PDF Attached does not include daily estimate of funds

Lower

trade in the soybean complex. Grains were higher with wheat leading the way in part to a strong rebound in EU milling wheat.

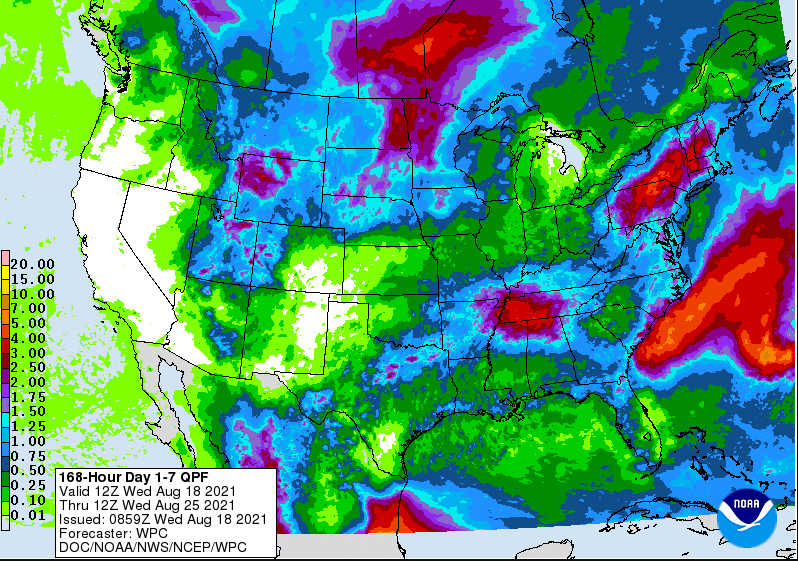

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

- Cool

temperatures occurred this morning in western Canada’s Prairies

o

Lows near dawn were in the middle and upper 30s and 40s

o

A patch or two of soft frost may have occurred near the front range of mountains in southwestern Alberta and near Albee, Alberta where readings were 33 to 35 Fahrenheit

- One

location in northwestern Saskatchewan also slipped to 35 - Autumn

coolness in western Canada is expected to prevail through the weekend and into early next week with some of the cooler conditions getting into the northwestern U.S. Plains, the far northern U.S. Rocky Mountain region and the eastern Prairies at times through

the first half of next week

o

Some pockets of frost may evolve briefly in a part of the Prairies next week and a close watch is warranted

- Cool

air will also slip through the U.S. Midwest during the middle and latter parts of next week with no threat of frost - Cooling

in Canada and the northern U.S. Plains will support waves of rain into early next week in each of these areas and in a part of the upper Midwest

o

Details for the rainfall are still not clear because of model run variations, but World Weather, Inc. believe Manitoba, eastern parts of the Dakotas and parts of Minnesota will receive 0.50 to 1.50 inches of rain with a few amounts

near or slightly over 2.00 inches by mid-week next week resulting from three waves of rainfall

o

Other areas in the Prairies and western parts of the northern Plains will receive 0.25 to 0.75 inch of rain with a few amounts of 1.00 inch or more expected in the eastern part of Saskatchewan

o

Look for more volatility in rain forecasts in the Prairies and northern Plains over the next few days; confidence is low for some of the rainfall in the central and western Prairies

- Southeastern

Alberta, however, should get another 0.50 to 1.50 inches of rain and locally more in this coming week - U.S.

Midwest, Delta and southeastern states will experience a good mix of weather over the next ten days to two weeks supporting relatively normal crop development

o

A few pockets of drying are expected in the Midwest, but they will be small in size and not likely to have a huge influence on the bottom line to production

o

Dryness in the far northwestern Corn Belt will be eased, but not eliminated

- U.S.

west-central and southwestern Plains will experience net drying conditions for a while leaving some dependency upon irrigation for normal crop development; however, some areas (like West Texas) have received significant moisture recently and crop development

will be good during the drier period - West

Texas cotton, corn and sorghum areas would benefit from greater heat units, but the moisture profile is very good for ongoing crop development

o

Cotton needs the heat more than the other crops

- South

Texas harvest weather will remain ideal over the next ten days - Another

hot day occurred Tuesday across the northern U.S. Plains with highs in the 90s and over 108 degrees Fahrenheit

o

The heat will begin to abate today with cooling through Friday from west to east across the northern Plains

- U.S.

