PDF Attached

Private

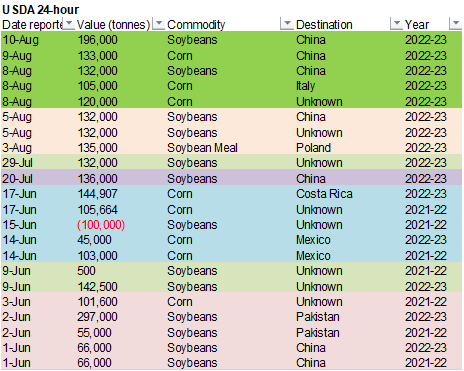

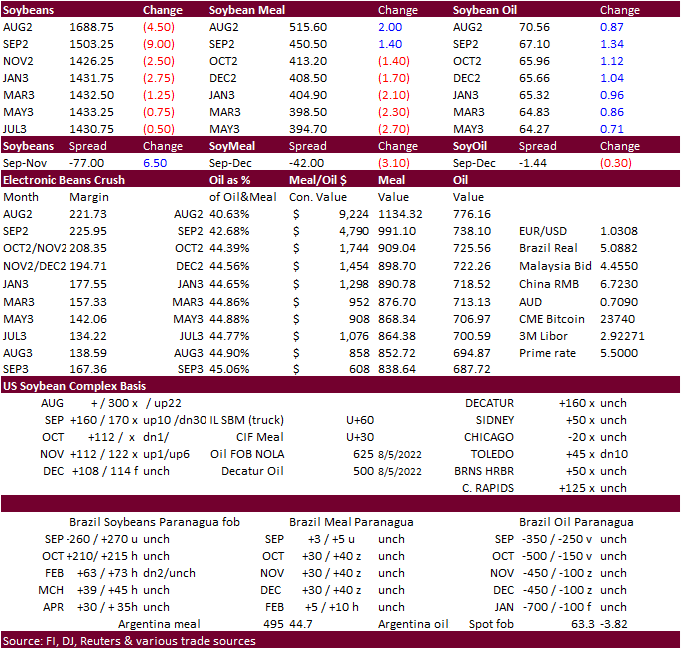

exporters reported sales of 196,000 metric tons of soybeans for delivery to China during the 2022/2023 marketing year.

US

inflation report (CPI) was bullish equities and bearish USD. WTI crude oil rallied. Grains started and ended higher. The US weather forecast this morning was mostly unchanged, but the midday did hint an increase in precipitation across the west for the back

end of the models. Soybean and meal spreads firmed early only to collapse on profit taking. Meal / oil spreading saw a large correction, also from profit taking. Positioning ahead of the USDA report should not be ruled out. Grains ended higher in part to the

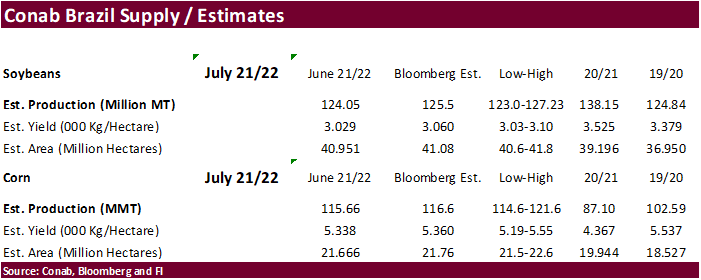

100+ points decline in the USD. Brazil’s Conab supply update will be released Thursday, then China’s CASDE & USDA on Friday. On Monday NOPA will update their July crush.

![]()

WEATHER

TO WATCH AROUND THE WORLD

- Central

U.S. crop areas are advertised drier today over the next ten days than that of earlier this week, but temperatures will be normal to be below normal

- The

situation will slow the deterioration of crop conditions because of the milder conditions, but rain will eventually be needed - Monsoonal

rainfall is expected to be drawn more abundantly into the interior western and southwestern United States over the next ten days - This

moisture insurgence may eventually reach the northwestern Plains and the southeastern Canada Prairies during the weekend and next week - Most

of the resulting rainfall will be light, but a few stronger storms might occur to bolster topsoil moisture locally - High

pressure over the central United States this weekend and into early next week will shift to the west and may completely dissipate for a short period of time - World

Weather, Inc. believes the ridge will return later this month in the Plains, but much of that feature will be determined by tropical activity - World

Weather, Inc. anticipates the next more favorable period for tropical cyclone development the Atlantic Basin may hold off until after August 19 and specifically in the Aug. 19-23 period

- U.S.

