PDF Attached

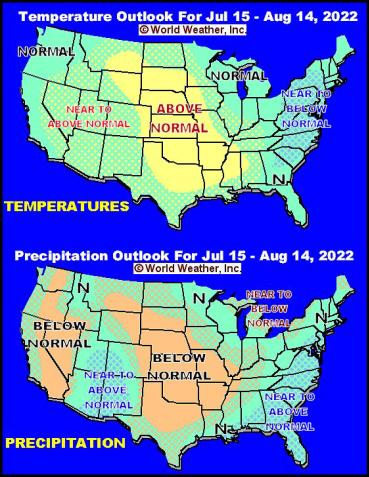

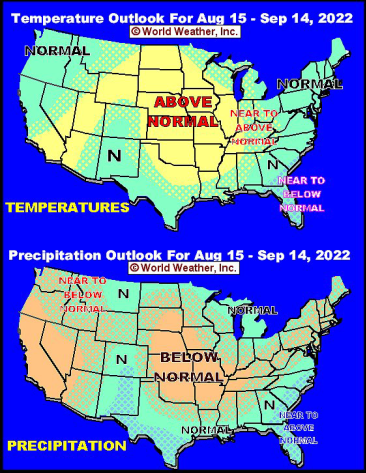

Hot

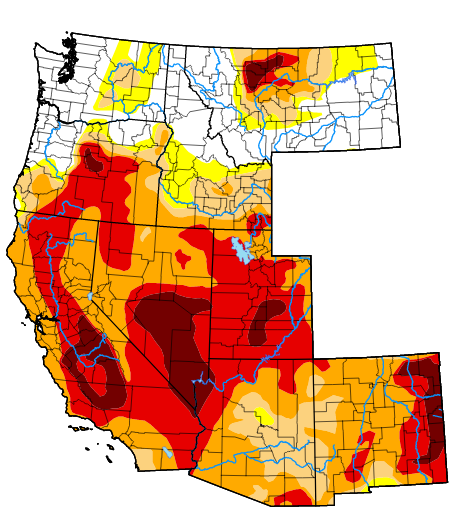

and dry weather forecast for the US over the next week, sharply lower US dollar, and good strength in energy markets supported CBOT futures. Monday’s US weather outlook was mostly unchanged from Friday. US Great Plains and far WCB will see restricted rains

and hot temperatures this week. Expect heat advisories to triggered again several times this week across the far western spring wheat states. EU weather improves over the next two weeks. China’s forecast calls for rain favoring the North China Plains and western

Yangtze Valley crop areas. Argentina will see rain starting Thursday.

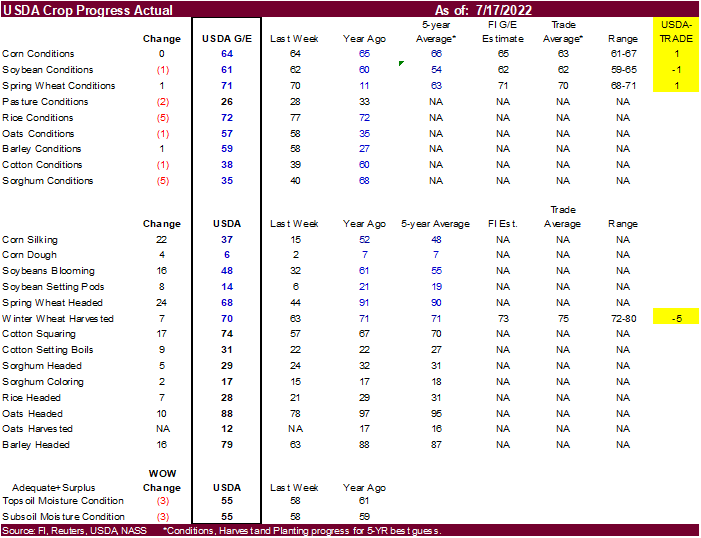

USDA

crop condition highlights

-

US

SOYBEAN – 61 PCT CONDITION GOOD/EXCELLENT VS 62 PCT WK AGO (60 PCT YR AGO) -USDA…….TRADE WAS 62 -

US

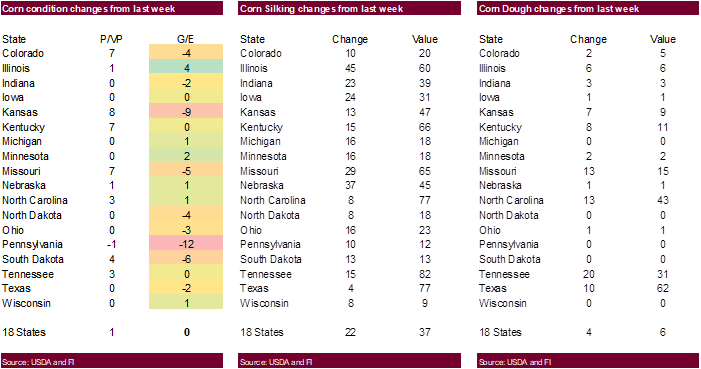

CORN – 64 PCT CONDITION GOOD/EXCELLENT VS 64 PCT WK AGO (65 PCT YR AGO) -USDA…….TRADE WAS 63 -

US

SPRING WHEAT – 71 PCT CONDITION GOOD/EXCELLENT VS 70 PCT WK AGO (11 PCT YR AGO) -USDA…….TRADE WAS 70 -

US

WINTER WHEAT – 70 PCT HARVESTED VS 63 PCT WK AGO (71 PCT 5-YR AVG) -USDA…….TRADE WAS 75 -

US

RICE – 72 PCT CONDITION GOOD/EXCELLENT VS 77 PCT WK AGO (72 PCT YR AGO) -USDA -

US

COTTON – 38 PCT CONDITION GOOD/EXCELLENT VS 39 PCT WK AGO (60 PCT YR AGO) -USDA

Calls:

Soybeans

Steady/Mixed

Soybean

meal Steady

Soybean

oil Steady to Lower

Corn

Down 2-5

Chicago

wheat Down 3-5

KC

wheat Down 3-5

MN

wheat Down 4-7

World

Weather Inc. issued a bullish special outlook Monday afternoon. https://worldweather.cc/

for subscription information.

World

Weather Inc.

WEATHER

TO WATCH AROUND THE WORLD

- U.S.

weekend rainfall occurred mostly as advertised - Rain

fell most significantly from northern Illinois to parts of western and central Ohio with 1.00 to 3.00 inches and local totals of 3.00 to nearly 5.00 inches in west-central Ohio

- Another

area of significant rain fell in northern Missouri and interior southeastern Illinois where 1.00 to 2.00 inches resulted with local totals over 3.00 inches in southeastern Illinois - Rainfall

in Iowa was minimal and the same was true for much of Minnesota, the eastern Dakotas, eastern Nebraska, eastern Kansas, central Missouri, parts of Kentucky and central Michigan - Southern

states – from Oklahoma and much of Texas through the central Delta to the interior parts of the southeastern states – were left dry - Most

of the showers in central Plains were too light for much impact on soil or crop conditions, although locally heavy rain fell in south-central Nebraska benefiting winter wheat and some summer crops - U.S.

Pacific Northwest was dry and warm to hot during the weekend as was California and the Great Basin

- Temperatures

continued hot in the central and southern Plains with highs of 95 to 107 degrees Fahrenheit - U.S.

weather in the coming week will be restricted in the Great Plains and a part of the western Corn and Soybean production areas - A

net loss in soil moisture is expected from portions of the eastern Dakotas and eastern Nebraska through a large part of Iowa and northwestern Illinois as well as eastern Kansas and western Missouri - Rain

in the Delta over the next ten days will vary from 0.25 to 0.80 inch with a few totals of 1.00 to 2.00 inches - Most

of the rain will be quite light - Rain

the northern Midwest from the eastern Dakotas to Michigan will be sufficient to support crops

- Rain

will be greatest from southern Illinois and southeastern Missouri into Ohio and Kentucky along with the southeastern states from Tennessee to Florida, Georgia and the Carolinas - Net

drying is likely in most of the Plains, despite a few showers and thunderstorms in the west-central high Plains - Net

drying is likely in the Pacific Northwest and the northwestern Plains - California

will continue dry - Monsoonal

rainfall is expected to increase from Arizona and New Mexico into the central Rocky Mountain region during the coming week - Temperatures

will turn hotter in the Plains and the western Corn Belt Monday and Tuesday - The

heat will ease during mid-week and then increase again late in the week - Hot

weather will continue into the coming weekend especially in the central and southern Plains and west-central and lower Midwest into the Delta - Extreme

highs in the 90s to 108 degrees Fahrenheit are expected in each of these areas - Central

and southern Plains temperature extremes will rise up to the range of 108 to 113 Fahrenheit - Temperatures

will be more seasonably warm in other areas - U.S.

central and southern Plains, Delta and southeastern states may see a boost in rainfall this weekend and next week as the ridge of high pressure shifts to the west allowing a couple of frontal systems to come into these areas generating some rain - The

bottom line for the United States will be one of continued concern for the west-central and southwestern Corn Belt and Delta, despite some showers. These areas will be warm to hot during much of the forecast period and rainfall could be notably limited which

should raise crop moisture stress. Greater rain must occur soon in some crop areas to prevent moisture and heat stress from threatening summer crop production. The northern and eastern Midwest, however, will continue to see timely rainfall and experience the

best temperatures for aggressive crop development. Dryness will remain in the Pacific Northwest and California where some periodic hot temperatures are expected that may stress crops even though irrigation is widespread. Texas and Oklahoma dryness will remain

widespread threatening corn, sorghum cotton and some soybeans, peanuts and rice this workweek, but there will be a chance for showers and thunderstorms Friday into the weekend and again later next week as a couple of frontal systems push through the region.

- Parts

of Ontario, Canada need rain while Quebec crops continue to develop favorably with timely rainfall and warmer than usual temperatures

- Drought

in northeastern Mexico and the southern U.S. Plains is unlikely to change in the next two weeks

- Most

likely the only way drought will break in these areas will be from a tropical cyclone and none is expected for a while – at least not in that region.

