PDF Attached

Other

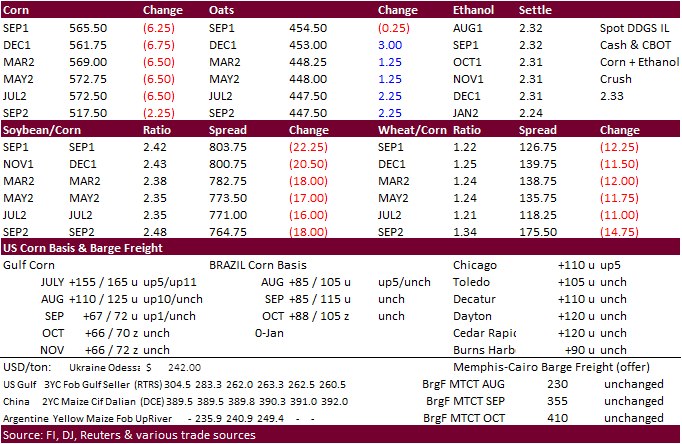

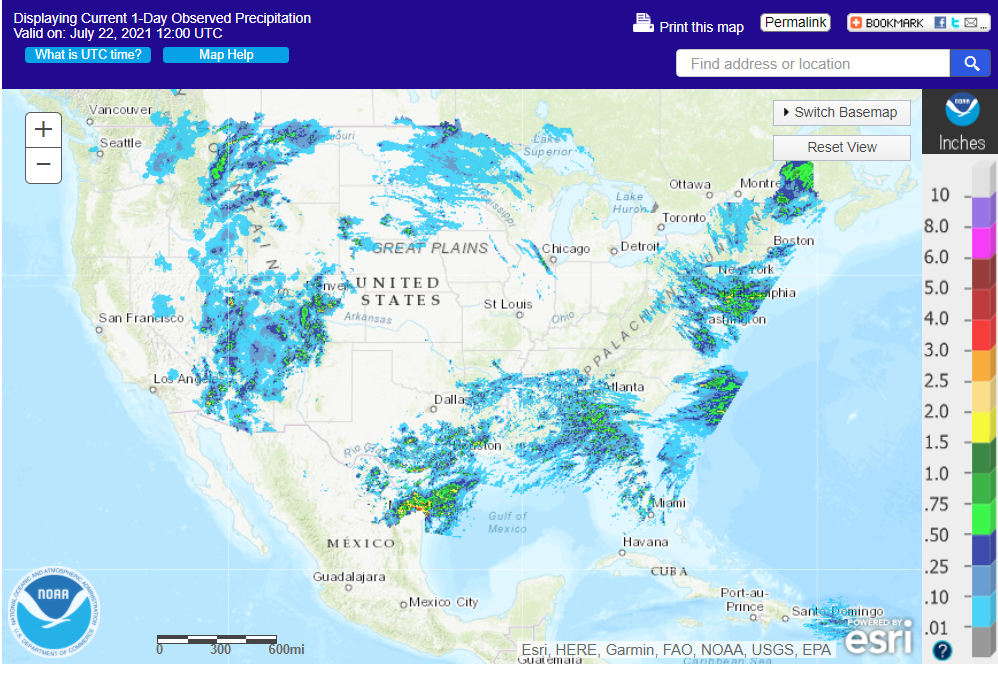

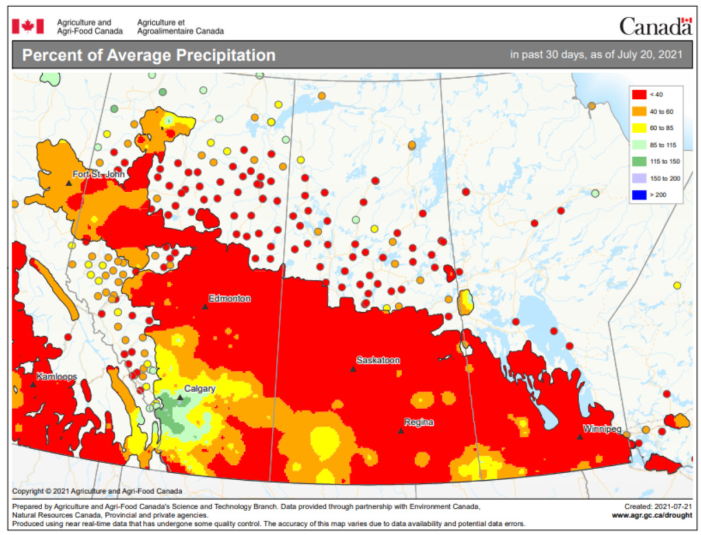

than rice and nearby Minneapolis wheat, CBOT agriculture commodities traded lower as weather models indicated improving conditions for the US WCB and north of the US border. Northern and western Alberta will see rain fall periodically. Northern Saskatchewan

and parts of Manitoba will also get some showers. For the US, models suggest a cooler than expected August. Following the hot temperatures over the next week, rain will develop across the WCB and upper Great Plains around the end of this month. There are

still issues across other parts of the world, most notably China flooding, which in turn could increase their already large appetite for imported grains. USDA export sales were poor, IMO, except for all-wheat.

![]()

Day

1

Day

2

7-day

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

-

Another

day of torrential rain and serious flooding occurred from central and eastern Henan into Hebei, China Wednesday.

-

Another

30.00 inches of rain fell in northeastern Henan Wednesday after a similar amount occurred Tuesday in north-central parts of the province -

Rain

totals in the past six days have reached 40-45 inches across these north-central and northeastern Henan locations resulting in horrific flooding -

World

Weather, Inc. estimates 91,000 square miles of China crop land may be in flood because of this week’s excessive rain in Hebei and Henan alone -

Permanent

crop damage is suspected in a part of this region -

Typhoon

In-Fa is still expected to bring torrential rain, flooding and damaging wind to Zhejiang, China this weekend -

Rainfall

of 10.00 to 20.00 inches will result in serious flooding with a potential impact on rice and many other crops

-

Western

Guangdong China reported over 10.00 inches of rain Wednesday from Tropical Depression Cempaka -

Flooding

was most significant near the coast and may have impacted a small part of the province’s rice

-

Cempaka

will move through the northeastern Gulf of Tonka later today and then turn to the east and pass through Hainan, China -

Most

of the storm’s intensive rain will drift off into Vietnam limiting the impact on Hainan -

U.S.

forecast models are too wet in the western Corn Belt during the first week of August today -

A

cool northwesterly flow pattern is expected to evolve aloft, but the frontal boundary and waves of rain advertised in that first week of the month is way overboard and future model runs will have to trend a little drier -

Some

rain is expected when the cool air comes into the Midwest, but the amounts advertised are too great and occur too often in the western crop areas -

U.S.

