Black

Sea grain shipping uncertainty could influence the Sunday night open. One day after an agreement was reached, Russia bombed Odesa, a major Ukraine grain hub.

Sunday

Night Calls

Soybeans

8-12 higher

Soybean

oil 50-100 higher

Soybean

meal $2-$5 higher

Corn

3-5 higher

Chicago

Wheat 5-10 higher

KC

Wheat 6-12 higher

MN

Wheat 4-8 higher

Friday,

we saw positioning across the commodity markets. Russia, Ukraine, Turkey and the UN reached an agreement to secure grain shipments out of Ukraine, but there is still a lot of uncertainty over actual shipments. The USD grinded lower, WTI was lower led by the

nearby position, and US equities lower. Soybeans rallied led by soybean oil, meal was lower, corn trended lower from sharply lower wheat. US temperatures will increase again this week increasing crop stress.

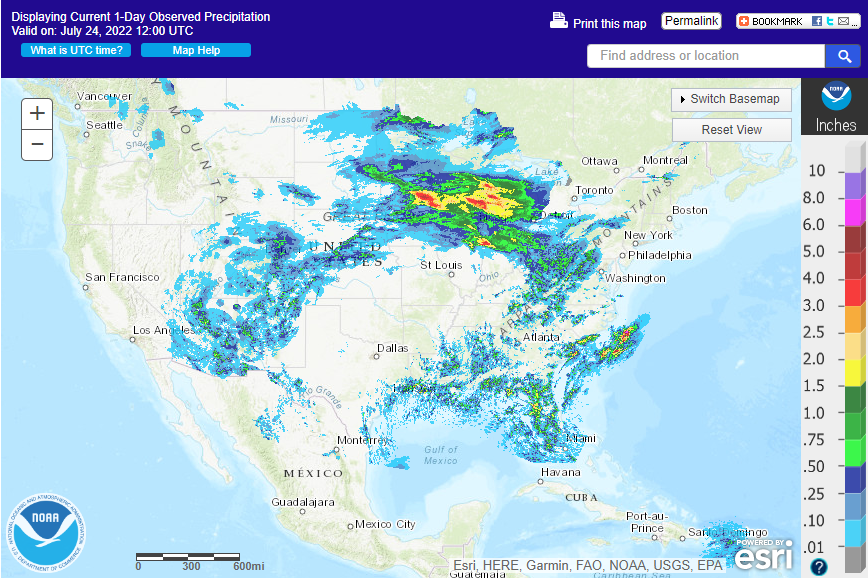

Last

seven days

World

Weather Inc.

WEATHER

TO WATCH AROUND THE WORLD

- Not

much change occurred overnight for world weather - Europe

heat and dryness will continue a concern for the next ten days - The

region of greatest concern will be from Slovakia into Greece where dryness is already significant in many areas - Warmer

than usual temperatures and restricted rainfall in these areas will keep crops stress and lower production will be inevitable in unirrigated corn, soybean, sorghum and sunseed production areas - Daily

high temperatures in the 90s Fahrenheit with some extremes over 100 are expected - Western

Europe will also continue drier biased, but temperatures will not be as hot as they were earlier this week, and a few showers may occur - Net

drying is expected to continue with France at the center of the most negatively impacted nations - Rain