- Mexico

rain will be most abundant in the west and southern parts of the nation - Canada’s

Prairies weekend rainfall was mostly confined to central and northern Alberta, northeastern and east-central Saskatchewan and southern Manitoba where rainfall of 0.25 to 1.00 inch resulted and local totals of up to 1.58 inches in southern Manitoba - Temperatures

were warm to hot with highest readings in the 80s and 90s Fahrenheit - Central

and southwestern Saskatchewan were hottest - Today

and Tuesday rainfall in Canada’s Prairies will be sufficient to ease dryness from central and interior southeastern Alberta through interior southern Saskatchewan to interior southern Manitoba - Rainfall

will vary from 0.30 to 1.50 inches and a few amounts over 2.00 inches - Not

much other precipitation is expected, although a few isolated to scattered showers will be possible - Temperatures

will continue warmer than usual, but not quite as hot as in recent past days - Areas

near the U.S. border may still have need for greater rain after this week has passed, but improvements in crop and field conditions should occur in the interior south - Western

Europe will be impacted by three waves of scattered showers and thunderstorms - The

first is expected Tuesday into Thursday with 0.10 to 0.70 inch and a few totals near 1.00 inch will impact northern France, Germany, Belgium, Netherlands and the U.K.

- A

second wave of rain is expected early next week with another 0.15 to 0.60 inch and a few totals to 0.75 – mostly in the north half of Europe - Another

opportunity for rain will evolve early late next week and early indications do not suggest more than 0.50 inch of moisture – again favoring the north - Temperatures

in western Europe will be hot early this week and then progressively cool to a more seasonably warm regime during the second half of this week, the weekend and next week - Eastern

Europe will turn hotter later this week and into the weekend while rain scatters across the north - Most

of the hottest weather will be in the south from southern Germany and Slovakia into the Balkan Countries where 90s and a few lower 100-degree highs are expected - The

bottom line for Europe over the next two weeks will be a reduction in stress for crops and livestock in France, the U.K., Germany and Belgium, but early week heat stress will be significant. Showers and cooling later this week will bring on “some” welcome

relief, although greater rain will be needed to ensure significant relief to dryness. Southern Europe will be drier than the north over the next two weeks and crop moisture and heat stress is expected to become more widespread especially in the Balkan Countries.

- Russia’s

Southern Region is still advertised to be drier than usual in central parts of the region while rain falls near the Georgia border and in northern parts of the production region - The

area of net drying will be relatively small, but it is an important soybean, corn, sunseed and wheat production region

- Rainfall

will be less than 0.50 inch and soil moisture is already rated short to very short in the region - Temperatures

will be cooler than usual this week and a little more seasonable next week which may conserve soil moisture through lower evaporation rates this week - All

other Russia crop areas will experience frequent bouts of rain for the next couple of weeks resulting in moisture abundance for normal crop development - Temperatures

will be seasonable - Crop

development should advance well - Portions

of northern Ukraine may dry down during the next couple of weeks, but the north is expected to be favorably moist - India’s

monsoon is expected to continue performing favorably with widespread rain across most of the nation during the next couple of weeks - Central

and some northern parts of the nation may be a little too wet at times resulting in some flooding - Sufficient

breaks in the rain are expected to prevent a major flood from occurring - Argentina

rainfall will continue restricted this week except in east-central and northeastern parts of the nation where rain is expected Friday and again early next week - The

driest areas will be in central and southern Buenos Aires, La Pampa and southern Cordoba where little to no rain is expected for a while - Showers

may evolve in a part of this dry region during early to mid-week next week, but confidence is low - The

European model is much wetter than then GFS and It may be overdoing the precipitation - South

America temperatures over the next week will be near to above average with some cooling likely in Argentina and southern Brazil during the middle to latter part of next week - Brazil

rainfall will be minimal except in Atlantic coastal areas and from the southernmost parts of Mato Grosso do Sul and Parana into Rio Grande do Sul and Paraguay during the next week - Rainfall

will be light and some areas will experience net drying - Greater

rain will evolve next week when 1.00 to 3.00 inches may return to the region - Drying

in other areas of Brazil will be great for Safrinha crop harvesting - China

weekend rainfall was greatest in the Yellow River Basin maintaining wet conditions in some northern areas after heavy rain fell for a while last week - Rainfall

varied from 1.35 to more than 3.00 inches - Extreme

amounts reached 4.00 inches in Shaanxi and nearly 10 inches in western Shandong - Lighter

rain fell in the Northeast Provinces where western Heilongjiang was dry and rainfall elsewhere varied from 0.15 to 1.25 inches - A

few local amounts reached 2.75 to nearly 4.00 inches - Temperatures

were warm to hot over the central and interior southeast and mild in the northeast - All

of China’s crop region east of Tibet will get rain at one time or another during the next two weeks and all of it will be good for summer crop development - The

greatest rainfall may occur in Liaoning, Jilin and Heilongjiang this week - Temperatures

will continue near to above normal - China’s

Xinjiang province continues to experience relatively good weather - A

few showers and thunderstorms are expected, but most of the region will be dry with temperatures varying greatly over the week to ten days - The

bottom line for China crop areas is mostly good, but there has been some excessive rain in the east this year that likely damaged crops. Most of the serious flooding is over, but the ground remains saturated in many areas and there is need for more net drying.

World Weather, Inc. believes early rice production in southern China was slashed because of flooding and there has been some damage to grain, oilseed cotton and rice in east-central and northeastern China this year, but it probably has not been as great as

that of last year. Some of the early rice loss could be made up by a bigger late rice crop.

