PDF Attached

Calls:

soybeans down 5-10, corn steady and wheat steady to 7 lower bias spring to downside.

We

were little surprised top and subsoil conditions were down from the previous week.

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

- Heavy

rain fell in India during the weekend as expected and more will occur early this week in northern Madhya Pradesh and southeastern Rajasthan resulting in some significant flooding. - Weekend

rain totals varied from 2.50 to more than 6.00 inches from Jharkhand through northern Madhya Pradesh to eastern Rajasthan and a part of Haryana - Another

4.00 to 10.00 inches of rain will fall today and Tuesday in northern Madhya Pradesh and southeastern Rajasthan

- Flooding

is expected to become serious enough to cause damage to crops and personal property - Showers

and thunderstorms elsewhere in India along and north of a line from southwestern Chhattisgarh to northwestern Madhya Pradesh to Nepal over the coming week will range from 2.00 to 6.00 inches

- Rainfall

to the south of this region and in Gujarat, northwestern Rajasthan and parts of Pakistan will vary from nothing to 0.65 inch - Net

drying is expected in most of these areas - Crop

stress will be increasing in those areas that have seen the least rainfall recently and will continue dry biased in this coming week - Some

relief to interior southern India dryness is expected next week, but the far south of the nation along with northwestern Gujarat, northwestern Rajasthan and southern Pakistan will remain quite dry - Rain

will be needed soon in these driest areas to protect summer production potentials - U.S.

rain during the weekend was most significant Friday into Saturday from southeastern South Dakota and eastern Nebraska to northern Missouri, west-central Illinois and the southwest half of Iowa.

- Rain

totals of 1.00 to 2.69 inches occurred in southwestern Iowa, east-central Nebraska, southeastern South Dakota and in northern Missouri with a few totals of up to 3.39 inches occurring in northeastern Missouri.

- A

few areas in west-central Illinois also received 1.00 to 2.00 inches while most of central through southeastern Illinois received 0.15 to 0.76 inch of rain - Other

showers and thunderstorms occurred in central Wisconsin producing 0.20 to 0.51 inch with one amount of 1.91 inches

- A

few more showers occurred in Michigan and in Kentucky with poor coverage and rainfall to 0.56 inch - Net

drying occurred in all other areas - Highest

temperatures Friday and Saturday were in the 70s and 80s Fahrenheit except in parts of Kansas, Missouri, southwestern Kentucky and southeastern Nebraska where a few lower 90s occurred Friday - Monsoonal

showers and thunderstorms remained active across most of the Intermountain West U.S. offering some break from dryness to some areas - Portions

of West Texas and the Texas Panhandle along with the central Plains and part of both the northern Delta and southeastern states also received weekend rainfall - Amounts

of 0.40 to 1.35 inches occurred in much of the central and north parts of West Texas with local totals over 2.00 inches.

- Portions

of the eastern Texas Panhandle received 1.00 to 3.61 inches of rain - North-central

Oklahoma received up to 2.83 inches of moisture - Parts

of Tennessee received 1.00 to 3.40 inches of rain and the northern Delta received up to 1.50 inches

- Rainfall

in the southeastern states was more sporadic and light with some 1.00 to 3.50-inch amounts in southeastern Virgin and northeastern North Carolina with one location reporting 5.55 inches. - Most

of the rainfall in the southeastern states varied from 0.05 to 0.69 inch - Coverage

in the Delta was less than 20$ and coverage in the southeastern states was 35% - U.S.

rainfall will be restricted in this first week of the two week outlook - Showers

will occur, but net drying is expected except from parts of Minnesota and Wisconsin into Michigan and Northern Illinois where 0.30 to 0.80 inch of rain with a few 1.00 to 2.00-inch amounts expected - Rainfall

of 0.20 to 0.75 inch will also occur in parts of eastern Kansas and Kentucky will 0.05 to 0.25 inch and a few amounts to 0.60 inch occur elsewhere - Ohio

and parts of Indiana will also receive 0.25 to 0.75 inch and a few totals over 1.00 inch - Net

drying is expected in most of the Midwest except in the Great Lakes region and lower eastern Midwest - Temperatures

will not be hot enough to seriously stress crops except in the driest areas in the northwest - Temperatures

will rise from the 70s and 80s Fahrenheit today and Monday to the 80s and lower to middle 90s Friday into Saturday with the western Corn Belt warmest - Nighttime

low temperatures will be in the 50s and 60s early this week and then rise to the 60s and lower 70s late this week and into the weekend - Week

two U.S. Midwest weather will bring back some rain to the production region - Rainfall

Monday through the second weekend of the two week outlook will range from 0.50 to 1.50 inches throughout the Midwest

- Rainfall

in the northern Plains will range from 0.30 to 0.80 inch, although South Dakota is advertised to be drier biased along with Nebraska and portions of eastern Montana - Temperatures

will be seasonably warm during much of next week. - U.S.

