PDF Attached

Mixed

trade. USD was 24 higher by the time the CBOT ag markets closed and WTI more than $1.30 lower, at about the time ag markets closed. Canola rallied while soybeans and corn fell. US wheat was up sharply led by Minneapolis. Soybean oil was higher following

canola and meal lower. We attached a Canadian canola balance.

![]()

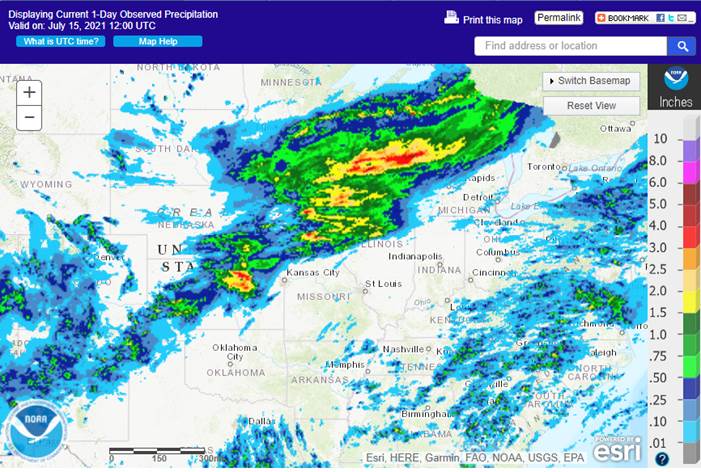

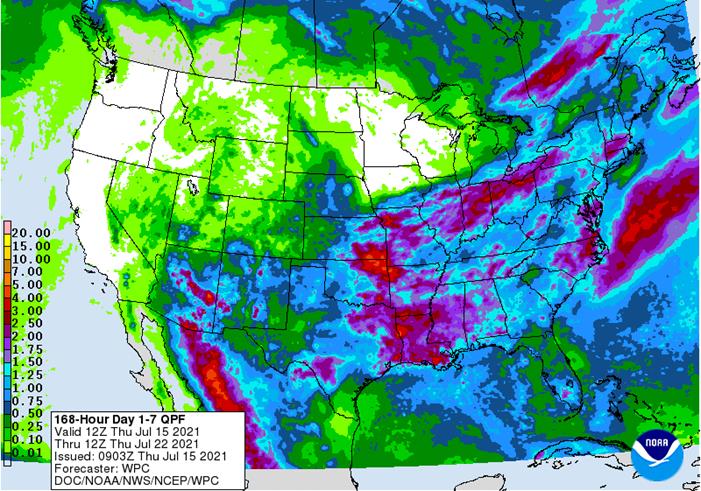

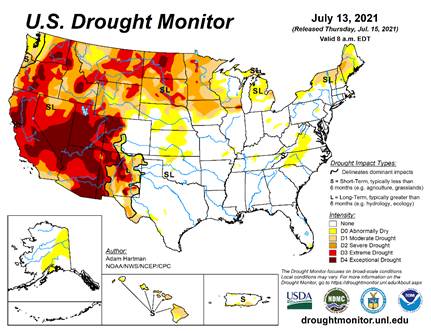

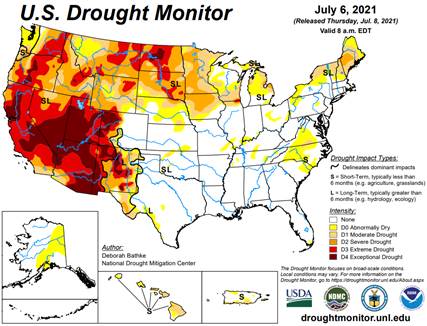

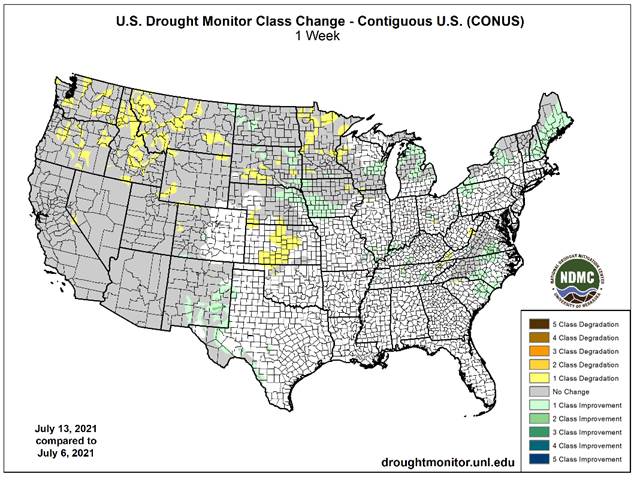

Drought

Monitor: Some negative changes in the central Plains, MT, SD and MN. ND improves.

WORLD

WEATHER INC.