Pacific Northwest and California will continue drier biased for a while - Monsoon

rainfall in the U.S. Rocky Mountain region and southwestern desert region will continue favorably over the next ten days - Western

and southern Mexico will continue to receive frequent rain over the next ten days benefiting all crops - Central

America will be plenty wet over the next couple of weeks supporting most crop needs

o

There may be some risk of flooding eventually

- A

good mix of shower activity and warm temperatures will occur in central and western Ukraine, Belarus and western and northern Russia over the next ten days to maintain most crop needs - Tropical

Storm Grace will pass over the Cayman Islands today producing heavy rain. The system could become a hurricane prior to landfall in the Yucatan Peninsula Thursday

o

Grace will emerge in the southwestern Gulf of Mexico Friday with landfall in Veracruz, Mexico during the weekend possibly as a hurricane once again

o

Heavy rain and windy conditions will occur from Veracruz across central Mexico during the weekend and early next week before the storm moves out over the eastern Pacific Ocean next week

- Damage

to some citrus, sugarcane and rice is possible with at least some threat to coffee in Veracruz and states to the immediate west.

o

Very little rain from Grace will reach the drought areas of northeastern Mexico, although a few showers may evolve.

o

South Texas will not be impacted by this tropical cyclone

- Tropical

Storm Henri is southwest of Bermuda today and will be drifting closer to the United States late this week and into the weekend. Landfall is possible in southeastern New England late this weekend into early next week

o

There is still some potential the storm will veer to the east and reach Nova Scotia, Canada

o

Heavy rain, strong wind and rough seas will accompany the storm inland and the system will need to be closely monitored.

- Drying

is expected in the Ural Mountain region and a part of the southern New Lands of Russia into Kazakhstan during the next ten days speeding along spring crop maturation and early harvesting

o

A few late season crops may mature under stress threatening a small decline in yield or quality, but the impact should be low

o

Spring wheat and sunseed have likely been impacted by this year’s heat and dryness

- Kazakhstan

and Russia’s southern New Lands may get some rain after August 27, but confidence is low on its significance.

- Showers

will occur in eastern Ukraine and neighboring areas that have been dry recently during the Friday through Monday period

o

The moisture will be light, but welcome as temporary relief from recent drying

o

Drier biased conditions will resume after that for a little while

- Rain

will fall periodically in western and northern Russia, western Ukraine, Belarus and the Baltic States - Europe

rainfall ill continue restricted through the weekend especially in the southeast where crop moisture stress is already a big problem in unirrigated summer crop areas of the Balkan Countries

o

Dryness in the Balkan Countries may be a persistent feature that lasts into early September

- Northern

and central Europe will trend wetter next week - China

will continue to see alternating periods of rain and sunshine over the next ten days with areas between the Yellow River Basin and the Yangtze Rivers wettest

o

Some additional flooding may impact a part of the region

o

A favorable mix of weather is expected in Northeastern China and near and north of the Yellow River

o

Drier weather is needed in spring wheat areas of northeastern China where rain has been a little too frequent recently

o

Temperatures will be seasonable

- Northwestern

India is still advertised to be drier than usual over the next two weeks along with parts of Pakistan

o

A few showers reached eastern Gujarat Tuesday, but resulting amounts were light

o

Gujarat, western and northern Rajasthan and central and southern Pakistan may not get enough rain to counter evaporation

- Crop

stress will continue to rise in unirrigated fields - Most

of India will experience a good mix of weather over the next two weeks supporting normal crop development - South

Africa weather turned dry again Monday and Tuesday after weekend rain fell in some eastern wheat areas

o

More rain is needed for unirrigated wheat in the east, but the weekend precipitation was welcome and beneficial

o

The nation’s western wheat is already well established and poised to perform well

- South

Africa will experience some additional rain over the next ten days with southern and easternmost parts of the nation wettest - Argentina

southern and eastern crop areas will get some rain in the balance of this week, but western crop areas are expecting to be dry biased through the next two weeks

o

Winter crops are dormant or semi-dormant right now making the moisture shortage in the west of little concern, but spring rainfall will be very important

- Brazil

rainfall will continue limited to the far south over the next two weeks which is not unusual for this time of year

o

Large moisture deficits remain in center south Brazil from 2020-2021 and could be a factor in spring crop development potential if La Nina delays the onset of season moisture

o

River and stream flow remain critically low in much of the Parana River Basin

- Brazil

temperatures will rise well above normal above normal in the west and south as well as in Paraguay and northern Argentina during the coming week resulting in rising crop stress

o

Stress will be greatest in coffee production areas where crop damage has already occurred because of late July frost and freezes