Delta and southeastern states along with the Blacklands of Texas and most of western Texas will see a good mix of weather for the next two weeks supporting most crop needs - South

Texas harvesting of cotton, sorghum and corn should advance relatively well over the next week, but some rain could evolve infrequently to slow fieldwork, but no cause any harm to mature crops - West

Texas is not advertised to be as wet this week as previously suggested late last week, but the environment will be good for summer crop development - Overall,

during the next two weeks much of the Midwest will get a good mix of weather with temperatures a little warmer than usual in the northwestern crop areas this week and more seasonable next week. Temperatures in other parts of the Midwest will be near to slightly

below average. Rainfall will be restricted in this first week of the outlook with gradual drying expected outside pf the Great Lakes region and eastern Minnesota. Some timely rainfall will occur next week offering a little relief from this week’s drying. However,

some of the rain in the western Corn Belt is overdone and a larger part of the region may not get enough rain to counter evaporation. Nevertheless, rain that falls next week will slow down the drying rates and offer a little relief to dryness and crop stress

that evolve this week. The second half of August will be cooler than usual in the eastern Midwest with periodic rain and temperatures in the west will be a little warmer than usual at times and will have a little more trouble getting sufficient rain to counter

evaporation leaving dryness most significant in the northwestern Corn Belt.

- Not

much rain fell in Canada’s Prairies during the weekend - A

few showers occurred from southern Alberta to far southwestern Saskatchewan and in central parts of Manitoba with rainfall to 0.39 inch - More

than 80% of the prairies was dry and warm - Highest

afternoon temperatures were in the 80s and lower 90s Fahrenheit except in a few interior southeastern Alberta locations where middle 30s were noted.

- Canada’s

Prairies will receive restricted amounts of rain this week and experience more net drying except in Alberta where scattered showers and thunderstorms will produce 0.20 to 0.80 inch of rain with a few amounts near the front range of mountains getting 1.00 to

2.00 inches - Temperatures

will be warmer than usual this week - Canada’s

Prairies will trend slightly cooler next week with a little more rain - Sunday

and Monday (Aug. 8-9) will be wettest with a few more showers later next week

- Rainfall

of 0.10 to 0.60 inch and a few totals over 1.00 inch will be possible - Not

all areas will be impacted - The

forecast seems a little too wet and watch for some changes early this week for next week - China

received heavy rain in the northeastern provinces during the weekend as remnants of Tropical Storm In-Fa finally moved out of the nation.

- Additional

rain since Friday ranged from 2.50 to more than 6.00 inches from northern Shandong and eastern Hebei through Heilongjiang - Local

flooding occurred, but the impact was much lower than that of last week when the storm produced copious amounts of rain from northern Zhejiang and southeastern Anhui to Shandong - Temperatures

in central China crop areas turned quite warm during the weekend with highs in the 90s and near 100 Fahrenheit common outside of the rainy areas noted above - Quick

drying occurred in most of those crop areas - Extreme

high temperatures reached 104 Fahrenheit in several areas east of Tibet - China

will experience a good mix of rain and sunshine over the coming week - Temperatures

will be seasonable - Rainfall

will be near to below average with east-central China to receive the lightest moisture totals relative to normal

- The

northeastern provinces will be wettest with some 1.00 to 2.00-inch totals expected

- Some

heavy rain will fall this week along the south coast due to tropical weather disturbances - Next

week’s rainfall will increase in southern China near and south of the Yangtze River and it will continue frequently in the northeastern provinces while the north China Plain and Yellow River Basin are driest

- China’s

bottom line is one of improvement for this week. Flooding that has been serious in eastern China during the past two weeks will finally ease and that will allow some farmers to assess the damage. Losses in parts of Hebei, Henan, southeastern Anhui, northern

Zhejiang and parts of both Shandong and Jiangsu may be significant, although the world may never know how serious it has been because of poor communications from the region. Crop conditions in the northeast will remain mostly good and the same is expected

in parts of the far south. - Southern

and eastern Thailand did not receive much rain during the weekend and these areas are advertised to receive minimal amounts of rain in the next two weeks - Western

Cambodia will be included in this drier bias - Other

areas in mainland Southeast Asia will receive a good distribution of rain and sunshine over the same two week period ending Aug. 16.

- Indonesia

and Malaysia rainfall was restricted during the Friday through Sunday period except in northwestern Sumatra where rainfall varied from 0.75 to 2.00 inches - Greater

rain is desired across parts of Indonesia where erratic rainfall recently has allowed the soil to dry down

- Philippines

rainfall increased greatly last week across western Luzon where flooding was widespread and threatening to rice and a few other crops - Additional

weekend rainfall was lighter and less threatening, although the region still needs to dry down - Soil

conditions in Philippines are now driest in western Mindanao and in some of the southern Visayan Islands - Europe

is advertised to trend drier next week, but periodic light rainfall will occur during this first week of the outlook resulting in some harvest delay and concern over unharvested small grain and late winter rapeseed quality - Next

week’s drying will be ideal in getting harvest progress back on track and to stop any declining trend in crop conditions - Weekend

rainfall in Europe was favorably mixed to support some winter crop harvest progress while some rain fell for summer crops - Net

drying occurred from central France to Poland and in the Mediterranean region - Very

warm to hot temperatures occurred in the Mediterranean region during the weekend with the Balkan Countries in need of significant rain soon after recent dry and warm to hot conditions - Europe

needs rain in southeastern parts of the continent soon to prevent moisture and heat stress from adversely impacting unirrigated summer crops from Italy to western Romania, Bulgaria and parts of Hungary. Eastern Ukraine also needs some rain