WORLD

WEATHER HIGHLIGHTS FOR JULY 15, 2021

- U.S.

northern Plains and Canada’s Prairies are still looking for excessive heat developing this weekend and prevailing for nearly a full week thereafter - Extreme

highs of 100 to 110 will be common with a few readings above 110 not out of the realm of possibilities - Wednesday’s

mid-day GFS model run was out of line with the extreme temperatures advertised, but it will still get very warm to hot briefly in the upper Midwest with some upper 90- and near 100-degree highs expected in the Red River Basin of the North and Neighboring areas - Livestock

stress and crop failures will result from the dry and hot weather that is forthcoming in the northern Plains and Canada’s Prairies

- China

will receive less rain during the coming week favoring better crop and field conditions after recent excessive rain and flooding - India’s

monsoon will continue to underperform in parts of the nation, but all areas will eventually get rain to support crop development - The

situation is not a crisis, but greater rain will continue needed in the far northwest and extreme south - Cooling

is expected in southern Brazil Sunday through Tuesday resulting in very chilly temperatures Tuesday and Wednesday of next week

- Frost

and freezes will occur in some southern winter cereal areas from Parana to Rio Grande do Sul - Soft

frost may reach into a few sugarcane, citrus and coffee areas from northern Parana to Sul de Minas - Australia

weather will be well mixed over the next couple of weeks - Abundant

rain in France and Germany will abate after another day or two with a short term break from too much moisture - Much

needed rain will fall in the Balkan Countries in southeastern Europe over the next week to ten days easing long term dryness and improving crops - South

Africa will continue to get beneficial moisture in the western winter crop areas during the coming week to ten days - Ivory

Coast and Ghana will continue to dry out over the next two weeks - Some

of this is normal for this time of year - Argentina

will experience a week of net drying and rain is still needed in western winter crop areas - Much

talk continues about returning La Nina in the fourth quarter and the impact that might have on Brazil and Argentina - The

situation does not bode well for fixing long term dryness in the soil and does raise some concerns about summer crop production

Source:

World Weather Inc.

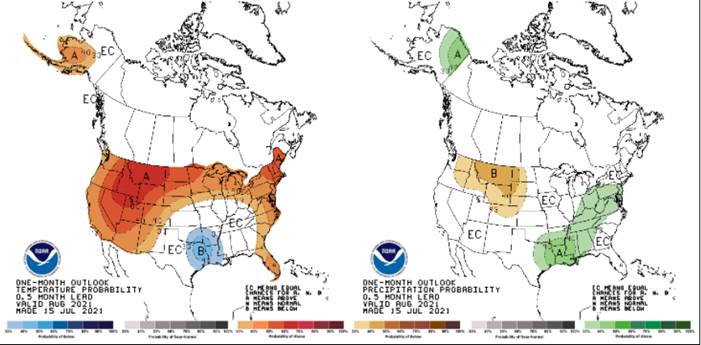

NOAA

August forecast

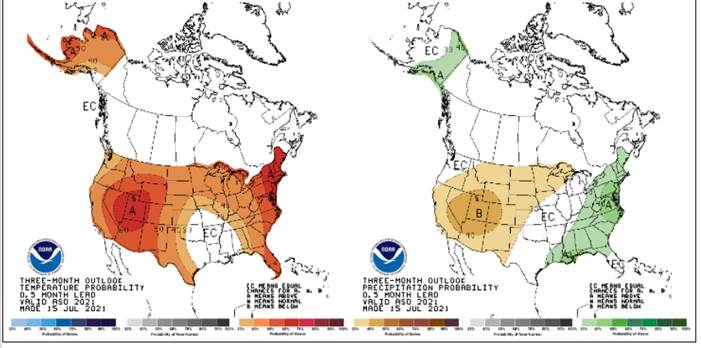

NOAA

3-month forecast

Bloomberg

Ag Calendar

Thursday,

July 15:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China

2Q pork output and inventory levels - Malaysia

July 1-15 palm oil export data - Malaysia

crude palm oil export tax for August (tentative) - Port

of Rouen data on French grain exports - Barry

Callebaut 9-month key sales figures

Friday,

July 16:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Cocoa

Association of Asia releases 2Q cocoa grinding data

Source:

Bloomberg and FI

US

Initial Jobless Claims Jul 10: 360K (est 350K; prevR 386K)

US

Continuing Claims Jul 3: 3241K (est 3300K; prevR 3367K)

US

Empire Manufacturing Jul: 43 (est 18.0; prev 17.4)

US

Philadelphia Fed Business Outlook Jul: 21.9 (est 28.0; prev 30.7)

US

Import Price Index (M/M) Jun: 1.0% (est 1.1%; prevR 1.4%)

US

Import Price Index Ex-Petroleum (M/M) Jun: 0.7% (est 0.6%; prev 0.9%)

US

Import Price Index (Y/Y) Jun: 11.2% (est 11.1%; prevR 11.6%)

US

Export Price Index (M/M) Jun:1.2% (est 1.4%; prev 2.2%)

US

Export Price Index (Y/Y) Jun: 16.8% (est 16.3%; prevR 17.5%)

US

Industrial Production (M/M) Jun: 0.4% (est 0.6%; prevR 0.7%)

US

Capacity Utilization Jun: 75.4% (est 75.6%; prevR 75.1%)

US

Manufacturing (SIC) Production Jun: -0.1% (est 0.3%; prev 0.9%)

Canadian

Existing Home Sales (M/M) Jun: -8.4% (prev -7.4%)

