PDF Attached

WASHINGTON,

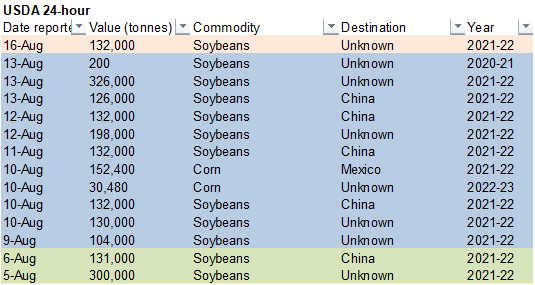

Aug 16, 2021- Private exporters reported to the U.S. Department of Agriculture export sales of 132,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

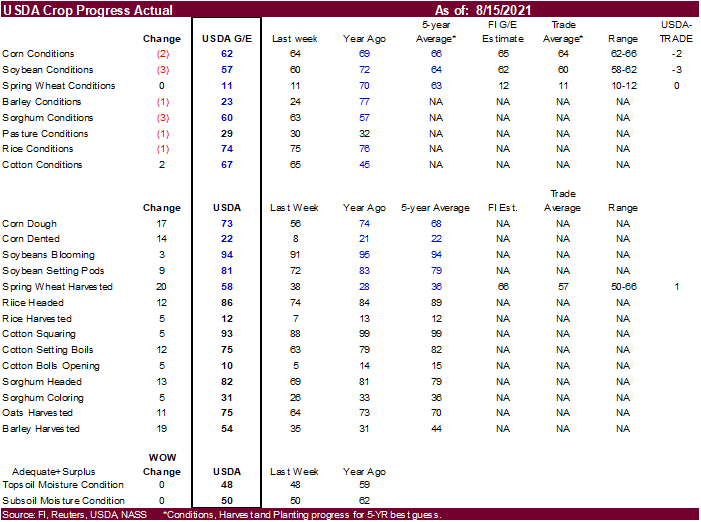

US

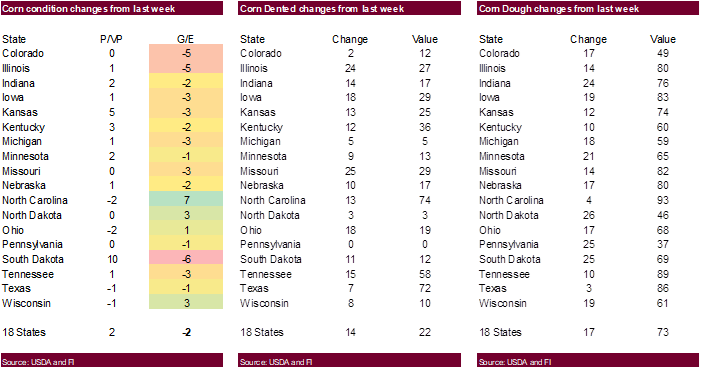

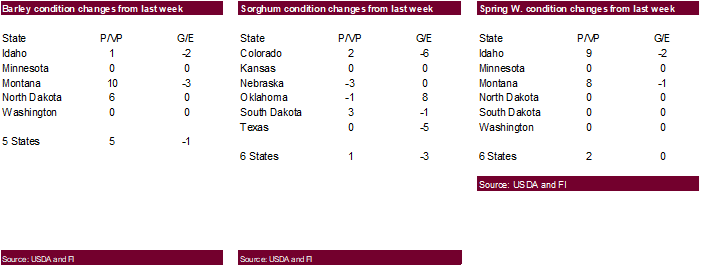

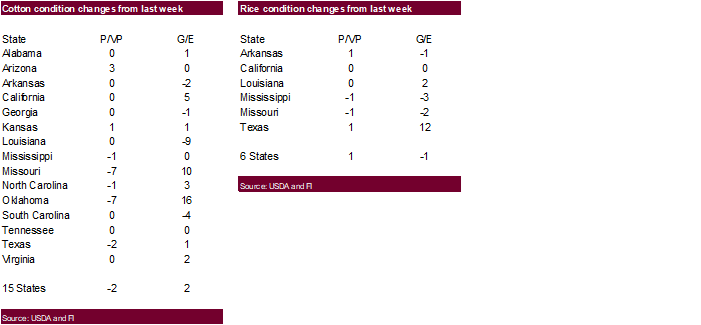

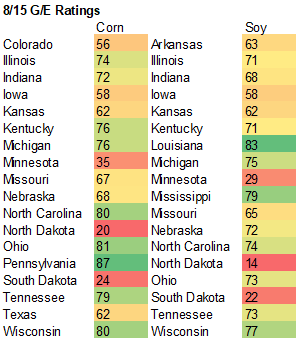

corn crop conditions declined 2 points to 62% and soybean dropped 3 points to 57%. Spring wheat was unchanged at 11%. Spring wheat harvest 58%, up from 38% last week.

