Funds

N/A at time this was sent

Attached

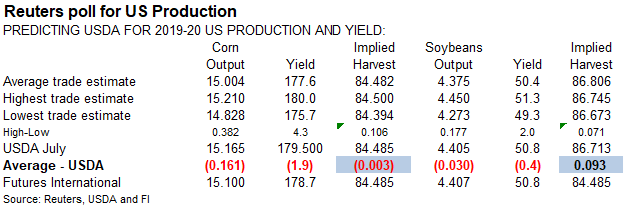

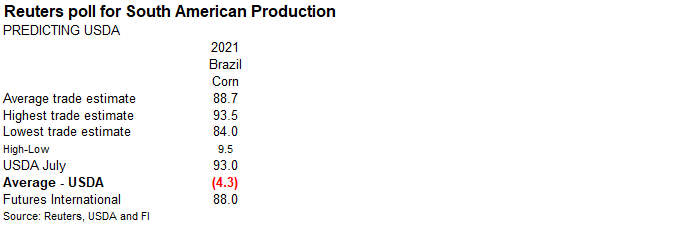

is our updated US corn S&D (changes can be found under the corn section).

MPOB

Malaysian palm oil S&D data was bullish and this lifted CBOT soybean oil and back month soybeans higher. Meal was on the defensive. Rotterdam cash vegetable oil prices were sharply higher and meal unchanged to 3 euros lower. CBOT corn traded higher following

soybeans. Wheat traded two-sided, ending lower. Thursday

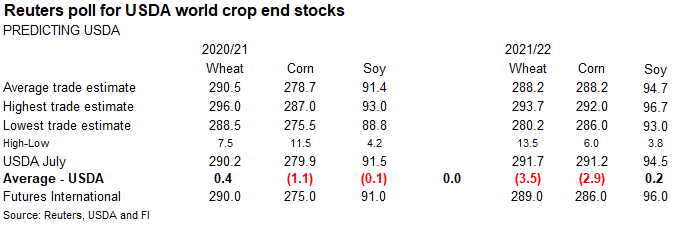

USDA will update their S&D’s. We may also see a China CASDE update overnight.

Weather

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

- Tropical

Storm Fred will impact Dominican Republic today and Cuba Thursday and Friday

o

The storm will produce some heavy rain and windy conditions, but crop impacts are expected to be low due to the storm’s weak intensity

o

Fred will become a threat to Florida Friday through Monday with heavy rain expected to begin in the Keys and along the southwest coast late Friday into the weekend

o

Landfall is still expected near the Apalachicola area of northwestern Florida late Sunday or Monday

- Another

disturbance in the eastern tropical Atlantic Ocean will be closely monitored for possible development through the weekend

o

This disturbance should take a path to the left (west) of Tropical Storm Fred which might bring the system into the Gulf of Mexico next week

- Confidence

is very low, though - Another

heat wave is expected to evolve in the far western U.S. and western Canada over the next few days before advancing east into the Canada Prairies and northern U.S. Plains this weekend and early next week

o

Temperature extremes in the 90s and over 100 degrees Fahrenheit will occur in many areas once again and little to no rain will occur as the heatwave evolves

o

Most of the heat wave will shift to Ontario, Quebec and a part of both the U.S. Great Lakes region and northeastern states next week

- Cooling

that follows the North America heat wave over the next week to ten days will be significant in western Canada and the U.S. Pacific Northwest

o

A strong low-pressure center is expected to evolve as a frontal system develops separating the heat wave from the cooler air to the west

- The

low-pressure center “may” pull some monsoon moisture from the Rocky Mountain region and some Gulf of Mexico moisture northward to set the stage for some significant rain in parts of the northern Plains and Canada’s Prairies

- The

environment looks favorable of slow-moving thunderstorms and some significant rain, but the event is too far away to have high confidence.

- The

situation should be closely monitored, though - Florida

citrus is not likely to be seriously impacted by Tropical Storm Fred unless the storm becomes more intense than expected

o

Some wind gusts of 40 to 50 mph may occur in western production areas as the storm passes by to the west

o

Excessive rain and flooding is expected mostly in coastal areas

- Flooding

may be greatest from Naples through Sarasota and possibly the Tampa Bay area and the mostly in northwestern Florida away from key crop areas - Florida

sugarcane is not likely to be seriously impacted by Tropical Storm Fred as long as the storm follows the path advertised by the U.S. National Hurricane Center - U.S.

central and southern Plains will experience sporadic shower and thunderstorm activity during the next week to ten days resulting in favorable mix of weather for many crops

o

Unirrigated summer coarse grain and oilseed crops would benefit from greater rainfall

- West

Texas cotton would benefit from warmer temperatures at least some rainfall

o

The moisture is expected, but temperatures may be a little milder than desired for a while

- U.S.