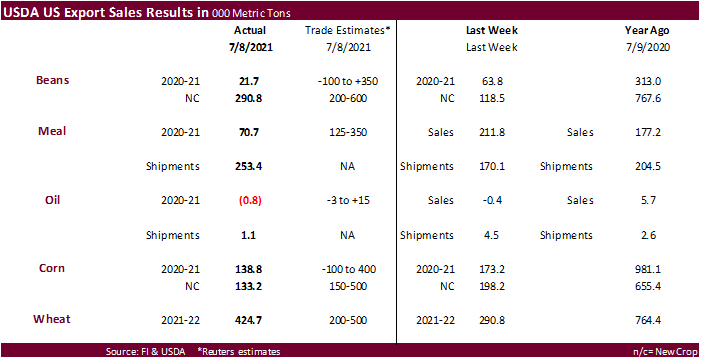

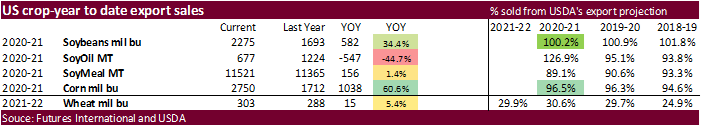

USDA

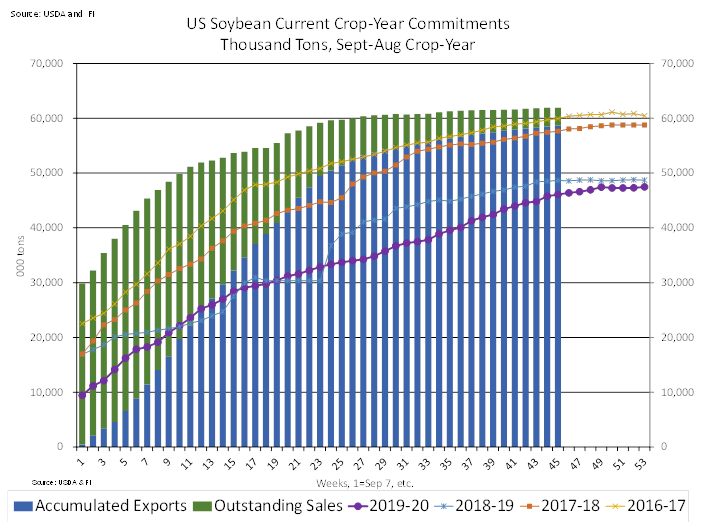

Export Sales

China

was quiet last week. Old crop soybean export sales were a disappointing 21,700 tons and new-crop improved from the previous week to 290,800 tons with Mexico taking the bulk (248,600 tons). Soybean oil sales were negative 800 tons. Meal sales were 70,700

tons (Israel bought 10,000), down from 211,800 tons week earlier. Shipment of meal were very good at 253,400 tons. Soybean oil shipments were 1,100 tons. Corn export sales on a combined basis were withing expectations but remain below average. All-wheat

export sales were good at 424,700 tons and included the Philippines, Mexico, and unknown destinations. There were no barley sales and sorghum were only 400 tons. Pork sales slowed to 10,600 tons, down 76% from the previous week.

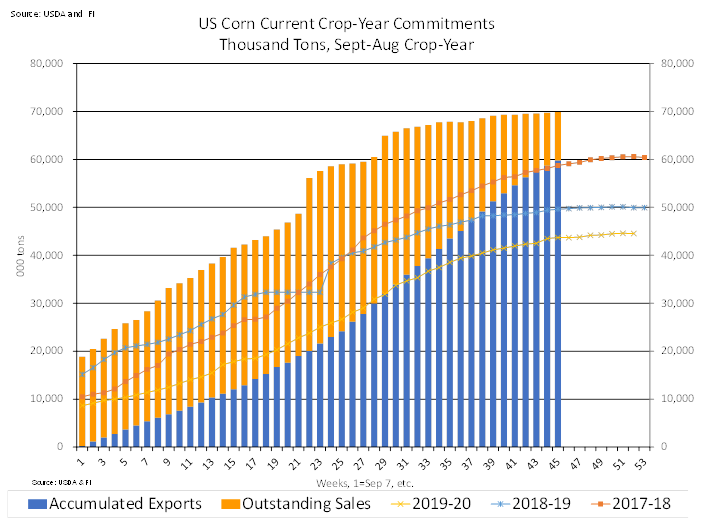

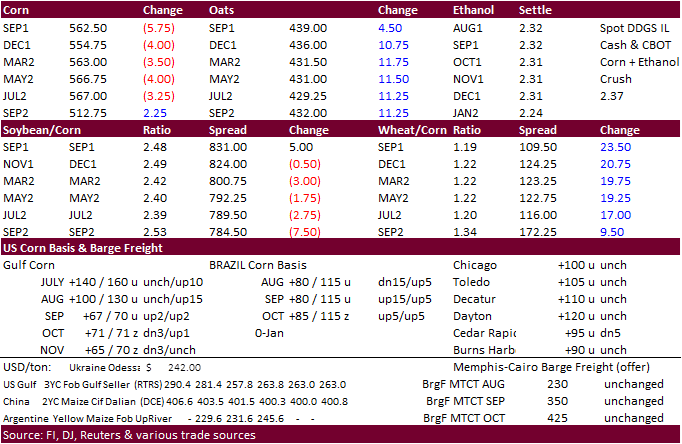

- Corn

ended lower led by old crop, but losses were limited from a weather outlook calling for drier conditions for the Midwest over the next 7-10 days. Trading activity was quiet. Headed into today, December had corn rebounded nearly 20 cents since July 9, so

some think today’s pause was about expected. - USD

was higher and WTI lower. - US

Midwest weather this morning was largely unchanged. The WCB did see the 24-hour rain amount expected in yesterday’s forecast, a welcome event ahead of net drying expected over the next 7-10 days.

