PDF Attached

We

updated our price ranges, lowering nearly all of them based on recent fund liquidation and potential increase in Ukraine grain exports. For today, Black Sea grain shipping uncertainty caused a rebound in the wheat market after a missile strike by Russia over

the weekend. Wheat prices retreated well off session highs with a slow morning trade before rebounding on bottom picking. The World Food Program seeks 30,000 tons of Ukrainian milling wheat for August delivery. Brazil and China are re-negotiating the corn

export protocol and the Brazil AgMin thinks there is a possibility the country will ship corn to China as soon as second half 2022. Ukraine appears to still be pushing for grain exports as workers return to ports. Soybeans were higher led by a very strong

meal market. US weather concerns supported that market. Soybean oil fell on product spreading despite a higher WTI crude oil market. Corn and wheat were higher on Black Sea shipping uncertainties.

US

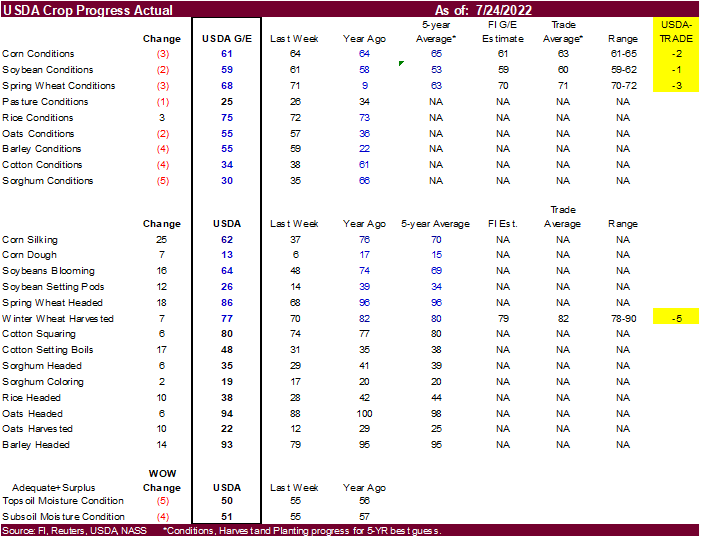

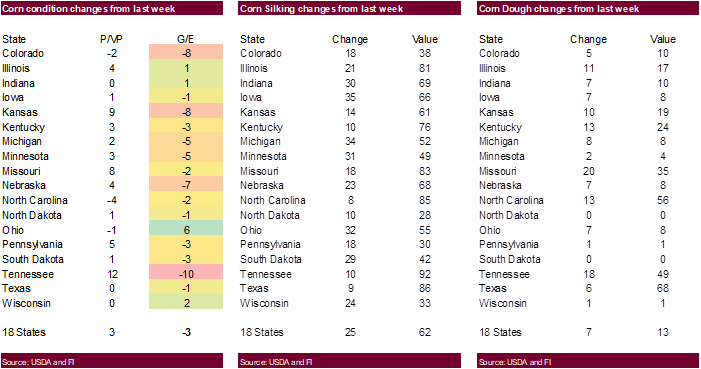

CORN – 61 PCT CONDITION GOOD/EXCELLENT VS 64 PCT WK AGO (64 PCT YR AGO) -USDA

US

CORN – 62 PCT SILKING VS 37 PCT WK AGO (70 PCT 5-YR AVG) -USDA

US

CORN – 13 PCT DOUGH VS 6 PCT WK AGO (15 PCT 5-YR AVG) -USDA

US

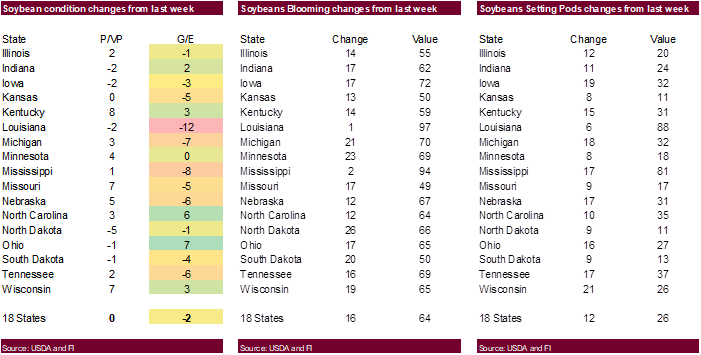

SOYBEAN – 59 PCT CONDITION GOOD/EXCELLENT VS 61 PCT WK AGO (58 PCT YR AGO) -USDA