outlook in this first week of the outlook is warm and dry in the western Corn Belt with some hot temperatures in the Plains -

The

environment will dry down the topsoil and raise some crop and livestock stress, but if the second week outlook trends cooler and wetter as suggested today there might not be much impact from this first week of warm and dry conditions -

Confidence

is high that cooling will take place in August, but the changes to wet and cool weather today are overdone -

Texas

weather will be mostly good for all summer crops -

Restricted

rain and warmer temperatures will slowly firm up the soil and stimulate more aggressive crop development in those areas with abundant soil moisture -

Dry

weather in South Texas after Friday will be good for early cotton maturation and the start of harvesting -

U.S.

far western states will continue dry biased through the next ten days with warm temperatures, but no oppressive heat -

Monsoon

moisture in the southern Rocky Mountain region and Arizona will be frequent and significant enough to improve soil moisture and induce a little runoff -

Crop

conditions will steadily improve in Arizona because of expected rainfall -

Portions

of Canada’s Prairies will continue to suffer from ongoing dryness -

Central,

northern and western Alberta will experience the most significant rainfall during the next ten days translating into improving crop development -

Temperatures

are not quite as oppressively hot in Canada as they have been in the past and that is slowing the decline in crop conditions, but the trend remains -

Southeast

Canada’s corn, soybean and wheat conditions are rated favorably and weather conditions during the next two weeks will be favorably mixed -

Brazil

weather Wednesday and early today produced no more threatening cold and conditions were dry -

A

new bout of cooling is expected late next week and into the following weekend, but confidence over another wave of crop damaging cold is low for sugarcane, citrus and coffee areas -

Wheat

production areas in southern Brazil could be negatively impacted -

Brazil

will see some periodic rain in the south during the next ten days -

Argentina

weather will be mostly dry over the next ten days -

Some

winter wheat would welcome rain especially in the west, but crop conditions are much better than last year at this time -

Crops

are mostly semi-dormant right now -

No

meaningful precipitation fell during the weekend -

Europe

is taking a break from frequent rain that occurred from eastern France to Poland last week and during the weekend -

The

drier weather is needed -

Too

much rain too often delayed small grain maturation and harvest progress and reduced crop quality -

Some

winter oilseed conditions may have also been compromised -

Rain

will return to Europe from France to Poland this weekend and next week possibly delaying fieldwork and returning concern over unharvested winter crop quality -

Russia’s

Southern New Lands and northwestern Kazakhstan will receive rain over the next two days -

The

moisture will be good for developing crops and should reduce heat and moisture stress that has evolved recently -

More

rain will be needed soon, though -

Net

drying will continue in northwestern Russia for a while possibly resulting in a little crop moisture stress for the driest areas -

Rain

may improve in these areas next week -

Some

net drying is expected in central Ukraine and parts of southwestern Russia over the coming ten days, despite some shower activity -

A

few areas may become a little too dry and crop stress may increase -

Rain

will be needed soon to protect production potentials -

Southwestern

Xinjiang, China was unusually cool again Wednesday due to rain -

High

temperatures were in the 80s and lower 90s northeast and only in the upper 60s and 70s in the far west

-

Rainfall

in the far west ranged up to 1.57 inches with as much as 2.75 inches at one location.

-

Warming

and drier weather will occur over the next week -

Xinjiang

degree day accumulations continue behind normal -

Warming

is needed and expected along with drier weather -

India

rainfall over the next two weeks will slowly increase bringing rain to most of the nation and improve crop and field conditions over time

-

There

is some concern over net drying in the far south and extreme northwest, but most other areas will receive sufficient rain to bolster soil moisture and support improving crop development and long term moisture supply -

Ivory

Coast and Ghana rainfall will be restricted over the next couple of weeks -

Seasonal

rainfall should return normally in September, but August rainfall will be lighter than usual -

Other

areas in West Africa will see a better distribution of rain -

East-central

Africa rainfall will continue favorable for coffee and cocoa, although some areas in Uganda and Kenya may receive less than usual rainfall -

Ethiopia

rainfall is expected to continue improving after a slow start to the rainy season -

Southern

Oscillation Index has reached back about +14.43 and it is expected to remain strongly positive this week while slowly leveling off after a strong rising trend since June 22 when the index was -3.36 -

Southeast

Asia rainfall recently and that which is expected in the next two weeks will continue somewhat erratic

-

Laos,

Cambodia and northern Philippines will see the greatest rainfall -

Southern

Sumatra and Java, Indonesia may experience less than usual rainfall for a while -

Thailand

will also experience less than usual rainfall in pockets, although there has been some beneficial moisture recently -

Australia

weather this month has been ideal for improving winter wheat, barley and canola establishment in much of the nation -

Some

additional rain is still needed in South Australia, northwestern Victoria and from western New South Wales to Queensland -

South

Africa has been cold during the past week with waves of rain in the southwest -

Weekend

rainfall was still cool, but rain ended in many areas -

The

moisture has been good for future wheat development -

Dryness

remains in some of the unirrigated eastern wheat production areas -

Some

warming is expected over the coming week, but the precipitation anomalies will prevail -

Mexico

weather has improved with increased rainfall in the south and west parts of the nation -

Drought

conditions are waning and crops are performing better -

Dryness

remains in Chihuahua and northeastern parts of the nation -

Weather

over the next ten days will offer some relief, but more rain will be needed in the drier areas -

Central

America rainfall has been plentiful and will remain that way except in Honduras where recent rainfall has been lighter and more sporadic than usual -

Nicaragua

has received frequent bouts of rain this month easing long term dryness, but more may be needed in some locations -

New

Zealand rainfall during the coming week will be near to above normal in North Island and western portions of South Island while below average in eastern South Island -

Temperatures

will be seasonable

Source:

World Weather Inc.

Bloomberg

Ag Calendar

Thursday,

July 22:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - USDA

to release world supply-demand outlook for orange and its juice - Port

of Rouen data on French grain exports - USDA

total milk, red meat production - U.S.

cold storage data – pork, beef, poultry - HOLIDAY:

Japan

Friday,

July 23:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

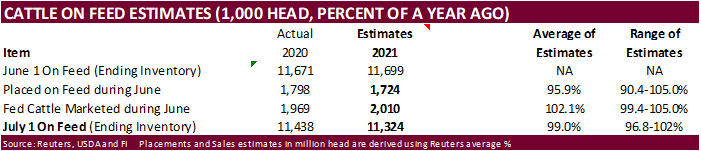

weekly update on crop conditions - U.S.

cattle on feed, poultry slaughter, cattle inventory - HOLIDAY:

Japan

Source:

Bloomberg and FI

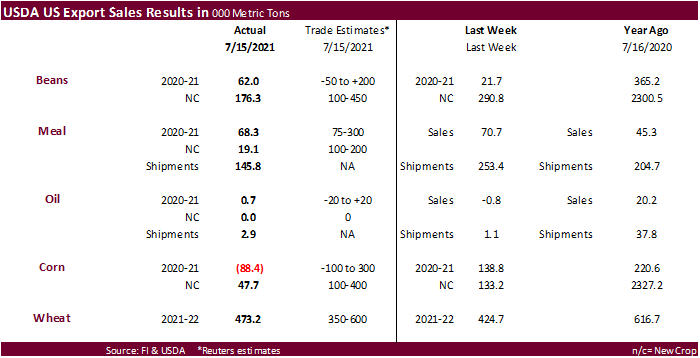

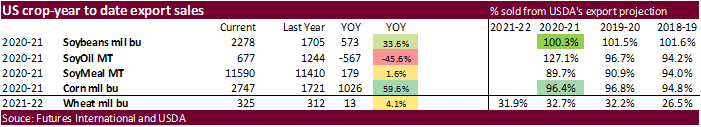

USDA

Export Sales

USDA

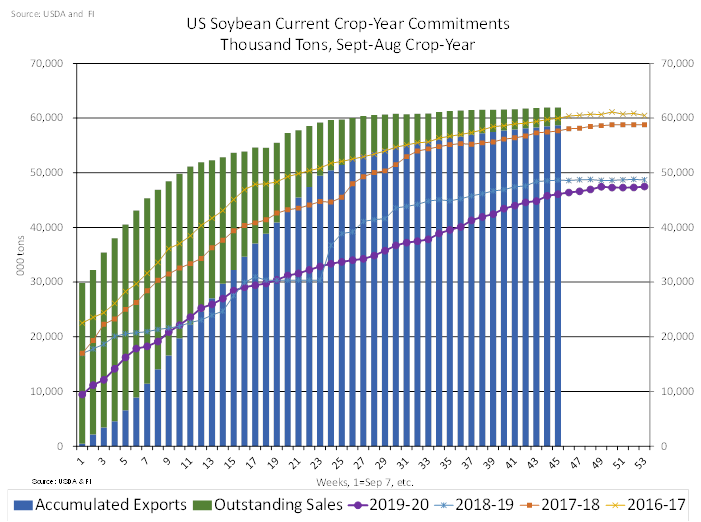

export sales were poor for corn, soybean meal (marketing year low) and soybean oil. Soybeans were on the low side of expectations and wheat was within. The report is viewed negative for the soybean complex and corn. Pork sales were ok at 24,500 tons and

included 10k for Mexico. There were 52,200 tons of sorghum sales, for Japan and Mexico.

73

Counterparties Take $898.197 Bln At Fed’s Fixed-Rate Reverse Repo (prev $886.206 Bln, 71 Bidders)

US

Initial Jobless Claims Jul 17: 419K (est 350K; prevR 368K; prev 360K)

US

Continuing Claims Jul 10: 3236K (est 3100K; prevR 3265K; prev 3241K)

US

Existing Home Sales Change Jun: 5.86M (est 5.90M; prev 5.80M)

–

Existing Home Sales (M/M) Jun: 1.4% (est 1.7%; prev -0.9%)

–

Inventory Of Homes For Sale Jun: 1.25 Mln Units, 2.6 Month’s Worth (prev 1.23 Mln Units, 2.5 Months)

–

National Median Home Price For Existing Homes Jun: 363.3K, +23.4% (prev $350,300, +23.6%From May 2020)

US

EIA Natural Gas Storage Change (BCF) 16-Jul: +49 (est +43; prev +49)

–

Salt Dome Cavern Natural Gas Storage Change (BCF): -4 (prev -3)

US

NatGas Rises To $4, First Time Since December 2018

Corn

- Corn

opened sharply

lower on weather models suggesting a slightly wetter bias for the WCB. Price declines paired some losses by afternoon trading. September closed 7.25 cents lower at $5.6450 and December fell 7.25 to $5.6125. Looking back at the last couple weeks, the charts

suggest a sideways trading range for old and new crop. A break above $5.7350 basis the December contract could generate some buying.

- Looking

forward, we see the US corn condition unchanged to down one-point next week when updated by USDA. Also, next week we should see private US corn estimates released, a previous for the upcoming August S&D report.