- The

EPA reported US fuel blending credits rose in June than in May. 1.27 billion ethanol (D6) blending credits were generated in June, up from 1.26 billion in May. For D4 biodiesel, 428 million blending credits were generated last month, up from 397 million

the month prior. - China’s

pork production increased 35.9% in the first half of 2021 versus a year earlier to 27.15 million tons, according to the National Bureau of Statistics (NBS). China slaughtered 337.42 million hogs in the first six months of the year, up 34.4% from year earlier.

The pig herd expanded 29.2% year-on-year to 439.11 million head as of end of June.

Export

developments.

- Jordan

seeks 120,000 tons of feed barley on July 28 for Nov/Dec shipment.

September

corn is seen is a$4.75-$6.25 range

December

corn is seen in a $4.25-$6.00 range.

-

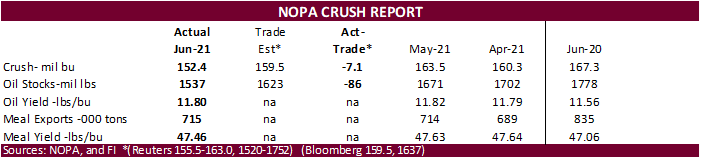

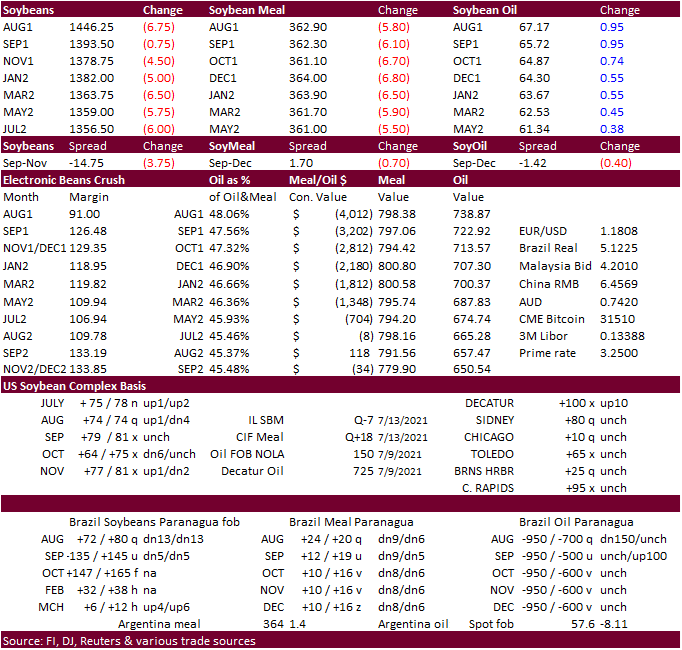

Soybeans

started higher led by a sharply higher trade in soybean oil, but prices fell from a softer than expected NOPA June crush. Old crop soybean prices fell more so than new-crop on indications USDA will increase the 2020-21 US carryout by 5-10 million bushels

next month. Soybean oil remained firm all day on vegetable oil supply concerns. Meal was under pressure from product spreading.

-

We

raised our August soybean oil range by 2.5 to 3 cents. -

NOPA

released a bearish US crush figure for the month of June, but implied domestic soybean oil use and soybean meal exports were good. The slowdown in crush was more obvious for the eastern regions of the US where soybeans are harder to source. Others noted

much needed downtime for plants. We look for USDA to lower current crop year crush by at least 5 million bushels from 2.170 billion. We were currently at 2.165 billion and may lower that projection to 2.160 billion.

-

Canadian

November canola was up $17.20 or1.9% to $910.70 per ton. In its weekly crop progress report for the week ended July 12, the province of Saskatchewan rated its oilseed crop at 18% good to excellent. ICE canola limits expand to $50 per ton effective Thursday.

-

We

lowered our Canadian canola production to little over 17 million tons after cutting the yield and area. See attached balance sheet.

-

Argentina

river problems are affecting the amount of grains can be loaded onto boats. A Reuter story noted the sailing draft at Rosario is 10.51 meters, or 34 feet and six inches. Today it’s at 8.96 meters, or 29 feet and 4 inches. Paraguay declared a state of emergency

due to the low river water levels. -

There

were rumors China was inquiring for US soybeans. They have been very quiet all month but note Chinese crush margins have been gradually improving. However, there were no USDA 24-hour sales announcements this morning. The trade reacted by selling soybeans

at the open, but they quickly rebounded. -

Meanwhile

CNGOIC reported the weekly soybean stocks at a 9-month high to 7.1 million tons.