Calls:

Soybeans up 5-9, corn up 4-6, spring wheat unchanged to 3 higher. Chicago wheat unchanged/higher. KC mixed. Pro Farmer crop tour started today.

Ohio

and South Dakota averages should be out later this afternoon. Twitter feed #PFCropTour21

Weather

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

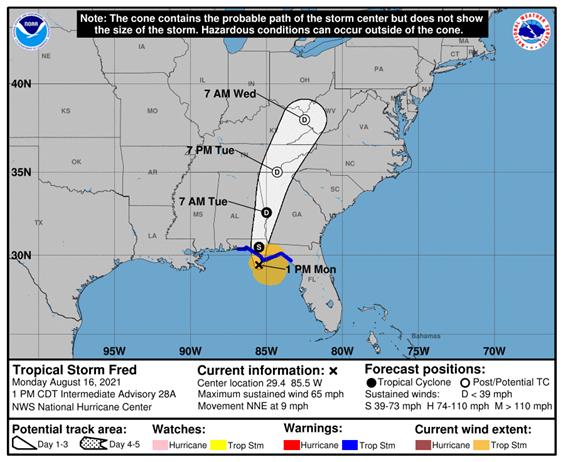

- Tropical

Storm Fred will reach areas east of Destin, Florida this evening and will produce 3.00 to 6.00 inches of rain from that area north northeast into east-central Alabama and immediate neighboring areas of west-central Georgia through Tuesday

o

Rainfall farther north in northern Georgia and the Appalachian Mountains will range from 1.50 to 4.00 inches

o

Flooding is most likely near the coast in Florida and in a few areas of southeastern Alabama

o

Crop damage is expected to be minimal

o

Property damage is possible near the Florida coast

- Tropical

Depression Grace will produce 4.00 to 12.00 inches of rain in southern parts of Hispaniola today and Tuesday while the north half of the island receives less than 4.00 inches with some areas getting only 0.50 inch

o

No wind damage is expected

o

Flooding near the south coast may cause some damage to crops and urban areas

- Tropical

Depression Grace will become a tropical storm as it moves between Jamaica and Cuba late Tuesday into Wednesday and then will move to the northeastern Yucatan Peninsula of Mexico late this week

o

The storm could still become a hurricane and should be watched

o

Ultimate landfall may be in northeastern Mexico and/or in far southern Texas during the weekend

- Tropical

Depression Eight is expected to become a tropical storm today while it loops around Bermuda. The system is unlikely to be a threat to the island or North America.

- Hurricane

Linda in the eastern Pacific Ocean poses no threat to North America - West

Texas rainfall during the weekend was a little greater than expected in some areas

o

Rain amounts varied from nothing to 2.26 inches (4 miles southeast of Lubbock) with about one-third to one-half of the region reporting 0.30 to 0.80 inch with many 1.00 to 1.50-inch amounts in the north

- Driest

in the south and east parts of the region - U.S.

weekend precipitation was greatest from Texas through the Delta to the southeastern states

o

The precipitation was scattered and highly varied, but some locations reported 1.00 to more than 2.00 inches while others were left dry

o

Good harvest weather continued in South Texas with a couple of exceptions

o

Temperatures were hot in the far western and north-central states and quite warm in the south from central Texas and Oklahoma to the middle southern Atlantic Coast States

o

Midwest temperatures were seasonable

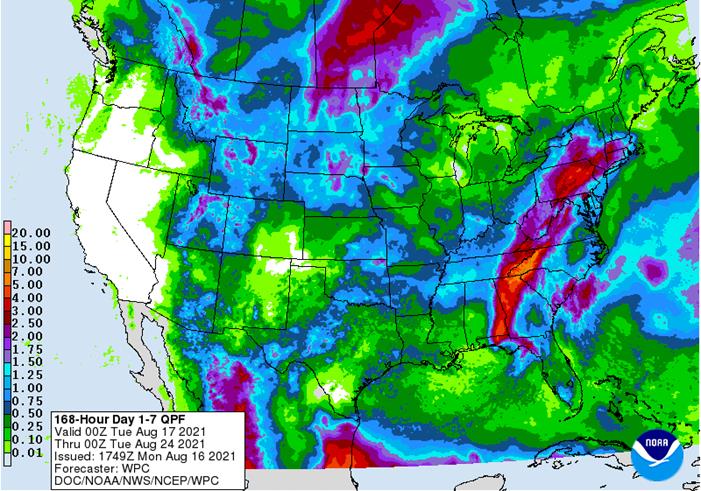

- Strong

Gulf of Mexico moisture flux into central U.S. could set the stage for greater rain in northern U.S. Plains, Canada’s Prairies late this week

o

However, Tropical Depression Grace could interfere with this moisture flux which leaves the potential for significant rain still up for big debate

