PDF Attached

WASHINGTON,

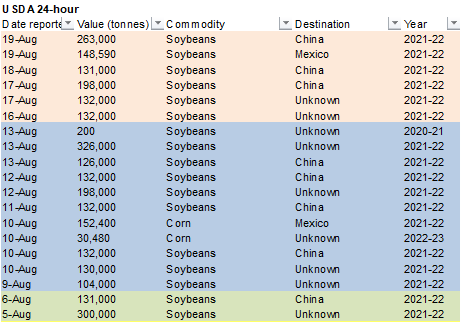

August 19, 2021–Private exporters reported to the U.S. Department of Agriculture the following activity:

Export

sales of 263,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year; and

Export

sales of 148,590 metric tons of soybeans for delivery to Mexico during the 2021/2022 marketing year.

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

- Not

much change around the world overnight - Net

drying is expected in the heart of the central and eastern U.S. Midwest for a while in this coming week, but rain is likely in the northwest

o

Some of the northwestern rain will spread across the Midwest this weekend and next week, although it will be somewhat sporadic with some areas getting more rain than others

o

Cooling is likely this weekend into next week, as well

- The

milder conditions will conserve soil moisture and help maintain relatively good crop conditions, despite low soil moisture in some areas - Autumn

coolness in western Canada is expected to prevail through the weekend and into early next week with some of the cooler conditions getting into the northwestern U.S. Plains, the far northern U.S. Rocky Mountain region and the eastern Prairies at times through

the first half of next week

o

Some pockets of frost may evolve briefly in a part of the Prairies next week and a close watch is warranted

- Cool

air will also slip through the U.S. Midwest during the middle and latter parts of next week with no threat of frost - Rain

will fall across the northern Plains, eastern Canada’s Prairies and the northwestern Corn Belt into Saturday with a follow up disturbance expected Sunday into Monday

o

Rainfall of 0.30 to 1.25 inches and local totals of 1.60 inches will be possible in the western Dakotas and eastern Montana while 0.75 inch to 1.50 inches and local totals over 2.00 inches occurs in eastern North Dakota, western

and northern Minnesota and Manitoba

- Local

totals of 2.00 to more than 3.00 inches are possible in Manitoba and a couple of counties over the border in North Dakota and Minnesota - U.S.

west-central and southwestern Plains will experience net drying conditions for a while leaving some dependency upon irrigation for normal crop development; however, some areas (like West Texas) have received significant moisture recently and crop development

will be good during the drier period - West

Texas cotton, corn and sorghum areas would benefit from greater heat units, but the moisture profile is very good for ongoing crop development

o

Cotton needs the heat more than the other crops

- South

Texas harvest weather will remain ideal over the next ten days - A

good mix of weather will occur from the U.S. southern Plains into the southeastern states - U.S.

Northern Plains high temperatures Wednesday contrasted from the upper 40s and 50s in central Montana to the 60s and 70s in eastern Montana while in the 90s to 101 in central parts of the Dakotas - U.S.

Pacific Northwest and California will continue drier biased for a while - Monsoon

rainfall in the U.S. Rocky Mountain region and southwestern desert region will continue favorably over the next ten days - NWS

30-Day Weather Outlook for the U.S.

o

September weather was advertised to be wetter than usual from eastern Texas, the lower Mississippi River Basin and interior southeastern states to Michigan, western New York and New Jersey

o

Below average precipitation was suggested from California to interior parts of Washington, Montana, North Dakota and northern Minnesota

o

Equal chances for above, below and near normal precipitation were given for the remainder of the nation

o

Temperatures were advertised above normal in most of the region from California and western Arizona, Washington, Idaho, Montana, North Dakota and northern and western South Dakota. Similar conditions were suggested for the northern

Great Lakes region and from eastern Pennsylvania and New Jersey to New England. Southern Florida was also suggested to be warmer than usual.

o

Temperatures will be cooler than usual in Mississippi, Louisiana, Arizona, southeastern Oklahoma and eastern Texas while all other areas were given equal chances for above, below and near normal temperatures

- NWS

90-Day Weather Outlook for the U.S.

o

Warmer than usual temperatures for September through November except near the Canada border from northwestern North Dakota to Washington State and in the central and western Gulf of Mexico Coast States where there was an equal

chance for above, below and near normal temperatures

o

Precipitation was advertised lighter than usual from California, Arizona and New Mexico to Montana, North Dakota, Minnesota and Wisconsin

o

Above normal precipitation was suggested for areas from Louisiana and northern Florida to New York and New England while all other areas were given equal chances for above, below and near normal precipitation

- Western

and southern Mexico will continue to receive frequent rain over the next ten days benefiting all crops - Central

America will be plenty wet over the next couple of weeks supporting most crop needs

o

There may be some risk of flooding eventually

- Hurricane

Grace has reached the Yucatan Peninsula and will be downgraded to tropical storm status briefly today

o

The storm will move over the Bay of Campeche tonight and Friday while returning to hurricane status

o

Landfall is expected Friday night and early Saturday in Veracruz, Mexico where torrential rain, flooding and damaging wind will impact personal property, citrus, rice, sugarcane and a few other crops

- Coffee

may also be impacted in Veracruz, Hidalgo and northern Puebla, although damage potentials are low in these areas - Hurricane

Grace will diminish while moving through central Mexico, but is expected to emerge in the Pacific Ocean next week at which time it will regenerate into a tropical cyclone and move out to sea - Tropical

Storm Henri will become a hurricane in the western Atlantic Ocean over the next couple of days and it may impact New England as well as Nova Scotia, Canada late this weekend into early next week

o

Heavy rain, flooding, rough seas and strong wind gusts will impact New England and Nova Scotia, Canada this weekend and early next week as the storm reaches those areas

