PDF Attached

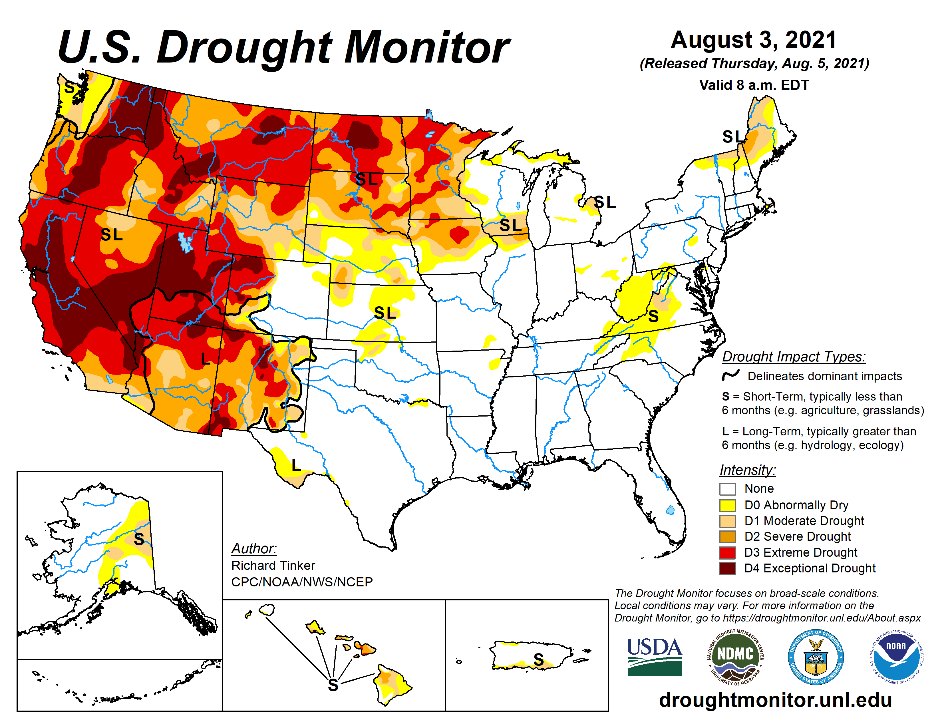

Grains and oilseed firmed on demand and drought worries, but gains were limited on forecasted rains for the Corn Belt and heightened concerns on “ demand destruction” from the increased cases from the Delta variant of COVID-19.

WASHINGTON, Aug 5, 2021- Private exporters reported to the U.S. Department of Agriculture export sales of 300,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

WORLD WEATHER INC.