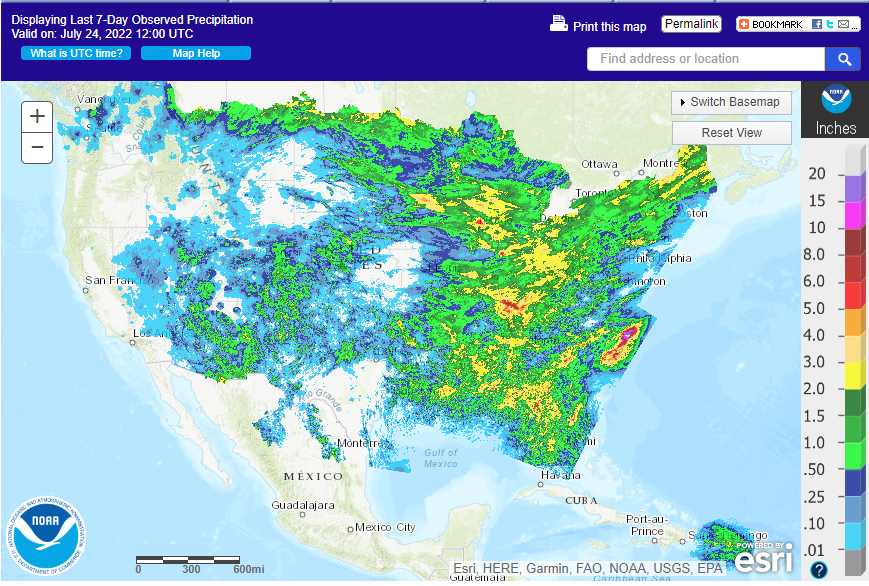

will fall most often from Czech Republic into the Baltic States and Belarus including Poland where the best soil and crop conditions are likely - U.S.

weather is still advertised to be favorable in the coming ten days with rain for most areas; including some of the drier areas of the Plains and southwestern Corn Belt - Rain

advertised for northern and western Texas and Oklahoma does not occur significantly until late next week and into the following weekend - Some

of the advertised rain may be overdone and it will be totally dependent upon the cold surge from Canada being as great as advertised

- The

cold may be overdone and there is nearly a week between now and then for the model to moderate its outlook – so use some caution - U.S.

second week outlook is expected to trend drier and hotter with the heat first bubbling up in the central and southern Plains and southwestern Corn Belt - The

relief expected in the central Plains, Oklahoma and northern Texas as well as the northern Delta will only last ten days – at the most and since some of these areas do not get rain or any cooling until late next week the period of relief may be restricted

to less than a week - West

Texas cotton, corn and sorghum areas will get “some” showers late next week through the first couple of days in August, but the odds are not high that there will be enough rain to change the bottom line - Northern

U.S. Delta, central Missouri, eastern Kansas and neighboring areas will not likely get much rain or relief from recent hot and dry weather until late next week - Showers

and thunderstorms should evolve late next week and into the following weekend offering a short term bout of relief - Much

more rain will be needed, though, to turn around crops and follow up rainfall may not be very great

- U.S.

northern Plains will get some showers in the next week to ten days, but much of it may be a little too light to change soil moisture especially in the northwest where the driest soil is present

- Excessive

heat in the central U.S. is expected to abate for a little while, but the next few days will continue hot enough to stress crops, livestock and humans from eastern Montana and South Dakota to Texas - Highest

temperatures will be in the upper 90s to 110, although most readings will stay below 107 and the hottest readings will stay mostly in the southern Plains.

- All

of the heat should retreat into Texas next week and into the following week while near to below average temperatures impact the northern Plains and Midwest - Montana

and South Dakota will be hot today and milder after that - Central

U.S. Plains and southwestern Corn Belt will be hottest through Saturday and possibly Sunday before cooling down to more seasonable levels - Drought

in the western United States will be intensified during the latter part of July and early August because of a ridge of high pressure expected in the region and resulting hot and dry conditions - U.S.

southeastern states will continue to experience a favorable mix of weather for a little while longer, but may dry down briefly this weekend into next week before resuming in the second week of the outlook - Drought

in northeastern Mexico and the southern U.S. Plains is unlikely to change in the next two weeks

- Most

likely the only way drought will break in these areas will be from a tropical cyclone and none is expected for a while – at least not in that region.

