PDF Attached

Mixed

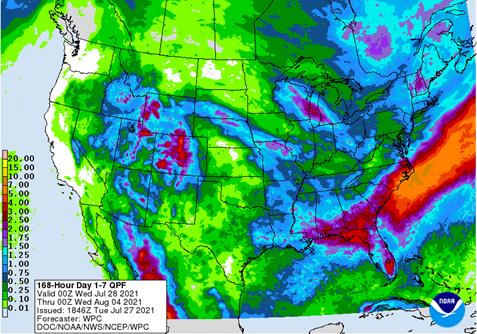

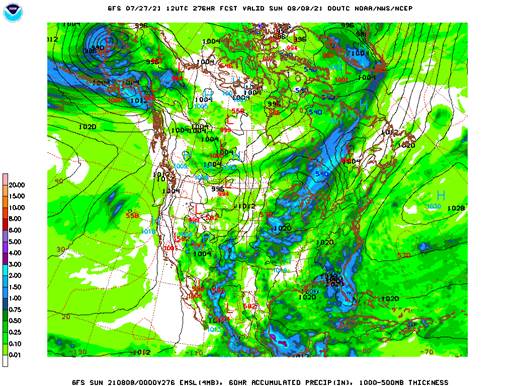

close. Midday weather models indicated good rain could fall across western IA and surrounding areas.

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

-

Not

much change in North America weather was noted in today’s two week outlook -

Restricted

rain will fall in Canada’s Prairies, although some rain is expected periodically in central and northern Alberta that will support crops well -

U.S.

northern Plains and northwestern Corn Belt will continue dry bias during much of the coming ten days to two weeks, despite a few showers and thunderstorms -

U.S.

greatest rainfall in this first week of the outlook is expected from southern South Dakota through eastern Nebraska and southwestern Iowa to northern Missouri Friday -

Rainfall

of 0.50 to 1.50 inches and locally more will be possible -

Very

warm to hot temperatures will occur in the northern U.S. Plains through Wednesday and impact a part of the western Corn Belt and central U.S. Plains Wednesday into Thursday as well -

Timely

rainfall and seasonable temperatures are likely in other areas in the U.S. Plains, Midwest, Delta and southeastern states -

West

Texas will warm up for a few days and then receive rain as temperatures cool down for a little while early next week

-

U.S.

Delta and southeastern states will see a good mix of weather for the next ten days.

-

Far

western U.S. dryness is expected to prevail for a while -

Southeastern

Canada corn, soybean and wheat production areas continue to experience a favorable mix of weather -

Wheat

areas would benefit from an extended period of dry weather to support the best harvest conditions -

Australia

weather will be favorably mixed for canola, wheat and barley -

Crops

have established well in most of the nation -

Queensland

and northern New South Wales need more rain -

Europe

will experience periodic showers this week slowing some of the small grain and winter rapeseed harvest progress -

Some

worry over crop quality is expected, but it will not be as wet as it was earlier this month from eastern Germany to Poland -

Most

CIS crop areas will see a good mix of weather during the next couple of weeks -

However,

dryness will remain in parts of Russia’s Southern Region and areas east northeast through Kazakhstan -

Ukraine

soil and crop conditions should remain favorably rated, although some increase in rainfall may be needed in parts of the region -

China

received more heavy rainfall Monday from Tropical Storm In-Fa over Zhejiang, Jiangsu and southeastern Anhui -

Flooding

has been significant the past few days in parts of Zhejiang -

In-Fa

will advance to the northeast over the next few days spreading rain from east-central China into the northeastern part of the nation -

India

weather continues to benefit many central, northern and eastern parts of the nation, but drying is ongoing in the south and in a few far northwestern parts of the nation -

Southern

Pakistan is also unlikely to get much beneficial moisture for a while -

Ethiopia

rainfall has been sufficient to support coffee and other crops recently, but Uganda and Kenya rainfall has been light -

The

pattern will continue for a while longer -

West-central

Africa rainfall has diminished seasonably for a while -

Rain

will be needed in Ghana and Ivory Coast soon -

Recent

rain in southeastern Asia has been good for bolstering soil moisture and improving crop conditions in Laos, parts of Cambodia, eastern Thailand and western Myanmar -

Philippines

rain diminished Monday in the northwest after excessive rain impacted western Luzon Island during the weekend -

