PDF Attached

Higher

trade led by soybeans and oats on follow through buying post the bullish USDA report. Corn ended mixed on wheat/corn & soybean corn spreading. US weather looks good over the next week for the Corn Belt. Settlement prices can be found near the end of the

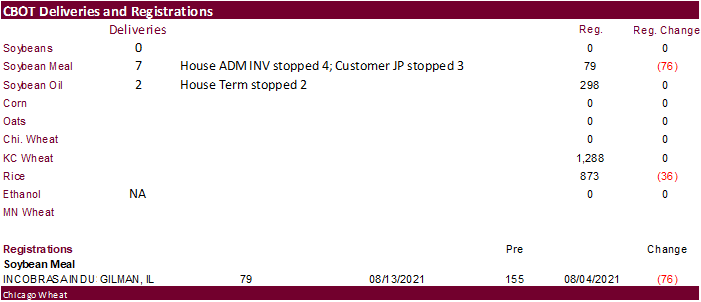

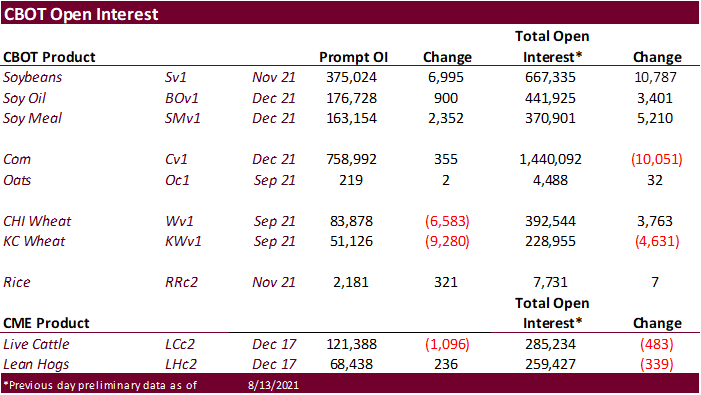

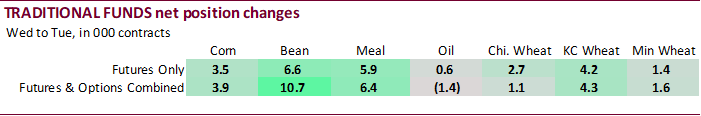

PDF. There were no surprises reported by CFTC for the COT positions. Deliveries and registrations were updated (below) to reflect late Friday data.

