest in Philippines, some mainland areas and New Guinea.

- Southern

Australia will get periodic rainfall southern wheat, barley and canola production areas through the next ten days - Winter

crops are establishing well - South

Korea rice areas are still dealing with a serious drought, despite some rain that fell recently.

- Some

rain is expected over the next couple of weeks and it should gradually be enough to ease dryness and crop stress - East-central

Africa rainfall will be greatest in central and western Ethiopia and lightest in parts of Uganda.

- Tanzania

is normal dry at this time of year and it should be that way for the next few of weeks - Some

areas in Kenya are expected to trend wetter in the next ten days - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

greater rain would still be welcome in the drier areas of Ivory Coast - South

Africa’s crop moisture situation is favorable for winter crop emergence, although some additional rain might be welcome - Some

rain will fall in the southwestern crop areas periodically over the next couple of weeks maintaining good soil moisture for winter crop establishment - Central

America rainfall will continue to be abundant to excessive and drying is needed - Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely - Today’s

Southern Oscillation Index was +14.77 and it will move erratically lower during the coming week - New

Zealand weather is expected to be well mixed over the next ten days - Temperatures

are expected to be a little milder than usual

Source:

World Weather INC

Wednesday,

July 13:

- China’s

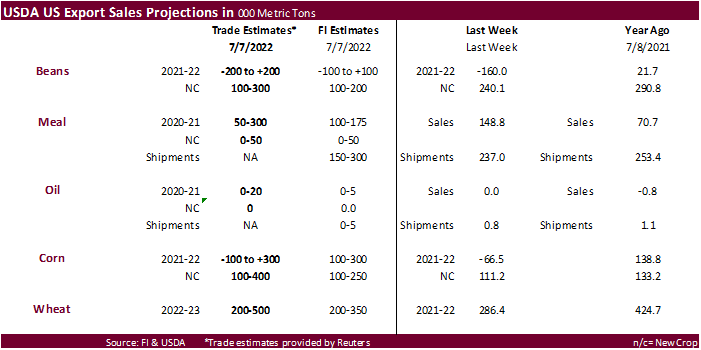

first batch of June trade data, incl. soybean, edible oil, rubber and meat imports - EIA

weekly U.S. ethanol inventories, production, 10:30am - France

AgriMer monthly grains outlook - New

Zealand food prices - HOLIDAY:

Thailand

Thursday,

July 14:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - HOLIDAY:

France

Friday,

July 15:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

1H pork output and hog inventory - Malaysia’s

July 1-15 palm oil export data - FranceAgriMer

weekly update on crop conditions - The

Cocoa Association of Asia releases 2Q cocoa grind data

Macros

96

Counterparties Take $2.155 Tln At Fed Reverse Repo Op (prev $2.146 Tln, 96 Bids)

US

CPI (Y/Y) Jun: 9.1% (est 8.8%; prev 8.6%)

US

CPI (M/M) Jun: 1.3% (est 1.1%; prev 1.0%)

US

CPI Ex Food And Energy (Y/Y) Jun: 5.9% (est 5.7%; prev 6.0%)

US

CPI Ex Food And Energy (M/M) Jun: 0.7% (est 0.5%; prev 0.6%)

US

Real Avg Hourly Earning (Y/Y) Jun: -3.6% (prevR -2.9%)

US

Real Avg Weekly Earning (Y/Y) Jun: -4.4% (prevR -4.0%)

Fed

Swaps Show Around 79bp Hikes Priced In For July After CP

US

Interest Rates Futures Now See 80% Chance Of Another 75 Bps Hike In Sept – Fedwatch

US

Rate Futures Pricing In 22% Chance Of 100 Bps Hike In July Meeting, 79% Of 75 Bps – Fedwatch

Euro

Hits Parity Vs US Dollar For First Time Since December 2002 (yesterday technically)

Corn

·

CBOT corn traded two-sided, ending higher on renewed concerns over hot and dry temperatures for the US. US CPI came in much higher than expected, renewing recession concerns, that did little to slow fund buying for US agriculture

markets. Prices did pair some gains on positive Black Sea developments.

·

Funds bought and estimated net 7,000 corn contracts.

·

Ukraine, Russia, UN, and Turkey are making progress in figuring out a way to boost grain exports out the Black Sea via Ukraine. Although the talks ended with an “unknown,” it’s a step forward. Last we heard is that Russia offered

to escort grain ships from Ukraine. Reuters reported that about 20 million tons of grain was back up in Odesa. Later in the day Turkey said they are willing to sign an agreement next week.

