PDF Attached

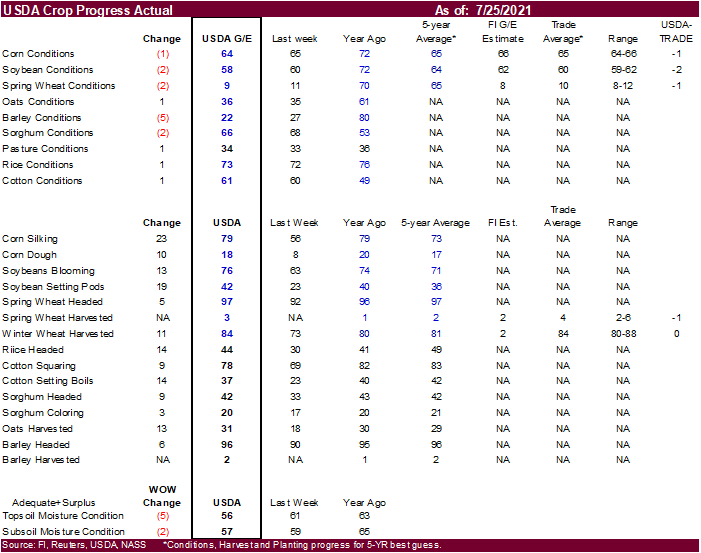

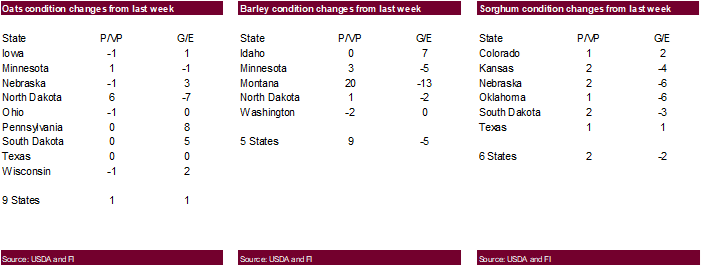

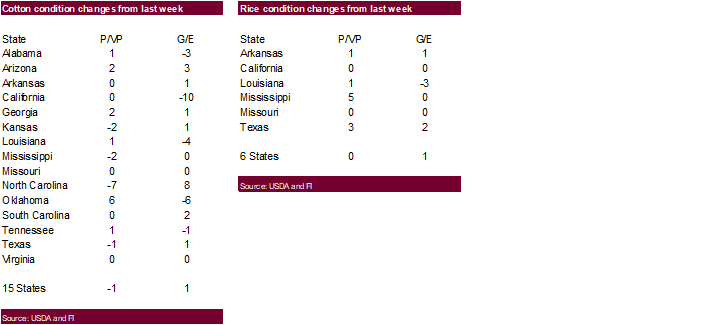

Crop

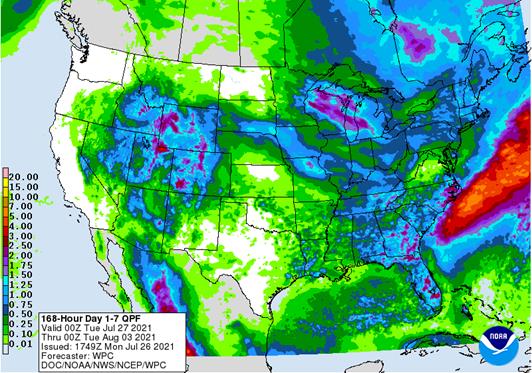

conditions are viewed friendly for corn, soybeans and spring wheat. Corn was down one point for the G/E, soybeans down two and spring wheat down two. Trade was looking for unchanged corn and soybeans and spring wheat down one. The midday weather models indicated

a drier outlook for the 1-5 & 6-10 day outlooks, and a warmer northern Plains and northern Midwest for the 11-15 day. Attached is our updated Baltic Dry Index charts.

Calls:

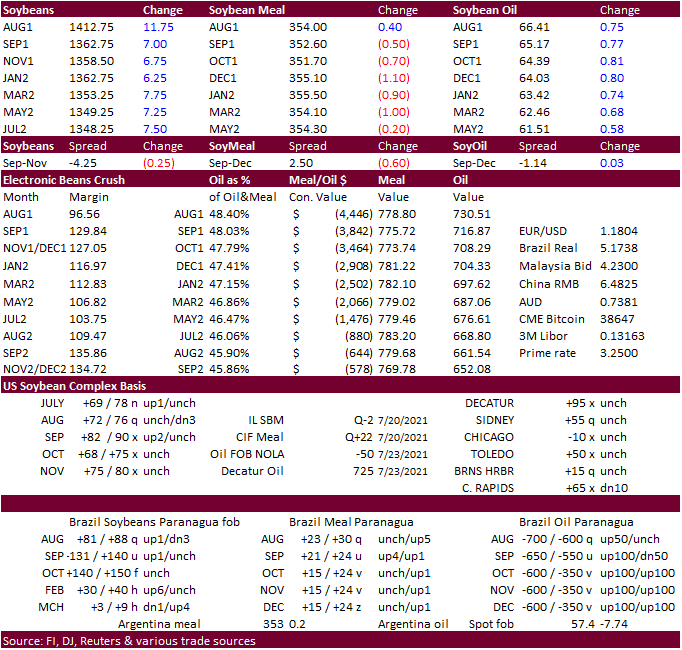

Soybeans

6-12 higher (ECB did improve, WCB and Delta declined)