Indonesia

rainfall has decreased, but should be increasing again soon -

South

Africa weather is expected to be dry for a while, but recent rain has western wheat and barley crops well established -

A

boost in rainfall is needed in unirrigated eastern wheat production areas -

Argentina

needs rain in its western wheat production areas, although cold weather has the crop dormant or semi-dormant right now leaving the need for a moisture boost to a time later in August and September prior to aggressive spring crop development -

Rain

will fall in southern Brazil crop areas today and Wednesday followed by colder weather -

Frost

and some freezes are expected in coffee production areas of Sul de Minas, Brazil Friday and Saturday -

Most

low temperatures will be zero to +4 Celsius (32-40F) with a few readings as cold as -3 in the traditionally coldest areas of the region -

Western

coffee areas will only experience some patches of light frost -

Sugarcane

and citrus in Brazil are not likely to be seriously impacted by frost and freezes Friday or Saturday, but some vegetative development will be negatively impacted -

No

blossom bud damage is expected in citrus areas and leaf mass damage on the cane will not kill the crop, but it will set back its growth rates for a while -

Southern

Oscillation Index has reached +15.86 and it is peaking after a strong rising trend since June 22 when the index was -3.36 -

Mexico

weather has improved with increased rainfall in the south and west parts of the nation -

Drought

conditions are waning, and crops are performing better -

Dryness

remains in Chihuahua and northeastern parts of the nation -

Weather

over the next ten days will offer some relief, but more rain will be needed in the drier areas -

Central

America rainfall has been plentiful and will remain that way -

Both

Honduras and Nicaragua have received frequent bouts of rain this month easing long term dryness, but more may be needed in some locations -

Flooding

rainfall occurred in a part of the region from southern Nicaragua into Panama during the weekend -

New

Zealand rainfall during the coming week will be near to above normal in western portions of South Island while near to below average in most other areas -

Temperatures

will be seasonable

Source:

World Weather Inc.

Bloomberg

Ag Calendar

Wednesday,

July 28:

- EIA

weekly U.S. ethanol inventories, production - Brazil

Unica cane crush, sugar production (tentative) - UN

Food Systems Pre-Summit in Rome - HOLIDAY:

Thailand - EARNINGS:

Bunge, Pilgrim’s Pride

Thursday,

July 29:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports

Friday,

July 30:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received

Source:

Bloomberg and FI

Archer-Daniels

Midland Q2 EPS $1.33 Beats $0.99 Est., Sales $22.93B Beat $17.88B Est.

US

Durable Goods Orders Jun P: 0.8% (est 2.1%; prevR 3.2%; prev 2.3%)

US

Durable Goods Orders Ex-Transportation Jun P: 0.3% (est 0.8%; prevR 0.5%; prev 0.3%)

US

Cap Goods Orders Nondef Ex-Air Jun P: 0.5% (est 0.8%; prevR 0.5%; prev 0.1%)

US

Cap Goods Ship Nondef Ex-Air Jun P: 0.6% (est 0.8%; prevR 0.9%; prev 0.1%)

US

CB Consumer Confidence Jul: 129.1 (est 123.8; prev 127.3)

–

Present Situation: 160.3 (prev 157.7)

–

Expectations: 108.4 (prev 107.0)

US

CB 1-Year Consumer Inflation Expectations Jul: 6.6% (prev 6.7%)

71

Counterparties Take $927.419 Bln At Fed’s Fixed-Rate Reverse Repo (prev $891.203 Bln, 70 Bidders)

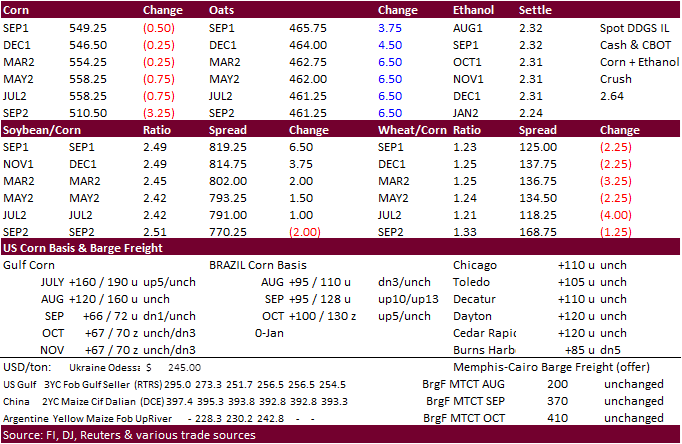

- Corn

started higher on a lower than expected decline in US crop ratings but fell around 10 am CT after fund buying eroded and outside commodity markets softened. Corn ended 0.50-3.25 cents lower.