MOST IMPORTANT WEATHER OF THE DAY

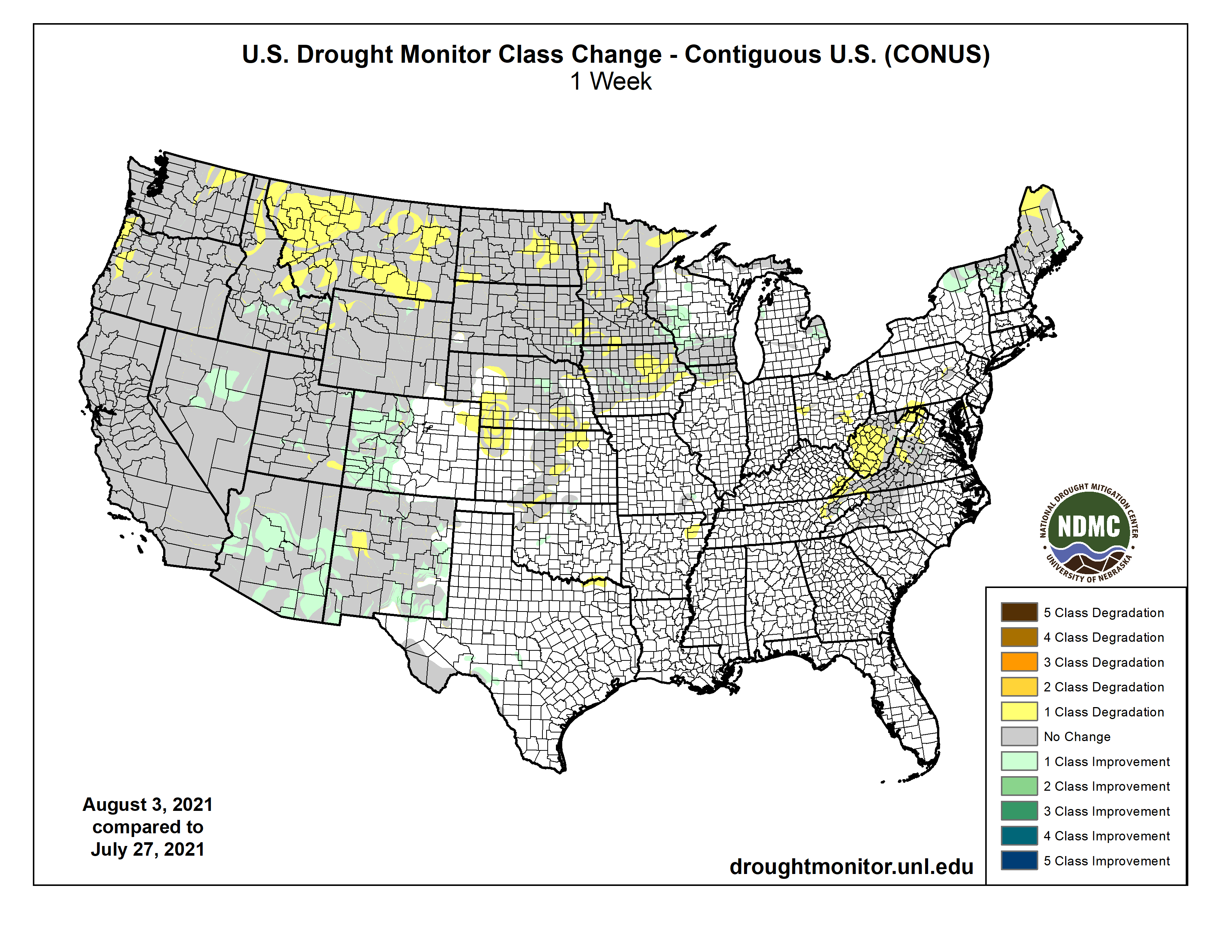

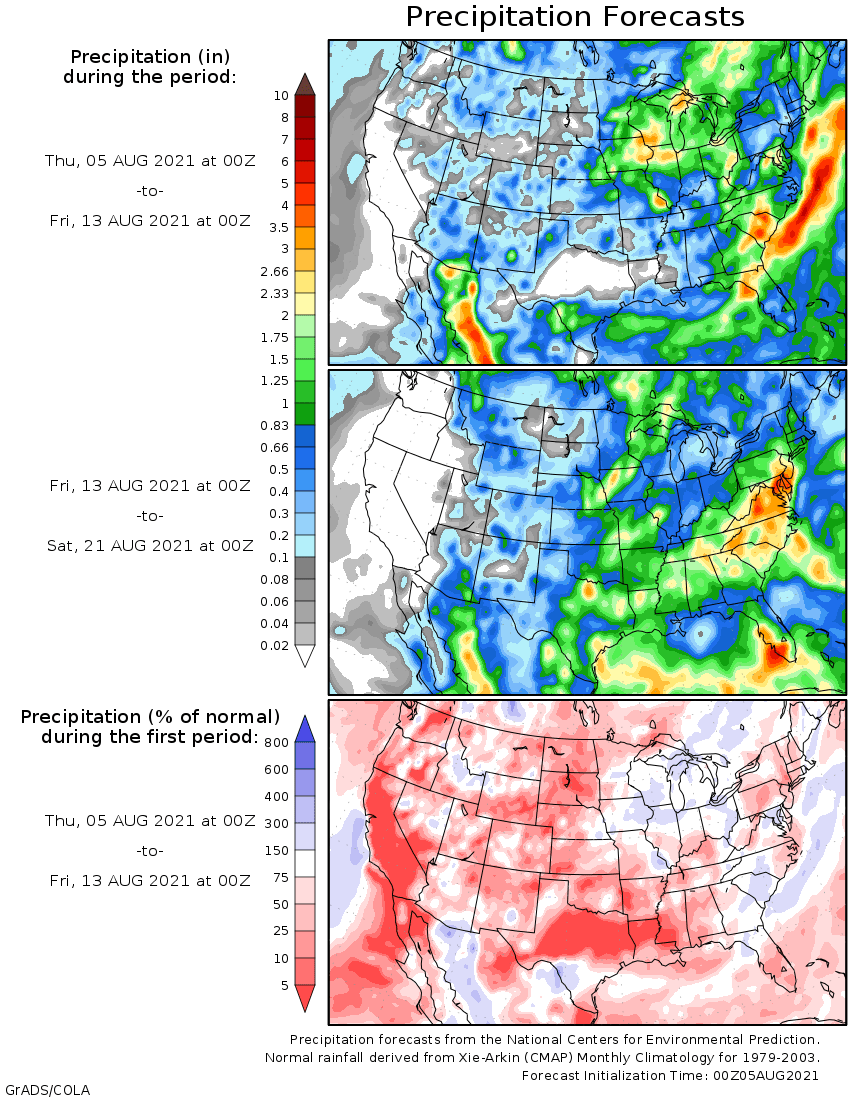

- Important rain events are advertised in the upper Midwest for this weekend and possibly again during mid-week next week

o Confidence is high for the weekend rain event in Iowa, eastern Minnesota, Wisconsin and northern Illinois

- Sufficient rainfall will occur to lift topsoil moisture so that crop moisture stress is unlikely to worsen for a while

o Follow up rainfall during mid-week next week would be ideal if it were to verify, but there is some doubt that the event will be as great as advertised by some of the models today

- Any follow up moisture that occurs, though, will further help stave off a more stressful environment for crops a little longer

- Net drying and crop moisture stress will continue in the Dakotas while expanding southward through Nebraska into Kansas

o Timely rainfall is expected in the remainder of the Midwest Corn and Soybean Belt

- U.S. Midwest temperatures will be mild over the next few days reducing evaporation rates with daily highs in the 70s and 80s Fahrenheit and lows in the 50s and 60s

o Some warming will occur again this weekend into next week

o The warmest weather will be in the Plains this weekend and will shift into the western Corn Belt for a while next week

- Late next week and into the following weekend should be warmest

- Cooling will occur after that

- Texas rainfall will be restricted in both West Texas and the Blacklands for a while, but after weekend rain fell in these areas the change will be good for crops

o Some warming is needed in West Texas and that should evolve for a little while with late week and weekend temperatures rising to the 90s and close to 100 degrees eventually

o Showers will be possible in parts of West Texas late in the coming weekend and early next week

- South Texas harvest weather will be mostly good, but some showers are expected today and into Friday that will disrupt some of the field progress

- A good mix of rain and sunshine is expected in the U.S. southeastern states

- Rainfall in the U.S. Delta is expected to become lighter and more sporadic for a while

