PDF Attached does not include daily estimate of funds.

Updated US soybean meal S&D attached (raised domestic demand)

Talk

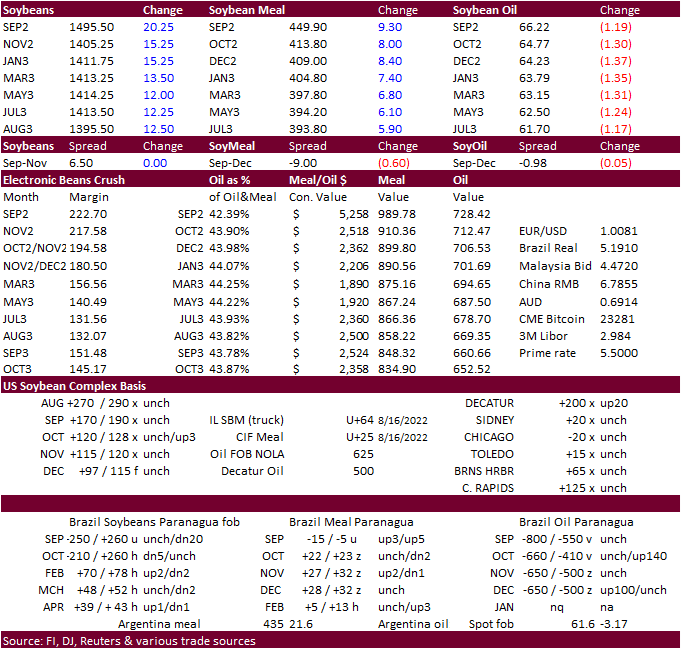

of Chinese demand for US soybeans, strong soybean meal futures, and spreading against corn & wheat sent soybean contracts higher. Soybean oil fell on weaker global vegetable oil prices despite sharply higher WTI crude oil. Soybean meal was higher in part to

concerns Argentina soybean meal exports will be slow over the short term. Corn traded two-sided, ending higher. Wheat fell hard from a strong US Dollar and increase in Ukraine shipping activity.

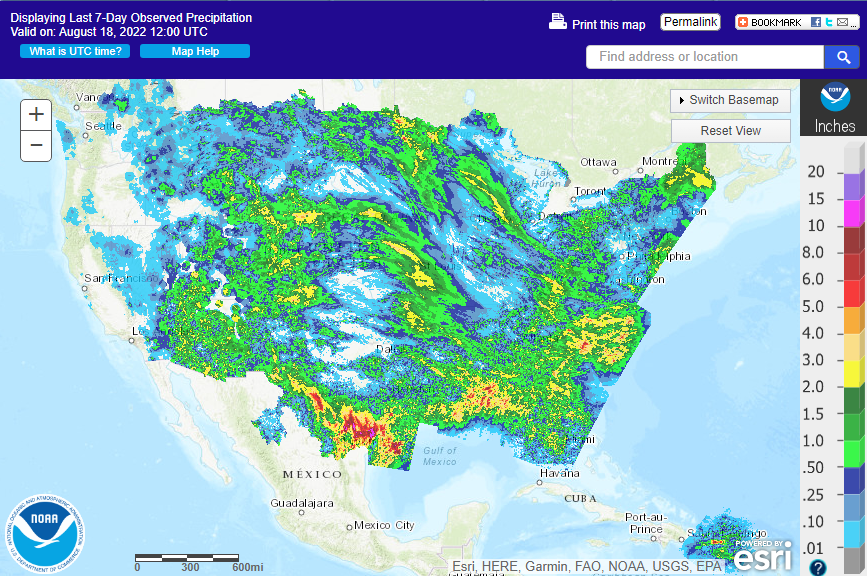

OK & TX will see rain through Friday. The US Midwest west-central areas will see rain late Friday through Saturday before moving into the east-central areas Sunday. Argentina will remain dry through the balance of the week before improvement

next week. The EU will see additional rains across the dry areas this week.

China’s Yangtze Valley will continue to see unwanted net drying.

WEATHER

TO WATCH AROUND THE WORLD

- Very

little change today relative to that of Wednesday - U.S.

Midwest crop weather will continue mostly good with a combination of mostly favorable soil moisture, timely rainfall and milder than usual temperatures expected

- There

are pockets of dryness and some areas of crop stress, but the environment today is not very threatening to production and as long as temperatures are mild deteriorating conditions will occur only gradually - Timely

rainfall will impact the U.S. Delta and southeastern states through the next ten days maintaining a very good environment for crop development - U.S.

southwest monsoon is expected to be quite active during the coming week with moisture abundance expected from northwestern Mexico into the southern U.S. Rocky Mountain region

- The

breakdown of high pressure in the central U.S. this week and next week will allow some of this moisture to stream across Texas and Oklahoma - Texas

and Oklahoma are still expecting significant rain Saturday through Monday after scattered showers occur today into Friday - Sufficient

amounts of rain will fall to bolster soil moisture from West Texas and the Texas Panhandle through much of central and southern Oklahoma to the Texas Blacklands - Rain

totals of 1.00 to 3.00 inches and local totals to 5.00 inches are expected with the Red River Valley and the Texas Panhandle to be wettest - The

relief from drought will be welcome, but it comes too late for a serious change in 2022 production for corn, sorghum cotton or most any other crop - The

moisture will help improve topsoil moisture for better range and pasture conditions this autumn and it might rain enough to improve planting prospects for winter wheat - Follow

up rain will be very important for wheat planting and establishment and the odds are relatively good that drier weather will resume in September – at least for a while - Mild

to cool temperatures in the central and eastern U.S. over the next ten days will be good for most crops and should help to conserve soil moisture through slower evaporation rates - The