- Funds

sold an estimated net 1,000 corn contracts. - Private

group Soybean and Corn Advisory lowered their estimate for the Brazil corn crop to 86 million tons from 88MMT, and increased Argentina by 1MMT to 48 million.

- Per

Fastmarkets, domestic price of Brazilian corn is on the rise in part to a pickup in exports mid-July, with Cepea reporting over 100 real per bag – highest since May. Fastmarkets calculates a 3.2 million ton Argentina corn export lineup, which is large.

- AgRural

reported the Brazil center-south second corn harvest progress at 39% complete, well down from 53% year earlier.

- Anec

sees Brazil’s corn exports at 3.2 million tons, slightly below their previous forecast.

- China

will auction off 202,264 tons of imported US corn and 49,695 tons of imported Ukrainian corn on July 30.

- China

pork prices averaged 20.01 yuan (about 3.1 U.S. dollars) per kg in June, down 16.6 percent month on month. The price index dropped 54.1 percent compared with the same period last year. (Bloomberg) - The

European Union granted imports licenses for 285,000 tons of corn imports, bringing cumulative 2020-21 imports to 752,000, 8 percent below same period year ago.

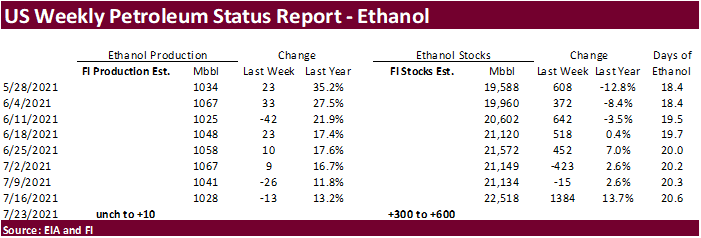

- A

Bloomberg poll looks for weekly US ethanol production to be up 3,000 barrels (1008-1054 range) from the previous week and stocks up 130,000 barrels to 22.648 million.

Export

developments.

- Qatar

seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery. - Jordan

seeks 120,000 tons of feed barley on July 28 for Nov/Dec shipment.

September

corn is seen is a $5.00-$6.25 range

December

corn is seen in a $4.25-$6.00 range.

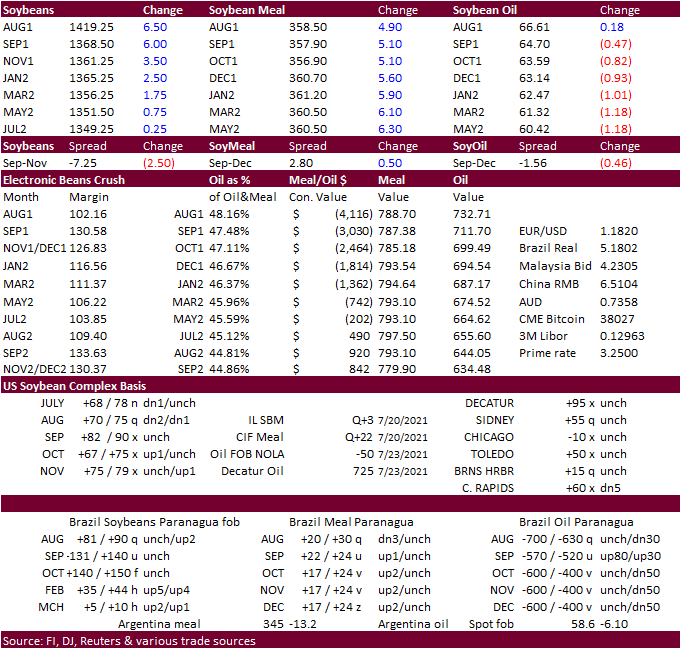

Soybeans

-

Soybean

complex started higher on a lower than expected decline in US crop ratings and support from outside markets. Soybean meal rallied on talk of US crush downtime and reversal in product spreads. Soybean meal ended $5.20 to $6.50 higher and soybean oil 17 to

134 points lower (bull spreading). The front four month soybean contracts ended higher. That market also saw bull spreading. August soy was up 5.50 cents and November up 1.75 cents. See attached spreads changes (includes modified close).