- Some

rain is expected, but the mid-day GFS model run was likely too wet in Saskatchewan and possibly in parts of the Plains and western Corn Belt - The

evening GFS model run (18z) has shifted the greatest rain into extreme eastern Saskatchewan and northern and western Manitoba and this too is debatable - The

model run is likely too wet in these areas - Some

rain and strong wind will impact a part of the northern U.S. Plains and Canada’s Prairies during mid-week this week. However, the drought will not be over

o

Manitoba, southwestern Alberta and a few areas near the southwest Saskatchewan/southeastern Alberta border area will be wettest

o

Corn, soybeans and flax in Manitoba may be the greatest recipient of rain and crops may improve further after getting some significant rain last week

- Most

likely the advertised rain by the European model run today is overdone and some of the rain on the GFS model is probably a little high as well - 0.50

to 1.50 inches and locally more is possible, but confidence is low - U.S.

Midwest, Delta and central and southern U.S. Plains will experience a good mix of weather during the next ten days with sufficient rain to limit the expansion of dryness into the key Corn and Soybean Belt production areas

o

Rainfall will vary widely with some areas getting enough to maintain favorable crop development, a few trending a little wetter and a few others drying down

- No

aggressive dry down is expected; however, the most limited rainfall this week will be in the Great Lakes region and the middle and upper Mississippi River Valley - Some

rain may come to this crop region next week and it will be important after this week’s drying trend

o

Temperatures will be seasonable with a warmer than usual bias in the northern Plains and portions of the Rocky Mountain region, Great Basin and far western states

- U.S.

southeastern states will be trending wetter this week because of remnants of Tropical Storm Fred and a mid-latitude frontal system that will produce near to above normal rainfall except in southwestern Alabama and southeastern Mississippi where rainfall may

be less than usual

o

Florida’s Peninsula is also expecting less than usual rainfall

- Northeast

Mexico could benefit greatly from rain if Tropical Depression Grace decides to move into that region.

o

The area has been drought-stricken for a few years and needs rain to change the outlook for 2022

- Western

and southern Mexico crop conditions remain favorable due to well-timed rainfall, although Baja California and some immediate mainland coastal areas need rain - Excessive

heat occurred in Spain and some of the islands in the western Mediterranean Sea during the weekend with highs of 100 to 113 occurring in central and interior southern Spain and southern Portugal

o

Cordoba, Spain reported an extreme of 116.6 Fahrenheit

o

A few extreme highs over 100 Fahrenheit also occurred in northern parts of the Italian Peninsula

o

Other areas in Europe were warm and drier than usual supporting a big improvement in winter crop harvest conditions

o

Rapid drying in the topsoil was noted, but some timely rain will fall early this week to slow the trend and follow up rain will be needed later this month

- Some

of the excessive heat in Africa and the western Mediterranean region will surge northward later this week impacting a larger part of southern Europe for several days

o

Extreme highs in the 90s to 106 degrees Fahrenheit will impact the southern half of the continent

- Cooling

and some rain will follow next week

o

Drying across the continent later this week and into the weekend will be great for harvest progress and for speeding along summer crop development

- Areas

with short to very short soil moisture will experience rising stress and that will include the Balkan Countries where it has already been dry for several weeks - Crop

yields will continue to slide lower in this region - Rain

developed from extreme eastern Ukraine and western most parts of Russia’s Southern Region into the middle Volga River Basin during the weekend

o

Resulting rainfall varied from 0.15 inch to 0.88 inch with a couple of locations reporting 2.50 to 4.60 inches

- The

heavier rainfall was extremely localized

o

Additional rain will fall in this region and in neighboring areas of Russia’s Southern Region and lower Volga River Basin early this week followed by several days of drying and then a few more showers

- Net

drying continued during the weekend and will persist into next week in many Kazakhstan and southern Russia New Lands crop areas

o

Moisture stress this year has cut into spring wheat and sunseed production and those losses have continued, although the greatest losses have already occurred