·

The morning US weather forecast improved for the Midwest will more rain seen this weekend, but overall conditions will be dry over the next week. Indiana, Michigan and Minnesota should be monitored.

·

We look for US crop conditions to drop 1-2 points when updated on Monday.

·

News was fairly light with macros largely in focus today.

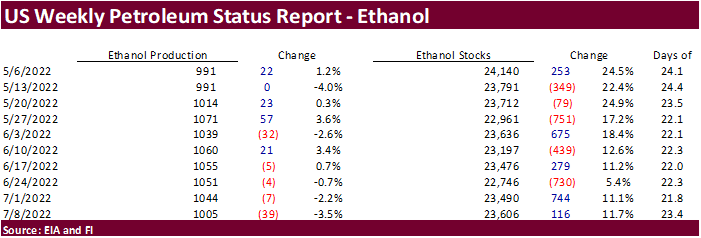

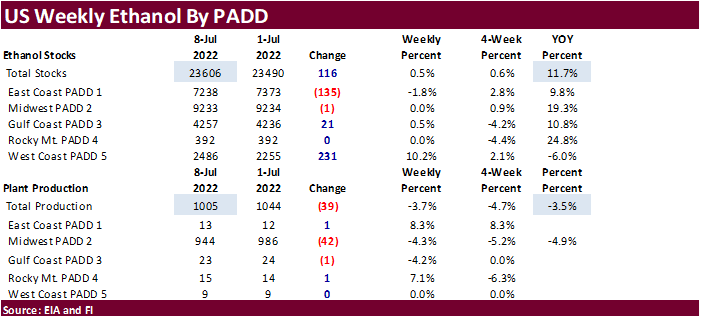

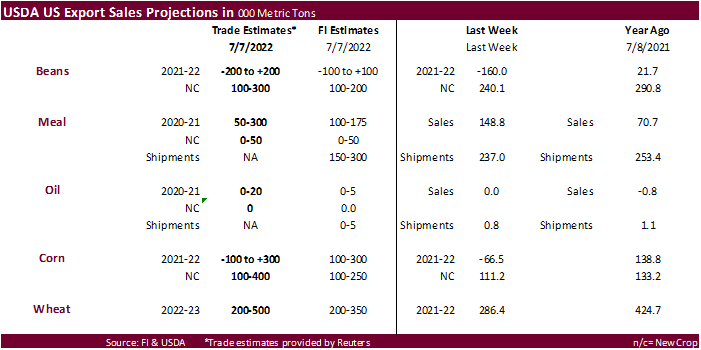

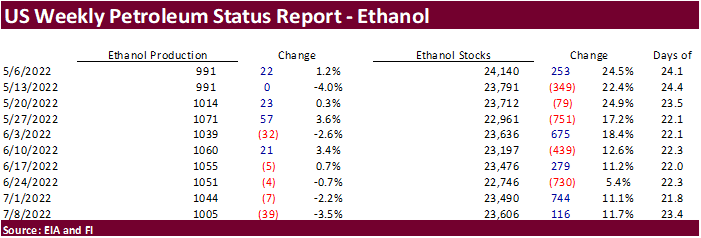

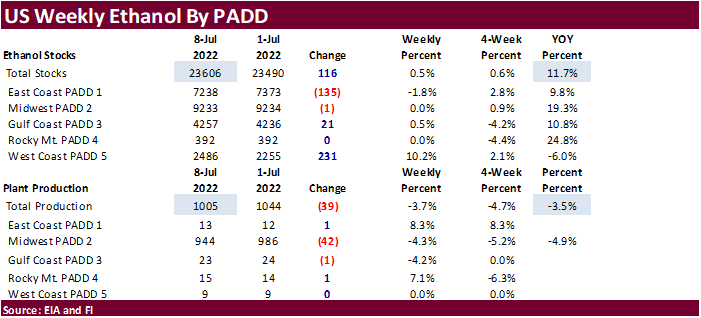

Weekly

US ethanol production

fell 39,000 barrels to 1.005 million barrels. The trade was looking for unchanged at 1.044 million. We see July ethanol production falling 2 percent from June, daily adjusted. The steep decline in US ethanol production over the past four weeks prompted us

to downward revise our 2021-22 US corn for ethanol use. Stocks were up 116,000 barrels to 23.606 million barrels. The trade was looking for 23.618 million, so not that far off. Stocks are up a combined 860,000 barrels over the past two weeks. Refinery and

blender net input of oxygenates fuel ethanol was 887,000 barrels, down from 904,000 week earlier and lowest since April 15. The ethanol blend rate into finished motor gasoline was 90.3%, up from 89.7% previous week. US gasoline product supplied (glimpse of

gasoline demand) decreased 1.35 million barrels to 8.062 million, lowest level since the first week of January 2022. US gasoline stocks increased 5.8 million barrels to 224.9 million.

