PDF Attached

Wheat traded two-sided while corn and the soybean complex were on the defensive for most of the session. The midday wheat models turned slightly more favorable for the 6-10 and 11-15 day, but hot and dry conditions will continue to prevail for much of the heart of the US and western US over the next two weeks. Long term US weather models suggest dry and hot conditions through August. Egypt passed on their import tender for wheat but floated another set to close Wednesday for the same shipment periods of September 16-30, October 16-31, and November 1-15 shipment.

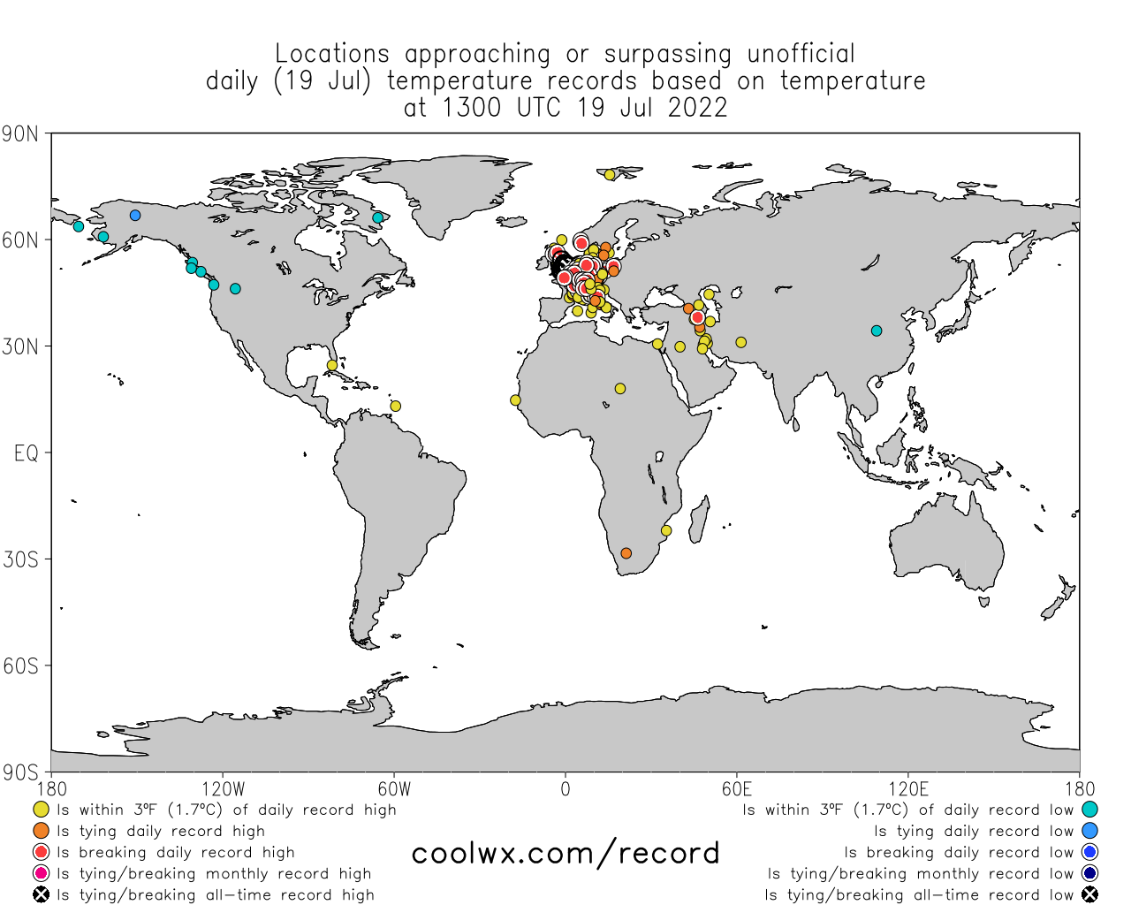

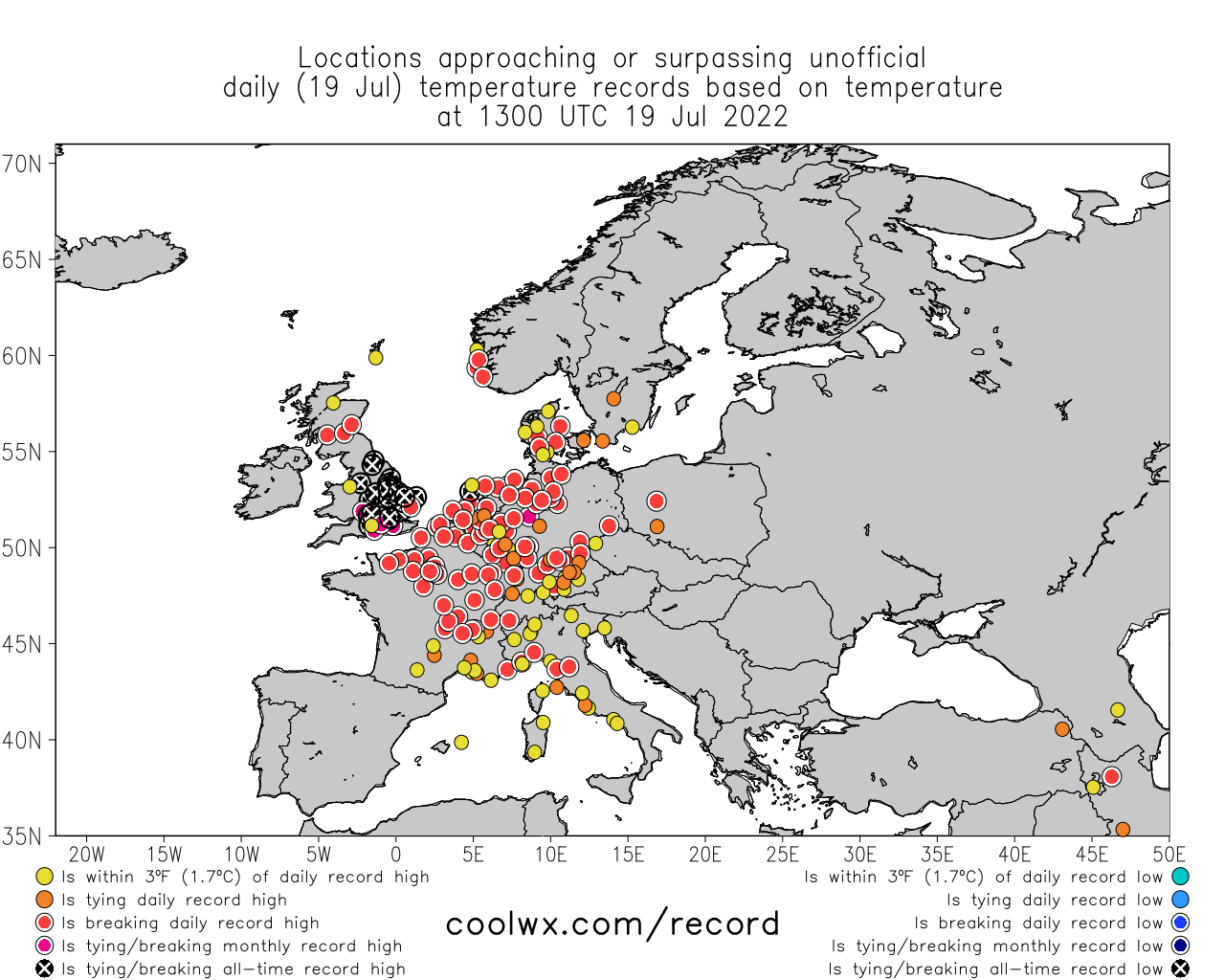

Record breaking heat is occurring across parts of the globe. Coolwx.com has some interesting maps.

World Weather Inc.

WEATHER TO WATCH AROUND THE WORLD

- Excessive heat in western Europe continues to cause livestock and crop stress and places a huge demand on cooling fuels wherever air conditioning is available

- Temperatures were in the 90s to 104 degrees at mid-day today in France, Germany and the U.K., as well as northern Italy and additional warming was expected over the next few hours

- Spain and Portugal are not as hot as in previous days

- Europe’s heat and dryness is stressing many crops and depleting soil moisture

- The next ten days will be driest in the central and southern parts of the continent where crop stress and production threats will be greatest

- The Balkan Countries will experience the most persistent warm and dry conditions from later this week through most of next week and into the following weekend

- Relief is expected in northern parts of Europe after today’s heat abates with waves of showers and thunderstorms expected along with some cooler temperatures

- Russia’s Southern Region is expecting some timely rainfall during the coming week to ten days that should improve topsoil moisture