Corn

4-7 higher (WCB declined 5.1% using our adjusted index, ECB was up 1.1%)

Wheat

5-10 higher bias MN upside

Weather

WORLD

WEATHER INC.

CHANGES

OVERNIGHT

- Heavy

rain continued to fall in central India Sunday after beginning Saturday - Weekend

amounts through dawn today (India time) have ranged from 1.73 to 4.00 inches in southern Rajasthan, northwestern Madhya Pradesh and eastern Gujarat which was nearly perfect for summer crops - Rain

totals in western Gujarat reached 8.20 inch and varied from 5.07 to 8.93 inches in from eastern Madhya Pradesh to northeastern Maharashtra - Some

heavy rain also fell along the middle west coast while lighter rain fell elsewhere in the nation - Additional

rain will fall in the northern and eastern portions of India during the coming ten days while net drying occurs from interior Maharashtra southward through Telangana, Andhra Pradesh and Karnataka to Tamil Nadu - Rainfall

will be restricted in far northwestern Rajasthan, central and southern Pakistan and western Gujarat

- Rainfall

elsewhere in the central, east and far north will var5y from 3.00 to 8.00 inches and locally more - Flooding

is possible in some of the wetter areas in the north - Excessive

rain fell in a few parts of China during the weekend - North-central

Inner Mongolia reported 3.15 to more than 8.00 inches resulting in some flooding

- Heavy

rain also occurred in northeastern Heilongjiang where 4.00 to nearly 8.00 inches resulted - Tropical

Storm In-Fa brought nearly 16.00 inches to northern Zhejiang - Port

activity and shipping delays occurred in the mouth of China’s Yangtze River and around the Shanghai area during the weekend with general rainfall of 3.00 to more than 10.00 inches - Local

totals to nearly 16.00 inches occurred as noted above - Additional

rain delays are expected through mid-week, but the heaviest rainfall should be abating - Shipping

activity will slowly resume, but normal loading patterns are not expected before the second half of this week - Heavy

rain continued to fall over western Luzon Island, Philippines Sunday after beginning early in the weekend - 3-day

rainfall ending at dawn today varied from 5.43 to 11.83 inches with one location reporting 15.87 inches - Flooding

resulted in much of western Luzon - Additional

rain is expected in the same areas periodically this week with daily rain lighter than that of the weekend - Additional

rain fell in Laos, eastern Thailand and along the middle Myanmar coast during the weekend resulting in some flooding - Rain

totals varied from 4.00 to 6.65 inches except in coastal areas of Myanmar where up to 10.00 inches was reported - Interior

western Thailand, western Cambodia and Vietnam’s Central Highlands did not get much rain - Southeast

Asia rainfall recently and that which is expected in the next two weeks will continue somewhat erratic

- Laos,

eastern Cambodia and northwestern Philippines will see the greatest rainfall - Southern

Sumatra and Java, Indonesia may experience less than usual rainfall for a while - Thailand

will also experience less than usual rainfall in pockets, although there has been some beneficial moisture recently

WEATHER

OF GREATEST INTEREST ELSEWHERE

- U.S.

weather early to mid-week this week will be quite warm with restricted rain and net drying in much of the Midwest corn and soybean production areas - Showers

and thunderstorms will occur in the Great Lakes region while rain elsewhere will not be great enough to counter evaporative moisture losses - Temperatures

will be in the 90s with extremes near and over 100 in the northern and central Plains early this week and in the central Plains and western fringes of the Corn Belt briefly during mid-week - Nighttime

low temperatures will be in the 70s during the early to middle part of this week, but they should cool down to the 60s and lower 70s during the late week and weekend - Extreme

high temperatures in the eastern Dakotas and southwestern Minnesota southward into Missouri and Kansas will range from 95 to 105 Tuesday through Thursday - Kansas

and Missouri and parts of Illinois will be warm into the latter part of this week - Any

rain that falls will not counter evaporation through Thursday and into Friday morning outside of the Great Lakes region - U.S.

weather at the end of this week and during the weekend will increase in a part of the western Corn Belt with coverage reaching 40% and rainfall varying from 0.20 to 0.80 inch with a few amounts over 1.00 inch

- Additional

rain is possible in a part of the western Corn Belt during the early to middle part of next week - The

southwestern Corn Belt is expected to be driest - Showers

will also impact a part of the eastern Midwest during the weekend and next week, but there will be many holes in the precipitation raising the need for follow up rain. - Temperatures

will not be as hot during the week and early next week as they will be over the first five days of the two week forecast, but readings will remain above normal.

