PDF Attached

Corn

3-5 higher

Soybeans

3-5 higher

Soybean

meal $0.50 to 1.00 higher

Soybean

oil 15-30 higher

Chicago

wheat 4-6 higher

KC

wheat 4-8 higher

MN

wheat 5-10 higher

US

weather improves this week. Midday weather models appeared to be a little cooler for the central US for the 11-15 period, but warmer for the upper Great Plains and southern Canada for the 1-5 day.

Rains over the weekend were about as expected for the northwestern Corn Belt and eastern Midwest. Southern IA, much of IL and Mansouri was mostly dry. Temperatures will be cooler this week for the Midwest and parts of the Great Plains.

Rains favor the north central and southwest areas today, southeast Tuesday through Wednesday, and northwest areas Friday.

Grains

and the soybean complex ended mixed. The US Senate bill supported soybean oil. Meal and soybeans were lower after trading two-sided. Chicago wheat was higher on fund buying while higher protein wheat fell. Corn was lower on improving US weather.

Private

exporters reported the following sales activity:

-132,000

metric tons of soybeans for delivery to China during the 2022/2023 marketing year

-105,000

metric tons of corn for delivery to Italy during the 2022/2023 marketing year

-120,000

metric tons of corn for delivery to unknown destinations during the 2022/2023 marketing year

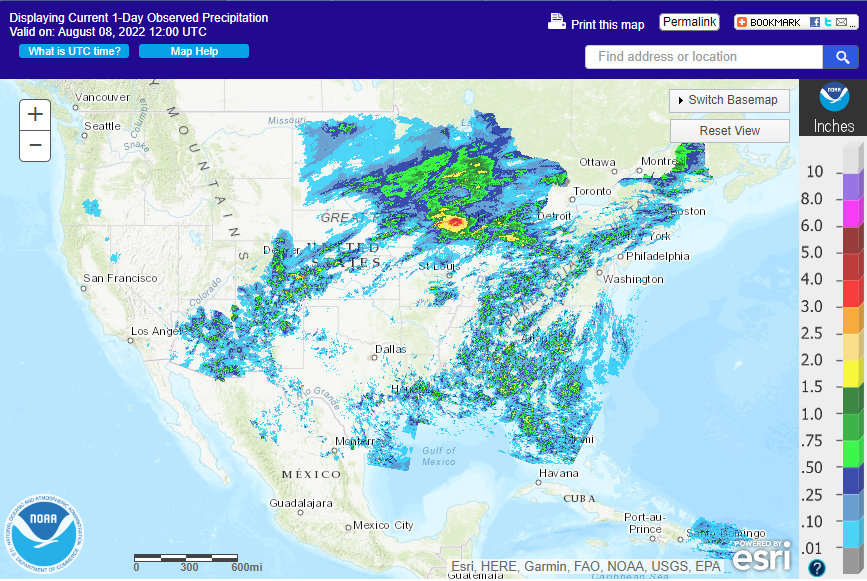

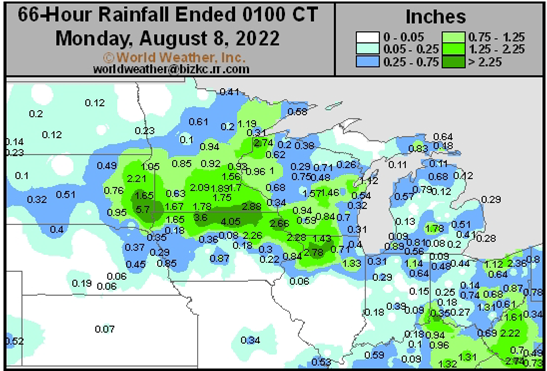

Rains

on Sunday for the NW Corn Belt were near expectations

7-day

WEATHER

TO WATCH AROUND THE WORLD

- A

sukhovei will evolve later this week and continue into next week in Russia’s Southern Region, western Kazakhstan and eastern Ukraine - A

“sukhovei” is a hot, dry, wind that blows across the Russian Steppes periodically, but in serious episodes it can generate enough heat, low humidity and strong wind to desiccate a crop over a relatively short period of time.

