PDF Attached

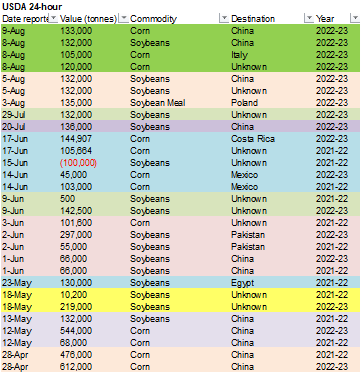

USDA 24-Hour: Private exporters reported sales of 133,000 metric tons of corn for delivery to China during the 2022/2023 marketing year.

US ag markets rallied overnight on worsening crop conditions and as traders position for this week’s WASDE report. Also adding to the bullishness was an independent consultancy calling for a 167.2 bpa US corn yield and 48.9 bpa yield for US soybeans. When the markets opened the for the US session. Traders used the strength to sell. US ags finished higher on the day, but off the overnight highs except soymeal.

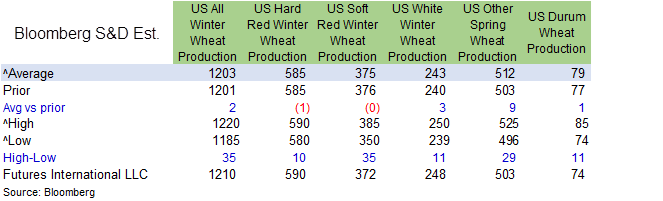

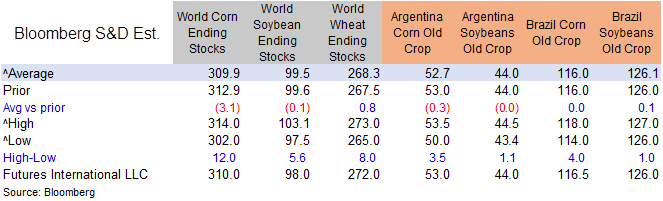

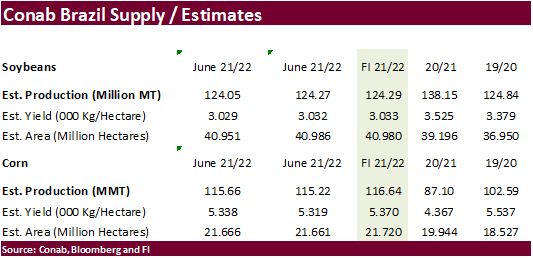

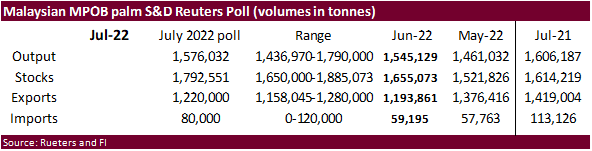

Monthly S&D reports kick off late tonight with Malaysia updating their July S&D estimates, followed by Brazil’s Conab supply update Thursday, then China’s CASDE & USDA on Friday.

WEATHER TO WATCH AROUND THE WORLD

- East-central China is in a significant drying mode that will last for the next ten days

- No rain and very warm to hot temperatures are expected daily

- Highs in the 90s to 108 degrees will occur often just as was reported Monday

- Most of the heat is expected to concentrate on the Yangtze River Basin, but will include much of east-central and southeastern China

- China’s North China Plain and areas northwest to some south-central Inner Mongolia crop areas reported moderate to heavy rain Monday and early today

- Rainfall varied from 1.50 to 3.20 inches in general, but local totals reached over 5.00 inches in a few northern Shandong and southern Hebei locations

- Northeastern China, the North China Plain and central Yellow River Basin will experience alternating periods of rain and sunshine for the next two weeks resulting in favorable crop development

- A developing tropical cyclone will produce significant rain along the Guangdong and Guangxi coasts of China with some heavy rain expected farther inland by a short distance over the next few days.

