PDF Attached include three/four NASS updates (US flour milling up 1% from Q1)

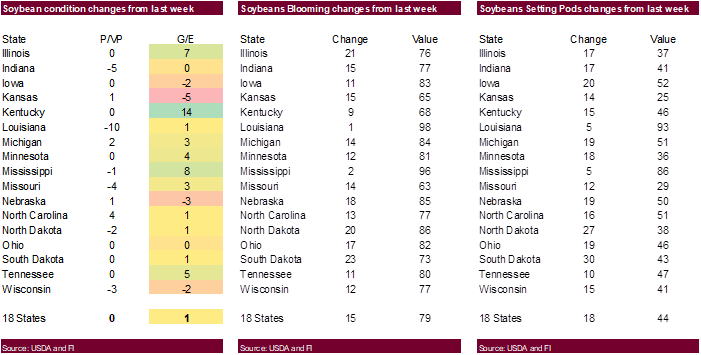

Soybeans

10-15 lower

Soybean

meal $1.50-3.00 lower

Soybean

oil 50-100 lower

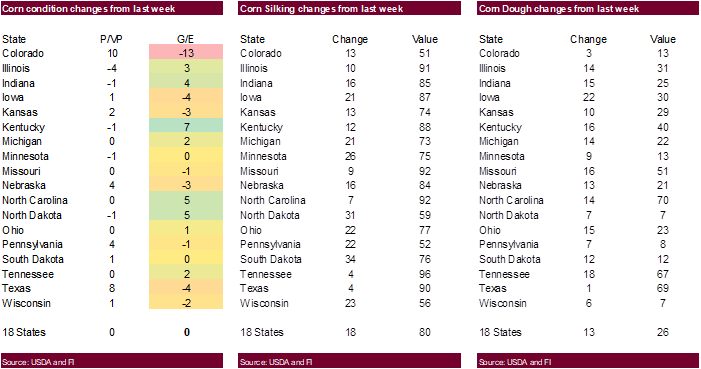

Corn

4-8 lower

Chicago

wheat 5-10 lower

KC

wheat 5-10 lower

MN

wheat 7-12 lower

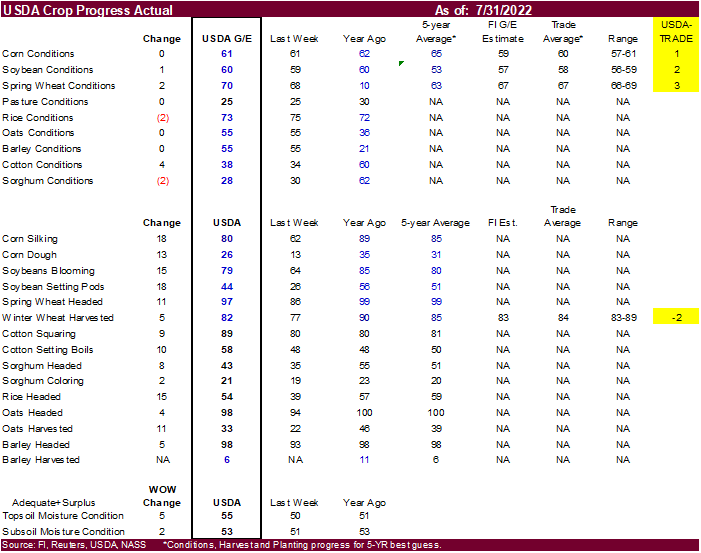

US

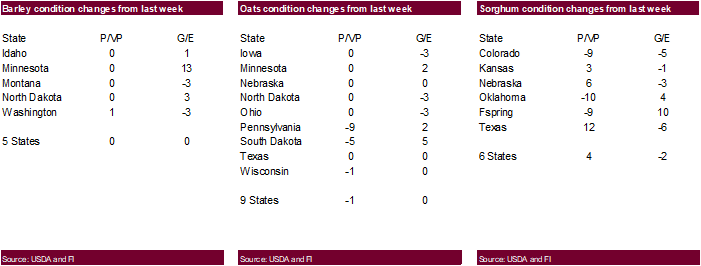

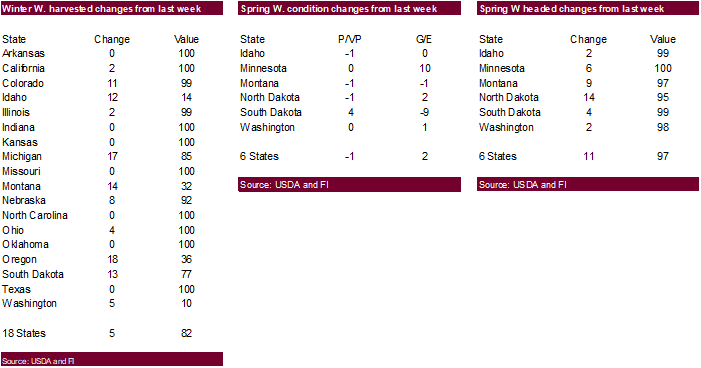

crop conditions were surprisingly high. Three other reports were released by USDA. Yields 178.5 corn and 49.9 soybeans looking at for Aug report.