- World

Weather, Inc. is concerned about this coming event because of the potential for it to be a longer lasting event than usual which may resulting in a prolonged period of 90- and lower 100-degree high temperatures, low humidity and wind speeds of 25 to 40 mph

with higher gusts late this week into next week - Soil

moisture is already low in the lower Volga River Basin and western Kazakhstan including the eastern half of Russia’s Southern Region - A

sukhovei now would not bode well for crops in that region - Soybeans,

sunseed and corn are produced in the region among other crops - The

event is not a sure thing, but the situation needs to be closely monitored.

- Interior

southeastern and east-central China will be hot and dry through the next ten days - The

area includes the Yangtze River Basin and areas southward into Fujian, but Guangdong, Guangxi and Yunnan get plenty of rain

- Extreme

highs during the weekend in east-central and interior southeastern parts of China ranged from 96 to 108 Fahrenheit and similar temperatures are likely through the next week to ten days.

- China’s

Yellow River Basin, North China Plain and northeastern provinces stay plenty wet over the next ten days - Temperatures

in the northeast will be more seasonable than east-central areas. - The

bottom line for China should be mostly good, although rice and some minor corn oilseed production areas in the interior southeast will experience moisture and heat stress due to daily temperatures in the 90s to slightly over 100 degrees Fahrenheit and little

to no rain. Crop conditions elsewhere should remain good. - Xinjiang,

China crop weather will continue favorably mixed over the next ten days - Central

India will be subjected to excessive rain both this week and next week by two separate monsoon low pressure systems that evolve over the Bay of Bengal and move to northern India - The

greatest rain in both weeks will occur from Odisha and northeastern Andhra Pradesh through Chhattisgarh, southern and western Madhya Pradesh and northeastern Maharashtra to southern Rajasthan and Gujarat.

- Rainfall

through Friday of this week will range from 3.00 to 9.00 inches with local totals of 10 to 14 inches

- Next

week’s rainfall will vary from 2.00 to 8.00 inches and local totals to 10 inches - Flooding

is expected and some crop damage will result. The region produces an abundance of soybeans, groundnuts, corn, sorghum and some rice. Each of these crops will be vulnerable to some damage. Heavy rain in cotton areas in Gujarat and immediate neighboring areas

should not be quite as heavy as that in central India, but great enough to induce some flooding Wednesday into Friday of this week and again August 17-18.

- U.S.

weekend rainfall occurred from portions of the Dakotas through Minnesota, northeastern Nebraska and northern Iowa to Wisconsin and northern Illinois - The

greatest rain totals varied from 0.75 to 2.00 inches with local totals of 2.00 to 3.97 inches with most of those amounts occurring from southern Minnesota and northernmost Iowa into east-central Iowa, southern Wisconsin and far northern Illinois - Sioux

Falls, SD reported 5.7 inches of rain - Significant

relief occurred to one of the previously driest regions in the Corn Belt; including southern Minnesota, northwestern Iowa and southeastern South Dakota - Rain

also fell in the U.S. during the weekend as scattered showers and thunderstorms from Ohio and central Indiana into the southeastern states where rainfall varied greatly

- Some

areas received 1.00 to 3.00 inches while most reported 0.20 to 0.75 inch - U.S.

Delta weather was mostly dry, although a few showers occurred in both the north and southernmost parts of the region.

- Most

of the central and southern Plains were dry along with areas in the Midwest from southern Iowa, southeastern Nebraska, Kansas and Missouri to the heart of Illinois and northern Indiana.

