PDF Attached

Widespread

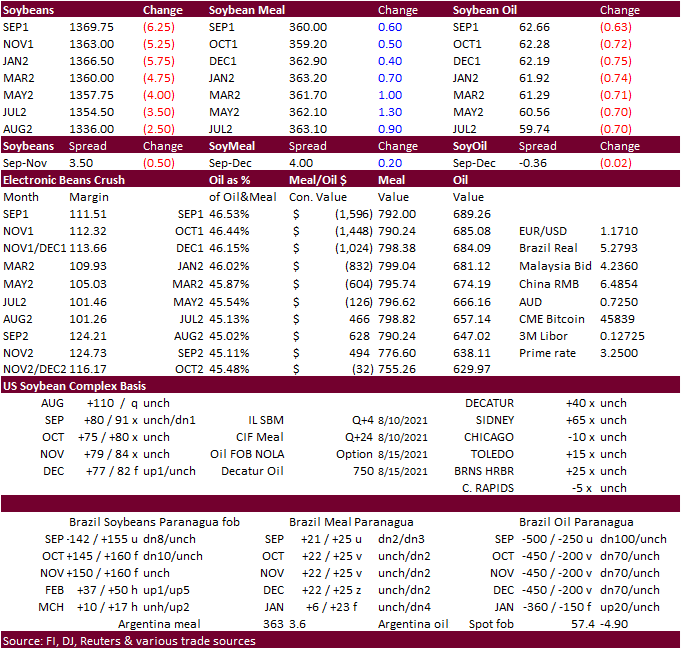

commodity selling was noted today. Soybeans, corn and wheat were lower, led by wheat. The USD was nearly 50 points higher by the time CBOT agriculture markets closed. We heard China was again in for soybeans. Attached are our updated US soybean complex

S&D’s.

WASHINGTON,

August 17, 2021–Private exporters reported to the U.S. Department of Agriculture the following activity:

- Export

sales of 198,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year; and - Export

sales of 132,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

- Tropical

Depression Fred reached west-central Georgia overnight

o

The storm induced no serious threat to crops or much property

o

Wind gusts did reach 68 mph near the coast in the Apalachicola area

o

Rainfall reached nearly 9.00 inches at Panama City, Fla. and 5.60 inches at Lumpkin, Ga while 1.00 to 3.00 inches and local totals to 4.00 inches occurred elsewhere

o

Fred will dissipate today while moving through the Appalachian Mountains

- Some

significant rain will fall from northern Georgia to Pennsylvania, New York and extreme southeastern Ohio

- Tropical

Storm Grace will strength while moving from the north coast of Jamaica across the Cayman Islands and to the Yucatan Peninsula over the next few days

o

Heavy rain and strong winds will impact all three areas resulting in some flooding and possible crop and property damage

- Losses

should be very low, however

o

Grace will emerge from the Yucatan Peninsula Thursday into the southwestern Gulf of Mexico with landfall this weekend in east-central Mexico

- Remnants

of the storm should move into the eastern Pacific Ocean next week without enhancing the southwestern U.S. monsoon flow - Very

little of the storm’s moisture will reach South Texas - Rain

in east-central and northeastern Mexico Tropical Storm Grace may improve soil moisture after a couple of years of drought

o

The moisture should improve the outlook for citrus, sugarcane, corn, sorghum and cotton in 2022, but might not have a big impact on this year’s production

- Harvest

delays are expected in northeastern Mexico because of the storm’s rain - Tropical

Storm Henri is not of much concern

o

The system will remain over open water south of Bermuda today and Wednesday and then safely between Bermuda and the United States late this week and into the weekend

o

The storm will eventually be ejected to the northeast out of the western Atlantic without impacting North America

- Dryness

relief is expected in a part of the central and eastern Dakotas, Minnesota, Manitoba and eastern Saskatchewan late this week as a storm system moves across those areas

o

Rainfall of 0.50 to 1.50 inches will be common with a few greater amounts from the Red River Basin of the U.S. into Manitoba

- Rain

will fall periodically this week along the Front Range of mountains in Alberta and eventually into central Montana.