- Lingering rain of significance continues in these areas through the weekend and into next week

- Some rain totals vary from 5.00 to 15.00 inches during the next seven days and flooding will be a threat to some rice and sugarcane

- Xinjiang, China weather will continue to be well mixed over the next ten days supporting relatively normal crop development

- A sukhovei will evolve later this week and continue into next week in Russia’s Southern Region, western Kazakhstan and eastern Ukraine

- A “sukhovei” is a hot, dry, wind that blows across the Russian Steppes periodically, but in serious episodes it can generate enough heat, low humidity, and strong wind to desiccate a crop over a relatively short period of time.

- World Weather, Inc. is concerned about this coming event because of the potential for it to be a longer lasting one that should result in a prolonged period of 90- and lower 100-degree high temperatures, low humidity and wind speeds of 25 to 40 mph with higher gusts late this week into next week

- Soil moisture is already low in the lower Volga River Basin and western Kazakhstan including the eastern half of Russia’s Southern Region

- A sukhovei now would not bode well for crops in that region

- Soybeans, sunseed and corn are produced in the region among other crops

- These areas in Russia are already in a net drying mode and the Sukhovei will only exacerbate the situation raising unirrigated crop stress and a potential threat to production

- Central India will be subjected to excessive rain both this week and next week by three waves of significant rain

- The greatest rain in both weeks will occur from Odisha and northeastern Andhra Pradesh through Chhattisgarh, southern and western Madhya Pradesh and northeastern Maharashtra to southern Rajasthan and Gujarat.

- Rainfall through Friday of this week will range from 3.00 to 9.00 inches Next week’s rainfall will vary from 2.00 to 6.00 inches early in the week with another 2 to 6 inches possible late in the week and on into the following weekend

- Flooding is expected and some crop damage will result. The region produces an abundance of soybeans, groundnuts, corn, sorghum and some rice. Each of these crops will be vulnerable to some damage. Heavy rain in cotton areas in Gujarat and immediate neighboring areas should not be quite great as that of central India, but possibly great enough early next week to induce some flooding

- Western Europe is expected to continue dry biased this week, but next week’s rain potentials are improving

- No general soaking is expected, but scattered showers and thunderstorms will occur to ease dryness and begin improving “some” crops

- Greater rain may still be needed in many areas

- Southeastern Europe will also experience periodic showers and thunderstorms during the next two weeks resulting in partial relief from dryness, but greater rain will still be needed to end the stressful environment

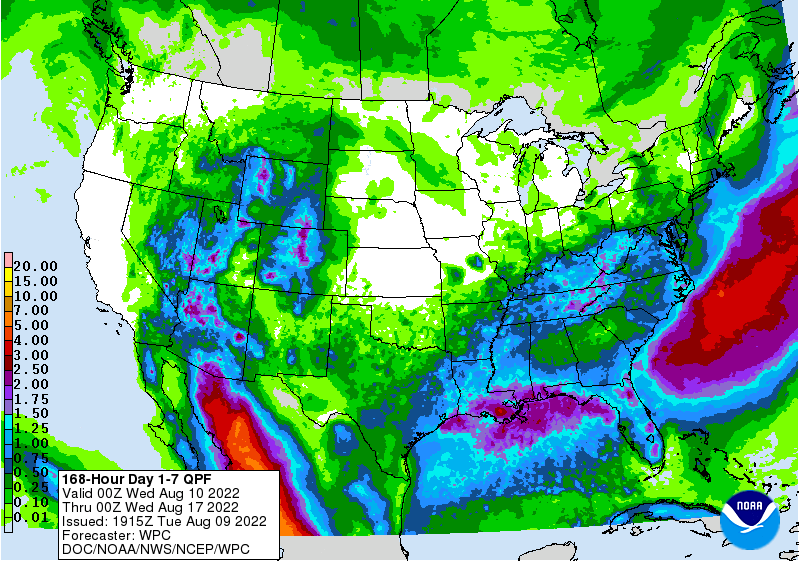

- U.S. weather is still expected to be dry biased in the coming week to ten days in a part of the western Corn Belt.