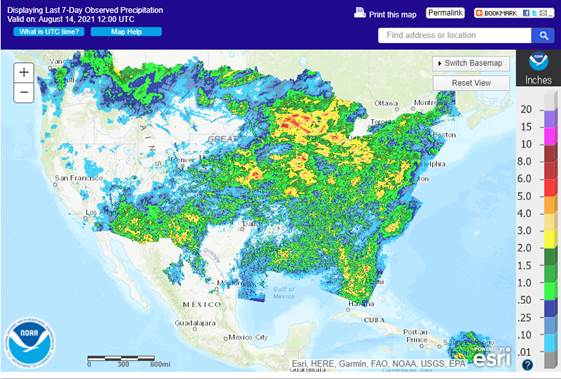

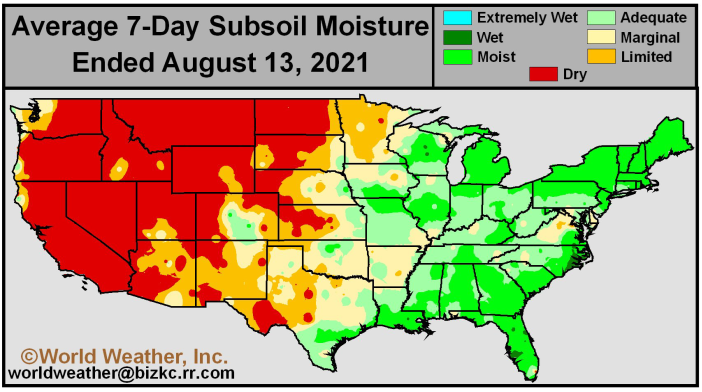

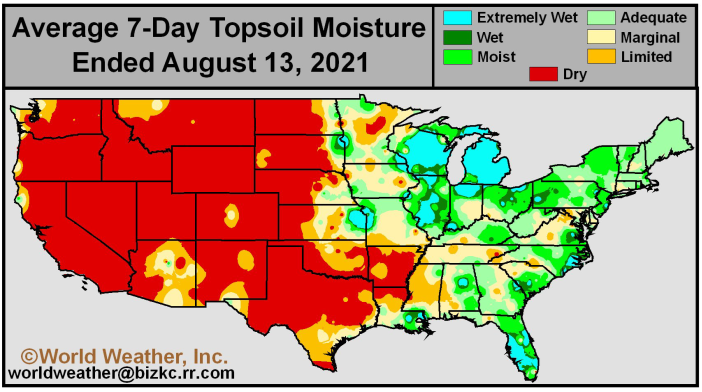

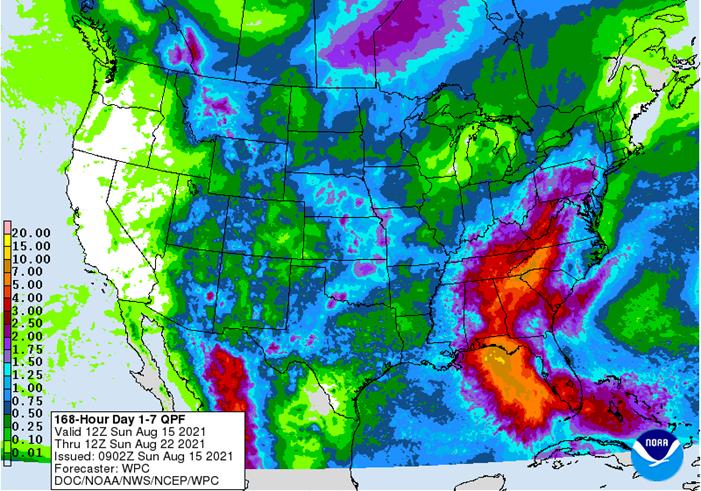

Weather

– last seven days:

WORLD

WEATHER INC.

WORLD

WEATHER HIGHLIGHTS FOR AUGUST 13, 2021

- Little

change was noted around the world overnight. - The

06z GFS model run has started very late and is only out six days at the time of this email - Tropical

Depression Fred will become a tropical storm later today and bring heavy rain to southern Florida this weekend and to northwestern Florida, eastern Alabama and western Georgia early next week.

- No

crop damage of significance is expected. - Another

tropical system will evolve near the Lesser Antilles this weekend. - A

new heatwave is expected in Canada’s Prairies and the northern U.S. Plains this weekend with highs in the 90s to over 100 Fahrenheit expected.

- The

heat will shift to eastern Canada, the U.S. Great Lakes region and northeastern states next week.

- A

few strong to severe thunderstorms will evolve during mid-week next week in the northern U.S. Plains, upper Midwest and Manitoba, Canada.

- Australia

weather will be tranquil through the next week to ten days with only brief bouts of light rain in the south - South

Africa will get some needed rain this weekend favoring better wheat conditions in Free State3 - India

is facing another monsoon depression that will bring heavy rain to central parts of the nation next week.

- Southern

China will get flooding rain over the next week to ten days - Europe

will see some favorable harvest conditions, although dryness in southeastern parts of the continent will hurt summer crops.

- Drying

will continue in Kazakhstan and some neighboring areas of Russia.

Source:

World Weather Inc.

Monday,

Aug. 16:

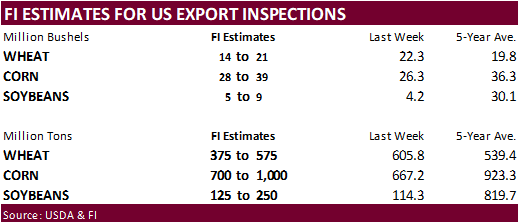

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn, cotton, soybeans, wheat, 4pm - Ivory

Coast cocoa arrivals - HOLIDAY:

Argentina

Tuesday,

Aug. 17:

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - HOLIDAY:

Indonesia

Wednesday,

Aug. 18:

- EIA

weekly U.S. ethanol inventories, production - China’s

second batch of July trade data for commodities, including corn, wheat, sugar and pork

Thursday,

Aug. 19:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Brazil’s

Conab releases sugar and cane production data (tentative) - USDA

total milk, read meat production - Port

of Rouen data on French grain exports - HOLIDAY:

India, Pakistan, Bangladesh

Friday,

Aug. 20:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

country-wise import data for farm goods such as soybeans, corn and pork - FranceAgriMer

weekly update on crop conditions - Malaysia

Aug. 1-20 palm oil export data - U.S.