US

SOYBEANS – 64 PCT BLOOMING VS 48 PCT WK AGO (69 PCT 5-YR AVG) -USDA

US

SOYBEANS – 26 PCT SETTING PODS VS 14 PCT WK AGO (34 PCT 5-YR AVG) -USDA

US

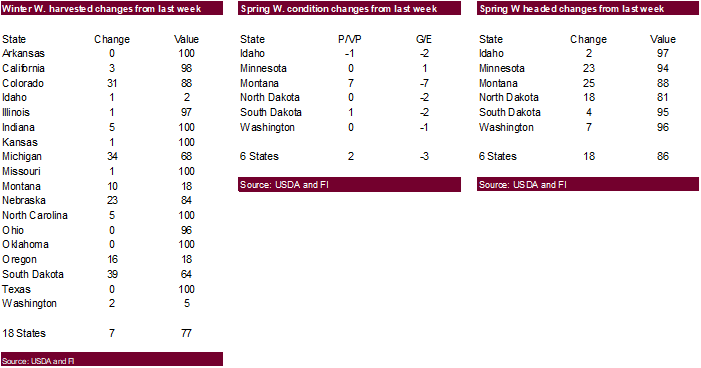

WINTER WHEAT – 77 PCT HARVESTED VS 70 PCT WK AGO (80 PCT 5-YR AVG) -USDA

US

SPRING WHEAT – 86 PCT HEADED VS 68 PCT WK AGO (96 PCT 5-YR AVG) -USDA

US

SPRING WHEAT – 68 PCT CONDITION GOOD/EXCELLENT VS 71 PCT WK AGO (9 PCT YR AGO) -USDA

Calls:

Soybeans

5-8 higher

Soybean

meal $0.50-$1.50 higher

Soybean

oil steady to 30 higher

Corn

4-7 higher

Chicago

wheat 3-6 higher

KC

wheat 4-7 higher

MN

wheat 3-6 higher

World

Weather Inc.

WEATHER

TO WATCH AROUND THE WORLD

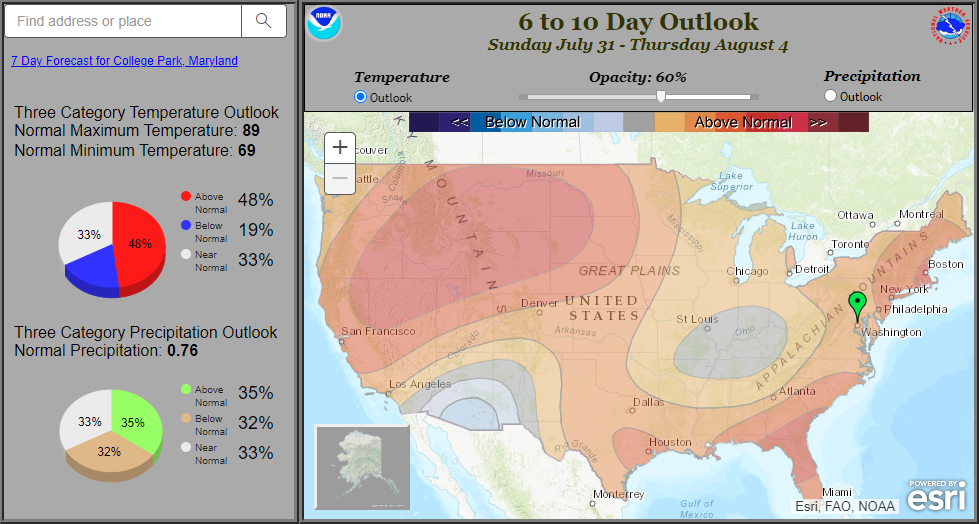

- U.S.

weather occurred mostly as expected during the weekend - Rain

fell in the northern Midwest with moderate to heavy amounts of 1.00 to 2.00 inches occurring from southeastern Minnesota and northeastern Iowa to west-central Michigan and northwestern Indiana - A

local amount of 4.26 inches occurred along the Wisconsin/Illinois border near Lake Michigan - 3.09

inches occurred near Rochester, Minnesota - Lower

parts of the Midwest were dry until overnight when rain developed from northeastern Kansas across Missouri to western Kentucky - Showers

and thunderstorms occurred from extreme eastern Texas through Louisiana to the Florida Panhandle and southwestern Georgia