- A

good mix of shower activity and warm temperatures will occur in central and eastern Ukraine, Belarus and western and northern Russia over the next ten days to maintain most crop needs - Drying

is expected in the Ural Mountain region and southern New Lands during the next ten days speeding along spring crop maturation

o

A few late season crops may mature under stress threatening a small decline in yield or quality, but the impact should be low

- China’s

Yangtze River Basin reported pockets of locally heavy rain during the weekend with more than 8.00 inches in the lower parts of the basin and as much as 13.46 inches near the southeastern Sichuan/Hubei border

o

Rainfall elsewhere was much more erratic with parts of the Yellow River Basin and northeastern provinces experiencing net drying conditions

o

Temperatures across the nation were seasonable with a slight cooler bias in the wetter areas of the interior south

- China

will continue to see alternating periods of rain and sunshine over the next ten days with the Yellow River Basin driest and the Yangtze River Basin wettest

o

Some additional flooding may impact a part of Sichuan and the Yangtze River Basin

o

Some periodic rainfall is also expected in northeastern China that will be more than sufficient to maintain a good outlook for summer crops

o

Temperatures will be seasonable

o

Next week may be wetter again in the Yellow River Basin

- Northwestern

India is still advertised to be drier than usual over the next two weeks along with parts of Pakistan

o

Gujarat, western and northern Rajasthan and central and southern Pakistan may not get enough rain to counter evaporation

- Crop

stress will continue to rise in unirrigated fields - India

rainfall during the weekend was restricted in many areas, but much more rain is expected in central and eastern parts of the nation over the next ten days

o

Northeastern Maharashtra, Madhya Pradesh and most of the Ganges River Basin, Bangladesh and far Eastern States will be wettest with 4.00 to more than 8.00 inches expected in many areas

o

Southern India will get rain, too, but it will be lighter and more beneficial

- Needed

rain fell in eastern South Africa wheat production areas during the weekend lifting soil moisture and improving unirrigated crop conditions ahead of spring development

o

The nation’s western wheat is already well established and poised to perform well

- Now

unirrigated eastern states will experience improvement, although some additional rain is still needed - South

Africa will experience some additional rain over the next ten days with southern and easternmost parts of the nation wettest - Argentina

southern and eastern crop areas will get some rain in the second half of this week, but western crop areas are expecting to be dry biased through the next two weeks

o

Winter crops are dormant or semi-dormant right now making the moisture shortage in the west of little concern, but spring rainfall will be very important

- Brazil

rainfall will continue limited to the far south over the next two weeks which is not unusual for this time of year

o

Large moisture deficits remain in center south Brazil from 2020-2021 and could be a factor in spring crop development potential if La Nina delays the onset of season moisture

o

River and stream flow remain critically low in much of the Parana River Basin

- Southeast

Asia nations will all receive sufficient rain to support crops during the next two weeks

o

The forecast includes an improving rain distribution for Sumatra, Java, Kalimantan, Thailand and the central and southern Philippines all of which have been trending a little too dry recently

- Thailand

will be the one nation to watch for possible inadequate rainfall - East-central

Africa rainfall in this coming week will continue abundant in Ethiopia and a routine occurrence of rain will also occur in Kenya and Uganda - West

Central Africa weather will be seasonable over the next two weeks

o

Rain will continue to fall periodically over the next couple of weeks, although the lightest rainfall will be in southern Ivory Coast and Ghana

- Australia

weather will continue favorably for wheat, barley and canola which are semi-dormant at this time of year. Soil moisture is favorable and ready to support spring growth when warming comes along especially if timely rainfall continues as advertised

o

Queensland and northern New South Wales still need significant rain to restore soil moisture after recent drying

- Southern

Oscillation Index has reached +5.43 and it will continue to drift lower this week, albeit at a slower pace.

- Central

America rainfall has been plentiful and will remain that way for the next ten days - New

Zealand rainfall during the coming week will be above average while temperatures are a little cooler than usual

Source:

World Weather Inc.

Monday,

Aug. 16:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn, cotton, soybeans, wheat, 4pm - Ivory

Coast cocoa arrivals - HOLIDAY:

Argentina

Tuesday,

Aug. 17:

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - HOLIDAY:

Indonesia

Wednesday,

Aug. 18:

- EIA

weekly U.S. ethanol inventories, production - China’s

second batch of July trade data for commodities, including corn, wheat, sugar and pork

Thursday,

Aug. 19:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Brazil’s

Conab releases sugar and cane production data (tentative) - USDA

total milk, read meat production - Port

of Rouen data on French grain exports - HOLIDAY:

India, Pakistan, Bangladesh

Friday,

Aug. 20:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

country-wise import data for farm goods such as soybeans, corn and pork - FranceAgriMer

weekly update on crop conditions - Malaysia

Aug. 1-20 palm oil export data - U.S.

