PDF Attached

Selected

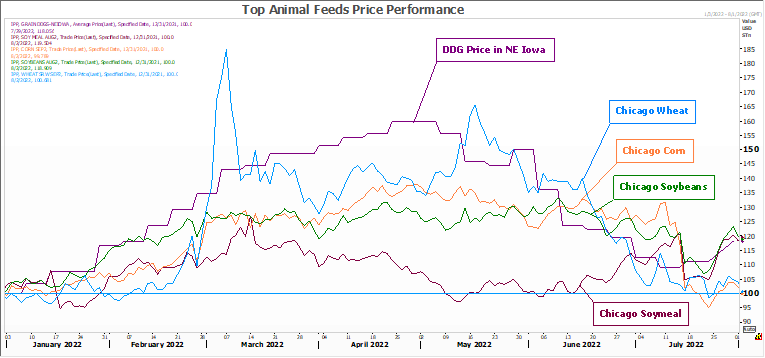

commodity price index from Jan 1

A

Bloomberg poll looks for weekly US ethanol production to be down 1,000 barrels to 1021 thousand (1009-1045 range) from the previous week and stocks down 65,000 barrels to 23.263 million.

World

Weather Inc.

WEATHER

TO WATCH AROUND THE WORLD

- Today’s

weather around the world has not changed greatly from that of Monday and most areas that have been dealing with weather adversity will continue to do so

- No

tropical cyclones or potential for tropical cyclones are present in the Atlantic Ocean Basin; including the Gulf of Mexico or the Caribbean Sea for the next five days - Tropical

Storm Frank and Tropical Depression Georgette remain over open water in the eastern Pacific Ocean posing no threat to land - No

tropical cyclones were present in the western Pacific or Indian Oceans today - Eastern

Ukraine and neighboring areas of Russia will receive rain over the next several days bolstering topsoil moisture for improved summer crop development - Net

drying is expected in Russia’s New Lands where temperatures may also be a little warmer biased, but crop conditions should remain favorably rated

- A

boost in rainfall is still needed in eastern parts of Russia’s Southern Region, western Kazakhstan and the lower Volga River Basin, although the situation is not critical - Europe

weather will continue drier than usual through the next ten days, despite a weak cool front and some showers expected Thursday into Friday from France to Poland - Some

brief showers will also occur in southeastern Europe’s dry region next week, but the precipitation will be light and sporadic - A

general boost in rainfall is needed in both western and southeastern Europe, but the precipitation noted above will fail to bring a serious change to any location and crop moisture stress will continue - Europe

temperatures will be quite warm relative to normal over the coming week in central and southern crop areas with highs in the 90s and a few extremes over 100 Fahrenheit expected

- Temperatures

next week will be warmer than usual in western Europe and in particular from Spain through France to Germany and the U.K. while more seasonably warm to the east - The

bottom line for Europe remains stressful for most unirrigated crops from France and the U.K. into Germany, as well as the Iberian Peninsula and the Balkan Countries. Dryness has been most persistent and threatening to production from Hungary into the lower

Danube River Basin and in parts of France and relief in the next couple of weeks is unlikely to be significant enough to make a difference to production potentials.