Delta weather will be favorably mixed over the next ten days for crop development

o

Harvest progress will advance around the precipitation

- South

Texas weather is expected to be dry for ten days favoring cotton, corn and sorghum harvesting

o

Rain is needed for citrus, sugarcane and many fruit and vegetable areas, although irrigation water is available and support most crops.

- U.S.

southeastern states will receive a good mix of rain and sunshine into the weekend, but could turn much wetter Sunday into Wednesday of next week due to Tropical Storm Fred

o

The storm is unlikely to produce damaging conditions for very many crops, but some flooding rain is expected and windy conditions should stay mostly in northwestern Florida

- Canada’s

Prairies will receive a few showers and experience cool weather into Friday morning

o

Warming is expected in western parts of the Prairies Friday and throughout the region Saturday and Sunday

- Temperatures

will rise from the 40s Fahrenheit Thursday and Friday mornings in the east to highs in the 90s to over 100 during the weekend

o

Cooling is expected next week and some thunderstorms producing significant rain may impact a part of the region as the cooler air arrives

- Far

western Alberta and the southeastern Prairies may be wettest next week - Southeastern

Canada corn and soybean production areas will experience a good mix of weather during the next ten days, although several days of drying and rising temperatures are expected from this weekend into next week

o

Soil moisture will become depleted in some areas and extreme temperatures may impact a part of the region briefly

o

Good wheat harvest conditions are expected as the region becomes drier

- Europe’s

weather this week will trend drier and warmer favoring a much better harvest environment for its small grain and winter rapeseed harvest

o

This marks an end to a lengthy period of frequent rain that delayed fieldwork and raised some crop quality issues

- Southeastern

Europe will continue to deal with dryness and crop moisture and heat stress this week

o

Temperatures will be hottest this weekend through at least the middle of next week

o

The Balkan countries will be most impacted and could experience a net decline in crop conditions with unirrigated summer crops losing a little yield potential without greater rain soon

o

Showers and some cooling may occur late next week and into the following weekend

- A

monsoon depression forms in the Bay of Bengal this coming weekend before moving inland across India from Odisha and northeastern Andhra Pradesh into northeastern Maharashtra and southern Madhya Pradesh next week.

o

The system is not expected to be a big rain producer, but some increased rainfall will evolve supporting summer crops more than harming them

- Northwestern

India and central and southern Pakistan will continue dry biased for the next ten days with some rain possible after Aug. 20

o

Gujarat, western and northern Rajasthan, Haryana , Punjab and the middle and southern parts of Pakistan will be left driest leading to stress for most unirrigated crops

- Southeast

Asia nations will all receive sufficient rain to support crops during the next two weeks

o

The forecast includes an improving rain distribution for Sumatra, Java, Kalimantan, Thailand and the central and southern Philippines all of which have been trending a little too dry recently

- China

rain this week will be greatest in the Yangtze River Basin and areas to the south where sufficient rain will fall to keep the ground saturated and for some local flooding.

o

Rainfall elsewhere will be more favorably mixed with bouts of dry and warm weather supporting very good crop development

- East-central

Africa rainfall in this coming week will continue abundant in Ethiopia and a routine occurrence of rain will also occur in Kenya and Uganda - West

Central Africa weather will be seasonable over the next two weeks

o

Rain fell significantly Tuesday in central and northern Ivory Coast benefiting some coffee and cocoa production areas

o

Rain will continue to fall periodically over the next couple of weeks, although the lightest rainfall will be in southern Ivory Coast and Ghana

- CIS

crop areas will be wettest across the north from the Baltic States through northern Russia during the next ten days

o

Rainfall of 1.00 to 2.00 inches is expected with a few amounts reaching 2.00 to 4.00 inches

o

Southern Russia rainfall will be more restricted, but some showers are expected

- Some

significant rain will fall in Krasnodar and the southwestern one-third of Russia’s Southern Region where 2.00 to more than 6.00 inches is possible - Wettest

near the Black Sea coast

o

Kazakhstan rainfall will be minimal for the coming week and temperatures will continue very warm to hot at times

o

Net drying is expected in much of Ukraine, much of the Volga River Basin and from northeastern parts of Russia’s Southern Region into Kazakhstan

o

Rain is expected in northern parts of Russia’s Southern Region into the lower Volga River Basin benefiting some late summer crops