- A

good mix of rain and sunshine will continue in the southern U.S. Plains, Delta and southeastern states over the next ten days - Europe

weather will be good for fieldwork and late season crop development from France to western Russia - Southeastern

Europe remains too dry and warm with little change likely for ten days - Cooling

in northern Russia will bring temperatures to the frost range next week, but only on the northern fringes of western Russia’s crop region and in the northern and eastern most New Lands - Drying

will continue in Kazakhstan and much of Russia’s New Lands for the next ten days speeding along spring and summer crop maturation, but maintaining worry over spring cereal and sunseed yield in Kazakhstan and southern parts of the New Lands

o

No rain in these areas now can improve wheat or sunseed yields

- Western

Ukraine, Belarus and western and northern Russia will see a good mix of shower activity and warm temperatures will occur in central and over the next ten days to maintain most crop needs - Showers

will occur in eastern Ukraine and neighboring areas that have been dry recently over the next few days

o

The moisture will be light, but welcome as temporary relief from recent drying

o

Drier biased conditions will resume after that for a little while

- Northwestern

India will continue dry; including Gujarat, western and northern Rajasthan and neighboring areas of Pakistan

o

Punjab and Haryana should get some rain

o

Central and especially eastern India will receive abundant rainfall during the next ten days keeping the ground saturated in many areas and inducing a little flooding

- West-Central

Africa will continue to receive periodic rainfall with a boost in Ivory Coast and Ghana rainfall expected gradually during the next two weeks - Ethiopia

will be wetter than usual - China

will continue to see alternating periods of rain and sunshine over the next ten days with areas between the Yellow River Basin and the Yangtze Rivers wettest

o

Some additional flooding may impact a part of the region

o

A favorable mix of weather is expected in Northeastern China and near and north of the Yellow River

o

Drier weather is needed in spring wheat areas of northeastern China where rain has been a little too frequent recently

o

Temperatures will be seasonable

- Northeastern

Xinjiang, China weather will improve after 3.5 days of stormy weather and unusually cool condition

o

Abundant rain and severe thunderstorms impacted many areas

o

High temperatures Wednesday were limited to the 60s Fahrenheit

o

Southwestern Xinjiang weather has not been nearly as adverse.

- South

Africa received more rain in western winter crop areas Wednesday and early today

o

The moisture continues to create an ideal environment for wheat development this season

- South

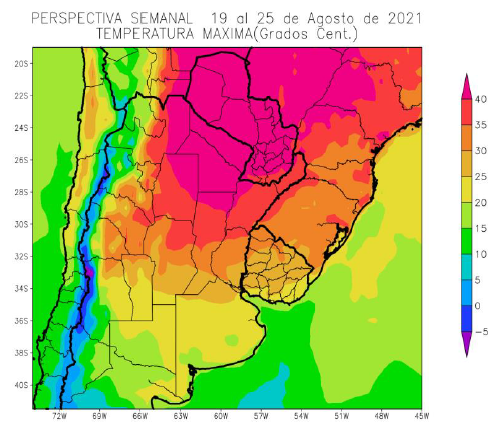

Africa will experience some additional rain over the next ten days with southern and easternmost parts of the nation wettest - Argentina

southern and eastern crop areas will get some rain in the balance of this week, but western crop areas are expecting to be dry biased through the next two weeks

o

Winter crops are dormant or semi-dormant right now making the moisture shortage in the west of little concern, but spring rainfall will be very important

- Brazil

rainfall will continue limited to the far south over the next two weeks which is not unusual for this time of year

o

Large moisture deficits remain in center south Brazil from 2020-2021 and could be a factor in spring crop development potential if La Nina delays the onset of season moisture

o

River and stream flow remain critically low in much of the Parana River Basin

- Brazil

temperatures will rise well above normal above normal in the west and south as well as in Paraguay and northern Argentina during the coming week resulting in rising crop stress

o

Stress will be greatest in coffee production areas where crop damage has already occurred because of late July frost and freezes

- Southeast

Asia nations will all receive sufficient rain to support crops during the next two weeks

o

The forecast includes an improving rain distribution for Sumatra, Java, Kalimantan and the central and southern Philippines all of which have been trending a little too dry recently

- Thailand

will be the one nation to watch for possible inadequate rainfall - Australia

weather will continue favorably for wheat, barley and canola which are semi-dormant at this time of year. Soil moisture is favorable and ready to support spring growth when warming comes along especially if timely rainfall continues as advertised

o

Queensland and northern New South Wales still need significant rain to restore soil moisture after recent drying

- Southern

Oscillation Index has reached +4.41 and it will move erratically over the next several days - New

Zealand rainfall during the coming week will be above average in western South Island and near to below average elsewhere; temperatures will be seasonable

Source:

World Weather Inc.

Thursday,

Aug. 19:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Brazil’s

Conab releases sugar and cane production data (tentative) - USDA

total milk, read meat production - Port

of Rouen data on French grain exports - HOLIDAY:

India, Pakistan, Bangladesh

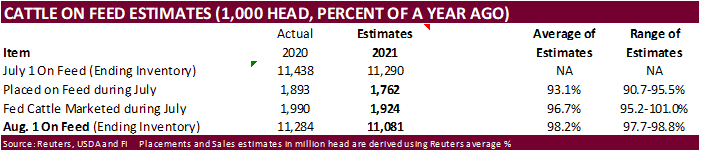

Friday,

Aug. 20:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

country-wise import data for farm goods such as soybeans, corn and pork - FranceAgriMer

weekly update on crop conditions - Malaysia

Aug. 1-20 palm oil export data - U.S.