- No

rain fell in Washington, Oregon or California’s central valleys, but showers and thunderstorms occurred in the Snake River Valley, central Great Basin, Wyoming and south-central Montana benefiting some sugarbeet and dry bean production areas along with a few

other crops. - U.S.

temperatures during the weekend were warmest in the southern Plains - Highest

temperatures Friday through Sunday were in the Plains where upper 90- and 100 to 108 degree readings were noted - Highs

in the 90s occurred between the Missouri and Mississippi Rivers - US

weather this week…. - Rain

is expected today into Wednesday morning in lowermost parts of the Midwest with 0.25 to 0.75 inch and local totals to 1.50 inches resulting - Showers

will also occur during this period in parts of the Delta and southeastern states with random showers of light intensity in the southern Plains - Rainfall

in the Delta and southeastern states will vary from 0.15 to 0.80 inch with a few amounts to 1.50 inches - Less

than 0.50 inch will occur in the southern Plains with coverage of 40% - Drier

weather will dominate the second half of this week into the weekend in the Midwest, central and southern Plains, Delta and southeastern states after a frontal system sweeps southward on Wednesday and Thursday ending the rain in the Delta and southeastern states

as well as the lower Midwest - Midwest

temperatures will be seasonable this week with many highs in the upper 70s and 80s after some 80- and 90-degree highs occur today and Monday - Temperatures

in the Plains will be seasonably warm early this week and then trend hotter in the second half of the week and into the weekend with 90s and extremes over 100 expected - U.S.

Pacific Northwest will turn hot again early this week with extremes of 95 to 105 Fahrenheit Monday and Tuesday before cooling returns later this week generating more of a seasonably warm range of upper 80- and 90-degree highs - Cool

temperatures will be in the northern Plains and upper Midwest today with highs in the 60s and 70s

- The

cool conditions will shift to the Great Lakes region Monday as warming begins - High

pressure ridge will build into the Great Plains late this week and prevail into the first half of next week - This

feature will be broad based enough to include the western parts of the Corn Belt, but most of the heat will be farther to the west - U.S.

weather next week….. - High

pressure ridge in the Plains may retrograde to the west briefly during the middle to latter part of next week pushing the hottest weather into the Great Basin and northwestern states and allowing some cooling in the Midwest

- GFS

model advertises some rain during the coming weekend from eastern Missouri, the northern Delta and Illinois into eastern Iowa, Minnesota and parts of both the Dakotas and Wisconsin with rainfall of 0.10 to 0.75 inch and locally more - A

cool front moves through the Midwest early to mid-week next week producing rain and thunderstorms mostly in the northern and eastern Midwest with 0.20 to 0.80 inch of rain resulting with a few greater amounts - Another

frontal system may move into the northern and eastern Midwest Aug. 20-22, but confidence in the timing and rain amounts are low - Rainfall

would range from 0.10 to 0.75 inch and local totals to 1.50 inches - Western

Corn Belt and Great Plains are not favored for rain next week or in the following weekend, although some showers of limited significance are expected - Temperatures

will continue near to slightly below normal next week in the eastern Midwest while the Plains and far western U.S. are warmer than usual - The

U.S. bottom line remains one of concern for crops in the Plains and some western Corn Belt locations due to dry or mostly dry and warm conditions. No excessive heat is expected for a while – at least not in key Midwestern locations. Some warmer than usual

temperatures will occur in the western fringes of the Corn and Soybean Belt especially late this week through much of next week, but the majority of the Midwest will not be impacted by the warmer bias. Rainfall will be most limited in the second half of this

week through much of next week in the western Corn Belt and a part of the Great Plains resulting in declining soil moisture and some rise in crop moisture stress. The areas of greatest concern due to drying and crop stress will be in southern and western Iowa,

northern Missouri northeastern through central Kansas and Nebraska. Net drying is expected in the Dakotas and Minnesota, although rain in the past couple of days has lifted soil moisture to carry crops for a while during the next week and there may be a few

showers of light intensity coming with next week’s frontal system. Most crops in the Delta and southeastern states will experience a good mix of weather for ongoing crop development.