- Hurricane

Estelle was located well east of southwestern Mexico in the eastern Pacific Ocean moving west northwesterly away from land - The

storm poses no threat to North America - There

were no other organized tropical cyclones in the world today - Sumatra,

Indonesia rainfall remained lighter than usual during the weekend some areas staying dry - Below

average precipitation has occurred in many areas from northern and central Sumatra into northwestern Borneo in recent weeks and greater rain is desired - Some

increase in rain is expected this week, but amounts may continue lighter than usual in many areas

- All

other Southeast Asian nations will experience an abundance of rainfall during the next few weeks resulting in some flooding in the Philippines and the Maritime provinces - Recent

rain has improved soil moisture in parts of Thailand after a drier than usual bias earlier this season - Southern

Australia rainfall has been limited recently, but sufficient moisture has been present in most areas to support a well-established winter crop of wheat, barley and canola - Australia

weather in the coming ten days will be favorable for most winter crops - Central

Queensland will get some rain during mid-week this week, although it will be sporadic and mostly light - Rain

totals may range from 0.30 to 1.25 inches and locally more - Western

Australia will get most of the significant rain this week outside of central Queensland - Southeastern

parts of the nation will be driest this week, but rain will impact Victoria next week - South

Korea rice areas are still dealing with a serious drought, despite some rain that fell recently.

- Some

additional rain is expected over the next couple of weeks and it should gradually be enough to ease dryness and crop stress, but production will be down - East-central

Africa rainfall will be greatest in central and western Ethiopia and lightest in parts of Uganda.

- Tanzania

is normally dry at this time of year and it should be that way for the next few of weeks - Some

areas in Kenya are expected to trend wetter in the next ten days - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

greater rain would still be welcome in the drier areas of Ivory Coast - Cotton

areas are expecting much greater rainfall in the next couple of weeks and there is some potential for flooding - Flooding

is also possible in Guinea, Sierra Leone and southern Mali over the next couple weeks

- Mali

has been drier than usual over the past 30 days and rain would benefit cotton – at least for a while - South

Africa’s crop moisture situation is favorable for winter crop establishment, although some additional rain might be welcome - Restricted

rainfall is expected for a while, but the crop is rated better than usual - Central

America rainfall will continue to be abundant to excessive and drying is needed - Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely - Today’s

Southern Oscillation Index was +11.65 and it will move lower during the coming week - New

Zealand weather is expected to be well mixed over the next ten days - Temperatures

are expected to be a little cooler than usual - Rain

will impact all areas at one time or another

Source:

World Weather INC

Monday,

July 18:

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop conditions for spring and winter wheat, corn, soybeans and cotton, 4pm - China’s

second batch of June trade data, including corn, pork and wheat imports - HOLIDAY:

Japan

Tuesday,

July 19:

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction

Wednesday,

July 20:

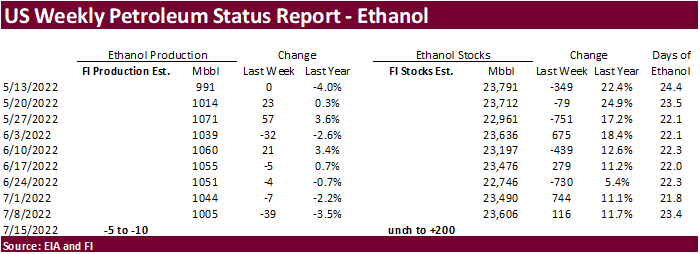

- EIA

weekly U.S. ethanol inventories, production, 10:30am - China’s

third batch of June trade data, including soy, corn and pork imports by country - Malaysia’s

July 1-20 palm oil export data

Thursday,

July 21:

- International

Grains Council releases monthly report - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

total milk and red meat production, 3pm

Friday,

July 22:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - US

cattle inventory; cold storage data for beef, pork and poultry, 3pm

Source:

Bloomberg and FI

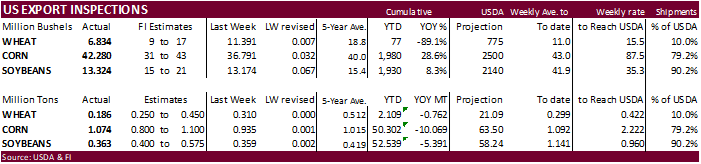

USDA

export inspections

improved from the previous week for corn and soybeans and were within a range of trade expectations. Wheat declined from the previous week and were below a range of trade expectations. Shipments to China are back on top for corn and soybeans. We did not see

much in the way of revisions to the previous week as we thought.

USDA

inspections versus Reuters trade range

Wheat

185,989 versus 250000-525000 range

Corn

1,073,972 versus 700000-1150000 range

Soybeans

362,622 versus 100000-575000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JUL 14, 2022

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 07/14/2022 07/07/2022 07/15/2021 TO DATE TO DATE

BARLEY

0 798 200 847 2,119

CORN

1,073,972 934,533 1,076,668 50,302,233 60,370,800

FLAXSEED

0 0 0 0 0

MIXED

0 0 0 0 48

OATS

1,497 0 0 4,291 100

RYE

0 0 0 0 0

SORGHUM

112,930 184,025 63,875 7,063,963 6,620,836

SOYBEANS

362,622 358,527 143,934 52,538,523 57,929,605

SUNFLOWER

0 0 0 2,260 240

WHEAT

185,989 310,002 532,898 2,108,759 2,870,678

Total

1,737,010 1,787,885 1,817,575 112,020,876 127,794,426

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

US

Crude Oil Futures Settle At $102.60/Bbl, Up $5.01 Or 5.13%

Canadian

Housing Starts Jun: 273.8K (est 274.0K; prev 287.3K)

President

Biden on Friday set up a presidential emergency board (PEB) to block a US railroad union strike, which allows a 60-day pause period.

