Commitment of Traders and daily estimate of funds will be sent separately

PDF Attached

There

were no 24-H USDA sale announcements. Front month soybeans and meal ended lower, soybean oil rebounded to close higher, corn traded two-sided to end higher and wheat closed up in part to technical buying. The annual Pro Farmer crop

tour starts Monday.

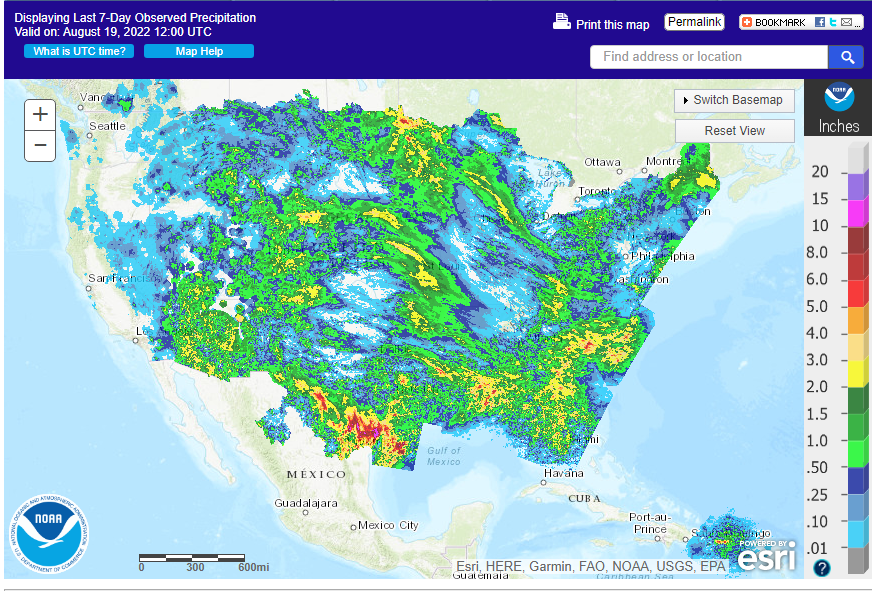

US

weather forecast was unchanged but some models a little south for the central US. The 7 day shows a wet bias for the southern US, slowing corn harvest progress for the Delta. The Midwest west-central areas will see rain Saturday before moving into the east-central

areas Sunday. China’s Yangtze Valley will continue to see unwanted net drying.

WEATHER

TO WATCH AROUND THE WORLD

-

U.S.

Midwest Corn and Soybean Production areas will get rain today through the weekend, but drier weather is expected thereafter -

The

drying is unlikely to have a big impact because of an absence of excessive heat and the presence relatively good soil moisture for this time of year -

Net

drying is expected and some moisture will be needed in the last days of August and early September to preserve production potentials in the drier areas -

U.S.

southwest monsoon is expected to be quite active during the coming week with moisture abundance expected from northwestern Mexico into the southern U.S. Rocky Mountain region

-

The

breakdown of high pressure in the central U.S. this week and next week will allow some of this moisture to stream across Texas and Oklahoma -

Excessive

rain will fall from parts of the Texas Panhandle through the Red River Valley of the South late this weekend into early next week -

Flooding

will be possible especially in northern parts of Texas and in particular in the northern Blacklands -

Rain

totals next week in the northern Blacklands will vary from 4.00 to more than 8.00 inches

-

The

European model forecast has suggested rain totals of 8 to 12 inches are possible -

Rain

in West Texas will vary from 1.00 to 3.00 inches except in a few southern production areas where less than 1.00 inch is expected -

Irrigated

cotton will benefit from the moisture, but the improvement will be limited because of damage done to cotton earlier this summer due to excessive heat and dryness -

Soil

moisture improvements in a part of the southern Plains in the coming week will be great for livestock due to improved range and pasture conditions over time, although some flooding may occur first -

The

moisture boost will also be great for wheat planting in early September especially if there is a little follow up precipitation

-

U.S.