US

weather is getting friendlier, for the two-week forecast, but the threat of heat and dryness has not all abated. Global economic concerns sent US WTI crude oil slightly lower for the evening trade (it was down sharply Monday during the day), pressuring outside

related commodity markets. Reuters noted manufacturing data in several countries weighed on the demand outlook for energies. OPEC+ has meetings this week. July mineral oil global output was a little better than expected.

US

weather outlook improved over the past weekend for the US and the midday GFS model confirmed that, with little more rain for the Corn Belt, bias south and east, and less threatening hot temperatures, at least over the near term. 11-15 day suggests hot and

dry.

Despite

and sharply lower USD and US crop conditions on the decline, CBOT US agriculture markets traded lower, in part to heavy technical selling and Ukraine shipping a Black Sea cargo. Negative US / China trade talks should be not overlooked.

World

Weather Inc.

WEATHER

TO WATCH AROUND THE WORLD

- Western

U.S. Corn Belt is likely to dry down this week because of hot temperatures and limited rainfall - Two

waves of hot weather will impact the Plains and western Corn Belt with highs in the 90s to 104 degrees Fahrenheit expected in the first wave (slightly hotter in the heart of the Plains with extremes to 108)

- Second

wave late this week into the weekend will generate highs in the 90s to 102 with slightly warmer readings in the Plains - Insignificant

rainfall is expected during the week allowing net drying to occur especially in the Plains and Missouri River Valley

- Soil

moisture is already short to very short in the northwestern Corn Belt and it is expected to dry down in the southwestern Corn Belt this week - U.S.

second week outlook in the Plains and western Corn Belt may bring along some periodic rainfall to slow the drying trend and possibly offer a little relief to the driest areas - Temperatures

will not be nearly as hot next week as they will be at times this week in the Western Corn Belt - Rain

will fall periodically in the eastern U.S. Midwest over the next ten days to two weeks resulting in a mostly favorable crop development environment

- U.S.

Delta and southeastern states weather is expected to be favorably mixed over the next ten days to two weeks - Texas

crop areas away from the coast and away from the Panhandle will continue to experience hot and dry weather resulting in some ongoing crop stress.

- Heavy

rain fell in the Texas Panhandle during the weekend with Goodnight, Texas reporting 6.71 inches of rain

- Rain

fall of 1.00 to more than 4.00 inches occurred across central parts of the Panhandle seriously bolstering soil moisture for improved crop development potential - U.S.

soil moisture is mixed across key crop areas with dryness most serious in the Dakotas, eastern Nebraska, southern Minnesota and western Iowa - These

areas are experiencing very short topsoil moisture and short to very short subsoil moisture.

- Some

areas are drier than others, but the longer these areas go without rain the more serious the stress is likely to become - U.S.

Delta soil moisture has improved with recent rain, but subsoil moisture is still rated very short - Much

more rain is still needed to support crops in the long run - Soil

moisture in the central and eastern Midwest is still rated quite favorably and these areas will continue to get significant rainfall

- Soil

moisture improved greatly in cotton, corn and sorghum areas from southwestern Kansas into the Texas Panhandle and in northern parts of Oklahoma during the past week

- World

Weather, Inc. believes the Plains and western fringes of the U.S. Corn Belt will continue to experience a drier biased scenario during the next two weeks, but the central and eastern Midwest will get timely rain to maintain a favorable outlook for crop development

from the Mississippi River valley into the eastern Midwest - This

outlook is similar to that of earlier this summer, but wetter than that of late last week

- Excessive

heat continued in the Pacific Northwest during the weekend with extreme highs of 104 to 113 reported officially - Some

areas in Oregon and southern Idaho did not warm above 100, but were in the upper 90s - Crop

and livestock stress was tremendous - A

few heat-related deaths occurred to humans - Livestock

losses have likely occurred, but not yet confirmed - Temperatures

reached 108 as far north as Lytton, British Columbia - A

huge demand was placed on water supply in the region all of last week and through the weekend

- Relief

is expected in the U.S. Pacific Northwest during mid-week this week with temperatures easing back to near normal levels for a while, but heat may return to parts of the region for a little while net week

- U.S.

bottom line is very similar to that of earlier this summer. Dryness is not an issue in the central or eastern Midwest (outside of a few pockets). Dryness is a little more common in the western Corn and Soybean production region with some areas drier than others.