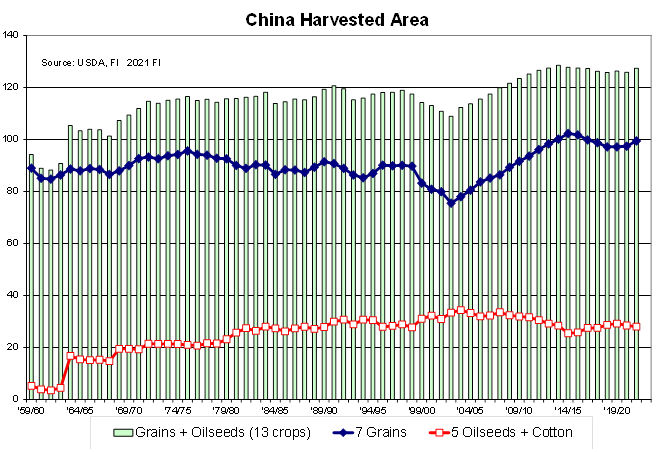

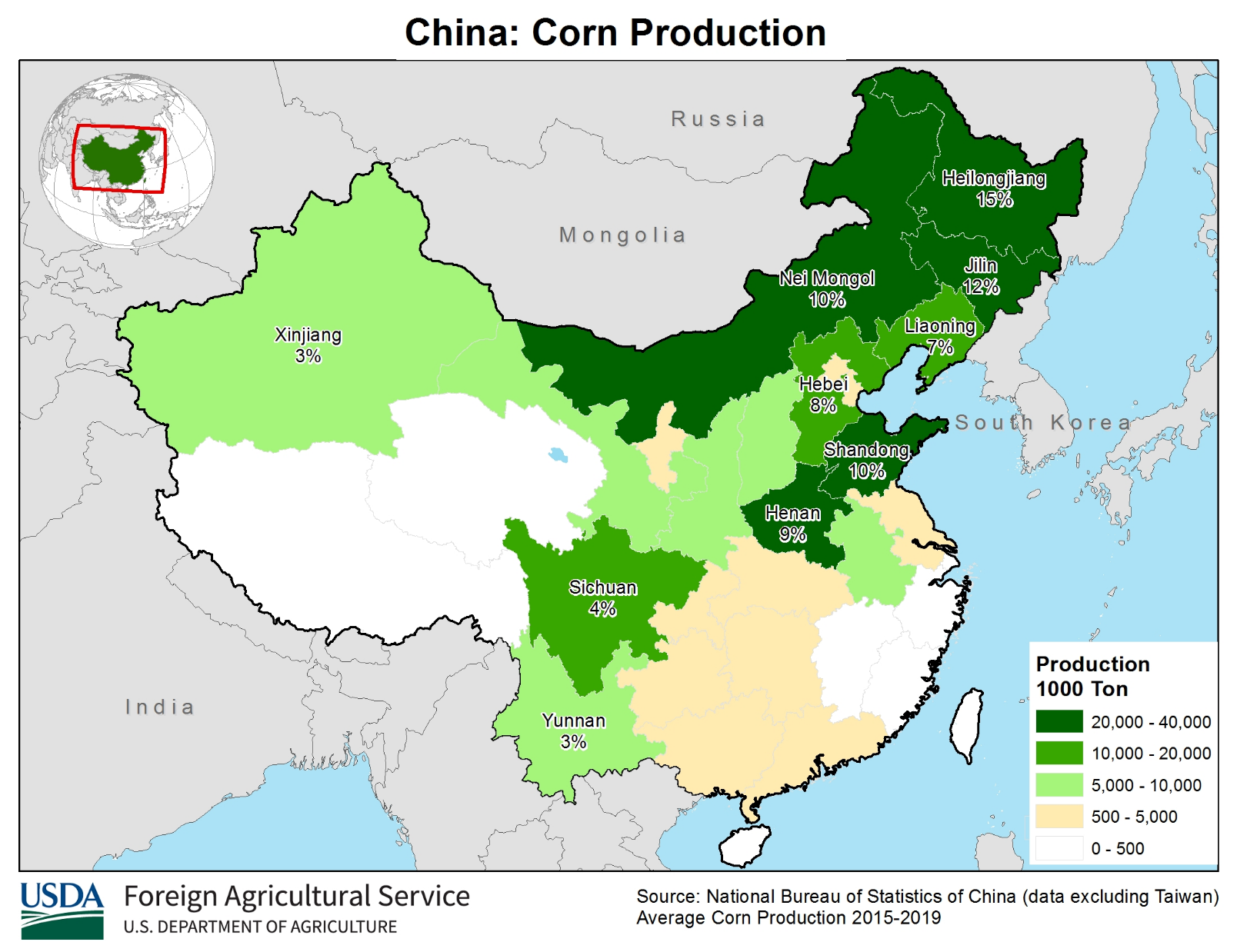

- China

saw another day of torrential rain from central and eastern Henan into Hebei. 30 inches of rain fell in northeastern Henan Wednesday after a similar amount occurred Tuesday across the north-central areas. It might be time to think again about China demand.

After recent flooding in China that likely damaged summer crops, this could increase Chinese import demand from what is already projected by USDA for grains and at a lesser extent, oilseeds, since China plants more grains than oilseeds. Question remains by

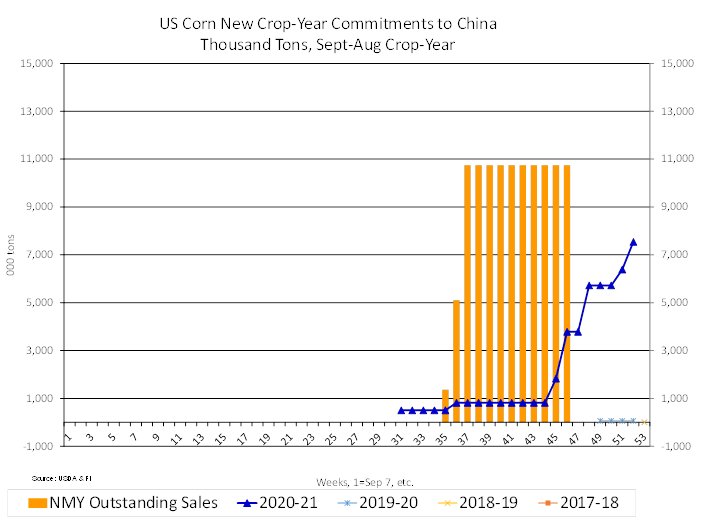

how much? - China’s

National Meteorological Center said the Henan floods may have only a minor impact on corn and the overall impact on production is “not significant.” They noted the flooded area accounted for just 12% of the total corn area in Henan. We may see some crop loss

but overall total China corn production is easily expected to eclipse last year. We are also in the camp USDA is too high on their 26 million ton import estimate for new-crop (2020-21). FI is using 22 million tons. Note China bought nearly 11 million tons