-

Decatur,

IL soybean basis was up 10 to 100 over the November. -

Malaysian

palm futures rallied to a 6-week high (up 152 points overnight)in part to higher than expected palm exports over the past five days and strength in soybean oil on Wednesday. ITS reported Malaysian palm exports at 694,835 tons, up 5.5 percent from the same

period a month ago. Trade was looking for around a 3% increase. AmSpec was at 684,615 tons, up 4.9%. SGS reported a 3.8% increase to 682,426 tons from 657,474 tons same period a month ago.

- South

Korea’s Agro-Fisheries & Food Trade Corp. seeks around 7,600 tons of GMO-free soybeans on July 21 for arrival in South Korea between Aug. 20 and Oct. 20.

Updated

7/15/21

August

soybeans are seen in a $13.25-$15.25 range; November $11.75-$15.00

August

soybean meal – $330-$410; December $320-$425

August

soybean oil – 64.50-70.00;

December 46-67 cent range

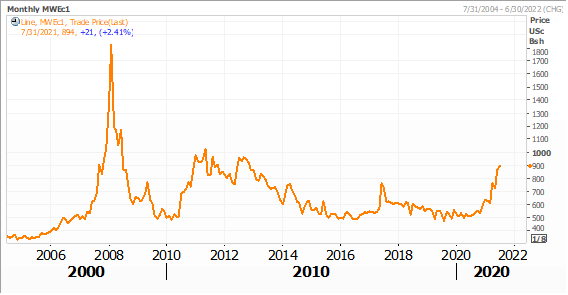

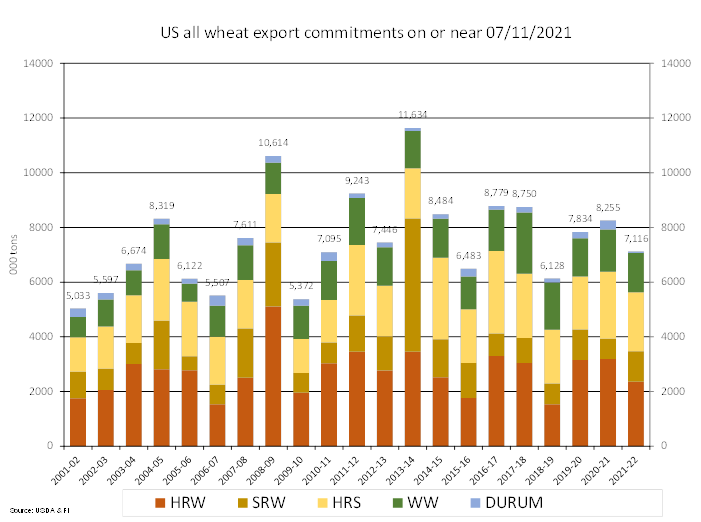

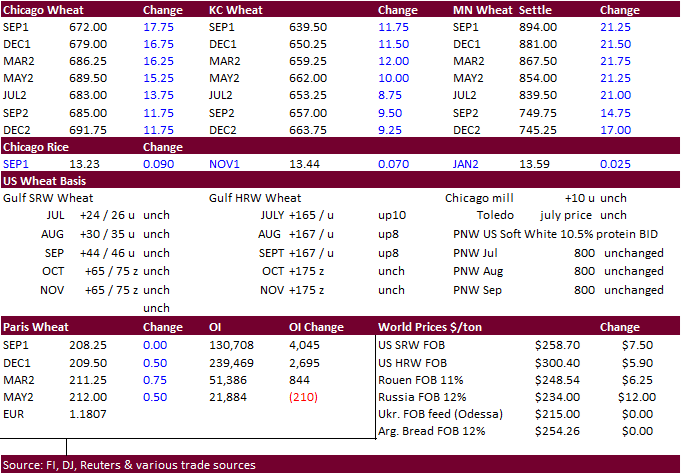

- Wheat

ended sharply higher led by the Minneapolis contracts on ongoing North American weather concerns. Weekly Drought Monitor showed drought conditions slightly worsened for South Dakota and improved a touch for North Dakota. Minneapolis wheat is back leading

Chicago & KC higher. Outside the US, weather models call for an improvement across many major global wheat areas. Monthly MN wheat chart below.

- U.S.

northern Plains and Canada’s Prairies are still looking for excessive heat developing this weekend through at least 7 days. Extreme highs of 100 to 110 will be common.

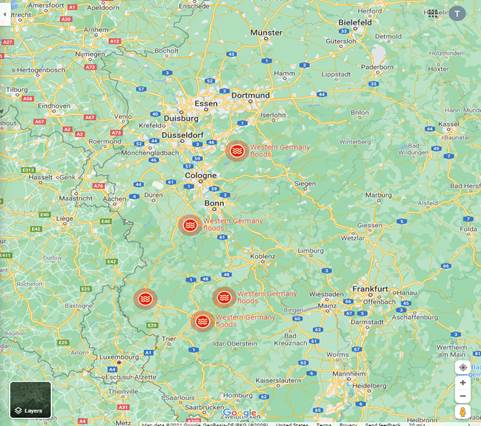

- It

is not known if the local flooding across parts of western Europe hindered/impacted crop development and transportation.

Source:

Google Maps

- USDA

export sales of 424,700 tons of wheat were good. They were up 46% from the previous week and up 44% from the prior 4-week average. - Rosario

exchange estimated the Argentina 2021-22 wheat crop at 20.5 million tons, up 500,000 tons from previous from good conditions across Pampas. 90% of Argentina’s wheat crop had been planted and most of the emerged wheat is in good/excellent condition.

