PDF Attached

COVID-19

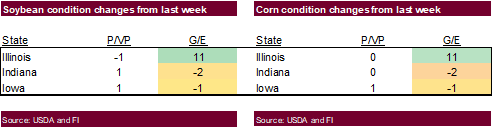

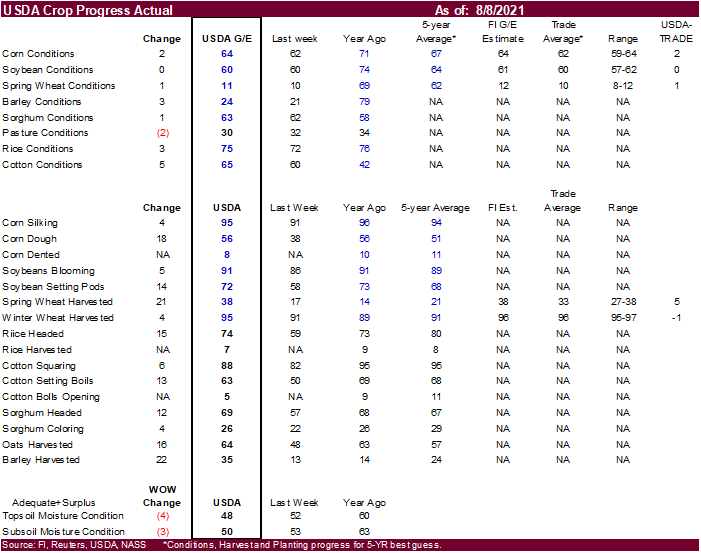

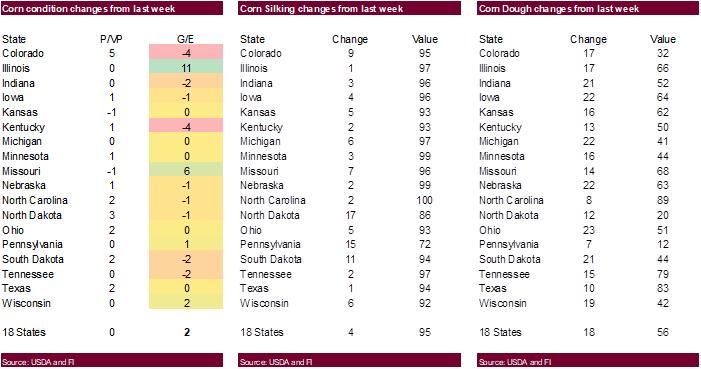

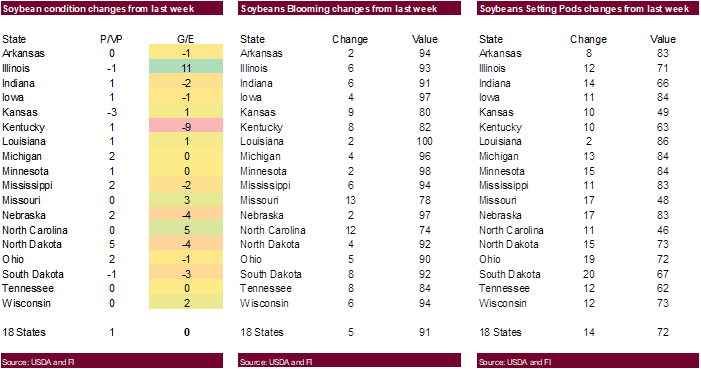

Delta & Lambda variant concerns pressured energy and other commodity markets. USD was higher. Grains were lower and soybean complex mixed (meal higher). US corn conditions improved 2 points G/E with IL leading the way by improving 11 points. Corn for IA

was down one point and IN was down 2. Missouri corn improved 6 points. SD was down 2. US soybean conditions were unchanged but the poor/very poor was up 1. Similar for corn, conditions for Illinois soybeans increased 11 points, IN was down 2 and IA down