- Canada’s

Prairies will receive limited rainfall this week except in western, northern and some central Alberta locations as well as a few areas in northwestern Saskatchewan later this week where rain is expected. - Net

drying will continue across most of the southern Prairies for at least the next full week, despite a few showers - Scattered

showers will occur again next week favoring western and northern Alberta and northern Saskatchewan while net drying occurs in many other areas - The

bottom line will be one of concern for rising crop moisture stress in the southern Prairies where soil moisture was already rated very short Friday. Continued declining crop moisture in the southern Prairies will raise concern for late season canola, corn,

soybean and flax yields while promoting quick crop maturation and harvest progress of peas, lentils, wheat, barley, oats and early season canola - Europe

dryness will continue through the weekend except in some Italy and Balkan Country locations where scattered showers and thunderstorms are possible - Most

of the rain will be light and relief from long term dryness will be limited - Portions

of Romania may get some significant rain during this workweek with a few areas getting 1.00 to 3.00 inches – mostly away from the lower Danube River Valley - Some

locally heavy rain may also impact the Italian Peninsula and western parts of the Balkan region - Western

Europe will continue very warm and dry this week, but cooling is expected with next week’s showers - The

bottom line for Europe will be one of continued concern over crop development and water supply in western parts of the continent. Temperatures in Western Europe will be excessively warm for a number of days this week, but cooling is expected during the weekend

and especially next week as showers evolve. In the meantime, southeastern Europe will see enough showers for partial relief to dryness, but many areas will still have a big need for rain and water levels on the lower Danube River will remain quite low.

- Russia’s

Southern Region and neighboring areas in western Kazakhstan and the southeastern New Lands will experience net dying conditions this week with above normal temperatures resulting in net drying and a possible rise in crop moisture and heat stress - Temperatures

will not be excessively warm, but highs in the upper 80s and 90s Fahrenheit are likely with a few extremes near 100 - Other

areas in Russia should receive timely rainfall and continue to experience good crop development potential - The

bottom Line for Russia and Ukraine is mostly good, but a closer watch on eastern Ukraine and Russia’s Southern Region is warranted as well as other southern New Lands crop areas due to declining soil moisture and warm temperatures. Some of these areas already

had low soil moisture late last week and the declining trend could prove threatening to some late corn, sunseed and soybean yields. The only moisture stress recently has been in eastern parts of Russia’s Southern Region. An expansion in the driest area is

expected, but it will be a while before crops experience enough stress for a threat to yields outside of this already dry region. - Argentina’s

western wheat areas will receive some light rainfall today - Moisture

totals will vary from 0.05 to 0.60 inch with a local total of 1.00 inch possible in La Pampa, San Luis, southern and central Cordoba, southern Santa Fe and Entre Rios - The

precipitation will be welcome, but not enough to seriously improve soil moisture. Much of the rain will be quite light and follow up moisture will still be needed to fix the long term moisture deficit in the region.

- Southern

Brazil wheat and early season corn production areas will get some rain through Wednesday - The

moisture will be great for bolstering soil moisture, but a few areas in Parana may get some heavy rainfall of 1.00 to 3.00 inches.

- Some

of this moisture will also reach through Mato Grosso do Sul to western and southern Mato Grosso and Paraguay - Another

round of rain will impact southern Brazil during the first half of next week - Continued

favorable wheat development conditions are expected as a result of the rain. Planting moisture for early season corn will be improved and should help that crop get off to a good start. Rain in Mato Grosso may interfere with the cotton harvest that was 50%

done on July 30. - Parana,

Mato Grosso do Sul and Sao Paulo coffee, citrus and sugarcane areas will get some rain early this week and again a week later - Most

of the rain in coffee areas will be greatest in northern Parana and southern Sao Paulo where there might be a little flowering - Northeastern

Sao Paulo and southern Sul de Minas will not receive enough rain for flowering

- Cooling

is expected briefly early to mid-week this week and again during the middle part of next week, but there is no risk of crop damaging cold through August 17 - Excessive

rain is predicted for southern Myanmar rice and sugarcane areas possibly resulting in some crop damage during the next couple of weeks - Other

areas in mainland areas of Southeast Asia will get plenty of rain, but nothing too extreme - Weekend

rain was heavy in parts of the Philippines and Indonesia where local flooding resulted.