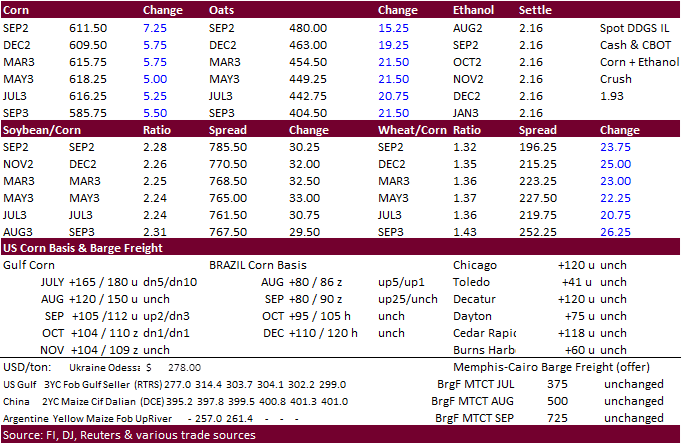

Corn

·

CBOT corn traded in a wide range for the combined night and day session, ended 8.0 cents higher for the September, well off its session high. December ended 7.0 cents higher, near its overnight session open. That contract tested

and traded above its 200-day MA of $6.2375 but settled at $6.1075.

·

Corn futures were generally supported by unfavorable hot and dry conditions for the US this week, a sharply lower USD, and more than $4.50 per barrel rally in WTI crude oil.

·

The funds bought an estimated net 7,000 corn contracts.

·

The US Corn Belt will see restricted precipitation over the next ten days and temperatures will be hot. Heat advisories are expected to be on and off from the car western states to as far east as central and southern US.

·

Note the US corn crop is in the current critical pollination phase.

Corn

silking progress was reported by USDA at 37 percent and compares to 52 percent last year and 48 percent ear ago. Corn dough was 6 percent and compares to 7 percent average.

·

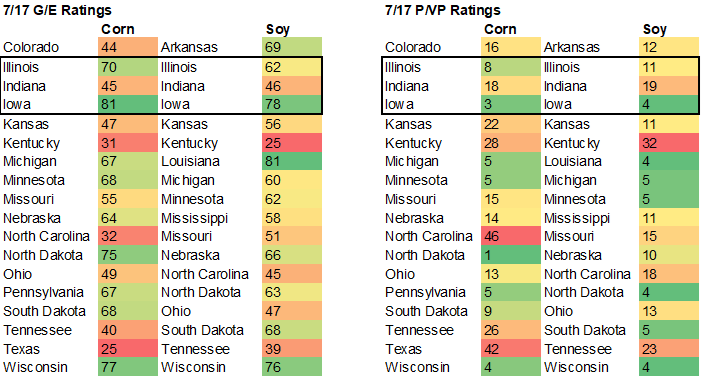

USDA US corn conditions were unchanged from the previous week in the combined G/E condition at 63 percent, one point above trade expectations.

·

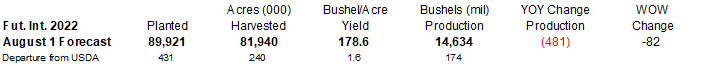

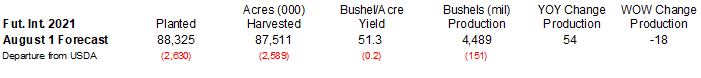

We lowered our US corn yield estimate by 1.0 bushel per acre, but still above USDA.

·

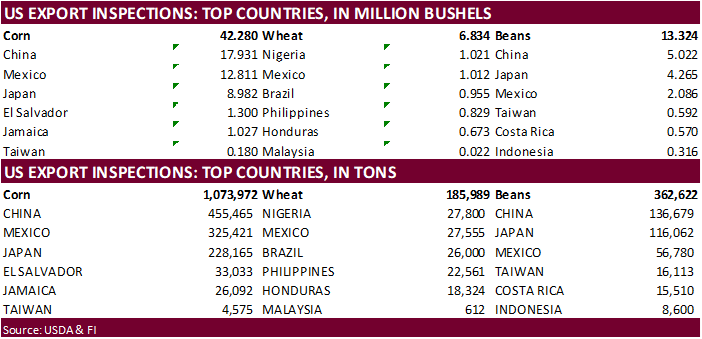

USDA US corn export inspections as of July 14, 2022, were 1,073,972 tons, within a range of trade expectations, above 934,533 tons previous week and compares to 1,076,668 tons year ago. Major countries included China for 455,465

tons, Mexico for 325,421 tons, and Japan for 228,165 tons.

·

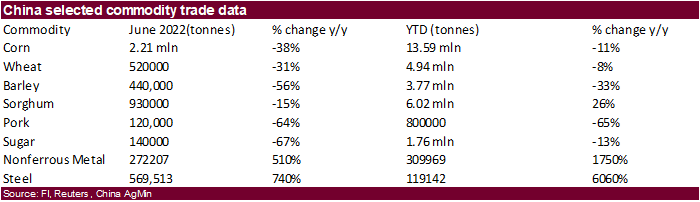

China June corn imports fell 38% from the previous year to 2.21 million tons.

