PDF Attached

US

Senate passed the $1 trillion infrastructure bill in a 69-30 vote. Higher wheat and soybeans (rebound) limited losses in corn. Meal gave up gains after soybean oil reversed to trade higher.

WASHINGTON,

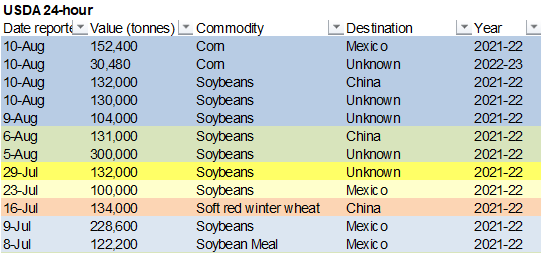

August 10, 202—Private exporters reported to the U.S. Department of Agriculture the following activity:

*Export

sales of 182,880 metric tons of corn for delivery to Mexico. Of the total, 152,400 metric tons is for delivery during the 2021/2022 marketing year and 30,480 metric tons is for delivery during the 2022/2023 marketing year

*Export

sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year

*Export

sales of 130,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

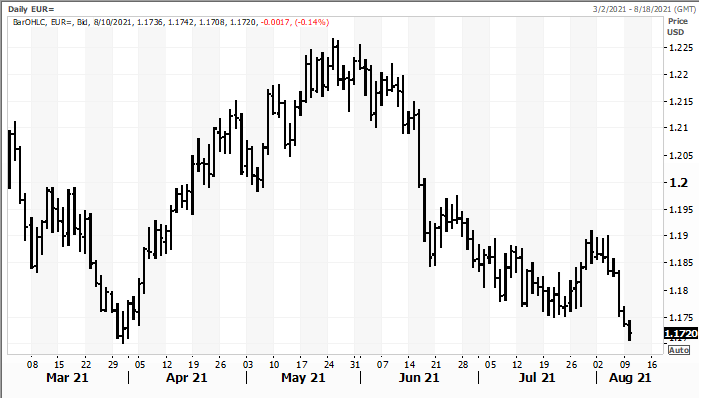

Euro

Weather

By

day 3, rain will hammer the lower Delta, making it way north Day 4-5. By day 6, rain will dissipate as it moves east.

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

-

Rain

fell significantly in southern Manitoba, northeastern North Dakota, and far northwestern Minnesota along with a few locations in south-central Saskatchewan

o

Most of the rainfall varied from 0.30 to 1.00 inch, but local totals to 2.20 inches were noted

o

The moisture was long overdue, a little too late for some crops, but beneficial to those crops that have managed to stay healthy during the drought

o

More rain is needed

-

A

boost in rainfall continues needed throughout Canada’s Prairies and in the western and north-central United States, but no serious changes are expected until the second half of next week when some improved rainfall is expected in Canada and the northern U.S.

Plains – “possibly”

o

The advertised rain event may be a little overdone

o

Some rain from that same system could impact a part of the western U.S. Corn Belt late next week, but confidence is very low for that region to get much more than light showers and a few thunderstorms,

despite today’s 06z GFS model suggesting greater rain

-

U.S.

Midwest weather Monday included scattered showers and thunderstorms and more of the same was expected over the balance of this week to maintain very good crop development potential -

Western

U.S. Corn and Soybean Belt will experience net drying for the coming full week, although a few showers and thunderstorms are possible in the west briefly late this weekend into early next week

o

Some expanding crop moisture stress is expected, but the decline in crop conditions will be gradual especially for those areas getting rain recently

-

A

good mix of weather is predicted for the U.S. Delta and southeastern states through the weekend -

Tropical

Storm Fred may bring significant rain to western Florida and parts of the U.S. southeastern states late in the coming weekend through the first half of next week

o

Very few cotton bolls are open in the region which should minimize the impact on that crop

o

Some heavy rain may occur, but flooding is not likely to be great enough to seriously harm crops

o

Citrus trees and fruit should not be seriously impacted in Florida unless then storm become more intense than predicted and it moves directly over the peninsula which is not currently expected