Pacific Northwest is anticipating a new heatwave for next week with temperatures well above normal in both that region and neighboring British Columbia - U.S.

Delta and southeastern states will see a good mix of weather over the next ten days to two weeks - Texas

will get a few showers through Thursday and then have a better chance for showers and thunderstorms in the second half of next week and into the following weekend - The

moisture will come largely too late to seriously change corn, sorghum and cotton production because of adverse conditions that dominated most of the growing season - Any

crop improvement would have a slight impact on production - Canada’s

southwestern Prairies will continue drying out over the next ten days to two weeks, but some scattered showers and thunderstorms will be possible in the southeastern Prairies for brief periods of time late this weekend into next week

- East-central

China is in a significant drying mode that will last for the next ten days - No

rain and very warm to hot temperatures are expected daily - Highs

in the 90s to 108 degrees will occur often just as was reported Monday - Most

of the heat is expected to concentrate on the Yangtze River Basin, but will include much of east-central and southeastern China - China’s

North China Plain and areas northwest to some south-central Inner Mongolia crop areas reported moderate to heavy rain Monday and Tuesday resulting in some flooding - Rainfall

varied from 1.50 to 3.20 inches in general, but local totals reached over 5.00 inches in a few northern Shandong and southern Hebei locations - Northeastern

China, the North China Plain and central Yellow River Basin will experience alternating periods of rain and sunshine for the next two weeks resulting in favorable crop development - Korean

Peninsula began receiving rain Tuesday and it will become heavy at times over the next couple of weeks resulting in some significant flood potential

- Southern

parts of North Korea and much of South Korea will frequent bouts of receive heavy rain

- Flooding

is expected in both areas with 4.00 to 10.00 inches of additional rain expected by the weekend near the North and South Korea border and another round of heavy rain may occur Sunday through Wednesday of next week - Crop

damage may occur to rice production in both North Korea and northern parts of South Korea because of this week’s heavy rain event - A

tropical disturbance will produce significant rain along the Guangdong and Guangxi coasts of China with some heavy rain expected farther inland by a short distance over the next few days.

- Over

11.00 inches occurred in western Guangdong Tuesday into this morning - Lingering

rain of significance will continue from Guangdong into Yunnan and northern Vietnam and northern Laos through the next several days

- Some

rain totals will vary from 5.00 to 12.00 inches during the next seven days and flooding will be a threat to some rice and sugarcane - Xinjiang,

China weather will continue to be well mixed over the next ten days supporting relatively normal crop development - A

sukhovei will evolve later this week and continue into next week in Russia’s Southern Region, western Kazakhstan and eastern Ukraine - A

“sukhovei” is a hot, dry, wind that blows across the Russian Steppes periodically, but in serious episodes it can generate enough heat, low humidity and strong wind to desiccate a crop over a relatively short period of time.

- World

Weather, Inc. is concerned about this coming event because of the potential for it to be a longer lasting one that should result in a prolonged period of 90- and lower 100-degree high temperatures, low humidity and wind speeds of 25 to 40 mph with higher gusts

late this week into next week - Soil

moisture is already low in the lower Volga River Basin and western Kazakhstan including the eastern half of Russia’s Southern Region - A

sukhovei now would not bode well for crops in that region - Soybeans,

sunseed and corn are produced in the region among other crops - These

areas in Russia are already in a net drying mode and the Sukhovei will only exacerbate the situation raising unirrigated crop stress and a potential threat to production

- Central

India will be subjected to excessive rain both this week and next week by three waves of significant rain - The

greatest rain in both weeks will occur from Odisha and northeastern Andhra Pradesh through Chhattisgarh, southern and western Madhya Pradesh and northeastern Maharashtra to southern Rajasthan and Gujarat.