of US new-crop corn, according to USDA export sales. - Henan

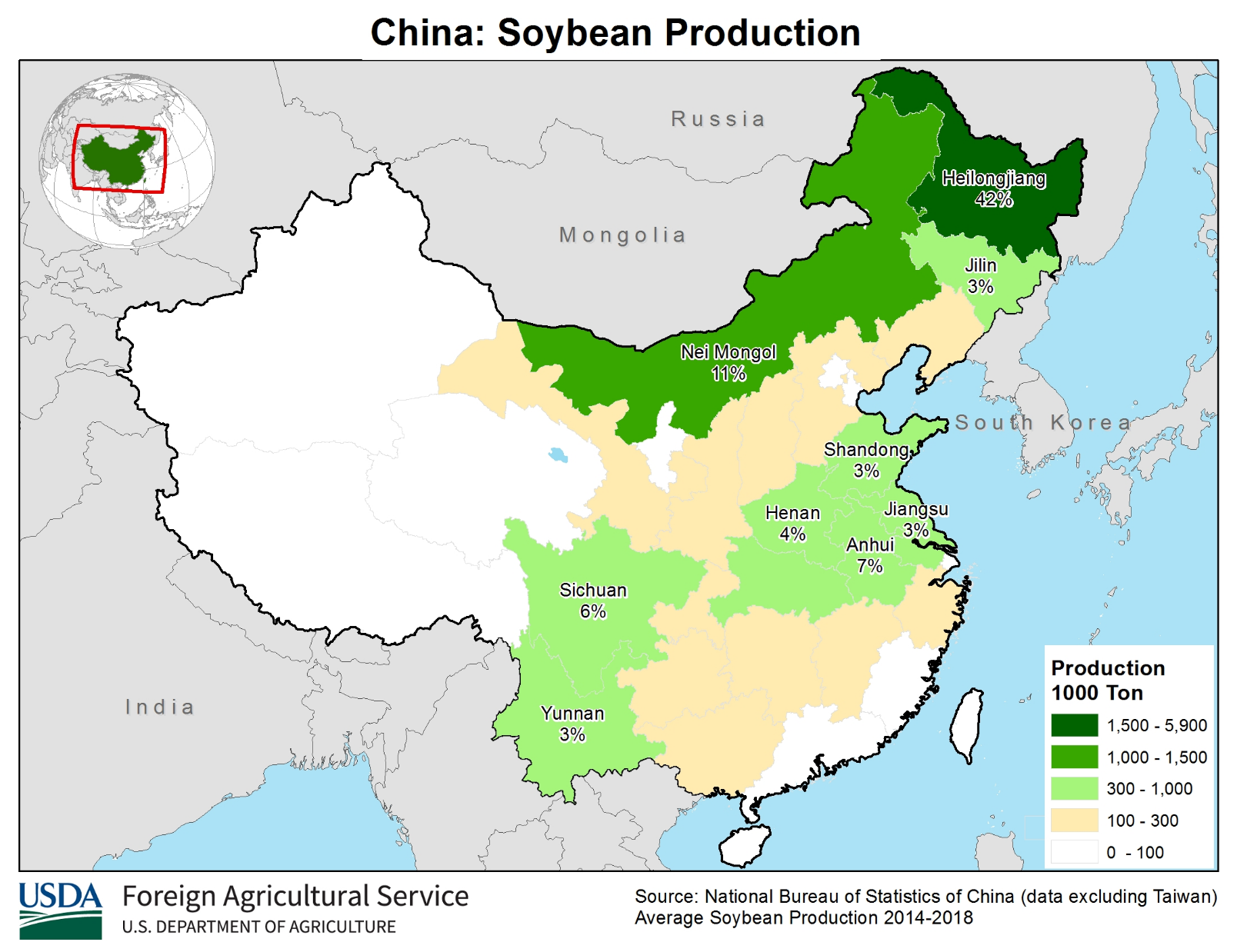

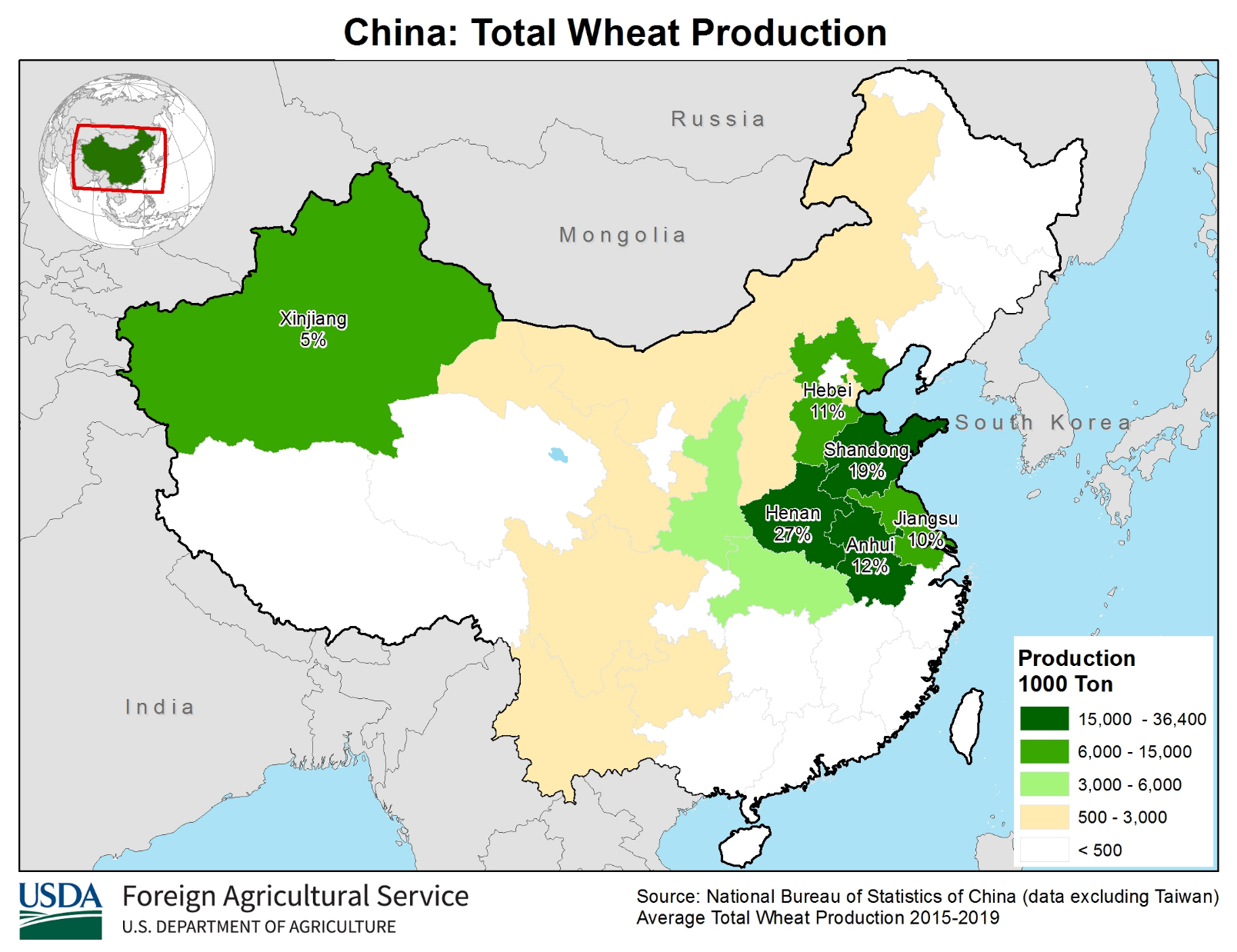

is one of two provinces with the highest amount of farming acreage in China. Hebei ranks around seventh largest. Back to Henan, about 27 percent of China’s all-wheat crop is grown in that province. For corn, Henan makes up about 9 percent of total production.

World Weather, Inc. estimates 91,000 square miles (23.6 million hectares) of China area may be impacted by flooding. We are unsure how much of that is of farmland. World Weather inc. later noted “In Hebei the worst conditions were in the western 40% of the

province while in Henan the worst conditions occurred from the south through the northeast.” It’s difficult to calculate production areas impacted due to lack of available detailed mapping.

- Typhoon

In-Fa is still expected to bring torrential rain, flooding and damaging wind to Zhejiang, China this weekend (World Weather and FI).

- Inserted

after the wheat comment are USDA’s crop areas for corn, soybean, and wheat by China province, for reference.

- Below

are total acres versus oilseeds & grains. 2021-22 is FI projection.

- We

think the $5.88 CBOT September corn gap is still not out of reach.

Export

developments.

- Jordan

seeks 120,000 tons of feed barley on July 28 for Nov/Dec shipment.

Updated

07/13/21

September

corn is seen is a $4.75-$6.25 range

December

corn is seen in a $4.25-$6.00 range.