o

Two waves of precipitation are expected with one already under way this morning

- The

second wave of rain will occur Thursday into Saturday

o

The moisture boost will be good for late season crop development and possibly for some winter wheat planting

- Soft

frost may evolve early next week in northern Alberta and northwestern Saskatchewan as temperatures turn cooler - Temperatures

will fall into the 50s and 60s Fahrenheit for highs in Montana and parts of Alberta during the second half of this week through early next week

o

The cool weather will slow drying rates and plant maturation rates

- Another

hot day occurred Monday across the northern U.S. Plains and central and southeastern parts of Canada’s Prairies with highs in the 90s and over 100 degrees Fahrenheit

o

The western Dakotas reported highs to 105 degrees

o

The heat will prevail today and then be replaced by cooling conditions Wednesday and Thursday

- U.S.

corn and soybean production areas in the Midwest, Delta and southeastern states will see a good mix of weather over the next ten days

o

Crop development will advance normally

o

Cool conditions may occur for a while next week in the northern Plains and upper Midwest

- Recent

rain in West Texas has maintained a very good outlook for cotton, corn and sorghum

o

Some rain is still needed in the southwestern dryland production areas

o

What is needed most is warmer temperatures to speed along crop development

- Warming

is not likely to come very quickly or very dramatically for a while - U.S.

Pacific Northwest will continue drier biased for a while - Monsoon

rainfall in the U.S. Rocky Mountain region and southwestern desert region will continue favorably over the next ten days - Western

and southern Mexico will continue to receive frequent rain over the next ten days benefiting all crops - Central

America will be plenty wet over the next couple of weeks supporting most crop needs

o

There may be some risk of flooding eventually

- A

good mix of shower activity and warm temperatures will occur in central and western Ukraine, Belarus and western and northern Russia over the next ten days to maintain most crop needs - Drying

is expected in the Ural Mountain region and a part of the southern New Lands of Russia during the next ten days speeding along spring crop maturation

o

A few late season crops may mature under stress threatening a small decline in yield or quality, but the impact should be low

- Europe

rainfall ill continue restricted over the next ten days especially in the southeast where crop moisture stress is already a big problem in unirrigated summer crop areas of the Balkan Countries - China

will continue to see alternating periods of rain and sunshine over the next ten days with the Yellow River Basin driest and the Yangtze River Basin wettest

o

Some additional flooding may impact a part of Sichuan and the Yangtze River Basin

o

Some periodic rainfall is also expected in northeastern China that will be more than sufficient to maintain a good outlook for summer crops

o

Temperatures will be seasonable

o

Next week may be wetter again in the Yellow River Basin

- Northwestern

India is still advertised to be drier than usual over the next two weeks along with parts of Pakistan

o

Gujarat, western and northern Rajasthan and central and southern Pakistan may not get enough rain to counter evaporation

- Crop

stress will continue to rise in unirrigated fields - South

Africa weather turned dry again after weekend rain fell in some eastern wheat areas

o

More rain is needed for unirrigated wheat in the east, but the weekend precipitation was welcome and beneficial

o

The nation’s western wheat is already well established and poised to perform well

- South

Africa will experience some additional rain over the next ten days with southern and easternmost parts of the nation wettest - Argentina

southern and eastern crop areas will get some rain in the second half of this week, but western crop areas are expecting to be dry biased through the next two weeks

o

Winter crops are dormant or semi-dormant right now making the moisture shortage in the west of little concern, but spring rainfall will be very important

- Brazil

rainfall will continue limited to the far south over the next two weeks which is not unusual for this time of year

o

Large moisture deficits remain in center south Brazil from 2020-2021 and could be a factor in spring crop development potential if La Nina delays the onset of season moisture

o

River and stream flow remain critically low in much of the Parana River Basin

- Some

unexpected rain of significance fell in northern Rio de Janeiro and immediate neighboring areas of Minas Gerais, Brazil Monday

o

None of the coffee areas benefited much from the rain

- Southeast

Asia nations will all receive sufficient rain to support crops during the next two weeks

o

The forecast includes an improving rain distribution for Sumatra, Java, Kalimantan and the central and southern Philippines all of which have been trending a little too dry recently

