PDF Attached

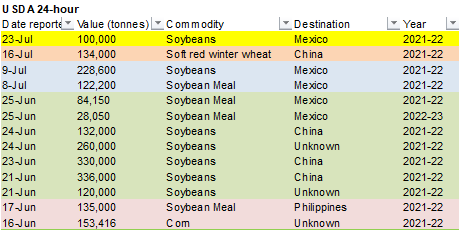

USDA

announced 100,000 tons of soybeans were sold to Mexico for 2021-22 delivery under the 24-hour announcement system.

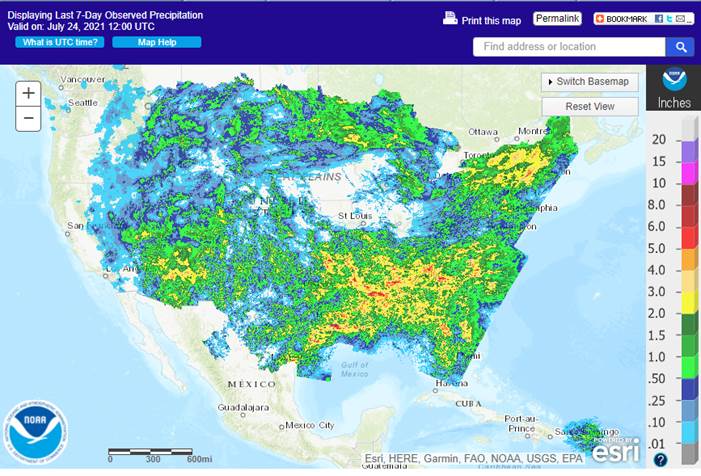

Weather

looks wetter for the late weekend into early next week for the Plains. The Midwest will see erratic rains through Tuesday.

BA

Grains Exchange

7-day

(wetter than that of Friday)

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

- U.S.

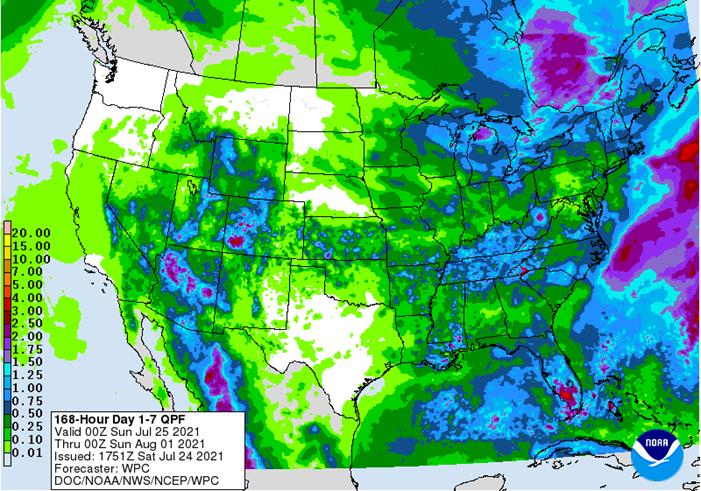

weather seems to be heavily debated these days – mostly because of recent model forecasts of abundant rain - Today’s

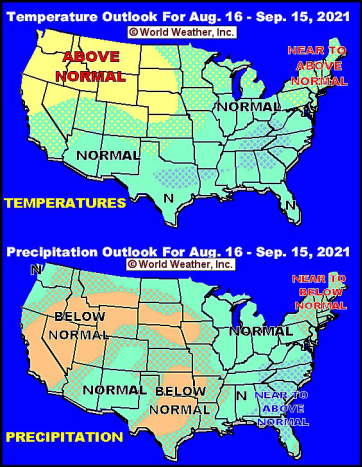

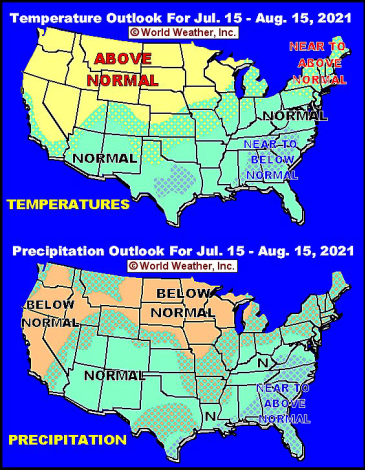

forecast models seem to be shaking off some of the wetter biases of late, but there is still too much rain suggested for the western Corn Belt - World

