PDF Attached

![]()

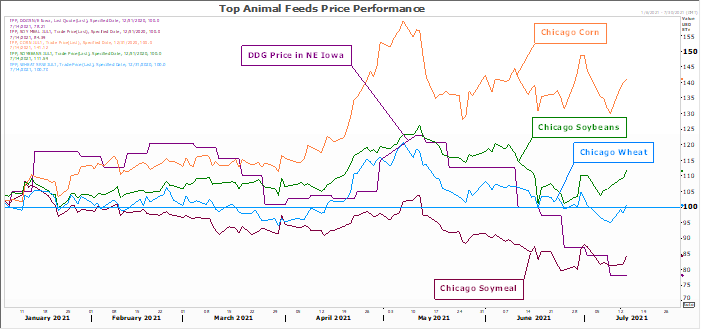

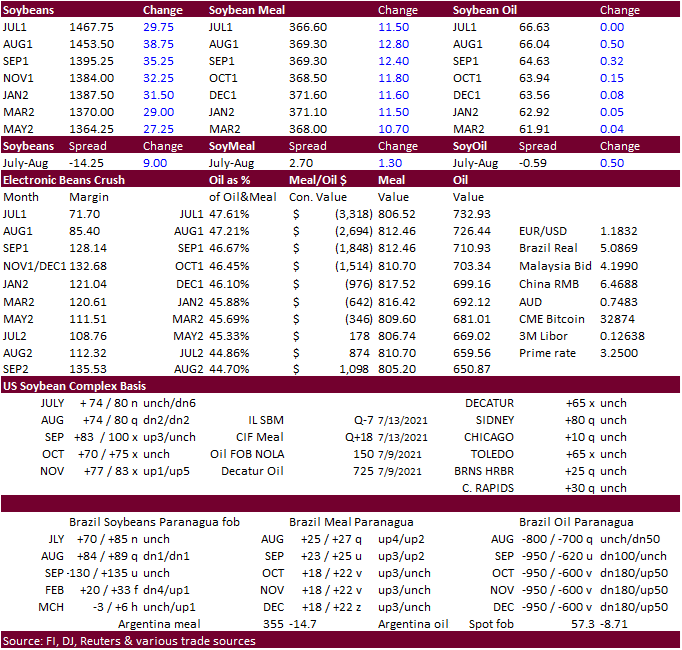

CBOT

agriculture markets rallied on inflation fears, lower USD, technical buying and rising concerns over US supplies amid a weather forecast calling for drier conditions for the US growing areas next week. November soybeans filled a 13.8250 gap.

100=January

1, 2021

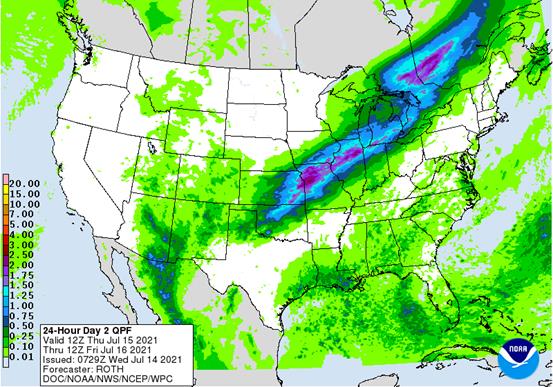

Day

1

Day

2

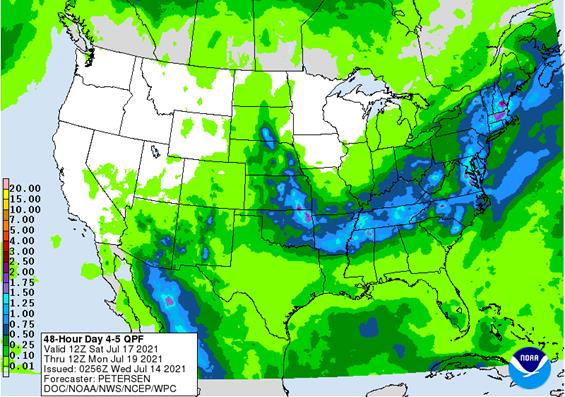

Days

4-5

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

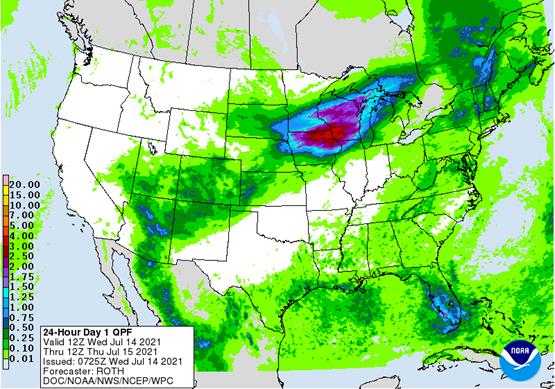

- Rain

in South Dakota, northern Nebraska, southwestern Minnesota, and northwestern Iowa overnight will shift to the east today