- August

weather is still expected to be dominated by a ridge of high pressure over western North America and a northwesterly flow pattern aloft in the east half of the continent - Temperatures

in the central and eastern Midwest will be below normal in the second half of the month if not sooner - Western

Corn Belt temperatures will still be a little warmer than usual - Rainfall

should continue lighter than usual in the western and northern Midwest, although these areas may not be completely dry - Timely

rain will fall farther to the east maintaining good eastern Midwest soil moisture - Texas

crops will benefit from drier and warm biased weather over the next two weeks - Totally

dry weather is not likely, but much of the rain that falls will not be enough to counter evaporative moisture losses - Degree

day accumulations in West Texas are a little below average and the warming trend will prove favorable for cotton, corn, sorghum and other crops - Excellent

harvest weather is expected in South Texas over the coming ten days - U.S.

Delta and southeastern states will experience a good mix of weather during the next two week supporting normal crop development - The

Delta started to dry down during the weekend as did parts of the southeastern states - Southeast

Canada corn, soybean and wheat production areas are seeing a very good mix of weather this summer and production potentials are high for all three crops - Wheat

harvesting is under way - U.S.

Far west will continue quite dry, although not as hot as in recent weeks - Monsoon

moisture in the southern U.S. Rocky Mountain region and Arizona will be frequent and significant enough to improve soil moisture and induce a little runoff - Weekend

rainfall in Arizona ranged from 1.00 to 2.79 inches bolstering soil moisture and easing drought.

- More

than 3.00 inches occurred in north-central Arizona - Crop

conditions will steadily improve in Arizona because of expected rainfall - The

bottom line for the U.S. will maintain status quo conditions in the eastern Midwest over the next couple of weeks, but western crop areas will experience pockets of dryness and crop moisture stress will be rising in portions of the western Corn and Soybean

Belt. - No

change in Canada Prairies drought status is expected over the next two weeks, despite some shower activity - Rain

will return to northern and western Alberta early this week and temperatures will be milder there than anywhere else - Some

of the rain will shift through northern and eastern parts of the Prairies late this week and into the weekend, but moisture totals will not be great enough to counter evaporation in most areas - Another

wave of showers will move through the northern and eastern Prairies during the first half of next week - Rainfall

of 0.10 to 0.60 inch will be possible in both of these rain events - Above

normal temperatures will continue in the central and southern Prairies minimizing the benefit from rain noted above due to high evaporation rates - Crop

stress and falling yield potentials will also continue - Tropical

Storm Nepartak will move across northern Honshu Japan Tuesday into Wednesday producing 20-40 mph wind speeds and 1.50 to 5.00 inches of rain - The

system will come inland as a weak tropical storm and it will then turn to the east passing through Hokkaido - No

crop damage is expected - Remnants

of Tropical Storm In-Fa will produce flooding rain from northern Zhejiang and Anhui through Jiangsu to southern Shandong this week. Rainfall of 3.00 to 8.00 inches will occur in the mouth of the Yangtze River; including the major ports and shipping areas in

the region and including Shanghai. - Flooding

is expected to continue - Rainfall

in Jiangsu and southern Shandong will vary from 3.00 to 9.00 inches. - Some

rain may also impact a part of Hebei and Henan where flooding occurred last week - Brazil

coffee areas in Sul de Minas, northeastern Sao Paulo and southern Rio de Janeiro will be cold Friday and Saturday mornings with frost and some freezes possible - Lowest

temperatures will be in the range of 0 to 4 Celsius in the coolest areas of Sul de Minas while in the range of 3 to 8C in other areas from northern Parana to Sul de Minas - A

few harder freezes are possible - Damage

to coffee is expected - Brazil

citrus and sugarcane areas may experience a little frost during the latter part of this week - crop

damage should be low, but there could be some impact in a few of the coldest areas - Frost

and light freezes are expected in Parana to northern Rio Grande do Sul grain areas Wednesday through Friday with lows in the upper 20s and 30s Fahrenheit (-3 to +3C).

- Flooding

in Hebei and Henan from last week’s record setting rainfall will continue this week, but the situation will slowly improve - Crop

and property damage assessments will begin as the flood water abates - Losses

are suspected of being tremendous - Xinjiang,

China was warm and dry during the weekend with highest temperatures in the 90s and lowest morning readings in the 60s and lower 70s.