·

Traders remain optimistic China will be in for US corn over the near-term.

·

Brazil’s second corn crop is expected to be running above 55 percent as of Monday. IMEA reported 85 percent of Mato Grosso was collected as of Friday, up 11 points from the previous week.

·

The U.S. International Trade Commission on Monday revoked U.S. anti-dumping and anti-subsidy duties on ammonium nitrate fertilizer solutions from Russia and Trinidad and Tobago, after investigating anti-dumping claims.

·

None reported

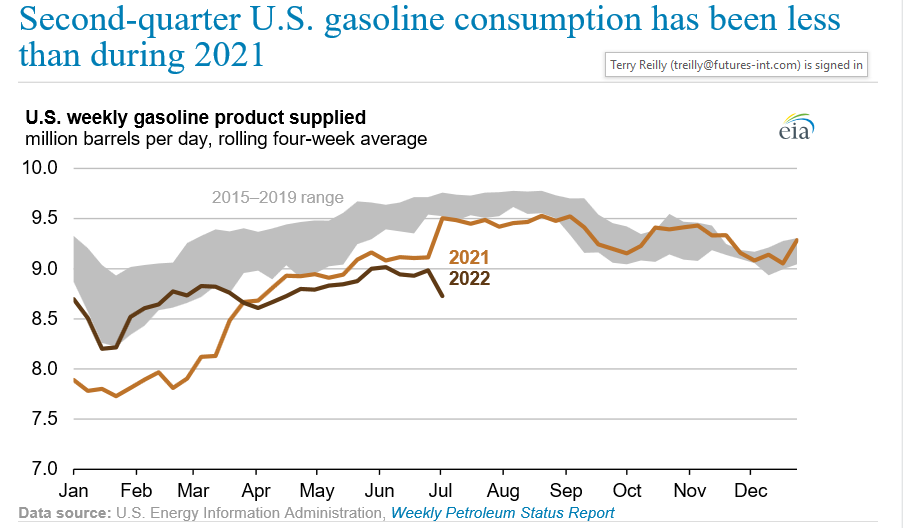

https://www.eia.gov/todayinenergy/detail.php?id=53060&src=email

September

corn is seen in a $5.50 and $7.50 range

December

corn is seen in a wide $5.00-$8.00 range

·

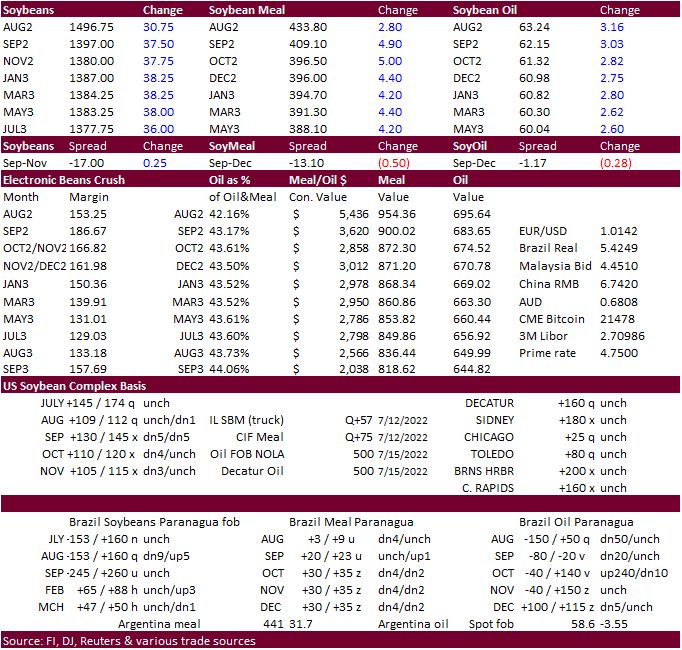

US weather concerns, talk of China buying around 3 cargoes of US soybeans for Feb/Mar shipment, strength in soybean oil, and sharply lower USD sent soybeans higher. August was up 31.25 cents and November rallied 38 cents. Soybean

oil was supported by higher palm oil futures and strength in energy prices. That market rallied a large 312 points for August and December was up 265 points. Meal ended well off session highs with August through December contracts finishing $3.50-5.00/short

ton higher.

·

Funds bought 17,000 soybeans, bought 2,000 meal and bought 8,000 soybeans oil.

·

The US will see adverse hot temperatures during the remainder of July bias western and central Midwest, stressing soybean development. Some traders are nervous the dry conditions will last well into mid-Aug when soybeans will

be in the critical podding stage.

·

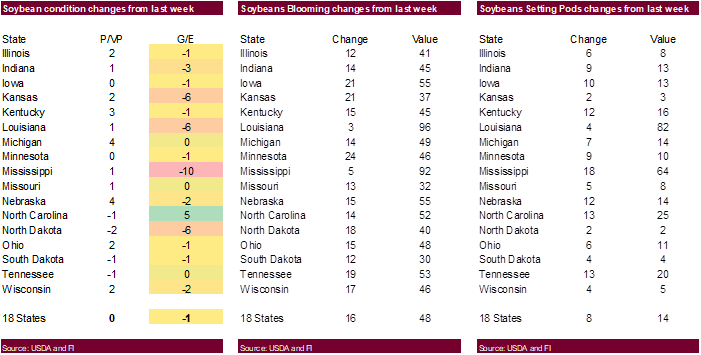

USDA US soybean conditions declined one point in the combined G/E condition to 62 percent, same as what the trade was looking for. Soybeans blooming were 48 percent, up 16 points from the previous week and compares to 61 percent

year ago and 55 percent average. Soybeans setting pods were 14 percent and compares to 19 percent average.