- Southeast

Asia nations will all receive sufficient rain to support crops during the next two weeks

o

The forecast includes an improving rain distribution for Sumatra, Java, Kalimantan and the central and southern Philippines all of which have been trending a little too dry recently

- Thailand

will be the one nation to watch for possible inadequate rainfall - East-central

Africa rainfall in this coming week will continue abundant in Ethiopia and a routine occurrence of rain will also occur in Kenya and Uganda - West

Central Africa weather will be seasonable over the next two weeks

o

Rain will continue to fall periodically over the next couple of weeks, although the lightest rainfall will be in southern Ivory Coast and Ghana

- Australia

weather will continue favorably for wheat, barley and canola which are semi-dormant at this time of year. Soil moisture is favorable and ready to support spring growth when warming comes along especially if timely rainfall continues as advertised

o

Queensland and northern New South Wales still need significant rain to restore soil moisture after recent drying

- Southern

Oscillation Index has reached +4.41 and it will continue to drift lower this week, albeit at a slower pace.

- New

Zealand rainfall during the coming week will be above average in western South Island and near to below average elsewhere; temperatures will be seasonable

Source:

World Weather Inc.

Thursday,

Aug. 19:

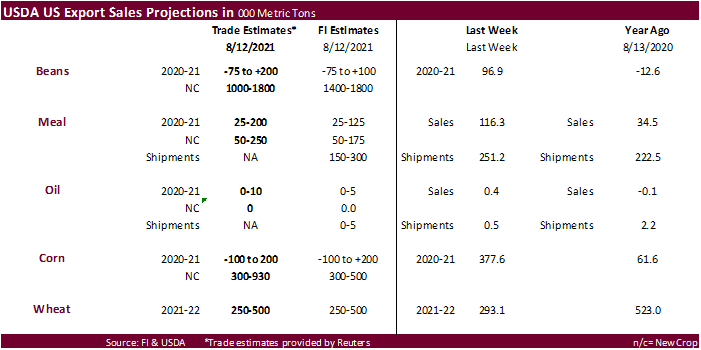

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Brazil’s

Conab releases sugar and cane production data (tentative) - USDA

total milk, read meat production - Port

of Rouen data on French grain exports - HOLIDAY:

India, Pakistan, Bangladesh

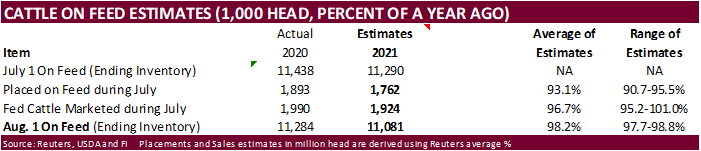

Friday,

Aug. 20:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

country-wise import data for farm goods such as soybeans, corn and pork - FranceAgriMer

weekly update on crop conditions - Malaysia

Aug. 1-20 palm oil export data - U.S.

Cattle on Feed, 3pm

Source:

Bloomberg and FI

82

Counterparties Take $1115.656 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1053.454 Bln, 70 Bidders)

US

Housing Starts Jul: 1534K (est 1600K; prevR 1650K; prev 1643K)

US

Housing Starts (M/M) Jul: -7.0% (est -2.6%; prevR 3.5%; prev 6.3%)

US

Building Permits Jul: 1635K (est 1610K; prevR 1594K; prev 1598K)

US

Building Permits (M/M) Jul: 2.6% (est 1.0%; prevR -5.3%; prev -5.1%)

Canadian

CPI (Y/Y) Jul: 3.7% (est 3.4%; prev 3.1%)

Canadian

CPI NSA (M/M) Jul: 0.6% (est 0.3%; prev 0.3%)

Canadian

CPI Core-Common (Y/Y) Jul: 1.7% (est 1.8%; prev 1.7%)

Canadian

CPI Core-Median (Y/Y) Jul: 2.6% (est 2.4%; prev 2.4%)

Canadian

CPI Core-Trim (Y/Y) Jul: 3.1% (est 2.5%; prev 2.6%)

US

DoE Crude Oil Inventories (W/W) 13-Aug: -3233K (est -1450K; prev -448K)

–

Distillate Inventories: -2697K (est 200K; prev 1767K)

–

Cushing Crude Inventories: -980K (prev -325K)

–

Gasoline Inventories: 696K (est -2000K; prev -1401K)