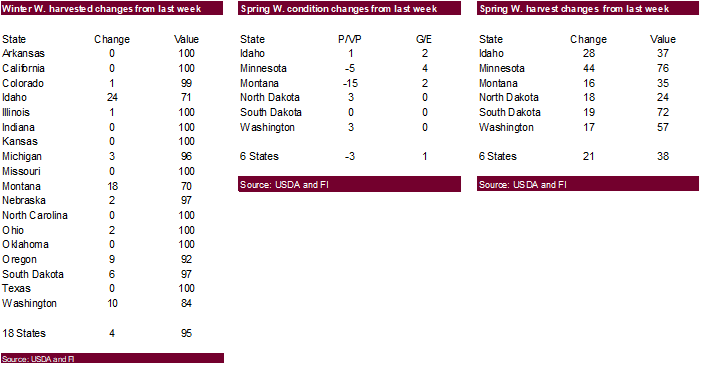

1. Soybean conditions in KY fell 9 points. US spring wheat conditions increased one point and harvest progress was up 21 points to 38 (5 points above a trade guess and compares to 14 year ago and 21 average). Interesting to see corn and soybean G/E conditions

having identical changes for the “I” states.

Calls:

Corn

1-3 lower

Soybeans

steady to 4 lower

Chicago

steady to 3 lower, KC steady to 3 lower, and MN wheat 1-5 lower

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

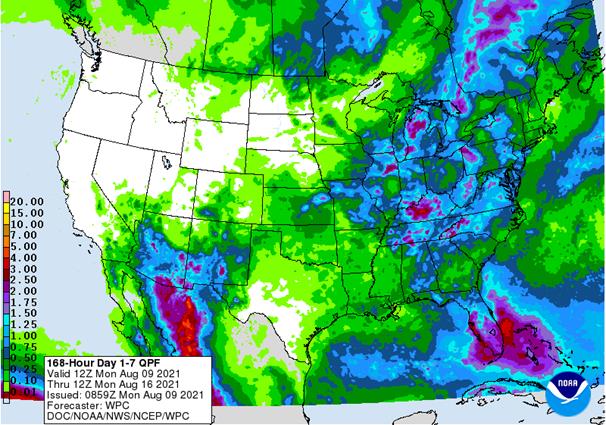

- Weekend

rainfall was lighter than expected in southeastern Iowa, northwestern Illinois, northern Missouri, northeastern Nebraska, southeastern South Dakota, southwestern Minnesota and northwestern Iowa

o

These areas will all have a head start of this week’s drying

o

Rain advertised for some of this region late this week and during the weekend is overdone and may not verify very well

o

Drying through Friday will expand crop moisture stress over these areas that missed rainfall during the weekend

o

Temperatures will be near to above average, but that is sufficiently warm to stimulate a steady rate of drying adding to low soil moisture that is already present

- Rain

that fell heavily in Wisconsin, southeastern Minnesota and northeastern Iowa during the weekend will help carry crops through this week’s drier biased weather

o

Crop conditions in these areas will be mostly good, despite some flooding resulting from the weekend rainfall

- Other

areas in the U.S. Midwest experienced erratic rainfall during the weekend and will continue doing so over the next couple of weeks

o

Most crops east of the Mississippi River will stay in favorable condition because of adequate subsoil moisture and/or timely rainfall

- A

tropical depression is expected to develop soon near the Lesser Antilles and will move across Puerto Rico and Hispaniola during mid-week this week producing heavy rain and windy conditions

o

The system could become a tropical storm

o

The tropical disturbance will eventually reach Florida and today’s computer forecast models suggest it will move up through at least a portion of Florida’s Peninsula resulting in heavy rain and windy conditions in citrus and sugarcane

areas

- Early

indications suggest no serious damage, but there may be some citrus fruit droppage and minor tree limb breakage if the storm comes through the heart of the production region as a tropical storm - There

is no indication of this system becoming a hurricane, but it will still need to be closely monitored

o

The storm may eventually impact part of Georgia and South Carolina as well as Florida

- Another

tropical disturbance in the central tropical Atlantic Ocean may bring rain to the Lesser Antilles late this week and into the weekend before moving swiftly across the Caribbean Sea with possible impact on the Yucatan Peninsula early next week

o

The system does not have much potential for intensification, although it will be closely monitored.

- West

Texas weather will be very good this week with warm to hot temperatures early in the week and then slowly increasing shower activity later this week into next week that will bring temperatures back down once again.

- U.S.