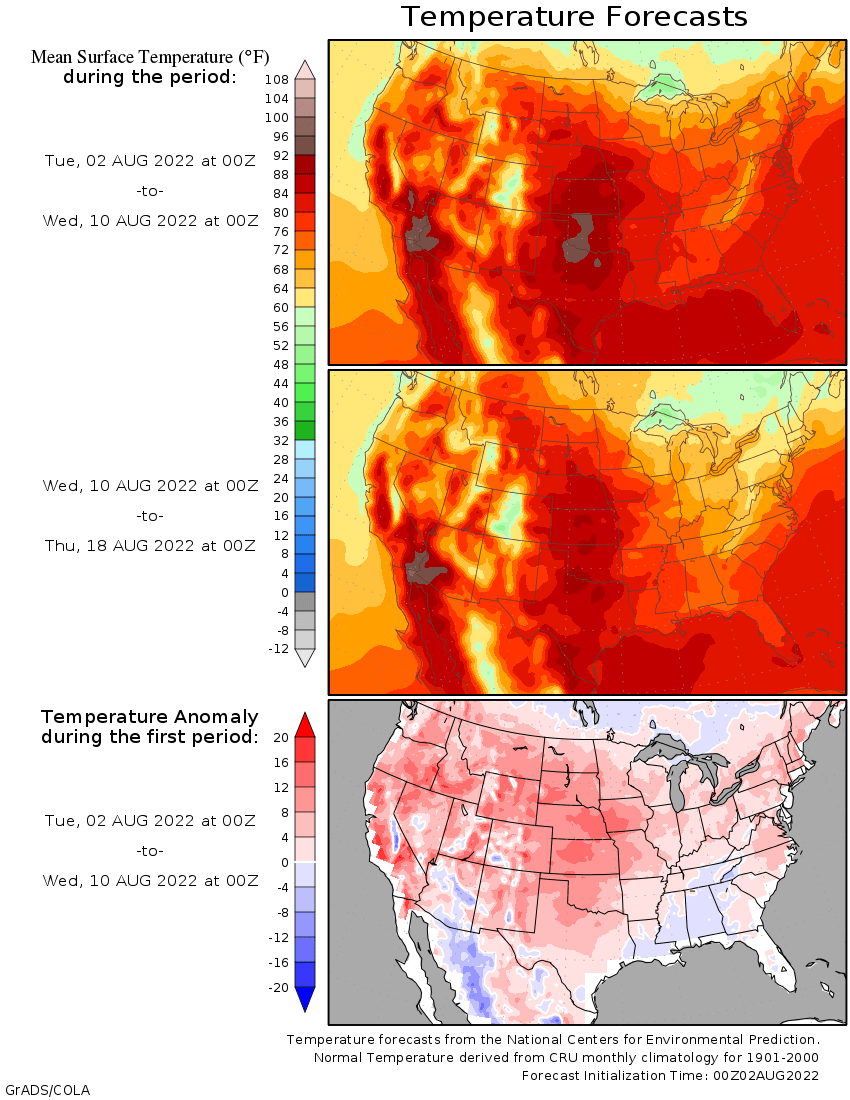

- U.S.

Pacific Northwest cooling is expected over the next few days ending a prolonged period of excessive heat and dryness, but the break will not last long - Warmer

than usual temperatures will be back during the weekend and especially next week with more temperatures in the 90s to over 100 Fahrenheit possible - Some

cooling already occurred Monday with highs in the 90s to near 100 which was down from 100 to 113 during the weekend - U.S.

Plains and western Corn Belt will be hot periodically into the end of this week causing greater crop and livestock stress in areas that have been quite dry recently - Temperatures

in the 90s to 106 degrees Fahrenheit occurred from Montana into South Dakota and western Nebraska Monday - Very

warm to hot weather occurred in the central and southern Plains as well Monday with highs in the 90s to 104 - Extreme

highs today will vary from 96 to 108 from Texas to South Dakota and in the 90s to 102 from southwestern Minnesota to Arkansas.

- Most

of the heat will become confined briefly to the southern Plains and southwestern Corn Belt Wednesday before returning to areas from the Dakotas and eastern Montana to Texas Thursday and Friday

- The

heat will then concentrate on the southern Plains and southwestern Corn Belt this weekend into early next week

- U.S.

eastern Midwest, Delta and southeastern states will experience a more seasonable range of temperatures and experience periodic showers and thunderstorms during the coming week to ten days resulting in a favorable environment for crop development - U.S.

crop moisture stress remains serious in the southern Plains and is worsening in the northwestern Corn and Soybean Belt, the northern Plains and in a few areas of southern Canada’s Prairies - Not

much relief is expected for a while even though some showers and thunderstorms may pop up during the weekend and next week - Favorable

U.S. crop weather continues near and east of the Mississippi River in the Midwest and throughout areas from the lower Delta into the southeastern states - Recent

rain in the northern Delta has brought relief from recent drying - Texas

corn, cotton, sorghum and other crops outside of the Panhandle will remain quite dry through the next ten days to two weeks with temperatures seasonably warm to occasionally hot, but not as hot as earlier this summer - Northeastern

Mexico and Texas drought will not end without the help of a tropical cyclone, and none are anticipated for a while - Northeastern

Mexico has been quite dry this year and will see lower production of many crops - Canada’s

southern Prairies will continue drier than usual along with the northern U.S. Plains through the next ten days to two weeks - Crop

moisture stress is rising and will continue to rise with lower production for late season crops possible without a weather change soon - Southeastern

Canada (Quebec and Ontario) crop conditions are rated favorably with little change likely for a while - Argentina’s

drought stricken western wheat and barley areas will have a new chance for rain late this weekend and into early next week - Early

indications suggest 0.10 to 0.60 inch of moisture will result with locally more, but confidence is low for now - Southern

Brazil weather will continue favorably moist for winter crops - Brazil’s

Safrinha cotton harvest is advancing well due to dry and warm weather - Brazil’s

coffee, citrus and sugarcane areas continue dry, but the harvest season has been good because of limited precipitation - There

is no threat of frost or freezes in the next ten days - Eastern

China’s weather in the next ten days will be drier than usual in the interior southeast and favorably to excessively wet from the Yellow River Basin and North China Plain into northeastern China - Xinjiang,

China will see a good mix of weather over the next two weeks maintaining favorable crop development and normal yield potentials