-

Very

warm to hot temperatures in the central and southern U.S. Plains Monday was good for degree day accumulations in West Texas, but stressful for livestock and unirrigated summer crops

o

Extreme highs were in the upper 90s to 106 degrees Fahrenheit

o

The heat will slowly abate this week, but another couple of warm to hot days will occur first

-

West

Texas, the Texas Panhandle and Blacklands will experience a good mix of rain and sunshine through the coming week resulting in a very good environment for corn, sorghum, cotton, and other crops -

South

Texas cotton, corn and sorghum harvesting will advance with little weather-related delay due to dry conditions that will dominate the next ten days -

Far

western U.S. weather will continue warm and dry for the next ten days -

An

active monsoon season will continue from Arizona and New Mexico northward into Montana with daily showers and thunderstorms expected offering a few pockets of locally heavy rainfall -

Canada

Prairies are unlikely to see significant changes in weather over the next ten days, despite the GFS model trying to produce significant rain in the Prairies for next week.

o

Showers will occur today in southern and eastern parts of the Prairies with Manitoba getting some additional rain Tuesday

o

After this event is over the region will experience cooler and drier conditions for a while late this week and then a strong warming trend is expected during the weekend and early next week with

restricted rainfall continuing

o

Extreme low temperatures in the 40s and a few upper 30s may occur with this week’s cold high pressure center as it settles into the Prairies

-

Some

weekend low temperatures in Alberta already slipped into a few 30s Fahrenheit -

Canada

Prairies weather will remain mixed with brief periods of rain and thunderstorms intermixing with mild to warm temperatures during the next ten days

o

Early season harvest are possible at times, but no serious harm to early maturing crops is expected

o

Late season crops will benefit from the moisture

-

Southeast

Canada corn, soybean and wheat production areas will be warm biased with periodic rain expected this week and then drier weather next week

o

The bottom line environment will be good for summer crops and wheat harvest delays will occur periodically

-

Europe’s

weather this week will trend drier and warmer favoring a much better harvest environment for its small grain and winter rapeseed harvest

o

This marks an end to a lengthy period of frequent rain that delayed fieldwork and raised some crop quality issues

-

Southeastern

Europe will continue to deal with dryness and crop moisture and heat stress this week

o

The Balkan countries will be most impacted and could experience a net decline in crop conditions with unirrigated summer crops losing a little yield potential without greater rain soon

-

A

monsoon depression forms in the Bay of Bengal this coming weekend before moving inland across India from Odisha and northeastern Andhra Pradesh into northeastern Maharashtra and southern Madhya Pradesh early next week.

o

The system is not expected to be a big rain producer, but some increased rainfall will evolve supporting summer crops more than harming them

-

Northwestern

India and central and southern Pakistan will continue dry biased for the next two weeks

o

Gujarat, western and northern Rajasthan, Haryana , Punjab, and the middle and southern parts of Pakistan will be left driest leading to stress for most unirrigated crops

-

Southeast

Asia nations will all receive sufficient rain to support crops during the next two weeks

o

The forecast includes an improving rain distribution for Sumatra, Java, Kalimantan, Thailand, and the central and southern Philippines all of which have been trending a little too dry recently

-

China

rain this week will be greatest in the Yangtze River Basin and areas to the south where sufficient rain will fall to keep the ground saturated and for some local flooding.

o

Rainfall elsewhere will be more favorably mixed with bouts of dry and warm weather supporting very good crop development

-

East-central

Africa rainfall in this coming week will continue abundant in Ethiopia and a routine occurrence of rain will also occur in Kenya and Uganda -

West

Central Africa rainfall during the weekend was limited in coffee, cocoa, sugarcane, and rice areas, but timely in cotton areas

o

Rain will continue to fall periodically over the next couple of weeks, although the lightest rainfall will continue in Ivory Coast and Ghana

-

CIS

crop areas will be wettest across the north from the Baltic States through northern Russia during the next ten days

o

Rainfall of 1.00 to 2.00 inches is expected with a few amounts reaching 2.00 to 4.00 inches

o

Southern Russia rainfall will be more restricted, but some showers are expected

-

Some

significant rain will fall in Krasnodar and the southwestern one-third of Russia’s Southern Region where 1.50 to more than 4.00 inches is possible

o

Kazakhstan rainfall will be minimal for the coming week and temperatures will continue very warm to hot at times

o

Net drying is expected in Ukraine, much of the Volga River Basin and from northeastern parts of Russia’s Southern Region into Kazakhstan