Delta and southeastern states will see a good mix of rain and sunshine along with seasonable temperatures during the next week to ten days - Limited

rainfall is expected in the northern U.S. Plains through early next week - Far

western U.S. weather will remain dry - An

active monsoon season will continue from Arizona and New Mexico northward into Montana with daily showers and thunderstorms expected offering a few pockets of locally heavy rainfall - Canada

Prairies are unlikely to see significant changes in weather over the next ten days, despite the GFS model trying to produce significant rain in the Prairies for next week.

o

Showers will occur today in southern and eastern parts of the Prairies with Manitoba getting some additional rain Tuesday

o

After this event is over the region will experience cooler and drier conditions for a while late this week and then a strong warming trend is expected during the weekend and early next week with restricted rainfall continuing

o

Extreme low temperatures in the 40s and a few upper 30s may occur with this week’s cold high pressure center as it settles into the Prairies

- Some

weekend low temperatures in Alberta already slipped into a few 30s Fahrenheit - Canada

Prairies weather during the weekend was dry in much of the key grain and oilseed production areas, although rain did fall in western and far northern Alberta and in a few areas along the northern fringes of Saskatchewan and Manitoba crop areas

o

Some showers also occurred in southernmost Alberta with a few areas reporting upward to 2.50 inches near the mountains and near the U.S. border

o

Temperatures were warm except in the far west where readings were closer to normal if not slightly cooler biased.

- Southeast

Canada corn, soybean and wheat production areas will be warm biased with periodic rain expected this week and then drier weather next week

o

The bottom line environment will be good for summer crops and wheat harvest delays will occur periodically

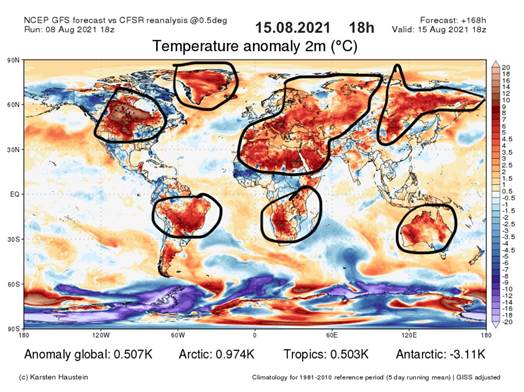

- Europe’s

weather this week will trend drier and warmer favoring a much better harvest environment for its small grain and winter rapeseed harvest

o

This marks an end to a lengthy period of frequent rain that delayed fieldwork and raised some crop quality issues

- Southeastern

Europe will continue to deal with dryness and crop moisture and heat stress this week

o

The Balkan countries will be most impacted and could experience a net decline in crop conditions with unirrigated summer crops losing a little yield potential without greater rain soon

- Tropical

Storm Lupit moved across portions of Japan during the weekend and it will complete that process today

o

The center of the storm was near 37.5 north, 136.1 east or 192 miles northwest of Yokota, Japan moving northeasterly at 16 mph and producing maximum sustained wind speeds of 46 mph near its center

o

The storm has will continue to impact citrus and rice areas, but damage should be limited because of its weak intensity

- Tropical

Storm Mirinae stayed east of Honshu during the weekend, but passed relatively close to Tokyo producing some rain , but no damaging wind

o

Mirinae was moving east northeasterly over open water east of Japan and will pose no more threat to land over the next few days as it slowly weakens

- A

monsoon depression forms in the Bay of Bengal this coming weekend before moving inland across India from Odisha and northeastern Andhra Pradesh into northeastern Maharashtra and southern Madhya Pradesh next week.

o

The system is not expected to be a big rain producer, but some increased rainfall will evolve supporting summer crops more than harming them

- Northwestern

India and central and southern Pakistan will continue dry biased for the next two weeks

o

Gujarat, western and northern Rajasthan, Haryana , Punjab and the middle and southern parts of Pakistan will be left driest leading to stress for most unirrigated crops

- Southeast

Asia nations will all receive sufficient rain to support crops during the next two weeks

o

The forecast includes an improving rain distribution for Sumatra, Java, Kalimantan, Thailand and the central and southern Philippines all of which have been trending a little too dry recently

- China

weather during the weekend was mostly good for summer crops with net drying in many areas

o

Localized areas of moderate to heavy rain were noted, but new flooding should have been mostly confined to coastal Fujian, northeastern Sichuan and southern Shaanxi

o

Temperatures were warm which accelerated drying rates in those areas that were unaffected by rain

- China

rain this week will be greatest in the Yangtze River Basin and areas to the south where sufficient rain will fall to keep the ground saturated and for some local flooding.

