PDF Attached

Soybean

complex and wheat ended higher and corn & oats lower. See our corn section that touches on corn trend yields and conditions.

WASHINGTON,

July 16, 2021–Private exporters reported to the U.S. Department of Agriculture export sales of 134,000 metric tons of soft red winter wheat for delivery to China during the 2021/2022 marketing year.

Past

7 days

WORLD

WEATHER INC.

WORLD

WEATHER HIGHLIGHTS FOR JULY 16, 2021

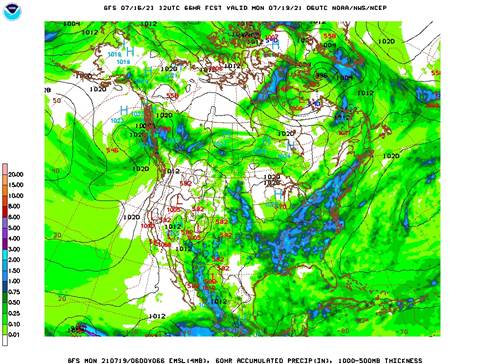

- Today’s

06z GFS model run brought heavy rain to southeastern Minnesota, northeastern Iowa and western Wisconsin during the second weekend of the forecast.

- That

event is overdone and not likely to verify, although a few showers might occur.

- The

general theme of weather has not changed overnight for North America. - Canada’s

Central and southern Prairies, the northwestern Corn Belt and northern U.S. Plains will have a tough time getting enough rain to make any difference in soil moisture event though some scattered storms are expected tonight and Saturday night in the Dakotas.

- Excessive

heat is expected in some of these production areas next week and into the following weekend - Showers

are still advertised to ease dryness in Russia over the coming week to ten days - Dryness

will remain a concern for southern portions of Russia’s Southern Region and Kazakhstan during the next ten days - Rain

in southeastern Europe will help heal crop stress and dryness in the Balkan Countries.

- Less

rain is expected in central Europe reducing concerns over small grain quality in France and Germany this weekend and next week - China

will be bracing for a tropical cyclone during mid-week next week - Otherwise,

scattered showers will continue to intermix with periods of rain - Recent

flooding in China damaged some crops and the drier outlook is very important - India’s

rainfall should improve in the coming week to ten days. - Northwestern

crop areas should finally get at least some rain - Ghana

and Ivory Coast will continue to dry down - Coolness

in Brazil will be mostly an issue for some of its wheat crop due to frost and freezes Tuesday and Wednesday - No

permanent crop damage is expected, but some of the crop may be burned back by the cold - Corn

is mature enough to withstand and frost or light freezes - Coffee,

citrus and sugarcane areas are not likely to encounter much potential for damaging cold, although a few patches of soft frost might occur Thursday and Friday - Australia

weather will remain favorably mixed - Southeast

Asia crop weather will continue either good or improving - Argentina

winter crops would benefit from some rain

Source:

World Weather Inc.

Bloomberg

Ag Calendar

Friday,

July 16:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Cocoa

Association of Asia releases 2Q cocoa grinding data

Sunday,

July 18:

- China

customs to publish trade data, including imports of corn, wheat, sugar and pork

Monday,

July 19:

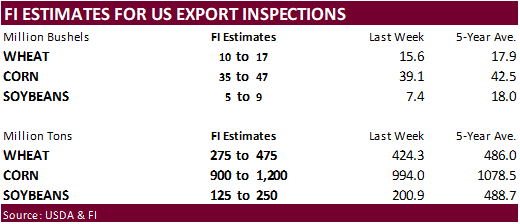

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn, cotton, soybeans, wheat, 4pm - Ivory

Coast cocoa arrivals

Tuesday,

July 20:

- China

customs to publish by-country breakdown for imports of farm goods including soy - New

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data - HOLIDAY:

Malaysia, Indonesia, Singapore

Wednesday,

July 21:

- EIA

weekly U.S. ethanol inventories, production - Malaysia

July 1-20 palm oil export data - HOLIDAY:

India

Thursday,

July 22:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - USDA

to release world supply-demand outlook for orange and its juice - Port

of Rouen data on French grain exports - USDA

total milk, red meat production - U.S.

cold storage data – pork, beef, poultry - HOLIDAY:

Japan

Friday,

July 23:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

cattle on feed, poultry slaughter, cattle inventory - HOLIDAY:

Japan

Source:

Bloomberg and FI

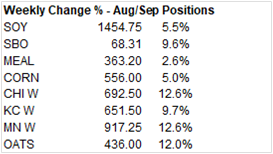

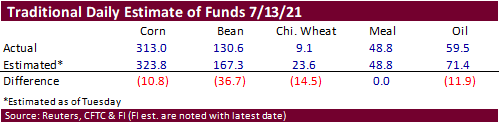

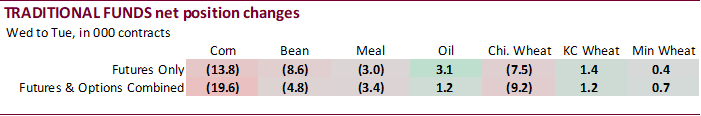

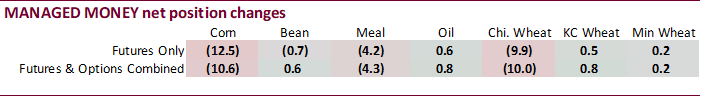

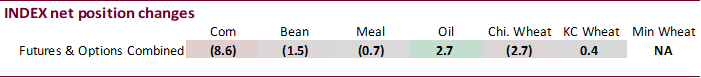

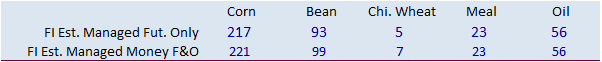

Funds

sold more longs than expected with exception of soybean meal.

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

145,593 -13,522 431,986 -8,572 -526,592 20,534

Soybeans

24,133 -3,262 169,549 -1,498 -180,928 2,551

Soyoil

21,766 2,457 120,988 2,710 -152,031 -7,088

CBOT

wheat -55,159 -8,434 146,905 -2,709 -77,131 10,609

KCBT

wheat 4,949 971 64,665 367 -67,497 -1,838

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

208,799 -10,572 253,757 2,538 -497,877 15,466

Soybeans

82,773 592 79,790 -2,007 -154,667 4,579

Soymeal

16,704 -4,259 88,159 -1,449 -147,982 4,899

Soyoil

48,927 753 110,680 426 -167,498 -3,534

CBOT

wheat -23,636 -10,018 67,014 -1,213 -49,716 9,898

KCBT

wheat 21,667 786 43,990 -179 -61,200 -1,559

MGEX

wheat 8,982 156 2,808 -32 -24,707 272

———- ———- ———- ———- ———- ———-

Total

wheat 7,013 -9,076 113,812 -1,424 -135,623 8,611

Live

cattle 55,114 -7,768 86,699 -458 -157,054 7,830

Feeder

cattle 6,670 -1,159 5,845 -86 -1,216 477

Lean

hogs 69,446 2,239 61,699 -1,296 -132,425 -1,491

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

86,307 -8,994 -50,987 1,561 2,055,274 -40,372

Soybeans

4,859 -5,371 -12,754 2,209 937,499 -7,792

Soymeal

18,176 876 24,942 -66 417,092 -9,824

Soyoil

-1,384 434 9,276 1,921 575,087 -370

CBOT

wheat 20,953 799 -14,615 535 416,511 5,882

KCBT

wheat -2,338 452 -2,119 500 210,612 9,821

MGEX

wheat 1,974 533 10,943 -927 84,473 3,971

———- ———- ———- ———- ———- ———-

Total

wheat 20,589 1,784 -5,791 108 711,596 19,674

Live

cattle 26,840 -85 -11,599 481 341,576 -3,713

Feeder

cattle 1,597 -43 -12,896 811 52,846 -632

Lean

hogs 12,800 -416 -11,520 963 335,442 -326

Source:

Reuters, CFTC & FI

US

Retail Sales Advance (M/M) Jun: 0.6% (est -0.3%; prevR -1.7%; prev -1.3%)

US

Retail Sales Ex-Auto (M/M) Jun: 1.3% (est 0.4%; prevR -0.9%; prev -0.7%)

US

Retail Sales Ex-Auto, Gas (M/M) Jun: 1.1% (est 0.5%; prevR -1.0%; prev -0.8%)

US

Retail Sales Control Group Jun: 1.1% (est 0.4%; prevR -1.4%; prev -0.7%)

Canadian

Housing Starts Jun: 282.1K (est 270K; prevR 286.3K; prev 275.9K)

Canadian

International Securities Transactions May: 20.79B (prevR 9.90B; prev 9.95B)

Canadian

Wholesale Trade Sales (M/M) May: 0.5% (est 1.1%; prevR 0.6%; prev 0.4%)

US

Univ. Of Michigan Sentiment Jul P: 80.8 (est 86.5; prev 85.5)

–

Current Conditions: 84.5 (est 91.0; prev 88.6)

–

Expectations: 78.4 (est 85.0; prev 83.5)

–

1-Year Inflation: 4.8% (est 4.3%; prev 4.2%)

–

5-10 Year Inflation: 2.9% (prev 2.8%)

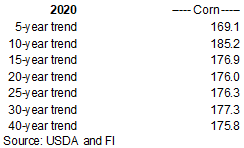

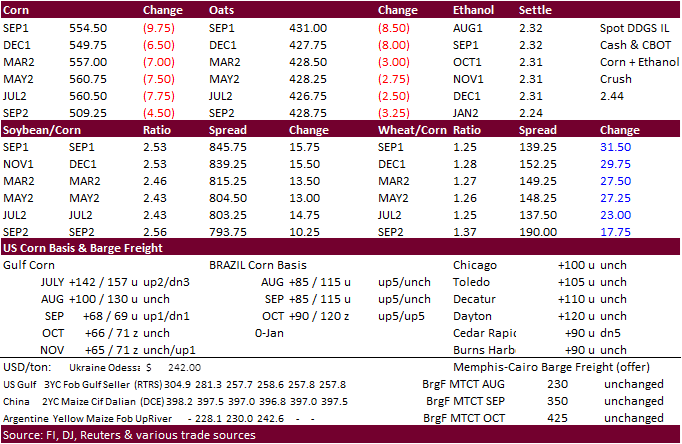

Corn

- Corn

started higher following soybeans and wheat but ended lower. September settled down 8.25 cents at $5.56 and December corn ended down 4.25 cents at $5.52. Both contracts closed near session lows. September was up 26.50 cents this week or 5.0%. Oats were

up 12.0% for the week. - Corn

turned lower in late morning trading apparently after a bearish comment from a weather group suggesting below trend yields for corn are no longer likely, unless August goes hot and dry. Following this there was a lot of talk on Twitter over whether corn yields

will end up below or above trend this year, but some of the comments had no mention how many years they are basing their trend yield (5 years, 10 years, 30?). Today is July 16, so we have a way to go before the August yield settles. Keep in mind NASS surveys

are conducted between 7/28 and 8/6 for the August crop production report. My thinking is if we see no improvement across the Dakota’s, those two states will be a yield drag for national August corn and soybean yields. If we see August yields at or slightly

above USDA’s estimates, I would be not surprised. Since 2013 we have seen larger than expected yields reported by USDA in years were crop conditions had been questionable. Note the 10-year trend for corn is 185.2 while 30-year is 177.3.

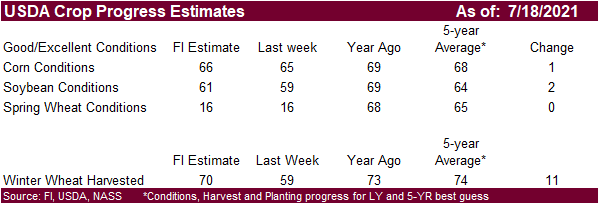

Last

year the USDA G/E rating for corn was 72 percent around August 1. Latest rating for this year was 65. USDA increased the yield last August (2020) to 181.8 bushels per acre from 178.5 from their July working estimate. The trade for August 2020 was 180.4.