Crop stress is already present in a significant manner in the northwestern Corn Belt while expanding across the northern Plains. World Weather, Inc. believes relief in the northern Plains and northwestern Corn Belt is not likely until next week when the weekend

high pressure ridge either breaks down or shifts to the west. Until then, rainfall is unlikely to be great enough to offer serious relief from heat and dryness. Next week will offer some partial relief to heat and dryness in the Plains and westernmost Corn

Belt, but the ridge might return a little later in August quickly closing the door of opportunity for relief in the westernmost crop areas. Overall, crop conditions will stay good in the Delta, southeastern states and central and eastern Midwest while moisture

and heat stress (in this first week only) will occur in the westernmost Corn Belt and Great Plains pressuring crop development, but actual losses in production will be more determined by next week’s weather in these areas than this week. World Weather, Inc.

is concerned that the second week rainfall in the Plains and western fringes of the Corn Belt will be restricted limiting relief. In the meantime, relief is expected in the Pacific Northwest from the excessive heat, although rainfall will be minimal. Rain

is also unlikely in the northwestern U.S. Plains where crop moisture stress will continue next week despite cooler temperatures.

- Western

Europe was left dry during the weekend and temperatures began to turn warmer with highest temperatures back into the 80s and lower 90s Fahrenheit in France and hotter in Spain while in the 70s and lower 80s in Germany and the U.K.

- Western

Europe is unlikely to get much precipitation during the next ten days, although it will not be totally dry - Resulting

rainfall is not likely to be very great and no serious change in crop moisture and livestock stress is expected - Temperatures

will be above normal for the next full week and possibly ten days - Extreme

highs in the 80s and 90s are expected over many parts of western Europe with extremes over 100 in the southwest; including southwestern France - Eastern

Europe received rain during the weekend with Poland, Czech Republic and a part of Slovakia getting 1.00 to 2.63 inches - One

location in eastern Czech Republic received 5.35 inches - Showers

also occurred in Serbia, western Bulgaria, Romania and western Ukraine with coverage of 75% and rainfall of 0.05 to 0.62 inch - A

few local totals of 0.88 to nearly 3.00 inches resulted - Most

of the rain was welcome, but only a few areas that had been too dry received enough rain to seriously improve soil moisture - Drought

remains and is unlikely to change without greater rain - Eastern

Europe weather will experience isolated to scattered showers over the next ten days with the Balkan Countries driest and warmest - Crop

stress will continue in areas that failed to get rain during the weekend - The

bottom line in Europe is still quite favorable in the Baltic Plain, Belarus and the Baltic States as well as Czech Republic, but dryness is still a concern in most of western and southeastern Europe, despite temporary relief in the southeast during the weekend.

Rainfall in the next two weeks will be a little too light and infrequent while temperatures are warmer than usual to induce any serious change in crop or field conditions. Crop stress will continue in France, southern parts of the U.K., portions of Germany,

Belgium, Netherlands, Spain, Portugal, southern Italy and from parts of Greece and Bulgaria to Hungary and a part of Slovakia.

- A

split jet stream is expected over parts of Russia resulting in net drying conditions in the eastern portions of the Volga River Basin Ural Mountains region, western Kazakhstan, eastern parts of Russia’s Southern Region and the eastern Russia New Lands during

the next ten days - Temperatures

will be near to above normal inducing a net decline in soil moisture - Some

drying has already occurred, and a little crop stress is possible as time moves along during the next two ten days - Eastern

Ukraine and portions of southwestern Russia will experience periods of rain this week improving topsoil moisture and crop conditions - This

will include western parts of Russia’s Southern Region - Some

rain totals by Saturday may vary from 1.00 to 3.00 inches - Northeastern

China received additional rain during the weekend from northern Jiangsu and southern Shandong into Heilongjiang - Rainfall

varied from 1.00 to 3.00 inches except in southern Shandong and northern Jiangsu where 10.00 to 11.30 inches of rain were noted