o

Rainfall elsewhere will be more favorably mixed with bouts of dry and warm weather supporting very good crop development

- East-central

Africa rainfall in this coming week will continue abundant in Ethiopia and a routine occurrence of rain will also occur in Kenya and Uganda - West

Central Africa rainfall during the weekend was limited in coffee, cocoa, sugarcane and rice areas, but timely in cotton areas

o

Rain will continue to fall periodically over the next couple of weeks, although the lightest rainfall will continue in Ivory Coast and Ghana

- CIS

crop areas will be wettest across the north from the Baltic States through northern Russia during the next ten days

o

Rainfall of 1.00 to 2.00 inches is expected with a few amounts reaching 2.00 to 4.00 inches

o

Southern Russia rainfall will be more restricted, but some showers are expected

- Some

significant rain will fall in Krasnodar and the southwest half of Russia’s Southern Region where 1.50 to more than 4.00 inches is possible

o

Kazakhstan rainfall will be minimal for the coming week and temperatures will continue very warm to hot at times

- Australia

weather will continue favorably for wheat, barley and canola which are semi-dormant at this time of year. Soil moisture is favorable and ready to support spring growth when warming comes along especially if timely rainfall continues a advertised

o

Queensland and northern New South Wales still need significant rain to restore soil moisture after recent drying

- Buenos

Aires, Argentina received rain Saturday into this morning and the precipitation was continuing today

o

Most of the precipitation will end today and some wheat and barley will have benefited from 0.20 to 1.00 inch of rain and locally more than 2.50 inches

- The

northeast half of Buenos Aires and Entre Rios have been wettest along with southern Santa Fe - Rainfall

in Cordoba, La Pampa and far western Buenos Aires was minimal leaving those dry areas in need of significant rain

o

Dry weather will resume Tuesday and prevail for at least ten days

o

Wheat establishment has gone well this year, but some greater rain is needed in western areas to induce better establishment prior to aggressive spring growth

- Brazil

weather was mostly dry during the weekend, although a few showers occurred in coastal areas - Rain

will occur infrequently in southern Brazil during the next ten days benefiting wheat production areas and possibly improving some moisture for early season corn planting and establishment - South

Africa weather was dry Friday through Sunday

o

A greater rain event is possible late this week and into the weekend that may bring some needed moisture from Western and Eastern Cape into Free State

- The

event may be a little overdone in the forecast model runs today and a little caution is advised before fully buying into the event, but rain is needed in Free States and this would be very helpful for dryland wheat establishment if it verifies

- Follow

up rain will still be needed - Southern

Oscillation Index has reached +10.35 and it will continue to decline over the next several days - Mexico

weather will remain wettest in the far west and extreme south for the next ten days

o

Greater rain is needed in the northeast

o

Crop conditions have improved in recent weeks especially in the west

- Central

America rainfall has been plentiful and will remain that way for the next ten days - New

Zealand rainfall during the coming week will be above average in southern parts of North Island and western parts of South Island

o

temperatures will be seasonable with a slight cooler bias

Source:

World Weather Inc.