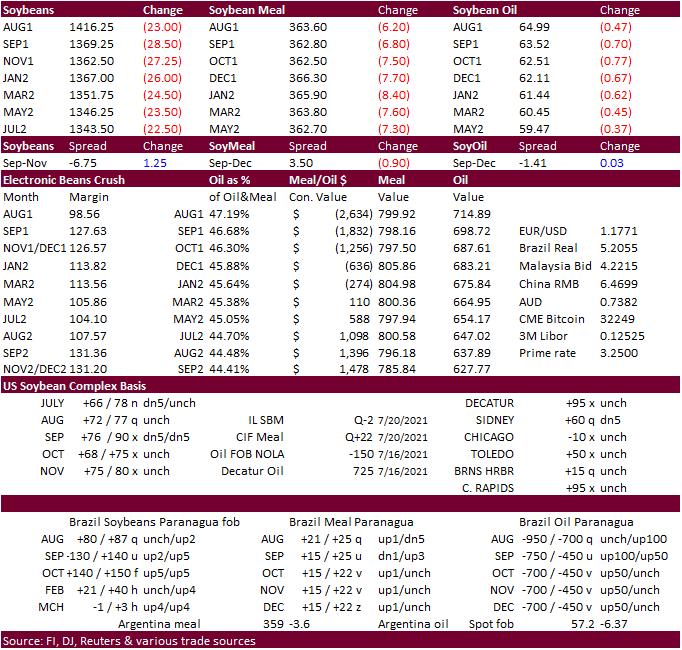

Soybeans

-

It

came as a surprise that the soybean complex traded sharply lower this morning. Some of the losses were paired by afternoon trading. Soybean meal initially saw limited losses from a 125-160 point decline in soybean oil but after soybean oil recovered, meal

prices were pressured despite India’s SEA (crush association) request to the government to consider allowing imports of soybean meal to boost supplies. India has been playing catchup on replenishing vegetable oil supplies recently. They will likely buy the

soybean meal from Argentina like they do for soybean oil. -

August

soybeans fell 23 cents, August meal down $6.60, and August soybean oil off 46 points. The back months for soybeans and products were weaker than August. We are unclear what triggered the bull spreading sentiment as spot US domestic demand has slowed. USDA

may lower the current crop year crush by 10 million bushels in the August S&D update.

-

For

US soybeans, US weather was the main feature for the surprise selloff. Fundamental news was light. It seems until we get the August

Crop

Production report,

prices will be largely influenced by changes in the US weather models. Note private US crop production estimates will start to trickle out next week which could impact prices over the short term. Our August estimates will be set late Monday afternoon post

USDA crop progress report. Currently we look for an unchanged US soybean G/E rating for this week.

-

November

Canadian canola, in a remarkable trade, closed slightly higher at 881.30/ton, erasing nearly all its losses during the session. The contract failed to test its 20-day MA.

- South

Korea’s Agro-Fisheries & Food Trade Corp. bought 4,000 tons of non-GMO soybeans, as expected, at $948.72/ton for arrival between Sep 10 and Oct 20.

Updated

7/21/21

August

soybeans are seen in a $13.25-$15.25 range; November $11.75-$15.00

August

soybean meal – $330-$410; December $320-$425

August

soybean oil – 64.50-70.00; December 48-67 cent range

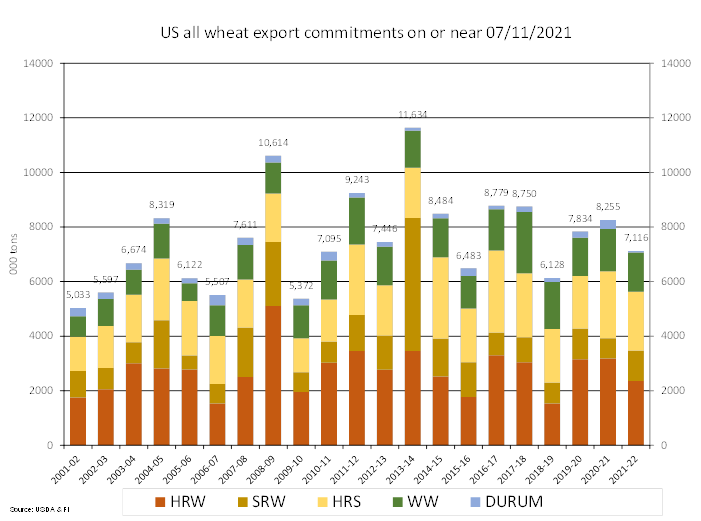

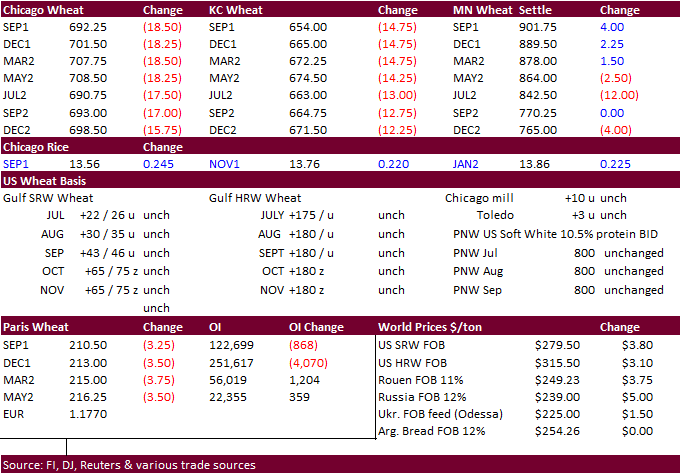

- US

wheat opened

sharply lower in all three markets following corn and soybeans but a rebound in Minneapolis wheat paired some losses for KC and Chicago. The USD was up 14 points as of 1 pm CT. Parts of the northern spring wheat areas are expected to see rain. This theme

and an improving weather situation for selected parts of Canada added to the negative undertone set by the soybean and corn market earlier. However, after MN wheat plunged early, that provided a buying opportunities for commercials. The September MN wheat

contract closed 6.25 cents higher at $9.0400. September Chicago wheat ended 18.50 cents lower, and September KC was down 15 cents.

- USDA

export sales were good for all-wheat. Usual suspects were reported. - Harvesting

pressure added to the negative undertone for KC wheat. Spring wheat harvesting started, and we could see a 1-3 percent progress figure is updated by USDA on Monday.

- Russia’s

Southern Region and parts of the dry areas of Kazakhstan will see rain through Friday evening. This is welcome. Russia’s wheat harvest is lagging last year and average.

- December

Paris wheat was down 3.25 at 313.00 euros. - Consultancy

Strategie Grains lowered their French 2021 soft wheat production after a crop tour showed lower than expected yields in the northeastern region, between 37.0 and 37.5 million tons from 38 previous. This compares to the French AgMin estimate of 37.1 million

tons, and well up from 29 million tons of soft wheat collected in 2020.

- Results

awaited: Ethiopia seeks 400,000 tons of wheat on July 19.

