PDF Attached

Adverse

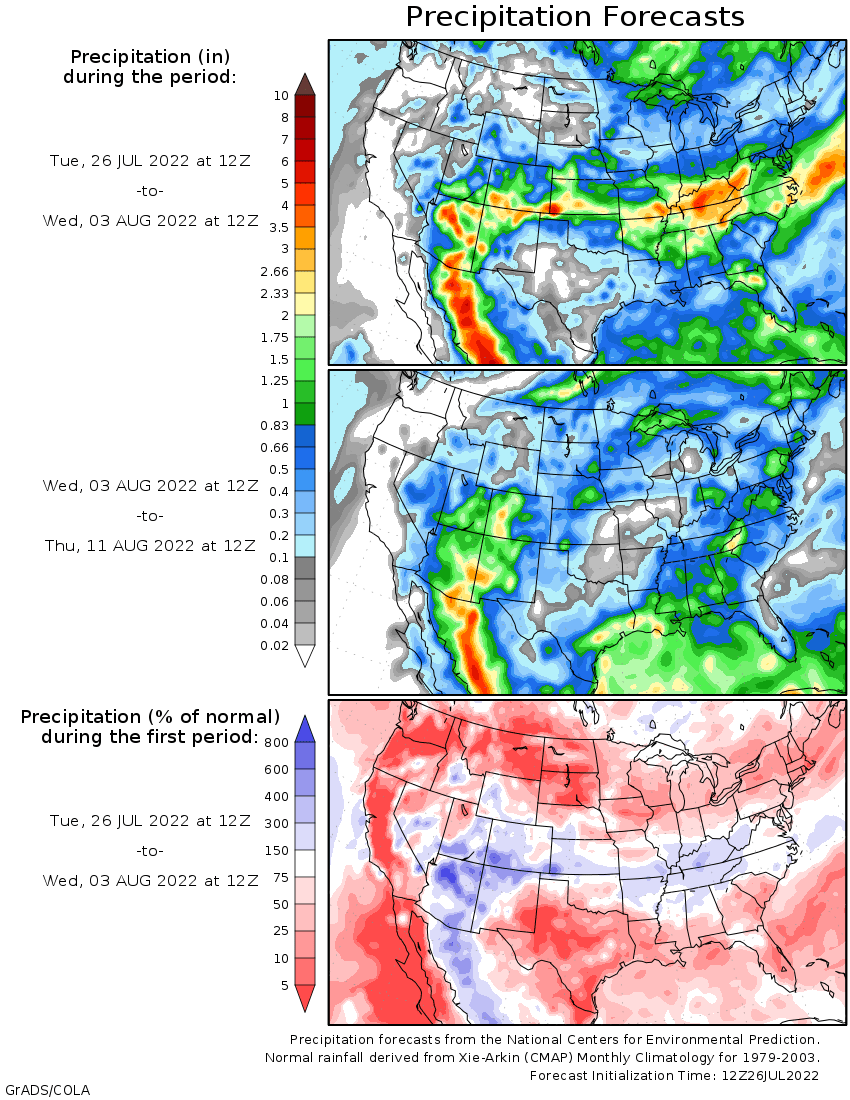

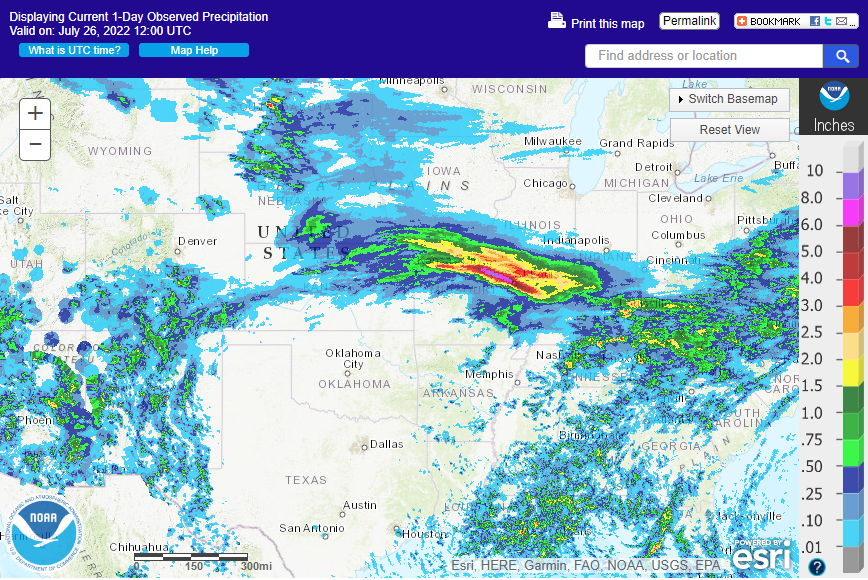

US weather expected through mid-August and Black Sea shipping uncertainties sent CBOT agriculture markets higher. A high pressure ridge is in the forecast for the US Midwest next week.