- No

significant rain was noted - Weather

over the coming week to ten days will seasonably warm with a few showers and thunderstorms, but no general soaking - Europe

weather was trending wetter again in the west during the weekend it will continue wet in the west this week while expanding to the east - A

brief break from frequent rain last week helped improve crop maturation and harvest conditions in small grain and unharvested winter rapeseed production areas - Some

concern over returning rainfall and crop quality declines are expected - Periodic

rain will continue into the first week of August maintaining some concern for the situation - Limited

rainfall is expected from eastern Ukraine through the middle and lower Volga River Basin and Kazakhstan during the next ten days

- Temperatures

will be warmer than usual - Some

crop stress is expected in unirrigated areas because of already dry conditions in parts of this region - Ivory

Coast and Ghana rainfall will be restricted over the next couple of weeks - Seasonal

rainfall should return normally in September, but August rainfall will be lighter than usual - Nigeria

and Cameroon will receive more rain than Ghana and Ivory Coast, but amounts will still be less than usual - East-central

Africa rainfall will continue favorable for coffee and cocoa, although some areas in Uganda and Kenya may receive less than usual rainfall - Ethiopia

rainfall is expected to continue improving after a slow start to the rainy season - Southern

Oscillation Index has reached +15.32 and it is peaking after a strong rising trend since June 22 when the index was -3.36 - Brazil

will see some periodic rain in the south over the next week to ten days favoring wheat development and improving topsoil moisture for use in the early corn planting season which is approaching next month - However,

frost and freezes late this week could temporarily injure some of the wheat crop - Argentina

weather will be mostly dry over the next ten days - Showers

will occur briefly in the east today into Monday - Some

winter wheat would welcome rain especially in the west, but crop conditions are much better than last year at this time - Crops

are mostly semi-dormant right now - No

meaningful precipitation fell during the weekend - Australia

weather this month has been ideal for improving winter wheat, barley and canola establishment in much of the nation - Some

additional rain is still needed in South Australia, northwestern Victoria and from western New South Wales to Queensland - Most

of the nation except Queensland will get rain over the next ten days - South

Africa has been cold during the past week with waves of rain in the southwest - Weekend

weather was still cool, but rain ended in many areas - The

moisture has been good for future wheat development - Dryness

remains in some of the unirrigated eastern wheat production areas - Some

warming is expected over the coming week, but the precipitation anomalies will prevail - Cool

weather has wheat development semi-dormant - Mexico

weather has improved with increased rainfall in the south and west parts of the nation - Drought

conditions are waning, and crops are performing better - Dryness

remains in Chihuahua and northeastern parts of the nation - Weather

over the next ten days will offer some relief, but more rain will be needed in the drier areas - Central

America rainfall has been plentiful and will remain that way - Both

Honduras and Nicaragua have received frequent bouts of rain this month easing long term dryness, but more may be needed in some locations - New

Zealand rainfall during the coming week will be near to above normal in western portions of South Island while near to below average in most other areas - Temperatures

will be seasonable

Source:

World Weather Inc.

Bloomberg

Ag Calendar

Monday,

July 26:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn, cotton, soybeans, wheat, 4pm - MARS

monthly EU crop conditions report - Malaysia

July 1-25 palm oil export data (tentative) - UN

Food Systems Pre-Summit in Rome - Ivory

Coast cocoa arrivals - HOLIDAY:

Thailand

Tuesday,

July 27:

- EU

weekly grain, oilseed import and export data - UN

Food Systems Pre-Summit in Rome - EARNINGS:

ADM

Wednesday,

July 28:

- EIA

weekly U.S. ethanol inventories, production - Brazil

Unica cane crush, sugar production (tentative) - UN

Food Systems Pre-Summit in Rome - HOLIDAY:

Thailand - EARNINGS:

Bunge, Pilgrim’s Pride

Thursday,

July 29:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports

Friday,

July 30:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received

Source:

Bloomberg and FI

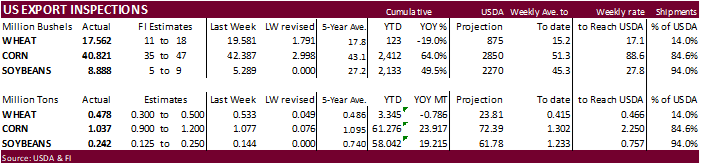

USDA

inspections versus Reuters trade range

Wheat

477,964 versus 300000-600000 range

Corn

1,036,910 versus 700000-1200000 range

Soybeans

241,897 versus 90000-300000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JUL 22, 2021

— METRIC TONS —

————————————————————————–

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 07/22/2021 07/15/2021 07/23/2020 TO DATE TO DATE

BARLEY

698 200 0 2,817 416

CORN

1,036,910 1,076,668 840,796 61,276,281 37,358,824

FLAXSEED

24 0 0 24 317

MIXED

0 0 0 48 0

OATS

0 0 0 100 600

RYE

0 0 0 0 0

SORGHUM

90,792 63,192 84,084 6,710,753 4,350,597

SOYBEANS

241,897 143,934 505,331 58,041,712 38,826,741

SUNFLOWER

0 0 0 240 0

WHEAT

477,964 532,898 544,010 3,344,650 4,130,890

Total

1,848,285 1,816,892 1,974,221 129,376,625 84,668,385

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

US

New Home Sales Jun: 676K (est 800k; prev 769K; prevR 724K)