- Australia

weather will continue favorably for wheat, barley and canola which are semi-dormant at this time of year. Soil moisture is favorable and ready to support spring growth when warming comes along especially if timely rainfall continues as advertised

o

Queensland and northern New South Wales still need significant rain to restore soil moisture after recent drying

- Argentina

will be dry through Monday with some rain possible later next week in the south and east

o

Western parts of the nation will continue dry and will need greater rain prior to spring to protect wheat and barley production potentials and to improve spring planting prospects

- Rain

will occur infrequently in southern Brazil during the next ten days benefiting wheat production areas and possibly improving some moisture for early season corn planting and establishment - South

Africa weather was dry Tuesday

o

A greater rain event is possible Friday into the weekend that may bring some needed moisture from Western and Eastern Cape into Free State

- Rainfall

will be light, but beneficial to unirrigated wheat areas in particular - Follow

up rain will still be needed - Southern

Oscillation Index has reached +10.21 and it will vary in a narrow range for a while - Mexico

weather will remain wettest in the far west and extreme south for the next ten days

o

Greater rain is needed in the northeast

o

Crop conditions have improved in recent weeks especially in the west

- Central

America rainfall has been plentiful and will remain that way for the next ten days - New

Zealand rainfall during the coming week will be above average in the coming week while temperatures are a little cooler than usual

Source:

World Weather Inc.

Wednesday,

Aug. 11:

- EIA

weekly U.S. ethanol inventories, production - Malaysian

Palm Oil Board’s stockpiles, output and production data - Brazil’s

Unica publishes data on cane crush and sugar output (tentative) - Vietnam’s

customs department releases July trade data - EARNINGS:

JBS, Wilmar - HOLIDAY:

Indonesia

Thursday,

Aug. 12:

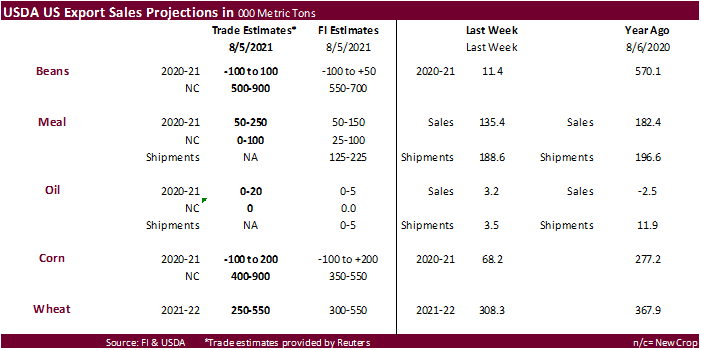

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China

farm ministry’s monthly supply-demand report (CASDE) - New

Zealand Food Prices - Port

of Rouen data on French grain exports - HOLIDAY:

Thailand

Friday,

Aug. 13:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - EARNINGS:

Olam, Golden Agri

Source:

Bloomberg and FI

70

Counterparties Take $1000.46 Bln At Fed’s Fixed-Rate Reverse Repo (prev $998.654 Bln, 71 Bidders)

US

CPI (M/M) Jul: 0.5% (est 0.5%; prev 0.9%)

US

CPI Ex Food, Energy (Y/Y) Jul: 4.3% (est 4.3%; prev 4.5%)

US

CPI Ex Food, Energy (M/M) Jul: 0.3% (est 0.4%; prev 0.9%)

US

Real Avg Weekly Earnings (Y/Y) Jul: -0.7% (prevR -1.0%; prev -1.4%)

US

Real Avg Hourly Earnings (Y/Y) Jul: -1.2% (prevR -1.6%; prev -1.7%)