-

Australia

weather will continue favorably for wheat, barley and canola which are semi-dormant at this time of year. Soil moisture is favorable and ready to support spring growth when warming comes along especially if timely rainfall continues a advertised

o

Queensland and northern New South Wales still need significant rain to restore soil moisture after recent drying

-

Argentina

will be dry through Monday with some rain possible later next week in the south and east

o

Western parts of the nation will continue dry and will need greater rain prior to spring to protect wheat and barley production potentials and to improve spring planting prospects

-

Brazil

weather was mostly Monday except for a few showers in the far south -

Rain

will occur infrequently in southern Brazil during the next ten days benefiting wheat production areas and possibly improving some moisture for early season corn planting and establishment -

South

Africa weather was dry Monday except for a few coastal showers

o

A greater rain event is possible late this week and into the weekend that may bring some needed moisture from Western and Eastern Cape into Free State

-

The

event may be a little overdone in the forecast model runs today and a little caution is advised before fully buying into the event, but rain is needed in Free States and this would be very helpful for dryland wheat establishment if it verifies

-

Follow

up rain will still be needed -

Southern

Oscillation Index has reached +10.45 and it will vary in a narrow range for a while -

Mexico

weather will remain wettest in the far west and extreme south for the next ten days

o

Greater rain is needed in the northeast

o

Crop conditions have improved in recent weeks especially in the west

-

Central

America rainfall has been plentiful and will remain that way for the next ten days -

New

Zealand rainfall during the coming week will be above average in southern parts of North Island and western parts of South Island

o

temperatures will be seasonable with a slight cooler bias

Source:

World Weather Inc.

Tuesday,

Aug. 10:

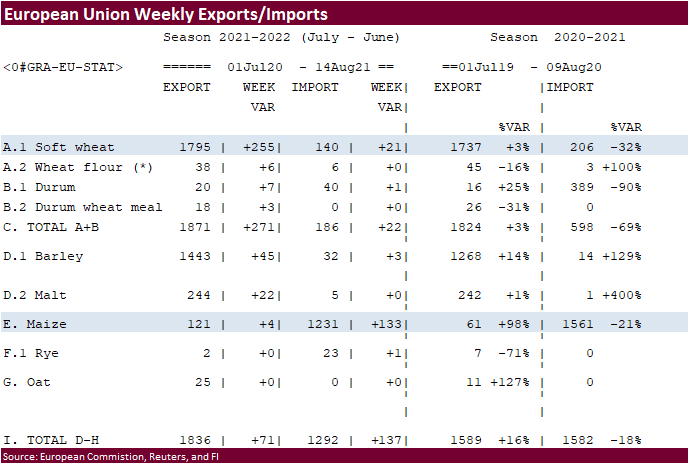

- EU

weekly grain, oilseed import and export data - Brazil’s

Conab releases data on yield, area and output of corn and soybeans - Purdue

Agriculture Sentiment - HOLIDAY:

Malaysia

Wednesday,

Aug. 11:

- EIA

weekly U.S. ethanol inventories, production - Malaysian

Palm Oil Board’s stockpiles, output and production data - Brazil’s

Unica publishes data on cane crush and sugar output (tentative) - Vietnam’s

customs department releases July trade data - EARNINGS:

JBS, Wilmar - HOLIDAY:

Indonesia

Thursday,

Aug. 12:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China

farm ministry’s monthly supply-demand report (CASDE) - New

Zealand Food Prices - Port

of Rouen data on French grain exports - HOLIDAY:

Thailand

Friday,

Aug. 13:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - EARNINGS:

Olam, Golden Agri

Source:

Bloomberg and FI

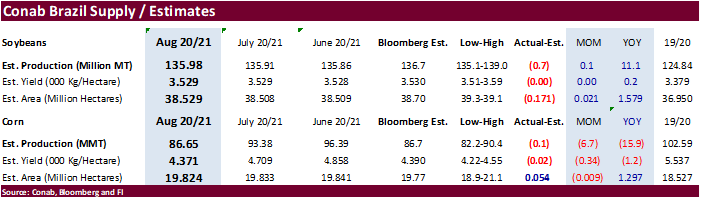

Conab

was out this morning

US

Senate Passes $1 Tln Infrastructure Bill In 69-30 Vote

- US

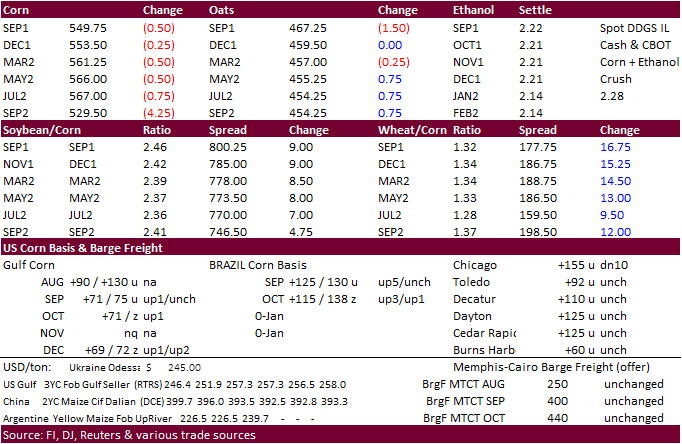

corn futures ended lower but losses were limited from higher wheat and a USDA 24-hour export announcement of 182,880 tons. US corn conditions improved 2 points last week. IL was up 11 points. IA was down one point and IN was down 2. Missouri corn improved

6 points. SD was down 2. -

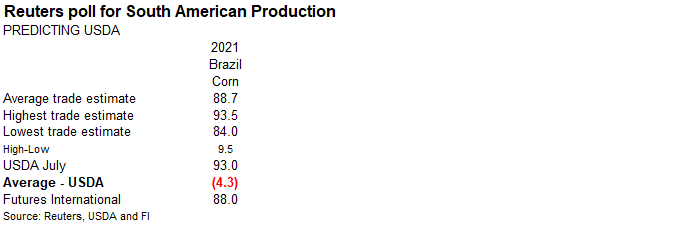

Conab

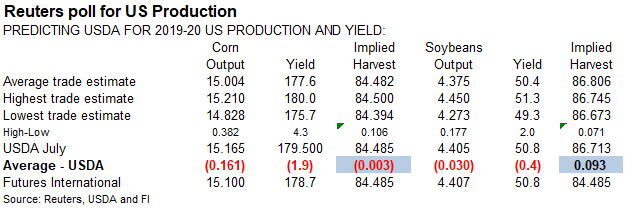

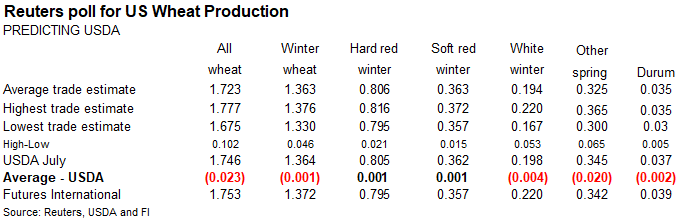

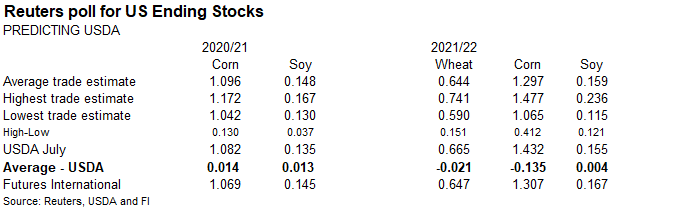

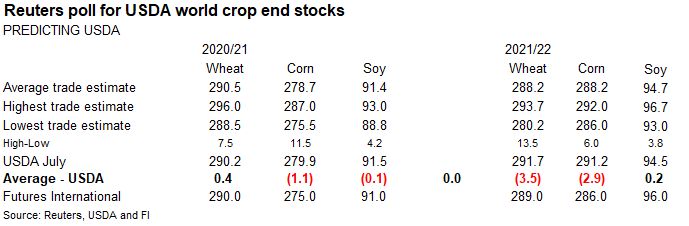

decreased their Brazil 2020-21 corn production by 6.7 million tons to 86.7 million, only 100,000 tons below a Bloomberg trade average and 15.9 million below year ago. This was neutral in our opinion. USDA could cut their Brazil corn outlook by more than

5 million tons when updated Thursday (trade looking for 4.3 MMT decrease to 88.7 MMT from USDA July of 93.0 MMT).