Cattle on Feed, 3pm

Source:

Bloomberg and FI

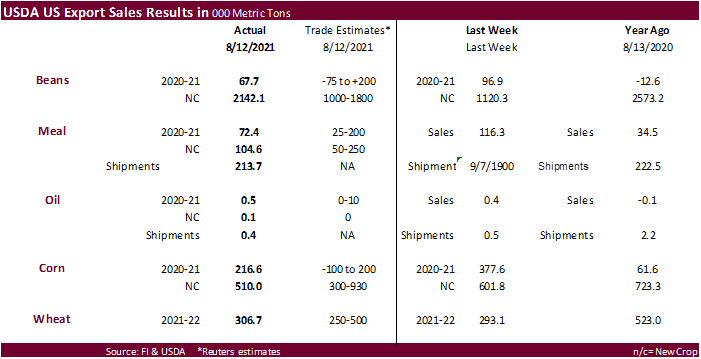

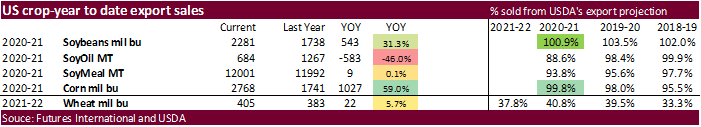

USDA

Export Sales

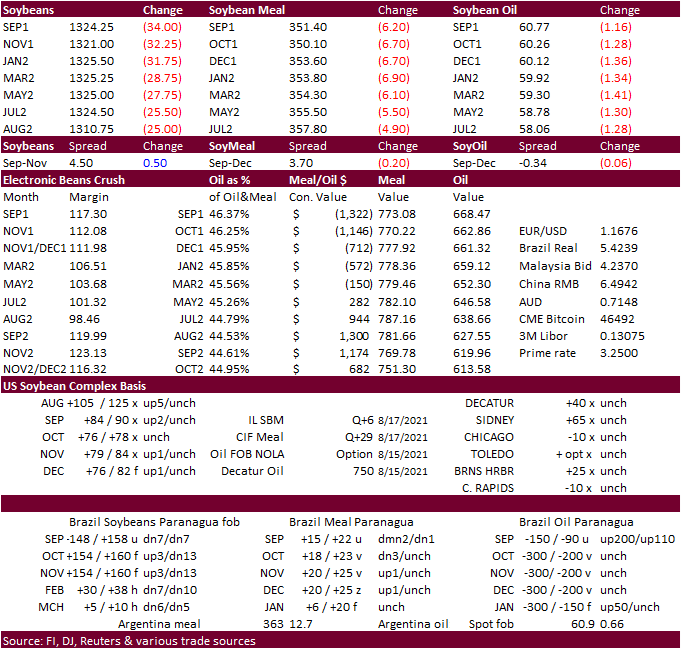

Soybeans

new-crop sales of 2.142 million tons were above the top end of a range of expectations and viewed friendly for new-crop futures. New-crop soybeans included China (1,030,000 MT) and unknown destinations (841,000). Soybean meal sales were within expectations

and shipments of 213,700 tons were good for this time of year. Soybean oil sales continue to struggle at less than 1,000 tons for combined old and new-crop. Corn sales for old crop were 216,600 tons, with only a couple weeks left in the crop year, and new-crop

was 510,000 tons, down from 601,800 tons previous week. Mexico dominated the corn sales. All-wheat sales were 306,700 tons (China 197,400 MT, including 195,000 MT switched from unknown destinations), above 293,100 tons previous week.

78

Counterparties Take $1109.938 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1115.656 Bln, 82 Bidders)

China

To Continue To Release Copper, Aluminum, Zinc From State Reserves – National Reserves Administration

US

Initial Jobless Claims Aug 14: 348K (est 364K; prevR 377K; prev 375K)

US

Continuing Claims Aug 7: 2820K (est 2800K; prevR 2899K; prev 2866K)

US

Philadelphia Fed Business Outlook Aug: 19.4 (est 23.1; prev 21.9)

US

August Philly Fed Fed Prices Paid Index At 71.2 (prev 69.7)

US

August Philly Fed Factory Index At 19.4 (prev 21.9)

US

August Philly Fed Employment Index At 32.6 (prev 29.2)

US

August Philly Fed Prices Paid At 71.2 (prev 69.7)

US

August Philly Fed Prices Received At 53.9 (prev 46.8)

US

August Philly Fed New Orders At 22.8 (prev 17.0)

US

August Philly Fed Shipments 18.9 (prev 24.6)

US

August Philly Fed Inventories -18.1 (prev -4.0)

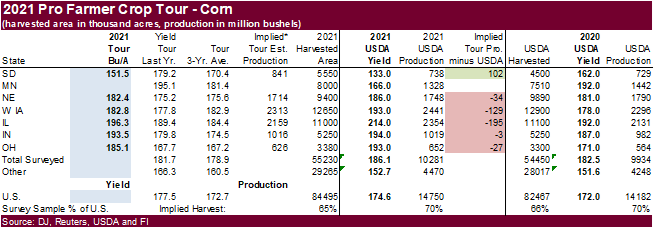

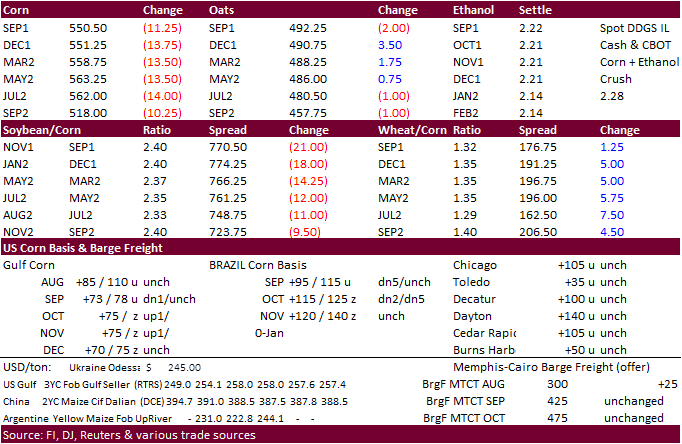

Corn

-

US

corn ended lower on a lack of US demand, slowing domestic use, higher USD, decline in WTI crude and lower wheat. News was light.

