PDF Attached

The

Midwest will see rain across the south and east today, southeast & northwest over the weekend, and north & west central areas early next week. Keep an eye on the ECB as rain over the next several days could stabilize the soybean crop. Northwestern Iowa and

northeastern Nebraska could see up to 1.00 inch by Sunday and

1-2 inches could occur from eastern South Dakota into central and southern Minnesota. But note weather models vary for the rain projected from now through the weekend for the WCB.

Soybeans

and meal rallied by a large amount on talk of China buying US PNW soybeans. Soybean oil finished higher but lost big ground against meal. CBOT grains were higher led by KC wheat despite WTI crude oil making multi month lows. The USD was down 75 points. Traders

are monitoring Ukraine grain shipments.

![]()

World

Weather Inc.

WEATHER

TO WATCH AROUND THE WORLD

- France

to Poland showers today and Friday will offer a short term bout of relief from dryness, but rainfall will be mostly 0.10 to 0.60 inch which will not carry crops very far without follow up rain - Drier

biased conditions will follow for at least a week returning stressful conditions - Southern

areas in Europe will experience some showers and local thunderstorms as well, but most of those are expected during the weekend and next week - All

of the precipitation will be light, but whatever rain falls will be welcome - Dryness

in Europe remains most serious in France, but is also occurring in many other western and southeastern parts of the continent - Temperatures

will be warmer than usual in most of Europe for the next week to ten days - Much

of Russia’s crop region will also be warmer than usual over the next two weeks with temperatures most anomalously warm in this first week of the outlook

- Russia’s

Southern Region is not as wet today as advertised earlier this week and the same is true for some eastern Ukraine locations, but some of these areas have already received some rain - More

moisture is needed especially from eastern parts of Russia’s Southern region northward through a large part of the New Lands, although there is no crisis

- Warm

temperatures and restricted rain will lead to drying and a close watch on future rain distribution may be warranted as the region slowly dries down - India’s

Monsoon Depression expected to come out of the Bay of Bengal this weekend and move across the nation next week still has potential to produce some flooding rain from Odisha and northeastern Andhra Pradesh to Gujarat, southern Rajasthan and especially Maharashtra

and southern Madhya Pradesh - A

little crop and property damage will be possible - India’s

biggest weather need today is for greater rain in Uttar Pradesh, Bihar and Jharkhand where early season rainfall was well below average - Argentina’s

driest wheat areas are advertised to get rain early next week, but the area of significant rain seems to shrink a little as each day passes by - Cordoba,

La Pampa and neighboring areas of Santa Fe and San Luis are included in the rain event, but confidence is not high over its significance because of the daily decreasing trend in its distribution - Brazil

rainfall advertised from western Mato Grosso into Rio Grande do Sul, Santa Catarina, Parana and Sao Paulo for early next week may be a little overdone, but some moisture is expected - Sugarcane

and wheat areas will benefit most from the precipitation - Only

a minimal amount of rain will reach into Sao Paulo and southern Minas Gerais coffee, citrus and sugarcane areas and that which does occur will be light - Cotton

harvesting will be briefly delayed in Mato Grosso because of the rain, but no serious quality change is expected - U.S.

Midwest will get some timely precipitation over the next ten days with nearly all areas getting rain at one time or another; however, the precipitation will be lightest in the west-central and southwestern corn and soybean production areas - Rainfall

will be greatest in the lower eastern Midwest and from South Dakota to Wisconsin, including parts of Iowa - Relief

from dryness in South Dakota, southern Minnesota, and parts of both Iowa and eastern Nebraska is expected, although follow up rain will be needed - U.S.

ridge of high pressure will be weak and far enough removed to the west over the next ten days to support scattered showers and thunderstorms in many Midwestern locations - U.S.

Midwest temperatures are expected to be warm in the far west over the next few days and seasonable elsewhere - Temperatures

will trend warmer in the Great Plains and western most Corn Belt during the Aug. 12-18 period. - U.S.