- Rainfall

through Friday of this week will range from 3.00 to 9.00 inches Next week’s rainfall will vary from 2.00 to 6.00 inches early in the week with another 2 to 6 inches possible late in the week and on into the following weekend - Flooding

is expected and some crop damage will result. The region produces an abundance of soybeans, groundnuts, corn, sorghum and some rice. Each of these crops will be vulnerable to some damage. Heavy rain in cotton areas in Gujarat and immediate neighboring areas

should not be quite great as that of central India, but possibly great enough early next week to induce some flooding

- Western

Europe is expected to continue dry biased this week, but next week’s rain potentials are improving

- No

general soaking is expected, but scattered showers and thunderstorms will occur to ease dryness and begin improving “some” crops - Greater

rain may still be needed in many areas - Southeastern

Europe will also experience periodic showers and thunderstorms during the next two weeks resulting in partial relief from dryness, but greater rain will still be needed to end the stressful environment

- Argentina’s

western wheat have resumed a drier weather bias that will prevail for the next ten days - Recent

precipitation was welcome, but not enough to improve long term soil moisture. More rain is needed, but not much is expected for a while. The precipitation was enough to induce some better emergence and establishment in the wetter areas of Cordoba and Santa

Fe. - Southern

Brazil wheat and early season corn production areas will get some additional rain early today and then another round of it Sunday through Friday of next week - The

moisture will be great for bolstering soil moisture - Continued

favorable wheat development conditions are expected as a result of the rain.

- Parana,

Mato Grosso do Sul, Sao Paulo coffee and southern Minas Gerais, citrus, coffee and sugarcane areas received some rain Tuesday and early today - The

moisture was great for improving soil moisture and stimulating a little new crop development - Some

coffee flowering will occur in Parana and southwestern Sao Paulo, but not much of significance was expected in Sul de Minas.

- Excessive

rain is predicted for southern Myanmar rice and sugarcane areas possibly resulting in some crop damage during the next couple of weeks - Other

areas in mainland areas of Southeast Asia will get plenty of rain, but nothing too extreme - Philippines

and Indonesia weather will continue frequently wet during the next ten days

- Australia

weather in the coming ten days will be favorable for most winter crops - Some

greater rain might be desirable in Queensland and parts of interior South Australia, but no crisis is expected in either area - Winter

crop development potential in the spring is looking very good for most of the nation. For now, crops are semi-dormant in many areas, although new crop development has been occurring a little more significantly in Queensland recently.

- East-central

Africa will be most significant in Ethiopia this week while Uganda and Kenya rainfall becomes more sporadic and light.

- Flooding

has been occurring in parts of Ethiopia recently - Tanzania

is normally dry at this time of year and it should be that way for the next few of weeks - “Some”

increase in rain is expected in Uganda next week - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

greater rain would still be welcome in the drier areas of Ivory Coast and Ghana

- Seasonal

rains have shifted northward leading to some drying in southern areas throughout west-central Africa – this is normal for this time of year - Cotton

areas are expecting frequent rainfall in the next couple of weeks - South

Africa’s crop moisture situation is favorable for winter crop establishment, although some rain would be welcome - Restricted

rainfall is expected for a while, but the crop is rated better than usual because of frequent rainfall during the autumn planting season and timely rain since then - Central

America rainfall will continue to be abundant to excessive and drying is needed - Mexico

rain will be most abundant in the west and southern parts of the nation - Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely - Today’s

Southern Oscillation Index was +9.59 and it will move erratically lower over the next week - New

Zealand weather is expected to be quite cool the remainder of this week with rain slowly resuming across the north - Next

week will trend warmer and wetter for most areas, but especially in the north

Source:

World Weather INC

Bloomberg

Ag Calendar

Wednesday,

Aug. 10:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Malaysian

Palm Oil Board’s data on stockpiles, production and exports - Malaysia’s

Aug 1-10 palm oil export data - Brazil’s

Unica to release cane crush, sugar production data (tentative)

Thursday,

Aug. 11:

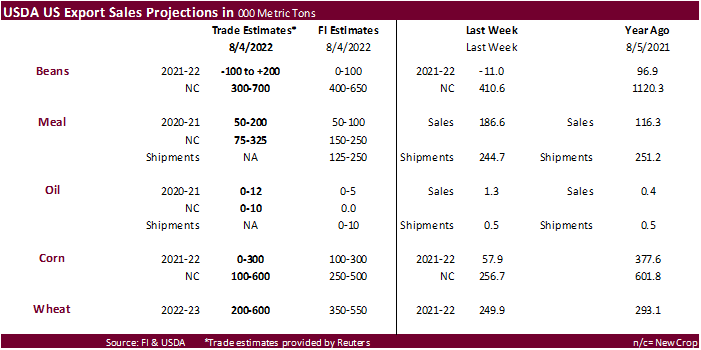

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Brazil’s

Conab to publish output and planting data for soybeans and corn - HOLIDAY:

Japan

Friday,

Aug. 12:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - New

Zealand food prices - FranceAgriMer

weekly update on crop conditions - EARNINGS:

Olam, Golden Agri - HOLIDAY:

Thailand

Source:

Bloomberg and FI

US

CPI (Y/Y) Jul: 8.5% (est 8.7%; prev 9.1)

US

CPI (M/M) Jul: 0.0% (est 0.2%; prev 1.3)

US

CPI Core (M/M) Jul: 0.5% (est 0.5%; prev 0.7)

US

CPI Core (Y/Y) Jul: 5.9% (est 6.1%; prev 5.9)

US

Real Avg Weekly Earnings (Y/Y) Jul: -3.6% (prev 1.3)

US

Real Avg Hourly Earnings (Y/Y) Jul: -3.0% (prev 1.3)

Fed

Seen Raising Interest Rates By 50Bps In September, Based On Fed Funds Futures Pricing

–

Versus 75Bps Hike Seen Before CPI Report

US

Wholesale Inventories (M/M) Jun F: 1.8% (est 1.9%; prev 1.9%)

–

Wholesale Trade Sales (M/M) Jun: 1.8% (est 0.5%; prev R 0.7%)

96

Counterparties Take $2.178 Tln At Fed Reverse Repo Op (prev $2.187 Tln, 95 Bids)

·

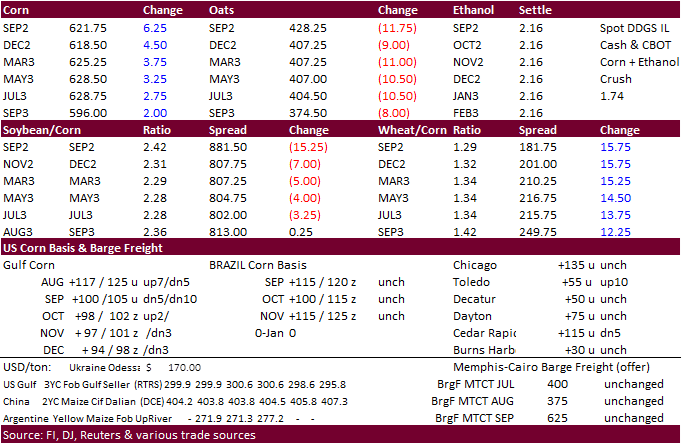

Corn prices opened and ended higher on US corn yield concerns for the north-central and far northwestern Corn Belt. A sharply lower USD supported grain prices. Soybeans sold off and that trimmed some of the gains in corn futures,

but corn spreads remained firm unlike soybeans, a possible sign some traders were unwinding nearby soybean / corn spreads. The SU2/CU2 ratio traded out to 2.457 yesterday, highest level since mid-February, and settled at 2.429 today.

·

Funds bought an estimated net 4,000 corn contracts.

·

EU corn production concerns lent support to US futures.

·

The US CPI report showed inflation rose at a slower pace than expected.

·

News for the agriculture markets was light.

·

A second grain ship to arrive in Ukraine docked in the port of Chornomorsk and will load 30,000 tons of corn.

·

China inflation was 2.7% in July from a year ago, a two-year high. Pork prices were up 20.2% from a year ago.