Cattle on Feed, 3pm

Source:

Bloomberg and FI

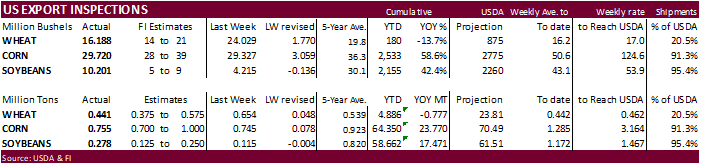

USDA

inspections versus Reuters trade range

Wheat

440,567 versus 300000-625000 range

Corn

754,929 versus 600000-1000000 range

Soybeans

277,637 versus 75000-300000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING AUG 12, 2021

— METRIC TONS —

—————————————————————————

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 08/12/2021 08/05/2021 08/13/2020 TO DATE TO DATE

BARLEY

866 1,297 1,996 6,377 2,461

CORN

754,929 744,934 1,139,132 64,350,092 40,579,955

FLAXSEED

0 0 0 24 317

MIXED

0 0 0 48 0

OATS

0 0 0 100 800

RYE

0 0 0 0 0

SORGHUM

55,165 75,837 87,240 6,898,032 4,731,435

SOYBEANS

277,637 114,718 932,541 58,661,647 41,190,721

SUNFLOWER

0 0 0 240 0

WHEAT

440,567 653,969 495,513 4,885,643 5,663,073

Total

1,529,164 1,590,755 2,656,422 134,802,203 92,168,762

————————————————————————

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Canadian

Manufacturing Sales (M/M) Jun: 2.1% (est 2.4%; prev -0.6%)

Canadian

Wholesale Trade Sales (M/M) Jun: -0.8% (est -2.0%; prev 0.5%)

OPEC+

Sees No Need To Release More Oil Into Mkt At The Moment ‘Beyond What Is Already Planned’ Despite US Calls – RTRS Citing OPEC+ Sources

70

Counterparties Take $1036.418 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1050.94 Bln, 70 Bidders)

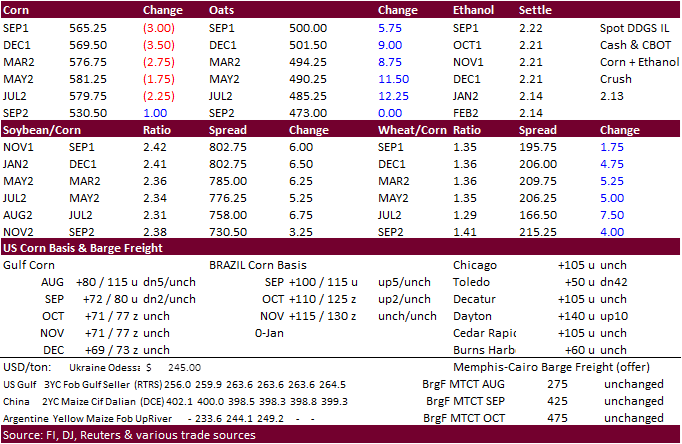

- US

corn ended

lower in the nearby contracts on follow through selling and lack of fresh US export developments. Technical selling was noted. Good amount of option flow occurred on the close. CZ 700c lifted 10,000x paid 4.5-5.0 in the last 2 minutes.

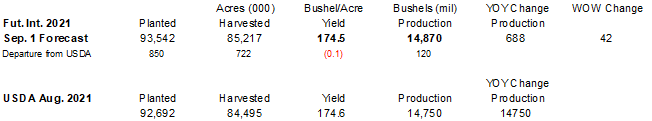

- USDA

reported US corn crop conditions dropped 2 points to 62 percent. The trade was looking for unchanged.

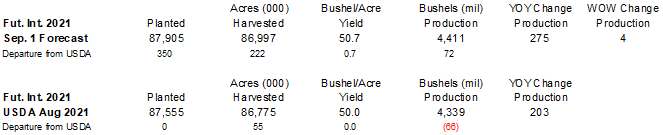

- Recall

last week’s FSA numbers indicated the US corn planted area could be revised up more than 1 million acres later this season. We raised our working planted estimate for the US corn area by 850,000 acres above USDA to 93.54 million, and harvested area by 722,000

acres to 85.22 million. - US

weather appears to be non-threatening for the majority of the Corn Belt, with cooler and drier conditions this week, bias east. Excessive heat is expected across the Great Plains and eastern Canada today before turning windy Tuesday into Wednesday.