Weather, Inc. has made no changes to its late summer outlook since February and we see no need for a change here - The

Plains and western Corn Belt will see net drying in August, despite a northwesterly flow pattern aloft in parts of the Midwest - The

pattern will leave the northern Plains drier biased and allow the central Plains to dry down and heat up - Some

of the drier and warmer biased weather in the Plains will creep into the western Corn Belt as well – especially the southwestern parts of the region - Eastern

Midwest crop areas will see milder than usual weather in August with the second half of the month cooler than usual for some areas - Scattered

showers and thunderstorms will occur frequently in the northern and eastern Midwest, but rainfall in western Minnesota and the Dakotas will be limited and often lighter than usual - No

change in Canada Prairies drought status is expected over the next two weeks - Rain

fell Thursday in central and northeastern Alberta with rainfall to 0.60 inch - A

few thunderstorms in east-central Saskatchewan crop areas also occurred with Indian Head reporting 1.34 inches, but that was and enigma and not representative of what occurred in most crop areas which was insignificant rainfall and very warm temperatures - Rain

will return to northern and western Alberta next week and temperatures will be milder there than anywhere else - Above

normal temperatures will continue in the central and southern Prairies - Crop

stress and falling yield potentials will also continue - Typhoon

In-Fa will pound Zhejiang, China with torrential rain, flooding and strong wind speeds this weekend - Damage

to crops and property are expected - Remnants

of the storm may move northeast into a part of the Korean Peninsula and northeastern China, but only after much impact on Zhejiang - Flooding

in Hebei and Henan from this week’s record setting rainfall will continue into next week, but the situation will slowly improve - Crop

and property damage assessments will begin as the flood water abates - Losses

are suspected of being tremendous - India

will receive heavy rain from two monsoon low pressure centers; one today through this weekend and the other in the following weekend - Significant

moisture improvements are likely in Gujarat and southern Rajasthan where it has been quite dry in recent weeks - Flooding

is expected in Madhya Pradesh and some neighboring areas in association with these two monsoon lows.

- Pakistan,

far northwestern Rajasthan, India and the southern portions of India from southern Maharashtra to Tamil Nadu and parts of Andhra Pradesh will not receive much rain and net drying is expected to continue for a while - Unirrigated

crop stress is expected - India

rainfall Thursday began to increase in Madhya Pradesh and northeastern Maharashtra as well as northeastern Telangana where rainfall of 2.00 to nearly 4.00 inches resulted - Heavy

rain also fell in Goa where 8.14 inches resulted - Rain

elsewhere was more limited with net drying from Gujarat to Punjab and Haryana and throughout Pakistan - Europe

weather will begin trending wetter again today in the west and then spreading eastward this weekend into next week - A

brief break from frequent rain this week helped improve crop maturation and harvest conditions in small grain and unharvested winter rapeseed production areas - Some

concern over returning crop quality declines are expected because of the returning rain - Periodic

rain will continue into the first week of August maintaining some concern for the situation - Limited

rainfall from eastern Ukraine through the middle and lower Volga River Basin during the next ten days and warm temperatures will raise some concern over crop development in unirrigated areas because of already dry conditions in parts of this region - Recent

rain in Russia’s Southern Region and northwestern Kazakhstan has provided a short term bout of relief, but it was not enough, and more rain will be required over the next few weeks - A

drier than usual bias is expected to resume in this area after some lingering rain occurs today - Ivory

Coast and Ghana rainfall will be restricted over the next couple of weeks - Seasonal

rainfall should return normally in September, but August rainfall will be lighter than usual - Other

areas in West Africa will see a better distribution of rain - East-central

Africa rainfall will continue favorable for coffee and cocoa, although some areas in Uganda and Kenya may receive less than usual rainfall - Ethiopia

rainfall is expected to continue improving after a slow start to the rainy season - Southern

Oscillation Index has reached back about +14.80 and it is expected to remain strongly positive during the coming week while slowly leveling off after a strong rising trend since June 22 when the index was -3.36 - Typhoon