-

Gulf

soybean meal basis was up $6-$7/short ton to $22 to $33 over the August. We heard many crushers out west were taking downtime.

-

Funds

bought an estimated net 4,000 soybeans, bought 2,000 soybean meal and sold 3,000 soybean oil.

-

November

Canadian canola was down 6.50 at $890/ton. - Indonesia’s

biodiesel production was 4.56 million kiloliters in January to June (APROBI). Indonesia Domestic biodiesel consumption were 4.17 million kiloliters and exports were 21,809 kiloliters. -

SGS

reported Malaysia July 1-25 palm oil exports down 1.5% to 1,150,452 tons (in line with other estimates).

-

Argentina

ship workers are thinking of striking on Friday. -

Argentine

producers sold 25.8 million tons of soybeans through July 21, up 747,600 tons from the previous week, below 27.9 million tons at this time year ago. BS Grains Exchange is at 43.5 million tons, below 49 million produced in 2019-20. - Anec

sees Brazil’s soybean exports at 8.5 million tons, below their previous forecast of 9.5 million.

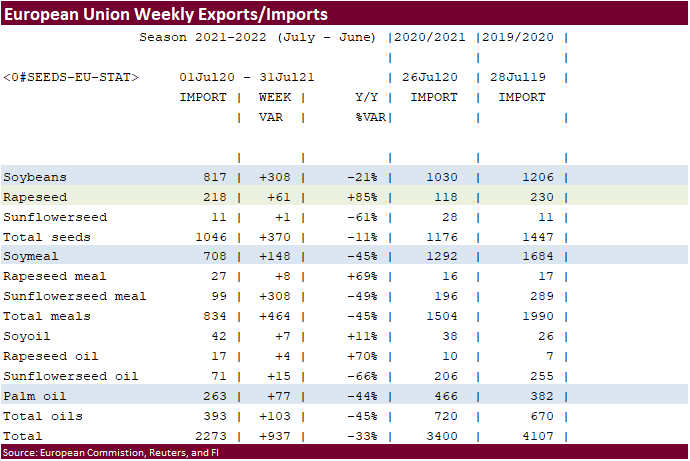

- The

European Union reported soybean import licenses since July 1 at 817,000 tons, below 1.030 million tons a year ago. European Union soybean meal import licenses are running at 708,000 tons so far for 2020-21, below 1.3 million tons a year ago. EU palm oil import

licenses are running at 263,000 tons for 2020-21, below 466,000 tons a year ago, or down 44 percent.

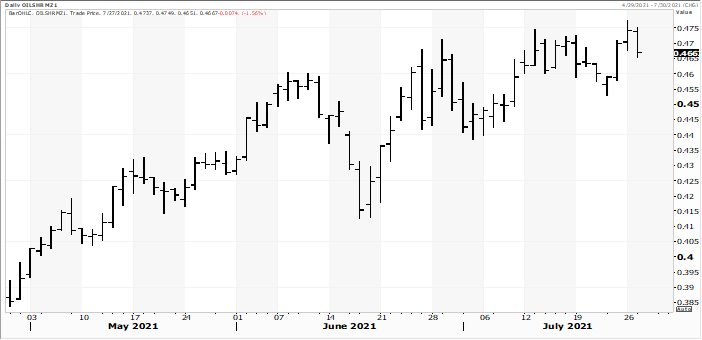

December

oil share

Source:

Reuters and FI

- The

USDA seeks 2,880 tons of packaged oil for use under the PL480 program on August 3 for Sep 1-30 shipment.