Plains will be coolest relative to normal and especially in the southern Plains over this first week of the outlook - Much

of the coolness will be a byproduct of cloudiness and rain in this coming week - Canada’s

central and southwestern Prairies remain too dry along with the northwestern U.S. Plains and the U.S. Pacific Northwest - Temperatures

in these areas will be above normal for an extended period of time - Late

season crop stress in unirrigated areas will continue along with some livestock stress - Rain

is expected in eastern and northern parts of the Prairies where crop production potential is still expected to be good - Some

of today’s forecast models have introduced the potential for some rain in southern Alberta next week, but confidence is low - Production

from the Prairies in general will still be well above that of last year and some areas will report impressive yields, but there will be some other areas that will not yield well

- Ontario

and Quebec, Canada, Manitoba Canada, eastern Saskatchewan, Canada and western, central and northern Alberta will get timely rain supporting coarse grain and oilseed development over the next two weeks. - Northeastern

Mexico drought is not likely to change much without a tropical cyclone coming inland.

- A

disturbance in the Caribbean Sea near Honduras will move across the Yucatan Peninsula in the next couple of days before reaching the Gulf of Campeche where some development will be possible - The

disturbance could move into northeastern Mexico during the weekend or early part of next week bringing “some” relieving rain, but much more will be needed - China’s

hot, dry weather in the Yangtze River Basin is expected to prevail for at least another week and then only partial relief is expected - Topsoil

moisture is rated very short while subsoil moisture is declining and will soon be short to very short as well - Crop

conditions are staying fair to good, but recent heat and dryness has induced some stress to crops and livestock - Damage

to rice is most suspected and China already lost rice production earlier this year because of flooding - Northern

China; including the Northeast Provinces and the North China Plain, will remain plenty wet if not a little too wet

- Some

drying would be welcome after a long summer of abundant to excessive moisture - Xinjiang,

China will continue to receive a mix of weather during the next two weeks maintaining a favorable summer crop outlook for corn, cotton and other crops - Xinjiang

may be a little cooler than usual this week with a few showers expected - Portions

of Russia and Kazakhstan have been drying out significantly and may need rain to protect late season crop yields - Eastern

portions of Russia’s Southern Region, western Kazakhstan and areas north to the Volga Vyatka and Ural Mountains have been drying most significantly, although southern parts of the region have been most impacted - Relief

is unlikely for the next ten days - Temperatures

have been in the 90s Fahrenheit most often in this region with a few readings over 100 in Kazakhstan - The

heat will prevail along with the lack of rain - Western

portions of Russia’s Southern region and Ukraine will receive periodic showers of rain and a few thunderstorms in the next few days offering some temporary relief from recent drying - Rainfall

will vary from 0.20 to 0.80 inch with a few pockets of an inch or more, but coverage of the greater amounts will be light - Relief

from recent drying may be limited, but there will be some short-term improvements to a few crops - Europe’s

dry bias in the west and southeast remains and is not likely to go away for a while - Scattered

showers will impact these areas through the weekend, but resulting rainfall may be a little too light for a serious change in crop and field conditions - A

ridge of high pressure building over central and western Europe next week will stifle the precipitation potentials and bring back warmer than usual temperatures while showers persist in a part of southeastern Europe - The

ridge will break down in the last days of August - None

of the rain will be great enough to seriously lift river and stream flows; including the Sein, Rhine and Danube Rivers - India’s

rainfall Tuesday and Wednesday was greatest in Gujarat, Rajasthan and Pakistan - Most

of the rain was not excessively great and most of it will prove to be quite beneficial for cotton, groundnut and a host of other crops produced in the region - India

will experience additional waves of rain over the coming ten days from Odisha and neighboring Bay of Bengal coastal areas through parts of Madhya Pradesh and northeastern Maharashtra to Gujarat, Pakistan and Rajasthan - A

new monsoon low will move from Odisha to Gujarat and Rajasthan as well as Pakistan beginning Friday in the east and ending Tuesday in the northwest

- Production

potentials are quite high in northwestern India and neighboring areas of Pakistan

- Some

areas in Madhya Pradesh, Chhattisgarh and Odisha are too wet and will benefit from another couple of days of drying that are coming - Uttar

Pradesh, Bihar and Jharkhand weather recently has improved after the very poor start to the monsoon season, but moisture deficits remain and greater rain is still needed - Parts

of Australia have been trending too wet recently - Western

Australia should receive less rain for a while, but showers will continue in Victoria, New South Wales and southeastern South Australia

- Drying

in the west will be welcome - Queensland

will be dry for the next week to nearly ten days - No

change in South America’s predicted weather is expected over the next ten days

·

Western wheat areas in Argentina will continue drier biased and in need of greater precipitation

·

Eastern Argentina will continue to have favorable soil moisture

·

Southern Brazil rain is expected to end today and early Friday

- Some

areas are a little too wet - Drying

in southern Brazil will occur from Friday afternoon through much of next week and the change will be welcome to all crops

- Korean

Peninsula will receive waves of rain over the next two weeks resulting in favorable soil moisture