- The precipitation will be greatest in the second half of this week into early next week and temperatures will be cooler than usual resulting in lower evaporation rates between showers

- Some crop improvements will result

- Central and eastern portions of Russia’s Southern Region has been too dry in recent weeks

- All other Russia crop areas will experience frequent bouts of rain for the next couple of weeks resulting in moisture abundance for normal crop development

- Temperatures will be seasonable

- Crop development should advance well

- Portions of northern Ukraine may dry down during the next couple of weeks, but the north is expected to be favorably moist

- Southern Canada’s Prairies received much needed rain Monday and early today and the forecast is expected to promote additional rain from southeastern Saskatchewan into Manitoba today and tonight

- Rainfall in interior southeastern Alberta ranged from 0.45 to 1.10 inches with several areas getting 1.57 to 3.27 inches

- Rain in south-central Saskatchewan ranged from 0.60 to 1.69 inches and local totals to 2.09 inches

- Southwestern Manitoba rainfall varied from 0.67 to 1.69 inches and local amounts to 2.13 inches

- Southwestern and west-central Saskatchewan and southeastern Saskatchewan reported 0.05 to 0.43 inch

- Dry conditions occurred in northern and far western parts of the Prairies

- The moisture brought needed relief to areas in the southern Prairies that had been too dry in recent weeks

- More rain would be welcome, but some areas have received good amounts of moisture to support crops for a while

- Canada’s Prairies weather will turn drier after today and tonight’s rain ends in the southeastern parts of the Prairies

- Temperatures will be near to above normal with restricted rainfall

- Crop development should advance relatively well in most areas, but timely rain will soon be needed once again

- U.S. heatwave continued to impact the central and southern Plains Monday

- Extreme highs reached 112 Fahrenheit in north-central Texas and 111 in northwestern Nebraska while readings in the 90s to 108 occurred form southern parts of Canada’s Prairies throughout the Great Plains

- Highs in the western Corn and Soybean production areas were mostly in the 90s and the same occurred in the Delta

- Hot conditions will prevail in the central United States over the next five to seven days with 90- and 100 to 110-degree heat will occur frequently from South Dakota to Texas while 90s to 104 occur from the northern Plains and western Corn Belt into the Delta

- Cooling is expected in these areas next week

- None of the hot weather is expected to reach into the eastern Midwest or southeastern states

- Timely rainfall is expected in the northern, central and eastern U.S. Midwest during the next ten days to two weeks favoring normal crop development

- Rain will be restricted from the northern Delta and Texas to Montana and South Dakota during the next ten days to two weeks

- Net drying in these areas will continue to threaten summer crop production; including corn, soybeans, sorghum and cotton

- Some sunseed and canola may also be negatively impacted

- U.S. late July and early August weather will bring cooling to the central states, but it may remain hot in the southern Plains

- The far western U.S. is expected to heat up during this period of time as well

- Texas and Oklahoma cotton, sorghum and corn production continues stressed with lower yields expected because of excessive heat and dryness recently

- No serious change will occur over the next seven days, but a few more showers may evolve in the second week of the outlook with less oppressive heat

- U.S. southeastern States and lower Delta will receive timely rainfall similar to that of the Midwest during the next two weeks

- Crop conditions will be favorable into early August

- Parts of Ontario, Canada need rain while Quebec crops continue to develop favorably with timely rainfall and warmer than usual temperatures

- Drought in northeastern Mexico and the southern U.S. Plains is unlikely to change in the next two weeks

- Most likely the only way drought will break in these areas will be from a tropical cyclone and none is expected for a while – at least not in that region.

- Many corn, sorghum, citrus, sugarcane and dry bean crops are being negatively impacted in Mexico along with various other fruit and vegetable crops

- Mexico rain will be most abundant in the west and southern parts of the nation

- India’s monsoon is expected to continue performing favorably with widespread rain across most of the nation during the next couple of weeks

- Central and some northern parts of the nation may be a little too wet at times resulting in some flooding

- Sufficient breaks in the rain are expected to prevent a major flood from occurring

- South America temperatures over the next week will be near to above average with some cooling likely in Argentina and southern Brazil during the middle to latter part of next week

- Brazil rainfall will be minimal except in Atlantic coastal areas and from the southernmost parts of Mato Grosso do Sul and Parana into Rio Grande do Sul and Paraguay during the next week