·

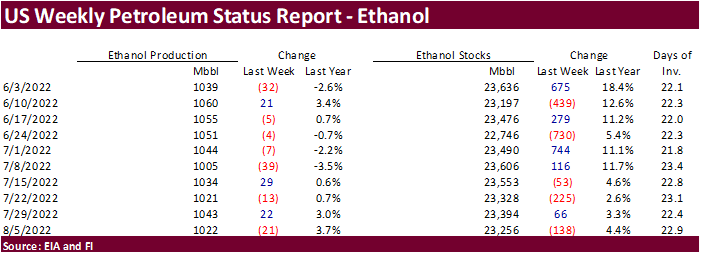

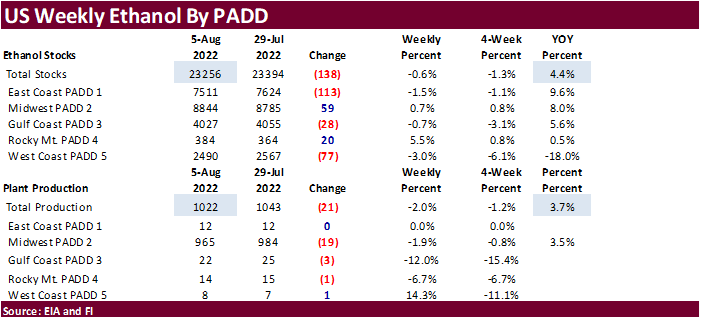

EIA reported US ethanol production for the week ending declined 21,000 barrels per day to 1.022 million, lowest in two weeks and up about 4 percent from this time year ago. A Bloomberg survey was looking for production to decline

8,000 barrels. Stocks fell 138,000 barrels to 23.256 million barrels. The trade was looking for a 118,000 barrel increase. US gasoline demand increased 582,000 barrels to 9.123 million, highest level since the third week of December 2021. Gasoline stocks fell

to their lowest level since early July.

US

DoE Crude Oil Inventories (W/W) 05-Aug: +5.457M (est -1.000M; prev +4.467M)

–

Distillate: +2.166M (est -1.000M; prev -2.400M)

–

Cushing: +723K (prev +926K)

–

Gasoline: -4.978M (est -1.100M; prev +163K)

–

Refinery Utilization: +3.3% (est +0.5%; prev -1.2%)

US

Crude Output Reaches 12.2M Bpd, Highest Since April 2020

·

None reported

Updated

8/10/22

September

corn is seen in a $5.75 and $6.75 range

December

corn is seen in a $5.00-$7.50 range

·

Soybeans and meal started and eventually traded higher, but prices collapsed on profit taking. Nearby soybeans ended lower led by the September position. Back months were higher (March and July). The Midday weather models increased

rain for the western growing areas during the second week of the forecast. Soybean oil started lower but rallied on profit taking in meal/oil spreads and rebound in soybean oil.

·

USDA reported sales of 196,000 tons of soybeans for delivery to China during the 2022-23 marketing year.

·

Despite the late session selling in soybeans and meal funds bought an estimated net 1,000 soybeans, bought 1,000 meal and bought 2,000 soybean oil.

·

We heard an Argentina soybean cargo was sold to China and that China was inquiring for PNW soybeans.

·

Bloomberg said the Rhine River could be become impassible on August 12 for selected locations.

·

Egypt said they have enough strategic vegetable oil reserves for the next 5.3 months.

·

Palm futures snapped a 3-day winning streak on Wednesday.

·

MPOB reported Malaysian July palm oil stocks at 1.773 million tons, 20,000 tons below a Reuters trade guess. Production of 1.574 million tons were near expectations. Exports of 1.322 million tons came in 102,000 tons above expectations.

Imports were 131,000 tons, more than double than that of June and year ago.

·

AmSpec reported Malaysian palm oil exports during the August 1-10 period at 339,669 tons, up 10.2 percent from 308,290 tons from the same period month earlier. ITS reported Aug 1-10 exports at 364,910 tons, up 10.5 percent.

Export

Developments

·

Private exporters reported sales of 196,000 tons of soybeans for delivery to China during the 2022/2023 marketing year.