- Rainfall

ranged from 0.56 to 1.52 inches with local totals to 2.55 inches in west-central Louisiana

- West-central,

Florida received 1.00 to 3.33 inches - Most

of West Texas failed to get enough rain to counter evaporation, but a small part of the Rolling Plains received 0.30 to 1.30 inches with local totals to 2.63 inches

- Other

areas were dry and warm - Highest

weekend temperatures in the central U.S. were in the 90s Fahrenheit with extremes of 100 to 110 Fahrenheit from southern Nebraska and eastern Colorado into southern Texas with some lower 100s in Missouri, Arkansas and far southwestern Illinois - 90-degree

highs occurred in other western and southern Midwest locations, but only for a quick day or two.

- Sunday

afternoon temperatures were limited to the upper 60s and 70s Fahrenheit in the northern Plains and upper Midwest and in the 80s and lower 90s in the lower eastern Midwest

- Missouri

and southeastern Kansas into the Delta and southern states were still reporting 90- and lower 100-degree temperatures Sunday afternoon - U.S.

weather in the coming week includes waves of rain from the central Plains through the lower Midwest and Delta into the southeastern states

- Relief

from dryness is expected, although additional moisture will likely be needed - Areas

of locally great rainfall are still advertised, but some of the rain may be overdone - Waves

of rain will fall in the lower Midwest over the coming week bolstering soil moisture from Nebraska, Kansas and northern Oklahoma to Ohio, Kentucky, Tennessee and areas east to the Carolinas and Virginia - Rain

totals will vary from 0.75 to 2.00 inches with a few amounts of 2.00 to possibly 4.00 inches - Kentucky

and Tennessee will be wettest - Northern

Plains and northern Midwest precipitation will be minimal through the weekend resulting in net drying conditions, despite some shower activity - Scattered

showers will occur in the northern Plains and northern Midwest - Resulting

rainfall will be light, but soil moisture should not change greatly because of cool temperatures expected during much of the week

- Temperatures

will be near to below average in the central and northern Plains and Midwest and near normal in the southeastern states and Delta while the southern Plains continue very warm to hot - Far

western U.S. is expected to turn hotter this week with temperatures rising into the 90s and over 100 degrees Fahrenheit

- Extreme

highs will rise to 110 degrees Fahrenheit in the dry areas of the Yakima Valley, 104 in the Snake River Valley

- Some

of this heat will push into the northwestern Plains this weekend - U.S.

weather August 2-8 will be trending hotter in the Plains and western Corn Belt and a little warmer in the eastern Midwest while some cooling in the far western states will remove this week’s extreme heat from the region - Rainfall

will be restricted in the northwestern, central and southern Plains and will become lighter than usual in the western Corn Belt and the northern Plains - Eastern

Midwest rainfall will continue, but mostly in the north and east parts of the region - West

Texas cotton, corn and sorghum areas will get “a few” showers of limited significance late this next week through the first couple of days in August, but the odds are not high that there will be enough rain to change the bottom line which is still warm to

hot and dry - The

Texas Panhandle, southwestern Kansas and western Oklahoma will get enough rain to induce short term crop moisture improvements that might temporarily improve corn, sorghum and cotton conditions - The

bottom line for the United States includes improving crop conditions in the lower Midwest and especially in the southwestern corn and soybean production areas during the coming week because of rain and cooler temperatures. Portions of the northern Delta will

also see some improvement along with a part of the central Plains. The northern Plains will likely see status quo conditions which are likely to be mixed over the next ten days with a need for greater rain in the west and central parts of the region. Hotter

and drier weather in the Pacific Northwest, California and the Great Basin is likely to worsen forest fires and stress crops and water supply. The southeastern U.S. and lower Delta will likely experience a mostly good environment for crop development as will

be the case in the northern Midwest. Changing weather next week bringing back drier and warmer weather in the central and southern Plains, Delta and southwestern Corn Belt will return net drying, but crop stress is not likely to be very great until mid-month

after drying occurs for several days next week. Corn and soybean development will benefit from the coming week to ten days of rain in the Midwest and Delta while crop stress in the Pacific Northwest and California will increase. Concern remains about the potential

for drier and warmer biased weather to prevail in the central United States in the second half of August, although confidence in such a persistence of the pattern is not as high as it could be which demands a close watch over the next few weeks.