o The environment will be good for corn harvesting and for more aggressive crop development in rice, cotton and soybean areas

- Far western U.S. will continue dry for much of the coming ten days and temperatures will be warm biased

- Canada’s Prairies weather will be unsettled into Tuesday of next week resulting in opportunities for periodic showers and thunderstorms

o Resulting rainfall is not expected to be widespread and heavy, but many areas will experience scattered showers and thunderstorms and a few areas locally moderate rain is possible

o Today’s computer forecast models are wetter from north-central Montana to east-central and northeastern Saskatchewan for late this weekend and early next week

- Rainfall of 0.20 to 0.80 inch is possible, although confidence is still low

o The moisture in Saskatchewan and southern Alberta will be falling too late for early season crops like peas, lentils, wheat, barley, oats and early canola most of which have been seriously drought stressed and early harvesting is already under way

- The moisture will be good for late season canola, corn, soybeans and flax, although the majority of the late season coarse grain and oilseed crops are in areas that will not get much of the advertised rain

o Temperatures will be warmer than usual over the next two weeks, but a short term bout of cooling is expected next week that will bring temperatures down to near and slightly below average levels

- GFS model has too much ridge building in the Midwest late next week and into the following weekend

o Future model runs are likely to reduce the significance of the ridge, but a short term bout of warming is predicted, but temperatures are much too hot

o Both the European and GFS Ensemble are sending the ridge back to the west which makes the most sense

- Additional rain fell in India’s flood ravaged area of southeastern Rajasthan and northern Madhya Pradesh, although additional amounts were less than 3.00 inches

o More rain will fall in this same region through the weekend perpetuating the flood situation

o Some crop and property damage has resulted from this week’s flooding, but most of the damage has been in southeastern Rajasthan and northern Madhya Pradesh