- India’s

monsoonal rainfall is expected to continue widespread across the nation during the next two weeks with all areas impacted and most getting sufficient rain to bolster soil moisture and/or induce flooding - Some

central areas may become too wet, but the precipitation will occur with sufficient breaks in this coming week to prevent serious flooding from occurring - Worry

over Uttar Pradesh, Bihar and Jharkhand will continue even though timely rain is expected - These

three states and immediate neighboring areas received well below normal precipitation earlier this summer and have moisture deficits still lingering - Greater

rain is needed in these areas but may be slow in coming. - Nationwide

rainfall is still expected to be above normal through mid-August and additional relief should occur to the dry areas of Uttar Pradesh and Bihar, but the amounts will need to be closely monitored. Cotton, groundnut and soybean areas of northwestern India should

experience mostly good weather for crop improvements after flooding rain earlier this month - Sumatra,

Indonesia rainfall continues a little too erratic and greater moisture is still needed in some areas, despite a little rain earlier this week - Greater

rain is expected to slowly evolve over the next two weeks - All

other Southeast Asian nations will experience an abundance of rainfall during the next few weeks resulting in some flooding in the Philippines and the Maritime provinces - Australia

weather in the coming ten days will be favorable for most winter crops - Central

Queensland received rain Wednesday and Thursday favoring a boost in topsoil moisture for a part of winter crop country

- Western

Australia will get most of the significant rain this coming week, but some rain will eventually reach the southeastern parts of the nation in time next week.

- South

Korea rice areas are still dealing with drought, despite some rain that fell recently.

- Some

additional rain is expected over the next couple of weeks - East-central

Africa rainfall is increasing and will be greatest in central and western Ethiopia, but Uganda and Kenya will get some much needed improved rainfall - Tanzania

is normally dry at this time of year, and it should be that way for the next few of weeks - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

greater rain would still be welcome in the drier areas of Ivory Coast and Ghana

- Seasonal

rains are shifting northward leading to some drying in southern areas throughout west-central Africa - Cotton

areas are expecting frequent rainfall in the next couple of weeks - South

Africa’s crop moisture situation is favorable for winter crop establishment, although some additional rain might be welcome - Restricted

rainfall is expected for a while, but the crop is rated better than usual - Central

America rainfall will continue to be abundant to excessive and drying is needed - Mexico

rain will be most abundant in the west and southern parts of the nation - Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely - Today’s

Southern Oscillation Index was +8.36 and it will move erratically higher over the next week - New

Zealand weather is expected to be well mixed over the next two weeks - Temperatures

will be seasonable with a slight cooler bias

Source:

World Weather INC

Bloomberg

Ag Calendar

Tuesday,

Aug. 2:

- New

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data - Australia

commodity index - US

Purdue Agriculture Sentiment, 9:30am - EARNINGS:

FMC, Green Plains, Andersons

Wednesday,

Aug. 3:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Malaysia’s

July 1-20 palm oil export data - New

Zealand Commodity Price

Thursday,

Aug. 4:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - EARNINGS:

Corteva

Friday,

Aug. 5:

- FAO

World Food Price Index - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Malaysia’s

Aug. 1-5 palm oil export data

Several

trade groups are updating US yield estimates.

-STONEX

SAYS ESTIMATES U.S. 2022 CORN PRODUCTION AT 14.417 BILLION BUSHELS, YIELD OF 176.0 BU/ACRE

-STONEX

SAYS ESTIMATES U.S. 2022 SOYBEAN PRODUCTION AT 4.490 BILLION BUSHELS, YIELD OF 51.3 BU/ACRE (Reuters)

Soybean

and Corn Advisory

2022

U.S. Corn Yield Lowered 1.0 bu/ac to 174.0 bu/ac

2022

U.S. Soybean Yield Lowered 0.5 bu/ac to 50.5 bu/ac

Barchart

is at 51.4 & 177.8

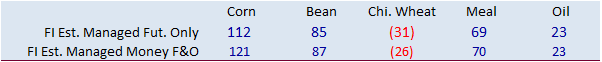

FI

is at 49.9 & 177.6

Macros

105

Counterparties Take $2.156 Tln At Fed Reverse Repo Op (prev $2.162 Tln, 103 Bids)

Canadian

S&P Global Manufacturing PMI Jul: 52.5 (prev 54.6)

Canadian

PMI At 25-Month Low In July

US

Briefing 2/8/22: Pelosi Poised To Visit Taiwan As China Threatens Military Action, Eurozone Yields Fall As Taiwan Jitters Boost Safe-Haven Demand

Oil

Slips As Global Demand Concerns Weigh, OPEC+ Meeting Eyed

US

JOLTs Job Openings Jun: 10.698M (prev R 11.303M)

White

House’s Kirby: US Monitoring Pelosi’s Travel, Taken Measures To Ensure Safety

–

Anticipated Chinese Announcements About Military Drills

–

China Has Positioned Itself To Take Further Steps

–

Expect China To React Beyond Pelosi’s Trip, Including By Scheduling Live Fire Exercises

–

Other Steps By China Could Include Economic Coercion

–

US Will Continue To Operate In Seas And Skies Of Western Pacific