- Pakistan’s

TCP seeks 500,000 tons of wheat on July 27. 200,000 tons are for August shipment, and 300,000 tons are for September shipment.

Rice/Other

-

Mauritius

seeks 6,000 tons of white rice on July 27 for October through December shipment.

Updated

7/21/21

September Chicago wheat is seen in a $6.25-$7.50 range

September KC wheat is seen in a $5.90-$7.25

September MN wheat is seen in a $7.75-$9.50

USDA export sales were poor for corn, soybean meal (marketing year low) and soybean oil. Soybeans were on the low side of expectations and wheat was within. The report is viewed negative for the soybean complex and

corn. Pork sales were ok at 24,500 tons and included 10k for Mexico. There were 52,200 tons of sorghum sales, for Japan and Mexico.

U.S. EXPORT SALES FOR WEEK ENDING 07/15/2021

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

137.0 |

1,631.1 |

1,695.6 |

119.5 |

858.9 |

1,618.0 |

0.0 |

0.0 |

|

SRW |

184.6 |

967.4 |

675.6 |

101.7 |

332.6 |

213.6 |

5.0 |

5.0 |

|

HRS |

113.5 |

1,533.0 |

1,770.1 |

165.3 |

742.3 |

838.3 |

0.0 |

0.0 |

|

WHITE |

38.0 |

1,065.1 |

1,172.2 |

84.5 |

408.2 |

496.2 |

0.0 |

0.0 |

|

DURUM |

0.0 |

8.4 |

203.0 |

0.0 |

41.7 |

158.8 |

0.0 |

0.0 |

|

TOTAL |

473.2 |

5,205.1 |

5,516.5 |

471.0 |

2,383.7 |

3,324.8 |

5.0 |

5.0 |

|

BARLEY |

0.0 |

23.5 |

36.6 |

0.2 |

1.6 |

2.1 |

0.0 |

0.0 |

|

CORN |

-88.5 |

9,019.4 |

6,678.2 |

1,003.5 |

60,751.2 |

37,032.1 |

47.7 |

16,127.4 |

|

SORGHUM |

-52.2 |

710.9 |

802.2 |

59.0 |

6,467.4 |

3,558.1 |

0.0 |

1,594.9 |

|

SOYBEANS |

62.0 |

3,132.2 |

7,865.4 |

164.1 |

58,855.8 |

38,529.1 |

176.3 |

9,864.9 |

|

SOY MEAL |

68.3 |

2,069.7 |

1,719.0 |

145.8 |

9,519.9 |

9,691.2 |

19.1 |

1,057.3 |

|

SOY OIL |

0.7 |

16.9 |

225.2 |

2.9 |

660.3 |

1,018.9 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

40.5 |

189.8 |

93.3 |

35.5 |

1,611.3 |

1,329.4 |

5.0 |

5.0 |

|

M S RGH |

0.0 |

8.0 |

23.6 |

0.3 |

25.9 |

72.9 |

0.0 |

7.0 |

|

L G BRN |

0.1 |

11.5 |

10.1 |

0.4 |

40.0 |

58.8 |

0.0 |

0.7 |

|

M&S BR |

0.1 |

0.7 |

31.7 |

22.3 |

156.2 |

86.5 |

0.0 |

0.0 |

|

L G MLD |

29.7 |

46.8 |

52.4 |

18.0 |

645.5 |

859.5 |

0.3 |

0.3 |

|

M S MLD |

2.8 |

113.0 |

83.9 |

3.8 |

579.8 |

661.3 |

0.1 |

12.3 |

|

TOTAL |

73.2 |

369.7 |

294.9 |

80.3 |

3,058.6 |

3,068.5 |

5.4 |

25.3 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

40.0 |

1,825.3 |

3,542.8 |

246.1 |

14,365.5 |

13,463.4 |

251.9 |

2,972.4 |

|

PIMA |

3.4 |

103.3 |

135.6 |

10.4 |

733.8 |

458.8 |

0.9 |

5.4 |

This

summary is based on reports from exporters for the period July 9-15, 2021.

Wheat: Net

sales of 473,200 metric tons (MT) for 2021/2022 were up 11 percent from the previous week and 44 percent from the prior 4-week average. Increases primarily for China (135,300 MT, including decreases of 3,300 MT), the Philippines (122,800 MT, including decreases

of 1,000 MT), Mexico (118,400 MT, including decreases of 2,800 MT), Nigeria (43,700 MT), and Ecuador (41,800 MT, including 41,300 MT switched from unknown destinations), were offset by reductions primarily for Vietnam (53,000 MT). Total net sales for 2022/2023,

of 5,000 MT were for unknown destinations. Exports of 471,000 MT were up 29 percent from the previous week and 28 percent from the prior 4-week average. The destinations were primarily to the Philippines (118,800 MT), Mexico (67,700 MT), China (63,500 MT),

Nigeria (48,700 MT), and Ecuador (41,800 MT).

Corn:

Net sales reductions of 88,500 MT for 2020/2021 were down noticeably from the previous week and from the prior 4-week average. Increases primarily for Japan (57,300 MT, including 43,700 MT switched from unknown destinations and 12,000 MT – late), Panama (20,700

MT), Colombia (10,800 MT, including decreases of 200 MT), Nicaragua (7,500 MT, switched from Honduras), and Canada (6,700 MT), were more than offset by reductions primarily for China (160,000 MT). For 2021/2022, net sales of 47,700 MT were primarily for Japan

(18,000 MT), Honduras (9,100 MT), Mexico (9,000 MT), Nicaragua (7,500 MT), and El Salvador (1,300 MT). Exports of 1,003,500 MT were down 6 percent from the previous week and 22 percent from the prior 4-week average. The destinations were primarily to China

(526,000 MT), Mexico (235,900 MT), Japan (95,400 MT, including 12,000 MT – late), Venezuela (47,100 MT), and Nicaragua (27,400 MT).

Optional

Origin Sales: For 2020/2021, the current outstanding balance of 30,500 MT is for unknown destinations. For 2021/2022, the current outstanding balance of 60,000 MT is for unknown destinations.

Late

Reporting: For 2020/2021, net sales and exports totaling 12,000 MT of corn were reported late to Japan.

Sorghum:

Net sales reductions of 52,200 MT for 2020/2021 resulting in increases for Mexico (900 MT) and Japan (100 MT), were more than offset by reductions for China (53,200 MT).

Exports of 59,000 MT were down 17 percent from the previous week, but up noticeably from the prior 4-week average. The destinations were to China (58,800 MT) and Mexico (200 MT).

Rice:

Net sales of 73,200 MT for 2020/2021 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for Haiti (27,500 MT), Venezuela (25,100 MT), Mexico (16,100 MT), Canada (2,000 MT), and Jordan (1,400 MT), were offset by

reductions for Guatemala (1,000 MT). For 2021/2022, net sales of 5,400 MT were primarily for Guatemala (5,000 MT), Costa Rica (200 MT), and Leeward Windward Islands (100 MT).