In-Fa is still expected to bring torrential rain, flooding and damaging wind to Zhejiang, China this weekend - Rainfall

of 10.00 to 20.00 inches will result in serious flooding with a potential impact on rice and many other crops

- China

weather improved Thursday, although one of the areas that reported more than 40.00 inches of rain during the past week received nearly 4.00 inches of additional rain

- Many

other areas in China trended drier - Temperatures

were seasonable with a warmer than usual bias in the northeast - Unusually

cool weather has occurred this week in western Xinjiang, China where three days of upper 60- and 70-degree highs occurred instead of readings in the 90s to near 100 - Rain

also fell frequently during mid-week - Northeastern

Xinjiang weather improved greatly this week with a strong warming trend after a prolonged period of cool weather - Degree

day accumulations in Xinjiang are behind normal which may lead to higher potential for frost and freeze damage this autumn if cold weather comes too soon - U.S.

Midwest soil moisture is still rated favorably in many key crop areas, but parts of the west are drying down - Texas

crops will benefit from drier and warm biased weather over the next two weeks - Degree

day accumulations in West Texas are a little below average and the warming trend will prove favorable for cotton, corn, sorghum and other crops - Excellent

harvest weather is expected in South Texas over the coming ten days - U.S.

Delta and southeastern states will experience a good mix of weather during the next two week supporting normal crop development - The

Delta needs to dry down will be successful with that over time - Southeast

Canada corn, soybean and wheat production areas are seeing a very good mix of weather this summer and production potentials are high for all three crops - Wheat

harvesting is under way - U.S.

Far west will continue quite dry, although not as hot as in recent weeks - Monsoon

moisture in the southern Rocky Mountain region and Arizona will be frequent and significant enough to improve soil moisture and induce a little runoff - Crop

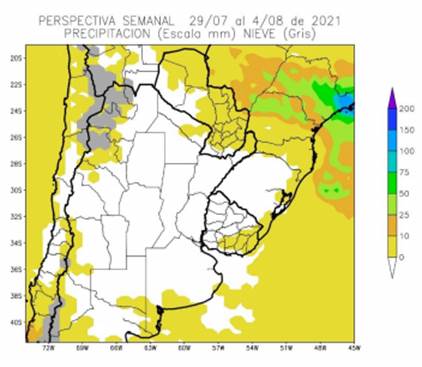

conditions will steadily improve in Arizona because of expected rainfall - Brazil

will see some periodic rain in the south Monday through Friday of next week favoring wheat development and improving topsoil moisture for use in the early corn planting season which is approaching next month - Argentina

weather will be mostly dry over the next ten days - Showers

will occur brief in the east this weekend - Some

winter wheat would welcome rain especially in the west, but crop conditions are much better than last year at this time - Crops

are mostly semi-dormant right now - No

meaningful precipitation fell during the weekend - Southeast

Asia rainfall recently and that which is expected in the next two weeks will continue somewhat erratic

- Laos,

Cambodia and northern Philippines will see the greatest rainfall - Southern

Sumatra and Java, Indonesia may experience less than usual rainfall for a while - Thailand

will also experience less than usual rainfall in pockets, although there has been some beneficial moisture recently - Australia

weather this month has been ideal for improving winter wheat, barley and canola establishment in much of the nation - Some

additional rain is still needed in South Australia, northwestern Victoria and from western New South Wales to Queensland - South

Africa has been cold during the past week with waves of rain in the southwest - Weekend

rainfall was still cool, but rain ended in many areas - The

moisture has been good for future wheat development - Dryness

remains in some of the unirrigated eastern wheat production areas - Some

warming is expected over the coming week, but the precipitation anomalies will prevail - Mexico

weather has improved with increased rainfall in the south and west parts of the nation - Drought

conditions are waning, and crops are performing better - Dryness

remains in Chihuahua and northeastern parts of the nation - Weather

over the next ten days will offer some relief, but more rain will be needed in the drier areas - Central

America rainfall has been plentiful and will remain that way except in Honduras where recent rainfall has been lighter and more sporadic than usual - Nicaragua

has received frequent bouts of rain this month easing long term dryness, but more may be needed in some locations - New

Zealand rainfall during the coming week will be near to above normal in western portions of South Island while near to below average in most other areas - Temperatures

will be seasonable

Source:

Source:

World Weather Inc.