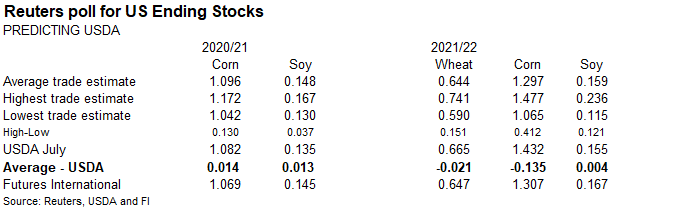

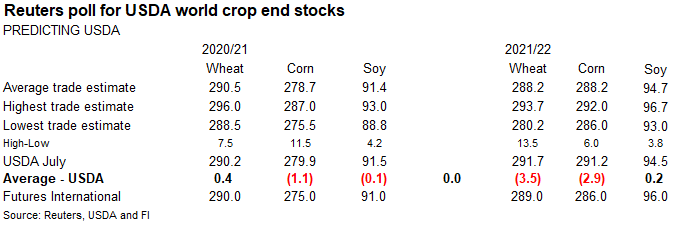

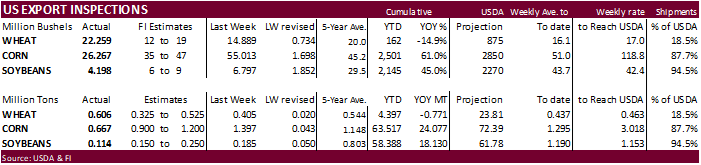

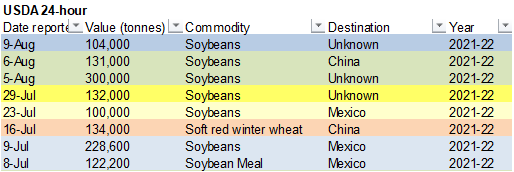

USDA

inspections versus Reuters trade range

Wheat

605,793 versus 350000-525000 range

Corn

667,220 versus 900000-1250000 range

Soybeans

114,253 versus 100000-300000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING AUG 05, 2021

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 08/05/2021 07/29/2021 08/06/2020 TO DATE TO DATE

BARLEY

299 599 0 4,513 465

CORN

667,220 1,397,406 1,312,530 63,517,449 39,440,823

FLAXSEED

0 0 0 24 317

MIXED

0 0 0 48 0

OATS

0 0 0 100 800

RYE

0 0 0 0 0

SORGHUM

75,669 55,210 111,119 6,842,171 4,644,195

SOYBEANS

114,253 184,988 843,196 58,387,701 40,258,180

SUNFLOWER

0 0 0 240 0

WHEAT

605,793 405,215 477,188 4,396,900 5,167,560

Total

1,463,234 2,043,418 2,744,033 133,149,146 89,512,340

Source:

USDA and FI

70

Counterparties Take $981.765 Bln At Fed’s Fixed-Rate Reverse Repo (prev $952.134 Bln, 68 Bidders)

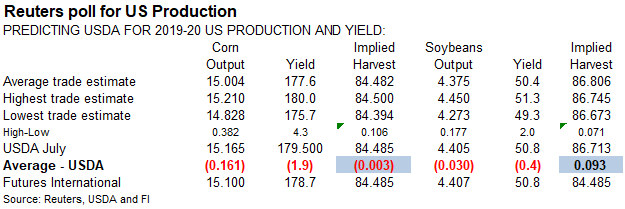

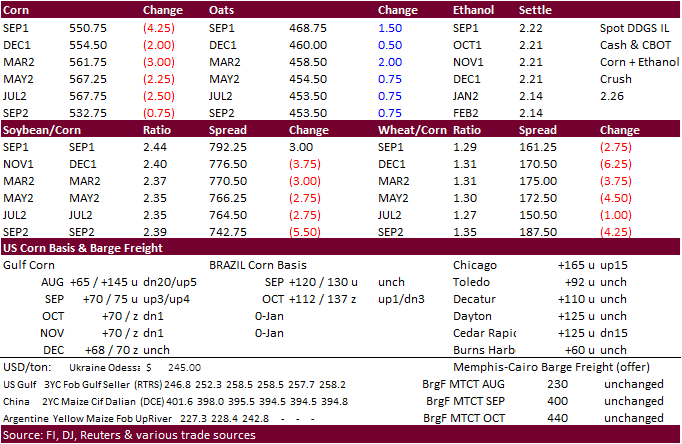

Corn

- Lower

trade but losses were limited on light commercial buying, keeping December corn prices within the 41 cent sideways trading range we have seen since mid-July. USD was up 16 points as of 2 pm CT. Outside markets were on the defensive from rising variant COVID-19

cases. News was light over the weekend. It will be a busy week with Conab, MPOB and USDA updating supply estimates. USDA corn inspections were below expectations at 138,209 tons, down sharply from the previous week of 839,556 tons.

- USDA

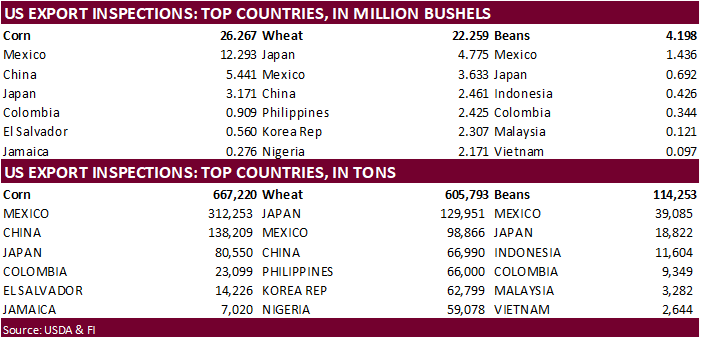

US corn export inspections as of August 05, 2021 were 667,220 tons, below a range of trade expectations, below 1,397,406 tons previous week and compares to 1,312,530 tons year ago. Major countries included Mexico for 312,253 tons, China for 138,209 tons, and