- Thailand

will be the one nation to watch for possible inadequate rainfall - East-central

Africa rainfall in this coming week will continue abundant in Ethiopia and a routine occurrence of rain will also occur in Kenya and Uganda - West

Central Africa weather will be seasonable over the next two weeks

o

Rain will continue to fall periodically over the next couple of weeks, although the lightest rainfall will be in southern Ivory Coast and Ghana

- Australia

weather will continue favorably for wheat, barley and canola which are semi-dormant at this time of year. Soil moisture is favorable and ready to support spring growth when warming comes along especially if timely rainfall continues as advertised

o

Queensland and northern New South Wales still need significant rain to restore soil moisture after recent drying

- Southern

Oscillation Index has reached +4.83 and it will continue to drift lower this week, albeit at a slower pace.

- New

Zealand rainfall during the coming week will be above average in western South Island and near to below average elsewhere; temperatures will be seasonable

Source:

World Weather Inc.

Tuesday,

Aug. 17:

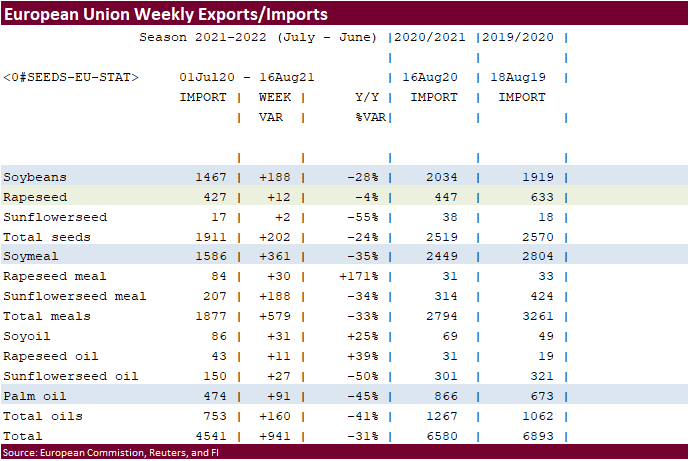

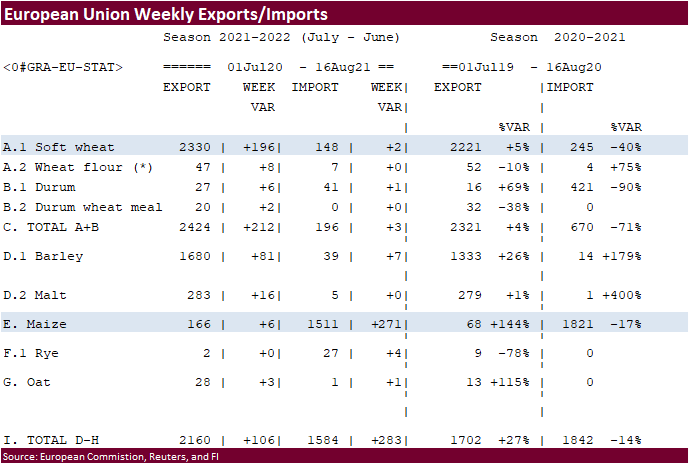

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - HOLIDAY:

Indonesia

Wednesday,

Aug. 18:

- EIA

weekly U.S. ethanol inventories, production - China’s

second batch of July trade data for commodities, including corn, wheat, sugar and pork

Thursday,

Aug. 19:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Brazil’s

Conab releases sugar and cane production data (tentative) - USDA

total milk, read meat production - Port

of Rouen data on French grain exports - HOLIDAY:

India, Pakistan, Bangladesh

Friday,

Aug. 20:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

country-wise import data for farm goods such as soybeans, corn and pork - FranceAgriMer

weekly update on crop conditions - Malaysia

Aug. 1-20 palm oil export data - U.S.

Cattle on Feed, 3pm

Source:

Bloomberg and FI

7th

straight day of $t trillion…….US fed accepts $1053.454 bln (1.053 trln) in daily reverse repo operation, awards at 0.05% to 70 bidders – NY Fed.