Looking at a similar year for corn crop conditions, the early Aug 2018 rating was 61 percent G/E. For that year analysts were looking for the USDA 2018 August corn yield to come in at 175.7. But USDA surprised the trade by reporting the 2018 August yield

at 178.4. A 179.5 yield (USDA 2021 June/July) is achievable this August, or most of the trend yields listed above.

- Note

corn will be ready to be cut in the far southern Delta in about 7-9 days. We are hearing above trend yield potential for much of the Delta.

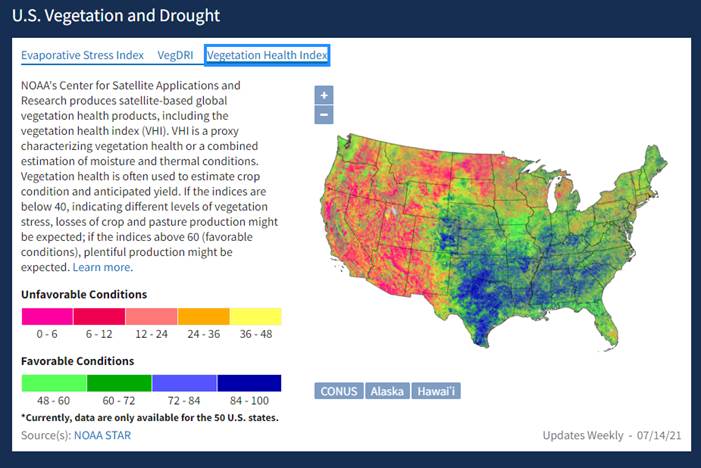

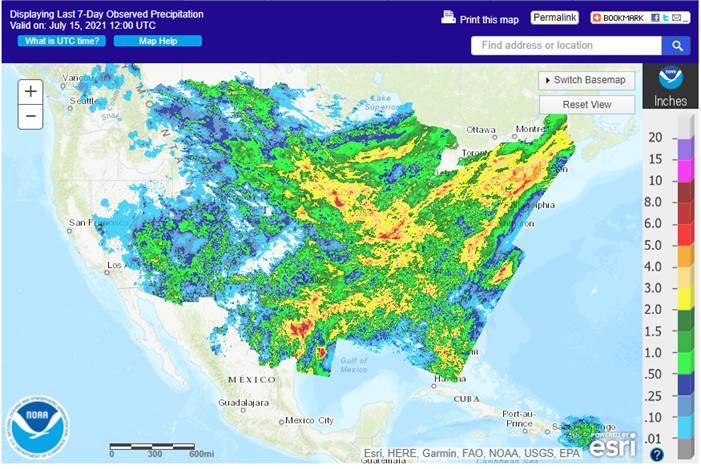

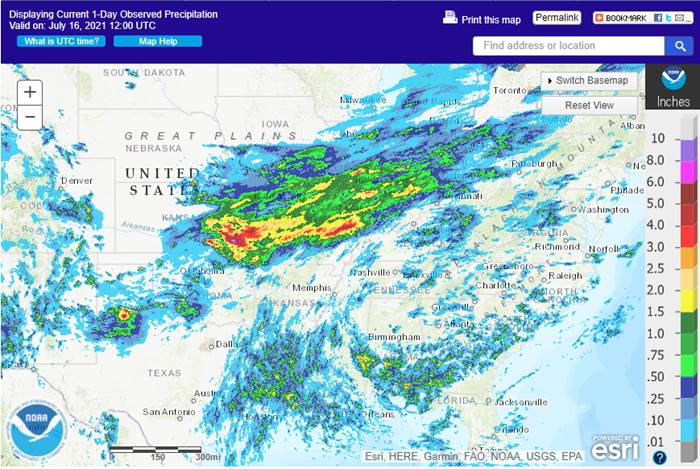

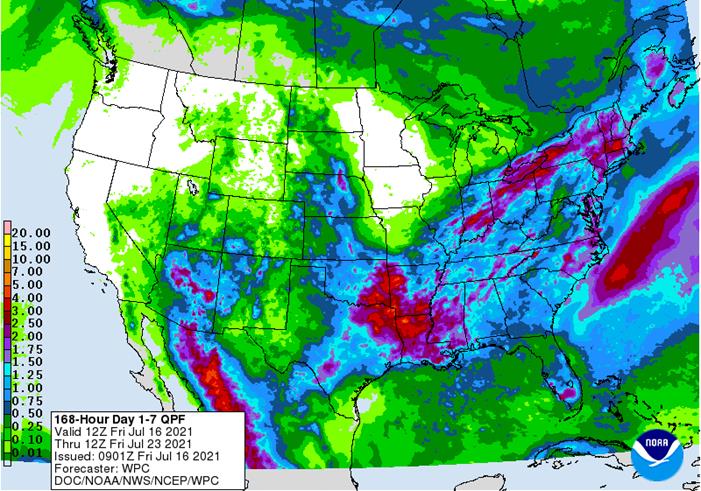

- The

theme for the US calling for restricted rain and hot temperatures for the WCB and upper Great Plains has not changed. Rain next week will be greatest across parts of the ECB and southeast. Past week rainfall should have benefitted crops. On Monday we look

for a 1 point improvement in US corn G/E ratings. - Brazilian

companies started washing out some corn export contracts due to the unfavorable weather for the second corn crop. Some of that corn maybe redirected to the domestic market. Brazil purchases of Argentina corn topped a half a million tons this week.

- A

few cases of ASF were discovered in Germany, 2 at small farms. - China

sold only 12,441 tons of imported US corn at an auction on Friday, 7% of the total offered.

- Ukraine’s

grain exports rose to 926,000 tons in the first half of July, up 206,000 tons from a year earlier (AgMin).