o

Rain totals in key crop areas of South Dakota ranged from 0.20 to 0.70 inch while the badlands near the Nebraska border and some locations in northern Nebraska ranged from 0.70 to 2.00 inches

- The

greatest rainfall was localized - A

few areas in northwestern Iowa reported more than 1.00 inch

o

Rain today and early Thursday will impact some of this region again with the greatest rain in northern Iowa, far southern Minnesota, southern Wisconsin and northwestern Illinois

- Amounts

will vary from 0.40 to 1.25 inches except in northeastern Iowa, southern Wisconsin and immediate neighboring areas where 1.25 to more than 3.00 inches is possible - Today’s

northwestern Corn Belt rain event will be last to be so well organized for at least ten days

o

Net drying and warming is expected

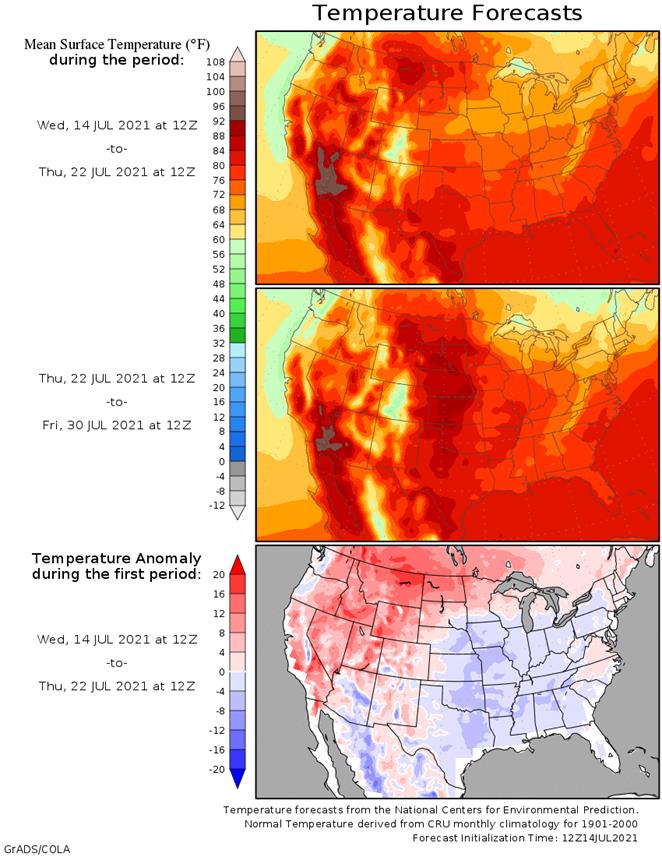

- Canada’s

Prairies, North Dakota, parts of Montana and northern Minnesota are facing ten days of very stressful conditions

o

Little to no rain and warm to eventually hot temperature are expected

o

Crop stress is already at serious levels and the lack of rain and continued very warm to hot temperatures will accelerate crop yield losses for spring, wheat, canola, barley, lentils and all other unirrigated early season crops

- Stress

to corn, flax and soybeans is also expected to steadily raise

o

Stress will expand or develop southward into South Dakota, Nebraska parts of Iowa and parts of Wisconsin over time, but it will take several days to deplete soil moisture enough to stress crops in those areas

- Unsettled

weather will continue in the U.S. Midwest for the coming five days adding more rainfall to areas that have already been receiving some rain periodically

o

Crop conditions will remain very good from southeastern Iowa and eastern Missouri to Ohio, Michigan and Kentucky

- North

America weather changes will begin this weekend and become pronounced during next week and on into late month.

o

Warmer temperatures will impact the Great Plains and much of the Midwest, although excessive heat is unlikely in the eastern Midwest