-

Pro

Farmer projected higher corn yields and higher soybean pod counts than last year & 3-year average in Illinois. For western Iowa, the tour pegged the corn yield higher than last year (2/3 districts above 3-year average) and pod count higher than 2020 and average.

Today they survey Minnesota and Eastern IA. Final tour results will be released around the close on Friday (1:30 PM CT they issued in 2020).

-

Traders

are seeing yield estimates form this tour for corn as bullish. We agree.

-

EPA

reported about 1.27 billion ethanol (D6) blending credits were generated in July, same amount as June.

-

The

U.S. Environmental Protection Agency on Wednesday announced they will ban the use on food crops of the pesticide chlorpyrifos. It has been linked to health problems in children. -

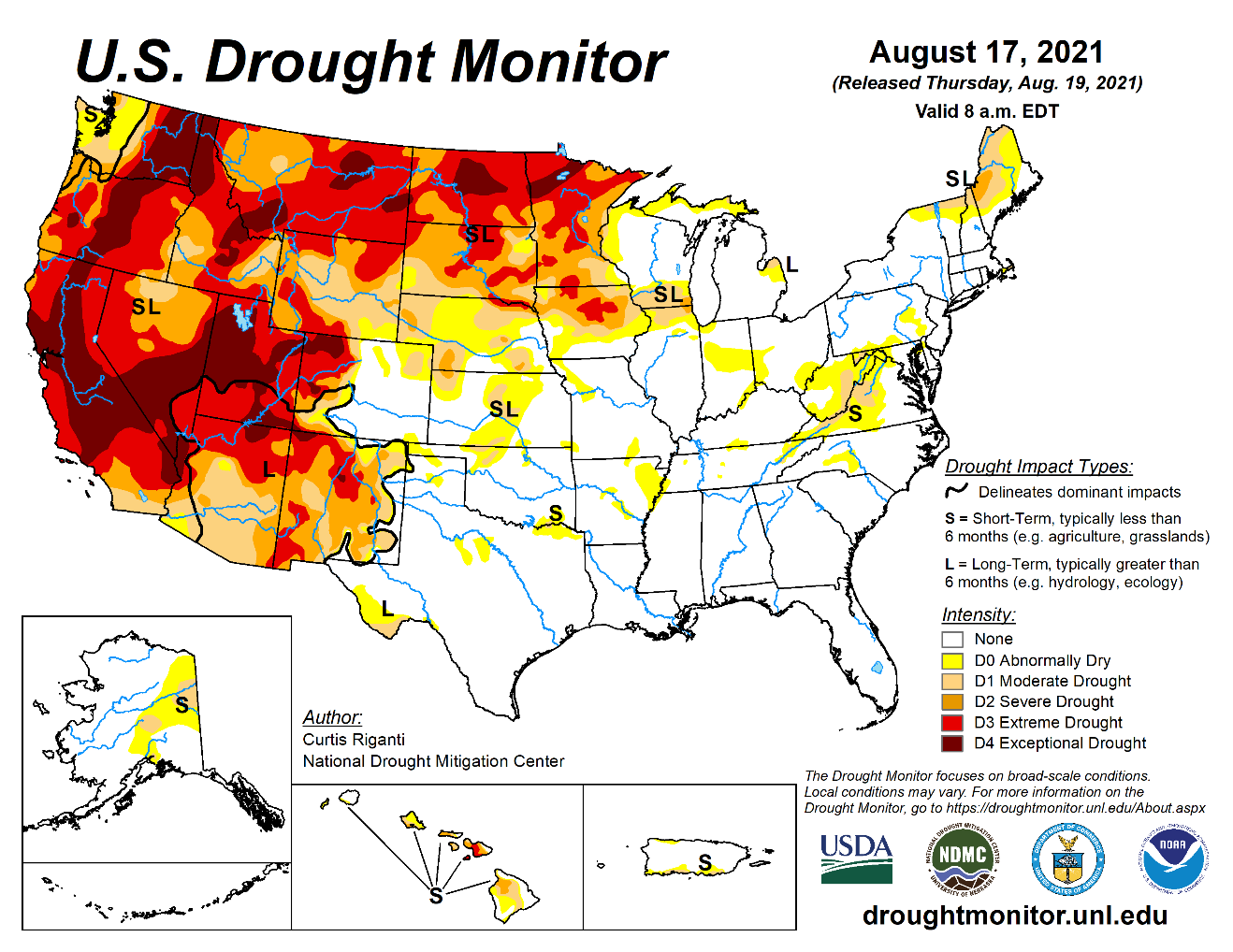

There

was talk in the market today about how strong hay prices have been. Hay prices, according to a monthly StoneX index, were up about $24/ton since the beginning of the year through July, via Reuters. We think with the drought across the west coast and upper

US, this is nothing out of the ordinary. Some livestock produces across the western US will have to get feed from the Great Plains or Midwest this season after realizing a short local grain crop.

-

Argentina’s

Buenos Aires Grain Exchange expects the 2021-22 corn area to expand to a record 7.1 million hectares, a 7.5% increase from the previous season from 6.6m hectares.

Export

developments.

