PDF Attached

EXPORT

SALE RETRACTION (FAS-ESR-068-22)

The

daily export sale announced by FAS this morning is withdrawn based on updated information received from the exporter. FAS-ESR-068-22 had reported the sale of 133,000 metric tons of corn for delivery to China during the 2022/2023 marketing year.

https://www.fas.usda.gov/newsroom/export-sales-china-17

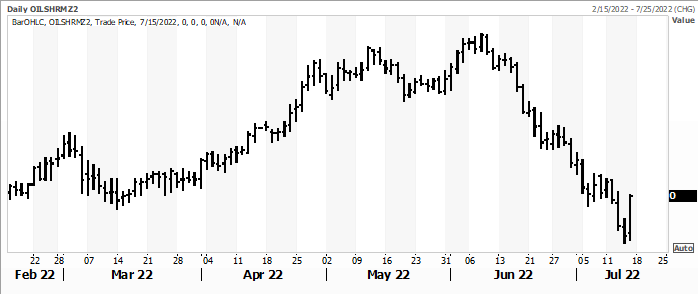

Oil

share rebounded with sharply higher soybean oil and lower meal. We think that was technical. Soybeans ended mixed with old crop on the defensive. US weather was mostly unchanged and there will be some rain for the Midwest for the week ending July 24th.

Corn was mostly higher, but gains were limited from lower Chicago wheat. The weakness in wheat reflected good rain over the past week for Canada and US spring areas, along with harvesting pressure in France.

Indonesia

on Saturday announced they will remove all palm export levies until August 31 and set the max palm oil export tax of $240/ton from September 1 when the reference price is above $1,500 per ton.

World

Weather Inc.

WEATHER

TO WATCH AROUND THE WORLD

-

No

significant theme changes were noted around the world overnight -

Much

of Europe continues drying out and this trend will last for the next ten days with temperatures hot in much of the west through the weekend and eventually spreading into central parts of the continent next week

-

Heat

and dryness will prevail through all next week, despite a few showers -

Extreme

highs in the 80s and 90s will be common across the continent this weekend into next week while western areas see some extremes of 96 to 108 degree readings across France and to 113 in Spain -

Germany

could eventually see a couple of extreme temperatures near 100 as well -

Crop

and livestock stress will threaten production for grains, oilseeds, milk, fruits and vegetables as well as result in lower animal weight gains -

Cooling

fuel demand will be quite strong -

Far

northeastern Europe will receive most of the significant rainfall in the continent over the next ten days -

Europe

weather Thursday was mostly dry and heating up in the west -

Rain

did fall from Czech Republic through southern Poland to northwestern Ukraine and part of Belarus with amounts to 0.68 inch -

All

other areas were dry -

Highest

temperatures were in the 90s to near 100 in central and southern France and southwestern Germany as well as northwestern Italy -

Spain

was hottest with widespread upper 90- and lower 100 degree readings and an extreme of 111 Fahrenheit in southern parts of the nation -

Highest

temperatures in northern France, southern U.K. and the remainder of Germany were in the upper 70s and 80s.

-

Russia’s

Southern Region will experience some periodic showers over the next ten days supporting “some” improvement for crop and field conditions after recent drying, but much more rain will be needed.

-

The

bulk of Russia’s Southern Region has low soil moisture and is experiencing some crop moisture stress -

Most

other areas in Russia, northern Ukraine, Belarus and the Baltic States will see rain routinely during the next couple of weeks resulting in moisture abundance -