Bloomberg

Ag Calendar

Friday,

July 23:

- ICE

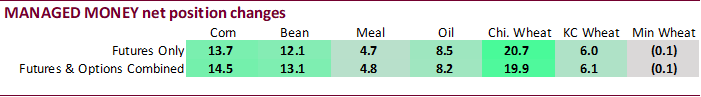

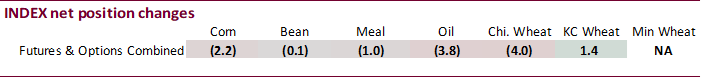

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

cattle on feed, poultry slaughter, cattle inventory - HOLIDAY:

Japan

Monday,

July 26:

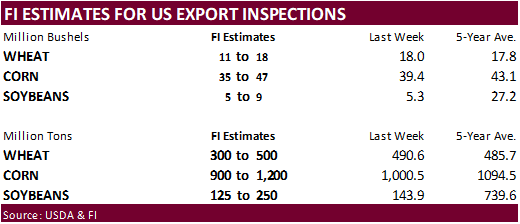

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn, cotton, soybeans, wheat, 4pm - MARS

monthly EU crop conditions report - Malaysia

July 1-25 palm oil export data (tentative) - UN

Food Systems Pre-Summit in Rome - Ivory

Coast cocoa arrivals - HOLIDAY:

Thailand

Tuesday,

July 27:

- EU

weekly grain, oilseed import and export data - UN

Food Systems Pre-Summit in Rome - EARNINGS:

ADM

Wednesday,

July 28:

- EIA

weekly U.S. ethanol inventories, production - Brazil

Unica cane crush, sugar production (tentative) - UN

Food Systems Pre-Summit in Rome - HOLIDAY:

Thailand - EARNINGS:

Bunge, Pilgrim’s Pride

Thursday,

July 29:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports

Friday,

July 30:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received

Source:

Bloomberg and FI

US

Markit Manufacturing PMI Jul P: 63.1 (est 62.0; prev 62.1)

–

Markit Services PMI: 59.8 (est 64.5; prev 64.6)

–

Markit Composite PMI: 59.7 (prev 63.7)

Canadian

Retail Sales (M/M) May: -2.1% (est -3.0%; prev -5.7%)

Canadian

Retail Sales Ex-Auto (M/M) May: -2.0% (est -1.5%; prev -7.2%)

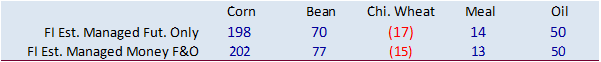

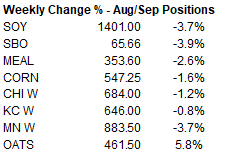

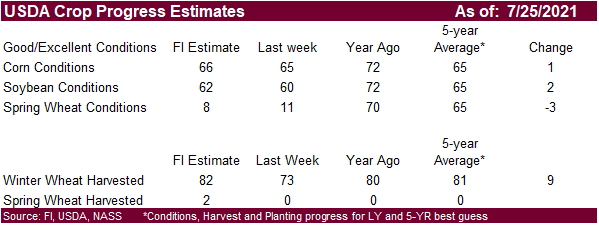

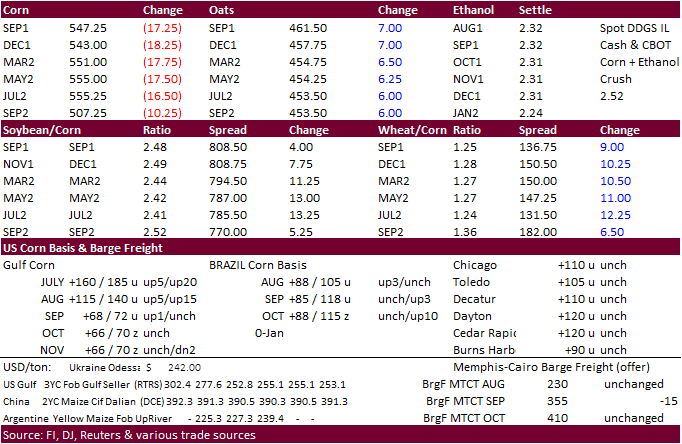

- Corn

prices traded sharply lower on profit taking ahead of the weekend. Some noted the 11-15 day US weather maps calling for a wetter bias for the Corn Belt. Weather outlook also looks wetter for the late weekend into early next week for the Plains. The Midwest