Delta and southeastern states will experience a little too much rain in the coming week to ten days raising some concern over early season crop maturation and harvest progress -

Rain

advertised for southern Alberta, Canada, Montana and far southwestern Saskatchewan, Canada next week may prove to be welcome and beneficial for winter crops and for getting moisture into the soil for 2023; however, the precipitation may fall a little too late

for much benefit to this year’s crops -

Rain

will disrupt some harvesting expected and there may be some decline in crop quality in areas where crops have been cut and left lying in the swath -

Recent

rain in southeastern Canada’s Prairies has been a boon to late season crops like corn, soybeans, late planted canola and flax -

Canada’s

central Prairies will remain too dry along with a part of the northwestern U.S. Plains and the U.S. Pacific Northwest in the next ten days -

Temperatures

in these areas will be above normal for an extended period of time -

Late

season crop stress in unirrigated areas will continue along with some livestock stress -

Production

from the Prairies in general will still be well above that of last year and some areas will report impressive yields, but there will be some other areas that will not yield well

-

Ontario

and Quebec, Canada, Manitoba Canada, eastern Saskatchewan, Canada and western, central and northern Alberta will get timely rain supporting coarse grain and oilseed development over the next two weeks. -

Northeastern

Mexico drought is not likely to change much without a tropical cyclone coming inland.

-

A

disturbance in the Caribbean Sea near Honduras will move across the Yucatan Peninsula in the next couple of days before reaching the Gulf of Campeche where some development will be possible -

The

disturbance could move into northeastern Mexico during the weekend or early part of next week bringing “some” relieving rain, but much more will be needed -

Europe

weather is not likely to be wet enough for a general improvement in late season summer crop conditions, but there has been some relief to crops in France recently -

Additional

showers will occur in western Europe this weekend and then a period warm to hot temperatures and no rain will occur for a while next week before showers return again late next week and in the following weekend -

Rain

in southeastern Europe during the coming week should slowly relieve unirrigated corn, sorghum, soybeans and sunseed from dryness that has been threatening production

-

Russia

will continue drying out and experiencing warmer than usual temperatures -

This

pattern will last for ten days -

Rain

is expected as scattered showers today and Saturday in western parts of Russia’s Southern Region and Ukraine, but resulting rainfall will be light and it should be followed by a week to ten days of limited rain and net drying -

China’s

hot, dry weather in the Yangtze River Basin is expected to prevail for at least another week and then only partial relief is expected -

Topsoil

moisture is rated very short while subsoil moisture is declining and will soon be short to very short as well -

Crop

conditions are staying fair to good, but recent heat and dryness has induced some stress to crops and livestock -

Damage

to rice is most suspected and China already lost rice production earlier this year because of flooding -

Southern

corn, soybean and ground areas may also be negative impacted, but the bulk of crops are located farther to the north from where the heat is most serious -

Northern

China; including the Northeast Provinces and the North China Plain may be too wet

-

Some

drying would be welcome after a long summer of abundant to excessive moisture and some of that needed weather change may evolve later this weekend into next week -

Xinjiang,

China will continue to receive a mix of weather during the next two weeks maintaining a favorable summer crop outlook for corn, cotton and other crops -

Xinjiang

may be a little cooler than usual this week with a few showers expected -

India’s

weather turned drier Thursday and the change was welcome after recent heavy rainfall in central parts of the nation -

India

will experience a new wave of moderate to heavy rain this weekend into early next week from Odisha and neighboring West Bengal through parts of Madhya Pradesh to Gujarat, Pakistan and Rajasthan -

Rainfall

may be heavy at times in this region and the ground is already too wet resulting in some new flooding

-

Drier

weather is expected in central India during the second half of next week and into the following weekend and the change will be welcome -

Uttar

Pradesh, Bihar and Jharkhand weather recently has improved after the very poor start to the monsoon season, but moisture deficits remain and greater rain is still needed -

Parts

of Australia have been trending too wet recently -

Western

Australia should receive less rain for a while, but showers will continue in Victoria, New South Wales and southeastern South Australia

-

Drying

in the west will be welcome -

Queensland

will be dry for the next week to nearly ten days -

No

change in South America’s predicted weather is expected over the next ten days

·

Western wheat areas in Argentina will continue drier biased and in need of greater precipitation

·

Eastern Argentina will continue to have favorable soil moisture

·

Southern Brazil rain is expected to end today and early Friday

-

Some

areas are a little too wet -

Drying

in southern Brazil will occur from Friday afternoon through much of next week and the change will be welcome to all crops

-

Korean

Peninsula will receive waves of rain over the next two weeks resulting in favorable soil moisture