Japan for 80,550 tons. - The

weekly rate left in this crop-year for inspections to reach USDA’s export projection for corn is 51 million bushels, and soybeans at 43.7 million, an indication both commodities will not meet expectations. There are nearly 4 weeks of weekly export inspections

left to be reported by the end of the crop season, so we will know a little more on the shortfall in a couple weeks. One analyst posted today that they look for corn to fall short of expectations by 50 million bushels.

- US

producer sales were slow over the weekend. A few processor and ethanol locations lowered basis bids.

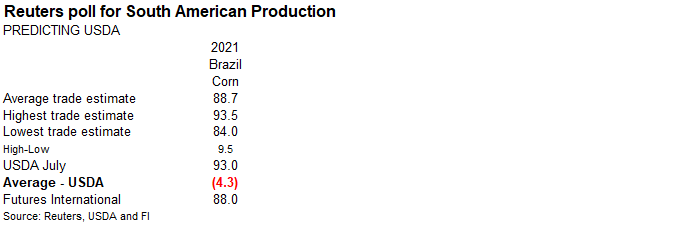

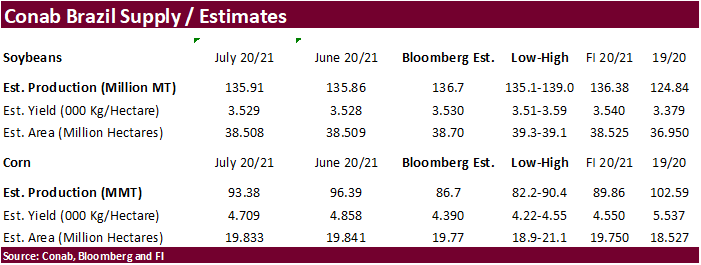

- Brazil’s

second corn crop across the center south was 58 percent harvested, according to AgRural, up 9 points from the previous week and below 70 percent a year ago.

Export

developments.

- Qatar

seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery.

September

corn is seen is a $5.25-$6.00 range.

December

corn is seen in a $4.25-$6.00 range.

-

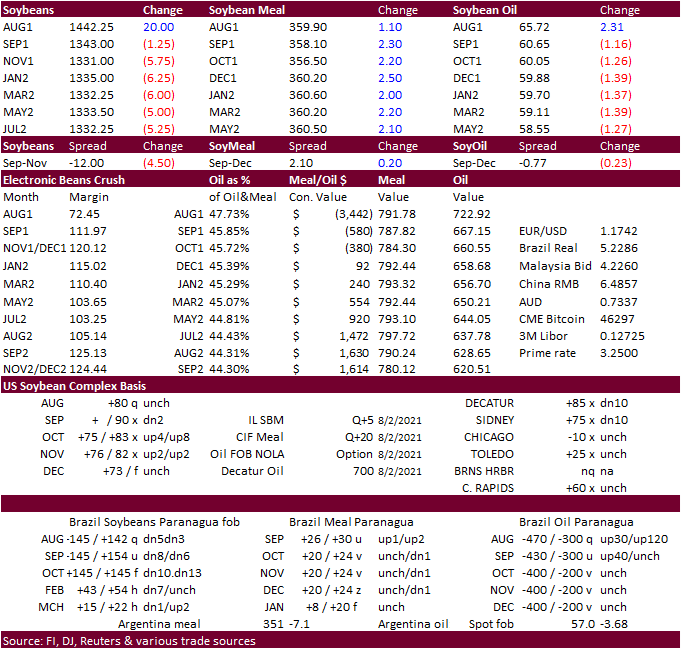

Soybeans

traded mixed, ending lower. Meal was higher on product spreading in part to India’s decision to allow for 1.5 million tons of soybean meal imports for animal feed use. Soybean oil was down more than 100 points from sharply lower WTI crude oil prices. China

reported a decline in July soybean arrivals from a year ago and Covid-19 concerns. India importers will be allowed to take soybean meal from any origin, according to an India analyst, but prices will still be heavily taken under considerations. Currently

Argentina soybean meal is cheapest out of the three major exporters (Argentina, Brazil and US).