- Many

corn, sorghum, citrus, sugarcane and dry bean crops are being negatively impacted in Mexico along with various other fruit and vegetable crops - Mexico

rain will be most abundant in the west and southern parts of the nation - India’s

monsoon is expected to continue performing favorably with widespread rain across most of the nation during the next couple of weeks - Central

and some northern parts of the nation may be a little too wet at times resulting in some flooding - Sufficient

breaks in the rain are expected to prevent a major flood from occurring - Russia’s

Southern Region will receive periods of rain and drizzle during the next several days while temperatures are cooler than usual - The

environment will be good for improving summer crops that have been recently stressed and strained by dryness

- Other

areas in Russia will experience a good mix of weather during the next ten days - Portions

of western and southern Ukraine are expected to miss out on rainfall during the next ten days to two weeks and that may raise the potential for crop moisture stress as time moves along - Argentina

rain potentials remain good for next week as two waves of moisture come into wheat production areas

- The

rain will bolster topsoil moisture for better germination, emergence and establishment, although follow up rain will be imperative

- Canada’s

Prairies weather will trend a little drier the remainder of this week and into next week, although some showers will occur periodically - Temperatures

will be near to normal with restricted rainfall - Crop

development should advance relatively well in most areas, but timely rain will soon be needed once again

- The

southwestern Prairies are expecting to be drier than normal for at least the next ten days - Southeastern

Canada crop conditions are rated favorably with little change likely for a while - South

America temperatures over the next week will be near to above average with some cooling likely in Argentina and southern Brazil during the middle to latter part of next week - Brazil

rainfall will be minimal except in Atlantic coastal areas and in far southern Brazil - Rainfall

will be light, and some areas will experience net drying - Drying

in other areas of Brazil will be great for Safrinha crop harvesting - Most

of China’s crop region east of Tibet and north of the Yangtze River Valley will get rain at one time or another during the next two weeks and all of it will be good for summer crop development - The

greatest rainfall may occur in east-central and northeastern parts of the nation

- Southeastern

China is expected to continue drying out through the next ten days and perhaps longer - Soil

conditions will eventually become a little too dry raising concern for the region’s late season rice and eventually stressing some sugarcane and a few other crops - Dryness

is not a problem today, but a couple of weeks from now the situation will be different

- Temperatures

will continue near to above normal - China’s

Xinjiang province continues to experience relatively good weather - A

few showers and thunderstorms are expected, but most of the region will be dry with temperatures varying greatly over the week to ten days - There

were no organized tropical cyclones in the world today, although a new disturbance is expected to evolve in the eastern Pacific in the coming week

- Sumatra,

Indonesia rainfall remained restricted Thursday - Below

average precipitation has occurred in many areas from northern and central Sumatra into northwestern Borneo in recent weeks and greater rain is needed - Locally

heavy rain fell in central Sumatra briefly Tuesday, but only a few areas were impacted - Some

increase in rain is expected in coming days, but amounts may continue lighter than usual in many areas

- Precipitation

will become more widespread next week - All

other Southeast Asian nations will experience an abundance of rainfall during the next few weeks resulting in some flooding in the Philippines and the Maritime provinces - Recent

rain has improved soil moisture in parts of Thailand after a drier than usual bias earlier this season - Australia

weather in the coming ten days will be favorable for most winter crops - Central

Queensland received rain Wednesday and Thursday favoring a boost in topsoil moisture for a part of winter crop country

- Western

Australia will get most of the significant rain this coming week, but some rain will eventually reach the southeastern parts of the nation in time next week.

- South

Korea rice areas are still dealing with a serious drought, despite some rain that fell recently.

- Some

additional rain is expected over the next couple of weeks, and it should gradually be enough to ease dryness and crop stress, but production will be down - East-central

Africa rainfall will be greatest in central and western Ethiopia and lightest in parts of Uganda.

- Tanzania

is normally dry at this time of year, and it should be that way for the next few of weeks - Some

areas in Kenya are expected to trend wetter in the next ten days - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

greater rain would still be welcome in the drier areas of Ivory Coast - Seasonal

rains are shifting northward leading to some drying in southern areas throughout west-central Africa - Cotton

areas are expecting much greater rainfall in the next couple of weeks and there is some potential for flooding - Flooding

is also possible in Guinea, Sierra Leone and southern Mali over the next couple weeks

- Mali

has been drier than usual over the past 30 days and rain would benefit cotton and many other crops – at least for a while - South