·

USDA US soybean export inspections as of July 14, 2022, were 362,622 tons, within a range of trade expectations, above 358,527 tons previous week and compares to 143,934 tons year ago. Major countries included China for 136,679

tons, Japan for 116,062 tons, and Mexico for 56,780 tons.

·

South American soybean oil cash prices was up $65 to $82 per ton on Monday.

·

Malaysia palm oil was sharply higher, by 331 ringgit, on talk of improving demand and technical buying, despite some bearish developments emerged over the weekend for soybean oil.

·

Indonesia on Saturday announced they will remove all palm export levies until August 31 and set the max palm oil export tax of $240/ton from September 1 when the reference price is above $1,500 per ton. Some traders think this

was already factored in. Later CNBC reported Indonesia is now looking at adjusting the reference price every two weeks so that the tax rate can move with market prices. GAPKI in a note said Indonesia will have to export 6 million tons of palm oil by the end

of August to have inventories return back to normal levels. About 7 million tons are currently held in tanks.

·

Russia raised their export quotas on sunflower oil effective through August 31. Russian export quotas were raised by 400,000 tons for sunflower oil (previously total 1.5 million tons) and 150,000 tons for sunflower meal (previous

total 0.7 million tons).

Export

Developments

·

South Korea’s NOFI group passed on 60,000 tons of soybean meal for arrival around November 20. Lowest offer was $541.49/ton c&f.

·

China looks to sell a half a million tons of soybeans out of reserves on July 22.

Reuters

technical team: Palm oil may retest a resistance at 3,782 ringgit per ton, a break above which could lead to a gain into 3,900-4,090 ringgit range, Reuters technical analyst Wang Tao said.

Source:

Reuters

Updated

7/14/22

Soybeans

– August $13.90-$16.00

Soybeans

– November is seen in a wide $12.75-$16.50 range

Soybean

meal – August $400-$485

Soybean

oil – August 56.00-62.00

·

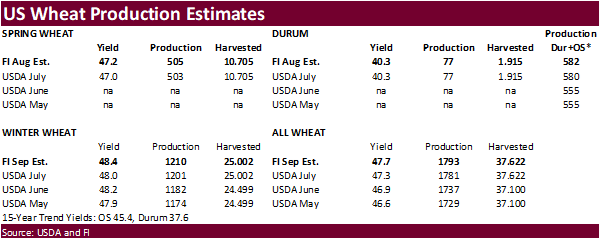

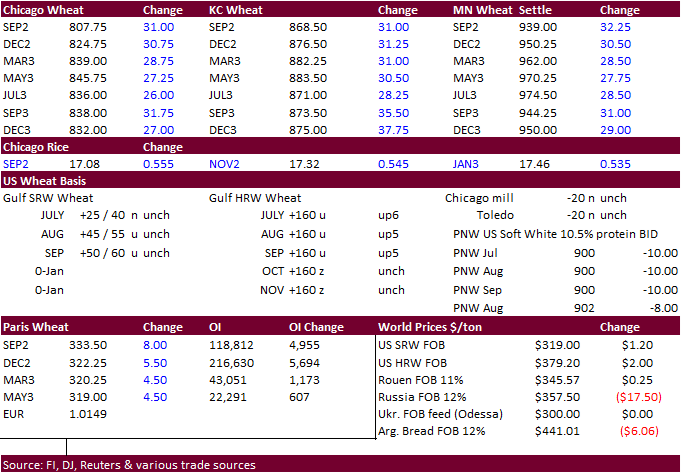

US wheat futures increased an impressive 28.50-36.50 cents higher for the combined three US markets for the front three-month positions. A sharply lower USD and net drying across parts of US spring wheat areas added to the bullish

undertone. Technical buying kicked off the session. Recall Chicago wheat fell $1.1475 last week and KC was down $1.0825. US wheat basis was steady to firmer as demand improved.

·

Funds bought an estimated net 12,000 Chicago wheat contracts.

·

Global demand for wheat improved last week into early this week. Egypt is in for wheat for three shipment periods that extend out until November and some traders are hoping US wheat will be a part of it. Tuesday is the tender

date.

·

Adverse weather for the Western US is threatening parts of spring wheat country. Traders should monitor the weather forecast the western Great Plains and PNW states where hot temperatures will occur this week. The Pacific Northwest

saw drought conditions expand last week. The Great Plains weather outlook favors winter wheat harvesting while spring wheat states will see stress.