Outside

markets had little influence on the rising grain prices, other than a lower WTI crude oil market that could have capped gains in soybean oil. The USD was up 71 points and US equities lower.

World

Weather Inc.

WEATHER

TO WATCH AROUND THE WORLD

- Argentina

began receiving some rain this morning and more will fall over the next few days improving wheat germination, emergence and establishment - Southern

Buenos Aires was wettest with a few amounts of 0.40 to 1.39 inches - La

Pampa also reported some rain with amounts of up to 0.80 inch. - Additional

rain will fall in Argentina’s wheat region during the next few days, but Cordoba and some immediate neighboring areas in western wheat and barley areas may not get enough rain to seriously moisten the soil - Crop

conditions in Buenos Aires, Entre Rios, southern Santa Fe and parts of La Pampa will improve following this week’s rain - GFS

operational model runs continue to push high pressure into the U.S. Midwest next week and into the following weekend - Such

a movement would result in dry and warmer biased conditions in key summer crop areas; however, confidence in the outlook is very lows - GFS

Ensemble, European Ensemble and the European operational models all keep the ridge axis farther to the west in the Plains with some short term presence over the western Corn Belt – these solutions are preferred over that of the operational GFS model solution - World

Weather, Inc. says to watch the positioning of the high pressure ridge not only because of the implications for the Midwest corn and soybean production areas, but also because of its potential to bring rain to west Texas cotton, sorghum and corn areas if the

ridge gets far enough to the east - U.S.

Midwest crop and soil moisture is good enough to support corn and soybean development into mid-August making the greatest risk to late season crops “if” a high pressure ridge moves over or closer to the Midwest

- There

are no tropical cyclones in the Atlantic Ocean, Caribbean Sea or Gulf of Mexico and non are expected during the next ten days - A

tropical depression has formed in the eastern Pacific Ocean west of Central America and southern Mexico - This

system is expected to become better organized and evolve to a tropical storm and/or a hurricane, but its movement should be away from western North America

- Net

drying continues in the northwestern U.S. Plains and southwestern portions of Canada’s Prairies over the next ten days - Crop

moisture stress is expected to slowly evolve especially as temperatures heat up during the coming week - Cooler

than usual temperatures are expected in the northern Plains and upper Midwest for the next five days resulting in slower crop development and slower drying rates - The

cool bias will be replaced by much warmer temperatures next week and into the following weekend

- Returning

excessive heat to the central United States next week will return crop and livestock moisture and heat stress, but conditions are improving in some areas this week because of rain and cooling - Rain

will be most significant from Colorado into Kansas and northern Oklahoma over the next few days - Texas

cotton, corn, sorghum, soybean and rice will continue seriously stressed by heat and dryness over the next ten days

- Significant

relief is unlikely unless a tropical system evolves and moves into Texas - Drought

also continues in northeastern Mexico with little to no rain and hot temperatures likely through the next ten days - U.S.

southeastern states and lower Delta will continue sufficiently wet enough to support crops favorably over the next ten days - Southeastern

Canada crop conditions are rated favorably with little change likely for a while - Much

of Europe rainfall will be restricted over the next ten days while temperatures are near to above normal

- Net

drying is expected in the majority of the continent, but especially in France, the U.K., Belgium, Netherlands, Germany, Spain, Portugal and from the lower Danube River Basin to Hungary - Eastern

Europe will receive rain this weekend into early next week from Czech Republic and Austria to Belarus and northwestern Ukraine with rainfall of 1.00 to 2.00 inches and locally more resulting - Net

drying will persist for the next couple of weeks from Hungary into Greece resulting in more threatening crop heat and moisture stress - A

mostly good mix of weather will occur in the Commonwealth of Independent States through the next two weeks

- Concern

remains over erratic rainfall in Russia’s Southern Region, southeastern Ukraine and parts of Kazakhstan - Rain

is expected in Russia’s Southern region and temperatures will be mild enough to conserve the resulting rainfall through lower evaporation rates - A

boost in rainfall is advertised for western, central and northern Ukraine after the end of this week and the moisture increase will bring on better crop and field conditions - India’s

monsoonal rainfall is expected to continue widespread across the nation during the next two weeks with all areas impacted and most getting sufficient rain to bolster soil moisture and/or induce flooding - Some

areas may become too wet, but the precipitation will occur with sufficient breaks to prevent serious flooding from occurring - Nationwide

rainfall is still expected to be above normal at mid-August and serious relief should occur to the dry areas of Uttar Pradesh and Bihar which have not received nearly as much rain as usual so far this year. Cotton, groundnut and soybean areas of northwestern