- The

warming will be most welcome to the wetter areas in the central and eastern Midwest and should stimulate additional aggressive crop development and good yield potentials

o

Warmer weather in the western Corn Belt and upper Midwest will slowly decrease soil moisture and raise stress in the driest areas

- The

greatest crop stress in the western Corn Belt is expected next week and it may last for ten days - soil

moisture will be quickly depleted and concern over production will begin to rise - Western

U.S. Corn Belt and upper Midwest crop stress will peak in the last days of July and early August with the ridge of high pressure expected to retrograde to the west in August returning showers and somewhat cooler temperatures - Warmer

temperatures in the U.S. southern Plains next week will be ideal for cotton, sorghum and corn which have experienced some milder than usual conditions recently

o

Periodic showers and thunderstorms will continue in cotton sorghum and corn areas of West Texas maintaining a very good long term outlook

o

West Texas does have a need for warming temperatures

- U.S.

Delta and southeastern states will experience a good mix of weather for a while - U.S.

Southwest monsoonal precipitation is expected to occur favorably in Arizona, New Mexico and areas north into the central Rocky Mountain region during the next two weeks - California,

Nevada and the Pacific Northwest will remain dry and very warm to hot over the next couple of weeks - Mexico

drought continues to slowly shrink with frequent rain expected in western and southern parts of the nation

o

Rain is needed in the northeast

- Western

Russia has dried out recently along with Ukraine, Belarus and neighboring areas, although subsoil moisture is carrying on normal crop development

o

Showers will resume this weekend and increase next week reversing the drying trend and improving crop conditions once again

- Ukraine,

Belarus and Baltic States weather will be very good for crops over the next two weeks - Welcome

rain is expected in the western Balkan Countries late this week into next week

o

The region has been too dry and warm in recent weeks stressing unirrigated crops from the eastern Adriatic Sea coast to Hungary and western Slovakia

- Too

much rain is falling in parts of France and Germany as well as in Belgium and southeastern Netherlands where drying will soon be needed

o

Rain totals of 2.00 to 6.00 inches are expected by the weekend including what fell overnight

o

Delays in cereal maturation and harvesting are expected with a little concern over crop quality, but rain should subside before a serious decline in grain quality results.

- Net

drying is expected in western France, the U.S. and parts of Scandinavia during the coming ten days

o

Drying is also expected in Spain, Portugal, southern Italy and Greece, but these areas are typically dry during the summer

- China

received more heavy rainfall Tuesday in Hebei, parts of Shandong, western Liaoning and in neighboring areas of Inner Mongolia where 2.00 to more than 4.00 inches resulted

o

Flooding has been significant over the past few days from northeastern Sichuan to Hebei, western Liaoning and neighboring areas of Inner Mongolia

o

Net drying occurred elsewhere in the nation

- Most

of China’s heavy rain event is over, but periodic showers and thunderstorms will maintain moisture abundance in many areas

o

The interior southeast will continue dry down for a while

o

A tropical cyclone may impact the lower east coast during mid-week next week, but confidence is low

- Xinjiang

weather will be fair to good for the next ten days

o

Showers and thunderstorms will pop up near the mountains while most crop areas remain dry

o

Temperatures will be cooler than usual with highs in the upper 70s and 80s northeast and in the 80s and 90s southwest.

- India’s

monsoon will distribute rainfall a little better across the nation, but resulting amounts will remain lighter than usual in many areas

o

Crop development should advance relatively well, but greater rain will be needed to ensure water supply has been restored and deep subsoil moisture is replenished for crop and human use during the long dry season

o

Sugarcane and other crops that are not irrigated could suffer from the lighter than usual precipitation if these conditions persist too long.

- West

Africa rainfall from Ivory Coast and Ghana to Cameroon and Nigeria will be lighter than usual during the coming ten days, but timely rainfall will maintain favorable crop conditions

o

Ivory Coast and Ghana will experience the least rainfall and have the greatest increase in rainfall needs over the next two weeks

- Erratic

rainfall has been and will continue to fall from Uganda and Kenya into parts of Ethiopia

o

A boost in precipitation is needed and is under way

- Ethiopia

rainfall is expected to continue gradually improving this week and then it will decrease next week

- East-central

Argentina rainfall will today

o

Recent rainfall benefited some eastern and central wheat production areas, but dry weather will occur elsewhere through much of the next ten days