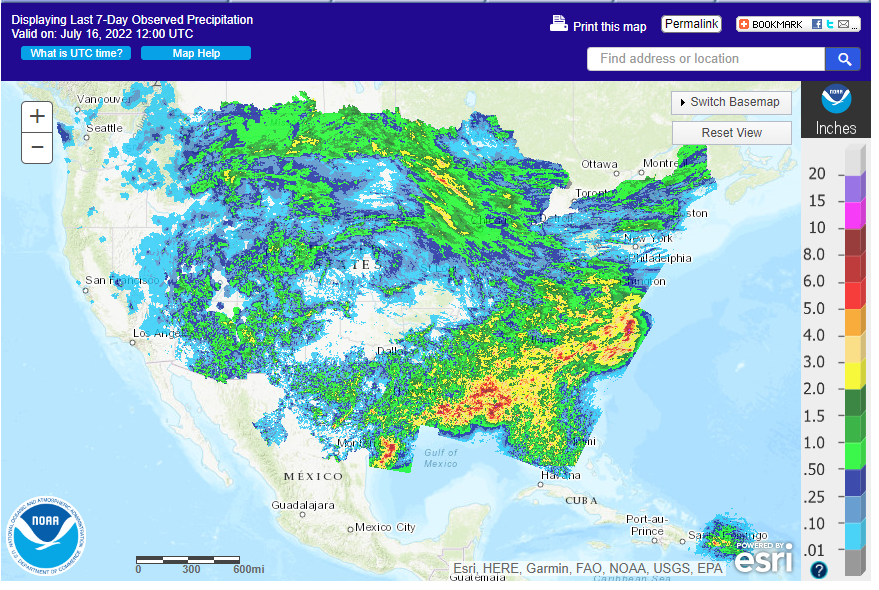

U.S.

weather has not changed much overnight -

Net

drying occurred in most of the nation’s crop areas, although some showers occurred near the Gulf of Mexico coast -

Hot

and dry weather is expected from South Dakota to Texas as well as portions of the northern Delta, Missouri and southwestern Iowa -

High

temperatures will be in the 90s to 108 degrees Fahrenheit frequently in the next week to ten days from South Dakota to Texas and in the upper 80s and 90s from southern Minnesota through Missouri and the northern Delta -

A

few extremes near 100 will occur as far east as the Missouri River -

Rainfall

will be minimal in most of these areas, although some weekend rain is possible in a part of Missouri and Sunday into Monday for the northern Delta -

Crop

moisture and heat stress will be greatest in the Plains states, but there will also be some milder heat and dryness from southwestern Iowa and eastern Kansas through the northern Delta; including most of Missouri

-

Crop

stress will also present a threat to yields especially late season crops -

Cotton,

corn and sorghum in the southern Plains has already lost production potential and more losses are likely -

Timely

rainfall will impact other areas in the northern and eastern U.S. Midwest through the next ten days and that should help support favorable corn and soybean development -

A

few pockets of dryness will prevail and must be watched for possible expansion later in the summer -

Lower

U.S. Delta and southeastern states weather will be most favorable for crop development during the next two weeks -

U.S.

Pacific Northwest will be dry and very warm to hot at times over the next ten days -

No

precipitation fell Thursday and highest temperatures reached over 100 degrees in a part of the Snake River region -

Most

other afternoon temperatures were in the upper 80s and 90s Fahrenheit -

Stress

to crops and livestock has been widespread, and no relief is expected -

No

drought relief in most of the far western U.S. until late autumn at the earliest -

Canada’s

southern Prairies will experience net drying conditions during much of the coming week to ten days -

However,

a weather disturbance moving east out of southern Alberta Sunday into Monday will produce significant rain in a relatively narrow band relieving some of the dryness -

Rain

totals of 050 to 2.50 inches will be possible -

Parts

of Ontario, Canada need rain while Quebec crops continue to develop favorably with timely rainfall and warmer than usual temperatures

-

Drought

in northeastern Mexico and the southern U.S. Plains is unlikely to change in the next two weeks

-

Most

likely the only way drought will break in these areas will be from a tropical cyclone and none are expected for a while – at least not in that region.

-

Mexico

rain will be most abundant in the west and southern parts of the nation -

Argentina

rainfall will continue restricted during the next ten days except in east-central and northeastern parts of the nation where rain is expected periodically -

The

driest areas will be in central and southern Buenos Aires, La Pampa and southern Cordoba where little to no rain is expected for a while -

South

America temperatures over the next week will be near to below average in northern and eastern Argentina while above normal in central and northern crop areas of Brazil -

Brazil

rainfall will be minimal except in Atlantic coastal areas and from the southernmost parts of Mato Grosso do Sul and Parana into Rio Grande do Sul and Paraguay during the next ten days -

Some

of the advertised rain will be heavy from Uruguay into Rio Grande do Sul where 1.00 to 3.00 inches and local totals over 4.00 inches are expected

-

Good

drying conditions are likely elsewhere supporting Safrinha crop maturation and harvest progress -