–

Refinery Utilization: 0.40% (est 0.20%; prev 0.50%)

-

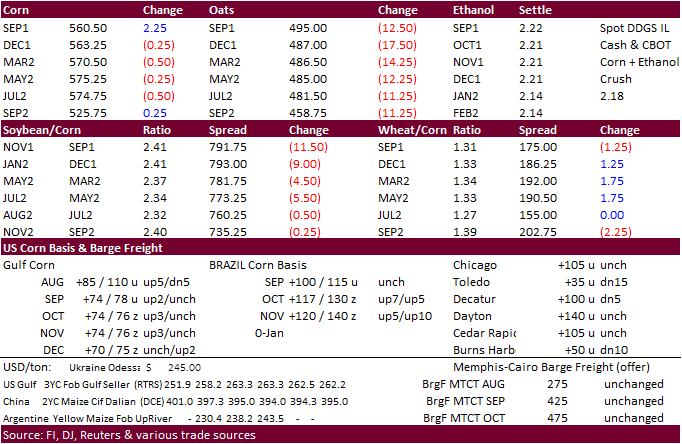

US

corn ended higher led by bull spreading (Sep gained 2 cents over Dec) on technical buying and US crop yield concerns. Although rain is expected across the northern U.S. Plains and upper Midwest for the next five to six days, much of the WCB crop is made.

We don’t expect a US corn harvest progress figure on Monday but may see a 1-3 percent number the following week. Delta harvesting is underway.

-

Upside

in corn was limited after Chicago wheat gave up some gains and WTI crude oil fell below $65/barrel for the first time since May. WTI settled at $65.13, down $1.46/barrel.

-

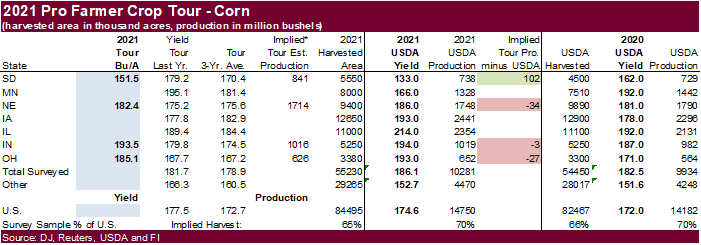

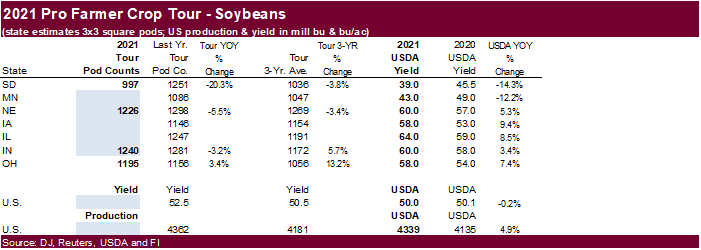

Pro

Farmer projected higher corn yields and lower soybean pod counts than last year in Nebraska. For Indiana, the tour pegged the corn yield higher than last year and pod count slightly below 2020.

-

Bulgaria

reported an outbreak of African swine fever at an industrial farm with 13,000 pigs in the central village of Apriltsi.

Export

developments.

- Results

awaited: Qatar seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery.

- Turkey

seeks 270,000 tons of barley on August 20 for shipment between Sep 1 and Sep 25.

September

corn is seen is a $5.40-$5.80 range.