- China

will auction off 36,789 tons of imported Ukrainian corn and 265,667 tons of imported US corn on August 13.

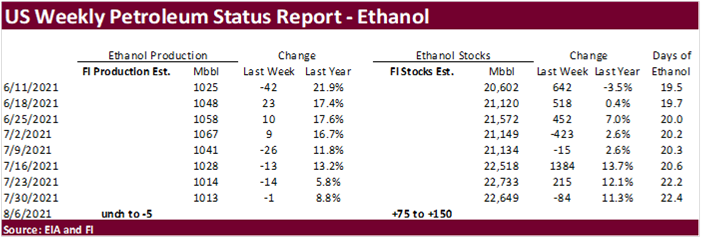

- A

Bloomberg poll looks for weekly US ethanol production to be down 3,000 barrels (995-1022 range) from the previous week and stocks down 32,000 barrels to 22,617 million.

- USDA

FAS noted the US June ethanol exports were 81.86 million gallons and 939,177 tons of distillers grains. Ethanol exports are above 70.4 million gallons in May and 81.3 million in June 2020. - The

European Union granted imports licenses for 133,000 tons of corn imports, bringing cumulative 2020-21 imports to 1.231 million tons, 21 percent below same period year ago.

Export

developments.

- Under

the USDA 24-hour reporting system, private exporters sold 182,880 tons of corn for delivery to Mexico. Of the total, 152,400 tons is for delivery during the 2021/2022 marketing year and 30,480 tons is for delivery during the 2022/2023 marketing year.

- Jordan

issued an import tender for 120,000 tons of feed barley on August 12 for Late October through December shipment.

- Qatar

seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery.

September

corn is seen is a $5.25-$6.00 range.

December

corn is seen in a $4.25-$6.00 range.

-

USDA

sales announcements to unknown & China supported soybean futures. They were already higher headed into the day session from a rebound in US energy markets and gold. Offshore values were leading the products higher after EU meal and global vegetable oil prices

failed to follow the lower CBOT complex trade on Monday. -

Conab

increased their Brazil 2020-21 soybean production by 100,000 tons to 135.6 million, 700,000 below a Bloomberg trade average and 11.1 million above year ago. This was neutral in our opinion.

-

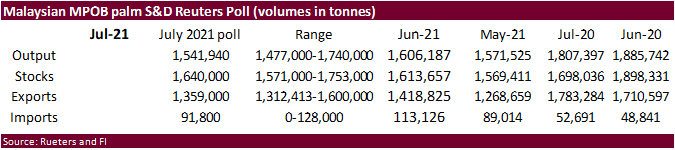

Malaysia

was on holiday and overnight S&D data will be released by MPOB. -

Cargo

surveyor ITS reported Malaysian palm shipments for the Aug 1-10 period at 364,546 tons, a 13% decrease from 418,145 tons during the same period a month ago.

-

Keep

an eye on global soybean meal tender developments. India’s decision to allow for 1.5 million tons of soybean meal imports for animal feed use may immediately attract some business.

-

ICE

Chat: Biden Admin. Weighs 2050 Target For Airlines To Run On 100% Jet Fuel From Renewable Resources – RTRS Sources -

Reminder:

Pro Farmer crop tour starts Tuesday, Aug 17, lasting until Friday the 20th.

-

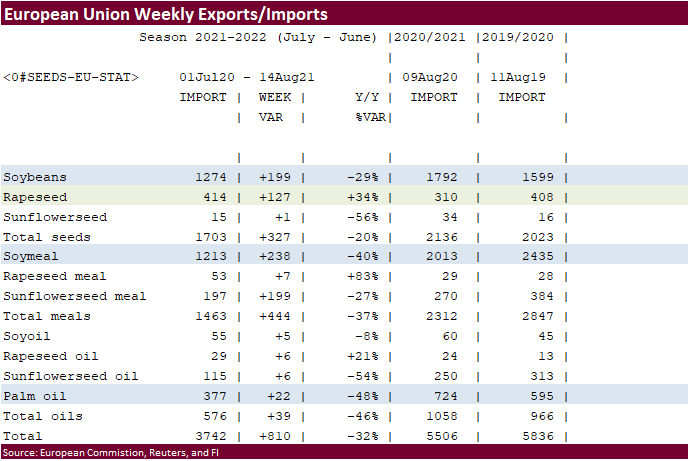

The

European Union reported soybean import licenses since July 1 at 1.274 million tons, below 1.792 million tons a year ago. European Union soybean meal import licenses are running at 1.213 million tons so far for 2020-21, below 2.013 million tons a year ago.