India’s

monsoon will continue to perform aggressively over the next two weeks with widespread rain of significance expected along the west coast and from Odisha and northeastern Andhra Pradesh to Maharashtra, Madhya Pradesh, Gujarat and Rajasthan -

Only

far southern and some east-central India locations will receive lighter than usual precipitation -

Uttar

Pradesh, Jharkhand and Bihar have been driest recently and need significant rain -

Uttar

Pradesh should get rain in the second half of next week -

Summer

crop development will advance well, although flooding has been a problem for a few central production areas and replanting may be necessary -

China

rainfall is expected to be periodic and often abundant in east-central and some northeastern crop areas while the interior southeast is drier biased -

Excessive

rain events should not occur as often as they have been, but the nation will continue very wet and would benefit from some drying -

Recent

drier and warmer weather in east-central China has helped to improve crop and soil conditions -

Parts

of China need sunnier weather to induce better drying conditions after recent excessive rainfall. Crop damage has occurred in various areas in recent weeks because of too much moisture and serious flooding. -

China’s

Xinjiang province continues to experience relatively good weather -

A

few showers and thunderstorms are expected, but most of the region will be dry with temperatures varying greatly over the week to ten days -

Sumatra,

Indonesia will continue receiving lighter than usual rainfall over the coming week, although there will be sufficient amounts to support most crop needs -

Greater

rain is expected in the July 21-27 period -

All

other Southeast Asian nations will experience an abundance of rainfall during the next few weeks resulting in some flooding

-

Southern

Australia will get periodic rainfall southern wheat, barley and canola production areas through the next ten days -

Winter

crops are establishing well -

South

Australia needs greater and more frequent rain -

South

Korea rice areas are still dealing with a serious drought, despite some rain that fell recently.

-

Some

rain is expected over the next couple of weeks and it should gradually be enough to ease dryness and crop stress -

East-central

Africa rainfall will be greatest in central and western Ethiopia and lightest in parts of Uganda.

-

Tanzania

is normal dry at this time of year and it should be that way for the next few of weeks -

Some

areas in Kenya are expected to trend wetter in the next ten days -

West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally -

Some

greater rain would still be welcome in the drier areas of Ivory Coast -

Cotton

areas are expecting much greater rainfall in the next couple of weeks -

South

Africa’s crop moisture situation is favorable for winter crop emergence, although some additional rain might be welcome -

Restricted

rainfall is expected for a while -

Central

America rainfall will continue to be abundant to excessive and drying is needed -

Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely -

Today’s

Southern Oscillation Index was +14.11 and it will move erratically lower during the coming week -

New

Zealand weather is expected to be well mixed over the next ten days -

Temperatures

are expected to be a little milder than usual -

Rain

will be heavy in this first week of the outlook in western portions of South Island and below average elsewhere -

Late

July rainfall will increase again in North Island and northern portions of South island

Source:

World Weather INC

Monday,

July 18:

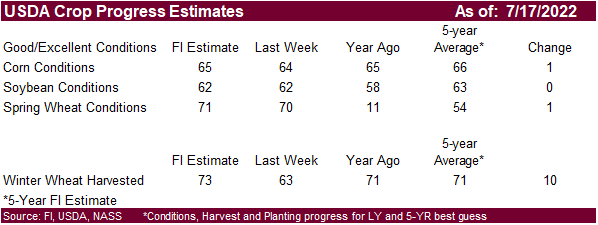

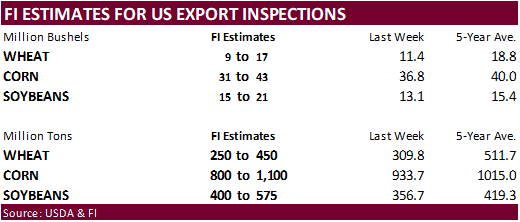

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop conditions for spring and winter wheat, corn, soybeans and cotton, 4pm - China’s

second batch of June trade data, including corn, pork and wheat imports - HOLIDAY:

Japan

Tuesday,

July 19:

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction

Wednesday,

July 20:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - China’s

third batch of June trade data, including soy, corn and pork imports by country - Malaysia’s

July 1-20 palm oil export data

Thursday,

July 21:

- International

Grains Council releases monthly report - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

total milk and red meat production, 3pm

Friday,

July 22:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - US

cattle inventory; cold storage data for beef, pork and poultry, 3pm

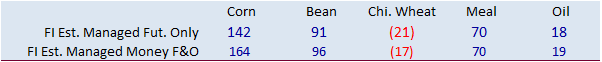

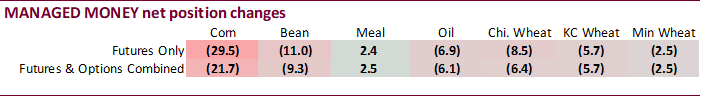

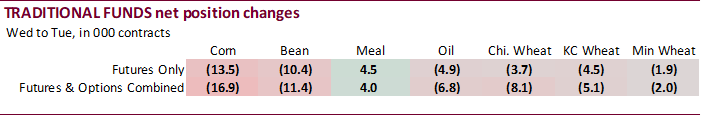

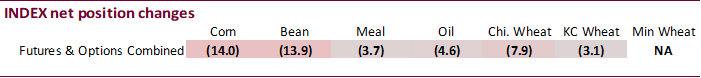

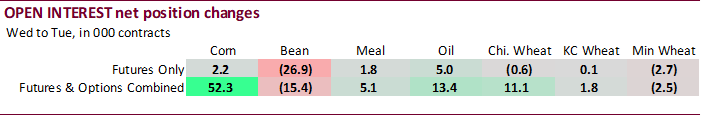

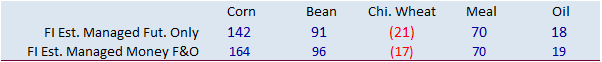

CFTC

Commitment of Traders

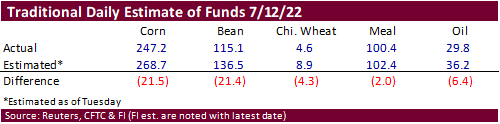

The

funds sold more than expected corn and soybeans than expected. The Chicago wheat position was near flat and now thought to be net short 6,400 contracts, futures only, as of Friday. The report is seen neutral for prices.

Reuters

Table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

66,874 -6,575 391,553 -14,046 -407,081 13,767

Soybeans

30,653 -2,911 156,331 -13,852 -154,078 11,536

Soyoil

450 -5,855 92,017 -4,614 -95,629 11,686

CBOT

wheat -48,176 -739 121,520 -7,919 -64,462 9,063

KCBT

wheat -5,518 -2,537 49,713 -3,050 -41,488 5,079

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

151,174 -21,693 262,817 -7,152 -411,514 17,200

Soybeans

95,711 -9,337 100,057 -4,999 -157,180 11,147

Soymeal

68,290 2,513 80,735 -1,393 -189,924 -5,648

Soyoil

18,877 -6,052 76,951 -3,222 -105,576 11,228

CBOT

wheat -6,444 -6,402 62,319 821 -51,080 7,658

KCBT

wheat 16,387 -5,650 26,161 383 -35,360 4,167

MGEX

wheat 2,654 -2,477 1,233 568 -5,324 1,110

———- ———- ———- ———- ———- ———-

Total

wheat 12,597 -14,529 89,713 1,772 -91,764 12,935

Live

cattle 18,080 3,782 59,636 -1,654 -95,402 -3,492

Feeder

cattle -5,809 1,722 3,401 -244 5,895 -652

Lean

hogs 39,934 11,450 49,694 -2,851 -77,775 -8,746

Other

NonReport Open

Net Chg Net Chg Interest Chg

Corn

48,869 4,791 -51,346 6,854 1,906,814 52,306

Soybeans

-5,683 -2,038 -32,907 5,226 790,441 -15,400

Soymeal

19,213 1,520 21,686 3,009 440,090 5,054

Soyoil

6,586 -738 3,163 -1,217 427,432 13,408

CBOT

wheat 4,087 -1,674 -8,883 -404 398,172 11,096

KCBT

wheat -4,482 592 -2,706 508 172,630 1,792

MGEX

wheat 2,678 521 -1,241 277 63,187 -2,511

———- ———- ———- ———- ———- ———-

Total

wheat 2,283 -561 -12,830 381 633,989 10,377

Live

cattle 20,279 633 -2,592 732 330,868 -10,617

Feeder

cattle 608 -560 -4,096 -266 52,496 -1,845

Lean

hogs -809 271 -11,045 -124 256,385 4,840

Macros

US

Univ. Of Michigan Sentiment Jul P: 51.1 (est 50.0; prev 50.0)