- India’s weather will continue wet in central and eastern parts of the nation for the next week to ten days while southern and far northwestern areas as well as Pakistan experience net drying conditions

o Some crop stress is expected in western Gujarat, western Rajasthan and southern and central Pakistan because of predicted dryness

o Interior southern India will be drying down, but crops will manage relatively well with lingering subsoil moisture – at least for a while

- Greater rain will be needed soon

- Grain quality concerns remain from France to Belarus where small grain and a few winter rapeseed crops have been negatively impacted by frequent rainfall this season

o Rain will continue frequently in these areas through the weekend

o Net drying is expected in many of these wetter areas next week

- Southeastern Europe’s dry and warm bias will continue over the next ten days

o The impact will be mostly on the Balkan countries where the ground is already dry and recent temperatures have been hot

o Unirrigated summer crops are stressed and need significant rain soon to protect production potentials

- China continues to recover from serious flooding, but another week may be needed for some of the flood water to recede from crop areas in east-central China

- China weather over the next ten days will be erratic with alternating periods of rain and sunshine in key grain, oilseed, rice and cotton areas

o Flooding rain is expected in eastern Guangdong, Fujian and some immediate neighboring areas due to Tropical Storm Lupit as it meanders through southeastern China

- 10.00 to 20.00 inches of rain will fall near the coast with 6.00 to 12.00 inches likely in many immediate neighboring areas a little farther inland

- Some crop damage to rice and some sugarcane will be possible

- Frequent rain will fall near and south of the Yangtze River during the next ten days resulting in some rising potential for localized flooding

- Thailand rainfall is expected to continue lighter than usual in many areas during the next ten days

o Totally dry weather is not likely, but a part of the interior east and interior south will fail to receive more than 1.50 inches which is well below that of most years

o Vietnam rainfall is also expected to be lighter than usual while Laos and eastern Cambodia are plenty moist along with Myanmar

- Indonesia and Malaysia weather is expected to trend wetter and that will prove to be quite favorable after recent weeks of lighter than usual rain

o The weekend and next week will be wettest with some heavy rain possible in western Sumatra and moderate amounts in Malaysia

- Philippines rainfall increased greatly last week across western Luzon where flooding was widespread and threatening to rice and a few other crops

o Less rain fell in the region Tuesday and Wednesday

- Some damage to rice and other crops has occurred

o Lighter rainfall will continue for a few days, but a boost in precipitation may occur again this weekend into next week restoring some of the flood conditions near the west coast of Luzon

o Soil conditions in Philippines are now driest in western Mindanao and in some of the southern Visayan Islands

- CIS weather over the coming ten days will provide net drying conditions in from eastern Ukraine through portions of Russia’s Southern Region and Volga River Basin into the southern Ural Mountains Region and northwestern Kazakhstan

o Rain will fall in western and central Ukraine, Belarus, the Baltic States, far western Russia and in most of the eastern Russia New Lands

- The moisture will be good for late season crops, but dryness in summer corn, sorghum and sunseed areas from southern Russia into Kazakhstan is a concern and greater rainfall needed, but not much more than sporadic showers will occur for at least ten days

- Brazil coffee areas are beginning to warm up after last week’s frost and freezes

o A lack of rain and warmer temperatures will likely stress crops while trying to recover from the freeze which should lead to some additional concern over 2022 production

- Most Brazil grain, citrus and sugarcane areas were also free of damaging cold Tuesday through this morning

o The impact of cold weather last week in citrus areas was minimal, but it may have been a little greater in sugarcane areas, but not as great as that which occurred July 19-21

o Winter wheat production may have been negatively impacted by the freezes of July 19-21 and July 29-30.

- Brazil rainfall will be limited to coastal areas during the coming week

o The nation’s temperatures will be mild to warm in the east with no other threats of frost or freezes

o Warm temperatures are expected to evolve in the west and north

o Some rain will evolve in the far south during mid-week next week

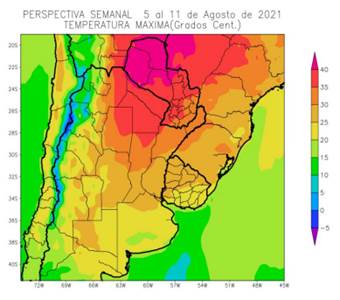

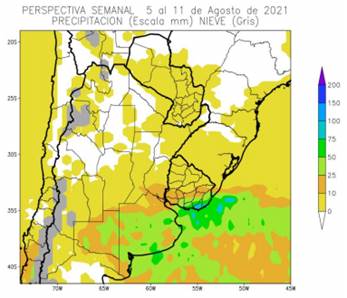

- Argentina weather will be dry biased until the weekend when rain is expected in the interior south and east

o Soil conditions are still dry in the west where wheat and barley may not be as well established as they should be, although most of the crop is in better shape than either of the past two years