- South

Korea’s KFA bought 65,000 tons of animal feed corn at an estimated $320.75 a ton c&f sourced from South America or South Africa for arrival in South Korea around Nov. 20. - Results

awaited: Qatar seeks about 100,000 tons of barley on August 18 for Sep-Nov delivery.

- Turkey

seeks 270,000 tons of barley on August 20 for shipment between Sep 1 and Sep 25.

September

corn is seen is a $5.40-$5.80 range.

December

corn is seen in a $4.75-$6.00 range

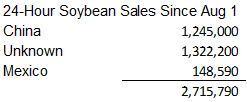

-

Widespread

global commodity selling weighed on the US soybean complex, led by soybeans, despite good export demand. Other news was light.

-

USDA

announced a combined 411,590 tons of soybeans were sold to China and Mexico.

-

US

soybean processor basis was down 5 cents for Decatur, IN, down 10 for Council Bluffs, IA, and down 30 for Lincoln, NE.

-

EPA

reported about 356 million biodiesel (D4) blending credits were generated during July, down from 429 million during June.

-

Malaysian

palm oil fell 63 points (10-day low) to 4,238 and cash was down $15/ton at $1,065/ton. Weak palm oil exports are weighing on palm futures.

Export

Developments

-

WASHINGTON,

August 19, 2021–Private exporters reported to the U.S. Department of Agriculture the following activity: -

Export

sales of 263,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year; and -

Export

sales of 148,590 metric tons of soybeans for delivery to Mexico during the 2021/2022 marketing year.

-

Egypt’s

GASC got one offer in sunflower oil tender at 1,336 a ton c&f, and they bought 10,000 tons. There were no soyoil offers. This is for arrival Oct 5-25. Payment is for 180-day letters of credit or at sight. Last GASC tender for sunflower oil was 6/22 for

10K @ $1133/ton. Prior to that was on June 8, GASC paid $1368/ton for combined 40k tons of sunoil.

- Results

awaited: South Korea’s Agro-Fisheries & Food Trade Corp. seeks 3,700 tons of non-GMO soybeans (August 19) for arrival between Oct. 20 and Nov. 19.

Updated

8/19/21

September

soybeans are seen in a $13.10-$14.00 range; November $11.75-$15.00

September

soybean meal – $345-$370; December $320-$425

September

soybean oil – 59-62;

December 48-67 cent range

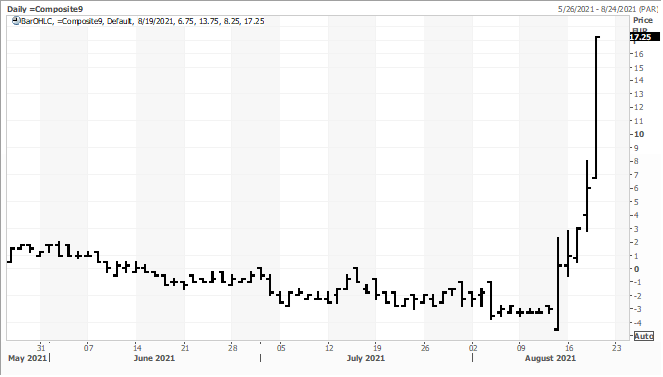

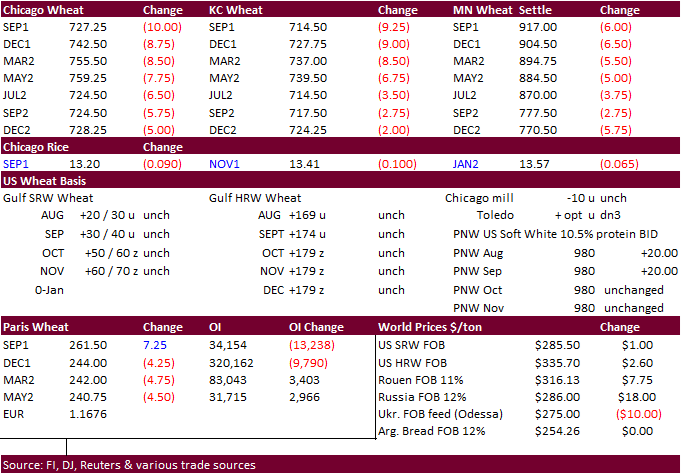

- Wheat

traded lower on a higher USD and widespread commodity selling. Limited losses in EU December wheat helped limit losses for the US contracts.

- EU

December wheat was down 4.50 euros at $243.75. Note September OI was over 30k headed into today’s trade, and with rain delaying the French wheat harvest this season, lack of the cash crop is causing some delivery headaches. The September Paris milling wheat

contract rallied 6.75 euros to settle at 261.00 euros. With December down 4.50, the Sep-Dec spread widened out to 17.25 euros, an impressive move since early last week. The September contract does not expire until September 10. Paris wheat deliveries start

September 13 (different delivery process than CBOT). See below.

- The

Euro hit a session low of 1.1664, lowest level since November 4, 2020. - Manitoba,

Canada, Crop Report: Harvest progress reached 21%, ahead of the 4-year average of 14% for the third week of August.

- Bulgaria’s

wheat crop was estimated at 7.1 million tons from 98.7% of the sown area, up 54% from a year ago.