- The Missouri River Valley is expected to be driest with a warm bias still prevailing, although not nearly as warm next week as it will be this week

- Timely rainfall and seasonable temperatures elsewhere in the Midwest will prove beneficial for crop development, although there will be pockets of dryness

- GFS and ECMWF forecast models are attempting to move the U.S. high pressure ridge far to the west next week and into the following weekend

- Some showers may move into the drier western Corn Belt production areas next week if the ridge of high pressure shifts as far west as advertised

- World Weather, Inc. believes this westward shift is overdone and it will not stay out to the west for very long without returning to the central Plains in time

- Caution is advised on buying into the far westerly position of the ridge next week

- Some cooling will impact the western Corn Belt briefly next week, but it will quickly warm again

- Future model runs may bring the ridge back to the west

- Scattered showers occurred in West Texas cotton, corn and sorghum areas Monday and additional showers are possible into Thursday

- Resulting rainfall will be mostly light, but a few areas will benefit more from the rain than others

- Much of the crops in West Texas have already been seriously hurt by summer heat and dryness, but showers may offer a little reprieve

- Texas Temperatures are unlikely to be nearly as extreme in the next two weeks as they have been in recent weeks

- Alternating periods of rain and sunshine will impact the U.S. southeastern states and Delta during the next couple of weeks supporting good crop development

- California, Washington and Oregon will continue dry or mostly dry and warm through the next ten days

- Monsoonal showers and thunderstorms from the southwestern U.S. will reach into the Rocky Mountain region and Great Basin offering a little reprieve from summer heat and dryness

- Showers will reach into crop areas of southern Idaho and Wyoming helping sugarbeets and dry edible bean development among other crops

- Canada’s Prairies will receive limited rainfall this week except in western, northern and some central Alberta locations as well as a few areas in northwestern Saskatchewan later this week where rain is expected.

- Net drying will continue across most of the southern Prairies for at least the next full week, despite a few showers

- Scattered showers will occur again next week favoring western and northern Alberta and northern Saskatchewan while net drying occurs in many other areas

- The bottom line will be one of concern for rising crop moisture stress in the southern Prairies where soil moisture was already rated very short Friday. Continued declining crop moisture in the southern Prairies will raise concern for late season canola, corn, soybean and flax yields while promoting quick crop maturation and harvest progress of peas, lentils, wheat, barley, oats and early season canola

- Argentina’s western wheat areas benefited from some rain the past two days

- Moisture totals will vary from 0.05 to 0.60 inch with a local totals to around 1.00 inch

- The precipitation was welcome, but not enough to seriously improve long term soil moisture. More rain is needed, but not much is expected for a while

- Southern Brazil wheat and early season corn production areas will get some additional rain through Wednesday

- The moisture will be great for bolstering soil moisture

- Some of this moisture will also reach through Mato Grosso do Sul to western and southern Mato Grosso and Paraguay

- Some significant rain fell in parts of Mato Grosso do Sul Monday especially near Campo Grande

- Another round of rain will impact southern Brazil during the first half of next week

- Continued favorable wheat development conditions are expected as a result of the rain. Planting moisture for early season corn will be improved and should help that crop get off to a good start. Rain in Mato Grosso may interfere with the cotton harvest that was 50% done on July 30.

- Parana, Mato Grosso do Sul and Sao Paulo coffee, citrus and sugarcane areas will get some rain over the next couple of days

- Most of the rain in coffee areas will be greatest in northern Parana and southern Sao Paulo where there might be a little flowering

- Northeastern Sao Paulo and southern Sul de Minas will not receive enough rain for flowering

- Cooling is expected briefly through mid-week this week, but there is no risk of crop damaging cold through August 17

- Excessive rain is predicted for southern Myanmar rice and sugarcane areas possibly resulting in some crop damage during the next couple of weeks

- Other areas in mainland areas of Southeast Asia will get plenty of rain, but nothing too extreme

- Philippines and Indonesia weather will continue frequently wet during the next ten days

- Sumatra, Indonesia rainfall continues below normal and needs to be increased to protect crop development

- Some improvement is still expected

- Australia weather in the coming ten days will be favorable for most winter crops

- Some greater rain might be desirable in Queensland and parts of interior South Australia, but no crisis is expected in either area

- Winter crop development potential in the spring is looking very good for most of the nation. For now, crops are semi-dormant in many areas, although new crop development has been occurring a little more significantly in Queensland recently.