- Tropical Storm Lupit will move into southern China over the next few days producing heavy rain and flooding in Guangdong and some immediate neighboring areas

- Tropical Storm Mirinae will influence Japan’s main Islands this weekend

o The storm will produce heavy rain and flooding in southeastern Honshu and it will need to be closely monitored for some impact on rice and citrus

- Southeastern Canada corn, soybean and wheat production areas continue to experience a favorable mix of weather

o Net drying is expected today and Friday followed by three waves of rain this weekend into next week

o Wheat harvest delays and grain quality concerns may evolve because of the rain, but the moisture will be great for corn and soybeans

- Australia weather will be favorably mixed for canola, wheat and barley

o Crops have established well in most of the nation

o Queensland and northern New South Wales need more rain

o This week’s rainfall will be lighter and less frequent than that of last week

- Ethiopia rainfall has been abundant in recent weeks along with that in Kenya, according to the U.S. Climate Prediction Center, but Uganda has been drier than usual

o The next two weeks will be wetter than usual in western and central Ethiopia and near to above normal in Kenya and Uganda coffee and cocoa production areas

- West-central Africa rainfall has diminished seasonably for a while

o Rainfall during July was below average in southwestern Nigeria and Cameroon while closer to normal in other coffee, cocoa, sugarcane and coffee areas

o Rainfall was above normal last month in Senegal

o Rain will be needed in Ghana and Ivory Coast soon, but this is the normal dry season and rain will resume in September

- South Africa weather was mostly dry Wednesday

o Some periodic showers will occur in the far southwest of the nation – mostly near the coast during the coming week while other areas will be dry

- Southern Oscillation Index has reached +12.99 and it will continue to decline over the next several days

- Mexico weather has been improving with increased rainfall in the south and west parts of the nation

o Drought conditions are waning and crops are performing better

o Dryness remains in eastern Chihuahua and northeastern parts of the nation

o Weather over the next ten days will offer some relief, but more rain will be needed in the drier areas

- Central America rainfall has been plentiful and will remain that way

o Central America rainfall will be near to above average during the next ten days

- New Zealand rainfall during the coming week will be near normal except in the western part of South Island where rainfall will be greater than usual

o Temperatures will be seasonable

Source: World Weather Inc.

Friday, Aug. 6:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

Saturday, Aug. 7

- China’s first batch of July trade data, incl. soybean, edible oil, rubber and meat imports