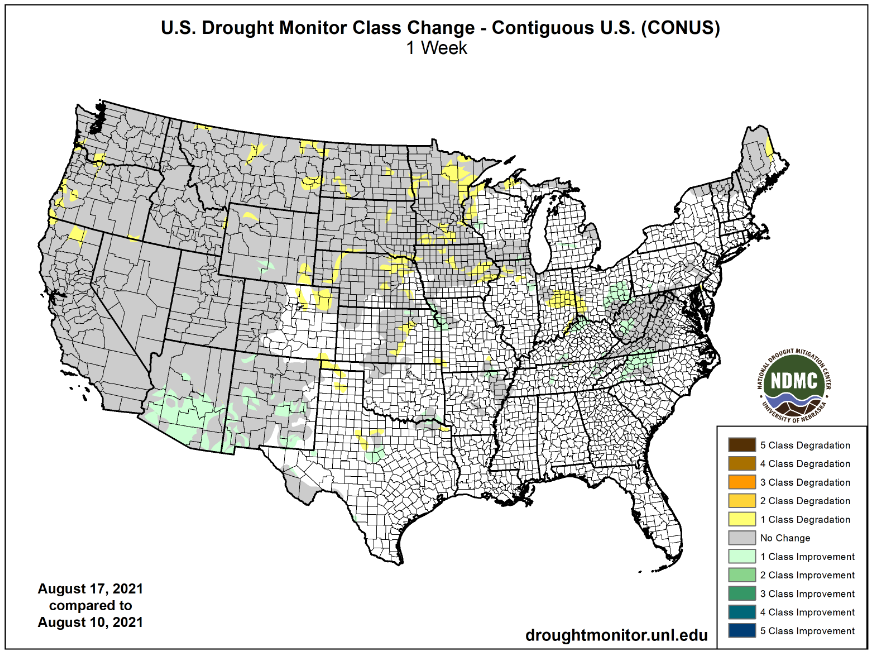

US

days 1-3 precipitation should provide relief to the upper Great Plains and far northwestern Corn Belt.

- Jordan

passed on barley. - Algeria

bought up to 290,000 tons of wheat at $350-$351/ton for September shipment.

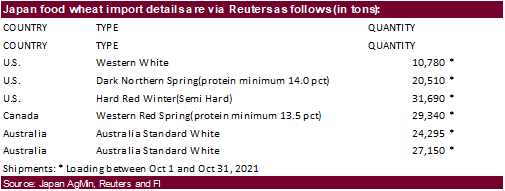

- Japan

bought 143,765 tons of food wheat. Original details as follows:

- Results

awaited: The Philippines seeks 280,000 tons of feed wheat (August 19) for October/November shipment.

- Jordan

floated a new import tender for wheat set to close Aug 25. - Bangladesh

seeks 50,000 tons wheat on September 1. - Pakistan

seeks 400,000 tons of wheat on August 23 for Sep/Oct shipment. - Morocco

seeks 363,000 tons of US durum wheat under a tariff import quota on August 24 for shipment by December 31.

Rice/Other

- None

reported

Updated 8/17/21

December Chicago wheat is seen in a $6.80‐$8.25 range

December KC wheat is seen in a $6.60‐$8.00

December MN wheat is seen in a $8.45‐$9.80

U.S. EXPORT SALES FOR WEEK ENDING 8/12/21

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

132.6 |

1,630.7 |

1,642.5 |

127.1 |

1,530.5 |

2,367.0 |

0.0 |

0.0 |

|

SRW |

42.1 |

889.4 |

691.1 |

156.5 |

705.8 |

384.9 |

0.0 |

0.0 |

|

HRS |

61.3 |

1,271.0 |

1,877.6 |

233.2 |

1,291.0 |

1,430.0 |

0.0 |

0.0 |

|

WHITE |

70.7 |

877.0 |

1,244.8 |

75.1 |

766.0 |

912.0 |

0.0 |

0.0 |

|

DURUM |

0.0 |

8.4 |

254.9 |

0.0 |

42.2 |

209.3 |

0.0 |

0.0 |

|

TOTAL |

306.7 |

4,676.5 |

5,710.9 |

591.8 |

4,335.5 |

5,303.2 |

0.0 |

0.0 |

|

BARLEY |

-0.1 |

22.0 |

31.1 |

0.6 |

2.9 |

8.2 |

0.0 |

0.0 |

|

CORN |

216.5 |

4,905.6 |

3,002.5 |

829.2 |

65,412.0 |

41,218.9 |

510.0 |

18,598.7 |

|

SORGHUM |

-108.2 |

368.9 |

289.1 |

50.5 |

6,712.6 |

4,340.0 |

0.0 |

1,594.9 |

|

SOYBEANS |

67.7 |

2,381.4 |

5,534.2 |

258.0 |

59,703.3 |

41,758.9 |

2,142.1 |

13,864.9 |

|

SOY MEAL |

72.4 |

1,585.4 |

1,464.0 |

213.7 |

10,415.6 |

10,528.0 |

104.6 |

1,522.0 |

|

SOY OIL |

0.5 |

17.5 |

175.3 |

0.4 |

666.0 |

1,091.4 |

0.1 |

0.7 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

54.5 |

222.3 |

144.8 |

36.1 |

36.1 |

26.7 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

9.0 |

28.1 |

0.2 |

0.2 |

0.8 |

0.0 |

0.0 |

|

L G BRN |

0.5 |

2.2 |

9.0 |

10.2 |

10.5 |

1.5 |

0.0 |

0.0 |

|

M&S BR |

0.2 |

0.1 |

30.1 |

0.2 |

0.2 |

1.7 |

0.0 |

0.0 |

|

L G MLD |

-13.8 |

176.2 |

54.8 |

25.4 |

26.9 |

6.0 |

0.0 |

0.0 |

|

M S MLD |

1.9 |

59.2 |

54.4 |

20.1 |

22.9 |

19.1 |

-2.1 |

0.0 |

|

TOTAL |

43.3 |

469.0 |

321.2 |

92.1 |

96.7 |

55.8 |

-2.1 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

242.4 |

4,807.1 |

5,995.0 |

221.1 |

411.7 |

700.1 |

59.5 |

575.6 |

|

PIMA |

10.6 |

112.9 |

181.2 |

3.7 |

11.4 |

14.1 |

0.0 |

0.0 |

This

summary is based on reports from exporters for the period August 6-12, 2021.