- CIS

weather during the weekend was driest in Ukraine and southwestern Russia and from Russia’s Southern Region through Kazakhstan where rainfall was light and sporadic

- Soil

conditions were already dry biased in these areas prior to the weekend and a better distribution of rain is needed to reduce moisture stress that might threaten some of the summer crops in these areas. Winter wheat is already maturing and beginning to be harvested

and the drier bias is good for those purposes, but summer coarse grain and oilseed crops in Ukraine and neighboring areas of Russia need more moisture to protect production potentials. Winter wheat yields are suspected of being good. Spring cereal and sunseed

production may be down because of dryness in parts of Kazakhstan and a few neighboring areas of Russia - CIS

weather over the coming ten days will provide net drying conditions in portions of Russia’s Southern Region and Volga River Basin into the southern Ural Mountains Region and northwestern Kazakhstan

- Rain

will fall in Ukraine, Belarus, the Baltic States, far western Russia and in most of the eastern Russia New Lands - The

moisture will be good for late season crops, but dryness in summer corn, sorghum and sunseed areas from southern Russia into Kazakhstan is a concern and greater rainfall needed, but not much more than sporadic showers will occur for at least ten days - Brazil

coffee areas were still a little frosty in southern Sul de Minas Saturday morning with low temperatures of zero to +5 Celsius

- Frost

damage that occurred Saturday morning was suspected of being minimal compared to the damaging freezes and frost of July 20 and July 30. - Most

Brazil grain, citrus and sugarcane areas were also free of damaging cold temperatures during the weekend

- The

impact of cold weather last week in citrus areas was minimal, but it may have been a little greater in sugarcane areas, but not as great as that which occurred July 19-21 - Winter

wheat areas were not harmed by cold weather Saturday morning and Sunday trended warmer - Brazil

crop areas were not bothered by meaningful rain during the weekend and the same is expected over the next ten days - The

nation’s temperatures will be mild to warm with no other threats of frost or freezes - Argentina

weather during the weekend was mild to cool and mostly dry - Additional

frost and freezes occurred keeping winter crops semi-dormant with a low immediate need for rainfall - Soil

conditions are still dry in the west where wheat and barley may not be as well established as they should be, although most of the crop is in better shape than either of the past two years - No

rain is expected this workweek, but some showers will be possible during the weekend and early next week that might prove to be welcome for some of the nation’s winter crops - Several

areas of disturbed tropical weather in the western Pacific Ocean may lead to multiple tropical cyclones this week - One

system may form nearly the southern Ryukyu Islands of Japan while another forms off the Guangdong, China coast and a third will form out over open water well to the east the Philippines and well south of Japan - Each

of these systems are not expected to move over land, but the proximity to southern China and Taiwan may lead to some heavier rainfall in those areas later this week and into the weekend - Southeastern

Canada corn, soybean and wheat production areas continue to experience a favorable mix of weather - Net

drying is expected in this first week of the outlook followed by three waves of rain in the following week - Wheat

areas will benefit most from this week’s drier bias - Australia

weather will be favorably mixed for canola, wheat and barley - Crops

have established well in most of the nation - Queensland

and northern New South Wales need more rain - This

week’s rainfall will be lighter and less frequent than that of last week - Ethiopia

rainfall has been abundant in recent weeks along with that in Kenya, according to the U.S. Climate Prediction Center, but Uganda has been drier than usual - The

next two weeks will be wetter than usual in western Ethiopia and mostly near normal in Kenya and Uganda coffee and cocoa production areas - West-central

Africa rainfall has diminished seasonably for a while - Rainfall

during July was below average in southwestern Nigeria and Cameroon while closer to normal in other coffee, cocoa, sugarcane and coffee areas - Rainfall

was above normal last month in Senegal - Rain

will be needed in Ghana and Ivory Coast soon, but this is the normal dry season and rain will resume in September - South

Africa weather was mostly dry during the weekend and is expected to be dry for a while - Some

periodic showers will occur in the far southwest of the nation – mostly near the coast - Southern

Oscillation Index has reached +14.37 and a gradual decline is expected this week - Mexico

weather has been improving with increased rainfall in the south and west parts of the nation - Drought

conditions are waning and crops are performing better - Dryness

remains in eastern Chihuahua and northeastern parts of the nation - Weather

over the next ten days will offer some relief, but more rain will be needed in the drier areas - Central

America rainfall has been plentiful and will remain that way - Central

America rainfall will be near to above average during the next ten days - New

Zealand rainfall during the coming week will be near normal and temperatures will be seasonable

Source:

World Weather Inc.