December

corn is seen in a $4.75-$6.00 range

-

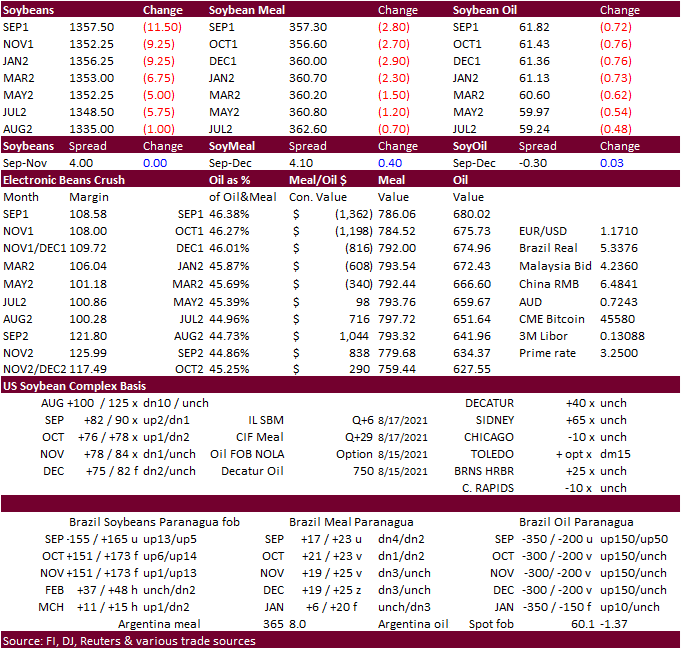

Soybeans,

meal, and soybean oil ended lower on favorable US weather (both ECB and WCB will see rain this week), weakness in US energy markets, lower lead this morning by offshore product values, lower trade in canola futures, and technical selling. November soybeans

fell 9.25 cents and settled at 13.5225, near its 50 and 100 day MA’s. A close below $13.4675 on Thursday, its 100-day MA, could be bearish. October soybean meal ended $2.50 lower and October soybean oil lost 65 points.

-

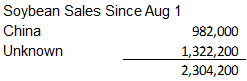

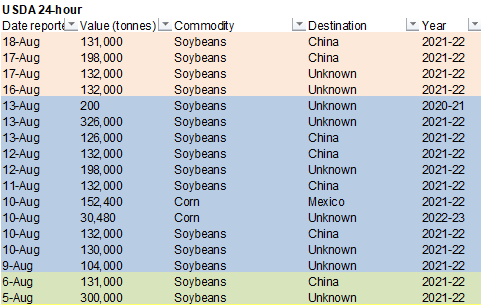

USDA

announced 131,000 tons of soybeans sold to China. -

Egypt

is in for vegetable oils on Thursday. -

Malaysian

palm oil fell 107 points (off 3%) to 4301 and cash was down $20/ton at $1,080/ton. Malaysian will keep its September crude palm oil export duty unchanged at 8 percent.

-

Indonesia’s

June palm oil exports fell 26.8% from the same month a year earlier to 2.03 million tons due to volatile prices, according to GAPKI. Crude palm oil production was up 9.4% in June from a year earlier to 4.48 million tons.

-

Indonesia

is expected to raise its export duties for September to $166 from $93 in August.

-

APK-Inform

expects Ukrainian sunflower oil exports during the new-crop September 2021 and August 2022 season to total 6.77 million tons from 5.38 million projected this season. They look for sunseed production to amount to 16.7 million tons in 2021 that could equate

to a 21.3% increase in sunflower oil production to 7.17 million tons. -

Pro

Farmer projected higher corn yields and lower soybean pod counts than last year in Nebraska. For Indiana, the tour pegged the corn yield higher than last year and pod count slightly below 2020.

-

Argentine

producers sold 27.3 million tons of 2020-21 soybeans, according to the AgMin, down from 29.4 million tons at this time last year.

Export

Developments

·

Under the 24-hour announcement system, private exporters sold 131,000 tons of soybeans to China.

·

Egypt’s GASC seeks at least 30,000 tons of soybean oil and 10,000 tons of sunflower on Thursday for arrival Oct 5-25. Payment is for 180-day letters of credit or at sight.

·

South Korea’s Agro-Fisheries & Food Trade Corp. seeks 3,700 tons of non-GMO soybeans on August 19 for arrival between Oct. 20 and Nov. 19.

Updated

8/17/21

September

soybeans are seen in a $13.10-$14.00 range; November $11.75-$15.00

September

soybean meal – $345-$370; December $320-$425

September

soybean oil – 61.75-64.00; December 48-67 cent range

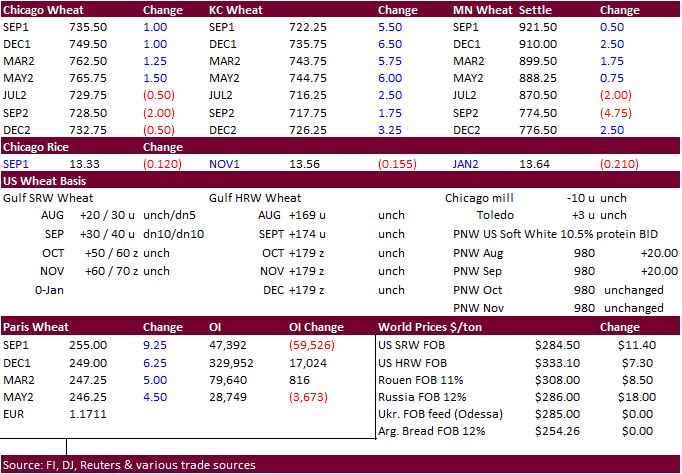

- Wheat

ended higher led by the KC contract on strong global demand and a rebound in EU wheat futures. Egypt’s GASC bought 180,000 tons of wheat from Romania (120,000 tons) and Ukraine (60,000) for at an average price of $296.65/ton fob, for shipment between Oct.