- Rainfall will be light and some areas will experience net drying

- Greater rain will evolve next week when 1.00 to 3.00 inches may return to the region

- Drying in other areas of Brazil will be great for Safrinha crop harvesting

- Most of China’s crop region east of Tibet will get rain at one time or another during the next two weeks and all of it will be good for summer crop development

- The greatest rainfall may occur in east-central parts of the nation and in Liaoning, Jilin and Heilongjiang

- Southeastern China is expected to continue drying out through the next ten days and perhaps longer

- Temperatures will continue near to above normal

- China’s Xinjiang province continues to experience relatively good weather

- A few showers and thunderstorms are expected, but most of the region will be dry with temperatures varying greatly over the week to ten days

- Hurricane Estelle was located well east of southwestern Mexico in the eastern Pacific Ocean moving west northwesterly away from land

- The storm poses no threat to North America

- There were no other organized tropical cyclones in the world today

- Sumatra, Indonesia rainfall remained minimal Monday after being restricted during the weekend

- Below average precipitation has occurred in many areas from northern and central Sumatra into northwestern Borneo in recent weeks and greater rain is desired

- Some increase in rain is expected this week, but amounts may continue lighter than usual in many areas

- Precipitation will become more widespread next week

- All other Southeast Asian nations will experience an abundance of rainfall during the next few weeks resulting in some flooding in the Philippines and the Maritime provinces

- Recent rain has improved soil moisture in parts of Thailand after a drier than usual bias earlier this season

- Australia weather in the coming ten days will be favorable for most winter crops

- Central Queensland will get some rain during mid-week this week, although it will be sporadic and mostly light

- Rain totals may range from 0.30 to 1.25 inches and locally more

- Western Australia will get most of the significant rain this week outside of central Queensland

- Southeastern parts of the nation will be driest this week, but rain will impact Victoria next week

- South Korea rice areas are still dealing with a serious drought, despite some rain that fell recently.

- Some additional rain is expected over the next couple of weeks and it should gradually be enough to ease dryness and crop stress, but production will be down

- East-central Africa rainfall will be greatest in central and western Ethiopia and lightest in parts of Uganda.

- Tanzania is normally dry at this time of year and it should be that way for the next few of weeks

- Some areas in Kenya are expected to trend wetter in the next ten days

- West-central Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally

- Some greater rain would still be welcome in the drier areas of Ivory Coast

- Cotton areas are expecting much greater rainfall in the next couple of weeks and there is some potential for flooding

- Flooding is also possible in Guinea, Sierra Leone and southern Mali over the next couple weeks

- Mali has been drier than usual over the past 30 days and rain would benefit cotton – at least for a while

- South Africa’s crop moisture situation is favorable for winter crop establishment, although some additional rain might be welcome

- Restricted rainfall is expected for a while, but the crop is rated better than usual

- Central America rainfall will continue to be abundant to excessive and drying is needed

- Rain in the Greater Antilles will occur periodically, but no excessive amounts are likely

- Today’s Southern Oscillation Index was +10.95 and it will continue to move lower this week

- New Zealand weather is expected to be well mixed over the next ten days

- Temperatures are expected to be a little cooler than usual

- Rain will impact all areas at one time or another

Source: World Weather INC

Wednesday, July 20:

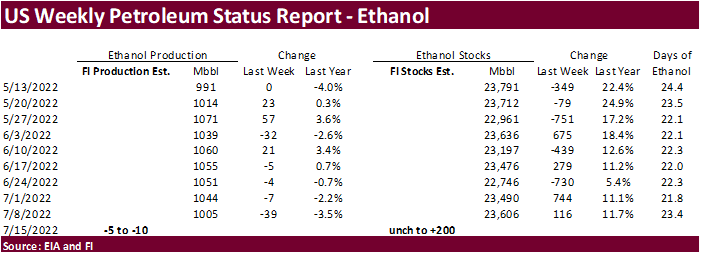

- EIA weekly U.S. ethanol inventories, production, 10:30am

- China’s third batch of June trade data, including soy, corn and pork imports by country

- Malaysia’s July 1-20 palm oil export data

Thursday, July 21:

- International Grains Council releases monthly report

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- USDA total milk and red meat production, 3pm