- Drying

occurred in the Yellow River Basin after heavy rain fell late last week - Showers

elsewhere in China were sporadic and mostly light - Temperatures

were warm enough induce quick drying - Eastern

China’s weather in the next ten days will be drier than usual in the interior southeast and favorably to excessively wet from the Yellow River Basin and North China Plain into northeastern China - Xinjiang,

China will see a good mix of weather over the next two weeks maintaining favorable crop development and normal yield potentials

- Argentina’s

next potential rain event in wheat areas is possible late this coming weekend into early next week

- Rainfall

may vary up to 0.50 inch, but the event is too far out in time to have much confidence in the event

- Rain

will also fall in northeastern Argentina Tuesday into Thursday, but that event will most the most important wheat areas and especially those that are driest in the west

- Far

southern Brazil will receive periodic rainfall during the next ten days maintaining a typically moist pattern in the soil from Rio Grande do Sul into Paraguay, southernmost Mato Grosso do Sul and parts of both Parana and southern Sao Paulo - The

moisture will be great for winter crops and should not have much impact on Safrinha crop maturation or harvesting - Some

forecast models have suggested rain in parts of Mato Grosso next week, but confidence in the event is very low - Safrinha

cotton and late corn harvesting in Brazil will advance well due to continued dry and warm weather through the coming weekend - There

is no threat of damaging cold weather in Brazil coffee, citrus or sugarcane areas during the next two weeks - Southeastern

Canada (Quebec and Ontario) crop conditions are rated favorably with little change likely for a while - Canada’s

southwestern and central Prairies will dry down over the next week to ten days and temperatures will slowly rise above normal.

- Crop

stress will rise once again as soil moisture is slowly depleted - The

greatest stress will eventually evolve in central, west-central, southwestern and south-central Saskatchewan and southeastern Alberta, but conditions will remain favorable through the weekend - India’s

monsoonal rainfall is expected to continue widespread across the nation during the next two weeks with all areas impacted and most getting sufficient rain to bolster soil moisture and/or induce flooding - Some

central areas may become too wet, but the precipitation will occur with sufficient breaks in this coming week to prevent serious flooding from occurring - Worry

over Uttar Pradesh, Bihar and Jharkhand will continue even though timely rain is expected - These

three states and immediate neighboring areas received well below normal precipitation earlier this summer and have moisture deficits still lingering - Greater

rain is needed in these areas but may be slow in coming. - Nationwide

rainfall is still expected to be above normal through mid-August and additional relief should occur to the dry areas of Uttar Pradesh and Bihar, but the amounts will need to be closely monitored. Cotton, groundnut and soybean areas of northwestern India should

experience mostly good weather for crop improvements after flooding rain earlier this month - Sumatra,

Indonesia rainfall continues a little too erratic and greater moisture is still needed in some areas, despite a little rain earlier this week - Greater

rain is expected to slowly evolve over the next two weeks

- All

other Southeast Asian nations will experience an abundance of rainfall during the next few weeks resulting in some flooding in the Philippines and the Maritime provinces - Australia

weather in the coming ten days will be favorable for most winter crops - Central

Queensland received rain Wednesday and Thursday favoring a boost in topsoil moisture for a part of winter crop country

- Western

Australia will get most of the significant rain this coming week, but some rain will eventually reach the southeastern parts of the nation in time next week.

- South

Korea rice areas are still dealing with drought, despite some rain that fell recently.

- Some

additional rain is expected over the next couple of weeks - East-central

Africa rainfall is increasing and will be greatest in central and western Ethiopia, but Uganda and Kenya will get some much needed improved rainfall - Tanzania

is normally dry at this time of year, and it should be that way for the next few of weeks - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

greater rain would still be welcome in the drier areas of Ivory Coast and Ghana

- Seasonal

rains are shifting northward leading to some drying in southern areas throughout west-central Africa - Cotton

areas are expecting frequent rainfall in the next couple of weeks - South

Africa’s crop moisture situation is favorable for winter crop establishment, although some additional rain might be welcome - Restricted

rainfall is expected for a while, but the crop is rated better than usual - Central

America rainfall will continue to be abundant to excessive and drying is needed - Mexico

rain will be most abundant in the west and southern parts of the nation - Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely - Today’s

Southern Oscillation Index was +7.83 and it will move erratically higher over the next week - New

Zealand weather is expected to be well mixed over the next two weeks - Temperatures

will be seasonable with a slight cooler bias

Source:

World Weather INC

Bloomberg

Ag Calendar

Monday,

Aug. 1:

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop conditions for wheat, corn, soybeans and cotton; spring wheat harvest, winter wheat crop progress, 4pm - USDA

soybean crush, DDGS production, corn for ethanol, 3pm - Honduras

and Costa Rica monthly coffee exports - International

Cotton Advisory Committee releases monthly outlook report - EARNINGS:

CF, Mosaic - HOLIDAY:

Canada

Tuesday,

Aug. 2:

- New

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data - Australia

commodity index - US

Purdue Agriculture Sentiment, 9:30am - EARNINGS:

FMC, Green Plains, Andersons

Wednesday,

Aug. 3:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Malaysia’s

July 1-20 palm oil export data - New

Zealand Commodity Price

Thursday,

Aug. 4:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - EARNINGS:

Corteva

Friday,

Aug. 5:

- FAO

World Food Price Index - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Malaysia’s

Aug. 1-5 palm oil export data

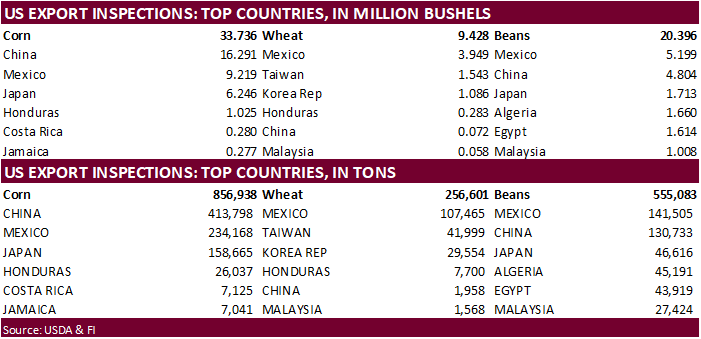

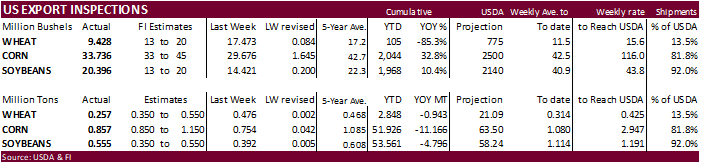

USDA

inspections versus Reuters trade range

Wheat

256,601 versus 250000-550000 range

Corn

856,938 versus 550000-1150000 range

Soybeans

555,083 versus 300000-800000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JUL 28, 2022

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 07/28/2022 07/21/2022 07/29/2021 TO DATE TO DATE

BARLEY

0 0 599 847 4,214

CORN

856,938 753,793 1,467,379 51,926,177 63,092,662

FLAXSEED

0 0 0 0 24

MIXED

0 0 0 0 48

OATS

0 798 0 5,089 100

RYE

0 0 0 0 0

SORGHUM

92,019 77,196 55,306 7,236,681 6,767,030

SOYBEANS

555,083 392,480 185,723 53,561,468 58,357,567

SUNFLOWER

0 0 0 2,260 240

WHEAT

256,601 475,526 405,215 2,848,425 3,791,107

Total

1,760,641 1,699,793 2,114,222 115,580,947 132,012,992

————————————————————————–

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

US

Construction Spending (M/M) Jun: -1.1% (est 0.1%; prev R 0.1%)

US

ISM Manufacturing Jul: 52.8 (est 52.0; prev 53.0)

–

Prices Paid: 60.0 (est 74.3; prev 78.5)

–

New Orders: 48.0 (est 49.0; prev 79.2)

–

Employment: 49.9 (est 49.9; prev 47.3)

9:08:02

AM livesquawk Ukraine’s State Gas Transit Operator: Gazprom Booked Transit Capacity At Sudzha Transit Point Of 41.72 Mcm For Aug 2, Same Volume As On Aug 1

Moody’s:

US Real GDP Growth Seen At 2.1% This Year, 1.3% In 2023

Moody’s:

Expects FOMC To Take Fed Funds Rate To3.50%-3.75% By End-2022, Above 4.0% By March 2023

WTI

fell today on renewed demand concerns. Yet, US SPR fell to 469.9 million barrels, lowest since May 1985.

Brazil

selected commodity exports

Commodity

July 2022 July 2021

CRUDE

OIL (TNS) 5,051,677 4,208,806

IRON

ORE (TNS) 31,889,651 31,560,509

SOYBEANS

(TNS) 7,518,153 8,669,658

CORN

(TNS) 4,123,973 1,991,369

GREEN

COFFEE(TNS) 146,797 142,914

SUGAR

(TNS) 2,884,256 2,468,740

BEEF

(TNS) 167,292 165,515

POULTRY

(TNS) 377,103 390,982

PULP

(TNS) 1,690,836 1,414,132