Updated

7/26/21

August

soybeans are seen in a $13.50-$15.00 range; November $11.75-$15.00

August

soybean meal – $330-$400; December $320-$425

August

soybean oil – 64.50-70.00; December 48-67 cent range

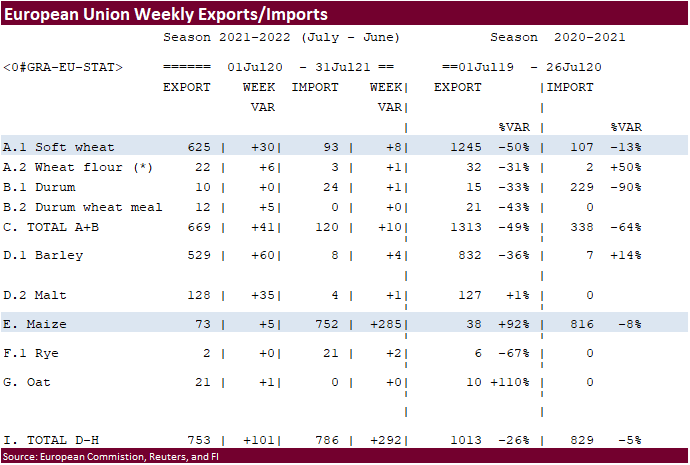

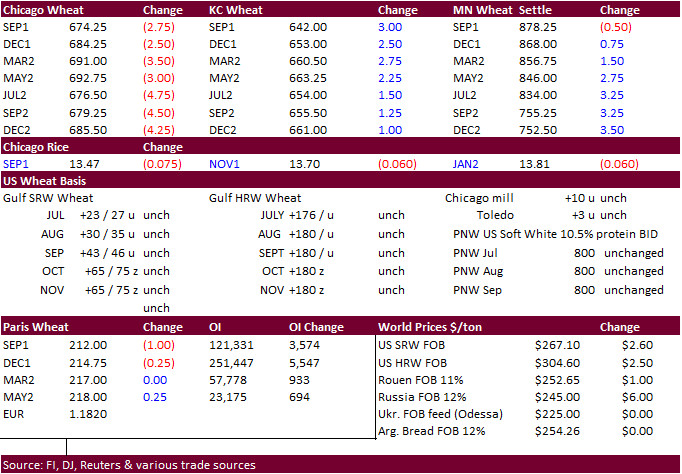

- Wheat

traded mostly higher on renewed global import demand and a drop in the US spring wheat crop ratings for the US, but Chicago turned lower in late trading to close off 2.50-4.50 cents, fourth consecutive session lower. KC and MN ended mostly higher.

Egypt

bought 180,000 tons of Ukrainian and Romanian wheat. - Funds

sold an estimated net 1,000 SRW wheat contracts. - The

US spring wheat tour started today. #wheattour21 Early estimates vary. North of Fargo yields look lower than average. Spring-wheat yield averaged 41 bu/acre after four stops along a route in south central N.D, according to Bloomberg. We may adjust lower

our spring and durum yield for the purpose of the August USDA Crop

Production

survey based results of this week’s spring wheat crop tour. - SovEcon

lowered its forecast for Russia’s wheat exports by 1.3 million tons to 37.1 million tons in the current 2021-22 marketing season. - North

and western Europe is expected to see cooler than normal temperatures over the next two weeks.

- December

Paris wheat was up 0.25 at 214.75 euros. - The

European Union granted export licenses for 30,000 tons of soft wheat exports, bringing cumulative 2020-21 soft wheat export commitments to 625,000, well down from 1.245 million tons committed at this time last year, a 50 percent decrease. Imports are down

13% from year ago at 93,000 tons.

- Egypt

bought 180,000 tons of wheat for September 20-30 shipment. It included 120,000 tons of Ukrainian wheat and 60,000 tons of Romanian wheat.

60,000

tons of Ukrainian wheat at $244.50 plus $34.50 freight, equating to $279.00.

60,000

tons of Ukrainian wheat at $244.80 plus $34.50 freight, equating to $279.30

60,000

tons of Romanian wheat at $246.86 plus $33.05 freight, equating to $279.91

- South

Korea’s FLC bought 65,000 tons of Black Sea feed wheat at $293.74/ton for Sep 20 through Oct 20 shipment.

- Jordan

bought 60,000 tons of wheat at $285/ton c&f for first half January 2020 shipment.

- Pakistan

lowest offer for 110,000 tons of wheat at $304/ton c&f. Pakistan’s

TCP seeks 500,000 tons of wheat on July 27. 200,000 tons are for August shipment, and 300,000 tons are for September shipment.

- Turkey’s

TMO seeks up to around 900,000 tons of 11.5-12.5% milling wheat (395k) and feed barley (515k) for late September 16-30 shipment. The barley is sought on August 3 and wheat on August 4. Turkey is one of Russia’s best customer.

- Results

awaited: Ethiopia seeks 400,000 tons of wheat on July 19.

Rice/Other

- Results

awaited: Mauritius seeks 6,000 tons of white rice on July 27 for October through December shipment.

Updated

7/26/21

September Chicago wheat is seen in a $6.25-$7.50 range

September KC wheat is seen in a $5.90-$7.25

September MN wheat is seen in a $8.10-$9.25

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.