US

balance update. Our

US 2021-22 corn for ethanol use was lowered to 5.411 billion bushels from previous 5.445 billion. USDA is at 5.375 after yesterday’s S&D report. For 2022-23, we look for 5.400 billion bushels, 25 above USDA. We lowered corn feed use a touch from the previous

month for both crop years. We revised lower our 2022-23 rolling corn crop year average based on a higher projected STU %. See attached.

US

DoE Crude Oil Inventories (W/W) 08-Jul: +3.254M (est -0.154M; prev +8.235M)

–

Distillate Inventories: 2.668M (est +1.591M; prev -1.266M)

–

Cushing OK Crude Inventories: 0.316M (prev +0.069M)

–

Gasoline Inventories: +5.825M (est -0.357M; prev -2.497M)

–

Refinery Utilization: 0.4% (est 0.5%; prev -0.5%)

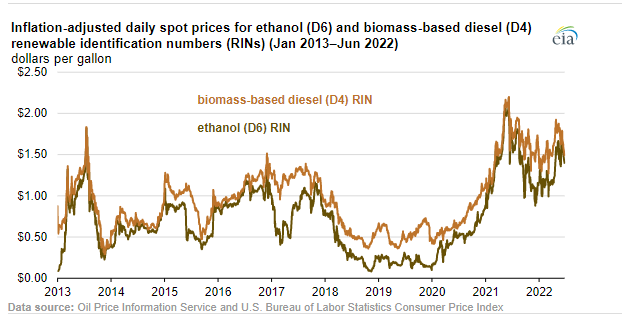

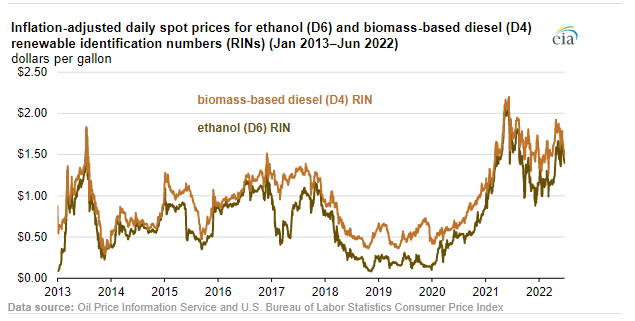

EIA:

Renewable identification number prices for ethanol and biomass-based diesel remain high

https://www.eia.gov/todayinenergy/detail.php?id=53019&src=email

·

South Korea’s KFA bought 68,000 tons of corn from South America at $324.99/ton c&f for arrival around October 20. They were in for 136k.

September

corn is seen in a $5.50 and $7.50 range

December

corn is seen in a wide $5.00-$8.00 range

·

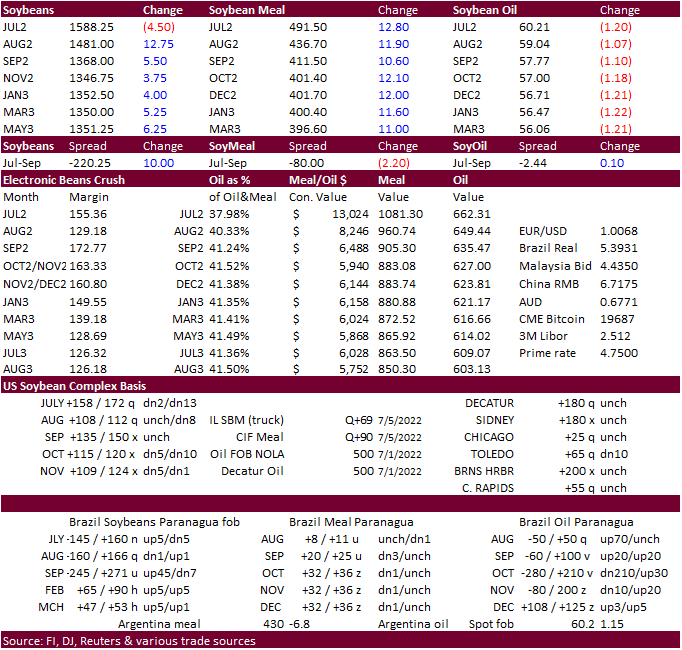

CBOT soybeans started lower (non-expiring) but finished higher in part to higher meal. Soybean oil was lower following outside markets. Funds bought 5,000 soybeans, bought 5,000 meal and sold 3,000 soybean oil.