will see erratic rains through Tuesday. - The

Saturday 1-7 day precipitation map appeared wetter than that of Friday. - The

September corn contract traded through a couple key MA’s, included the 100-day at $5.5350. Major support is seen at $5.00, but we think it will be hard for that contract to trade below $5.20 as US inventories are seen tight.

- Look

for private US trade supply estimates to trickle out next week. - Funds

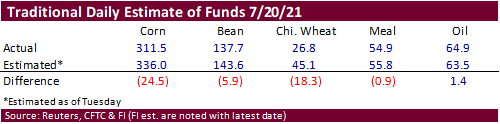

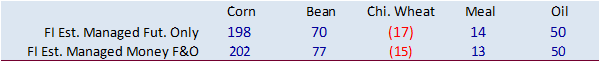

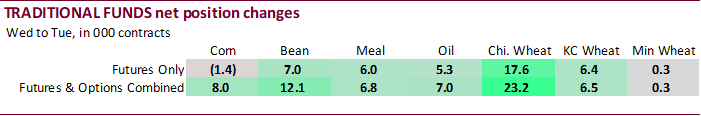

sold an estimated net 18,000 corn contracts. - A

Reuters exclusive noted Argentina grain shipping has to be cut by 25 percent due to severely low water levels. About 80 percent of Argentina’s Parana river carries farm goods. Water levels are at their lowest level in 77 years. Some estimate up to 40 percent

of what would be normally shipper later this year could be deterred if conditions fail to improve. This comes after Brazil experienced serious drought during the second half of the 2020-21 growing season. Rain is badly needed ahead of 2021 planting season

for Brazil that starts in October. - China

sold 8,207 tons of imported GMO corn at auction, only 4% of what was offered.

- Ukraine

grain exports so far this season were 1.7 million tons, up 49 percent from the previous period last season (crop year starts June 1). Corn exports were double at 824,000 tons, and most of that volume likely headed to China.

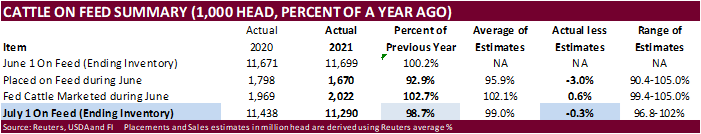

Cattle

on Feed

Placements

were less than expected. Animal units should be monitored later this year as they are already declining. Fed cattle was a little better than expected. Cattle on feed was near expectations.

Export

developments.

-

Jordan

seeks 120,000 tons of feed barley on July 28 for Nov/Dec shipment.

September

corn is seen is a $4.75-$6.25 range

December

corn is seen in a $4.25-$6.00 range.