- Southern

Brazil will receive brief waves of rain during the next ten days to two weeks. The precipitation will favor winter wheat, and be good for sugarcane, citrus and some coffee areas

o

Temperatures will trend cooler in next week and some frost or freezes will impact far southern grain areas during mid-week next week

- A

little wheat damage is possible, but it is too soon to determine temperatures that will be coldest July 20-21 - Australia

weather will provide periodic rainfall and bouts of sunshine with seasonable temperatures through the next two weeks supporting winter crop establishment

o

South Australia and northwestern Victoria are driest and have the greatest need for rain

- Some

precipitation is expected, but more may be needed - Southeastern

Canada’s Ontario and Quebec crop areas have received some welcome rain recently improving soil moisture and supporting long term crop- development

o

A good mix of weather is expected over the next two weeks

- Thailand,

Cambodia and Vietnam started to receive needed rain last week and it continued through the weekend and into Monday

o

A general improvement in crop conditions, soil moisture and eventually the water supply is expected, although more rain is needed

- Thailand,

corn, rice, sugarcane and other crops were becoming stressed because of dryness recently. The same may have been occurring in some Cambodia and Vietnam locations. These areas are now getting enough rain to begin seeing improving crop conditions - Indonesia

and Malaysia rainfall is expected to be sufficient to maintain or improve soil moisture for all crops - Philippines

rainfall will slowly increase during the next two weeks which should be welcome initially - South

Africa will experience additional showers in the far west periodically over the coming week

o

The moisture will be good for winter crops, but more moisture will be needed in Free State and other eastern wheat production areas

o

Summer crop harvesting has advanced well this year and the planting of winter grains has also gone well, but there is need for moisture in eastern winter crop areas

- Nicaragua

has been and will continue to receive welcome rain, but moisture deficits are continuing in some areas

o

Additional improvement is needed and may come slowly

- Honduras

has become the driest nation in Central America and needs significant rain, but precipitation may be erratic and light for a while - Southern

Oscillation Index is mostly neutral at +9.57 and the index is expected to continue rising for a few more days - New

Zealand weather during the coming week will be abundantly wet and then drier weather is expected next week

o

Temperatures will be near to below average

Source:

World Weather Inc.

Bloomberg

Ag Calendar

Wednesday,

July 14:

- EIA

weekly U.S. ethanol inventories, production - Brazil

Unica cane crush, sugar production (tentative) - Malaysia

2Q cocoa grinding data (tentative) - HOLIDAY:

France

Thursday,

July 15:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China

2Q pork output and inventory levels - Malaysia

July 1-15 palm oil export data - Malaysia

crude palm oil export tax for August (tentative) - Port

of Rouen data on French grain exports - Barry

Callebaut 9-month key sales figures

Friday,

July 16:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Cocoa

Association of Asia releases 2Q cocoa grinding data

Source:

Bloomberg and FI

US

PPI Final Demand (M/M) Jun: 1.0% (est 0.6%; prev 0.8%)

US

PPI Ex-Food, Energy (M/M) Jun: 1.0% (est 0.5%; prev 0.7%)

US

PPI Ex-Food, Energy, Trade (M/M) Jun: 0.5% (est 0.5%; prev 0.7%)

US

PPI Final Demand (Y/Y) Jun: 7.3% (est 6.7%; prev 6.6%)

US

PPI Ex-Food, Energy (Y/Y) Jun: 5.6% (est 5.1%; prev 4.8%)

US

PPI Ex-Food, Energy, Trade (Y/Y) Jun: 5.5% (est 5.6%; prev 5.3%)

Canadian

Manufacturing Sales (M/M) May: -0.6% (est 1.0%; prev -2.1%)

US

DoE Crude Oil Inventories (W/W): -7896K (est -4000K; prev -6866K)

–

Distillate Inventories: 3657K (est 1000K; prev 1616K)

–

Cushing Inventories: -1589K (prev -614K)

–

Gasoline Inventories: 1038K (est -2000K; prev -6075K)

–

Refinery Utilization: -0.40% (est 0.30%; prev -0.70%)