Source: Bloomberg and FI

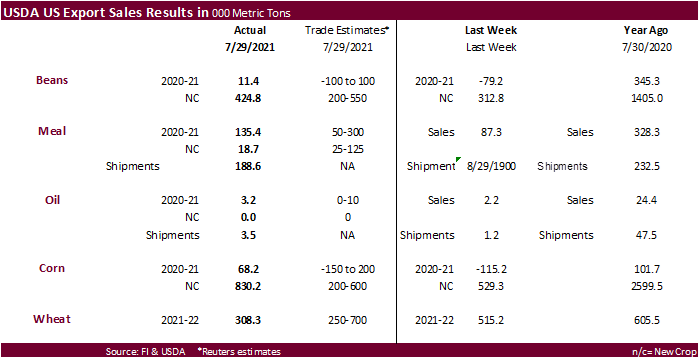

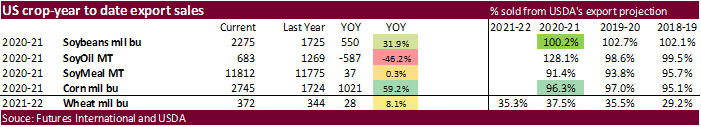

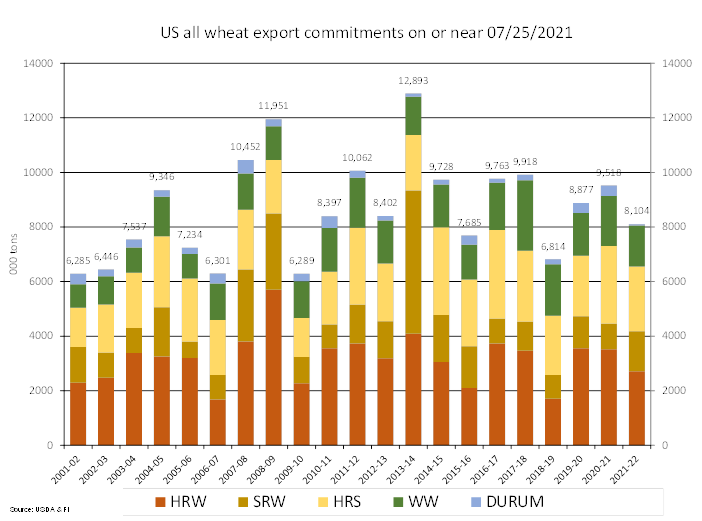

USDA weekly Export Sales

USDA export sales for new-crop corn and soybeans increased from the previous week with Mexico stepping up new-crop corn commitments and China with new-crop soybean commitments. New-crop corn of 830,200 tons included Mexico (238,800MT), Japan (210,700 MT), unknown destinations (101,700 MT), Colombia (96,300MT), and Nicaragua (82,500 MT). New-crop soybeans of 424,800 tons included unknown destinations(142,000 MT), China (129,000 MT), Egypt 65,000 MT), Mexico (43,700 MT), and Japan (20,000 MT). Old crop corn and soybean sales were minimal. Meal export sales were ok at 135,400 tons and shipments were good at 188,600 tons. Soybean oil sales and shipments were poor. All-wheat sales slowed to 306,300 tons and could be perceived as disappointing.

US Initial Jobless Claims Jul 31: 385K (est 383K; prevR 399K; prev 400K)

US Continuing Jobless Claims Jul 24: 2930K (est 3255K; prevR 3296K; prev 3269K)

US Trade Balance (USD) Jun: -75.7B (est -74.2B; prevR -71.0B; prev -71.2B)

Canadian International Merchandise Trade Jun: 3.23B (est -0.60B; prevR -1.58B; prev -1.39B)

- US corn futures rose today on improving corn export demand. The December corn contract has held above the 100-day MA @ 542.25 for two weeks so look for continued support there.

- The morning weather forecast still calls for rain to fall across IA for week one and week two.

- Positioning may have already started ahead of next week’s USDA report which will include initial USDA surveys of US soybean and corn production.

- Census reported US corn exports during June at 6.4 million tons (250 mil bu), up from 5.1 million a year earlier. There was talk this morning China has stepped up on US corn interest. We think that is true in terms of shipments. US corn inspections were big when reported on Monday with China taking 900,000 tons out of 1.4 million shipped during the week ending July 29. That was a large figure for China when comparing to latest Census export data for the month of June. US exported 2.75 million tons in June to China (642,000 ton weekly average), 43% of the 6.4 million tons total exports.

- China-US container shipping costs reached a new high of more than $20,000 per 40-foot container.

- Brazil’s consultancy Agroconsult lowered its second corn crop estimate by 4.4 million tons to 60.9 million tons due to frost damage in Parana and MGDS. This is much lower than last year’s 76.7 million tons and this year’s initial estimate of 83.9 million tons.

- Argentina’s BA Exchange reported that the corn harvest is 89.2% complete and left production unchanged at 48 million tons.

Export developments.

- China plans to auction off 219,218 tons of US imported corn on August 6, and 49,760 tons of Ukraine imported corn.

- Qatar seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery.

September corn is seen is a $5.25-$6.00 range. (down 25 cents for both ends)

December corn is seen in a $4.25-$6.00 range.

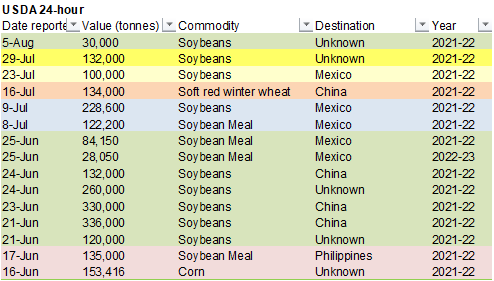

- US soybean futures turned higher after the day session open after USDA announced a snap export tender. USDA announced 300,000 tons of soybeans were sold under the 24-hour reporting system for 2021-22 delivery. Earlier there were rumors China was in for US soybeans off the PNW yesterday and two cargoes may have traded.

- Delta COVID-19 variant spreading across selected countries that is prompting lockdowns, such as parts of China, are creating concerns over food demand, although we have not seen a material disruption in global trade flows.