Carolinas and southeastern Georgia have dried out in the past two weeks and rain is needed - Some

of the needed moisture will occur in the Aug. 12-18 period. - Temperatures

will be seasonable - Northern

and some western Texas cotton, corn and sorghum production areas will get rain during mid-week next week - The

moisture will be welcome, but it will come too late to change production potentials and much more rain will be needed

- Central

U.S. Delta will dry out over the next five days and then get a chance for rain once again - Northern

and southern parts of the Delta should see more timely rainfall in support of crop development - U.S.

Pacific Northwest, the northwestern Plains and central through southwestern Canada’s Prairies will be drying out over the next ten days

- Crop

stress is already evolving again in the southwestern and central parts of the Prairies and late season crops could suffer some yield and quality declines if significant rain does not evolve soon - Northern

parts of Canada’s Prairies received some welcome rain Tuesday soil conditions are rated well from northern and central Alberta to northern Saskatchewan and in many areas across Manitoba.

- Northeastern

Mexico and Texas dryness will not change much until a tropical cyclone comes along which may occur later this summer or early in the autumn - U.S.

Pacific Northwest is seeing less oppressive heat for a while, but rainfall will be minimal - Hotter

conditions may return for a while next week - Ontario

and Quebec crop conditions remain favorably rated with a good mix of weather expected over the next couple of weeks - No

tropical cyclones or potential for tropical cyclones are present in the Atlantic Ocean Basin; including the Gulf of Mexico or the Caribbean Sea for the next five days - A

tropical disturbance is expected to form off the southwest coast of Mexico in the next few days, but it will move away from land - No

other tropical systems are present today in the eastern Pacific Ocean - No

tropical cyclones were present in the western Pacific or Indian Oceans today, although tropical depression 8W that evolved near the coast of China earlier this week moved inland near Hong Kong production some locally heavy rainfall - Eastern

China’s weather in the next ten days will be drier than usual in the interior southeast and favorably to excessively wet from the Yellow River Basin and North China Plain into northeastern China - Xinjiang,

China will see a good mix of weather over the next two weeks maintaining favorable crop development and normal yield potentials

- Sumatra,

Indonesia rainfall continues a little too erratic and greater moisture is still needed in some areas, despite a little rain earlier this week - Greater

rain is expected to slowly evolve over the next two weeks - All

other Southeast Asian nations will experience an abundance of rainfall during the next few weeks resulting in some flooding in the Philippines and the Maritime provinces - Australia

weather in the coming ten days will be favorable for most winter crops - A

good mix of rain and sunshine is expected that will favor well established crops prior to spring growth - South

Korea rice areas are still dealing with drought, despite some rain that fell recently.

- Some

additional rain is expected over the next couple of weeks - East-central

Africa rainfall is increasing and will be greatest in central and western Ethiopia, but Uganda and Kenya will get some much needed improved rainfall - Tanzania

is normally dry at this time of year and it should be that way for the next few of weeks - West-central

Africa rainfall has been and will continue to be sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

greater rain would still be welcome in the drier areas of Ivory Coast and Ghana

- Seasonal

rains have shifted northward leading to some drying in southern areas throughout west-central Africa - Cotton

areas are expecting frequent rainfall in the next couple of weeks - South

Africa’s crop moisture situation is favorable for winter crop establishment, although some additional rain might be welcome - Restricted

rainfall is expected for a while, but the crop is rated better than usual - Central

America rainfall will continue to be abundant to excessive and drying is needed - Mexico

rain will be most abundant in the west and southern parts of the nation - Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely - Today’s

Southern Oscillation Index was +9.13 and it will move higher over the next week - New

Zealand weather is expected to be well mixed over the next two weeks - Temperatures

will be cooler than usual

Source:

World Weather INC

Bloomberg

Ag Calendar

Friday,

Aug. 5:

- FAO

World Food Price Index - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Malaysia’s