US

Retail Sales Advance (M/M) Jul: -1.1% (est -0.3%; prevR 0.7%; prev 0.6%)

US

Retail Sales Ex-Auto (M/M) Jul: -0.4% (est 0.2%; prevR 1.6%; prev 1.3%)

US

Retail Sales Ex-Auto, Gas (M/M) Jul: -0.7% (est -0.1%; prevR 1.3%; prev 1.1%)

US

Retail Sales Control Group Jul: -1.0% (est -0.2%; prevR 1.4%; prev 1.1%)

Canadian

Housing Starts Jul: 272.2K (est 280.0K; prevR 281.2K; prev 282.1K)

Canadian

International Securities Transactions Jun: 19.70B (prev 20.79B)

US

Industrial Production (M/M) Jul: 0.9% (est 0.5%; prev 0.4%)

US

Capacity Utilization Jul: 76.1% (est 75.7%; prev 75.4%)

US

Manufacturing (SIC) Production Jul: 1.4% (est 0.7%; prev -0.1%)

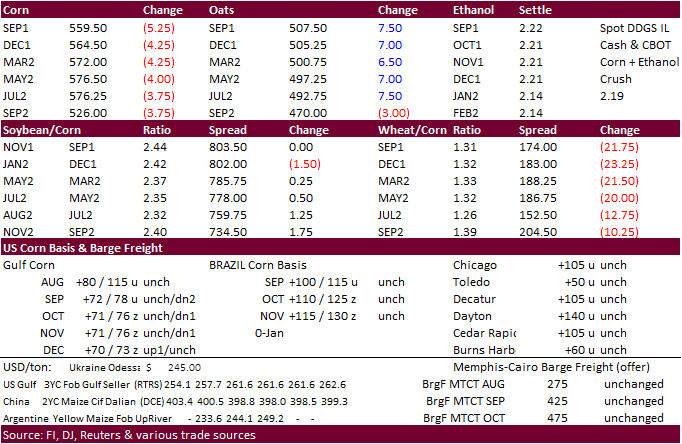

- Corn

closed

lower, by 4.25-6.50 cents bias nearby contracts to the downside. It did trade two-sided but a sharply lower wheat trade pressured the market. The USD was up 49 points by 1:20.

- Pro

Farmer projected lower corn yields and soybean pod counts than last year in South Dakota but higher Ohio yields and pod counts, as expected. However, using the 151.5 SD corn yield for South Dakota, implied corn production would end up 102 million bushels

above USDA’s August estimate. - Day

two results will be out later. - Day

one of the Pro Farmer crop tour. (2021/2020/3-year average corn yield/soybean pod count):

- Ohio

Corn: 185.06/167.69/167.20 - Ohio

Soybeans: 1195.4/1155.7/1056.0 - South

Dakota Corn: 151.45/179.24/170.44 - South

Dakota Soybeans: 996.9/1250.9/1036.1 - China’s

sow herd declined 0.5% in July to 45.6 million from the previous month, first monthly decline in nearly two years, in part to weaker hog prices. The herd number is still up 25 percent from a year ago. Farmers lost an average 665 yuan ($102) per head during

June, according to agriculture ministry data per Reuters. China’s pig herd increased 0.8% in July from the prior month to 439 million and was 31% larger than a year earlier. Both sows and pigs recovered from 2017 levels.

- US

weather appears to be non-threatening for the majority of the Corn Belt. Good rain is expected for parts of the upper Great Plains and WCB this workweek.

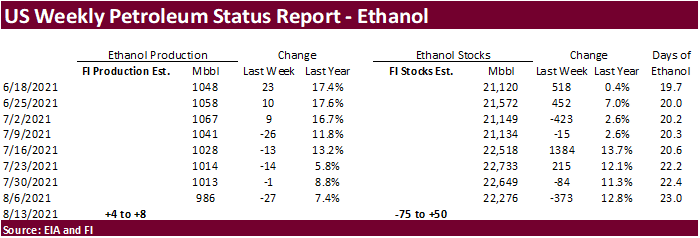

- A

Bloomberg poll looks for weekly US ethanol production to be up 1,000 barrels (973-1000 range) from the previous week and stocks down 104,000 barrels to 22,172 million.