- Tropical

storm Fred will hit the Florida Panhandle today. Rain from this storm is expected to reach into the upper Delta and blanket the SE this week.

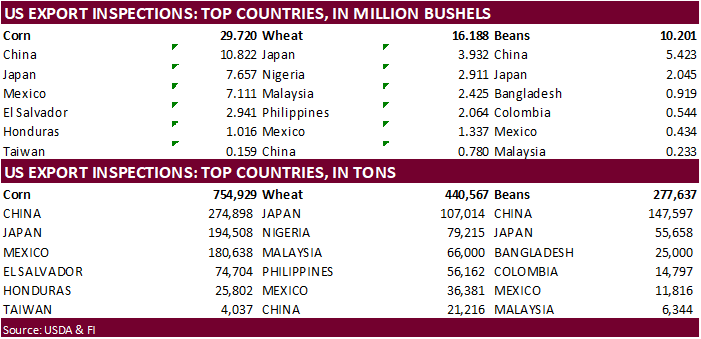

- USDA

US corn export inspections as of August 12, 2021 were 754,929 tons, within a range of trade expectations, above 744,934 tons previous week and compares to 1,139,132 tons year ago. Major countries included China for 274,898 tons, Japan for 194,508 tons, and

Mexico for 180,638 tons. - AgRural

reported Brazilian corn harvesting across the center-south at 70% of their second corn, behind 77% year ago. Mato Grosso farmers is finished.

Export

developments.

- Qatar

seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery.

- Turkey

seeks 270,000 tons of barley on August 20 for shipment between Sep 1 and Sep 25.

September

corn is seen is a $5.40-$6.00 range.

December

corn is seen in a $4.75-$6.00 range

-

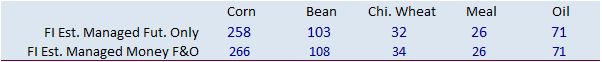

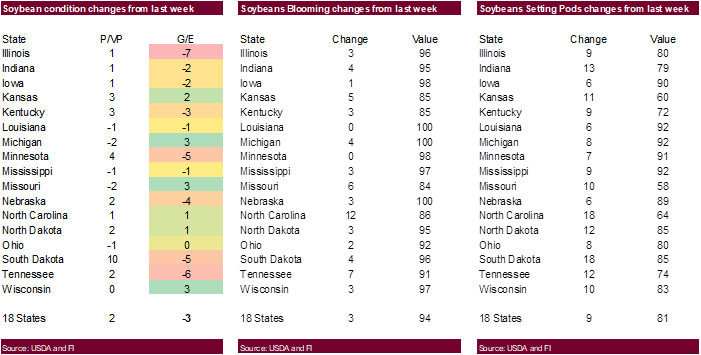

Soybeans

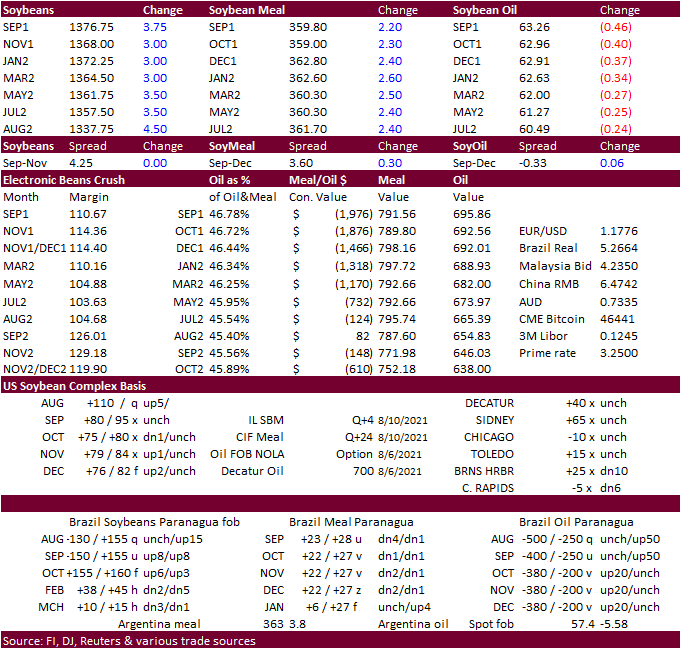

and meal were higher while soybean oil saw selling from lower energies and a bearish NOPA stocks figure. USDA announced 132,000 tons of soybeans sold to unknow. Canadian canola crop concerns supported canola futures.