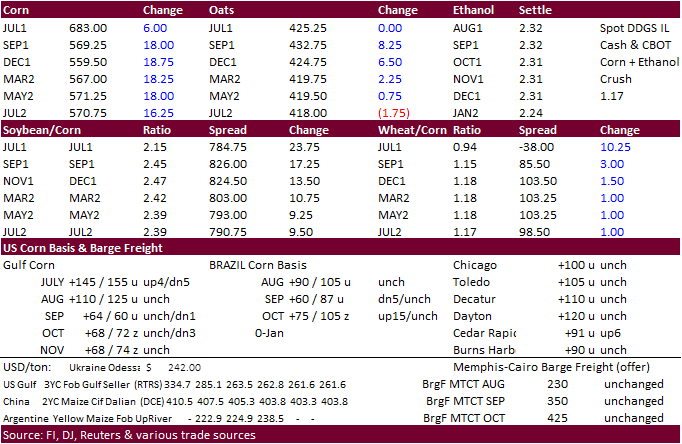

- Corn

ended higher on inflation concerns, weather outlook for less rain across the Midwest next week relative to this week, sharply lower USD and technical buying. U.S. producer prices increased more than expected in June, suggesting inflation could remain high.

Final demand increased 1.0% last month after rising 0.8% in May. - December

corn nearly tested its 50-MA of $5.6450. Note the gap is at $5.7375. Today the contract settled at $5.5875.

- We

are hearing corn harvest progress in the southern Delta will start in about 10 days (south of highway I20). This could put some pressure on basis.

- Traders

will be watching the WCB rain event over the next day as precipitation amounts will be important. By the end of the workweek rains shift east. IA looks mostly dry 3-7 days out.

- We

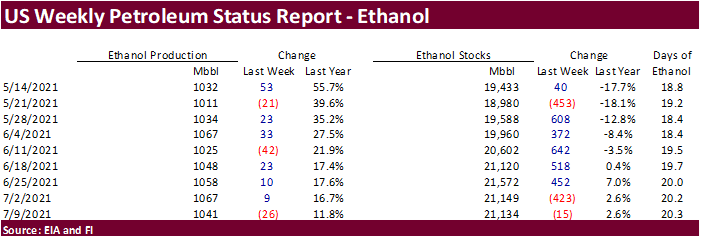

heard 8-10 Argentina corn cargoes were booked by Brazil recently. - US

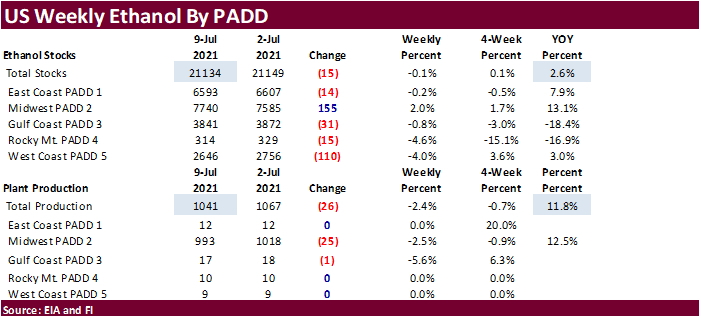

ethanol production last week fell 26,000 barrels and stocks were down 15,00 barrels, slightly bearish.

- The

USDA weekly Broiler Report showed eggs set in the US up 3 percent and chicks placed down 3 percent. Cumulative placements from the week ending January 9, 2021 through July 10, 2021 for the United States were 5.05 billion. Cumulative placements were up 1 percent

from the same period a year earlier.

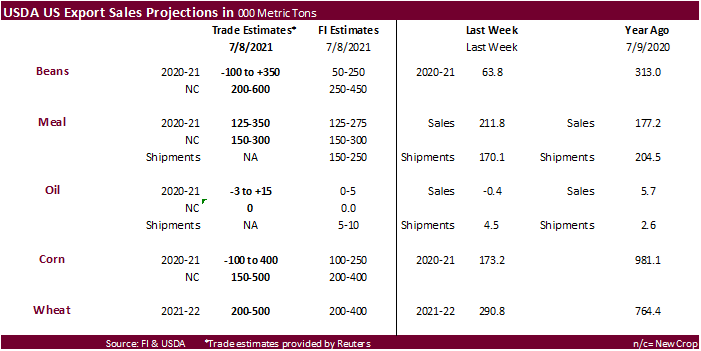

Export

developments.

- Jordan

seeks 120,000 tons of feed barley on July 28 for Nov/Dec shipment.

September

corn is seen is a$4.75-$6.25 range

December

corn is seen in a $4.25-$6.00 range.