- South Korea rice areas are still dealing with drought, despite some rain that fell recently.

- Heavy rain is expected to fall this week across northern and central parts of the nation

- Southern parts of North Korea will also receive heavy rain this week

- Flooding is expected in both areas with 4.00 to 10.00 inches of additional rain expected by the weekend near the North and South Korea border and another round of heavy rain may occur Sunday through Wednesday of next week

- Crop damage may occur to rice production in both North Korea and northern parts of South Korea because of this week’s heavy rain event

- East-central Africa will be most significant in Ethiopia this week while Uganda and Kenya rainfall becomes more sporadic and light.

- Tanzania is normally dry at this time of year and it should be that way for the next few of weeks

- “Some” increase in rain is expected in Uganda next week

- West-central Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally

- Some greater rain would still be welcome in the drier areas of Ivory Coast and Ghana

- Seasonal rains have shifted northward leading to some drying in southern areas throughout west-central Africa – this is normal for this time of year

- Cotton areas are expecting frequent rainfall in the next couple of weeks

- South Africa’s crop moisture situation is favorable for winter crop establishment, although some rain would be welcome

- Restricted rainfall is expected for a while, but the crop is rated better than usual because of frequent rainfall during the autumn planting season and timely rain since then

- Central America rainfall will continue to be abundant to excessive and drying is needed

- Mexico rain will be most abundant in the west and southern parts of the nation

- Rain in the Greater Antilles will occur periodically, but no excessive amounts are likely

- Today’s Southern Oscillation Index was +10.03 and it will move erratically lower over the next week

- New Zealand weather is expected to be quite cool this week with limited rainfall

- Next week will trend warmer and wetter

Source: World Weather INC

Bloomberg Ag Calendar

Tuesday, Aug. 9:

- EU weekly grain, oilseed import and export data

- HOLIDAY: Singapore, India, Bangladesh

Wednesday, Aug. 10:

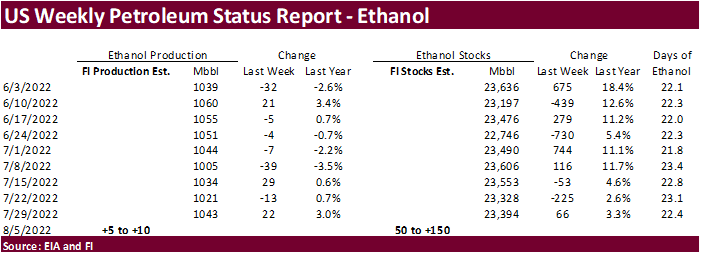

- EIA weekly U.S. ethanol inventories, production, 10:30am

- Malaysian Palm Oil Board’s data on stockpiles, production and exports

- Malaysia’s Aug 1-10 palm oil export data

- Brazil’s Unica to release cane crush, sugar production data (tentative)

Thursday, Aug. 11:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Brazil’s Conab to publish output and planting data for soybeans and corn

- HOLIDAY: Japan

Friday, Aug. 12:

- USDA’s monthly World Agricultural Supply and Demand (WASDE) report, 12pm

- China’s agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- New Zealand food prices

- FranceAgriMer weekly update on crop conditions

- EARNINGS: Olam, Golden Agri

- HOLIDAY: Thailand

Source: Bloomberg and FI

US Nonfarm Productivity Q2 P: -4.6% (est -4.7%; prevR -7.4%)

US Unit Labour Costs Q2 P: 10.8% (est 9.5%; prevR 12.7%)