Monday,

Aug. 2:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn, cotton, soybeans, wheat, 4pm - U.S.

corn for ethanol, soybean crush, DDGS production, 3pm - Ivory

Coast cocoa arrivals

Tuesday,

Aug. 3:

- EU

weekly grain, oilseed import and export data - Australia

Commodity Index - New

Zealand global dairy trade auction

Wednesday,

Aug. 4:

- EIA

weekly U.S. ethanol inventories, production - New

Zealand Commodity Price - France

agriculture ministry updates 2021 crop estimates

Thursday,

Aug. 5:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China’s

CNGOIC to publish monthly soy and corn reports - FAO

World Food Price Index - Port

of Rouen data on French grain exports - Malaysia

Aug. 1-5 palm oil export data - Risi

pulp conference, Sao Paulo - BayWa

earnings

Friday,

Aug. 6:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Saturday,

Aug. 7

- China’s

first batch of July trade data, incl. soybean, edible oil, rubber and meat imports

Source:

Bloomberg and FI

Brazil

selected commodity exports for July.

Commodity

July 2021 July 2020

CRUDE

OIL (TNS) 4,375,980 7,794,507

IRON

ORE (TNS) 31,730,259 33,981,748

SOYBEANS

(TNS) 8,665,732 9,955,019

CORN

(TNS) 1,983,372 3,979,224

GREEN

COFFEE(TNS) 142,914 167,791

SUGAR

(TNS) 2,468,753 3,290,486

BEEF

(TNS) 166,293 169,274

POULTRY

(TNS) 391,625 337,257

PULP

(TNS) 1,414,066 1,447,285

Source:

Reuters and FI

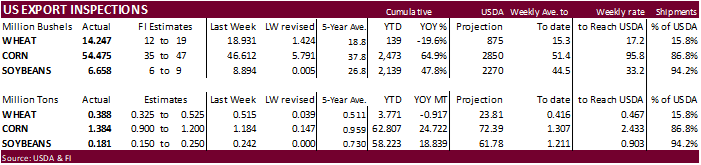

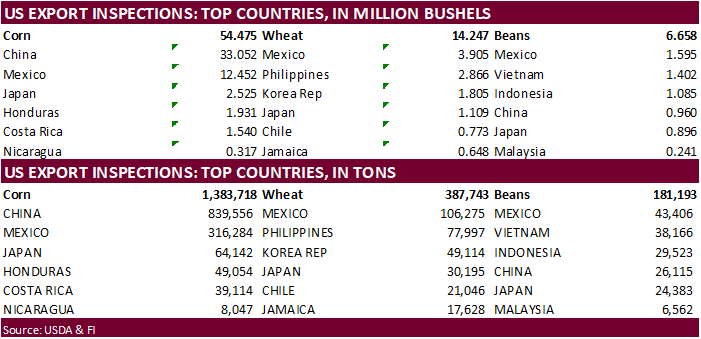

USDA

inspections versus Reuters trade range

Wheat

387,743 versus 325000-515000 range

Corn

1,383,718 versus 900000-1200000 range

Soybeans

181,193 versus 10000-300000 range

China

took 839,556 tons of US corn, up from 489,820 tons last week and 459,695 tons prior week, supportive in our opinion. China also took a small number of soybeans.

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JUL 29, 2021

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 07/29/2021 07/22/2021 07/30/2020 TO DATE TO DATE

BARLEY

599 1,496 49 4,214 465

CORN

1,383,718 1,184,012 726,657 62,807,101 38,085,481

FLAXSEED

0 24 0 24 317

MIXED

0 0 0 48 0

OATS

0 0 200 100 800

RYE

0 0 0 0 0

SORGHUM

54,420 90,792 182,479 6,765,712 4,533,076

SOYBEANS

181,193 242,044 557,607 58,223,052 39,384,348

SUNFLOWER

0 0 0 240 0

WHEAT

387,743 515,214 556,987 3,771,140 4,687,877

Total

2,007,673 2,033,582 2,023,979 131,571,631 86,692,364

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

US

ISM Manufacturing Jul: 59.5 (est 60.9; prev 60.6)

–

Prices Paid: 85.7 (est 88.0; prev 92.1)

–

New Orders: 64.9 (est 64.3; prev 66.0)

–

Employment: 52.9 (est 51.4; prev 49.9)

70

Counterparties Take $921.317 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1.039 Tln, 86 Bidders)