- Mainland

areas of Southeast Asia will get plenty of rain, but nothing too extreme over the next ten days - Philippines

and Indonesia weather will continue frequently wet during the next ten days

- East-central

Africa will be most significant in Ethiopia, although Uganda and Kenya rainfall is also expected to be favorable - Flooding

has been occurring in parts of Ethiopia recently and it may continue at times - Tanzania

is normally dry at this time of year and it should be that way for the next few of weeks - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

greater rain would still be welcome in the drier areas of Ivory Coast and Ghana

- Seasonal

rains have shifted northward leading to some drying in southern areas throughout west-central Africa – this is normal for this time of year - Cotton

areas are expecting frequent rainfall in the next couple of weeks with a few areas in Mali, northern Ivory Coast and Senegal becoming a little too wet

- South

Africa’s crop moisture situation is favorable for winter crop establishment, although some rain would be welcome - Restricted

rainfall is expected for a while, but the crop is rated better than usual because of frequent rainfall during the autumn planting season and timely rain since then - Crops

are semi-dormant and unlikely to develop aggressively for a few weeks leaving plenty of time for seasonal rains to resume normally - Central

America rainfall will continue to be abundant to excessive and drying is needed - Too

much moisture could induce some areas of flooding - Some

crop conditions would improve with a little less rain - Mexico

rain will be most abundant in the west and southern parts of the nation - Drought

will prevail in the northeast, although there will be some increase in shower and thunderstorm activity near the Rio Grande for a while this week and in a more broad-based event next week as weather patterns change temporarily - Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely - Rain

in the past 30-days has been notably lighter than usual because of limited tropical activity

- No

change in this drier bias is expected for a while - Today’s

Southern Oscillation Index was +9.67 and it will move lower during the coming week - New

Zealand weather is expected to turn warmer this week with rain becoming heavy at times in North Island and in northern and western parts of South Island - Some

flooding will be possible

Source:

World Weather INC

Bloomberg

Ag Calendar

Thursday,

Aug. 18:

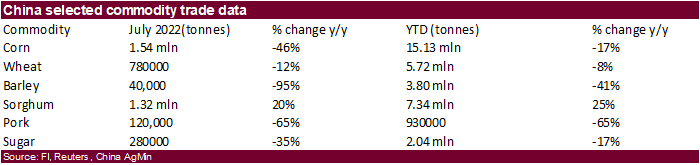

- China’s

second batch of July trade data, including corn, pork and wheat imports - International

Grains Council report - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

Friday,

Aug. 19:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Brazil’s

Conab releases sugar, cane and ethanol output data - US

cattle on feed, 3pm - EARNINGS:

Deere

Saturday,

Aug. 20:

- China’s

third batch of July trade data, including soy, corn and pork imports by country - AmSpec

to release Malaysia’s Aug. 1-20 palm oil export data

Source:

Bloomberg and FI

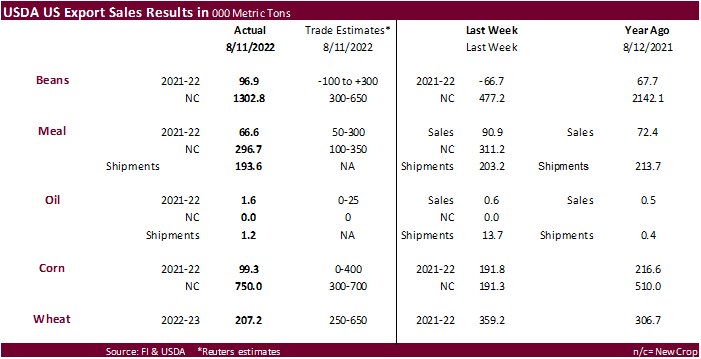

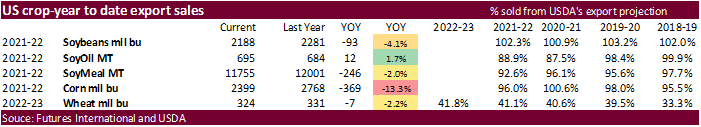

USDA

Export Sales

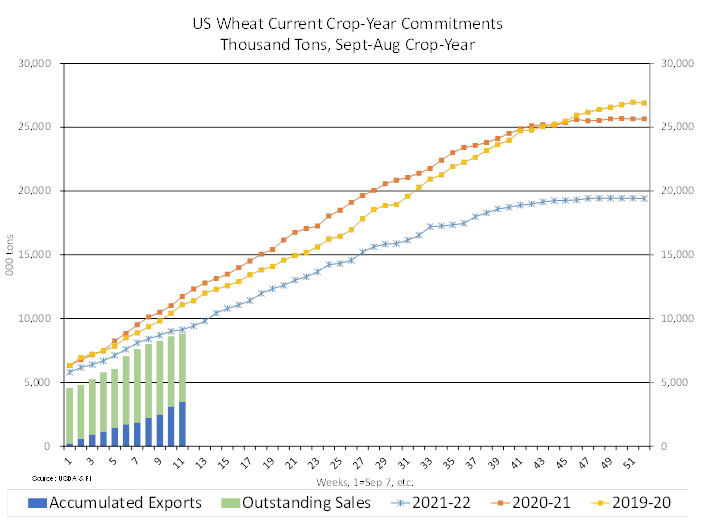

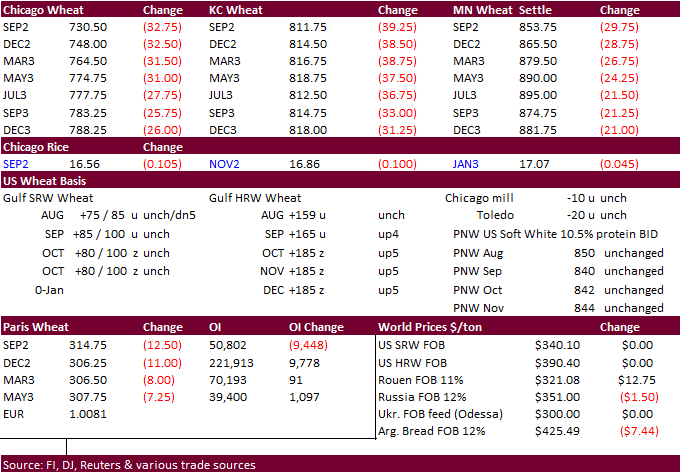

looked good with exception of soybean oil and wheat. Brazil and South Africa bought wheat from the US.

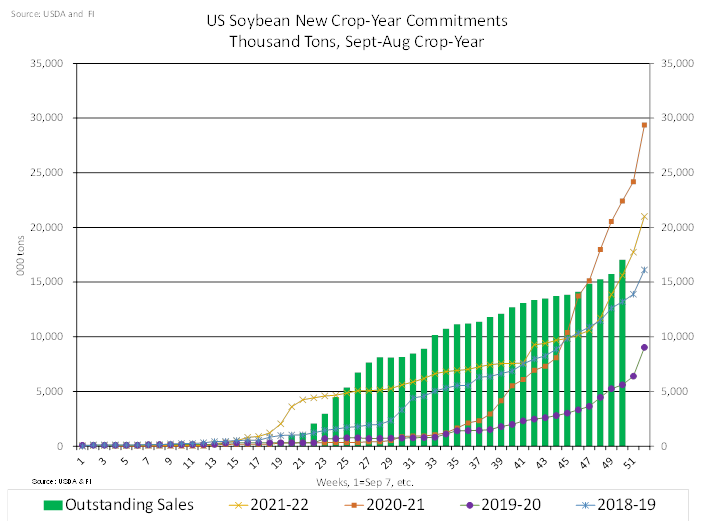

New

crop soybean sales were 1.303 million tons, well up from 477,200 tons previous week and reflects some of the 24-hour sales announcements reported during the week ending Aug 11. 2022-23 sales included China (779,000 MT), unknown destinations (273,000 MT), Mexico

(165,300 MT), and Egypt (60,000 MT). Old crop soybean sales of 96,900 tons were within expectations. Soybean meal sales were 66,600 MT for 2021-22. 2022-23 meal sales were a good 296,700 tons that included Mexico (123,000 MT), the Philippines (88,000 MT),

and Canada (53,300 MT). Shipments for meal were 193,600 tons. Soybean oil sales were only 1,600 tons and shipments were 1,200.

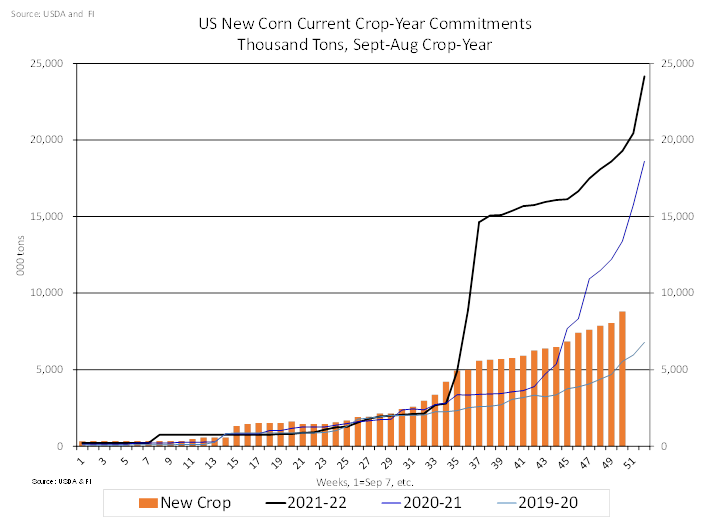

Old

crop corn sales were only 99,300 tons but new crop were 750,000 tons. The 2022-23 sales included China (51,300 MT, including 50,000 MT switched from unknown destinations) and Mexico (10,200 MT), were offset by reductions for unknown destinations (50,000 MT).

All wheat sales were 207,200 tons, below expectations and Included Mexico (85,300 MT, including decreases of 3,100 MT), the Philippines (64,800 MT), Brazil (28,200 MT, including 25,000 MT switched from unknown destinations), Japan (26,300 MT), and South Africa

(16,500 MT).

US

Initial Jobless Claims Aug 13: 250K (est 264K; prev 262K; prevR 252K)

–

Continuing Claims Aug 6: 1.437K (est 1450K; prev 1428K; prevR 1430K)

US

Philadelphia Fed Business Outlook Aug: 6.2 (est -5; prev -12.3)

US

Existing Home Sales Change Jul: 4.81M (est 4.87M; prev R 5.11M)

–

Existing Home Sales (M/M): -5.9% (est -4.9%; prev R -5.5%)

–

Median Home Price (Y/Y) (USD): 403.8K or +10.8% (prev 416.0K or +13.4%)

US

Leading Index (M/M) Jul: -0.4% (est -0.5%; prev R -0.7%)

Canada

Producer Prices (M/M) Jul: -2.1% (prev -1.1%; prevR -0.8%)

–

Producer Prices (Y/Y) Jul: 11.9% (prev 14.3%)

–

Raw Mat Prices (M/M) Jul: -7.4% (prev -0.1%)

–

Raw Mat Prices (Y/Y) Jul: 19.1% (prev 32.4%)

98

Counterparties Take $2.218 Tln At Fed Reverse Repo Op (prev $2.200 Tln, 103 Bids)

2022

U.S.