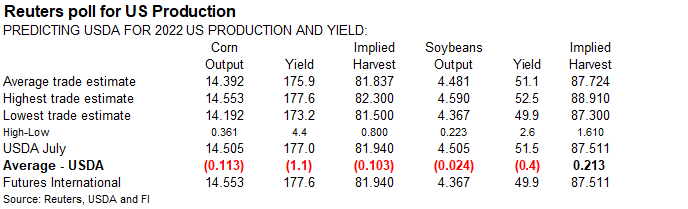

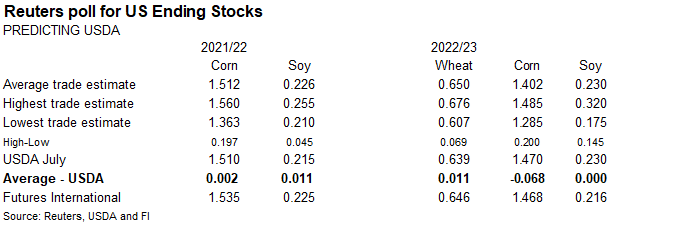

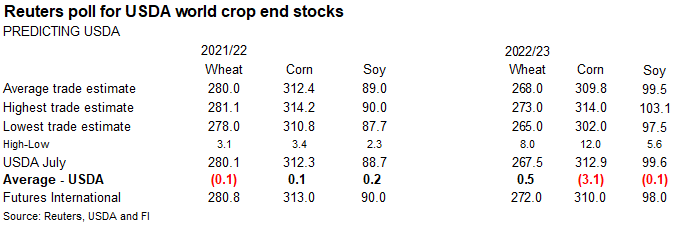

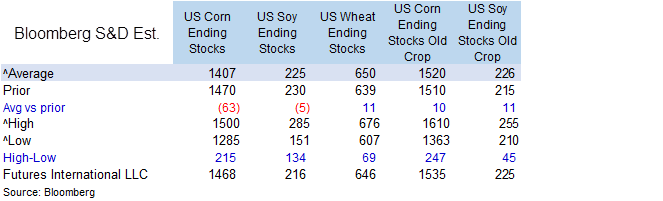

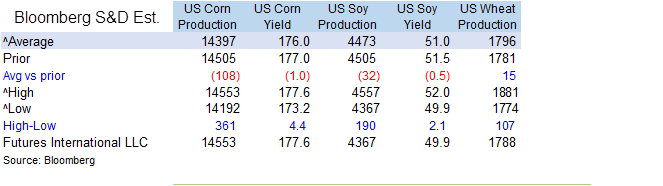

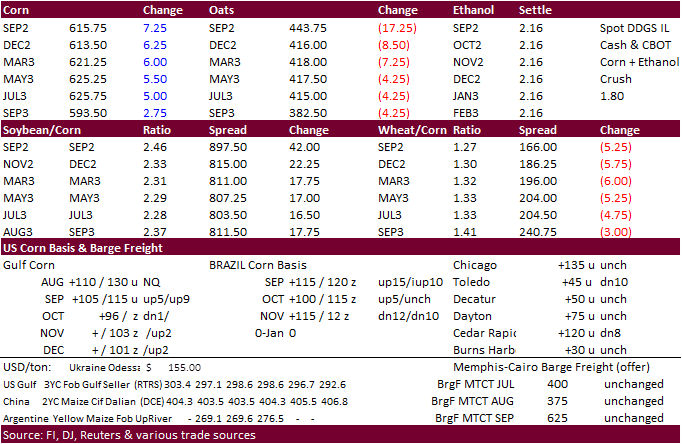

· Corn ended higher after USDA reported a larger than expected drop in the US corn rating and positioning ahead of this week’s WASDE report.

· The market continues to digest street estimates for US corn and soybean yields. One independent consultancy suggested sub 170. Based on our August yield relationship, that would suggest 175.8 bushels per acre.

· Funds bought an estimated net 8,000 corn contracts.