-

Mainland

areas of Southeast Asia will get plenty of rain, but nothing too extreme over the next ten days -

Philippines

and Indonesia weather will continue frequently wet during the next ten days

-

East-central

Africa will be most significant in Ethiopia, although Uganda and Kenya rainfall is also expected to be favorable -

Tanzania

is normally dry at this time of year and it should be that way for the next few of weeks -

West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally -

Some

greater rain would still be welcome in the drier areas of Ivory Coast and Ghana

-

Seasonal

rains have shifted northward leading to some drying in southern areas throughout west-central Africa – this is normal for this time of year and the precipitation is expected to move southward soon -

Cotton

areas are expecting frequent rainfall in the next couple of weeks with a few areas in Mali, northern Ivory Coast and Senegal becoming a little too wet

-

South

Africa’s crop moisture situation is favorable for winter crop establishment -

Restricted

rainfall is expected for a while, but the crop is rated better than usual because of frequent rainfall during the autumn planting season and timely rain since then -

Crops

are semi-dormant and unlikely to develop aggressively for a few weeks leaving plenty of time for seasonal rains to resume normally -

Central

America rainfall will continue to be abundant to excessive and drying is needed -

Too

much moisture could induce some areas of flooding -

Some

crop conditions would improve with a little less rain -

Mexico

rain will be most abundant in the west and southern parts of the nation -

Drought

will prevail in the northeast, although there will be some increase in shower and thunderstorm activity near the Rio Grande for a while this week and in a more broad-based event next week as weather patterns change temporarily -

Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely -

Rain

in the past 30-days has been notably lighter than usual because of limited tropical activity

-

No

change in this drier bias is expected for a while -

Today’s

Southern Oscillation Index was +9.07 and it will move lower during the coming week -

New

Zealand weather is expected to turn warmer this week with rain becoming heavy at times in North Island and in northern and western parts of South Island -

Some

flooding will be possible

Source:

World Weather INC

Bloomberg

Ag Calendar

Friday,

Aug. 19:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Brazil’s

Conab releases sugar, cane and ethanol output data - US

cattle on feed, 3pm - EARNINGS:

Deere

Saturday,

Aug. 20:

- China’s

third batch of July trade data, including soy, corn and pork imports by country - AmSpec

to release Malaysia’s Aug. 1-20 palm oil export data

Monday,

Aug. 22:

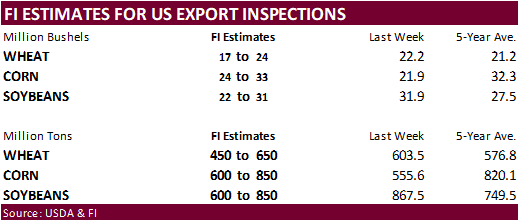

- USDA

export inspections – corn, soybeans, wheat, 11am - MARS

monthly EU crop conditions report - US

crop conditions for spring wheat, corn, soybeans and cotton; winter wheat harvesting, 4pm - USDA

total milk production, 3pm - EU

weekly grain, oilseed import and export data - US

cold storage data for pork, beef and poultry, 3pm

Tuesday,

Aug. 23:

- Sinofert

1H results briefing

Wednesday,

Aug. 24:

- EIA

weekly US ethanol inventories, production, 10:30am - Brazil’s

Unica may release cane crush, sugar production data (tentative) - US

poultry slaughter

Thursday,

Aug. 25:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Malaysia’s

Aug. 1-25 palm oil export data - USDA

red meat production

Friday,

Aug. 26:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Canada

Retail Sales M/M Jun: 1.1% (est 0.4%, prevR 2.3%)

Retail

Sales Ex Auto M/M Jun: 0.8% (est 0.9%, prev 1.9%)

98

Counterparties Take $2.222 Tln At Fed Reverse Repo Op (prev $2.218 Tln, 98 Bids)