EU palm oil import licenses are running at 377,000 tons for 2020-21, below 724,000 tons a year ago, or down 48 percent.

Export

Developments

- Under

the USDA 24-hour reporting system, private exporters sold: - 132,000

tons of soybeans for delivery to China during the 2021/2022 marketing year.

- 130,000

tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year. - South

Korea’s Agro-Fisheries & Food Trade Corp. seeks 3,700 tons of non-GMO soybeans on August 19 for arrival between Oct. 20 and Nov. 19. - USDA

On August 17 seeks 290,000 tons of veg oil for use in export programs. 210 tons in 4-liter cans and 80 tons in 4 liter cans or plastic bottles, for shipment Sep16 to Oct 15 (Oct 1-31 for plants at ports).

Updated

8/9/21

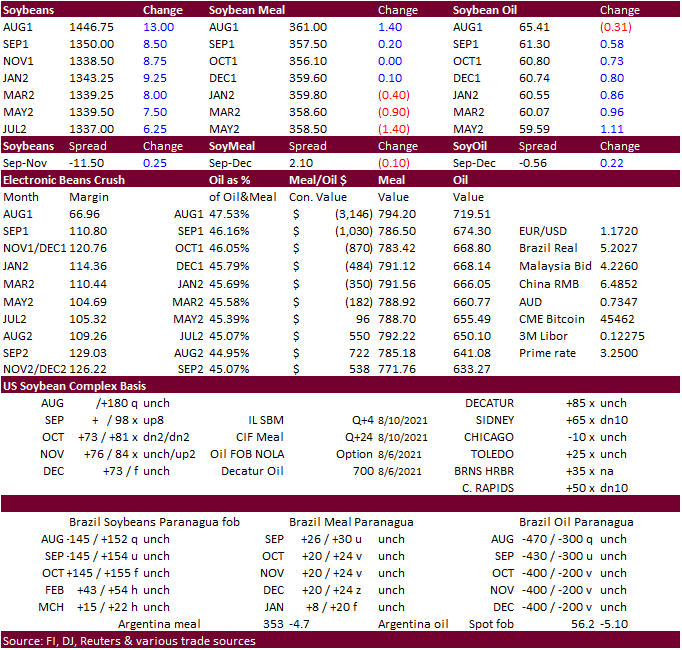

September

soybeans are seen in a $12.75-$14.50 range; November $11.75-$15.00

September

soybean meal – $335-$370; December $320-$425

September

soybean oil – 58.50-65.00; December 48-67 cent range

- US

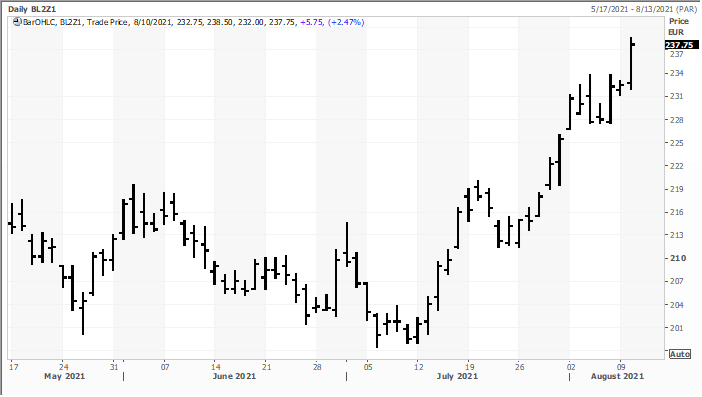

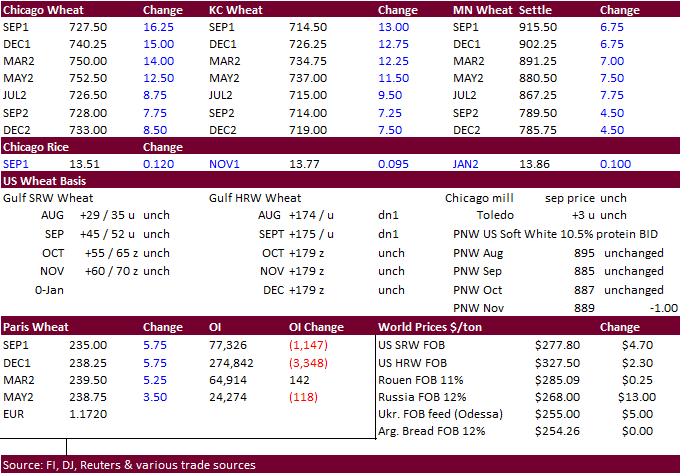

wheat ended higher on fresh contract highs in Paris wheat, strong world demand and ongoing concerns over the Russian crop. Chicago and KC gained over MN after USDA reported US spring wheat conditions improved over the past week.

- Russia’s

Southern Region and Kazakhstan will experience more dry weather while southeastern Europe will see heat and net drying this week.

- Paris

December wheat hit a new contract high on crop concerns, increase in global tenders and weakness in the euro. It settled up 5.25 euros, or 2.3%, at 237.75 euros ($278.57) a ton.

- The