- Canada’s

southwestern and south-central Prairies will dry down in the coming ten days that in the northwestern U.S. Plains increasing crop moisture stress - Rain

will fall more frequently in western, northern and far eastern parts of the Prairies over the next ten days supporting crop development - Temperatures

will be seasonable with a slight warmer bias in the west and a cooler bias in the east - Southeastern

Canada crop conditions are rated favorably with little change likely for a while - Europe

rainfall will be restricted over the next full week while temperatures are warmer than usual - Net

drying is expected in the majority of the continent, but especially in France, the U.K., Belgium, Netherlands, Germany, Spain, Portugal and from the lower Danube River Basin to Hungary - Second

week outlook in Europe will continue dry and warm in the west, but some increase in rainfall is expected in “parts” of eastern Europe August 2-8 - Poland,

Belarus, the Baltic States and western Russia will see the greatest increase in rainfall and some cooling - The

bottom line in Europe will remain one of concern for areas from Hungary to Greece and in France, the U.K. Spain, Portugal, Italy, Germany Belgium, Netherlands and Portugal. Too much warm and dry weather will maintain crop and livestock stress even through

temperature extremes will not be as great as those of the past. - A

mostly good mix of weather will occur in the Commonwealth of Independent States through the next two weeks

- Concern

remains over erratic rainfall in Russia’s Southern Region, eastern and southern Ukraine and western Kazakhstan - A

boost in rainfall is advertised for western, central and northern Ukraine after the end of this week and the moisture increase will bring on better crop and field conditions - Yield

potentials will be favorable timely rain occurs in the drier areas as advertised, but confidence in the distribution of the rain is still a little low - India’s

monsoonal rainfall is expected to be widespread across the nation during the next two weeks with all areas impacted and most getting sufficient rain to bolster soil moisture and/or induce flooding - Some

areas may become too wet, but the precipitation will occur with sufficient breaks to prevent serious flooding from occurring - Nationwide

rainfall is still expected to be above normal at mid-August and serious relief should occur to the dry areas of Uttar Pradesh and Bihar which have not received nearly as much rain as usual so far this year. Cotton, groundnut and soybean areas of northwestern

India should experience mostly good weather for crop improvements after flooding rain earlier this month - China’s

weather is still advertised to be drier than usual in the southeastern corner of the nation over the next ten days - Net

drying is expected to induce crop moisture stress in areas that were once seriously flooded earlier this year - The

area includes the lower Yangtze River Basin and most of the interior southeast where late season rice planting should be under way

- Early

season rice was seriously hurt by flooding in June and early July - Rain

will fall in most other areas in China during the next ten days to two weeks with sufficient amounts to maintain wet field conditions and relatively good crop development - There

is need for more sunshine and less rain from the Yellow River Basin into the northeastern provinces - Weekend

rainfall was greatest in the lower Yellow River Basin and a part of the North China Plain resulting in some local flooding - China’s

Xinjiang province continues to experience relatively good weather - A

few showers and thunderstorms are expected, but most of the region will be dry with temperatures varying greatly over the week to ten days - Argentina’s

rainfall later this week should bring improvement to wheat conditions across wheat and barley production areas - Next

week will trend drier again - Only

a limited amount of relief will occur in northwestern Argentina, but that area does not produce much wheat - Argentina

wheat and barley conditions will improve with this week’s rain, although it is unclear how much improvement will occur in Cordoba and immediate neighboring areas - Far

southern Brazil will receive periodic rainfall during the next ten days maintaining a typically moist pattern in the soil from Rio Grande do Sul into Paraguay, southernmost Mato Grosso do Sul and parts of both Parana and southern Sao Paulo - The

moisture will be great for winter crops and should not have much impact on Safrinha crop maturation or harvesting - Safrinha

cotton and late corn harvesting in Brazil will advance well due to continued dry and warm weather - There

is no threat of cold weather in Brazil coffee, citrus or sugarcane areas during the next two weeks - Some

cooling is expected in Argentina late this week into early next week - There

were no organized tropical cyclones in the world today, although a new disturbance is expected to evolve in the eastern Pacific later this week

- Sumatra,

Indonesia rainfall remained restricted in parts of the island and a soaking rain is needed to restore ideal soil and crop conditions after a drier than usual month of July - Some

increase in rain is expected over the next week to ten days - All

other Southeast Asian nations will experience an abundance of rainfall during the next few weeks resulting in some flooding in the Philippines and the Maritime provinces - Recent

rain has improved soil moisture in parts of Thailand after a drier than usual bias earlier this season - Australia

weather in the coming ten days will be favorable for most winter crops - Central

Queensland received rain Wednesday and Thursday favoring a boost in topsoil moisture for a part of winter crop country

- Western

Australia will get most of the significant rain this coming week, but some rain will eventually reach the southeastern parts of the nation in time next week.