·

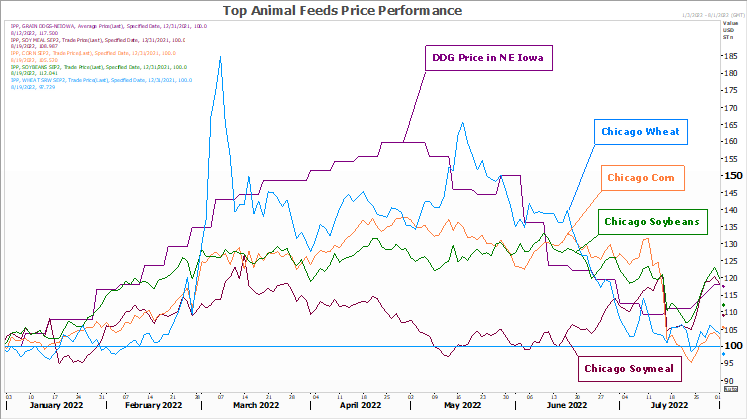

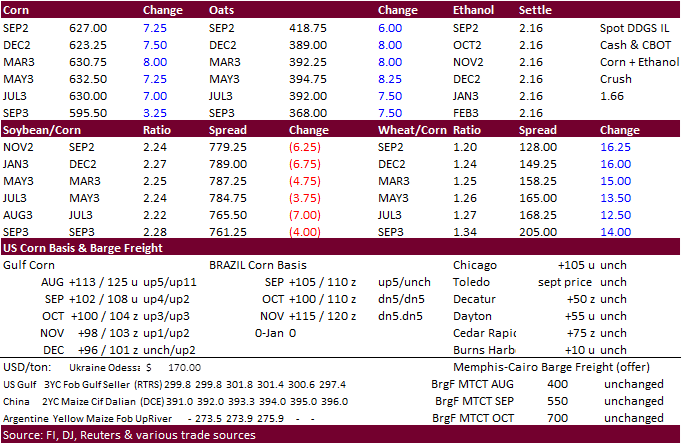

Corn futures traded higher on EU corn production concerns and technical buying. We would not rule out unwinding of soybean/corn spreads. Higher production prospects for Argentina and Brazil may have limited gains.

·

Gulf corn basis was higher by 2-11 cents, making some wonder if some business was executed.

·

The USD was sharply higher. WTI crude oil traded two-sided, ending higher.

·

French corn crop conditions fell 3 points for the week ending August 15 to 50 percent G/E and are down more than 30 points over the past month. Year ago, ratings were 91 percent.

·

Reuters reported another 10 ships are currently being loaded at Ukraine ports and will soon ship. More than 40 applications were submitted for shipping from Ukraine ports. 25 had already departed since the safe passage agreement.

Shipments need to significantly

increase in order to eventually ramp up to the AgMin target of three million tons per month.

·

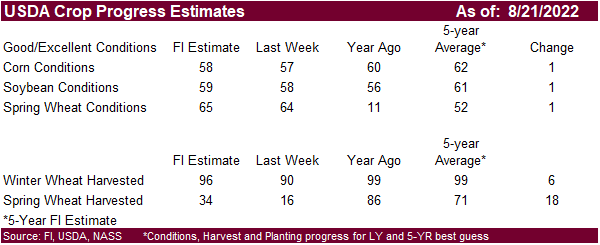

The annual Pro Farmer crop tour starts Monday. The WCB legs will be closely monitored. Delta states will not be part of this tour.

·

We are hearing yields across the Delta vary widely. Some parts of the Delta saw a long stretch of hot and dry weather, followed by recent, heavy, rains that are preventing some producers to cut the corn crop. One southern Delta

plot recorded 29 percent moisture. On the other hand, soybean yields could end up in good shape.

·

Most of the early cut corn across the far southern US is expected to go to domestic animal unit end users. Some might make it to ports but interior basis suggests end users badly need of it. We heard one chicken company is willing

to buy fresh harvested corn and dry it down themselves.

·

The Buenos Aires Grains Exchange increased Argentina’s corn production by 3 million tons for the 2021-22 season to 52 million tons. They raised the planted area to 7.7 million hectares from 7.3 million previously. The exchange

estimated 2022-23 Argentina corn area at 7.5 million hectares, lower due to profitability. Soybeans are favored next season.

·

A Reuters poll calls for Brazil 2021-22 corn production to end up near 115.8 million tons. Conab is at 114.5 million and USDA 116 MMT, up from 87 million for 2020-21. USDA has 126 MMT for the upcoming 2022-23 crop.

·

None reported

Updated

8/16/22

September

corn is seen in a $5.70 and $6.60 range

December

corn is seen in a $5.50-$7.00 range