Africa’s crop moisture situation is favorable for winter crop establishment, although some additional rain might be welcome - Restricted

rainfall is expected for a while, but the crop is rated better than usual - Central

America rainfall will continue to be abundant to excessive and drying is needed - Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely - Today’s

Southern Oscillation Index was +9.13 and it will continue to move lower over the next several days - New

Zealand weather is expected to be well mixed over the next ten days - Temperatures

are expected to be a little cooler than usual - Rainfall

will be greater than usual in North Island in this coming week and near to below average in South Island

Source:

World Weather INC

Bloomberg

Ag Calendar

Monday,

July 25:

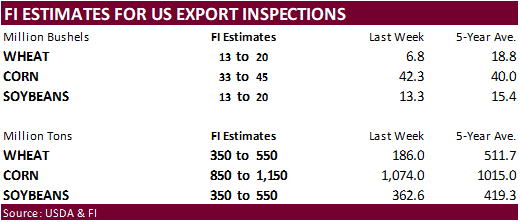

- USDA

export inspections – corn, soybeans, wheat, 11am - US

June poultry slaughter, 3pm - US

crop conditions for spring and winter wheat, corn, soybeans and cotton; spring wheat harvest, 4pm - Brazil’s

Unica to release cane crushing and sugar output data (tentative) - Malaysia’s

July 1-25 palm oil export data

Tuesday,

July 26:

- EU

weekly grain, oilseed import and export data - Earnings:

ADM

Wednesday,

July 27:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Earnings:

Bunge

Thursday,

July 28:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Buenos

Aires grains exchange weekly crop report - HOLIDAY:

Thailand

Friday,

July 29:

- Vietnam

July coffee, rice and rubber export data - FranceAgriMer

weekly update on crop conditions - ICE

Futures Europe weekly commitments of traders report - US

agricultural prices paid, received, 3pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Thailand