- More

of the same weather is expected for a while - Sumatra,

Indonesia rainfall continues below normal and needs to be increased to protect crop development

- Some

improvement is still expected - Australia

weather in the coming ten days will be favorable for most winter crops - Some

greater rain might be desirable in Queensland and parts of interior South Australia, but no crisis is expected in either area - Winter

crop development potential in the spring is looking very good for most of the nation. For now, crops are semi-dormant in many areas, although new crop development has been occurring a little more significantly in Queensland recently.

- South

Korea rice areas are still dealing with drought, despite some rain that fell recently.

- Heavy

rain is expected to fall this week across northern parts of the nation - North

Korea will also receive heavy rain this week - Flooding

is expected in both areas with 5.00 to 12.00 inches of rain expected by the weekend near the North and South Korea border and another round of heavy rain may occur Sunday through Tuesday of next week, Aug. 14-16 - Crop

damage may occur to rice production in both North Korea and northern parts of South Korea because of this week’s heavy rain event - East-central

Africa will be most significant in Ethiopia this week while Uganda and Kenya rainfall becomes more sporadic and light.

- Tanzania

is normally dry at this time of year and it should be that way for the next few of weeks - “Some”

increase in rain is expected in Uganda next week - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

greater rain would still be welcome in the drier areas of Ivory Coast and Ghana

- Seasonal

rains have shifted northward leading to some drying in southern areas throughout west-central Africa – this is normal for this time of year - Cotton

areas are expecting frequent rainfall in the next couple of weeks - South

Africa’s crop moisture situation is favorable for winter crop establishment, although some rain would be welcome - Restricted

rainfall is expected for a while, but the crop is rated better than usual because of frequent rainfall during the autumn planting season and timely rain since then - Central

America rainfall will continue to be abundant to excessive and drying is needed - Mexico

rain will be most abundant in the west and southern parts of the nation - Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely - Today’s

Southern Oscillation Index was +10.36 and it will move erratically over the next week - New

Zealand weather is expected to be quite cool this week with rain today into Monday and the drier and cool the remainder of this week

- Temperatures

will be well below normal until next week when warming is likely

Source:

World Weather INC

Bloomberg

Ag Calendar

Monday,

Aug. 8:

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop conditions for wheat, corn, soybeans and cotton; spring wheat harvest, winter wheat progress, 4pm - Vietnam

Customs releases July coffee, rice, rubber export data - HOLIDAY:

Pakistan

Tuesday,

Aug. 9:

- EU

weekly grain, oilseed import and export data - HOLIDAY:

Singapore, India, Bangladesh

Wednesday,

Aug. 10:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Malaysian

Palm Oil Board’s data on stockpiles, production and exports - Malaysia’s

Aug 1-10 palm oil export data - Brazil’s

Unica to release cane crush, sugar production data (tentative)

Thursday,

Aug. 11:

- USDA

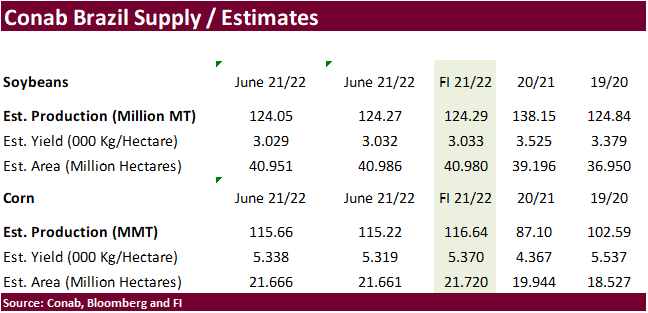

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Brazil’s

Conab to publish output and planting data for soybeans and corn - HOLIDAY:

Japan

Friday,

Aug. 12:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - New

Zealand food prices - FranceAgriMer

weekly update on crop conditions - EARNINGS:

Olam, Golden Agri - HOLIDAY:

Thailand

Source:

Bloomberg and FI

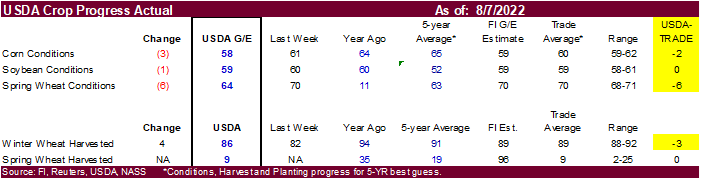

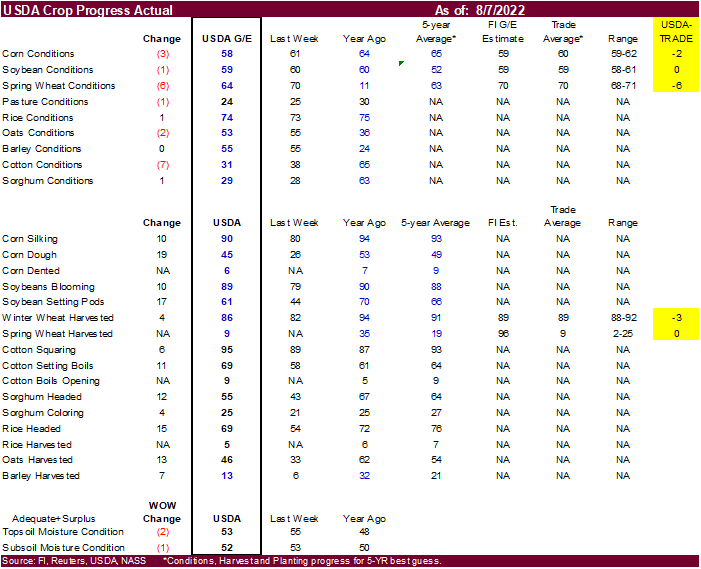

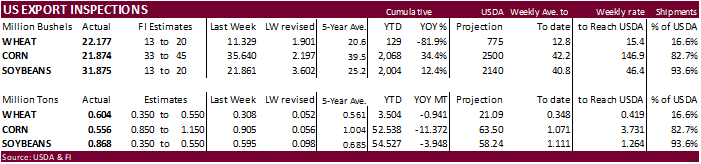

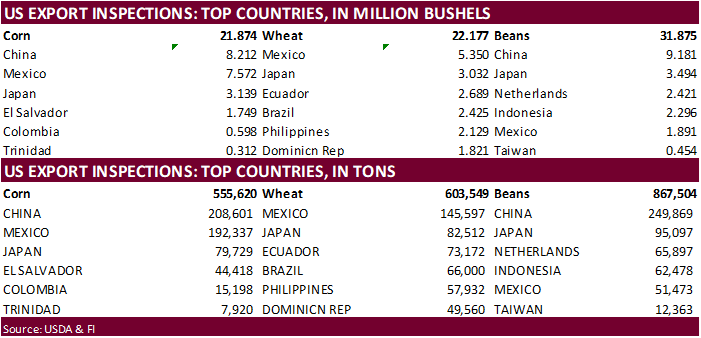

USDA

inspections versus Reuters trade range

Wheat

603,549 versus 250000-550000 range

Corn

555,620 versus 700000-1150000 range

Soybeans

867,504 versus 300000-750000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING AUG 04, 2022

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 08/04/2022 07/28/2022 08/05/2021 TO DATE TO DATE

BARLEY

73 0 1,297 920 5,511

CORN

555,620 905,293 816,337 52,537,592 63,909,709

FLAXSEED

0 0 0 0 24

MIXED

0 0 0 0 48

OATS

0 0 0 5,089 100

RYE

0 0 0 0 0

SORGHUM

60,471 92,019 75,837 7,297,642 6,842,867

SOYBEANS

867,504 594,958 114,865 54,527,013 58,475,270

SUNFLOWER

0 0 0 2,260 240

WHEAT

603,549 308,333 653,969 3,503,706 4,445,076

Total

2,087,217 1,900,603 1,662,305 117,874,222 133,678,845

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

US

Planning To Send Additional $4.5 Bln To Ukraine For Budget Needs

102

Counterparties Take $2.196 Tln At Fed Reverse Repo Op (prev $2.195 Tln, 97 Bids)