Cattle on Feed, 3pm

Source:

Bloomberg and FI

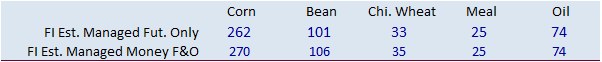

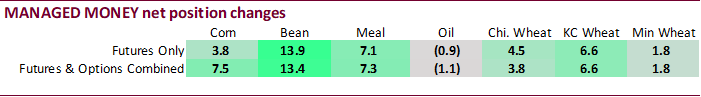

No

surprises this week

70

Counterparties Take $1050.941 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1087.342 Bln, 74 Bidders)

US

Import Price Index (M/M) Jul: 0.3% (est 0.6%; prevR 1.1%; prev 1.0%)

US

Export Price Index (M/M) Jul: 1.3% (est 0.8%; prev 1.2%)

US

Export Price Index (Y/Y) Jul: 17.2% (prev 16.8%)

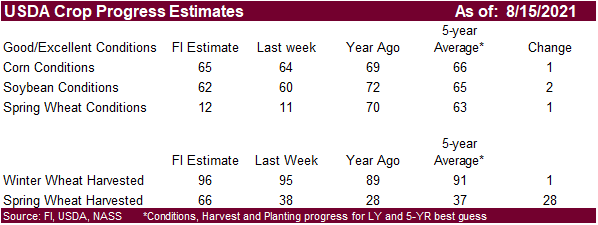

- US

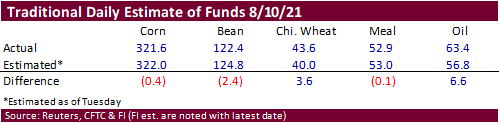

corn ended mixed on soybean/corn and wheat/corn spreading. Funds sold an estimated net 1,000 corn

contracts. - News

was very thin on Friday. Light profit taking was noted after a higher open.

- China

auctioned off 36,789 tons of imported Ukrainian corn and 265,667 tons of imported US corn. They sold 36.8k and 266k respectively.

Export

developments.

- Turkey

seeks 270,000 tons of barley on August 20 for shipment between Sep 1 and Sep 25.

- Qatar

seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery.

Trade

News Service:

September

corn is seen is a $5.40-$6.00 range.

December

corn is seen in a $4.75-$6.00 range

-

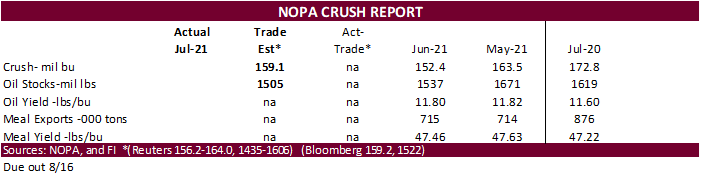

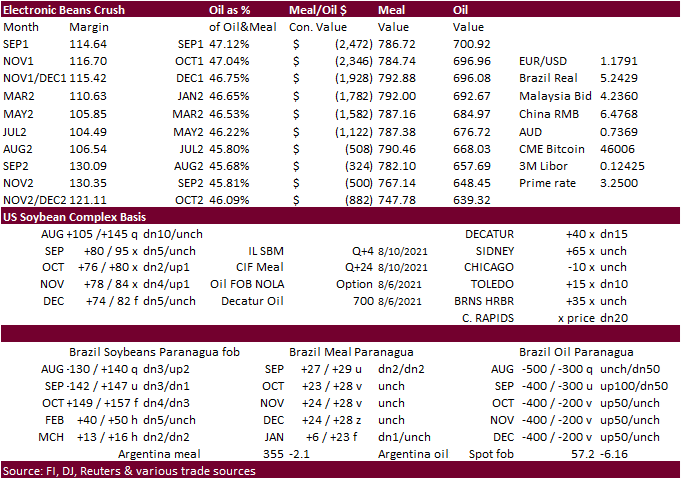

Soybeans

ended sharply higher in part to higher outside related markets and 147 point jump in September soybean oil. USDA 24-hour sales for China and unknown also underpinned soybeans. Some traders fear Canadian canola oil imports into the US will shrink after USDA

cut the Canadian canola crop to 16 million tons from 20.2 million forecast in July. We think imports will occur given the spread between Canadian canola and US soybean oil. Note StatsCan will update Canada canola production at the end of this month.

-

Funds

bought 10,000 soybeans, 1,000 meal and 6,000 soybean oil. -

Safras

estimated Brazil 2022 soybean imports at a large 90 million tons, up from their 2021 estimate of 86 million tons, which was left unchanged. Crush was expected to expand to 48.5 million tons in 2022 from 46.7 million for 2021.

-

Malaysia

palm oil futures hit a fresh contract high. - China

cash crush margins were last positive 87 cents on our analysis (94 previous) versus 80 cents late last week and 136 cents around a year ago.

-

Note

the Pro Farmer crop tour starts Tuesday, Aug 17, lasting until Friday the 20th. They meet Monday night for an opening dinner and hit the roads early Tuesday. Twitter feed #PFCropTour21

-

Trade

News Service: IL SBO basis 725 over, East 650 over, West 1750 over, and Gulf option.