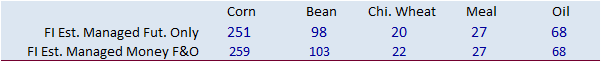

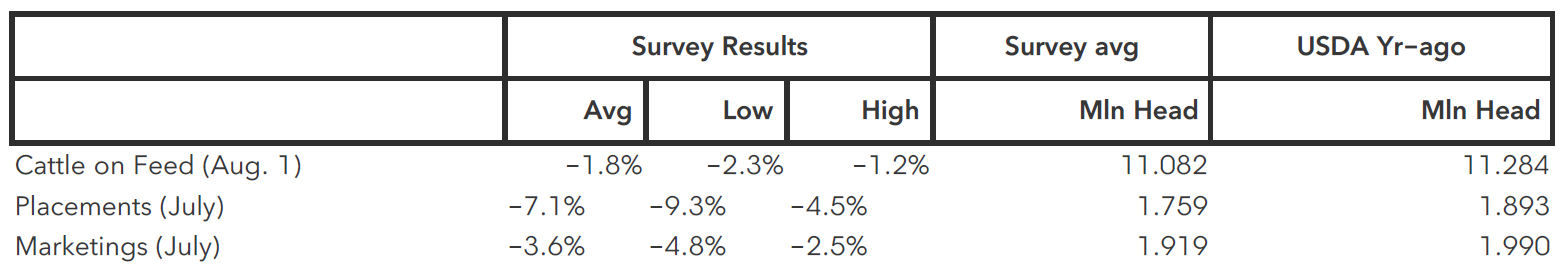

- Bloomberg

survey: U.S. Cattle on Feed placements are seen down 7.1% to 1.76 million head.

Export

developments.

- South

Korea’s NOFI bought 138,000 tons of feed corn from South America on two consignments for arrival in November. They passed on 69k. One cargo traded at $2.4920/bu over the December and second at $2.4765/bu over the Dec.

- Qatar

seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery.

- Turkey

seeks 270,000 tons of barley on August 20 for shipment between Sep 1 and Sep 25.

September

corn is seen is a $5.40-$5.80 range.

December

corn is seen in a $4.75-$6.00 range

-

Soybeans

opened higher (two-week high), gaining for the sixth consecutive session, but fell by late morning on profit taking. November soybeans saw stops at $13.62 (2000x). Soybeans were initially higher after on a decline in US soybean conditions and ongoing USDA

export sales. Nine straight days USDA announced sales to unknown or specific destinations. Today it included 198,000 tons of soybeans to China and 132,000 tons to unknown.

-

Egypt

announced they seek vegetable oils after the close. -

The

Pro Farmer crop tour showed pod counts for SD down 20.3% from year earlier. Day 2 results will be out this evening.

-

Soybean

meal also gave up earlier gains but ended up rallying to end $0.40 to $1.20 higher.

-

Canola

traded 5.90 higher. -

Soybean

oil traded 75-82 points lower. Soybean oil was down initially on weakness in outside related markets and follow through selling in WTI crude oil. Malaysian palm futures basis the November position was down 39 ringgit and cash fell $5/tons. Palm futures

were lower on profit taking and slowing Aug 1-15 shipments of Malaysian palm shipments from FH July. Note Malaysia’s Bursa exchange plans to launch a East Malaysian palm oil contract in October.

-

Attached

is our updated US soybean complex. We lowered SBO for biofuel (old and new) and raised food use (new-crop) based and slowing demand for SBO for biofuel and a reevaluation of food use. We lowered new-crop exports by a large amount as we think prices will

remain high relative to global vegetable oils, and much of the SBO produced will be diverted to the domestic market. We lowered old crop crush based on recent NOPA data. New-crop soybean exports were reduced based on lower than expected new-crop comments

(thinking SON shipment period). Other minor changes were made to the complex.

-

Traders

are already eying upcoming USDA reports. -

Surveys

for USDA’s September Crop

Production,

Small

Grains Summary,

and Grains

Stocks

will go out to producers and commercials on August 28, with data collection lasting until 9/6 for

Crop

Production)

& 9/11 for Small

Grains

and Stocks.