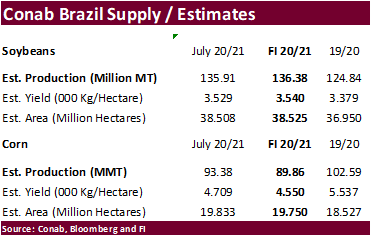

- There was talk Brazilian producers have been holding back on selling soybeans due to market volatility and declining domestic soybean prices. January through July Brazil soybean exports are down 3% to 66 million tons from a year ago. We look for Conab in their monthly production update to slightly lift 2021 Brazil soybean production to 136.4 million tons from 135.9 million. New crop supplies should be ample. We think 2021-22 Brazil soybean plantings could increase 4 percent from 2020 seedings. Meanwhile, Brazil’s Anec estimated 2021-22 soybean production at 144 MMT, with exports at 94.3 MMT (up from 85.5 MMT this season). Most of the trade looks for new-crop Brazil production to exceed 140 million tons.

- Census reported June US soybean exports at 925,000 tons (34 mil bu), well down from 1.8 million tons during June 2020, a 48 percent decrease. Census reported soybean meal shipments at 917,000 short tons for the month of June, down from 1.050 million short tons during May and 1.094 million during June 2020. Soybean oil shipments during June were 92 million pounds, up from 71 million during May and down from 168 million during June 2021.

- Argentina’s Bahia port strike is now impacting fertilizes. We are hearing grains have started to flow again and negotiations started. Truckers on strike since Friday in Argentina’s port of Bahia Blanca has slowed down arrivals of grains and soybeans. Demand at this southern location has been key this season as low water levels have forced ships to reduce drafts, then stop to get topped off Bahia Blanca before sailing onward.

- China futures were mixed again for the complex, with soybeans up 34 yuan or 0.6%, meal down 0.3%, and both SBO & palm up 2.0%.

- China cash crush margins were last positive 88 cents on our analysis (90 previous) versus 50 cents late last week and 129 cents around a year ago.

Export Developments

- USDA reported under the 24-hour reporting system 300,000 tons of soybeans were sold to unknown destinations for 2021-22 delivery.

Updated 8/3/21

September soybeans are seen in a $12.50-$14.50 range; November $11.75-$15.00

September soybean meal – $335-$370; December $320-$425

September soybean oil – 57.50-69.00; December 48-67 cent range

- SRW and HRW wheat fell today on lackluster export sales and virus worries. Spring wheat saw a small gain due to unfavorable North American, EU, and Russian weather.

- The US weather forecast for the Great Plains is unchanged. The morning forecast did increase rain for parts of the Canadian Prairie’s.

- Census reported June US wheat exports at 2 million tons (74 mil bu), below 2.3 million shipped year earlier.

- The world FOA price index for July fell for the second consecutive month to 123.0 from 124.6 in June, but it’s still up 31% from July 2020.

- December Paris wheat finished up 0.25 at 228.00 euros per ton.

- Iraqi grain board said the local wheat harvest dropped on low rainfall and reported that farmers sold 3.3 million tons to the government compared to 5 million tons last year.

- Argentina’s BA Exchange left the wheat planting unchanged at 6.5 million hectares from last week and the crop is 99.7% planted.

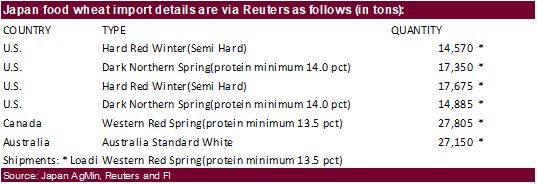

- Japan bought 92,285 tons of food wheat out of 119,435 tons sought. They passed on Australian wheat. Original tender announcement below.

- Pakistan seeks 400,000 tons of wheat for Sep and Oct shipment.

- South Korea seeks 135,100 tons of (50,000) Australian, (35,100) Canadian and (50,000) US wheat on Friday for October shipment.

- Tunisia seeks 100,000 tons of wheat and 100,000 tons of barley on Friday for late Aug through third week of September shipment.

- Jordan passed on 120,000 tons of barley.

- Jordan is back in for 120,000 tons of wheat on August 11.

- Japan (SBS) seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on August 18 for loading by November 30. Algeria seeks at least 50,000 tons of wheat for Aug/Sep shipment.