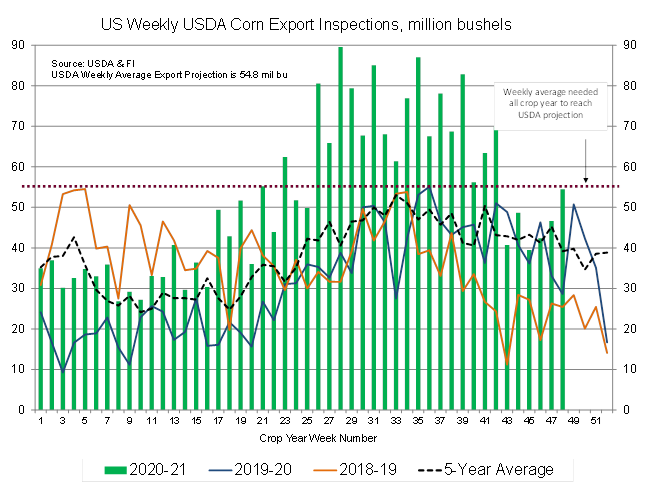

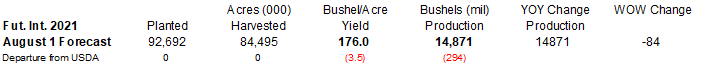

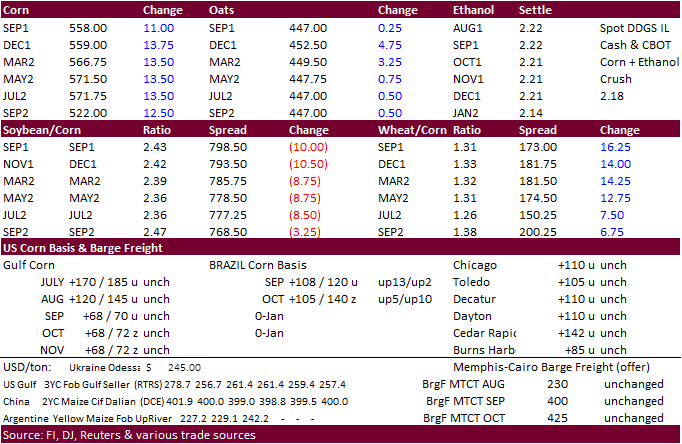

Corn

- Positioning

along with improving US Midwest weather conditions pressured soybeans and corn today.

- Lower

trade in corn futures this morning was erased after wheat surged and US corn inspections came in above a Reuters trade range. Traders also noted shrinking global supplies after AgRural lowered their estimate for Brazil’s second corn crop. Funds bought an

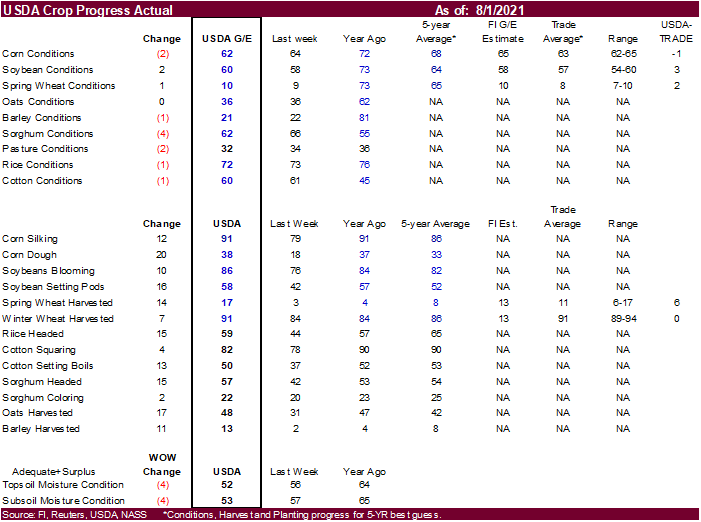

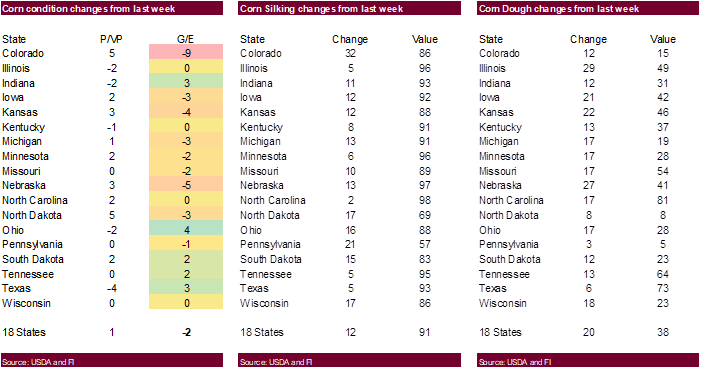

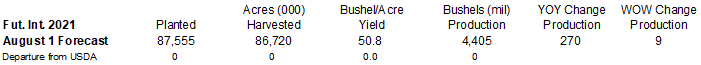

estimated net 13,000 corn contracts. - US

corn conditions declined 2 points to 62 percent for the G/E ratings, one point below expectations. We lowered out yield by a bushel.

- Weekend

rains occurred across many of the dry areas of the US. The US will trend drier this week than that of last week but the improvement in soil moisture for the WCB which should stabilize crop conditions.