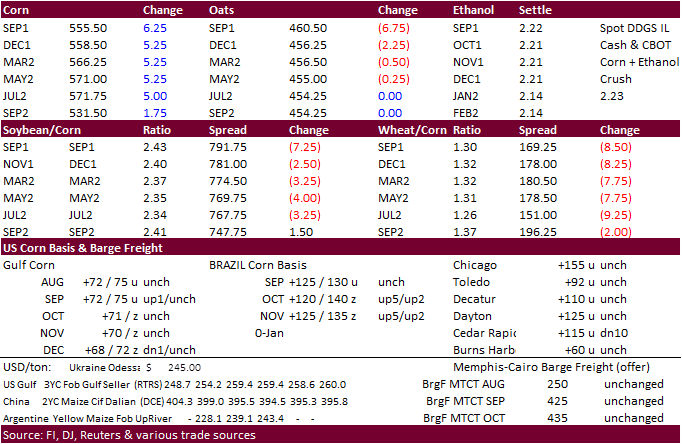

- US

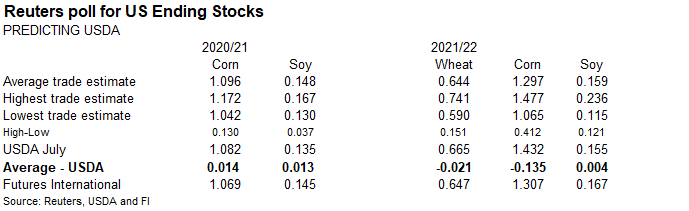

corn futures ended 5.75-7.00 higher led by bull spreading. Short covering was suspected ahead of the USDA report due out 11 am CT Thursday.

USD

was down 17 points by close. - Based

on June export data and corn inspections through Monday, we lowered our corn export projection to 2.800 billion bushels and compares to 2.850 billion by USDA. USDA may increase feed use by 25 million on Thursday and lower exports by 50 and leave corn for

ethanol unchanged. - FI

US corn S&D attached. - Note

the Pro Farmer crop tour starts Tuesday, Aug 17, lasting until Friday the 20th.

- The

USDA Broiler Report shower broiler-type eggs set in the United States up 4 percent and chicks placed down 2 percent. Cumulative placements from the week ending January 9, 2021, through August 7, 2021, for the United States were 5.79 billion. Cumulative placements

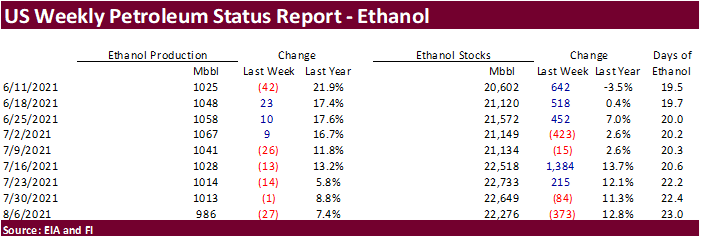

were up slightly from the same period a year earlier. - The

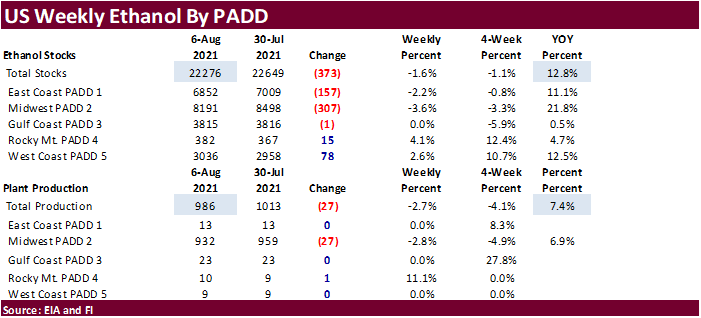

weekly US ethanol production fell 27,000 barrels per day to 986,000 barrels (trade was looking for down 3,000 barrels) and stocks decreased 373,000 barrels to 22.276 million (trade was looking down 32,000). Production was lowest since May 7. Ethanol production

on a corn crop-year basis appears to be on track to expand 3.5% from the previous season. US gasoline stocks fell 345,000 barrels to 9.430 million. Ethanol blended into finished motor gasoline was 93.9% last week, up from 93.1% previous week. We lowered

our 2020-21 corn for ethanol use to 5.059 billion from 5.077 billion previously, above 5.050 billion USDA July. For 2021-22 we maintain a 5.150 outlook.

Export

developments.

- South

Korea’s MFG seeks 120,000 tons of corn on August 11. - Jordan

seeks 120,000 tons of feed barley on August 12 for Late October through December shipment.

- China

will auction off 36,789 tons of imported Ukrainian corn and 265,667 tons of imported US corn on August 13.

- Qatar

seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery.

September

corn is seen is a $5.25-$6.00 range.

December

corn is seen in a $4.25-$6.00 range.