- USDA

reported soybean crop conditions dropped 3 points to 57 percent. The trade was looking for unchanged.

-

Pro

Farmer crop tour started today. Ohio and South Dakota averages should be out later this afternoon. Twitter feed #PFCropTour21

-

USDA

announced private exporters sold 132,000 tons of soybeans to unknown destinations for 2021-22 delivery.

-

USDA

US soybean export inspections as of August 12, 2021 were 277,637 tons, within a range of trade expectations, above 114,718 tons previous week and compares to 932,541 tons year ago. Major countries included China for 147,597 tons, Japan for 55,658 tons, and

Bangladesh for 25,000 tons. -

Argentina

was on holiday today. -

The

USDA announced they plan to raise the average US food stamp benefits by about 25% from pre-pandemic levels.

-

Cargo

surveyor SGS reported month to date August 15 Malaysian palm exports at 577,972 tons, 104,454 tons below the same period a month ago or down 15.3%, and 86,420 tons below the same period a year ago or down 13.0%.

AmSpec

reported Malaysian palm exports for the 1-15 period down 21% to 540,853 tons from 684,615 tons shipped during the same period last month. ITS reported a 24% decline to 528,736 tons.

-

Indian

vegetable oil imports during July fell 23% to 917,336 tons from June and were nearly down 40 percent from July 2020 when they imported 1.517 million tons. July palm imports were 465,600 tons, down from 587,500 tons.

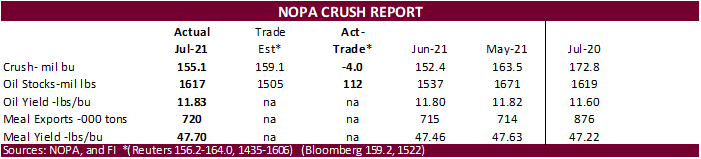

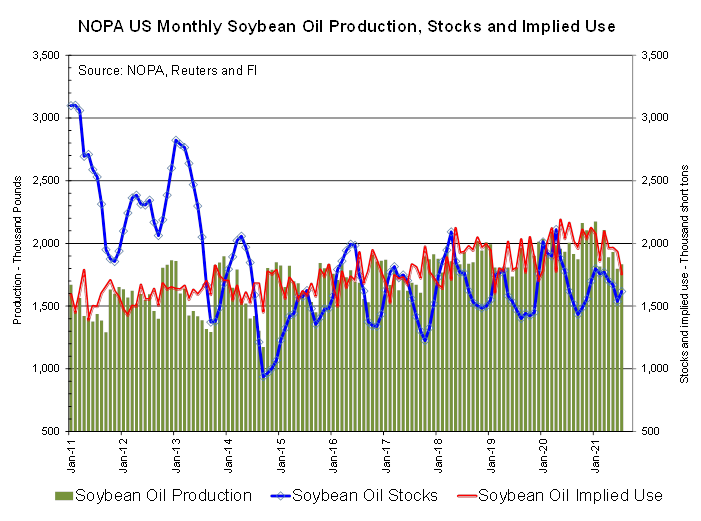

NOPA

reported a July crush of 155.1 million bushels, 4 million below a trade average, and lowest for the month since 2017. Daily adjusted the crush fell to its lowest level since September. Despite the 0.8 million/day decline in the daily July crush from the

previous month, the large soybean oil stocks surprised the trade as they increased to 1.617 billion pounds from 1.537 billion at the end of June. Implied US soybean use for the month of July is lowest since December 2019. The soybean oil yield increased

to 11.83 from 11.80 pounds per bushel from the previous month. Soybean meal exports were 720,000 short tons, up from 715,000 previous month and compares to 876,000 short tons during July 2020. US cumulative September through July crush of 1.862 billion bushels

is running 0.6% below the same period year earlier. My guess soybean oil stocks were so large was the fact the last couple EIA biofuel reports indicated less than expected SBO use, along with very high yields for production.

Export

Developments

- USDA

On August 17 seeks 290,000 tons of veg oil for use in export programs. 210 tons in 4-liter cans and 80 tons in 4-liter cans or plastic bottles, for shipment Sep16 to Oct 15 (Oct 1-31 for plants at ports).