–

Current Conditions: 57.1 (est 53.7; prev 53.8)

–

Expectations: 47.3 (est 47.0; prev 47.5)

–

1-Year Inflation: 5.2% (est 5.3%; prev 5.3%)

–

5-10 Year Inflation: 2.8% (est 3.0%; prev 3.1%)

US

Capacity Utilization (M/M) Jun: 80.0% (est 80.8%; prevR 80.3%)

US

Manufacturing (SIC) Production (M/M) Jun: -0.5% (est -0.1%; prevR -0.5%)

Labor

Forecast Predicts 9.6% Increase In Demand For Temporary Workers For Q3 2022

95

Counterparties Take $2.154 Tln At Fed Reverse Repo Op (prev $2.207 Tln, 97 Bids)

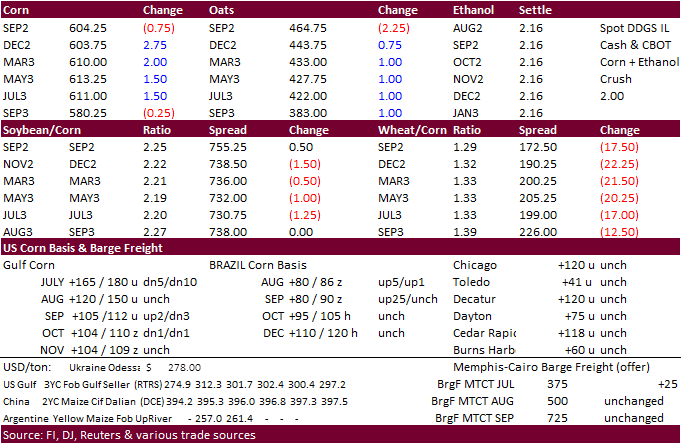

Corn

·

CBOT corn

ended mostly higher on Friday in large part to US weather concerns, but gains were trimmed from lower Chicago and KC wheat.

·

Funds were net even in corn.

·

Overall fundamentals have not changed.

·

Hot and dry US weather expected next week could limit downside risk in corn.

·

EXPORT SALE RETRACTION (FAS-ESR-068-22) The daily export sale announced by FAS this morning is withdrawn based on updated information received from the exporter. FAS-ESR-068-22 had reported the sale of 133,000 metric tons of

corn for delivery to China during the 2022/2023 marketing year.

September

corn is seen in a $5.50 and $7.50 range

December

corn is seen in a wide $5.00-$8.00 range

·

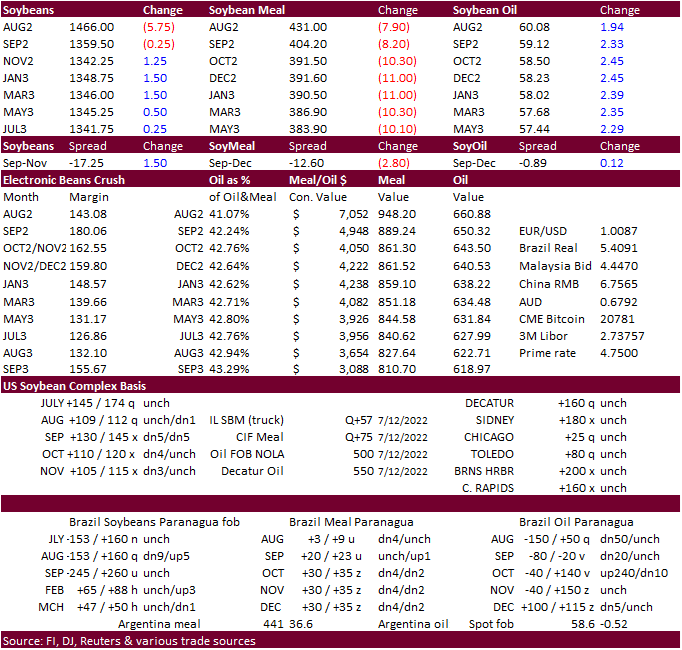

The US soybean complex was mixed. Soybeans ended 5.75 cents lower for August, September was down 0.25 and November up 1.25 cents.