- Strategie

Grains increased its EU soft wheat production at 133.0 million tons, up from 131.1 million projected in June and more than 14 million tons above last year. EU soft wheat exports are projected at 31.0 million tons, up from 28.6 million tons last month and

26.9 million tons in 2020-21. - IKAR

lowered its Russia 2021 wheat crop to 81.5 million from 83.5 million tons.

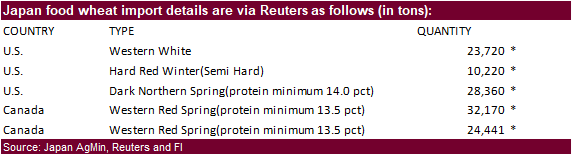

- Japan’s

AgMin bought 118,911 tons of food-quality wheat from the United States and Canada.

- Results

awaited: Bangladesh’s seeks 50,000 tons of milling wheat on July 15. - Results

awaited: Iran’s GTC seeks 60,000 tons of milling wheat for August and September shipment on Wednesday, July 14. - Taiwan

Flour Millers’ Association seeks 55,000 tons of million wheat from the United States on July 16 for shipment from the U.S. Pacific Northwest coast between Aug. 31 and Sept. 14.

- Bangladesh’s

seeks 50,000 tons of milling wheat on July 18.

- Ethiopia

seeks 400,000 tons of wheat on July 19.

- Pakistan’s

TCP seeks 500,000 tons of wheat on July 27. 200,000 tons are for August shipment, and 300,000 tons are for September shipment.

Rice/Other

- Mauritius

seeks 6,000 tons of white rice on July 27 for October through December shipment.

- South

Korea seeks 91,216 tons of rice from China, the United States and Vietnam for arrival in South Korea between Oct. 31, 2021, and April 30, 2022.

- Bangladesh

seeks 50,000 tons of rice on July 18.

Updated

7/12/21

September Chicago wheat is seen in a $5.90-$7.00 range

September KC wheat is seen in a $5.60-$6.70

September MN wheat is seen in a $7.75-$9.50

USDA Export Sales

U.S. EXPORT SALES FOR WEEK ENDING 07/01/2021

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

100.8 |

1,514.1 |

1,825.6 |

136.0 |

655.4 |

1,007.8 |

0.0 |

0.0 |

|

SRW |

11.9 |

932.4 |

610.8 |

119.3 |

151.1 |

117.9 |

0.0 |

0.0 |

|

HRS |

119.3 |

1,609.8 |

1,583.8 |

72.0 |

425.1 |

587.5 |

0.0 |

0.0 |

|

WHITE |

53.6 |

1,079.4 |

1,105.5 |

52.4 |

283.6 |

341.1 |

0.0 |

0.0 |

|

DURUM |

5.3 |

8.4 |

179.0 |

5.3 |

31.6 |

131.2 |

0.0 |

0.0 |

|

TOTAL |

290.8 |

5,144.1 |

5,304.7 |

385.1 |

1,546.8 |

2,185.5 |

0.0 |

0.0 |

|

BARLEY |

0.3 |

23.7 |

40.2 |

0.3 |

1.4 |

1.5 |

0.0 |

0.0 |

|

CORN |

173.2 |

11,034.3 |

7,541.8 |

1,286.3 |

58,685.9 |

34,966.9 |

198.2 |

15,946.5 |

|

SORGHUM |

0.0 |

893.1 |

846.2 |

0.0 |

6,337.0 |

3,364.3 |

0.0 |

1,594.9 |

|

SOYBEANS |

63.8 |

3,410.3 |

8,229.8 |

221.2 |

58,494.0 |

37,544.2 |

118.5 |

9,397.9 |

|

SOY MEAL |

211.8 |

2,329.9 |

1,905.6 |

170.0 |

9,120.6 |

9,282.1 |

55.8 |

911.8 |

|

SOY OIL |

-0.4 |

21.2 |

239.7 |

4.5 |

656.3 |

978.5 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

10.5 |

224.5 |

99.2 |

7.0 |

1,532.3 |

1,318.4 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

8.4 |

23.6 |

0.0 |

25.5 |

72.9 |

0.0 |

7.0 |

|

L G BRN |

0.3 |

11.9 |

11.2 |

0.6 |

39.5 |

57.2 |

0.0 |

0.7 |

|

M&S BR |

0.1 |

22.9 |

31.6 |

0.1 |

133.8 |

86.4 |

0.0 |

0.0 |

|

L G MLD |

5.4 |

46.5 |

55.6 |

4.1 |

611.8 |

834.9 |

0.0 |

0.0 |

|

M S MLD |

3.7 |

117.5 |

115.7 |

22.3 |

570.6 |

625.2 |

-0.3 |

12.3 |

|

TOTAL |

19.9 |

431.8 |

336.9 |

34.1 |

2,913.6 |

2,995.0 |

-0.3 |

20.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

52.1 |

2,182.8 |

4,156.3 |

294.8 |

13,933.5 |

12,880.4 |

177.0 |

2,604.1 |

|

PIMA |

5.4 |

107.7 |

121.5 |

19.2 |

720.0 |

455.7 |

0.0 |

4.1 |

This

summary is based on reports from exporters for the period July 2-8, 2021.