·

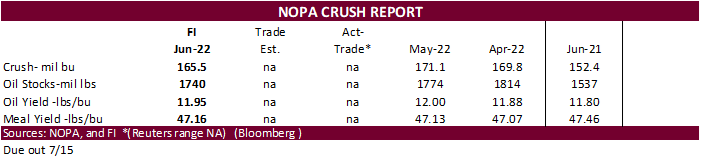

US soybean basis has appreciated for many locations from the previous week, in part to lack of producer selling. Some crushers started rolling more positions over to the November contract. We look for June NOPA crush to be down

slightly from May on a daily adjusted basis, but now wonder if July and August crush rates will also be trending lower.

·

China June soybean imports were only 8.25 million tons, a 23 percent decline from a year ago and compares to 9.67 million tons during May. Falling crush margins and a reduction in hog inventories slowed China soybean arrivals.

FH 2022 soybean imports were down 5.4% from same period a year ago at 46.28 million tons.

·

China crush margins across the north have been negative since mid-April, in part to lower vegetable oil prices.

·

Many global vegetable oil markets were lower on Wednesday.

·

One reason global vegoils are sharply lower pressuring oil share. China edible oil imports fell to only 254,000 tons last month, lowest since February 2015. They are down 20 percent from May and a large 75 percent from year ago.

At some point China will need beans to boost crush for replacement. something to watch over near-term. Recent Covid-19 lockdowns did not last very long.

·

There was chatter overnight of new China Covid lockdown concerns and slow Malaysian palm oil exports.

·

Meanwhile India imports for palm surged last month by 15% from May, most of it from Indonesia.

·

Cargo surveyor SGS reported month to date July 10 Malaysian palm exports at 397,140 tons, 10,930 tons below the same period a month ago or down 2.7%, and 9,757 tons below the same period a year ago or down 2.4%.

Export

Developments

·

USDA seeks 2,230 tons of vegetable oils for export on July 17 for Aug 16-Sep 15 shipment.

·

China looks to sell a half a million tons of soybeans out of reserves on July 15.