–

US New Home Sales (M/M) Jun: -6.6% (est 4.0%; prev-5.9%; -7.8%)

–

US Median Sales Price (Y/Y)Jun: $361,800 (prev $374,400)

70

Counterparties Take $891.203 Bln At Fed’s Fixed-Rate Reverse Repo (prev $877.251 Bln, 76 Bidders)

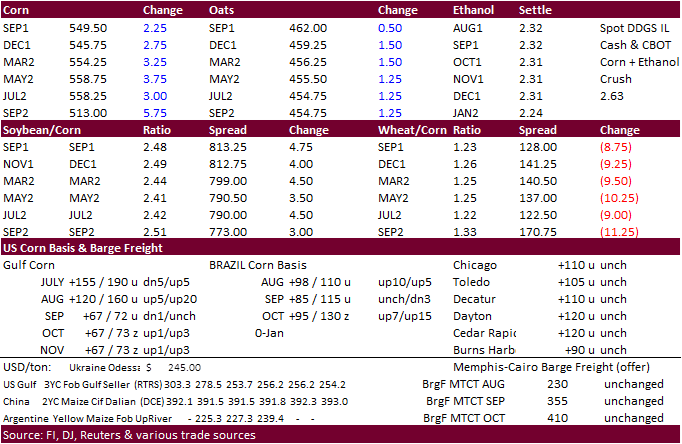

- Corn

opened lower but closed higher after the midday weather models turned drier for the WCB. USDA export inspections showed China took nearly 500,000 tons of US corn, a positive sign they still need the grain. Earlier corn and soybeans were on the defensive

in part to increasing concerns over China/US political relations. CZ traded below its 100-day MA of 5.3650 on and off before rallying to settle higher by 3.75 cents.

- Minnesota

through WI and Michigan saw good rain over the past week that improved conditions. The US weather forecast does still call for some rain to develop across the US WCB over the next seven days.

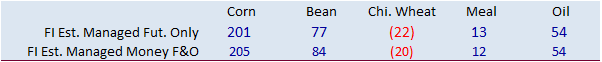

- Funds

bought an estimated net 3,000 corn contracts. - US

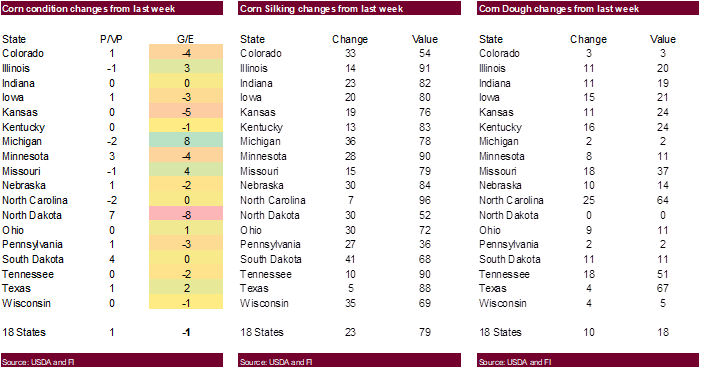

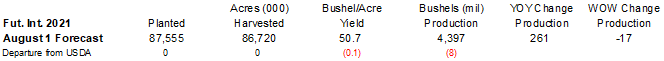

corn conditions fell one point to 64 percent good/excellent, one point below a 5-year average. Traders were looking for US corn conditions to be unchanged from the previous week. IL was up 3, IN unchanged and IA down 3. ND was down 8, KS down 5, CO down

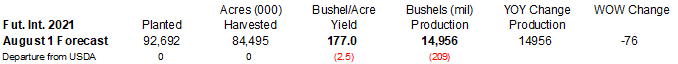

4, and MN fell 4 points. MI increased 8 points. - At

this stage for the development of the US corn crop, it’s possible to see the ECB, Delta and some parts of the southeast to offset losses for the upper and far northwestern Corn Belt yield losses. Our thinking is we see at least a 175 plus national US corn

yield when updated by USDA in August. We are currently at 177.0 for the August yield. ECB corn conditions are running about 1.9% above a 5-year average while WCB off 3.7%, on our adjusted CP index.

- The

US weather forecast for August still calls for a ridge of high pressure over western North America and a northwesterly flow pattern aloft in the east half of the continent, according to World Weather. Temperatures for the western Corn Belt will be warmer

than normal while the ECB temperatures near to below normal. Rainfall will be lighter than usual in the western and northern Midwest.