GENERATED 421 MLN BIODIESEL (D4) BLENDING CREDITS IN JULY, VS 491 MLN IN JUNE -EPA

U.S.

GENERATED 1.21 BLN ETHANOL (D6) BLENDING CREDITS IN JULY, VS 1.29 BLN IN JUNE -EPA

VS.

2021

U.S.

GENERATED 356 MLN BIODIESEL (D4) BLENDING CREDITS IN JULY, VS 429 MLN IN JUNE -EPA

U.S.

GENERATED 1.27 BLN ETHANOL (D6) BLENDING CREDITS IN JULY, VS 1.27 BLN IN JUNE -EPA

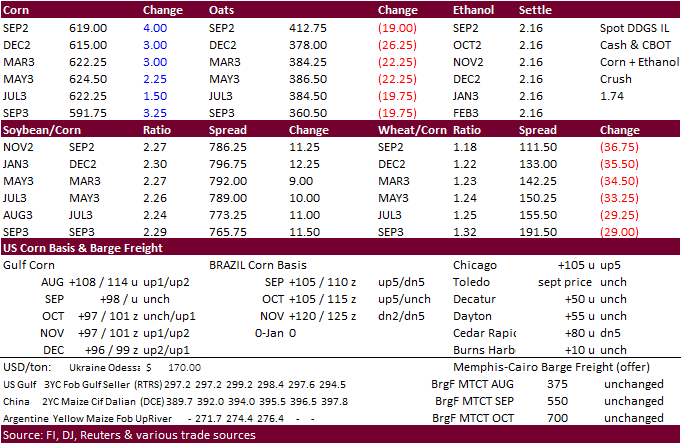

·

Corn futures traded two-sided, ending higher, with wheat sharply lower and soybeans higher. IGC cut their estimate of world corn production by 10 million tons to 1.179 billion. USDA is at 1.186 billion. The increase in Ukraine

port grain shipments and favorable US & EU weather limited gains.

·

Not all of the US Midwest will see rain over the next 7-10 days. However, many areas of the WCB where crop conditions have been struggling will see some type of relief. NE and parts of southern SD could see the least amount of

precipitation.

·

The 25th ship left Ukraine today. About 622,000 tons oof agriculture products have been shipped since the safe passage agreement.

·

China’s Sinograin and COFCO have formed a joint venture, called China Enterprise United Grain Reserve Co., to operate the country’s grain reserves, with 51% controlled by Sinograin. Goal is to improve food security.

·

China corn imports during July were 1.54 million tons, down 46 percent from year earlier. Part of the reason China corn imports were down so hard was from Covid lockdowns and Ukraine crop year to date July 1-Aug 15 grain exports

down 46 percent from year ago level.

·

The US and Taiwan may start trade talks early this fall. This could stir up China/US relations.

·

None reported

Due

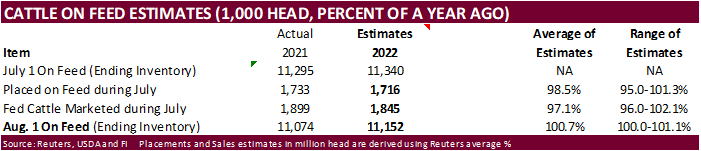

out Friday

Updated

8/16/22

September

corn is seen in a $5.70 and $6.60 range

December

corn is seen in a $5.50-$7.00 range

·

CBOT soybean

futures were higher led by strength in soybean meal. Improving US weather did little to slow buying in soybeans. New crop soybean export sales were better than expected and new-crop sales are starting to catch up to their respected three-year average. Soybean

oil was lower on weaker palm oil despite sharply higher WTI crude oil. Meal was very strong on concerns Argentina meal exports will be slow over the next few weeks.

·

We heard China bought at least six US cargoes of US soybeans so far this week. Most for nearby shipment.

·

Up to 2 million acres have been affected by the severe hot and dry conditions around the China Yangtze River Valley, the weather forecast does not improve over the next week.

·

Argentina soybean meal exports over the next couple of months will depend on producer selling, which they have been reserve sellers. July crush may have declined to 3.5 million tons from 3.9 MMY for June and 4.14 million during

May.

·

Russia does not plan to extend their sunflower seed export ban at the end of August. The ban has been in place since April 1. Russia does plan to leave its 50% export tax for sunflower seeds in place until the end of August 2023.

·

We lowered our domestic use for US cottonseed for 2022-23, resulting in about 9% decline in cotton meal from 2021-22, and raised 2022-23 SBM domestic consumption by about 200,000 short tons. Separately, we look for small growth

in 2022-23 crop-year in US animal units.

USDA

Attaché: Brail Oilseeds and Products Update

·

Tunisia seeks 6,000 tons of crude degummed vegetable oil on Wednesday for August 27 to September 10 shipment.

Updated

8/18/22

Soybeans

– September $13.75-$15.25

Soybeans

– November is seen in a $12.50-$16.00 range

Soybean

meal – September $405-$480,

December $380-$445

Soybean

oil – September 66.50-70.00, December 61.00-72.00

·

US wheat

futures traded sharply lower from a sharply higher USD (up 98 points by 1:00 pm CT), lack of bullish news, poor USDA export sales indicating slowing US export demand, and less threatening weather for late developing Northern Hemisphere spring wheat crops.