·

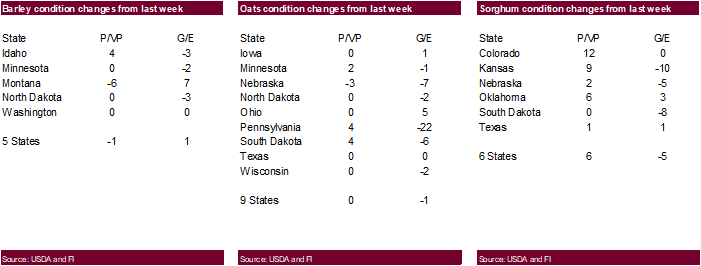

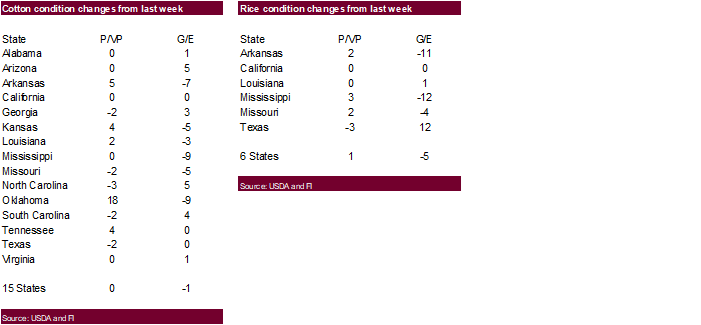

USDA spring wheat conditions were up one point to 71 G/E from the previous week and were one point above a trade average. 68 percent of the spring wheat crop was headed, below 91 percent year ago and 90 percent average.

·

US winter wheat harvesting progress was 5 points below trade expectations. It came in at 70 percent complete, up from 63 percent previous week, and compares to 71 percent year ago and 71 percent average.

·

USDA US all-wheat export inspections as of July 14, 2022, were 185,989 tons, below a range of trade expectations, below 310,002 tons previous week and compares to 532,898 tons year ago. Major countries included Nigeria for 27,800

tons, Mexico for 27,555 tons, and Brazil for 26,000 tons.

·

Paris wheat was up 1.25 euros at 326.75 euros as of 6:55 am CT. The wheat harvest is running well ahead of average, but concerns over the corn crop from hot temperatures was thought to have provided support to Paris wheat.

·

Agritel estimated the French soft wheat crop at 33.25 million tons for 2022-23, its initial estimate.

·

Note the French AgMin estimated the 2022 soft wheat crop at 32.90 million tons, down 35.43 million tons for 2021.

·

Bulgaria sees their 2022 wheat crop at over 6 million tons, near their 2021 level.

·

Russia’s AgMin reported Russian wheat yields are seen 24 percent higher from last year, at 4.2 tons per hectare.

·

Turkey’s Defense Minister said the UN, Russia and Ukraine are expected to meet this week over Black Sea grain shipments.

·

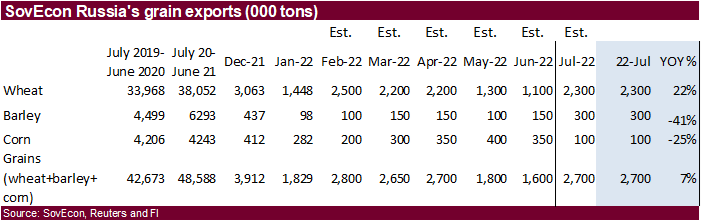

IKAR reported Russian 12.5% wheat export prices, as of Friday, from the Black Sea rose by $2.00/ton to $360 from the previous week. SovEcon reported a range of $355 to $360/ton.

·

Egypt is in for wheat on Tuesday for September 16-30, October 16-31, and November 1-15 shipment. Remember in their last import tender Egypt bought a large amount of wheat, but when spread out over a three-month shipping period

volumes on a monthly adjusted basis were lighter than other regular tenders.

·

The Philippines bought 42,000 tons of Australian feed wheat on Friday at $381/ton c&f for November shipment.

·

Pakistan received offers for 300,000 tons of wheat and lowest offer was $404.86/ton c&f.

·

Jordan seeks 120,000 tons of wheat on July 19 for possible shipment sometime in November and/or December.

·

Jordan seeks 120,000 tons of feed barley on July 20 for Dec and/or Jan shipment.

Rice/Other

·

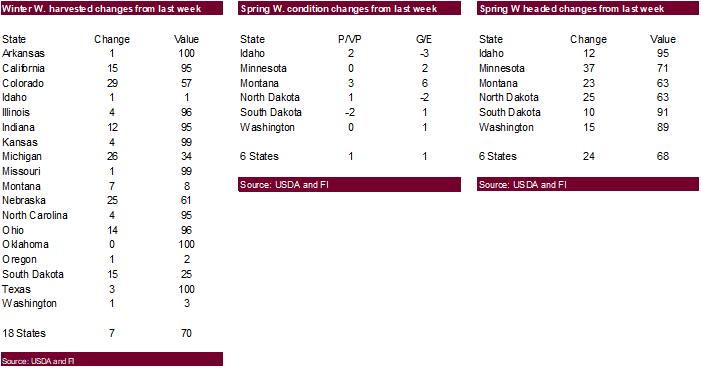

USDA rice conditions declined 5 points to 72 precent and compares to 72 percent year ago.

·

Cotton conditions were down 1 point to 38 percent and compares to 60 a year ago.

Updated

7/16/22

Chicago

– September $7.50 to $9.00 range, December $7.00-$11.00

KC

– September $7.85 to $10.25 range, December $8.00-$12.00

MN

– September $8.50‐$11.00, December $8.00-$12.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.