·

China looks to sell a half a million tons of soybeans out of reserves on August 12.

·

The CCC seeks 4350 tons of vegetable oil for use in export programs on Aug 16 for Sep 9-oct 15 shipment, October for plants at ports.

Updated

8/10/22

Soybeans

– September $14.25-$15.50

Soybeans

– November is seen in a $12.25-$16.00 range

Soybean

meal – September $420-$490

Soybean

oil – September 66.00-69.50.

·

Additional fund buying was seen in US wheat markets, especially with the USD more than 100 points weaker. Fundamental news was light. Some traders cited slowing Russian wheat sales. Earlier Ukraine noted they don’t expect wheat

shipments to start until next month.

·

Funds bought an estimated net 8,000 Chicago wheat contracts. The managed money net short position for Chicago is now estimated at 10,000 contracts.

·

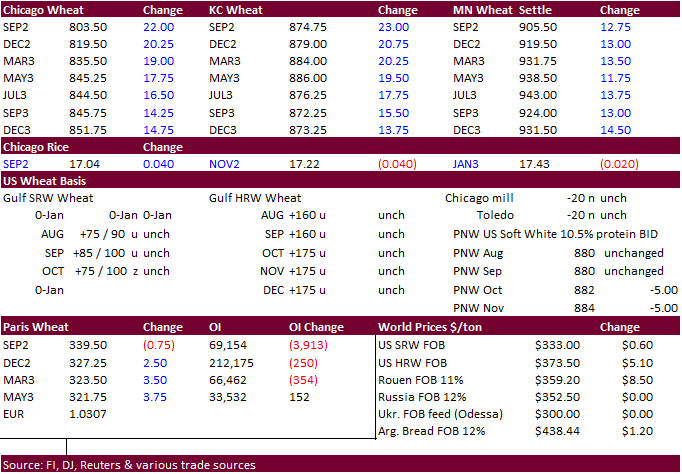

Paris September wheat was down 0.75 euro at 340.50 euros.

·

French wheat protein content varies across the country. Dry weather tends to boost protein content if the crop is in relatively good shape heading into maturity.

·

Egypt said they have enough strategic wheat reserves for the next 7.2 months.

·

Romania’s wheat production fell 15 to 18% to near 9.5 MMT vs 11.3 MMT last year.

·

The Philippines passed on 120,000 tons of wheat and 120,000 tons of barley for several shipment periods between October 2022 through January 2023.

·

Jordan passed on 120,000 tons of barley for Jan/Feb shipment.

·

Jordan issued a new wheat import tender, for 120,000 tons set to close August 16 for Jan/Feb shipment.

·

Results awaited: Iran’s GTC seeks 60,000 tons of wheat on Wednesday for Sep and Oct shipment.

·

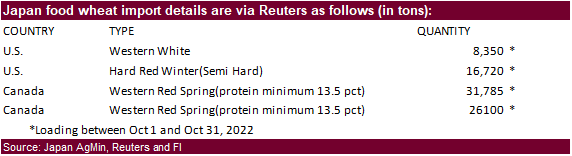

Japan’s AgMin seeks 70,000 tons of feed wheat and 40,000 tons of feed barley on August 19 for arrival by January 26, 2023.

·

Japan bought 82,955 tons of food wheat later this week from the US and Canada.

Rice/Other

·

(Bloomberg) — World 2022-23 production seen 1.1m bales lower than USDA’s previous estimate, according to the avg in a Bloomberg survey of seven analysts.

Avg

est. at 118.97m bales, ranging from 118m to 120m bales

World

ending stocks seen down 580,000 bales to 83.68m bales

US

production seen 750,000 bales lower, and US ending stocks seen 229,000 bales lower

·

Mauritius seeks 6,000 tons of rice, optional origin, for October 1 and December 31 delivery.

Updated

8/10/22

Chicago

– September $7.60 to $8.30 range,

December $7.00-$10.50

KC

– September $8.30 to $9.10 range,

December $7.00-$10.75

MN

– September $8.65‐$9.50,

December $8.00-$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.