-

Abiove

reported Brazil exported 2 million tons of soybean meal in July. 2021 soybean exports were estimated at 86.7 million tons, up from 82.9 million in 2020. Production as pegged at 137.5 million tons, unchanged from previous, versus 127.9 million tons in 2020.

2021 crush was expected to slip to 46.5 million tons from 46.84 million tons.

-

USDA

US soybean export inspections as of August 05, 2021 were 114,253 tons, within a range of trade expectations, below 184,988 tons previous week and compares to 843,196 tons year ago. Major countries included Mexico for 39,085 tons, Japan for 18,822 tons, and

Indonesia for 11,604 tons. -

China

July soybean imports were 8.67 million tons, down a hefty 14 percent from 10.1 million during July 2020. Jan-Jul soybean imports are still running above year ago.

-

Russia

set its sunflower oil export tax at $169.9 per ton from Sept. 1 based on an indicative price of $1,242.8 per ton. -

India

sunflower oil imports for 2021-22 could end up a record, according to International Sunflower Oil Association. Offers for crude sunflower oil was quoted by Reuters at $1,280/ton for late 2021 delivery, below $1330//ton for degummed soybean oil.

-

India

plans to spend $1.4 billion to reduce its dependance on vegetable oil imports, by expanding oilseed production and oil palm plantations. -

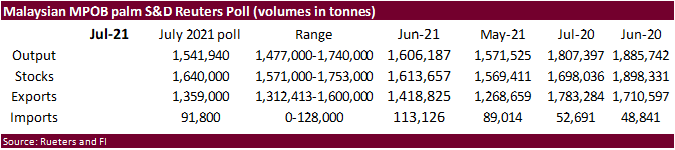

Malaysia

will be on a one-day holiday Tuesday.

Export

Developments

- Under

the 24-hour USDA announcement system, private exporters sold 104,000 tons of soybeans to unknown for 2021-22 delivery.

- USDA

last week bought 3,990 tons of packaged oil for use in export programs. 3,770 tons ranged from $2,072.90 to $2623.69 per ton and 220 tons priced at $1,994,73 per ton. - USDA

On August 17 seeks 290,000 tons of veg oil for use in export programs. 210 tons in 4 liter cans and 80 tons in 4 liter cans or plastic bottles, for shipment Sep16 to Oct 15 (Oct 1-31 for plants at ports).

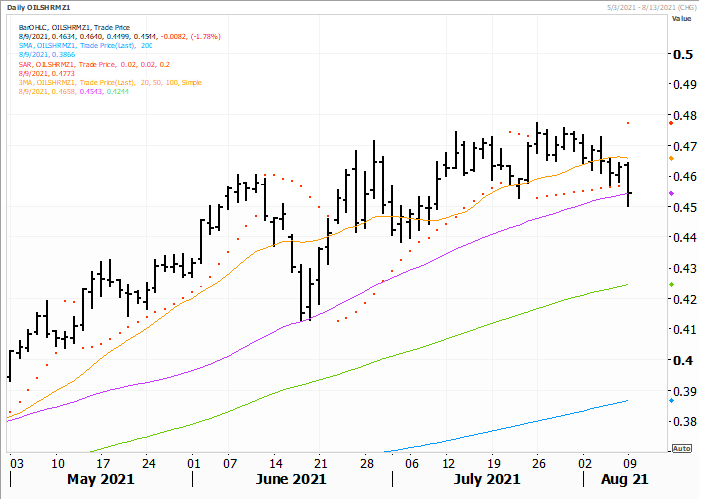

December

oil share

Source:

Reuters and FI

Updated

8/9/21

September

soybeans are seen in a $12.75-$14.50 range (up 25, unch); November $11.75-$15.00

September

soybean meal – $335-$370; December $320-$425

September

soybean oil – 58.50-65.00;