European Union granted export licenses for 255,000 tons of soft wheat exports, bringing cumulative 2020-21 soft wheat export commitments to 1.795 million tons, up from 1.737 million tons committed at this time last year, a 3 percent increase. Imports are

down 32% from year ago at 140,000 tons.

Source:

Reuters and FI

- US

spring wheat conditions increased one point and harvest progress was up 21 points to 38 (5 points above a trade guess and compares to 14 year ago and 21 average).

- Morocco

seeks 363,000 tons of US durum wheat under a tariff import quota on August 24 for shipment by December 31.

- Jordan

is back in for 120,000 tons of wheat on August 11. - Japan

(SBS) seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on August 18 for loading by November 30.

- Bangladesh

seeks 50,000 tons of wheat on August 18. - Pakistan

seeks 400,000 tons of wheat on August 23 for Sep/Oct shipment.

Rice/Other

- (Bloomberg)

— U.S. 2021-22 cotton production seen at 18.15m bales, 346,000 bales above USDA’s previous est., according to the avg in a Bloomberg survey of 11 analysts.

Estimates

range from 17.6m to 19.4m bales

U.S.

ending stocks seen at 3.5m bales vs 3.3m in July

Global

ending stocks seen 402,000 bales higher at 88.14m bales

-

South

Korea’s Agro-Fisheries & Food Trade Corp. seeks 39,226 tons of rice from the United States for arrival in South Korea on Jan. 31 and March 31, 2022.

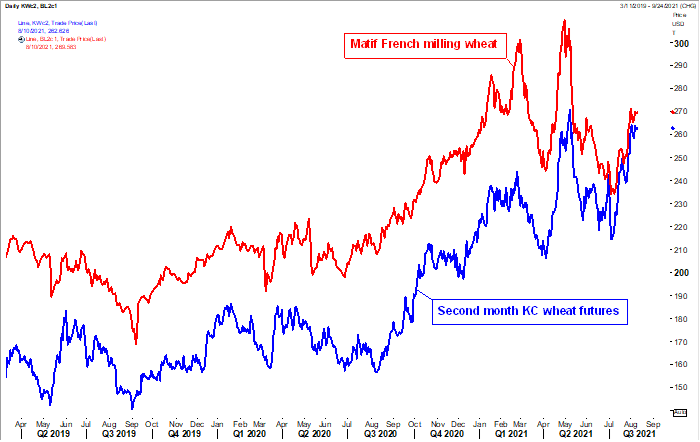

KC

versus Paris wheat

Source:

Reuters and FI

Updated 8/9/21

September Chicago wheat is seen in a $6.50‐$7.50 range

September KC wheat is seen in a $6.50‐$7.35

September MN wheat is seen in a $8.50‐$9.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.