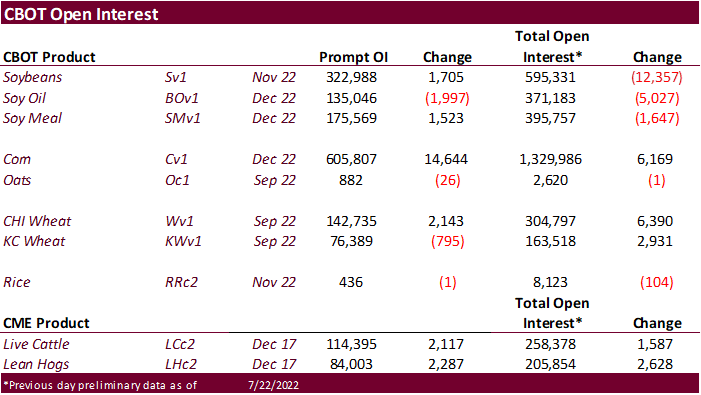

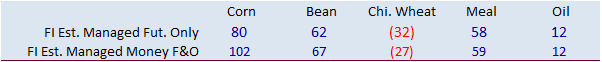

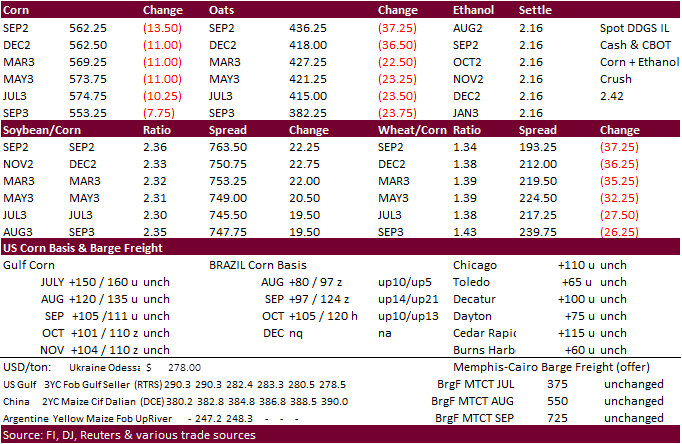

Below

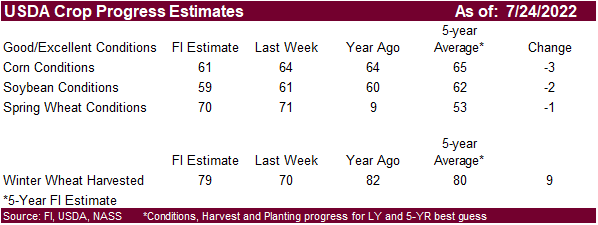

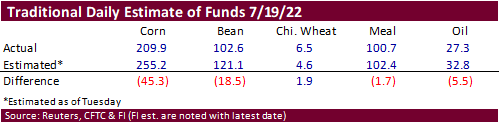

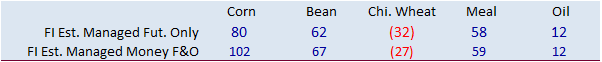

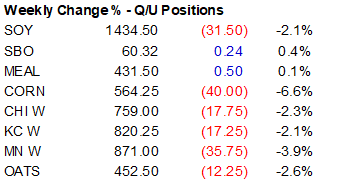

tables were updated to reflect end of close Friday

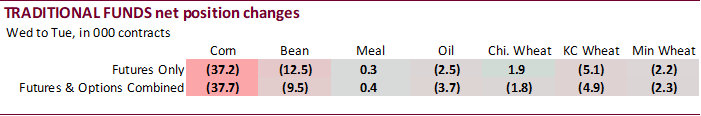

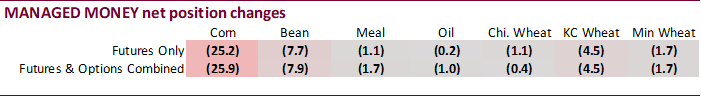

CFTC

COT

Traders

missed it for corn and soybeans

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

35,949 -30,925 381,692 -9,861 -374,576 32,505

Soybeans

26,451 -4,202 146,682 -9,650 -140,592 13,486

Soyoil

-2,481 -2,931 90,123 -1,894 -91,831 3,798

CBOT

wheat -47,233 941 118,733 -2,787 -62,736 1,726

KCBT

wheat -9,675 -4,157 49,564 -150 -36,708 4,780

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

125,303 -25,871 256,617 -6,201 -375,936 35,578

Soybeans

87,832 -7,879 95,111 -4,946 -143,128 14,052

Soymeal

66,588 -1,703 81,642 907 -191,420 -1,496

Soyoil

17,844 -1,033 77,952 1,001 -103,883 1,693

CBOT

wheat -6,816 -372 63,805 1,486 -50,858 221

KCBT

wheat 11,868 -4,519 26,943 781 -30,811 4,549

MGEX

wheat 982 -1,672 1,235 2 -4,153 1,170

———- ———- ———- ———- ———- ———-

Total

wheat 6,034 -6,563 91,983 2,269 -85,822 5,940

Live

cattle 19,665 1,585 59,798 161 -95,971 -568

Feeder

cattle -2,544 3,265 3,486 85 4,413 -1,481

Lean

hogs 45,345 5,411 47,404 -2,290 -81,174 -3,399

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

37,084 -11,785 -43,067 8,279 1,878,222 -28,592

Soybeans

-7,275 -1,592 -32,540 366 782,719 -7,722

Soymeal

21,354 2,141 21,836 150 444,043 3,953

Soyoil

3,898 -2,687 4,190 1,027 436,352 8,919

CBOT

wheat 2,633 -1,455 -8,763 120 411,445 13,273

KCBT

wheat -4,820 -337 -3,180 -474 178,991 6,361

MGEX

wheat 2,016 -662 -80 1,160 62,770 -417

———- ———- ———- ———- ———- ———-

Total

wheat -171 -2,454 -12,023 806 653,206 19,217

Live

cattle 19,426 -854 -2,916 -324 326,211 -4,658

Feeder

cattle 178 -430 -5,534 -1,439 49,753 -2,744

Lean

hogs -1,045 -236 -10,531 514 257,851 1,466

Macros

Canada

Retail Sales M/M May: 2.2% (est 1.6%, prevR 0.7%)