December 48-67 cent range

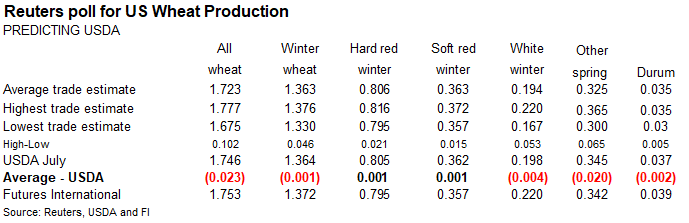

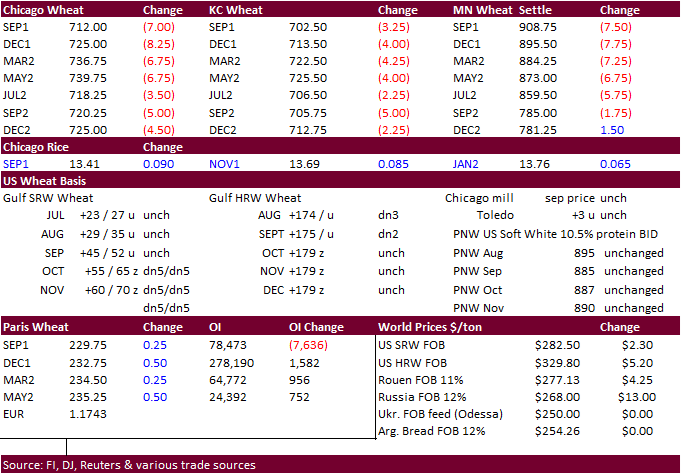

- Wheat

traded lower on renewed COVID-19 concerns slowing demand and harvest pressure for HRW and spring wheat. MN started the day higher on supply concerns. USDA is expected to trim the US spring wheat production on Thursday by 20 million bushels to 325 million.

- USDA

US all-wheat export inspections as of August 05, 2021 were 605,793 tons, above a range of trade expectations, above 405,215 tons previous week and compares to 477,188 tons year ago. Major countries included Japan for 129,951 tons, Mexico for 98,866 tons, and

China for 66,990 tons. - French

wheat shipments with some headed to Algeria that have been delayed over the past month are expected to push back barley shipments to China.

- December

Paris wheat was up 0.25 at 232.50 euros per ton, near its contract high.

- Russian

wheat exports are down 25% so far this season from a year earlier as of August 5 to 2.8 million, according to the Federal Center of Quality and Safety Assurance for Grain and Grain Products. However, for the week ending Aug 5, wheat exports did shoot up to

just over 1 million tons from about 700,000 previous week.

- Jordan

is back in for 120,000 tons of wheat on August 11. - Japan

(SBS) seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on August 18 for loading by November 30.

Algeria

seeks at least 50,000 tons of wheat for Aug/Sep shipment. - Bangladesh

seeks 50,000 tons of wheat on August 18. - Pakistan

seeks 400,000 tons of wheat on August 23 for Sep/Oct shipment.

Rice/Other

- South

Korea’s Agro-Fisheries & Food Trade Corp. seeks 39,226 tons of rice from the United States for arrival in South Korea on Jan. 31 and March 31, 2022. - (Bloomberg)

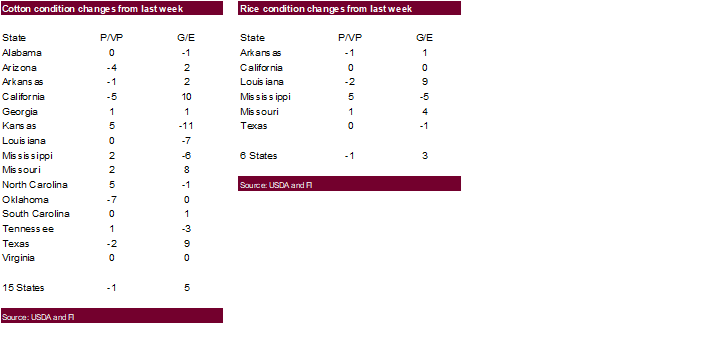

— U.S. 2021-22 cotton production seen at 18.15m bales, 346,000 bales above USDA’s previous est., according to the avg in a Bloomberg survey of 11 analysts.

Estimates

range from 17.6m to 19.4m bales

U.S.

ending stocks seen at 3.5m bales vs 3.3m in July

Global

ending stocks seen 402,000 bales higher at 88.14m bales

Updated 8/9/21

September Chicago wheat is seen in a $6.50‐$7.50 range (up 50, unch)

September KC wheat is seen in a $6.50‐$7.35 (up 60, up 10)

September MN wheat is seen in a $8.50‐$9.75 (unch, down 25 cents)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.