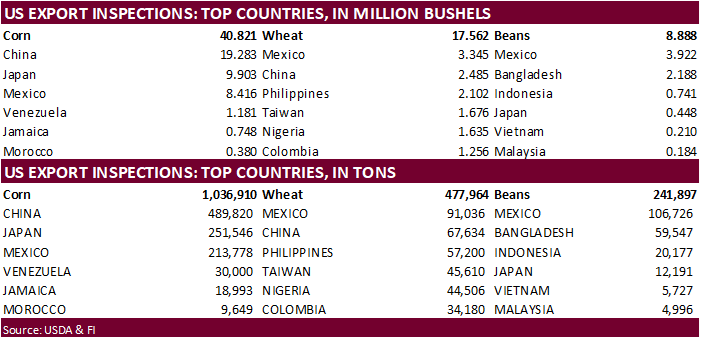

- USDA

US corn export inspections as of July 22, 2021 were 1,036,910 tons, within a range of trade expectations, below 1,076,668 tons previous week and compares to 840,796 tons year ago. Major countries included China for 489,820 tons, Japan for 251,546 tons, and

Mexico for 213,778 tons. - JBS

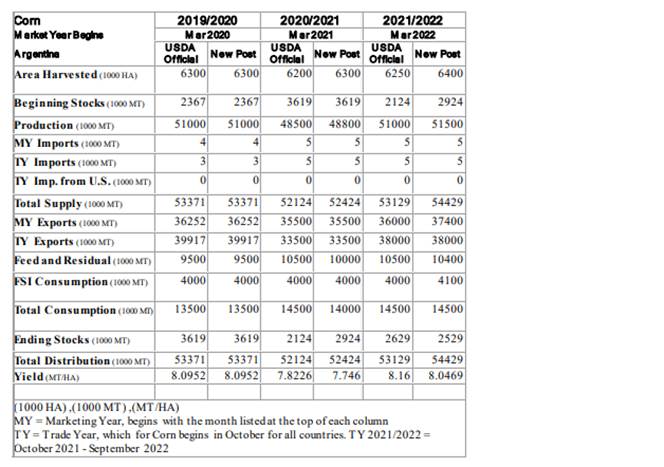

noted they purchased 30 shiploads of corn from Argentina for their Brazil feedlots, about 25% of the corn it is using as feed (surpassing 1 million tons).

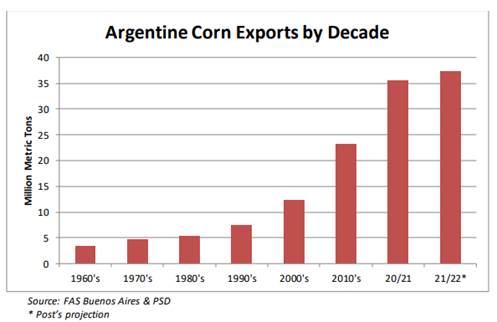

- Argentina

declared a 180-day state of water emergency. A Reuters exclusive noted Argentina grain shipping must be cut by 25 percent due to severely low water levels. About 80 percent of Argentina’s Parana river carries farm goods. Water levels are at their lowest

level in 77 years.

USDA

Attaché: Argentina Grain and Feed update https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Grain%20and%20Feed%20Update_Buenos%20Aires_Argentina_07-20-2021.pdf

Post

warned a dry spring could prompt Argentina producers to plant late planted corn. We heard the Argentina soybean area could be down around 3% next season, in part to higher returns for corn, but it makes sense that producers expecting a delayed start to spring

seedings would wait and plant corn instead. Post has 2021 corn production at 48.8 million tons, 300,000 higher than USDA official. 2022 is expected to be 51.5 million tons, 500,000 above USDA.

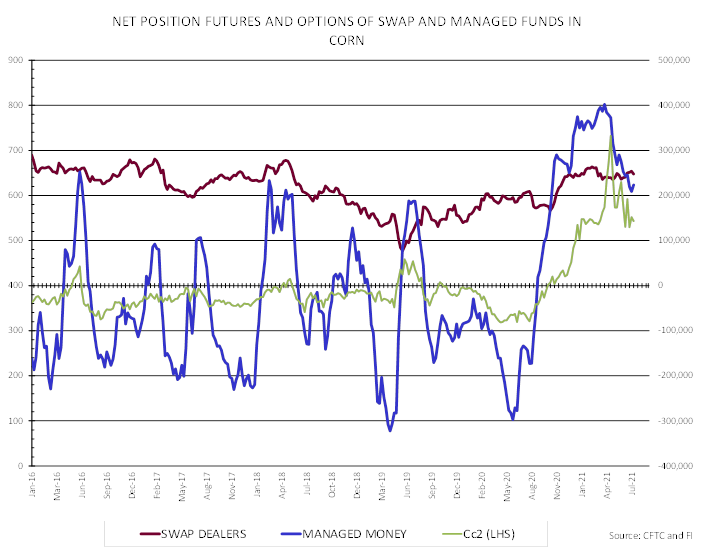

Since

April 20, managed money managers were net sellers of corn 11 out of the last 14 weeks. Last week they added 14,503 contracts to the long position.