Wheat: Net

sales of 306,700 metric tons (MT) for 2021/2022 were up 5 percent from the previous week, but down 23 percent from the prior 4-week average. Increases primarily for China (197,400 MT, including 195,000 MT switched from unknown destinations), South Korea (76,600

MT), Taiwan (48,600 MT), Vietnam (33,500 MT, including 30,600 MT switched from unknown destinations), and the Philippines (33,400 MT, including decreases of 5,500 MT), were offset by reductions primarily for unknown destinations (217,000 MT). Exports of 591,800

MT were down 6 percent from the previous week, but up 29 percent from the prior 4-week average. The destinations were primarily to Japan (124,800 MT), the Philippians (122,200 MT), Nigeria (79,200 MT), China (69,500 MT), and Mexico (46,900 MT).

Corn:

Net sales of 216,500 MT for 2020/2021 were down 43 percent from the previous week, but up noticeably from the prior 4-week average. Increases reported for Mexico (190,100 MT, including decreases of 22,900 MT), Canada (62,300 MT), El Salvador (24,000 MT, including

23,000 MT switched from Guatemala and decreases of 200 MT), Honduras (5,800 MT, including decreases of 4,500 MT), and China (2,900 MT), were offset by reductions for unknown destinations (32,700 MT), Guatemala (20,300 MT), and Japan (15,600 MT). For 2021/2022,

net sales of 510,000 MT primarily for Mexico (307,500 MT), Colombia (88,800 MT), Japan (50,000 MT), unknown destinations (50,000 MT), and Honduras (5,500 MT), were offset by reductions for Guatemala (3,900 MT). Exports of 829,200 MT were down 22 percent from

the previous week and 31 percent from the prior 4-week average. The destinations were primarily to Mexico (292,400 MT), China (274,900 MT), Japan (149,400 MT), Guatemala (54,600 MT), and El Salvador (26,400 MT).

Optional

Origin Sales:

For 2020/2021, the current outstanding balance of 30,500 MT is for unknown destinations. For 2021/2022, the current outstanding balance of 50,000 MT is for unknown destinations.

Barley:

Total net sales reductions for 2021/2022 of 100 MT were for Canada. Exports of 600 MT were unchanged from the previous week, but up noticeably from the prior 4-week average. The destinations were to Japan (500 MT) and South Korea (100 MT).

Sorghum:

Net sales reductions of 108,200 MT for 2020/2021 resulting increases for Mexico (6,500 MT), were more than offset by reductions for unknown destinations (110,000 MT) and China (4,700 MT). Exports of 50,500 MT were down 30 percent from the previous week and

20 percent from the prior 4-week average. The destination was primarily to China (50,400 MT).

Rice:

Net

sales of 43,300 MT for 2021/2022 primarily for Mexico (21,800 MT, including decreases of 600 MT), Costa Rica (18,400 MT), Guatemala (15,400 MT), the United Kingdom (5,100 MT), and Saudi Arabia (2,700 MT), were offset by reductions primarily for Haiti (22,400

MT). Total net sales reductions for 2022/2023, of 2,100 MT were for Japan. Exports of 92,100 MT were primarily to Haiti (22,600 MT), Mexico (19,900 MT), Japan (15,800 MT), the United Kingdom (10,100 MT), and Guatemala (9,500 MT).

Exports

for Own Account:

For 2021/2022, new exports for own account totaling 100 MT were to Canada. The current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans:

Net sales of 67,700 MT for 2020/2021 were down 30 percent from the previous week, but up noticeably from the prior 4-week average. Increases primarily for China (92,300 MT, including 68,000 MT switched from unknown destinations), Taiwan (12,300 MT, including

decreases of 300 MT), Japan (11,200 MT, including 9,000 MT switched from unknown destinations and decreases of 300 MT), Vietnam (11,200 MT), and Indonesia (7,600 MT, including decreases of 200 MT), were offset by reductions for unknown destinations (76,800

MT). For 2021/2022, net sales of 2,142,100 MT were primarily for China (1,030,000 MT), unknown destinations (841,000), Egypt (184,000 MT), Mexico (28,900 MT), and Taiwan (25,000 MT). Exports of 258,000 MT were up 99 percent from the previous week and 37

percent from the prior 4-week average. The destinations were primarily to China (144,200 MT), Japan (59,500 MT), Indonesia (15,600 MT), Colombia (14,800 MT), and Mexico (11,600 MT).

Exports

for Own Account:

For 2020/2021, the current exports for own account outstanding balance is 5,800 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 72,400 MT for 2020/2021 were down 38 percent from the previous week and 29 percent from the prior 4-week average. Increases primarily for Japan (37,000 MT, including 3,000 MT switched from unknown destinations), Mexico (12,900 MT, including decreases

of 1,100 MT), Canada (10,200 MT, including decreases of 200 MT), El Salvador (9,000 MT, including 9,600 MT switched from Guatemala and decreases of 600 MT), and Honduras (8,000 MT, including 6,000 MT switched from Nicaragua), were offset by reductions for

Guatemala (10,300 MT), Nicaragua (6,000 MT), unknown destinations (3,000 MT), and Belgium (2,200 MT).

For 2021/2022, net sales of 104,600 MT primarily for the Philippines (90,000 MT), Canada (6,500 MT), Mexico (4,600 MT), and Nicaragua (2,200 MT), were offset by reductions for Guatemala (1,900 MT).