- USDA

US corn export inspections as of July 29, 2021 were 1,383,718 tons, above a range of trade expectations, above 1,184,012 tons previous week and compares to 726,657 tons year ago. Major countries included China for 839,556 tons, Mexico for 316,284 tons, and

Japan for 64,142 tons. - Brazil

corn exports for July were a low 1.983 million tons from about 4 million tons year ago. This slow start to the export season for second crop corn is bullish US corn exports, in our opinion. At this time, we are unsure if USDA will upward adjust their US

corn export forecast for 2021-22, already largely dependent on what they report for US supply.

- AgRural

is bearish Brazil second crop corn yields citing they may fall to a 10-year low from unfavorable weather bias center-south, projecting 66.6 60-kilo bags per hectare. They are at 51.6 million tons for the second corn crop, down from 54.6 million tons previous,

and nearly 19 million tons below 70.5 million last year (AgriCensus and FI). The center south is about 65-70% harvested, or less, according to our estimate. MG is over 80 percent complete for harvesting. A downgrade in Brazil corn production expected by

USDA on August 12 coupled. Lagging year to date (calendar) Argentina grain exports is also supportive for US corn exports. China continues to take large amounts of US corn, as mentioned above (inspections).

- FC

Stone sees the Brazil corn crop at 87.14 million tons versus 87.93MMT previous (59.6 second corn crop for this year).

- Spot

US corn remains at a premium over Argentina, Ukraine and Brazil, but that is not stopping major importers from taking US corn. We look for old crop corn commitments to remain low but new-crop sales to increase in coming weeks. Many think USDA’s 2020-21 US

corn export program will not be reached. We are unsure as the export pace could increase over the next 3-4 weeks.

- (Bearish)

The Dominican Republic plans to cull tens of thousands of pigs after African swine fever swept through 11 of the country’s 32 provinces (35%), an aggressive measure. US producers have been put on high alert as these cases ASF come close to home.

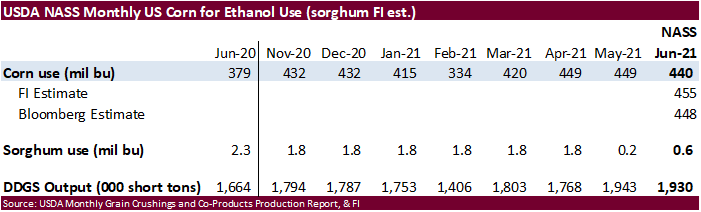

- June

US corn for ethanol use came in slightly below expectations.

Export

developments.

- Jordan

is in for wheat and barley. The wheat import tender for 100,000 tons is on August 4 and 100,000 tons of barley on August 5.

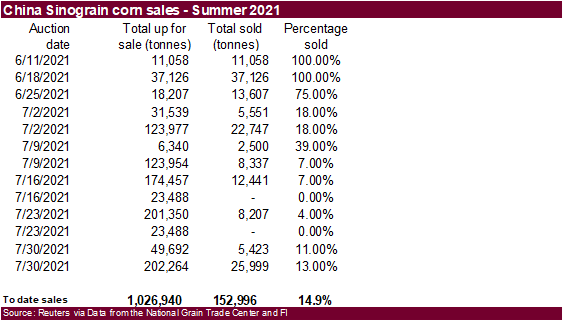

- China’s

Sinograin sold 25,999 tons of imported GMO corn at auction on Friday and 5,423 tons of non-GMO corn.

- Qatar

seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery.

September

corn is seen is a $5.00-$6.25 range

December

corn is seen in a $4.25-$6.00 range.

-

Soybeans

opened lower from weakness in soybean oil and improving US weather but rebounded after soybean oil, exception August, paired some losses, meal rallied $4.50 to $5.70/short ton, and wheat rallied to near a 3-month high. US soybean meal basis across the interior

was mostly flat. KC and Decatur, Indiana was up $2. Funds bought an estimated net 5,000 soybeans, bought 3,000 soybean meal and sold 2,000 soybean oil.

-

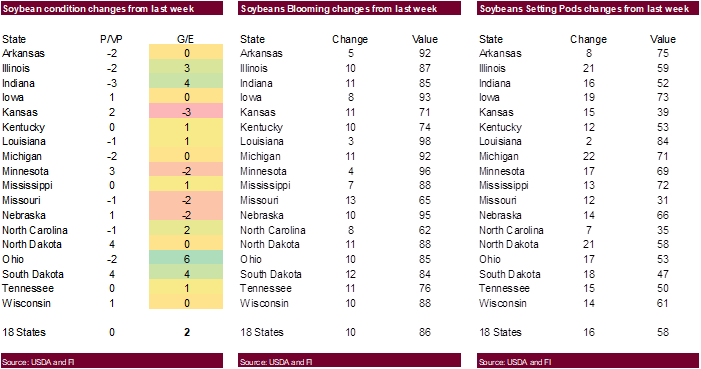

US

soybean crop ratings were up two for the combined good/excellent, 3 points above expectations. Our August yield is up one tenth of a bushel from last week.