Export

developments.

-

Jordan

seeks 120,000 tons of feed barley on July 28 for Nov/Dec shipment.

September

corn is seen is a $5.00-$6.25 range (up 25, unch)

December

corn is seen in a $4.25-$6.00 range.

Soybeans

-

Soybean

complex traded lower on improving US weather this morning but turned higher in part to a drier midday weather forecast and rally in soybean oil. Some noted the weakness earlier in soybeans was due to the US/China political/trade relations breaking down, and

rising cases of Covid-19. The White House this morning said they will not lift Covid travel restrictions. USDA export inspections were within expectations.

-

SX

ended at 13.5775, up 6.0 cents near its 20-day MA of 13.59/bu. -

Funds

bought an estimated net 7,000 soybeans, sold 1,000 soybean meal and bought 4,000 soybean oil.

-

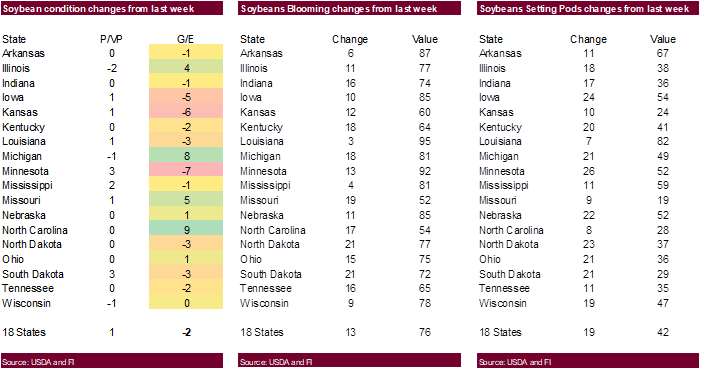

US

soybean conditions fell an unexpected 2 points to 58 percent, below a 5-year average of 64 percent. Traders were looking for US soybean conditions to be unchanged. IL increased 4 points, IM was down 1 and IA declined 5 points. KS fell 6 and MN dropped 7.

MI increased 8 points and Missouri was up 5.

- USDA

US soybean export inspections as of July 22, 2021 were 241,897 tons, within a range of trade expectations, above 143,934 tons previous week and compares to 505,331 tons year ago. Major countries included Mexico for 106,726 tons, Bangladesh for 59,547 tons,

and Indonesia for 20,177 tons. - CBOT

soybean registrations are now zero after 13 were cancelled Friday evening.

-

November

Canadian canola rebounded to end higher. - Palm

oil futures rallied Monday, and this lent support to soybean oil. ITS reported July 1-25 Malaysian palm exports at 1.137 million tons, down 0.5% from the same period a month earlier. AmSpec reported a 4% decrease to 1.127 million tons and SGS was not out

at the time this was written. - India

import margins favor RBD palm oil over crude palm and SBO. Sunflower oil is also profitable to import.

- Latest

palm production figures indicate a 6% decrease during the July 1-25th period versus 5% decline through the 20th.

- Last

week the USDA bought 14,500 tons of vegetable oil under the PL480 program. Prices reportedly range from $2186.52 to $2777.77 per ton.

- The

USDA seeks 2,880 tons of packaged oil for use under the PL480 program on August 3 for Sep 1-30 shipment.

Updated

7/26/21

August

soybeans are seen in a $13.50-$15.00 range (up 25, down 25);

November $11.75-$15.00

August

soybean meal – $330-$400 (unch, down $10);

December $320-$425

August

soybean oil – 64.50-70.00; December 48-67 cent range

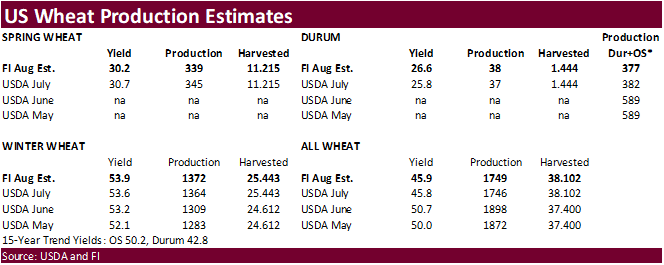

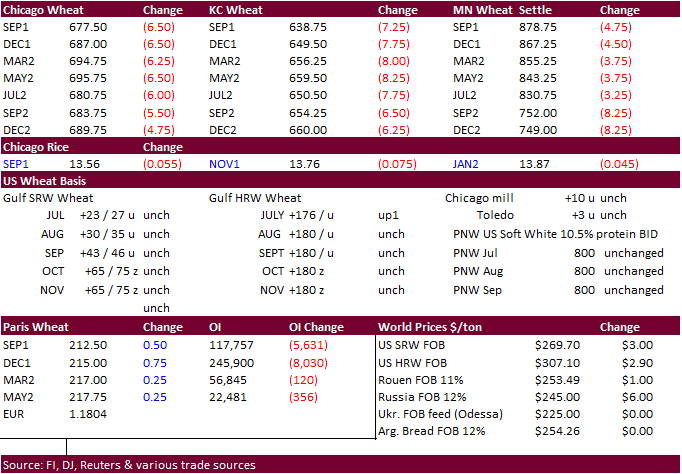

- US

wheat ended

lower in all three markets on improving US weather, but there is still uncertainty over global supplies. The US spring wheat tour will begin this week and we don’t look for much in the way for positive news. September Chicago wheat finished 7 cents lower,