- Bangladesh seeks 50,000 tons of wheat on August 18.

- The Taiwan Flour Millers’ Association seeks 48,000 tons of grade 1 northern spring, hard red winter and white milling wheat to be sourced from the United States, on Aug. 6 for shipment from the U.S. Pacific Northwest coast between Sept. 24 and Oct. 8.

- Pakistan seeks 400,000 tons of wheat on August 23.

Rice/Other

- South Korea’s Agro-Fisheries & Food Trade Corp. seeks 39,226 tons of rice from the United States for arrival in South Korea on Jan. 31 and March 31, 2022.

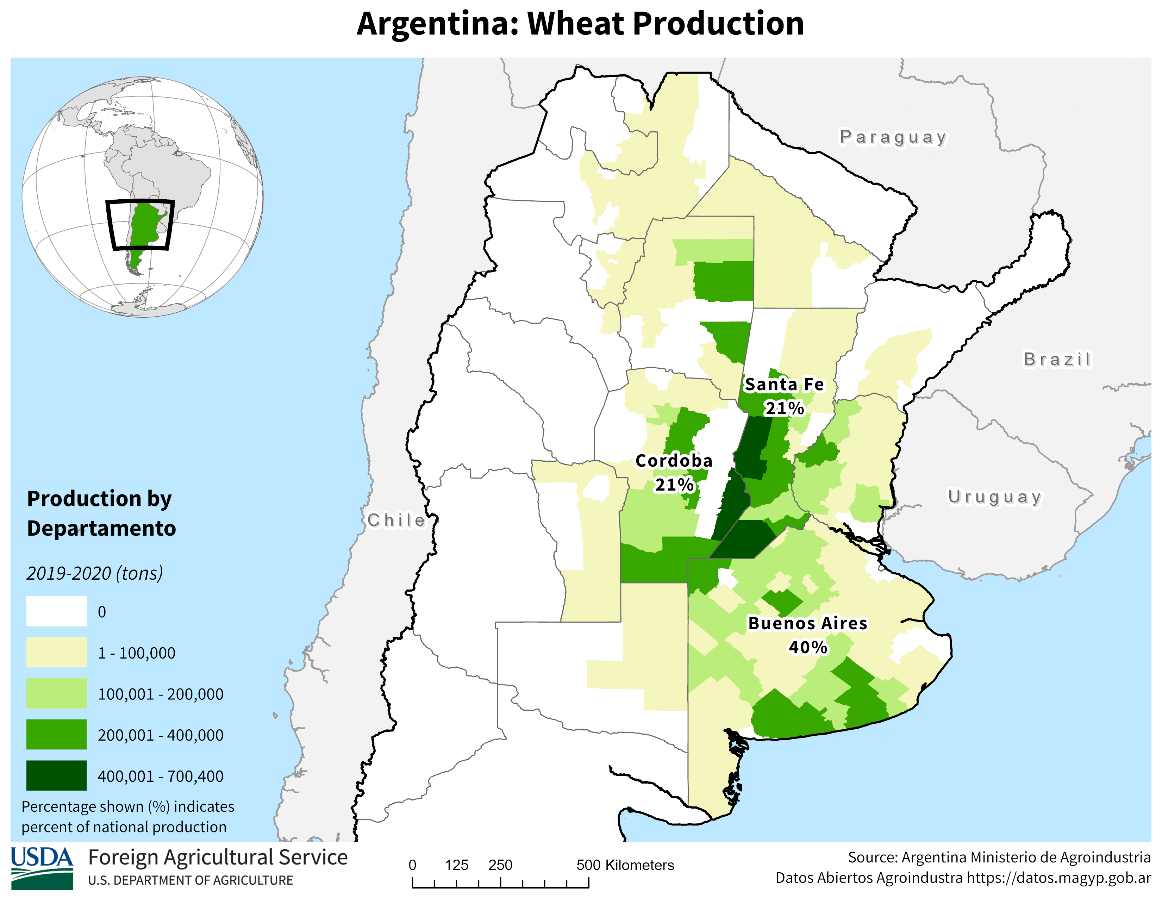

Argentina is expected to be hot (northern half) and dry through Aug 11. This should be monitored for the Cordoba and Santa Fe wheat production areas. Plantings recently ended.

Updated 7/29/21

September Chicago wheat is seen in a $6.25‐$7.50 range

September KC wheat is seen in a $5.90‐$7.25

September MN wheat is seen in a $8.50‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.