-

Lower

than expected Malaysian palm oil export data for the month of July and increasing global Covid-19 cases, caused palm oil futures to roll over on Monday, and that sent August soybean oil down 120 points today. Malaysian pam October futures were down 249 points

and cash off $50.00/ton to $1,030.00/ton. -

The

Southern Peninsula Palm Oil Millers’ Association estimated July production in some parts of Malaysia to have risen 2% from June.

-

ITS

reported Malaysian July palm exports down 5.2% at 1.440 million tons from June. AmSpec is at 1.427MMT, down 7.7%. SGS: July palm exports fell 6.3% to 1.448 MMT from 1.546 during June.

-

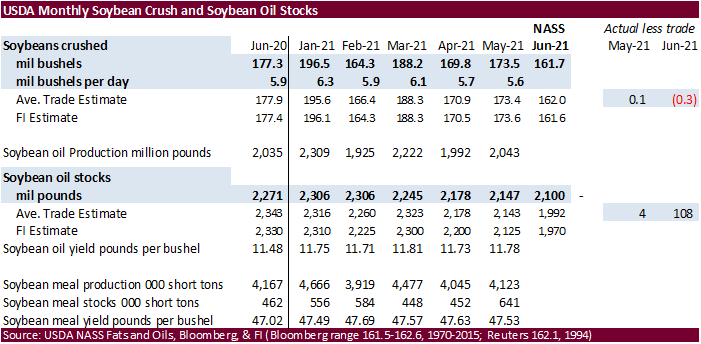

The

US June soybean crush was about as expected but soybean stocks were 108 million pounds below expectations.

-

USDA

US soybean export inspections as of July 29, 2021 were 181,193 tons, within a range of trade expectations, below 242,044 tons previous week and compares to 557,607 tons year ago. Major countries included Mexico for 43,406 tons, Vietnam for 38,166 tons, and

Indonesia for 29,523 tons. -

Brazil

is forecast to see drier weather for at least two weeks, a concern ahead of upcoming soybean planting progress. We are hearing producers may expand the soybean area by 3-5 percent which puts production north of 130 million tons. If persistent dryness occurs

into the fall, we think the soybean crop will still get planted, but it may cut into first crop corn plantings and second crop corn sowings could see a slow start late in the year.

- FC

Stone sees the Brazil 2021-22 (new-crop) soybean crop at 143.3 million tons.

-

Strategie

Grains estimated the EU rapeseed crop at 17.03 MMT, 2.5% above 16.61 MMT last year and near unchanged from previous estimate. USDA is at 17.00 million tons for EU 2021-22 production, up from 16.25 million tons year ago.

Export

Developments

-

The

USDA seeks 2,880 tons of packaged oil for use under the PL480 program on August 3 for Sep 1-30 shipment.

Updated

7/26/21

August

soybeans are seen in a $13.50-$15.00 range; November $11.75-$15.00

August

soybean meal – $330-$400; December $320-$425

August

soybean oil – 64.50-70.00; December 48-67 cent range

- US

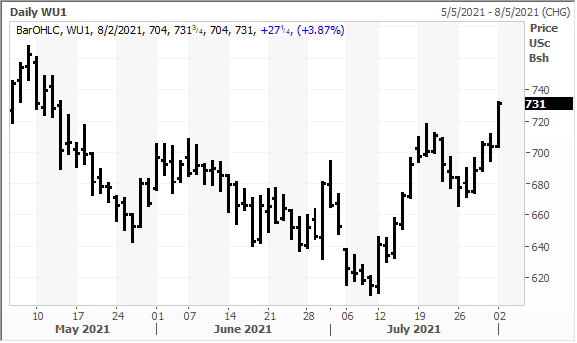

wheat traded near a 3-month high basis Chicago. All three contracts were higher led by KC (technicals look bullish) from strong global high protein import demand (Egypt, Algeria and Jordan) along with a rally in EU wheat futures. September contracts Chicago

was up 25.75 cents, KC up 30.25, and Minneapolis 18.0. Egypt’s GASC bought 60,000 tons of Romanian wheat (less than what we expected). Crop production concerns for Russia continue to linger. US cash wheat market was slow, at least in the morning. Funds