Nearby US wheat futures triggered technical selling after nearby contracts took out recent contract lows. EU wheat futures dropped to a 5-month low.

·

IGC raised their world wheat crop by 8 million tons to 778 million tons. USDA is at 771.6 MMT.

·

Ukraine is preparing to ramp up wheat shipments during September.

·

Paris September wheat was down a large 12.50 euros to 313.75 euros. Rain relief was seen for late maturing spring wheat, corn, and rapeseed. Corn and rapeseed EU futures also fell today.

·

Taiwan Flour Millers’ Association seeks 34,025 tons of grade 1 milling wheat from the United States on August 25 for shipment out of the PNW between October 12 and October 26.

·

Bangladesh seeks 50,000 tons of milling wheat on September 1, optional origin, for shipment within 40 days of contract signing.

·

Results awaited: Iraq’s state grains buyer seeks 50,000 tons of milling wheat from the United States.

·

Japan’s AgMin seeks 70,000 tons of feed wheat and 40,000 tons of feed barley on August 19 for arrival by January 26, 2023.

Rice/Other

·

Results awaited: Iraq’s state grains buyer seeks 50,000 tons of rice.

Updated

8/18/22

Chicago – September $7.00 to $8.25 range,

December $7.00-$10.50

KC – September $7.80 to $9.00 range,

December $7.00-$10.75

MN – September $8.00‐$9.25,

December $8.00-$11.50

This

summary is based on reports from exporters for the period August 5-11, 2022.

Wheat:

Net sales of 207,200 metric tons (MT) for 2022/2023–a marketing-year low–were down 42 percent from the previous week and 46 percent from the prior 4-week average. Increases primarily for Mexico (85,300 MT, including decreases of 3,100 MT), the Philippines

(64,800 MT), Brazil (28,200 MT, including 25,000 MT switched from unknown destinations), Japan (26,300 MT), and South Africa (16,500 MT), were offset by reductions primarily for unknown destinations (30,000 MT) and Portugal (18,000 MT). Exports of 349,600

MT were down 43 percent from the previous week, but up 1 percent from the prior 4-week average. The destinations were primarily to the Philippines (87,800 MT), Mexico (64,700 MT), Brazil (55,700 MT), Japan (36,200 MT), and Portugal (22,000 MT).

Corn:

Net sales of 99,300 MT for 2021/2022 were down 48 percent from the previous week and 8 percent from the prior 4-week average. Increases primarily for China (71,500 MT), Colombia (13,600 MT), Honduras (11,400 MT, including 7,500 MT switched from Nicaragua,

6,000 MT switched from El Salvador, and decreases of 6,900 MT), Mexico (7,000 MT, including decreases of 26,000 MT), and Costa Rica (5,000 MT), were offset by reductions primarily for Nicaragua (7,500 MT), El Salvador (6,000 MT), and Trinidad and Tobago (1,900

MT). Net sales of 750,000 MT for 2022/2023 were primarily for unknown destinations (286,000 MT), Mexico (216,400 MT), China (136,500 MT), Guatemala (30,400 MT), and Colombia (24,000 MT). Exports of 623,000 were down 12 percent from the previous week and

33 percent from the prior 4-week average. The destinations were primarily to China (273,500 MT), Mexico (271,300 MT), Trinidad and Tobago (25,100 MT, including 200 MT – Late), Panama (24,200 MT), and Honduras (14,700 MT).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 121,000 MT is for unknown destinations (65,000 MT), Italy (47,000 MT), and Saudi Arabia (9,000 MT). For 2022/2023, new optional origin sales of 3,000 MT were reported for Italy.

The current outstanding balance of 51,200 MT is for Italy.

Late

Reporting:

For 2021/2022, exports totaling 200 MT of corn were reported late for Trinidad and Tobago.

Barley:

No net sales or exports were reported for the week.

Sorghum:

Net sales of 11,500 MT for 2021/2022 reported for China (51,300 MT, including 50,000 MT switched from unknown destinations) and Mexico (10,200 MT), were offset by reductions for unknown destinations (50,000 MT).

Total net sales of 200 MT for 2022/2023 were for Japan. Exports of 63,600 MT were up 11 percent from the previous week, but down 19 percent from the prior 4-week average. The destinations were to China (54,000 MT) and Mexico (9,600 MT).

Rice:

Net

sales of 6,500 MT for 2022/2023 primarily for Canada (3,900 MT), Mexico (1,600 MT), Belgium (500 MT), Saudi Arabia (200 MT), and Liberia (200 MT), were offset by reductions for Guatemala (200 MT). Exports of 17,200 MT were primarily to Guatemala (8,600 MT),

Canada (3,200 MT), El Salvador (2,100 MT), Mexico (1,800 MT), and Belgium (500 MT).