-

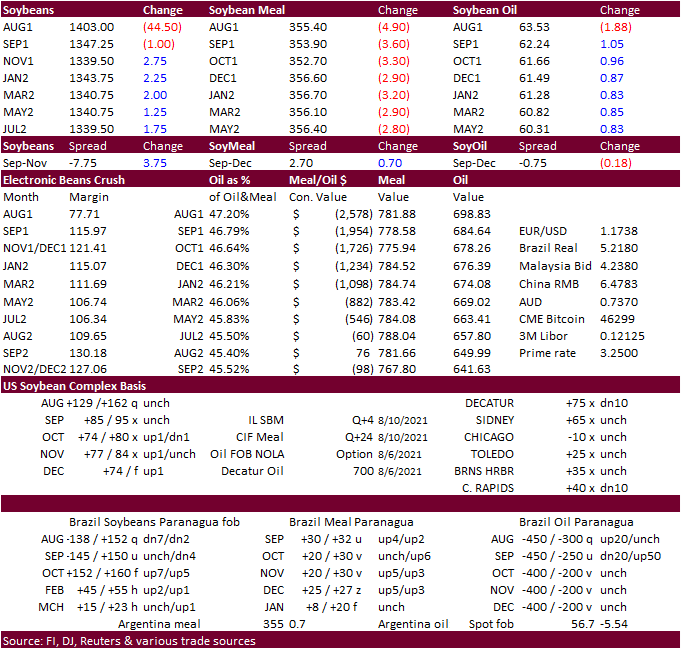

Soybeans

were higher to start but the front two-month contracts ended lower. Expiring August fell 42 cents and September was down 1.25. November ended 3.25 cents higher. USD was down 17 points by close.

-

Meal

was on the defensive and September ended $3.60 lower. Rotterdam cash vegetable oil prices are sharply higher and meal unchanged to 3 euros lower.

-

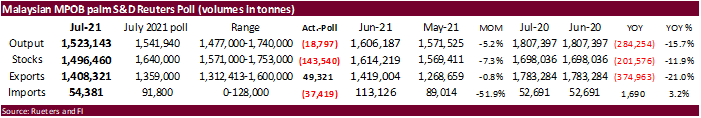

MPOB

Malaysian palm oil data was bullish and this is supported CBOT soybean oil. September SBO closed 103 points higher. There is/was a plant fire in Europe that was thought to have increased the prices of EU biofuel. There was talk Argentina SME was sold to

the EU but we could not confirm that. -

NOPA

will report July US crush and end of month soybean oil stocks on Monday. We are at 160.0 million bushels for the soybean crush and 1.505 billion for stocks, compared to 152.4 million during June and 1.537 billion stocks previous month. For other trade guesses,

we heard as high as 162 and low as 158, and stocks below 1.450 billion. - MPOB

Malaysian palm oil data was bullish. Malaysia palm futures, back from a one-day holiday, rallied 7.4% or 311 ringgit to 4,511 after MPOB reported July palm production declining 5.2% to 1.52 million tons, lowest since April, and 19,000 tons below a Reuters

trade guess. Stocks were reported at a 4-month low of 1.5 million tons, down 7% from June, and 143,500 tons below trade average. Exports were 1.4 million tons, 50,000 above trade expectations. Imports of 92,000 tons were less than expected. With production

coming in well below expectations, some groups are already trimming 2021 production below 18.5 million tons (MPOA earlier was just over 19 MMT). Cash RBD palm was up $87.50/ton at $1,135/ton from Monday (Tuesday holiday).

-

AmSpec

reported July 1-10 Malaysian palm oil exports at 368,763 tons, down from 410,915 tons for the same period in July, and 10.3 percent decrease.

Cargo

surveyor ITS reported Malaysian palm shipments for the Aug 1-10 period at 364,546 tons, a 13% decrease from 418,145 tons during the same period a month ago.

-

Argentine

producers sold 26.8 million tons of soy so far for the 2020/21 season, behind 28.9 million tons by the same date last year.

Export

Developments

- Under

the 24-hour USDA announcement system, private exporters sold 132,000 tons of soybean to China for 2021-22 delivery.

- USDA

On August 17 seeks 290,000 tons of veg oil for use in export programs. 210 tons in 4-liter cans and 80 tons in 4-liter cans or plastic bottles, for shipment Sep16 to Oct 15 (Oct 1-31 for plants at ports).