5-15. In early August they bought wheat at around $261.48/ton fob. - EU

December wheat rebounded, up 6.25 euros at $248.25 (257.75 absolute contract high established Friday).

- Manitoba,

Canada, Crop Report: Harvest progress reached 21%, ahead of the 4-year average of 14% for the third week of August.

- Kazakhstan

expects 2021 grain production to fall 24% to 15.3 million tons due to drought conditions. The country has harvested 1.5 million tons of grain from 9.9% of the area. Exports could end up between 6.5 and 7.0 million tons of grain, down from about 8 million

tons in 2020-21. - APK-Inform

estimated Ukraine grain exports rising to 57 million tons from 45.5 million during 2020-21, including 21.1 million tons of wheat and 31 million tons of corn.

EU

December wheat

Source:

Reuters and FI

- Algeria

bought up to 290,000-250,000 tons of wheat at $350-$351/ton for September shipment.

- Egypt’s

GASC bought 180,000 tons of wheat from Romania (120,000 tons) and Ukraine (60,000) for at an average price of $296.65/ton fob, for shipment between Oct. 5-15. In early August they bought wheat at around $261.48/ton fob. Reuters provide the following breakdown:

o

60,000 tons Romanian wheat at $294.99 a ton FOB plus $34.43 freight (ocean shipping) totaling $329.42 a ton c&f

o

60,000 tons Romanian wheat from Grain Export at $297.00 a ton FOB plus $34.43 freight totaling $331.43 a ton c&f

o

60,000 tons Ukrainian wheat at $297.95 a ton FOB plus $35.94 freight or $333.89 a ton c&f

- Jordan

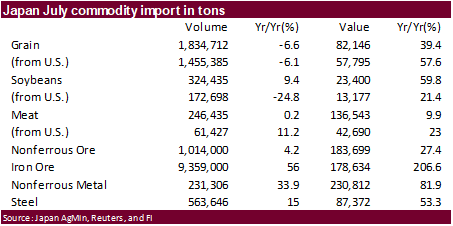

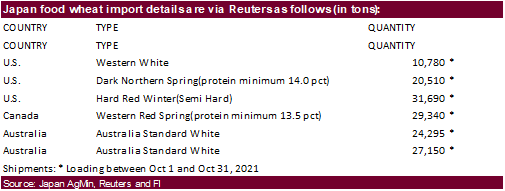

was believed to have passed on wheat. Lowest offer was $346/ton c&f. - Japan

in a SBS import tender, passed on feed wheat and barley. It was to be

loaded by Nov. 30 and arrive in Japan by Jan. 27, 2022. - Japan

is in for 143,765 tons of food wheat this week.

- Bangladesh

saw no offers for 50,000 tons of wheat. - The

Philippines seeks 280,000 tons of feed wheat on August 19 for October/November shipment.

- Jordan

seeks 120,000 tons of feed barley on August 19. - Pakistan

seeks 400,000 tons of wheat on August 23 for Sep/Oct shipment. - Morocco

seeks 363,000 tons of US durum wheat under a tariff import quota on August 24 for shipment by December 31.

Rice/Other

-

(Reuters)

– “Vietnam will consider cutting the area under rice cultivation if prices of the grain fall further, the country’s agriculture minister said, as farmers struggle to offload their new harvest due to weak demand and strict coronavirus movement curbs……Prices

for Vietnam’s 5% broken rice have fallen to around $390 per ton, the lowest since February 2020, due to weak demand. Vietnam is the world’s third-largest exporter of the commodity after India and Thailand…Hoan did not say by how much Vietnam planned to cut

the rice production area, but state media reports cited the ministry as saying earlier this year that it could cut the rice growing area by 5.4% to 3.5 million hectares (8.6 million acres) by 2030.”

Updated 8/17/21

December Chicago wheat is seen in a $6.80‐$8.25 range

December KC wheat is seen in a $6.60‐$8.00

December MN wheat is seen in a $8.45‐$9.80

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.