- South

Korea’s Agro-Fisheries & Food Trade Corp. seeks 3,700 tons of non-GMO soybeans on August 19 for arrival between Oct. 20 and Nov. 19.

Updated

8/12/21

September

soybeans are seen in a $12.75-$14.50 range; November $11.75-$15.00

September

soybean meal – $335-$370; December $320-$425

September

soybean oil – 60.00-65.00; December 48-67 cent range

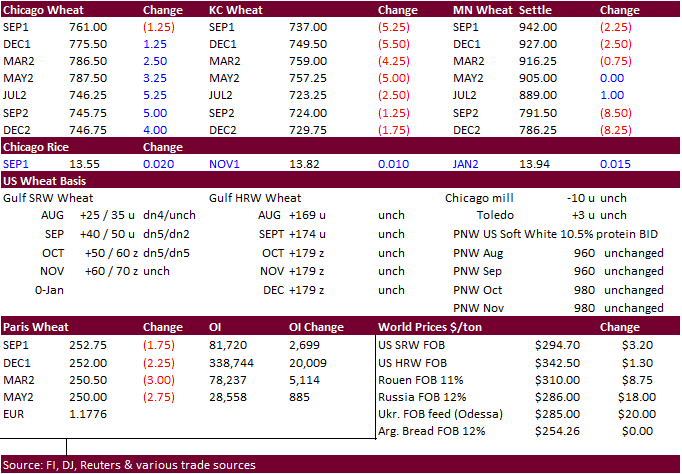

- US

wheat traded two-sided, with Chicago mostly higher, KC lower, and MN down in the front month contracts. Ongoing good global demand (Algeria and Philippines) for wheat and (Jordan and North Cyprus) for barley, and concerns over the French wheat & Russian

wheat crops underpinned prices, but in the end technical selling was a factor in today’s trade. Paris December wheat ended down 2.25 at 251.50 euros. The contract failed to test a contract high today.

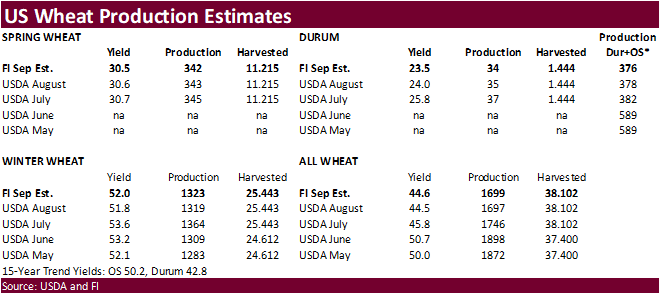

-

USDA

reported US spring wheat crop conditions unchanged at 11 percent, as expected. Spring wheat harvest advanced 20 points to 58 percent, one point above expectations.

-

USDA

US all-wheat export inspections as of August 12, 2021 were 440,567 tons, within a range of trade expectations, below 653,969 tons previous week and compares to 495,513 tons year ago. Major countries included Japan for 107,014 tons, Nigeria for 79,215 tons,

and Malaysia for 66,000 tons. - FranceAgriMer

warned the recent rains across France likely negatively impacted crop conditions for soft wheat. Uneven test weights were noted.

- SovEcon

lowered their Russian wheat crop estimate by 200,000 tons to 76.2 million. USDA is at 72.50 million tons.

- Russian

wheat cash prices rose $20/ton to $287/ton fob at the end of last week, according to IKAR. SovEcon reported at $18/ton increase from the previous week to $286/ton.

- North

Cyprus bought 30,000 tons of feed barley for Aug 15-31 shipment (282.80/ton c&f), Sep 1-15 shipment ($298.50/ton c&f) and Sep 15-30 shipment $293.50/ton c&f.

- Algeria

seeks an unspecified amount of wheat on Tuesday for September shipment. - The

Philippines seeks 280,000 tons of feed wheat on August 19 for October/November shipment.

- Jordan

seeks 120,000 tons of feed barley on August 19. - Japan

(SBS) seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on August 18 for loading by November 30.

- Bangladesh

seeks 50,000 tons of wheat on August 18. - Pakistan

seeks 400,000 tons of wheat on August 23 for Sep/Oct shipment. - Morocco

seeks 363,000 tons of US durum wheat under a tariff import quota on August 24 for shipment by December 31.

Rice/Other

-

None

reported

Updated 8/13/21

September Chicago wheat is seen in a $6.75‐$8.00 range

September KC wheat is seen in a $6.50‐$7.70

September MN wheat is seen in a $8.50‐$9.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.