July

16 (Reuters) – The U.S. Court of Appeals for the District of Columbia Circuit ruled on Friday in favor of environmental groups who argued against the U.S. government’s conclusion that biofuel blending obligations posed no danger to species’ habitats. The Environmental

Protection Agency decides on the amount of biofuels that oil refiners must blend into their fuel each year, per the U.S. Renewable Fuel Standard. The United States started the program to help farmers and boost the country’s energy independence. Corn-based

ethanol’s effect on carbon dioxide emissions depends on how the biofuel is made and whether indirect impacts on land use are considered, according to the Energy Information Administration. The court found that the EPA violated the Endangered Species Act by

failing to consult with the U.S. Fish and Wildlife Service and the National Marine Fisheries Service before ruling on biofuel blending obligations for 2019. The court also found that the EPA’s approach to determine the effect of the obligations on the environment

was contrary to record evidence and thus arbitrary and capricious.

Based

on the findings, the court ordered the EPA to reassess the 2019 renewable volume obligation decision.

We

are unsure if this will have any impact on setting biofuel blending obligations for 2020 & 2021.

Export

developments.

- Jordan

seeks 120,000 tons of feed barley on July 28 for Nov/Dec shipment.

September

corn is seen is a$4.75-$6.25 range

December

corn is seen in a $4.25-$6.00 range.