India should experience mostly good weather for crop improvements after flooding rain earlier this month - China’s

weather is still advertised to be drier than usual in the southeastern corner over the next ten days, but rain is expected thereafter - The

return of rain should benefit rice and other late season crops - Timely

rainfall is expected in most other areas in the nation during the next two weeks maintaining moisture abundance and a mostly good crop development environment - China’s

Xinjiang province continues to experience relatively good weather - A

few showers and thunderstorms are expected, but most of the region will be dry with temperatures varying greatly over the week to ten days - Far

southern Brazil will receive periodic rainfall during the next ten days maintaining a typically moist pattern in the soil from Rio Grande do Sul into Paraguay, southernmost Mato Grosso do Sul and parts of both Parana and southern Sao Paulo - The

moisture will be great for winter crops and should not have much impact on Safrinha crop maturation or harvesting - Safrinha

cotton and late corn harvesting in Brazil will advance well due to continued dry and warm weather - There

is no threat of cold weather in Brazil coffee, citrus or sugarcane areas during the next two weeks - Some

cooling is expected in Argentina late this week into early next week - Sumatra,

Indonesia rainfall has started to improve with a couple of central west coast locations reporting heavy rainfall Monday and early today - Rain

- All

other Southeast Asian nations will experience an abundance of rainfall during the next few weeks resulting in some flooding in the Philippines and the Maritime provinces - Australia

weather in the coming ten days will be favorable for most winter crops - Central

Queensland received rain Wednesday and Thursday favoring a boost in topsoil moisture for a part of winter crop country

- Western

Australia will get most of the significant rain this coming week, but some rain will eventually reach the southeastern parts of the nation in time next week.

- South

Korea rice areas are still dealing with a serious drought, despite some rain that fell recently.

- Some

additional showers are expected over the next couple of weeks, but a soaking rain will continue to elude the region - East-central

Africa rainfall this week will be greatest in central and western Ethiopia and lightest in parts of Uganda.

- Tanzania

is normally dry at this time of year, and it should be that way for the next few of weeks - Kenya

and Uganda will trend wetter next week - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

greater rain would still be welcome in the drier areas of Ivory Coast - Seasonal

rains are shifting northward leading to some drying in southern areas throughout west-central Africa - Cotton

areas are expecting greater rainfall in the next couple of weeks - South

Africa’s crop moisture situation is favorable for winter crop establishment, although some additional rain might be welcome - Restricted

rainfall is expected for a while, but the crop is rated better than usual - Central

America rainfall will continue to be abundant to excessive and drying is needed - Mexico

rain will be most abundant in the west and southern parts of the nation - Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely - Today’s

Southern Oscillation Index was +8.13 and it will continue to drift lower over the next several days - New

Zealand weather is expected to be well mixed over the next two weeks - Temperatures

will be seasonable with a slight cooler bias

Source:

World Weather INC

Bloomberg

Ag Calendar

Wednesday,

July 27:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Earnings:

Bunge

Thursday,

July 28:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Buenos

Aires grains exchange weekly crop report - HOLIDAY:

Thailand

Friday,

July 29:

- Vietnam

July coffee, rice and rubber export data - FranceAgriMer

weekly update on crop conditions - ICE

Futures Europe weekly commitments of traders report - US

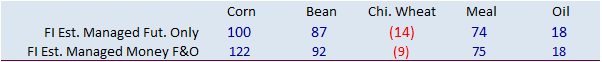

agricultural prices paid, received, 3pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Thailand

Macros

US

New Home Sales Change Jun: 590K (est 655K; prev R 642K)

–

New Home Sales (M/M): -8.1% (est -5.9%; prev R 6.3%)

–

Median Sale Price (Y/Y) (USD): 402.4K or +7.4% (prev 449.0K or +15.0%)

US

CB Consumer Confidence Jun: 95.7 (est 97.0; prev R 98.4)

–

Present Situation: 141.3 (prev R 147.1)

–

Expectations: 65.3 (prev R 65.8)

Philadelphia

Fed Non-Manufacturing Index Jul: 0.1 (prev 4.6)

US

To Sell Additional 20M Bbls Of Oil From Strategic Reserve As Part Of Plan To Sell 180M Bbls

98

Counterparties Take $2.189 Tln At Fed Reverse Repo Op (prev $2.192 Tln, 100 Bids)