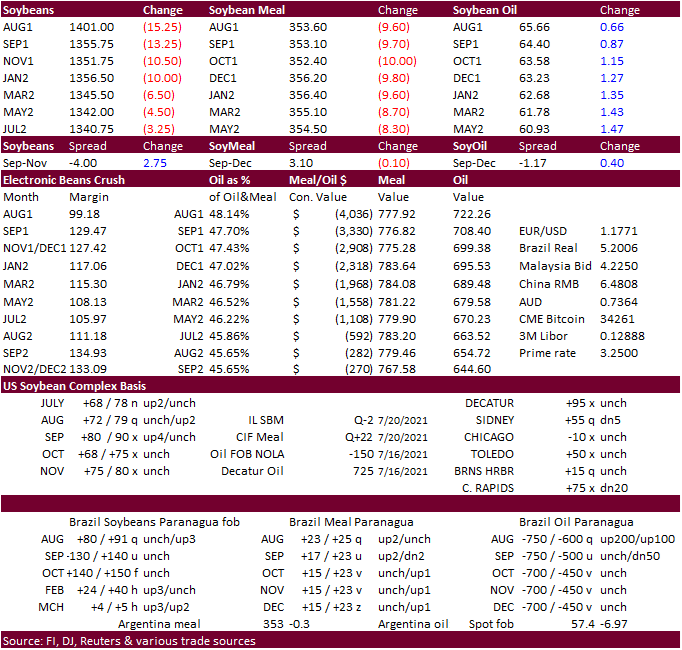

Soybeans

-

The

soybean complex ended the week in a choppy trade. Soybeans and meal were lower while soybean oil traded higher in part to a rally in Malaysian palm oil and Argentina transportation problems.

-

November

soybeans ended 10.50 cents lower, near its 20-day MA of $13.5450. Next level of support is seen at $13.26, its 100-day MA.

-

Funds

sold an estimated net 8,000 soybeans, 6,000 soybean meal and 1,000 soybean oil.

-

November

Canadian canola was up 2.10 at $883.40/ton.

-

India

imported 13.35 million tons of edible vegetable oils in 2020. This compares to 12.47 million tons produced domestically. Consumption was 25.82 million tons. -India AgMin

-

India

is the latest country to see too much rain. The monsoon rains caused widespread damage to property and more than 135 people have perished as of Saturday morning.

https://www.bbc.com/news/world-asia-india-57952521 -

Offshore

values as of Friday morning were leading SBO 132 points higher (209 higher for the week to date) and meal $0.40 lower ($6.40 lower for the week).

-

We

heard over the past week China was searching around for grain and oilseeds, notably hard red winter wheat from the US but nothing was posted by USDA.

-

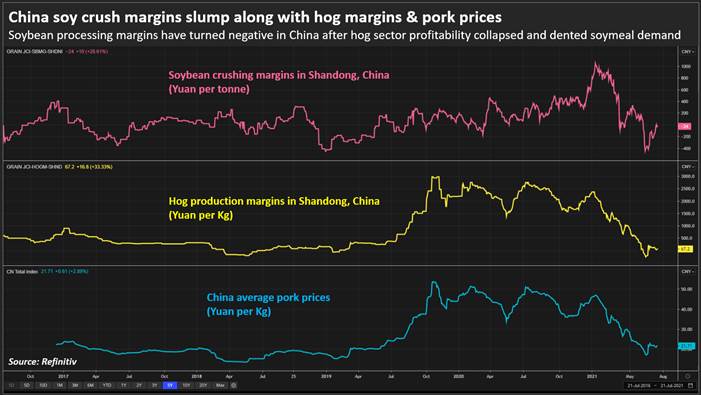

China

cash crush margins as of late Friday were last negative 9 cents on our analysis,

a little weaker than the start of the week. -

Paraguay

crushed 1.39 million tons of soybeans during the January through June period, well down from 1.77 million tons from a same period last year, according to AgriCensus. Paraguayan soybean meal is normally the preferable type for Middle Eastern buyers.

-

The

Rosario Grain Exchange sees Argentina’s soybean area declining 5 percent for 2021-22 (planted in a couple months) to 4.57 million hectares. AgriCensus noted producers may favor corn over soybeans this year.

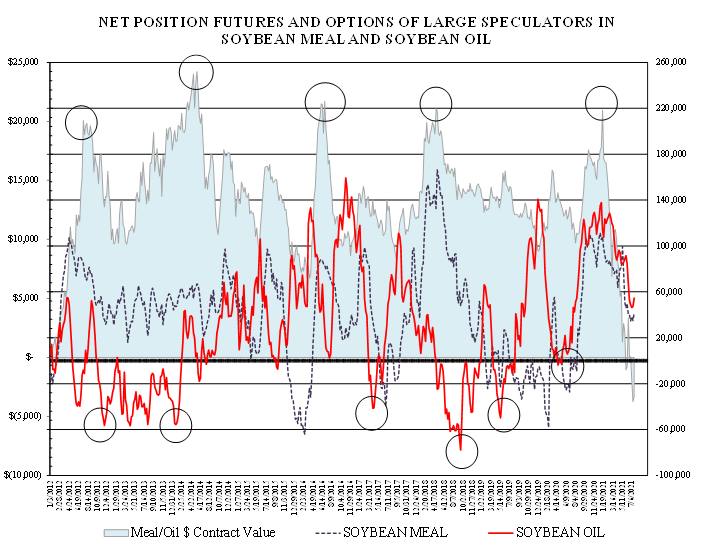

Soybean

meal is oversold relative to soybean oil, in our opinion.