Exports of 80,300 MT were up 24 percent from the previous week and 53 percent from the prior 4-week average. The destinations were primarily to Venezuela (26,300 MT), South Korea (22,200 MT), Haiti (15,300 MT), Honduras (5,500 MT), and Mexico (4,400 MT).

Exports

for Own Account: For 2020/2021, the current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans:

Net sales of 62,000 MT for 2020/2021 were up noticeably from the previous week, but down 22 percent from the prior 4-week average. Increases primarily for Japan (85,300 MT, including 53,200 MT switched from unknown destinations and decreases of 4,400 MT),

Mexico (13,100 MT, including decreases of 11,300 MT), Colombia (9,100 MT, including 8,500 MT switched from unknown destinations), Malaysia (5,600 MT), and Taiwan (5,000 MT), were offset by reductions primarily for unknown destinations (58,200 MT). For 2021/2022,

net sales of 176,300 MT were reported for unknown destinations (97,000 MT), Mexico (67,400 MT), China 6,000 MT), Taiwan (5,000 MT), and Vietnam (900 MT). Exports of 164,100 MT were down 17 percent from the previous week and 19 percent from the prior 4-week

average. The destinations were primarily to Mexico (60,300 MT), Japan (57,300 MT), Indonesia (22,000 MT), Colombia (9,100 MT), and Vietnam (4,400 MT).

Exports

for Own Account: For 2020/2021, the current exports for own account outstanding balance is 5,800 MT, all Canada.

Soybean

Cake and Meal: Net sales of 68,300 MT for 2020/2021–a marketing-year low–were down 3 percent from the previous week and 70 percent from the prior 4-week average. Increases primarily for Ireland (28,500 MT, including 30,000 MT switched from Poland and

decreases of 1,500 MT), Colombia (25,000 MT), unknown destinations (12,500 MT), Panama (7,100 MT), and Canada (6,700 MT, including decreases of 900 MT), were offset by reductions primarily for Poland (30,000 MT), the French West Indies (6,500 MT), and Nicaragua

(5,500 MT). For 2021/2022, net sales of 19,100 MT were primarily for Canada (15,500 MT), Mexico (2,800 MT), and Guatemala (500 MT).

Exports of 145,800 MT were down 43 percent from the previous week and 19 percent from the prior 4-week average. The destinations were primarily to the Philippines (49,400 MT), Ireland (28,500 MT), Canada (21,300 MT), Mexico (17,100 MT), and Honduras (7,500

MT).

Soybean

Oil: Net sales of 700 MT for 2020/2021 were down noticeably from the previous week and down 16 percent from the prior 4-week average. Increases were reported for Mexico (400 MT) and Canada (300 MT). Exports of 2,900 MT were up noticeably from the previous

week, but down 13 percent from the prior 4-week average. The destinations were to Mexico (2,400 MT) and Canada (500 MT).

Exports

for Own Account: For 2020/2021, the current exports for own account outstanding balance of 5,700 RB is for China (4,700 RB) and Vietnam (1,000 RB).

Late

Reporting: For 2020/2021, net sales and exports totaling 5,100 RB of upland cotton were reported late for Pakistan.

Hides

and Skins: Net sales of 355,800 pieces for 2021 were up 6 percent from the previous week, but down 32 percent from the prior 4-week average. Increases were primarily for China (192,300 whole cattle hides, including

decreases of 6,600 pieces), South Korea (71,200 whole cattle hides, including decreases of 1,100 pieces), Mexico (41,000 whole cattle hides, including decreases of 1,400 pieces), Taiwan (26,500 whole cattle hides), and Brazil (14,900 whole cattle hides).

Exports of 525,500 pieces were up 85 percent from the previous week and 54 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (364,000 pieces), South Korea (83,000 pieces), Mexico (36,800 pieces), Thailand (27,600 pieces),

and Brazil (8,100 pieces).

Net

sales of 278,300 wet blues for 2021 were up 7 percent from the previous week and 58 percent from the prior 4-week average. Increases were primarily for China (73,400 unsplit, 14,700 grain splits, and decreases of 100 unsplit), Vietnam (80,400 unsplit, including

decreases of 200 unsplit), Italy (52,400 unsplit, 100 grain splits, and decreases of 100 unsplit), Thailand (24,400 unsplit, including decreases of 400 unsplit), and Taiwan (23,600 unsplit). For 2022, net sales of 29,200 unsplit were reported for Italy (21,600

unsplit), Vietnam (4,000 unsplit), and China (3,600 unsplit). Exports of 185,600 wet blues were up 50 percent from the previous week and 41 percent from the prior 4-week average. The destinations were to China (40,800 unsplit and 18,000 grain splits), Italy

(37,500 unsplit and 3,200 grain splits), Vietnam (28,700 unsplit), Taiwan (15,000 unsplit), and Thailand (14,400 unsplit). Net sales of 157,500 splits resulting in increases for China (159,400 pounds), were offset by reductions for Vietnam (1,800 pounds).

Exports of 204,000 pounds were to Vietnam (160,000 pounds) and China (44,000 pounds).

Beef:

Net sales of 25,100 MT reported for 2021 were up noticeably from the previous week and up 63 percent from the prior 4-week average. Increases primarily for South Korea (8,600 MT, including decreases of 500 MT),

Japan (5,200 MT, including decreases of 600 MT), China (4,100 MT, including decreases of 100 MT), Canada (2,400 MT, including decreases of 100 MT), and Mexico (1,500 MT, including decreases of 100 MT), were offset by reductions for Belgium (100 MT).

Total net sales for 2022, of 300 MT were for Japan.

Exports of 21,400 MT–a marketing-year high–were up 38 percent from the previous week and 22 percent from the prior 4-week average. The destinations were primarily to South Korea (5,900 MT), Japan (5,500 MT), China (4,000 MT), Taiwan (1,500 MT), and Mexico

(1,400 MT).

Pork:

Net sales of 24,500 MT reported for 2021 were up noticeably from the previous week, but down 12 percent from the prior 4-week average. Increases primarily for Mexico (10,000 MT, including decreases of 900 MT), Japan

(5,200 MT, including decreases of 200 MT), Canada (4,000 MT, including decreases of 500 MT), Colombia (1,900 MT, including decreases of 100 MT), and Chile (900 MT, including decreases of 100 MT), were offset by reductions for China (100 MT) and Peru (100 MT).

Exports of 30,800 MT were up 22 percent from the previous week and 1 percent from the prior 4-week average. The destinations were primarily to Mexico (12,000 MT), China (5,400 MT), Japan (4,400 MT), South Korea (1,900 MT), and Canada (1,700 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.