- South

Korea’s Agro-Fisheries & Food Trade Corp. seeks 3,700 tons of non-GMO soybeans on August 19 for arrival between Oct. 20 and Nov. 19.

Updated

8/9/21

September

soybeans are seen in a $12.75-$14.50 range; November $11.75-$15.00

September

soybean meal – $335-$370; December $320-$425

September

soybean oil – 58.50-65.00; December 48-67 cent range

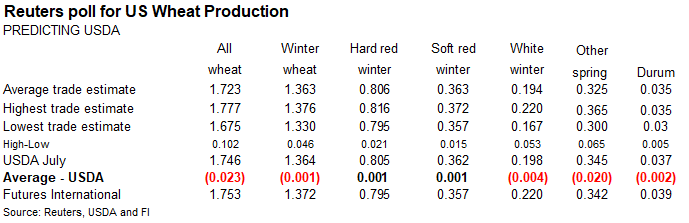

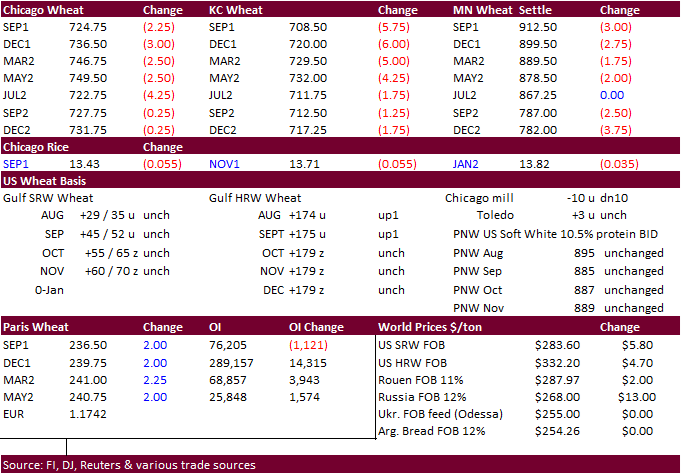

- US

wheat traded two-sided and ended mostly lower despite global supply concerns. Chicago September wheat was unchanged and December 0.25 cent lower. Lower USD limited losses. KC and MN were off 2.00-5.25 cents through the May positions.

- IKAR

lowered their Russian wheat production estimate by 1.5 million tons to 77 million tons. USDA is at 85 million tons. SovEcon noted on social media they cut their estimate but did not provide details. They were previously at 76.4 million tons for Russia.

- The

EU awarded 12,823 tons of wheat import quotas during August, including 6,000 from Ukraine. This compares to 61,606 tons during August 2000. Up to 650,000 tons are allowed this season.

- Paris

December wheat was up 2.00 at 239.75, near its contract high. - France

remains too wet. Russia’s Southern Region and Kazakhstan will experience more dry weather while southeastern Europe will see heat and net drying this week.

- Japan

sees a 60 percent chance of normal conditions (no ENSO event) through early winter, down from 70% previous forecast through fall.

- The

Philippines passed on 120,000 tons of animal feed wheat and 120,000 tons of feed barley for shipment in October and November. Prices were regarded as too high.

- Jordan

passed on 120,000 tons of milling wheat (2 offers were presented). - Thailand

seeks 139,500 tons of feed wheat on August 11 for OND shipment. - Morocco

seeks 363,000 tons of US durum wheat under a tariff import quota on August 24 for shipment by December 31.

- Japan

(SBS) seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on August 18 for loading by November 30.

- Bangladesh

seeks 50,000 tons of wheat on August 18. - Pakistan

seeks 400,000 tons of wheat on August 23 for Sep/Oct shipment.

Rice/Other

- (Bloomberg)

— U.S. 2021-22 cotton production seen at 18.15m bales, 346,000 bales above USDA’s previous est., according to the avg in a Bloomberg survey of 11 analysts.

Estimates

range from 17.6m to 19.4m bales

U.S.

ending stocks seen at 3.5m bales vs 3.3m in July

Global

ending stocks seen 402,000 bales higher at 88.14m bales

- South

Korea’s Agro-Fisheries & Food Trade Corp. seeks 39,226 tons of rice from the United States for arrival in South Korea on Jan. 31 and March 31, 2022.

Updated 8/9/21

September Chicago wheat is seen in a $6.50‐$7.50 range

September KC wheat is seen in a $6.50‐$7.35

September MN wheat is seen in a $8.50‐$9.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.