Aug. 1-5 palm oil export data

Sunday,

Aug. 7:

- China’s

first batch of July trade data, incl. soybean, edible oil, rubber and meat imports

Monday,

Aug. 8:

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop conditions for wheat, corn, soybeans and cotton; spring wheat harvest, winter wheat progress, 4pm - Vietnam

Customs releases July coffee, rice, rubber export data - HOLIDAY:

Pakistan

Tuesday,

Aug. 9:

- EU

weekly grain, oilseed import and export data - HOLIDAY:

Singapore, India, Bangladesh

Wednesday,

Aug. 10:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Malaysian

Palm Oil Board’s data on stockpiles, production and exports - Malaysia’s

Aug 1-10 palm oil export data - Brazil’s

Unica to release cane crush, sugar production data (tentative)

Thursday,

Aug. 11:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Brazil’s

Conab to publish output and planting data for soybeans and corn - HOLIDAY:

Japan

Friday,

Aug. 12:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - New

Zealand food prices - FranceAgriMer

weekly update on crop conditions - EARNINGS:

Olam, Golden Agri - HOLIDAY:

Thailand

Source:

Bloomberg and FI

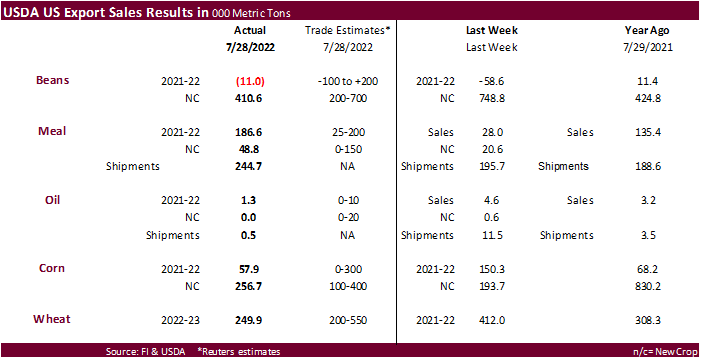

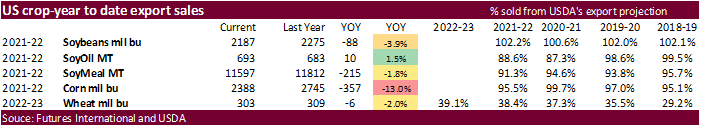

USDA

Export Sales

Export

sales for soybeans on a combined crop year basis were within expectations with 2022-23 net increases including unknown destinations (154,000 MT), China (144,000 MT), Bangladesh (55,000 MT), and Mexico (44,100 MT). Soybean meal sales improved at 186,600 MT

for 2021-20 and included the Philippines (95,800 MT), Colombia (55,800MT), and Honduras (10,400 MT). Soybean oil net sales were only 1,300 MT. Corn export sales for 2021-22 were a low 57,900 tons. New crop corn sales were 256,700 tons and Mexico and unknow

as the largest buyers. Crop-year to date corn sales are lagging 13 percent from the previous year. Sorghum sales were very low. Pork sales were a large 31,000 tons and included 16,800 tons for China. All wheat sales were 249,900 tons, down from 412,000 previous

week. Unknown, Indonesia and Mexico were largest buyers.

US

Initial Jobless Claims Jul 30: 260K (est 260K; prev 256K)

US

Continuing Claims Jul 23: 1416K (est 1383K; prev 1359K)

US

Trade Balance Jun: $-79.6B (est $-80.0B; prev $-85.5B)

US

Crude Oil Exports Reached 3.57 Million Barrels Per Day In June (3.44 Million BPD In May)

Canadian

Trade Balance Jun: C$5.05B (est C$4.90B; prev C$5.32B)

Canadian

Building Permits (M/M) Jun: -1.5% (est -2.0%; prev 2.3%)

101

Counterparties Take $2.192 Tln At Fed Reverse Repo Op (prev $2.182 Tln, 105 Bids)