-

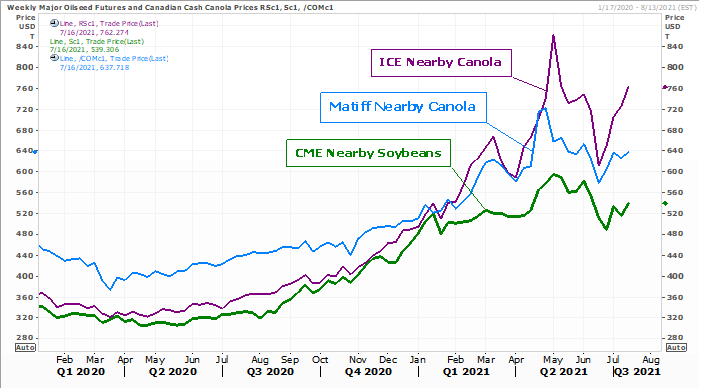

Soybeans

traded sharply higher despite a decline in November Canadian canola futures (down 19.60) Products were higher led by rare strong upside move in soybean meal.

-

November

soybeans nearly filled a gap at 13.8250. High of the day was 13.8575. -

Decatur

soybeans were up 25 cents to 90 over the November. Gulf beans are getting cheaper but PNW is still firm.

-

We

are now hearing most estimates for Canadian canola production being dropped into the 17 to 19-million-ton range. USDA is at 20.2 million tons.

-

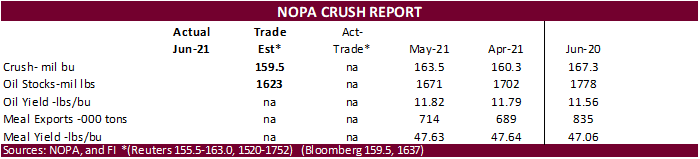

A

Reuters poll calls for the U.S. June soybean crush to fall to 159.5 million bushels from 163.5 million bushels in May and 167.3 million bushels in June 2020. Soybean stocks were estimated at 1.623 billion pounds, down from 1.671 billion previous month.

-

Germany’s

association of farm cooperatives estimated the 2021 winter rapeseed crop at 3.68 million tons, (2.67 June estimate) a 4.7% increase from year ago.

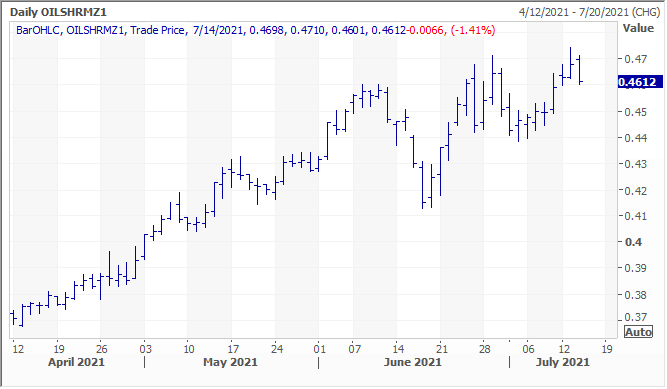

- Indonesia

May palm oil exports were 2.95 million tons, a 21.6% increase from a year ago and up 12% from April. Gapki reported Indonesia palm stocks fell 7.7% at the end of May from April to 2.88 million tons. Production was 4.35 million tons vs. 4.1 million in April.

- Malaysian

palm 1-15 shipment data is expected to be up 3% from the same period a month ago. That data will be out overnight.

- The

European Union changed their long-term renewable energy proposal to reflect to 40% of final consumption by 2030 to reduce greenhouse gas. That replaces a previous target for a 32% by 2030.

December

oil share lost some ground today

- South

Korea’s Agro-Fisheries & Food Trade Corp. seeks around 7,600 tons of GMO-free soybeans on July 21 for arrival in South Korea between Aug. 20 and Oct. 20.