Friday, July 22:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

- US cattle inventory; cold storage data for beef, pork and poultry, 3pm

Macros

Housing Starts In US Decline To Lowest Level Since September

US Housing Starts Jun: 1559K (est 1580K; prev 1549K)

US Building Permits Jun: 1685K (est 1650K; prev 1695K)

US Housing Starts (M/M) Jun: -2.0% (est 2.0%; prev -14.4%)

US Building Permits (M/M) Jun: -0.6% (est -2.7%; prev -7.0%)

98 Counterparties Take $2.212 Tln At Fed Reverse Repo Op (prev $2.190 Tln, 98 Bids)

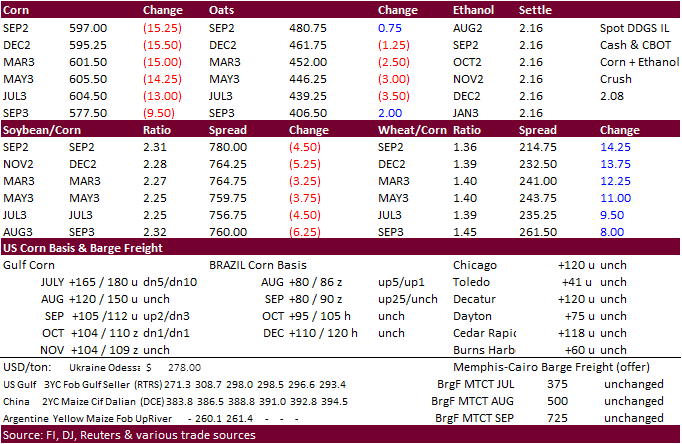

Corn

· CBOT corn futures declined around 15 cents for the nearby positions on technical selling and expectations for Ukraine to resume corn shipments, despite a sharply lower USD, rebound in WTI crude oil futures, and strong equity markets.

· Traders will be monitoring President Putin’s visit to Iran that started today. Many country leaders are optimistic a Black Sea grain shipping deal will be struck.

· The Philippines are negotiating with China and Russia for fertilizer imports.

· AgRural reported Brazil’s Center South second corn harvest was 53% complete, up from 40.5% week earlier and compares to 30.1% year ago. Deral reported Parana was 30 percent complete, copared to only 4 percent at this time year ago.

· Bloomberg Cattle on Feed report: June placements onto feedlots seen falling y/y to 1.58m head, according to a Bloomberg survey of ten analysts. That would be the biggest y/y decline since July 2021.

· A Bloomberg poll looks for weekly US ethanol production to be up 9,000 barrels to 1014 thousand (996-1030 range) from the previous week and stocks down 99,000 barrels to 23.507 million.

· FI ethanol estimates below.

USDA Attaché – South Africa: Grain and Feed Update

· None reported

September corn is seen in a $5.50 and $7.50 range

December corn is seen in a wide $5.00-$8.00 range

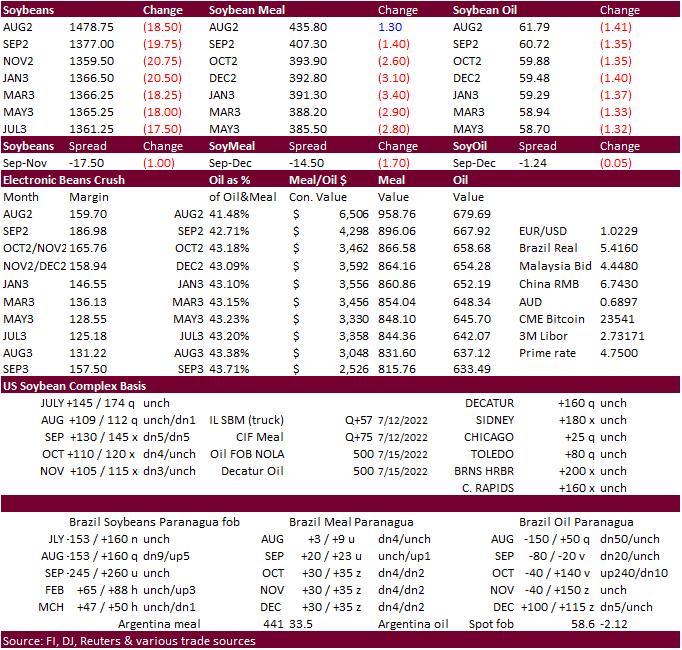

· News was light for the soybean complex. Soybeans initially traded lower on widespread commodity selling, but after WTI rebounded, soybeans remained lower. Soybean meal gained over soybean oil, despite sharply lower corn. August settled slightly higher and September down $2.40. August soybean oil fell 131 points and September by 129 points from weaker related vegetable oil markets.