- South

Korea rice areas are still dealing with a serious drought, despite some rain that fell recently.

- Some

additional showers are expected over the next couple of weeks, but a soaking rain will continue to elude the region - East-central

Africa rainfall this week will be greatest in central and western Ethiopia and lightest in parts of Uganda.

- Tanzania

is normally dry at this time of year, and it should be that way for the next few of weeks - Kenya

and Uganda will trend wetter next week - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

greater rain would still be welcome in the drier areas of Ivory Coast - Seasonal

rains are shifting northward leading to some drying in southern areas throughout west-central Africa - Cotton

areas are expecting greater rainfall in the next couple of weeks - Local

flooding is possible in Guinea, Sierra Leone and southern Mali over the next couple weeks

- Mali

has been drier than usual over the past 30 days and rain would benefit cotton and many other crops – at least for a while - South

Africa’s crop moisture situation is favorable for winter crop establishment, although some additional rain might be welcome - Restricted

rainfall is expected for a while, but the crop is rated better than usual - Central

America rainfall will continue to be abundant to excessive and drying is needed - Mexico

rain will be most abundant in the west and southern parts of the nation - Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely - Today’s

Southern Oscillation Index was +8.82 and it will continue to drive lower over the next several days - New

Zealand weather is expected to be plenty wet over the next two weeks - Temperatures

will be seasonable

Source:

World Weather INC

Bloomberg

Ag Calendar

Monday,

July 25:

- USDA

export inspections – corn, soybeans, wheat, 11am - US

June poultry slaughter, 3pm - US

crop conditions for spring and winter wheat, corn, soybeans and cotton; spring wheat harvest, 4pm - Brazil’s

Unica to release cane crushing and sugar output data (tentative) - Malaysia’s

July 1-25 palm oil export data

Tuesday,

July 26:

- EU

weekly grain, oilseed import and export data - Earnings:

ADM

Wednesday,

July 27:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Earnings:

Bunge

Thursday,

July 28:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Buenos

Aires grains exchange weekly crop report - HOLIDAY:

Thailand

Friday,

July 29:

- Vietnam

July coffee, rice and rubber export data - FranceAgriMer

weekly update on crop conditions - ICE

Futures Europe weekly commitments of traders report - US

agricultural prices paid, received, 3pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Thailand

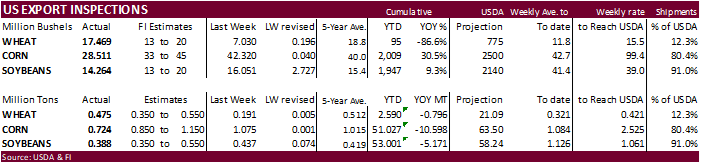

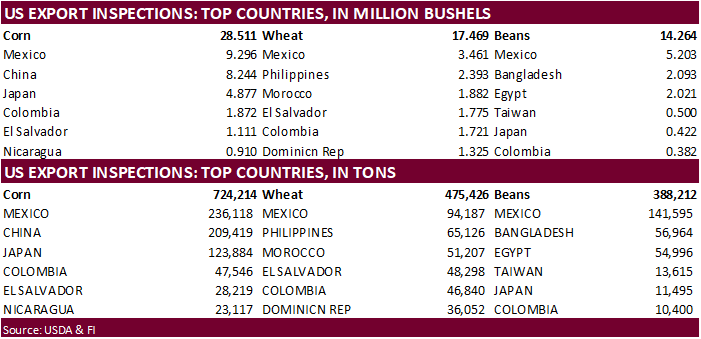

USDA

inspections versus Reuters trade range

Wheat

475,426 versus 200000-550000 range

Corn

724,214 versus 585000-1200000 range

Soybeans

388,212 versus 100000-575000 range

USDA

export inspections showed a dip in corn and soybean shipments, while wheat recovered. Revisions for soybeans in the previous weeks were 2.7 million bushels. We are still in the camp corn and soybean exports could end up below USDA’s current projections.