- USDA

announced 100,000 tons of soybeans were sold to Mexico for 2021-22 delivery.

Updated

7/21/21

August

soybeans are seen in a $13.25-$15.25 range; November $11.75-$15.00

August

soybean meal – $330-$410; December $320-$425

August

soybean oil – 64.50-70.00; December 48-67 cent range

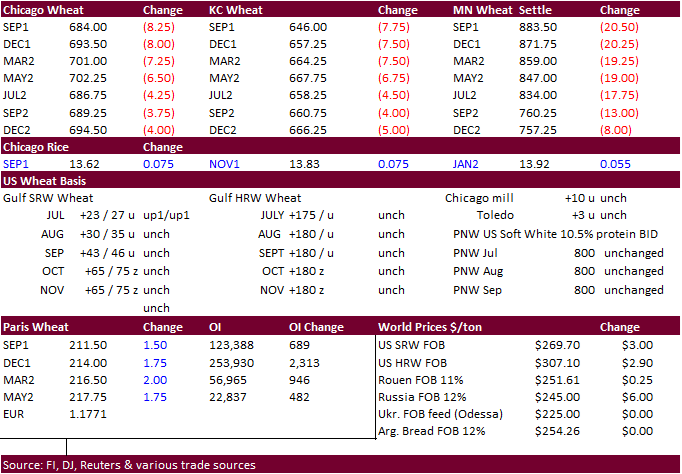

- US

wheat started

higher but closed lower in all three US markets on heavy selling in corn and profit taking. The USD ended Friday slightly higher.

- Funds

sold an estimated net 7,000 SRW wheat contracts. - Argentina’s

shipping woes due to low water levels may extend into the fourth quarter (OND) that could disrupt 2021 wheat shipments. Argentina harvests wheat December through January.

- Russia’s

AgMin noted wheat yields averaged 3.45 tons per hectare as of July 20, down from 3.47 tons a year earlier.

- Russia’s

Southern Region and parts of the dry areas of Kazakhstan will see rain through this (Friday) evening. This is welcome.

- Ukraine’s

wheat harvest is near 30 percent of the expected 8.9 million hectare area.

- December

Paris wheat was up 2.00 at 214.25 euros.

- French

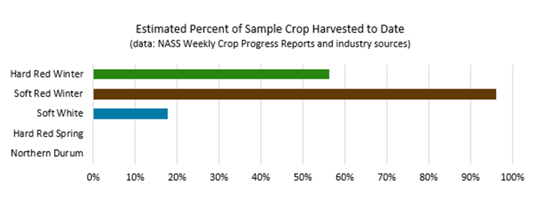

soft wheat conditions fell in the week to July 19 to 75% good or excellent against 76% a week earlier. 14% of the crop had been harvested versus 4% a week earlier and 67% a year ago. - US

wheat Associates: “The U.S. winter wheat harvest is approaching 60% complete as combines run in drier areas of the Plains. HRW crop conditions remain variable. Harvest of a larger SRW crop is almost complete and all samples have been tested. With above-normal

temperatures and very little rain in South Dakota, North Dakota, Minnesota and Montana, the HRS crop conditions declined again this week. Harvest of winter SW is progressing well ahead of normal in the dry Pacific Northwest. Durum conditions are slightly better

than HRS but remain drought and heat stressed.”

- Results

awaited: Ethiopia seeks 400,000 tons of wheat on July 19.

- Pakistan’s

TCP seeks 500,000 tons of wheat on July 27. 200,000 tons are for August shipment, and 300,000 tons are for September shipment.

Rice/Other

- Mauritius

seeks 6,000 tons of white rice on July 27 for October through December shipment.

Updated

7/21/21

September Chicago wheat is seen in a $6.25-$7.50 range

September KC wheat is seen in a $5.90-$7.25

September MN wheat is seen in a $7.75-$9.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.