· Malaysia will keep its export tax for crude palm oil unchanged at 8 percent for August. They are using a reference price of 5,257.91 ringgit ($1,181.55) per ton for the next month.

· Dorab Mistry pegged palm oil futures to hit 3,000 ringgit ($673/ton) by September, in large part from a surge in Indonesia CPO exports. Malaysia October palm sitting at 3916. That would be about a 20% decline.

· There was talk Indonesia will delay implementation of B35.

· India oilmeal exports were up 69% for June from May to 431,840 tons from 255,453 tons. This compares to 203,868 tons in June last year. Rapeseed meal exports were 308,549 tons in June compared to 169,148 tons in May, and soybean meal exports 32,194 tons versus 18,634 tons in May.

Export Developments

· South Korea’s MFG bought 60,000 tons of soybean meal from South America at an estimated $537.97 a ton c&f for shipment between Sept. 18 and Oct. 7. This comes after NOFI passed on soybean meal on Monday with lowest $541.49 a ton.

· China looks to sell a half a million tons of soybeans out of reserves on July 22.

Updated 7/14/22

Soybeans – August $13.90-$16.00

Soybeans – November is seen in a wide $12.75-$16.50 range

Soybean meal – August $400-$485

Soybean oil – August 56.00-62.00

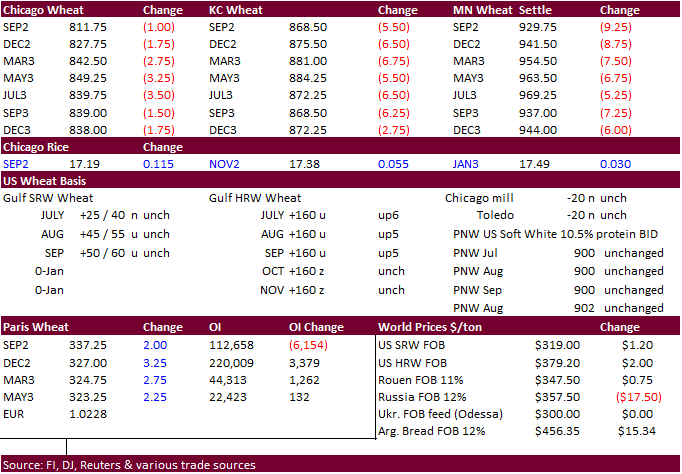

· US wheat futures traded two-sided, settling lower for all three markets. The lower bias was related to technical selling and hopes a Black Sea shipping resolution will be reached soon. The bullish bias came from a sharply lower USD, reversal in WTI crude oil and hopes Egypt on Wednesday will but US wheat.

· Egypt lowered their wheat protein level for US wheat for their import tender to 10.5% from previous 11.5% (acceptable down to 11%). They cancelled their import tender for today for wheat due to high prices but are back in again Wednesday for the same shipment periods of September 16-30, October 16-31, and November 1-15 shipment. It could include US origin. For today’s cancelled tender, US was offered cheapest for fob at $395.

· Paris wheat was up 2.00 euros at 337.00. Strong export demand and hot weather impacting spring crops were noted.

· Russia will start buying grain (wheat) for state reserves in August. A total of 1 million tons will be secured. Russia already harvested 22 million tons of grain so far.

· Egypt cancelled their import tender for wheat today (retendered) for September 16-30, October 16-31, and November 1-15 shipment. They are back in Wednesday for the same shipment period.

· Pakistan seeks 200,000 tons of wheat on July 25 for September 1-16 shipment. They maybe in for 300,000 tons.

· Jordan passed on 120,000 tons of milling wheat for possible shipment sometime in November and/or December.

· Jordan seeks 120,000 tons of feed barley on July 20 for Dec and/or Jan shipment.

Rice/Other

· US rice prices were higher today after USDA reported US rice conditions declined 5 points to 72 precent (72 percent year ago).

Updated 7/16/22

Chicago – September $7.50 to $9.00 range, December $7.00-$11.00

KC – September $7.85 to $10.25 range, December $8.00-$12.00

MN – September $8.50‐$11.00, December $8.00-$12.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.