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JUL 21, 2022

— METRIC TONS —

————————————————————————–

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 07/21/2022 07/14/2022 07/22/2021 TO DATE TO DATE

BARLEY

0 0 1,496 847 3,615

CORN

724,214 1,074,989 1,254,483 51,027,464 61,625,283

FLAXSEED

0 0 24 0 24

MIXED

0 0 0 0 48

OATS

798 1,497 0 5,089 100

RYE

0 0 0 0 0

SORGHUM

74,008 116,433 90,888 7,141,474 6,711,724

SOYBEANS

388,212 436,829 242,239 53,000,942 58,171,844

SUNFLOWER

0 0 0 2,260 240

WHEAT

475,426 191,333 515,214 2,589,529 3,385,892

Total

1,662,658 1,821,081 2,104,344 113,767,605 129,898,770

—————————————————————————

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

100

Counterparties Take $2.192 Tln At Fed Reverse Repo Op (prev $2.229 Tln, 101 Bids)

WH

National Security Council Spox: Russia’s Attack On Odesa Casts Serious Doubts On Russia’s Credibility On Grain Deal

WH

National Security Council Spox: US Will Continue To Explore Options With Int’l Community To Increase Ukraine Exports Through Overland Routes

USDA

raised their 2022 consumer food price index

(from 2021) to 9.5% from previous 8.5%. Back in February they had a modest 2.0%-3.0% range, against historical 2.4% increase. If realized, this would be the largest annual increase since 1979. Fats and oils were projected up 16.5-17.5% from 14-15% previous.

For 2023 USDA sees a 2.5-3.5% increase, so some light at the end of the tunnel.

·

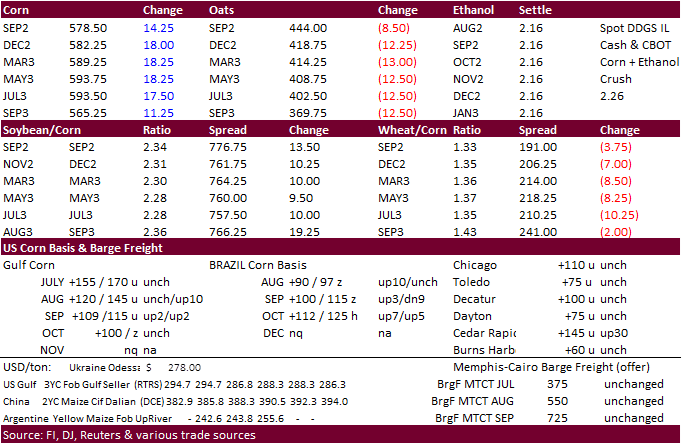

CBOT corn

was sharply higher following strength in wheat and uncertainty over Ukraine corn shipments. September lost ground to December as Ukraine is working on getting ports operational. They hope to ship their first cargo later this week. Turkey said it’s important

for their first shipment to sail as soon as possible.

·

Funds bought an estimated net 11,000 corn contracts.

·

Ukraine’s deal to ship grain safely through the Black Sea was initially seen bearish for corn, but after the missile strike over the weekend on Odesa several analysts are now wondering if Russia will honor their side of the agreement.

Ukraine grain exports are down nearly 40 percent since July 1, the start of the local marketing year.

·

Assuming Ukraine grain shipments will flow, traders over the weekend estimated export capacity for Ukraine could grow to around 5 million tons per month, but the Ukraine AgMin on Monday said Ukraine grain exports may reach 3.5

million tons a month in the near future. The AgMin went on to say the volume would gradually increase each month starting from about 1.5 million tons in August.

·

Brazil and China are re-negotiating the export protocol and the Brazil AgMin thinks there is a possibility the country will ship corn to China as soon as second half 2022.

·

AgRural looks for 87.3 MMT Brazil second corn crop (26.6MMT higher than year ago), up from previous 86.5 million, and estimated harvest progress at 62%, up from 39% year ago and 53% previous week. Mato Grosso is nearly complete

with corn harvest (AgriCensus).

·

Brazil will see cooler temperatures and rain later this week, slowing harvest progress.

·

The EU monitoring service MARS estimated the EU corn crop yield at 7.25 tons per hectare, down from 7.87 tons projected last month, 8.3 percent below 2021.

·

US corn crop conditions for the good-to-excellent categories were 61 percent, 3 points below the previous week and 2 points below expectations. 62% of the US corn crop was pollinated, 25 points above the previous week and compares

to 76 percent year ago and 70 percent average.

·

None reported

Updated

7/25/22

September

corn is seen in a $5.10 and $6.40 range

December

corn is seen in a $5.00-$7.50 range