Export

Developments

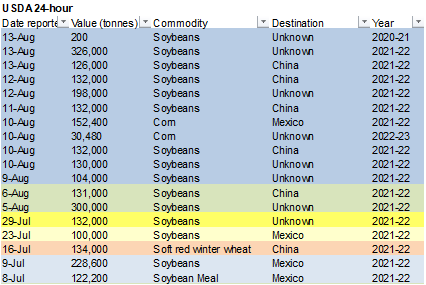

- Under

the 24-hour USDA announcement system, private exporters sold: - Export

sales of 326,200 metric tons of soybeans received in the reporting period for delivery to unknown destinations. Of the total, 200 metric tons is for delivery during the 2020/2021 marketing year and 326,000 metric tons is for delivery during the 2021/2022

marketing year; and -

Export

sales of 126,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year. - USDA

On August 17 seeks 290,000 tons of veg oil for use in export programs. 210 tons in 4-liter cans and 80 tons in 4-liter cans or plastic bottles, for shipment Sep16 to Oct 15 (Oct 1-31 for plants at ports).

- South

Korea’s Agro-Fisheries & Food Trade Corp. seeks 3,700 tons of non-GMO soybeans on August 19 for arrival between Oct. 20 and Nov. 19.

Updated

8/12/21

September

soybeans are seen in a $12.75-$14.50 range; November $11.75-$15.00

September

soybean meal – $335-$370; December $320-$425

September

soybean oil – 60.00-65.00; December 48-67 cent range

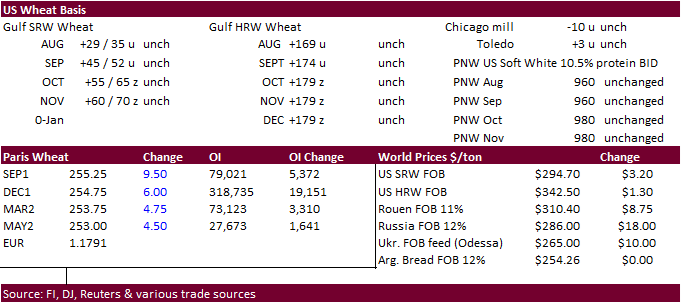

- US

wheat ended higher in most US contracts (back month KC contracts lower) on EU quality concerns (Paris futures sharply higher) and follow through buying from the USDA report. Funds bought an estimated net 6,000 Chicago wheat contracts. Next week it will be

important to keep an eye on Black Sea and EU wheat production estimates. Note Statistics Canada will update their wheat and other commodity production estimates on August 30.

- US

Chicago, KC and MN wheat, basis December and other selected months, hit fresh contract highs.

- We

revised up our price range for nearby Chicago wheat by 25 cents (high only) to $8.00/bu, for the next 15 days. Back month wheat continues to have a healthy carry over September, and to remain that way into FND at the end of this month.

- There

were no major export developments reported since Friday morning, other than Turkeys import tender announcement for 270,000 tons of barley (details in corn section).

- Paris

December wheat hit another fresh contract high, ending 6 euros higher at 254.25 euros. It earlier reached a contract high of 257.75 euros.

- CME

Group’s Black Sea December wheat hit to a contract high of $326. - France

had harvested 72 percent of the soft wheat crop as of Aug 9, up from 66 week earlier. Germany is two thirds complete. It’s unknown how much of the wheat crop is of poor quality but traders are starting to get nervous over upcoming physical deliveries.

- Ukraine

harvested 56 percent of their wheat crop.

US

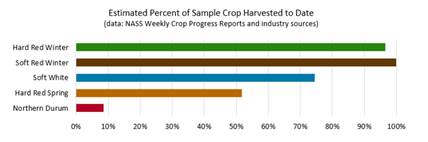

Wheat Associates:

“The

HRW harvest is nearly complete with data holding steady. SW harvest continues apace under hot, dry conditions; testing data are reflective of a stressed crop. HRS harvest is over 50% complete and initial sample data show test weight average of 62.0 lb/bu (81.5

kg/hl) and average protein 15.4% (12% mb). The northern durum crop is just under 10% harvested with variable yields reported.”

- Japan

(SBS) seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on August 18 for loading by November 30.

- Bangladesh

seeks 50,000 tons of wheat on August 18. - Morocco

seeks 363,000 tons of US durum wheat under a tariff import quota on August 24 for shipment by December 31.

- Pakistan

seeks 400,000 tons of wheat on August 23 for Sep/Oct shipment.

Rice/Other

-

None

reported

Updated 8/13/21

September Chicago wheat is seen in a $6.75‐$8.00 range (unch, up 25)

September KC wheat is seen in a $6.50‐$7.70

September MN wheat is seen in a $8.50‐$9.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.