Exports of 213,700 MT were down 15 percent from the previous week, but up 3 percent from the prior 4-week average. The destinations were primarily to Mexico (38,600 MT), Japan (38,100 MT), Colombia (31,500 MT), Guatemala (22,200 MT), and Honduras (22,000

MT).

Soybean

Oil:

Net sales of 500 MT for 2020/2021 were up 54 percent from the previous week, but down 67 percent from the prior 4-week average. Increases were reported for Canada (300 MT, including decreases of 100 MT) and Honduras (200 MT). Total net sales for 2021/2022

of 100 MT were for Honduras. Exports of 400 MT were down 14 percent from the previous week and 79 percent from the prior 4-week average. The destinations were to Canada (300 MT) and Mexico (100 MT).

Cotton:

Net sales of 242,400 RB for 2021/2022 primarily for China (161,900 RB, including 3,400 RB switched from Singapore, 600 RB switched from Hong Kong, and decreases of 11,100 RB), Turkey (46,100 RB, including decreases of 2,800 RB), Pakistan (16,400 RB, including

decreases of 700 RB), Vietnam (12,400 RB, including 4,000 RB switched from China, 1,000 RB from Japan, and decreases of 1,400 RB), and Peru (4,900 RB), were offset by reductions primarily for Singapore (3,400 RB) and Japan (1,400 RB). Total net sales of 59,500

RB for 2022/2023, were for Pakistan. Exports of 221,100 RB were primarily to Pakistan (49,600 RB), Vietnam (38,000 RB), Turkey (31,700 RB), China (22,100 RB), and Bangladesh (17,600 RB). Net sales of Pima totaling 10,600 RB primarily for China (3,800 RB,

including 300 RB switched from Germany), India (2,600 RB, including decreases of 600 RB), Pakistan (2,200 RB), the United Arab Emirates (900 RB), and Turkey (500 RB), were offset by reductions for Germany (300 RB). Exports of 3,700 RB were to India (1,400

RB), China (1,100 RB), Peru (800 RB), and Pakistan (400 RB).

Exports

for Own Account:

For 2021/2022, new exports for own account totaling 100 RB were to Vietnam. The current exports for own account outstanding balance of 4,800 RB is for China (4,700 RB) and Vietnam (100 RB).

Hides

and Skins:

Net sales of 190,400 pieces for 2021 were down 42 percent from the previous week and 43 percent from the prior 4-week average. Increases primarily for China (101,600 whole cattle hides, including decreases of 25,000 pieces), Thailand (67,200 whole cattle

hides, including 16,400 whole cattle hides switched from Taiwan and decreases of 700 pieces), Mexico (15,500 whole cattle hides, including decreases of 600 pieces), South Korea (8,200 whole cattle hides, including decreases of 1,100 pieces), and Canada (1,000

whole cattle hides, including decreases of 1,000 pieces), were offset by reductions primarily to Taiwan (3,500 whole cattle hides). Exports of 357,200 pieces were down 14 percent from the previous week and from the prior 4-week average. Whole cattle hides

exports were primarily to China (249,000 pieces), South Korea (48,900 pieces), Thailand (23,300 pieces), Mexico (11,300 pieces), and Taiwan (10,000 pieces).

Net

sales of 113,000 wet blues for 2021 were down 17 percent from the previous week and 12 percent from the prior 4-week average. Increases primarily for China (29,900 unsplit), Taiwan (28,100 unsplit, including decreases of 200 unsplit), Vietnam (23,900 unsplit),

Mexico (23,400 grain splits), and Thailand (8,000 unsplit, including decreases of 400 unsplit), were offset by reductions for Italy (200 unsplit and 100 grain splits). Exports of 148,000 wet blues were down 9 percent from the previous week, but up 3 percent

from the prior 4-week average. The destinations were to Italy (40,300 unsplit and 10,400 grain splits), China (30,100 unsplit), Vietnam (20,400 unsplit), Taiwan (19,200 unsplit), and Mexico (9,400 unsplit and 8,400 grain splits). Net sales of 336,900 splits

were reported for China (252,900 pounds, including decreases of 700 pounds) and Taiwan (84,000 pounds). Exports of 202,600 pounds were to Vietnam (160,000 pounds) and China (42,600 pounds).

Beef:

Net

sales of 11,100 MT reported for 2021 were down 18 percent from the previous week and 42 percent from the prior 4-week average. Increases primarily for Japan (2,800 MT, including decreases of 400 MT), South Korea (2,800 MT, including decreases of 400 MT),

China (1,800 MT, including decreases of 300 MT), Taiwan (900 MT, including decreases of 100 MT), and Mexico (600 MT, including decreases of 100 MT), were offset by reductions for Colombia (100 MT). Exports of 19,700 MT were up 6 percent from the previous

week, but down 1 percent from the prior 4-week average. The destinations were primarily to South Korea (5,600 MT), Japan (4,700 MT), China (4,200 MT), Mexico (1,200 MT), and Taiwan (1,100 MT).

Pork:

Net

sales of 20,000 MT reported for 2021 were up 37 percent from the previous week, but down 31 percent from the prior 4-week average. Increases primarily for Mexico (6,900 MT, including decreases of 700 MT), Japan (3,100 MT, including decreases of 300 MT), Colombia

(3,000 MT, including decreases of 200 MT), Canada (2,300 MT, including decreases of 700 MT), and South Korea (1,500 MT, including decreases of 100 MT), were offset by reductions for Australia (200 MT). Exports of 28,700 MT were up 4 percent from the previous

week, but down 2 percent from the prior 4-week average. The destinations were primarily to Mexico (13,500 MT), China (4,500 MT), Japan (4,300 MT), Canada (1,600 MT), and Colombia (1,400 MT).

August

19, 2021 1 FOREIGN AGRICULTURAL SERVICE/USDA

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.