· CBOT corn open interest on Monday dropped 26,795 contracts on Monday. September position was down 34,792 lots.

· Anec sees Brazil August corn exports at 7.882 MMT versus 6.221 previous.

· Reuters reported two more grain ships left Ukraine on Tuesday, bringing the total to 12 since the safe passage deal.

· US corn silking is nearly complete. US corn crop conditions dropped 3 points for the combined good and excellent categories to 58 percent, 2 points below trade expectations. Our theoretical yield would come out to 175.8 bushels per acre, below our previous working estimate of 177.6 bushels per acre.

· The EIA is scheduled to release its weekly report on energy tomorrow at 10:30 am ET. Ethanol Production is estimated at 1.035 mln bpd and Ethanol Stockpiles are estimated at 23.512 mln barrels.

· Omitting unknown destination, China’s last US corn 24-H purchase was mid-May

Updated 8/4/22

September corn is seen in a $5.50 and $6.45 range

December corn is seen in a $5.00-$7.50 range

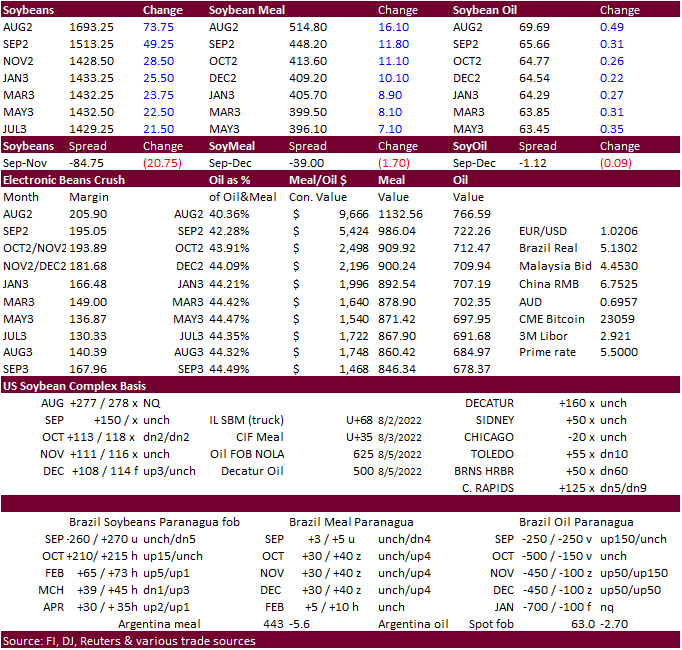

· The soybean complex is higher on good China spot demand, US yield concerns after USDA reported a G/E rating decline in soybeans, corn, and spring wheat Monday afternoon. The stronger BRL currency is also supportive as the US may see more export business due to Brazilian beans richening.

· Funds bought an estimated net 13,000 soybeans, 3,500 meal and net flat on soybean oil.

· We heard China was looking around for soybeans again today. Yesterday it was rumored they bought 6-8 charges: 2-3 from the PNW and rest from Brazil.

· There were no CBOT deliveries posted, but meal registrations were down 17 and stand at zero. We heard meal cancellations over the last 2 days were a couple of barges. A commercial bought the meal. This firmed the meal spreads this morning.

· US soybean conditions for the combined good and excellent categories were 59 points, down one point from the previous week and at trade expectations. We left our August yield unchanged at 49.9. A Bloomberg trade guess for Friday is at 51.0 bushels per acre.

· Anec sees Brazil August soybean exports at 5.667 MMT versus 5.101 previous, meal exports at 1.991 MMT versus 1.639 previous and corn exports at 7.882 MMT versus 6.221 previous.

· European Union soybean imports in the 2022-23 season (July 1 start) reached 1.35 million tons by Aug. 5, down from 1.54 million tons same week previous season. EU rapeseed imports had reached 628,542 tons, compared with 418,125 tons a year earlier. Soymeal imports totaled 1.42 million tons against 1.43 million tons prior season.