Wheat: Net

sales of 424,700 metric tons (MT) for 2021/2022 were up 46 percent from the previous week and 44 percent from the prior 4-week average. Increases were primarily for unknown destinations (132,700 MT), the Philippines (80,100 MT), Japan (58,900 MT), Mexico

(34,500 MT, including decreases of 600 MT), and Ecuador (31,500 MT). Exports of 365,900 MT were down 5 percent from the previous week, but up 4 percent from the prior 4-week average. The destinations were primarily to Japan (71,800 MT), the Philippines (64,100

MT), Mexico (56,000 MT), Nigeria (47,400 MT), and the United Arab Emirates (44,000 MT).

Late

Reporting:

For 2020/2021, net sales and exports totaling 10,100 MT of durum wheat were reported late for Italy.

Corn:

Net sales of 138,800 MT for 2020/2021 were down 20 percent from the previous week, but up 31 percent from the prior 4-week average. Increases primarily for Japan (191,500 MT, including 134,300 MT switched from unknown destinations and decreases of 2,800 MT),

Mexico (77,700 MT, including decreases of 1,900 MT), El Salvador (23,000 MT, including 22,000 MT switched from Guatemala), Jamaica (18,800 MT), and Venezuela (7,300 MT), were offset by reductions primarily for unknown destinations (104,300 MT). For 2021/2022,

net sales of 133,200 MT primarily for unknown destinations (76,600 MT), Mexico (32,000 MT), Japan (16,000 MT), Colombia (4,500 MT), and Taiwan (4,000 MT)), were offset by reductions for Nicaragua (2,000 MT). Exports of 1,061,700 MT were down 18 percent from

the previous week and 26 percent from the prior 4-week average. The destinations were primarily to China (477,600 MT), Mexico (253,700 MT), Japan (191,500 MT), Guatemala (67,600 MT), and Costa Rica (29,900 MT).

Optional

Origin Sales:

For 2020/2021, the current outstanding balance of 30,500 MT is for unknown destinations. For 2021/2022, the current outstanding balance of 60,000 MT is for unknown destinations.

Barley:

No net sales or exports were reported for the week.

Sorghum: Total

net sales for 2020/2021 of 400 MT were for China. Exports of 71,400 MT were up noticeably from the previous week and from the prior 4-week average. The destination was to China.

Rice:

Net sales of 9,800 MT for 2020/2021 were down 51 percent from the previous week and 74 percent from the prior 4-week average. Increases primarily for Honduras (2,500 MT), Canada (2,400 MT), Mexico (2,300 MT), Saudi Arabia (2,100 MT), and Singapore (200 MT),

were offset by reductions for El Salvador (400 MT). Exports of 64,800 MT were up 90 percent from the previous week and 16 percent from the prior 4-week average. The destinations were primarily to Mexico (29,900 MT), Haiti (12,200 MT), Guatemala (10,300 MT),

El Salvador (3,600 MT), and Japan (2,900 MT).

Exports

for Own Account:

For 2020/2021, the current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans:

Net sales of 21,700 MT for 2020/2021 were down 66 percent from the previous week and 76 percent from the prior 4-week average. Increases primarily for Indonesia (61,500 MT, including 68,000 MT switched from unknown destination and decreases of 10,700 MT),

France (18,500 MT, including 19,100 MT switched from unknown destinations and decreases of 600 MT), Japan (12,600 MT, including 10,000 MT switched from unknown destinations), the Netherlands (10,800 MT, switched from unknown destinations), and Cuba (8,000

MT), were offset by reductions primarily for unknown destinations (107,900 MT). For 2021/2022, net sales of 290,800 MT were for Mexico (248,600 MT), unknown destinations (19,700 MT), Japan (18,000 MT), Malaysia (2,500 MT), and Vietnam (2,000 MT). Exports

of 197,700 MT were down 11 percent from the previous week, but up 4 percent from the prior 4-week average. The destinations were primarily to Indonesia (70,000 MT), Mexico (28,000 MT), Colombia (19,000 MT), France (18,500 MT), and Costa Rica (16,500 MT).

Exports

for Own Account:

For 2020/2021, the current exports for own account outstanding balance is 5,800 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 70,700 MT for 2020/2021–a marketing-year low–were down 67 percent from the previous week and 72 percent from the prior 4-week average. Increases primarily for unknown destinations (20,000 MT), Israel (10,000 MT), Vietnam (7,700 MT), Mexico

(7,000 MT, including decreases of 16,200 MT), and Jamaica (7,000 MT), were offset by reductions primarily for Guatemala (2,800 MT). For 2021/2022, net sales of 126,400 MT were reported for Mexico (123,300 MT) and Canada (3,100 MT). Exports of 253,400 MT

were up 49 percent from the previous week and 53 percent from the prior 4-week average. The destinations were primarily to Vietnam (107,700 MT), Ecuador (31,800 MT), Morocco (26,000 MT), Guatemala (24,300 MT), and Canada (22,300 MT).

Soybean

Oil:

Total net sales reductions for 2020/2021 of 900 MT were reported for Canada. Exports of 1,100 MT were down 75 percent from the previous week and 78 percent from the prior 4-week average. The destinations were to Mexico (600 MT) and Canada (500 MT).