·

Funds were even in soybeans, sold 5,000 meal and bought 6,000 soybeans oil.

·

Brazil’s 2022-23 was estimated to increase 2.6% to a record, and production could end up at 151.5 million tons, also a record, according to Safras & Mercado. The growth in soybean area is expected to slow over the long term if

producers plant more corn amid potential exports to China.

·

China soybean reserve sales of imported soybeans were small again, a signal soybean procurements might be slow for the short term.

·

Ridging across the US is expected to restrict rain through June 28, but some rain is in the forecast for next week.

·

Indonesia on Saturday announced they will remove all palm export levies until August 31 and set the max palm oil export tax of $240/ton from September 1 when the reference price is above $1,500 per ton.

Earlier

this week we heard some palm oil in storage tanks were degrading in quality. End of May Indonesia palm stocks increased 18.5% from the previous month to 7.23 million tons.

·

Indonesia exported only 678,000 tons of palm oil in May, down 77 percent from May 2021. But during this period, the export ban was in place to May 23 (started April 28).

·

ITS: Malaysian 1-15 July palm oil exports were 518,520 tons, down 13.7 percent from same period month ago. AmSpec reported a 5.6 percent decrease to 499,964 tons.

·

Malaysia September palm was down 14 percent

for the week.

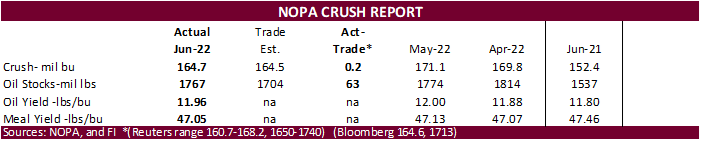

NOPA

was released early Friday morning and crush came in near trade expectations. Soybean oil stocks were 63 million pounds above trade expectations at 1.767 billion pounds (we were at 1.740 billion). We are thinking of shaving 50 million pounds off 2021-22 US

soybean oil demand, most for biofuel feedstock.

Export

Developments

·

USDA seeks 2,230 tons of vegetable oils for export on July 17 for Aug 16-Sep 15 shipment.

·

China sold less than 15,000 ton of soybeans out of reserves Friday, from little more than 500,000 tons offered.

·

China looks to sell a half a million tons of soybeans out of reserves on July 22.

December

oil share rebounded

Source:

Reuters and FI

Updated

7/14/22

Soybeans

– August $13.90-$16.00

Soybeans

– November is seen in a wide $12.75-$16.50 range

Soybean

meal – August $400-$485

Soybean

oil – August 56.00-62.00

·

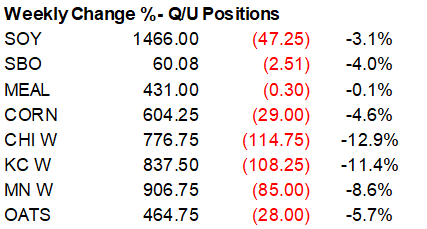

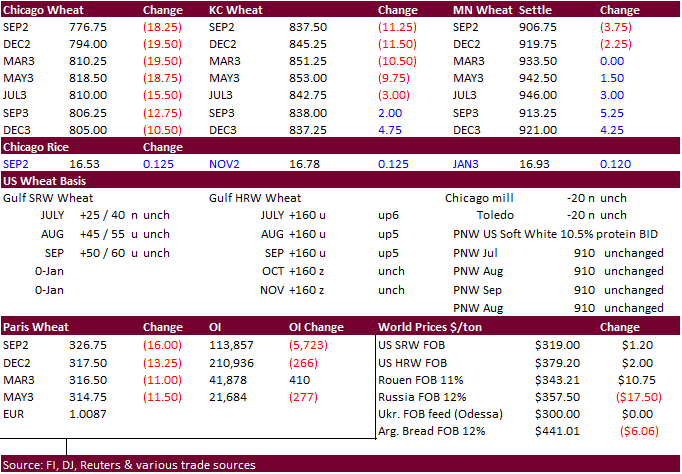

US wheat futures ended mostly lower (MN mixed) on follow through selling as US spring wheat areas received rain and Canadian Prairie crop conditions stabilized. France soft wheat harvest pressure added to the negative undertone.