FI

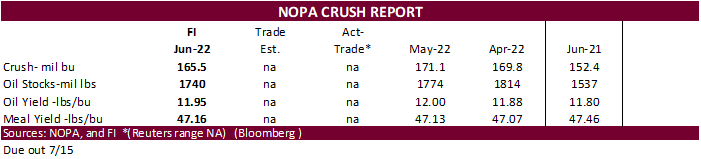

estimates for NOPA

US

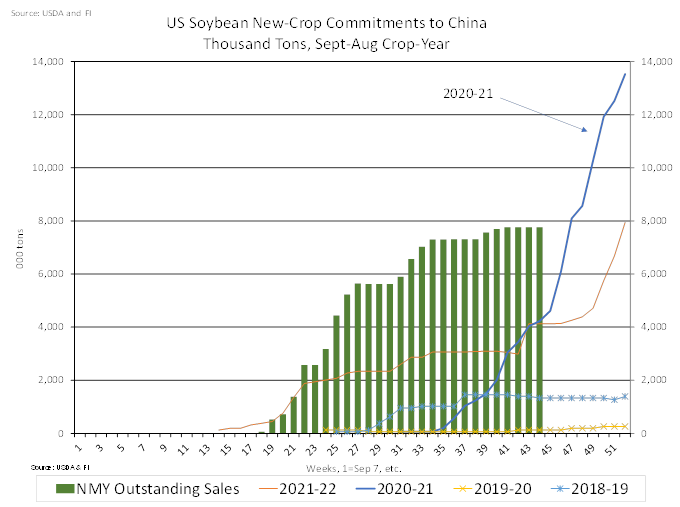

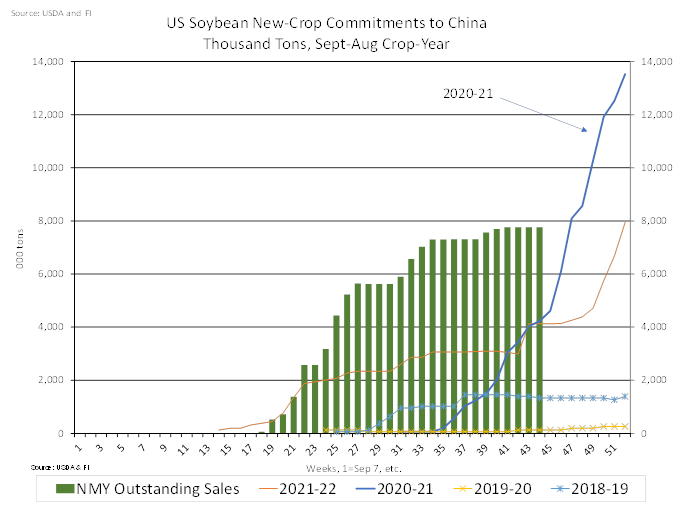

new-crop soybean commitments are off to a slow start.

Soybeans – August $13.90-$16.00

Soybeans – November is seen in a wide $12.75-$16.50 range

Soybean meal – August $360-$440

Soybean oil – August 57.00-64.00

·

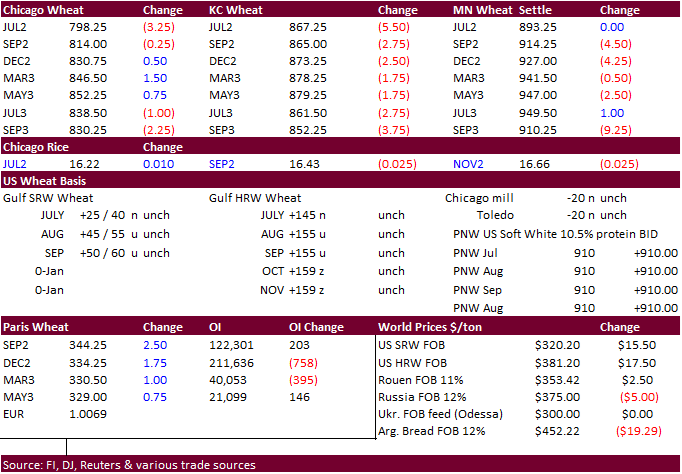

US wheat futures ended lower in part to renewed optimism Ukraine wheat and corn exports will soon sail. The euro currency hit parity against the USD, which is a reminder EU wheat exports are favored over US supplies. Taiwan did

buy US high protein wheat overnight, routine. We look for US export developments to slow or remain steady over the next month, then pick up as we approach spring wheat harvest progress. USDA export sales estimates for Thursday are not favorable.

·

Funds were even for Chicago wheat.

·

Paris wheat ended up 2.50 euros at 344.25 euros, after trading two-sided. The market remains near multi-month lows and favorable for major importers.

·

We are hearing wildfires are popping up in Europe from dry and hot conditions.

·

FranceAgriMer sees soft wheat exports throughout 2022-23 at a three-year high at 10.3 million tons. That would be up 17% from 8.8 million tons for 2021-22. Non-EU wheat exports are seen higher from last season.

·

Taiwan bought 44,725 tons of wheat from the US for Aug 31-Sep 14 shipment. Reuters noted the following:

-30,275

tons of U.S. dark northern spring wheat of 14.5% protein content bought at an estimated $395.05 a ton FOB U.S. Pacific Northwest coast.

-9,900

tons of hard red winter wheat of 12.5% protein bought at $394.26 a ton FOB

-4,550

tons of soft white wheat of 10.0% protein bought at $400.13 a ton FOB.

·

No offers were presented in Japan’s import tender for 70,000 tons of feed wheat and 40,000 tons of barley for arrival by December 22.

·

Jordan bought 60,000 tons of optional origin wheat at $413/ton c&f.

·

Jordan seeks 120,000 tons of barley on July 14 for Nov/Dec shipment. They bought 60,000 tons on July 6.

·

Pakistan issued a new import tender for 300,000 tons of wheat, set to close July 18 for Aug 1-25 shipment.

Rice/Other

·

None reported

Updated 7/1/22

Chicago – September $7.75 to $9.50 range, December $8.00-$11.00

KC – September $8.00 to $10.50 range, December $8.50-$12.00

MN – September $8.50‐$11.00, December $8.00-$12.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.