Cotton:

Net sales of 34,500 RB for 2020/2021 were down 34 percent from the previous week and 51 percent from the prior 4-week average. Increases primarily for Turkey (11,400 RB), Pakistan (7,500 RB, including 1,800 RB switched from Vietnam and decreases of 700 RB),

Bangladesh (3,500 RB, switched from Vietnam), Vietnam (3,500 RB), and China (3,500 RB), were offset by reductions for Japan (1,300 RB). For 2021/2022, net sales of 116,400 RB were primarily for Turkey (58,600 RB), Pakistan (25,400 RB), Vietnam (13,200 RB),

Guatemala (7,000 RB), and China (4,900 RB). Exports of 185,900 RB were down 37 percent from the previous week and 31 percent from the prior 4-week average. Exports were primarily to Vietnam (38,200 RB), Pakistan (32,500 RB), Turkey (22,200 RB), Mexico (22,100

RB), and China (22,100 RB). Net sales of Pima totaling 6,000 RB were up 10 percent from the previous week and 25 percent from the prior 4-week average. Increases were primarily for India (3,400 RB), Pakistan (1,000 RB), China (400 RB), Turkey (400 RB), and

Germany (400 RB). Total net sales for 2021/2022, of 300 RB were for Japan. Exports of 3,400 RB–a marketing-year low–were down 82 percent from the previous week and 76 percent from the prior 4-week average. The destinations were primarily to India (1,100

RB), Pakistan (800 RB), Turkey (600 RB), Greece (400 RB), and Peru (300 RB).

Exports

for Own Account:

For 2020/2021, new exports for own account totaling 1,000 RB were for Vietnam. The current exports for own account outstanding balance of 5,700 RB is for China

(4,700 RB) and Vietnam (1,000 RB).

Hides

and Skins:

Net sales of 337,300 pieces for 2021 were down 15 percent from the previous week and 32 percent from the prior 4-week average. Increases primarily for China (253,000 whole cattle hides, including decreases of 4,900 pieces), South Korea (42,600 whole cattle

hides, including decreases of 800 pieces), Mexico (18,900 whole cattle hides, including decreases of 800 pieces), Thailand (10,300 whole cattle hides, including decreases of 100 pieces), and Brazil (6,200 whole cattle hides, including decreases of 100 pieces),

were offset by reductions for India (700 pieces). Total net sales reductions for 2021 of 100 kip skins were for Belgium. Exports of 284,300 pieces were down 26 percent from the previous week and 21 percent from the prior 4-week average. Whole cattle hides

exports were primarily to China (199,300 pieces), South Korea (34,600 pieces), Mexico (18,900 pieces), Brazil (10,700 pieces), and Thailand (10,600 pieces). In addition, exports of 1,300 kip skins were to Belgium.

Net

sales of 261,000 wet blues for 2021 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for Vietnam (90,500 unsplit, including decreases of 100 unsplit), Italy (74,100 unsplit, including decreases of 100 unsplit

and 100 grain splits), China (57,900 unsplit, including decreases of 100 unsplit), Thailand (16,700 unsplit), and Brazil (12,100 unsplit). Total net sales for 2022 of 42,800 unsplit were for Italy. Exports of 123,500 wet blues were up 4 percent from the

previous week, but down 17 percent from the prior 4-week average. The destinations were to China (33,100 unsplit), Vietnam (32,500 unsplit), Italy (19,800 unsplit and 3,200 grain splits), Taiwan (16,200 unsplit), and Mexico (6,200 grain splits and 2,600 unsplit).

Net sales of 334,700 splits were reported for Taiwan (168,000 pounds), Vietnam (164,900 pounds), and China (1,800 pounds). Exports of 75,500 pounds were to China.

Beef:

Net

sales of 9,300 MT reported for 2021 were down 61 percent from the previous week and 44 percent from the prior 4-week average. Increases primarily for Japan (3,000 MT, including decreases of 700 MT), Mexico (1,800 MT), China (1,600 MT, including decreases

of 100 MT), Taiwan (700 MT, including decreases of 200 MT), and South Korea (600 MT, including decreases of 700 MT), were offset by reductions for Indonesia (100 MT). Exports of 15,500 MT were down 13 percent from the previous week and 15 percent from the

prior 4-week average. The destinations were primarily to Japan (4,100 MT), South Korea (3,800 MT), China (3,300 MT), Taiwan (1,100 MT), and Mexico (1,000 MT).

Pork:

Net

sales of 10,600 MT reported for 2021 were down 76 percent from the previous week and 68 percent from the prior 4-week average. Increases primarily for Mexico (5,300 MT, including decreases of 1,100 MT), Japan (3,100 MT, including decreases of 200 MT), Honduras

(900 MT), Colombia (800 MT, including decreases of 100 MT), and Chile (500 MT), were offset by reductions primarily for China (1,300 MT). Exports of 25,200 MT–a marketing-year low–were down 17 percent from the previous week and 25 percent from the prior

4-week average. The destinations were primarily to Mexico (11,400 MT), China (4,900 MT), Japan (3,500 MT), Canada (1,300 MT), and South Korea (1,200 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.