Argentina crop prospects are deteriorating though. The five major global suppliers of exportable wheat is still expected to end up at multi year lows, for stocks to use, by the end of the crop season.

·

Chicago wheat is priced at pre-war levels. For the week Chicago was down 114.75 cents, a 12.9% decline.

·

We revised our September and December price ranges (below).

·

Funds sold an estimated net 7,000 Chicago wheat contracts.

·

France collected 50 percent of this year’s soft wheat crop through July 11, up from 14 percent week earlier and compares to 3 percent year ago. 64% of soft wheat was in good or excellent condition, up from 63% the previous week

but down from 76% last year, according to FranceAgriMer.

·

Paris wheat was down 16 euros at 325.50, near its contract low.

·

Buenos Aires Grains Exchange estimated the Argentina wheat crop at 17.7 million tons, down from previous 18.5 million tons. It mirrors another slash this week to the crop. Argentina’s Rosario Grains Exchange lowered their wheat

production estimate to 17.7 million tons from previous 18.5 million. The expected area shrank due to dryness.

·

Russia issued proposals to help Ukraine Black Sea exports and apparently, they are supported by negotiators. A deal might be reached next week. Ukraine looks forward to signing a deal, according to a senior Ukraine official

talking with Reuters.

·

Meanwhile, Russia has increased military operations in Ukraine. Missiles hit the northeastern town of Chuhuiv in Kharkiv region.

·

Asian wheat importers were searching around for Black Sea and EU wheat cargoes late in the week, perhaps after the decline in prices.

US

Wheat Associates

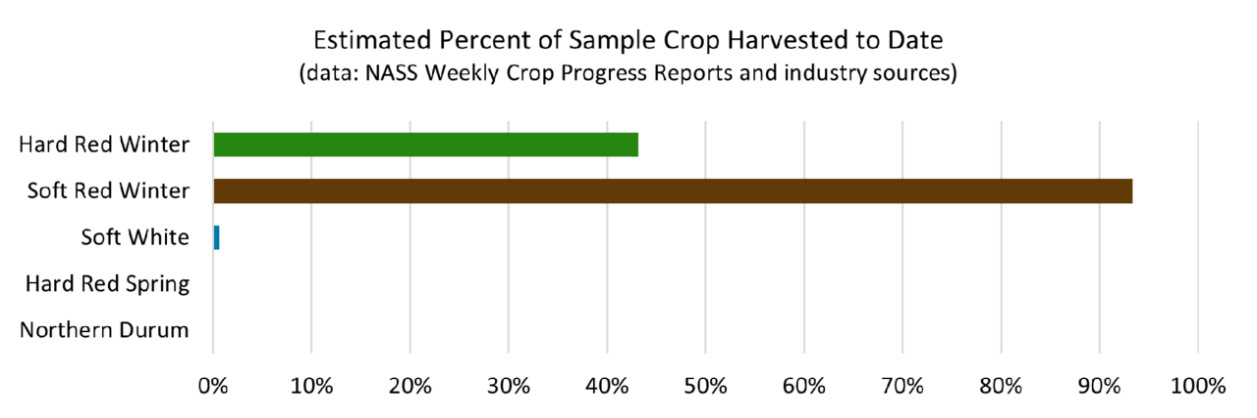

“The

HRW harvest is 43% complete in sampled states with 300 samples in the lab for testing. The SRW harvest is winding down and currently grades U.S. #1 SRW. Conditions for the PNW SW crop remain very good and test cutting has begun in the drier areas of Oregon

and Washington. The HRS and Northern durum crops are advancing steadily in good condition.”

·

The Philippines bought 40,000 tons of feed wheat for October 10 through November 10 shipment.

·

Another group in the Philippines bought 110,000 tons of feed wheat, at $376.50 c&f for Q4 shipment.

·

Pakistan seeks 300,000 tons of wheat, set to close July 18 for Aug 1-25 shipment.

·

Jordan seeks 120,000 tons of wheat on July 19 for possible shipment sometime in November and/or December.

Rice/Other

·

None reported

Updated

7/16/22

Chicago

– September $7.50 to $9.00 range, December $7.00-$11.00

KC

– September $7.85 to $10.25 range, December $8.00-$12.00

MN

– September $8.50‐$11.00, December $8.00-$12.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.