· Indonesia again lowered their palm oil export tax, to $52/ton, based on a reference price of $872.220/ton.

Export Developments

· China looks to sell a half a million tons of soybeans out of reserves on August 12.

· The CCC seeks 4350 tons of vegetable oil for use in export programs on Aug 16 for Sep 9-oct 15 shipment, October for plants at ports.

Updated 8/4/22

Soybeans – September $14.00-$15.50

Soybeans – November is seen in a $12.25-$16.00 range

Soybean meal – September $400-$500

Soybean oil – September 60.00-65.00.

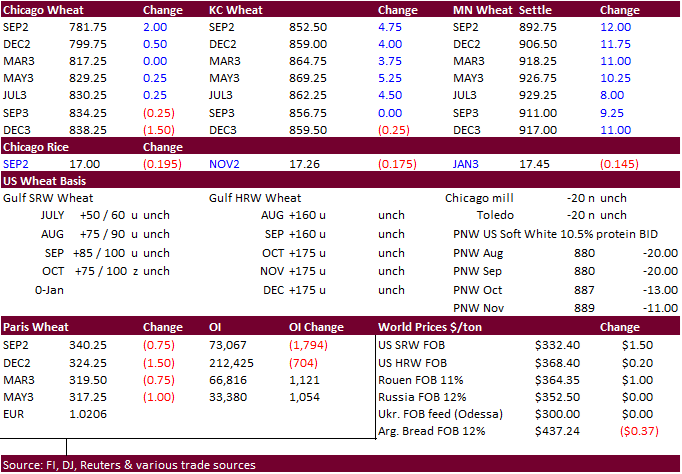

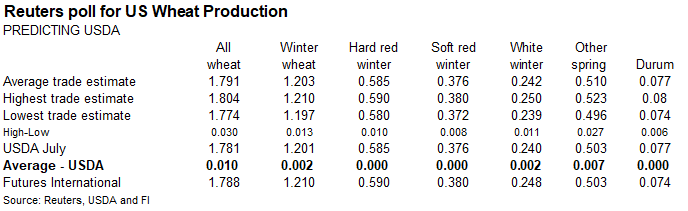

· A sizable drop in US spring wheat ratings reported by USDA Monday lifted US wheat futures higher today.

· Funds bought an estimated net 1,000 Chicago wheat contracts.

· US spring wheat conditions fell 6 points for the combined good and excellent categories, 6 points below expectations. That potentially shaves off 2 bushels from the spring wheat yield.

· A couple bearish points for wheat were the noted selling of US wheat futures to buy corn and soybean futures, and the continued shipments exiting Ukraine ports.

· Paris December wheat was down 1.00 euros at 324.75 euros.

· EU soft wheat exports from July 1 reached 2.49 million tons, up from 2.45 million tons by the same week in 2021-22.

· Iran’s GTC seeks 60,000 tons of wheat on Wednesday for Sep and Oct shipment.

· Jordan passed on 120,000 tons of wheat for Jan/Feb shipment. Three trading houses participated.

· The Philippines seek 120,000 tons of wheat and 120,000 tons of barley on Wednesday for several shipments between October 2022 through January 2023.

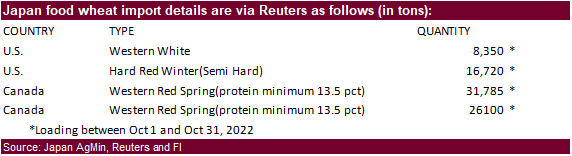

· Japan seeks 82,955 tons of food wheat later this week from the US and Canada.

· Jordan seeks 120,000 tons on Aug. 10 for Dec through Feb shipment.

Rice/Other

· Mauritius seeks 6,000 tons of rice, optional origin, for October 1 and December 31 delivery.

Updated 4/4/22

Chicago – September $7.35 to $8.50 range, December $7.00-$10.50

KC – September $7.70 to $9.00 range, December $7.00-$10.75

MN – September $8.25‐$9.75, December $8.00-$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.