September KC down 7 cents, and September Minneapolis 4.50 cents lower. The three day break in futures caught the attention for a couple major importers. US export developments have been quiet over the past few business days, but this afternoon Turkey floated

an import tender for wheat and barley. Then Egypt announced they are in for wheat for September 20-30 shipment.

- Funds

sold an estimated net 5,000 SRW wheat contracts. - US

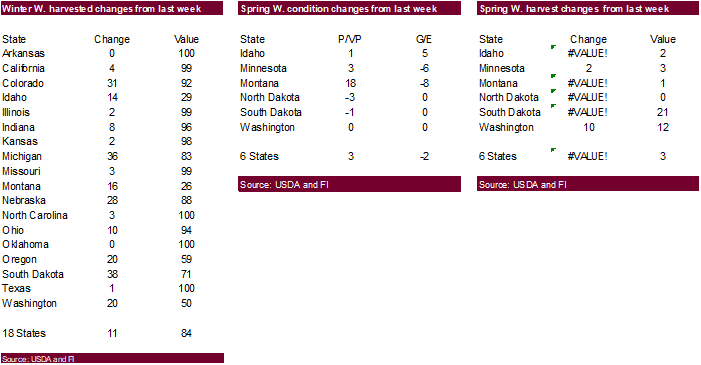

spring wheat conditions fell two points to nine for the good/excellent categories. Traders were looking for a one point drop in US spring wheat conditions. Montana was down 8 and Minnesota off 6. Idaho increased 5 points. We lowered our spring and durum

wheat production estimate but remain close to USDA’s latest estimate. We may adjust lower our spring and durum yield for the purpose of the August USDA

Crop

Production

survey based results of this week’s spring wheat crop tour.

Winter wheat harvest progress was 84 percent complete, as expected. US spring wheat harvest was 3 percent complete, one point below expectations.

- USDA

US all-wheat export inspections as of July 22, 2021 were 477,964 tons, within a range of trade expectations, below 532,898 tons previous week and compares to 544,010 tons year ago. Major countries included Mexico for 91,036 tons, China for 67,634 tons, and

Philippines for 57,200 tons. - Canada

Prairies drought conditions will persist over the next two weeks, but some rain is expected here than there.

- After

trading lower most of the day, December milling wheat closed 0.75 or 0.35% higher at 215 euros a ton.

- Argentina’s

shipping woes due to low water levels may extend into the fourth quarter (OND) that could disrupt 2021 wheat shipments. Argentina harvests wheat December through January.

- Russia’s

southern region of Krasnodar harvested a record grain crop of 12.4 million tons, according to its governor. Krasnodar is one of the largest wheat producing and exporting areas of the country, according to Reuters.

- Russian

wheat export prices with 12.5% protein loading from Black Sea were $248 a ton at the end of last week, up $7 from the previous week, according to IKAR. SovEcon reported a $6 rise to $245 per ton. - USDA

Attaché: Australia wheat production in the 2021-22 season that starts in October is now seen at 29.5 million tons, above the official USDA estimate of 28.5 million tons.

- Political

tensions have increased in Tunisia after the president removed the prime minister out of office and froze parliament. Some are calling it a coup.

https://www.reuters.com/world/middle-east/tunisian-president-relieves-prime-minister-his-post-2021-07-25/

- Morocco

harvested 10.3 million tons of grains, up 221% from last year, according to the AgMin, including 5.6 million tons of soft wheat, 2.48 million durum and 2.78 million barley.

- Turkey’s

TMO seeks up to around 900,000 tons of 11.5-12.5% milling wheat (395k) and feed barley (515k) for late September 16-30 shipment. The barley is sought on August 3 and wheat on August 4. Turkey is one of Russia’s best customer.

- Results

awaited: Ethiopia seeks 400,000 tons of wheat on July 19.

- Pakistan’s

TCP seeks 500,000 tons of wheat on July 27. 200,000 tons are for August shipment, and 300,000 tons are for September shipment.

Rice/Other

- Mauritius

seeks 6,000 tons of white rice on July 27 for October through December shipment.

Updated

7/26/21

September Chicago wheat is seen in a $6.25-$7.50 range

September KC wheat is seen in a $5.90-$7.25

September MN wheat is seen in a $8.10-$9.25

(up 35, down 25)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.