-

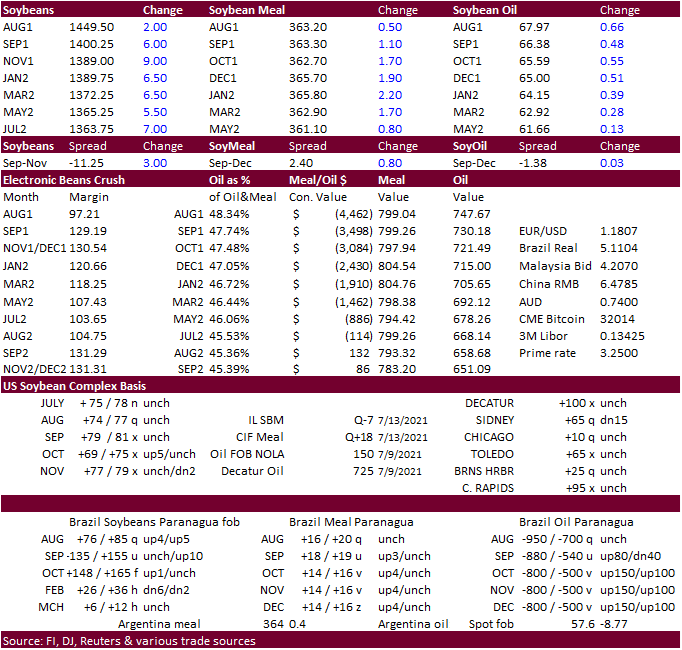

Soybeans

ended higher on strength in soybean oil. Parts of the US Corn Belt will see restricted rain over the next week. As the corn enters the pollination stage, some traders are shifting their focus on soybean development. August is the critical time for soybean

yields. Soybean oil ended 6 consecutive days higher. Soybean meal traded two-sided, ending higher.

-

August

soybeans settled 7.25 cents higher at $14.5475 cents and November ended up 11.75 cents at $13.9175. For the week August soybeans were 75.50 cents higher or 5.5%. August soybean oil was up 100 points and meal up 50 cents. For the week August SBO was up 9.6%

and August meal appreciated 2.6%. -

US

soybean ratings when updated Monday could be up 2 points based on good rain over the past workweek across the eastern Corn Belt.

-

November

Canadian canola rallied 5.40 and is near its contract high made on Wednesday.

-

Argentina

signed into law a revision to biofuel mandates. They took biodiesel down 5 percentage points to 5 percent and left ethanol unchanged at 12 percent (6 percent sugar cane and 6 percent corn ethanol). The Energy AgMin has the right to reduce the biodiesel blend

rate lower to 3% under special economic circumstances. The regulation is valid until 2030.

-

Malaysian

palm futures were 43 higher and closed out the week up 6%. - China

cash crush margins continue to improve and are nearly flat on our analysis looking at new-crop positions. JCI noted China is in need for soybeans for September coverage. There were no USDA 24-hour soybean sales announcements.

- South

Korea’s Agro-Fisheries & Food Trade Corp. seeks around 7,600 tons of GMO-free soybeans on July 21 for arrival in South Korea between Aug. 20 and Oct. 20.

Updated

7/15/21

August

soybeans are seen in a $13.25-$15.25 range; November $11.75-$15.00

August

soybean meal – $330-$410; December $320-$425

August

soybean oil – 64.50-70.00; December 46-67 cent range

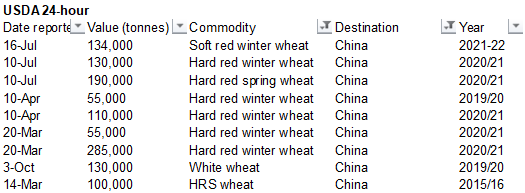

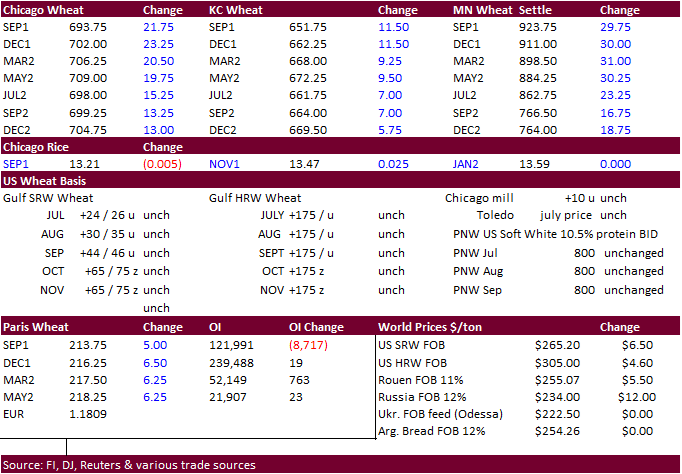

- US

wheat futures sharply higher on global supply concerns. Paris wheat hit a one month high.