Updated

7/13/21

August

soybeans are seen in a $13.25-$15.25 range; November $11.75-$15.00

August

soybean meal – $330-$410; December $320-$425

August

soybean oil – 62-67; December 46-67 cent range

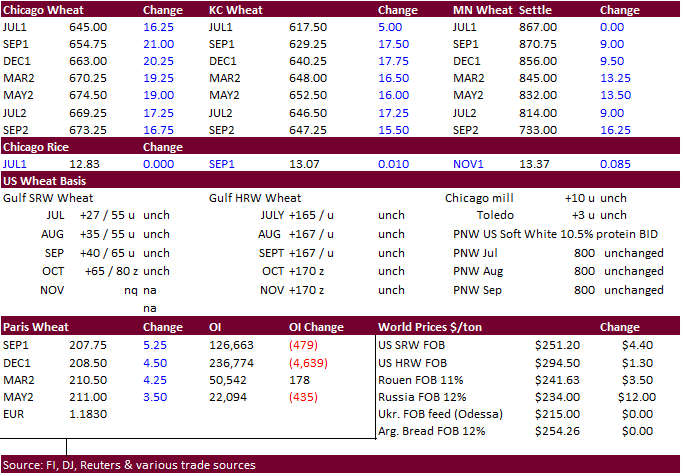

- US

and EU wheat were higher on North American supply concerns. The Chicago/Minneapolis wheat spread saw a partial correction, in part to fresh SRW fund long positioning. The USD was down 35 points by late morning.

Egypt

bought 180,000 tons of Romanian wheat. Hot

and dry conditions for the Canada’s Prairies, northern U.S. Plains, and far northwestern Midwest rekindled crop concerns. Upcoming daily highs will be in the 90s and over 100 Fahrenheit (32-40C) next week and into the following weekend.

- September

Paris wheat settled 5 euros higher at 209 euros. - Germany’s

association of farm cooperatives estimated the 2021 wheat harvest at 22.80 million tons, down from 22.98 million estimated in June and up 3.2% increase from last year.

- China’s

statistics bureau estimated summer wheat production at 134 million tons, up 2% from 2020. But some analysts warned quality in some top growing areas might have been compromised due to bad weather, including Shandong, Henan, Hebei and Hubei. Wheat acreage

and yield rose 0.9% and 1.1% from the previous year respectively. - Vietnam

will lift its 3% wheat import tariff and cut its corn import tariff from 3% from 5%. France is on holiday today.

- Ukraine

exported 700,000 tons of grain so far this season, nearly unchanged from same period a year ago. This included 223,000 tons of wheat, 95,000 tons of barley and 373,000 tons of corn. Ukraine may collect 76 million tons of grain this year, up from 65 million

tons in 2020.

- Egypt

bought 180,000 tons of Romanian wheat for September 11-20 shipment.

60,000

tons of Romanian wheat at $231.88 and $30.31 freight = $262.19

60,000

tons of Romanian wheat at $231.88 and $35.00 freight = $266.88

60,000

tons of Romanian wheat at $231.88 and $35.00 freight = $266.88

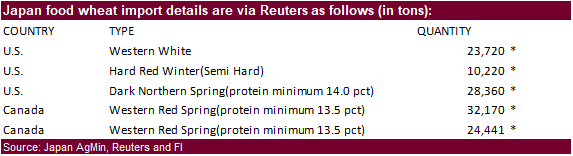

- Japan

passed on feed wheat and bought only 200 tons of feed barley. They

were seeking 80,000 tons of feed wheat and 100,000 tons of barley for arrival by December 23.

- Results

awaited: Iran’s GTC seeks 60,000 tons of milling wheat for August and September shipment on Wednesday, July 14. - Taiwan

Flour Millers’ Association seeks 55,000 tons of million wheat from the United States on July 16 for shipment from the U.S. Pacific Northwest coast between Aug. 31 and Sept. 14.

- Japan’s

AgMin seeks 118,911 tons of food-quality wheat from the United States and Canada.

- Bangladesh’s

seeks 50,000 tons of milling wheat on July 15. - Bangladesh’s

seeks 50,000 tons of milling wheat on July 18.

- Ethiopia

seeks 400,000 tons of wheat on July 19.

- Pakistan’s

TCP seeks 500,000 tons of wheat on July 27. 200,000 tons are for August shipment, and 300,000 tons are for September shipment.

Rice/Other

- South

Korea seeks 91,216 tons of rice from China, the United States and Vietnam for arrival in South Korea between Oct. 31, 2021, and April 30, 2022.

- Bangladesh

seeks 50,000 tons of rice on July 18.

Updated

7/12/21

September Chicago wheat is seen in a $5.90-$7.00 range

September KC wheat is seen in a $5.60-$6.70

September MN wheat is seen in a $7.75-$9.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.