-

Argentine

producers sold 27.3 million tons of 2020-21 soybeans, according to the AgMin, down from 29.4 million tons at this time last year.

Export

Developments

-

Egypt’s

GASC seeks at least 30,000 tons of soybean oil and 10,000 tons of sunflower on Wednesday for arrival Oct 5-25. Payment is for 180-day letters of credit or at sight.

-

USDA

announced private exporters sold 198,000 tons of soybeans to China and 132,000 tons to unknown destinations for 2021-22 delivery.

- Today

the USDA was in for 290,000 tons of veg oil for use in export programs. 210 tons in 4-liter cans and 80 tons in 4-liter cans or plastic bottles, for shipment Sep16 to Oct 15 (Oct 1-31 for plants at ports).

- South

Korea’s Agro-Fisheries & Food Trade Corp. seeks 3,700 tons of non-GMO soybeans on August 19 for arrival between Oct. 20 and Nov. 19.

Updated

8/17/21

September

soybeans are seen in a $13.10-$14.00 range;

November $11.75-$15.00

September

soybean meal – $345-$370; December $320-$425

September

soybean oil – 61.75-64.00;

December 48-67 cent range

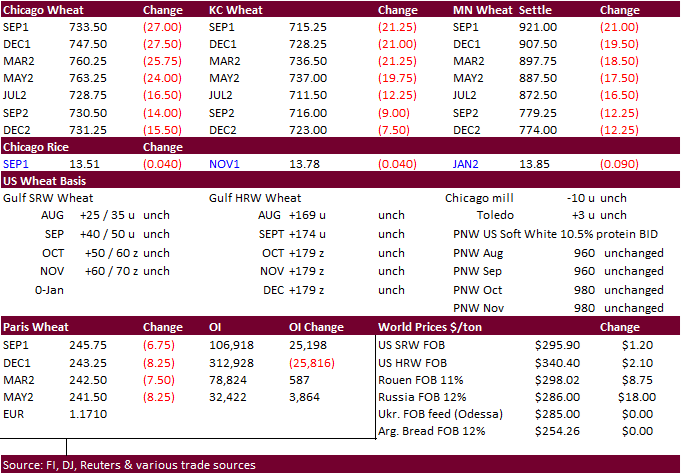

- The

rapid US spring wheat harvest progress initially pressured US wheat, followed by a sharply higher USD that added to the negative undertone. The USD was up 49 points by the time ags closed. Chicago wheat settled 26.0 lower basis September, KC Sep off 19.75

and MN Sep down 21 cents. Most wheat contracts hit contract - EU

December wheat was down 8.25 euros at 242.75 euros. That contract peaked on Friday, and on Monday it failed to test Friday’s highs.

- After

the close, Egypt announced they are in for wheat for Oct 5-15 shipment - EU

soft wheat exports so far this season reached 2.33 million tons by Aug. 15, including 407,000 tons for South Korea. - Germanys

association of farm cooperatives lower their estimates for the 2021 wheat and rapeseed crops. Germany’s wheat production was revised to 22.39 million tons from 22.80 million tons previous. Winter rapeseed was pegged at 3.51 million ton from 3.68 million

in July.

- Egypt

is in for wheat for Oct 5-15 shipment - Awaited:

Algeria started buying an unspecified amount of wheat for September shipment. Prices were around $348-$351/ton. Initial volume was around 200,000 to 250,000 tons.

- The

Philippines seeks 280,000 tons of feed wheat on August 19 for October/November shipment.

- Jordan

seeks 120,000 tons of feed barley on August 19. - Japan

(SBS) seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on August 18 for loading by November 30.

- Bangladesh

seeks 50,000 tons of wheat on August 18. - Pakistan

seeks 400,000 tons of wheat on August 23 for Sep/Oct shipment. - Morocco

seeks 363,000 tons of US durum wheat under a tariff import quota on August 24 for shipment by December 31.

Rice/Other

-

None

reported

Updated 8/17/21 (rolled to Dec)

December Chicago wheat is seen in a $6.80‐$8.25 range

December KC wheat is seen in a $6.60‐$8.00

December MN wheat is seen in a $8.45‐$9.80

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.