Exports

for Own Account:

For 2022/2023, the current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans:

Net sales of 96,900 MT for 2021/2022 primarily for China (80,800 MT, including 70,000 MT switched from unknown destinations and decreases of 200 MT), the Netherlands (66,100 MT, including 66,000 MT switched from unknown destinations), South Korea (59,600 MT,

including 62,000 MT switched from unknown destinations and decreases of 2,400 MT), Spain (58,300 MT, including 55,000 MT switched from unknown destinations), and Colombia (16,700 MT, including 12,000 MT switched from unknown destinations and decreases of 300

MT), were offset by reductions for unknown destinations (133,000 MT), Egypt (62,000 MT), and Mexico (9,900 MT). Net sales of 1,302,800 MT for 2022/2023 were primarily for China (779,000 MT), unknown destinations (273,000 MT), Mexico (165,300 MT), Egypt (60,000

MT), and Indonesia (14,500 MT), were offset by reductions for Japan (100 MT). Exports of 691,100 MT were down 23 percent from the previous week, but up 19 percent from the prior 4-week average. The destinations were primarily to China (285,000 MT), Mexico

(126,200 MT), the Netherlands (66,100 MT), South Korea (60,700 MT), and Spain (58,300 MT).

Export

for Own Account:

For 2021/2022, the current exports for own account outstanding balance is 6,300 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 66,600 MT for 2021/2022 were down 27 percent from the previous week and 36 percent from the prior 4-week average. Increases primarily for Mexico (29,600 MT, including decreases of 2,000 MT), Canada (19,600 MT), Morocco (16,000 MT), Guatemala

(10,600 MT, including decreases of 400 MT), and Colombia (3,900 MT, including decreases of 4,000 MT), were offset by reductions primarily for Vietnam (8,300 MT), El Salvador (5,600 MT), Costa Rica (4,500 MT), and Honduras (3,400 MT). Net sales of 296,700

MT for 2022/2023 were primarily for Mexico (123,000 MT), the Philippines (88,000 MT), Canada (53,300 MT), Colombia (8,300 MT), and El Salvador (8,000 MT). Exports of 193,600 MT were down 5 percent from the previous week and 2 percent from the prior 4-week

average. The destinations were primarily to Colombia (48,700 MT), Mexico (39,100 MT), Ecuador (38,000 MT), Morocco (30,000 MT), and Canada (20,700 MT).

Soybean

Oil:

Net sales of 1,600 MT for 2021/2022 were up noticeably from the previous week, but down 12 percent from the prior 4-week average. Increases reported for Guatemala (3,500 MT), were offset by reductions for Canada (1,900 MT). Exports of 1,200 MT were down

92 percent from the previous week and 82 percent from the prior 4-week average. The destinations were primarily to Mexico (700 MT) and Canada (400 MT).

Cotton:

Net

sales of 49,500 RB for 2022/2023 primarily for China (30,000 RB, including decreases of 5,500 RB), Turkey (14,600 RB, including decreases of 100 RB), Honduras (10,900 RB), Nicaragua (8,000 RB switched from Vietnam), and Indonesia (7,400 RB, including decreases

of 400 RB), were offset by reductions primarily for Vietnam (32,100 RB), Pakistan (3,700 RB), and India (2,900 RB). Net sales of 10,600 RB for 2023/2024 were reported for Bangladesh (5,500 RB) and Mexico (5,100 RB). Exports of 267,400 RB were primarily to

China (67,000 RB), Turkey (46,600 RB), Vietnam (30,400 RB), Bangladesh (20,900 RB), and India (20,800 RB). Net sales of Pima totaling 300 RB were reported for Turkey (200 RB) and Japan (100 RB). Exports of 1,700 RB were primarily to Indonesia (900 RB), India

(500 RB), and South Korea (300 RB).

Optional

Origin Sales:

For 2022/2023, new optional origin sales of 500 RB were reported for Pakistan. The current outstanding balance of 11,100 RB is for Malaysia (9,300 RB) and Pakistan (1,800 RB).

Export

for Own Account:

For 2022/2023, new exports for own account totaling 1,300 RB were reported for Vietnam. Exports for own account totaling 3,600 RB primarily to China (2,200 RB) were applied to new or outstanding sales. The current exports for own account outstanding balance

of 70,300 RB is for China (34,000 RB), Vietnam (23,500 RB), Turkey (10,600 RB), India (1,500 RB), Indonesia (400 RB), and Pakistan (300 RB).

Hides

and Skins:

Net sales of 455,500 pieces for 2022 were up 30 percent from the previous week and 18 percent from the prior 4-week average. Increases primarily for China (281,800 whole cattle hides, including decreases of 10,700 pieces), Thailand (107,000 whole cattle hides,

including 34,200 pieces switched from Taiwan and decreases of 900 pieces), Indonesia (21,700 whole cattle hides), South Korea (18,300 whole cattle hides, including decreases of 600 pieces), and Mexico (17,500 whole cattle hides, including decreases of 9,600

pieces), were offset by reductions primarily for Taiwan (30,100 pieces). In addition, total net sales of 7,200-kip skins were for Belgium. Exports of 526,200 pieces were up 30 percent from the previous week and 23 percent from the prior 4-week average.

Whole cattle hides exports were primarily to China (329,900 pieces), South Korea (82,600 pieces), Thailand (38,900 pieces), Mexico (34,600 pieces), and Indonesia (6,900 pieces). Total exports of 14,900 calf skins were to Italy. In addition, total exports

of 1,400-kip skins were to Italy.