- September

Chicago was up 20.50 cents, September KC up 11.25 cents and September Minneapolis up 23.25 cents. For the week Chicago and Minneapolis nearby wheat was up 12.6% and KC increased 9.7%.

- Under

the 24-hour

USDA announcement system, exporters sold 134,000 tons of soft red winter wheat to China. This was a surprise as China normally shows up in the 24-hour system for hard red winter wheat (6 times since 2017). This is the first time they showed up for SRW under

the USDA 24-hour since at least 2017, using our working history. Looking back at USDA export sales history, China booked about 175,000 tons of US soft red wheat in July/August 2020 for September shipment. Prior to that, their last large purchase was nearly

58,000 tons July 2015. But in 2014 the US shipped 3.57 million tons of SRW to China. Looking back at other years shipments were light until 2005, US shipped 724,627 tons.

-

Analyst

Dale Gustafson provided a brief observation of the quality of the wheat from a drive across selected states. He mentioned Idaho and Wyoming temperatures have been near or above 100 degrees. Wheat is headed but appears quite short compared to what he saw in

Kansas and Colorado. Irrigation is running everywhere and high prices with spring wheat appears justified for this. Potato plants look ok but without rain he is not sure irrigation can provide enough water to make a good crop.

- U.S.

northern Plains and Canada’s Prairies will see excessive heat developing this weekend through at least 7 days. Extreme highs of 100 to 110 will be common.

- There

is a chance the Dakota’s will see some rain Sunday through Monday according to the morning and midday weather models.

- US

Wheat Associates: “Despite delays due to rain and humidity, HRW harvest is 38% complete in sampled states with 266 samples in the lab for testing. The SRW harvest is 90% complete and sample collection has ended. The PNW continues to trend hot and dry as harvest

picks up pace; the first SW samples are being delivered to the lab this week. The HRS crop continues to mature at a faster than normal pace as the region struggles with prolonged drought. The northern durum growing region also needs rain.”

- December

Paris milling wheat settled up 6.25 euros, or 3.0%, at 216.00 euros ($255.07) a ton. The contract is up 8.3% over the week and highest since June 8.

- Concerns

are rising over the Russian wheat crop size (heat wave across the Black Sea) and adverse European weather (floods). Extent of crop damage and transportation problems from the floods is not known at this time. We are saddened to hear about the loss of life

and property damage. - French

soft wheat crop ratings declined by 3 points to 76% for the week ending July 12, well above 55% year ago.

- Under

the 24-hour

USDA announcement system, exporters sold 134,000 tons of soft red winter wheat to China.

- Taiwan

Flour Millers’ Association bought 50,000 tons of million wheat from the United States on July 16 for shipment from the U.S. Pacific Northwest coast between Aug. 31 and Sept. 14.

- Results

awaited: Bangladesh’s seeks 50,000 tons of milling wheat on July 15. - Results

awaited: Iran’s GTC seeks 60,000 tons of milling wheat for August and September shipment on Wednesday, July 14. - Bangladesh’s

seeks 50,000 tons of milling wheat on July 18.

- Ethiopia

seeks 400,000 tons of wheat on July 19.

- Pakistan’s

TCP seeks 500,000 tons of wheat on July 27. 200,000 tons are for August shipment, and 300,000 tons are for September shipment.

Rice/Other

- South

Korea seeks 91,216 tons of rice from China, the United States and Vietnam for arrival in South Korea between Oct. 31, 2021, and April 30, 2022.

- Bangladesh

seeks 50,000 tons of rice on July 18. - Mauritius

seeks 6,000 tons of white rice on July 27 for October through December shipment.

Updated

7/12/21

September Chicago wheat is seen in a $5.90-$7.00 range

September KC wheat is seen in a $5.60-$6.70

September MN wheat is seen in a $7.75-$9.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.