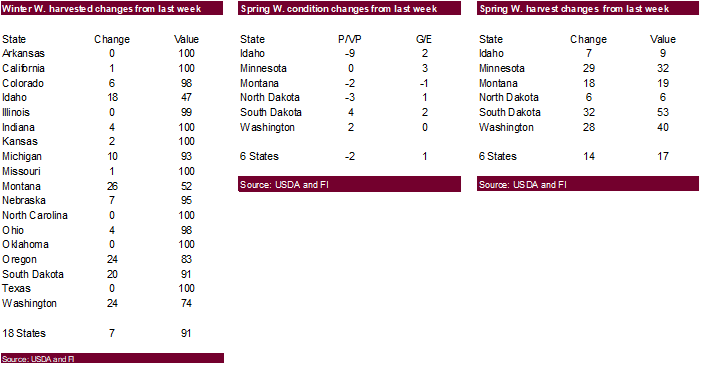

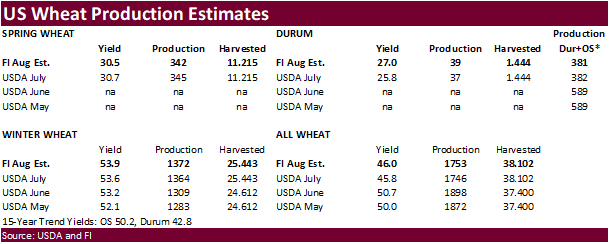

bought an estimated net 14,000 Chicago soft red winter wheat contracts. - US

spring wheat rating increased one point. Trade was looking for a one point decline. We made minor changes to spring and durum production. Spring wheat harvest was 17 percent, 6 points above trade expectations. Winter wheat harvest was 91 percent, as expected.

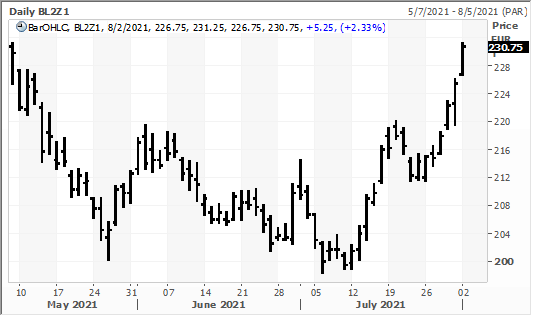

- December

Paris wheat settled 5.25 euros/ton higher or 2.33% at 230.75/ton. Chart below is from Reuters.

- USDA

US all-wheat export inspections as of July 29, 2021 were 387,743 tons, within a range of trade expectations, below 515,214 tons previous week and compares to 556,987 tons year ago. Major countries included Mexico for 106,275 tons, Philippines for 77,997 tons,

and Korea Rep for 49,114 tons. - SovEcon

lowered their Russian wheat production estimate by a large 5.9 million tons to 76.4 million tons. They cut the winter wheat area to 15.6 million hectares from 16.8 million hectares. IKAR is at 78.5 million tons after they recently lowered their estimate

by 3 million tons in large part to low yields in the Central and Volga regions. The private estimates mentioned above are well down from USDA’s 85MMT estimate, and we may see global production cut 4-5 MMT by USDA on Aug 12 from the current 792.4MMT global

estimate . However, world production will remain well above 775.8MMT produced in 2020. What’s changed? We think less available supplies of high protein wheat will be available, which is unfortunately is not broken out by USDA. Russian ruble hit its highest

level in about a month. - We

look for global feed wheat to be upward revised by USDA based on expectations for Brazil’s corn crop to be lowered, reducing exports that in turn reduce global grain feed use. We could be wrong if USDA leaves or downward adjusts China wheat for feed use.

We look for US wheat feed use to eventually be raised by USDA after producers reportedly cut spring wheat for hay.

- USDA

calls for Ukraine wheat production to end up at 30 million tons, up from 25.42 million tons, part of the reason Ukraine grain exports is off to a good start. Note Russian wheat exports are picking up. They climbed 700,000 tons last week to 1.7 million tons

since June 1, but still down 34 percent from last year.

- Russian

wheat export prices: IKAR up $6/ton to $254 & SovEcon up $10/ton to $225/ton.

- India

monsoon rains are projected to be above normal for the months of August and September, according to the state run weather office. Indian farmers have planted summer-sown crops on 84.8 million hectares, down 4.7% year-on-year (Reuters).

- Egypt’s

GASC bought 60,000 tons of Romanian wheat for shipment between Sept. 24 and Oct. 4, at $261.49 a ton FOB plus $32.25 a ton freight (ocean shipping costs), equating to $293.74 a ton c&f, per Reuters. Payment is 180-day letters of credit.

- Algeria

seeks at least 50,000 tons of wheat on Tuesday for Aug/Sep shipment.

- Jordan

is in for wheat and barley. The wheat import tender for 100,000 tons is on August 4 and 100,000 tons of barley on August 5.

- Turkey’s

TMO seeks up to around 900,000 tons of 11.5-12.5% milling wheat (395k) and feed barley (515k) for late September 16-30 shipment. The barley is sought on August 3 and wheat on August 4. Turkey is one of Russia’s best customer.

Rice/Other

- ICE coffee contract volume hit a record in July in large part to Brazil’s cold weather.

- BRAZIL EXPORTS 142,914 T OF GREEN COFFEE IN JULY VS 167,791 T YR AGO – GOVERNMENT – Reuters News.

- South Korea will release 80,000 tons of rice in August to help cool domestic prices.

- South Korea’s Agro-Fisheries & Food Trade Corp. seeks 39,226 tons of rice from the United States for arrival in

South Korea on Jan. 31 and March 31, 2022.

September Chicago wheat

Source: Reuters and FI

Updated 7/29/21

September Chicago wheat is seen in a $6.25‐$7.50 range

September KC wheat is seen in a $5.90‐$7.25

September MN wheat is seen in a $8.50‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.