Retail

Sales Ex Auto M/M May: 1.9% (est 1.8%, prev 1.1%)

101

Counterparties Take $2.229 Tln At Fed Reverse Repo Op (prev $2.272 Tln, 101 Bids)

Corn

·

CBOT corn

rallied earlier but lack of news led to fund selling and positioning ahead of the weekend. US and EU weather forecast changes were seen as minimal as of Saturday afternoon. Sunday weather was not available at the time this was written.

·

China’s adverse weather is abating, easing some concerns over corn and oilseed crop production losses.

·

Brazil’s weather favors second crop corn harvesting.

·

Technical buying was noted earlier Friday after a three day selling spree by the investment funds and higher soybeans. Sharply lower wheat chipped away at those gains and corn prices closed lower from widespread commodity selling

pressure and a 40+ cent decline in nearby US wheat.

·

Ukraine’s deal to ship grain safely through the Black Sea was seen bearish for corn, IMO, as bulk commodities take up storage space. But don’t expect significant quantities to be shipped over the medium term. Short term it might

be bearish US corn export demand. Long-term bullish US demand as it will be hard to move inventories from farms to ports.

·

Getting 60 million tons of grain shipped out of Ukraine during the remainder of local marketing year 2022-23 is unlikely. Too many logistical problems will hinder exports over the next several months, including rebuilding infrastructure

to move the grain from the country to ports.

·

After the weekend bombings traders should be cautious selling gains. Ukraine over the weekend said Russia cannot be trusted.

·

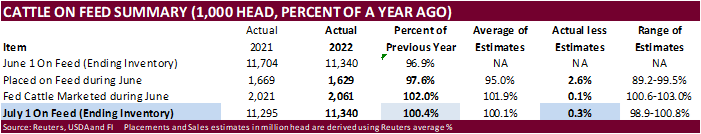

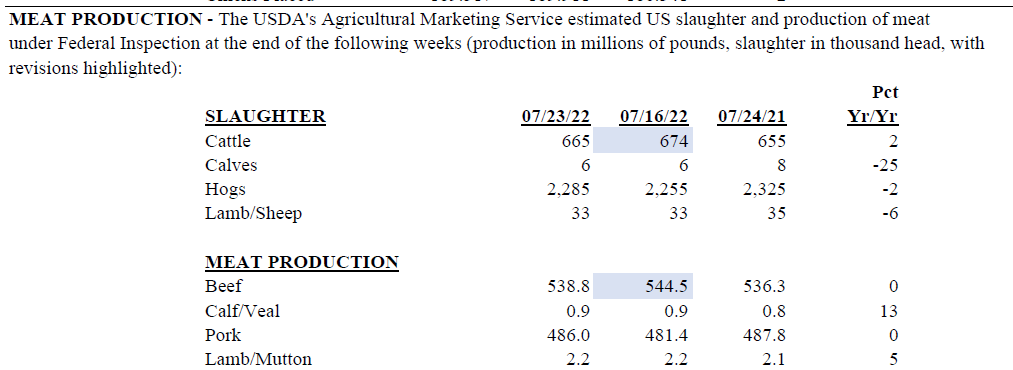

USDA Cattle on Feed showed July 1 inventories slightly above expectations, placements higher than expected and marketing near expectations.

·

Look for cattle prices to appreciate this week as rangers cull herds amid hot temperatures and dry conditions.

·

South Korea’s KFA bought about 65,000 tons of corn from SA and/or SAf At $310.39/ton c&f for arrival around November 10.

·

South Korea’s FLC bought about 65,000 tons of optional-origin feed corn at an estimated $317.22 a ton c&f for arrival in South Korea around Nov. 15.

Trade

News Service

September

corn is seen in a $5.50 and $7.50 range

December

corn is seen in a wide $5.00-$8.00 range