Net

sales of 93,300 wet blues for 2022 were down 25 percent from the previous week, but up 2 percent from the prior 4-week average. Increases reported for Italy (54,500 unsplit, including decreases of 200 unsplit), Vietnam (15,600 unsplit), China (11,600 unsplit),

Thailand (7,700 unsplit, including decreases of 800 unsplit), and Mexico (4,200 unsplit), were offset by reductions for Portugal (300 grain splits). Exports of 103,000 wet blues were down 29 percent from the previous week and 36 percent from the prior 4-week

average. The destinations were primarily to Italy (34,400 unsplit and 4,400 grain splits), Thailand (18,700 unsplit), Vietnam (17,200 unsplit), China (14,500 unsplit), and Brazil (5,200 unsplit). Net sales of 160,000 splits were up 41 percent from the previous

week, but down 60 percent from the prior 4-week average. Increases were reported for Taiwan (85,000 pounds), South Korea (64,000 pounds), Vietnam (10,500 pounds), and China (900 pounds). Exports of 499,300 pounds were down 8 percent from the previous week,

but up 6 percent from the prior 4-week average. The destinations were to South Korea (164,400 pounds), China (129,900 pounds), Vietnam (120,000 pounds), and Taiwan (84,900 pounds).

Beef:

Net sales of 18,900 MT for 2022 were up 29 percent from the previous week and unchanged from the prior 4-week average. Increases primarily for China (7,400 MT, including decreases of 100 MT), Japan (5,300 MT, including decreases of 200 MT), South Korea (1,900

MT, including decreases of 400 MT), Mexico (1,300 MT, including decreases of 200 MT), and Indonesia (900 MT), were offset by reductions for Chile (100 MT). Total net sales of 100 MT for 2023 were for Japan. Exports of 19,000 MT were down 9 percent from the

previous week and 4 percent from the prior 4-week average. The destinations were primarily to South Korea (5,600 MT), Japan (4,700 MT), China (3,800 MT), Taiwan (1,100 MT), and Mexico (1,100 MT).

Pork:

Net sales of 13,600 MT for 2022 were down 37 percent from the previous week and 43 percent from the prior 4-week average. Increases primarily for Mexico (7,100 MT, including decreases of 300 MT), Japan (2,600 MT, including decreases of 300 MT), South Korea

(900 MT, including decreases of 600 MT), Colombia (700 MT, including decreases of 300 MT), and Canada (600 MT, including decreases of 400 MT), were offset by reductions for Honduras (200 MT), Guatemala (100 MT), and Indonesia (100 MT). Exports of 25,600 MT

were down 6 percent from the previous week and 4 percent from the prior 4-week average. The destinations were primarily to Mexico (11,600 MT), China (5,000 MT), Japan (3,400 MT), South Korea (1,700 MT), and Canada (1,500 MT).

U.S. EXPORT SALES FOR WEEK ENDING 8/11/2022

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR

AGO |

CURRENT YEAR |

YEAR

AGO |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

46.4 |

1,471.3 |

1,630.7 |

93.1 |

1,162.8 |

1,530.5 |

0.0 |

0.0 |

|

SRW |

46.8 |

865.7 |

889.4 |

85.9 |

745.1 |

705.8 |

0.0 |

30.0 |

|

HRS |

71.7 |

1,489.2 |

1,271.0 |

89.7 |

1,011.0 |

1,291.0 |

0.0 |

0.0 |

|

WHITE |

42.3 |

1,419.6 |

877.0 |

80.9 |

521.0 |

766.0 |

0.0 |

0.0 |

|

DURUM |

0.0 |

109.4 |

8.4 |

0.0 |

18.0 |

42.2 |

0.0 |

0.0 |

|

TOTAL |

207.2 |

5,355.2 |

4,676.5 |

349.6 |

3,457.9 |

4,335.5 |

0.0 |

30.0 |

|

BARLEY |

0.0 |

11.7 |

22.0 |

0.0 |

3.8 |

2.9 |

0.0 |

0.0 |

|

CORN |

99.3 |

3,208.6 |

4,905.6 |

623.0 |

57,740.9 |

65,412.0 |

750.0 |

8,798.3 |

|

SORGHUM |

11.5 |

96.7 |

368.9 |

63.6 |

6,879.7 |

6,712.6 |

0.2 |

203.2 |

|

SOYBEANS |

96.9 |

4,076.2 |

2,381.4 |

691.1 |

55,482.0 |

59,703.3 |

1,302.8 |

17,045.8 |

|

SOY MEAL |

66.6 |

1,409.5 |

1,585.4 |

193.6 |

10,345.3 |

10,415.1 |

296.7 |

1,427.1 |

|

SOY OIL |

1.6 |

47.4 |

17.5 |

1.2 |

647.9 |

666.0 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

-0.2 |

59.8 |

222.3 |

10.6 |

10.6 |

36.1 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

16.6 |

9.0 |

0.0 |

0.0 |

0.2 |

0.0 |

0.0 |

|

L G BRN |

0.1 |

5.8 |

2.2 |

0.2 |

0.3 |

10.5 |

0.0 |

0.0 |

|

M&S BR |

0.2 |

6.9 |

0.1 |

0.2 |

0.3 |

0.2 |

0.0 |

0.0 |

|

L G MLD |

2.3 |

127.0 |

176.2 |

2.3 |

2.7 |

26.9 |

0.0 |

0.0 |

|

M S MLD |

4.1 |

79.7 |

59.2 |

3.7 |

4.9 |

22.9 |

0.0 |

0.0 |

|

TOTAL |

6.5 |

295.7 |

469.0 |

17.2 |

18.9 |

96.7 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

49.5 |

6,919.1 |

4,807.1 |

267.4 |

448.6 |

411.7 |

10.6 |

720.9 |

|

PIMA |

0.3 |

93.1 |

112.9 |

1.7 |

6.5 |

11.4 |

0.0 |

0.0 |

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.