PDF Attached

Soybeans, SBO, and corn ended higher, meal lower, and wheat mostly lower. Weather, US tight supplies, large Black Sea wheat production prospect, and positioning were major factors. US ethanol production fell for the seventh consecutive week in part to scare corn supplies.

![]()

WORLD WEATHER INC.

MOST IMPORTANT WEATHER OF THE DAY

- Better model agreement is present today over the possible tropical cyclone that will evolve in the Caribbean Sea late this week that may reach the Louisiana coast early next week

- Details of the storm’s intensity and precise landfall will not be available for a few more days, but conditions look good for a hurricane to evolve and it could become strong

- Landfall in western Louisiana is suggested by the ECMWF model while the GFS is farther to the east. The more westerly track is preferred, but until the storm center forms there will be much speculation

- Rain in northern U.S. Midwest Tuesday and overnight was welcome and good for many summer crops

- Additional precipitation will occur in the same region periodically through the coming week to ten days resulting in a further bolstering of soil moisture for late season crop development

- Southwestern U.S. corn and soybean production areas will experience dry weather for much of the coming week

- The proposed tropical cyclone that comes into Louisiana or the upper Texas coast next week could bring rain to the drier areas of the southwestern Corn Belt during the middle to latter part of next week

- U.S. southeastern states will experience a good mix of weather during the next two weeks supporting most crops in a favorable manner

- Texas crop areas have a better forecast today with the proposed tropical cyclone evolving in the Caribbean Sea this week possibly making landfall in Louisiana instead of Texas

- The more easterly track of this proposed storm could spare cotton, rice, sugarcane, citrus, corn and soybeans in the state from much if any adverse weather

- There is still time for changes in the forecast and the situation should be closely monitored

- West Texas cotton areas are benefiting from drier and warmer weather and this trend will continue for a while longer before some cooling evolves during the weekend

- Far western U.S. will continue in a notable drought with little potential for change

- Canada’s Prairies will continue to see a favorable mix of rain and sunshine over the next ten days supporting some harvest progress and helping to lift topsoil moisture periodically

- Recent rain has brought some notable relief from dryness in the topsoil, but subsoil moisture is still quite limited

- Ontario and Quebec soil moisture is decreasing, but summer crop conditions remain very good

- Wheat harvesting has and will continue to advance favorably

- India’s forecast today is a little wetter for Gujarat during the middle to latter part of next week

- The change was needed and if the rain falls as advertised some short-term improvements to crop development potential will result

- Western and northern Rajasthan and Pakistan remain in a dry weather mode with little change likely for the next week to ten days

- Weather conditions elsewhere in India are quite favorable and summer crop production is expected to be good

- Argentina weather is still looking good across eastern winter crop areas, but rain is needed in the west

- Some rain is advertised for the west late next week and into the following week, but the precipitation is expected to be erratic and light leaving need for more rain

- Brazil rain is expected to evolve in the south over the next few days

- Some of this moisture will reach into northern Parana and Sao Paulo Friday into the weekend bringing some moisture to wheat, coffee and some minor sugarcane areas

- The moisture in coffee and sugarcane areas is most likely to continue into early next week, but resulting rainfall should be light

- Australia’s winter crops remain favorably rated with little change likely in the next ten days

- The only exception is in Queensland and a few neighboring areas where there is need for rain especially with reproduction of wheat and barley coming soon

- China has been reporting localized pockets of heavy rainfall recently, but no widespread excessive rain event has occurred

- Rainfall this month has been greater than desired for many crops in the nation and that could have some impact on production

- Flooding has occurred periodically and some of it may have damaged a few crops

- A part of northeastern China’s small grain crop is probably too wet and may be suffering a quality decline, but corn, soybeans, rice, sugarbeets and other crops are likely in favorable condition

- China needs to dry down, but is unlikely to do so for a while

- Western Europe will be dry for the coming week

- Some showers will evolve late next week briefly in France and then another period of drying is likely

- The drier weather may stress a few late season crops in France and the U.K., but it will be good for fieldwork and for expediting early season crop maturation

- France and the U.K. will be driest, but some areas in Germany, Belgium, Netherlands, Denmark and Norway will also be impacted

- Eastern Europe will experience frequent rainfall and milder than usual temperatures over the next ten days

- Some rain will fall in the Balkan Countries where dryness has been a threat to unirrigated summer crop production in recent weeks

- Russia’s New Lands and Kazakhstan have been drier biased this month.

- Crop conditions have been favorable except in and north of Kazakhstan where too much heat and dryness hurt wheat and sunseed production

- Western Russia summer crop conditions have been good and little change is expected

- Harvesting 2021 crops and the planting of 2022 crops is occurring, but a little slower than desired in some of the wetter areas in western and northern Russia and neighboring areas.

- Southeast Asia crop areas will receive periodic showers and thunderstorms over the next two weeks

- West-central Africa rainfall over the next ten days will be sufficient to support most crops

- Coffee, cocoa, rice, sugarcane and cotton development has been and will continue to be good this year

- East-central Africa showers and thunderstorms have been and will continue to be timely and beneficial resulting in a good outlook for coffee, cocoa, rice, sugarcane and other crops that are produced from Ethiopia into Uganda and southwestern Kenya.

- Showers in South Africa will be erratic and light most of this week

- The precipitation will benefit many wheat, barley and canola crops

- Southern Oscillation Index was +3.27 Sunday and the index should move in a narrow range over the next week to ten days with some upward movement

- Mexico rainfall will be more limited for a while this week – at least in the interior two-thirds of the nation

- Rain will fall heavily in some eastern and western coastal areas

- A new tropical cyclone will threaten Tamaulipas early next week, although the storm may move into Texas and leave Mexico out of its significant rain and wind

- Central America rainfall will be routine and sufficient to maintain a very good outlook for all crops in the region from Panama to Guatemala

Source: World Weather Inc.

Wednesday, Aug. 25:

- EIA weekly U.S. ethanol inventories, production

- Malaysia Aug. 1-25 palm oil export data

- Unica cane crush, sugar production (tentative)

Thursday, Aug. 26:

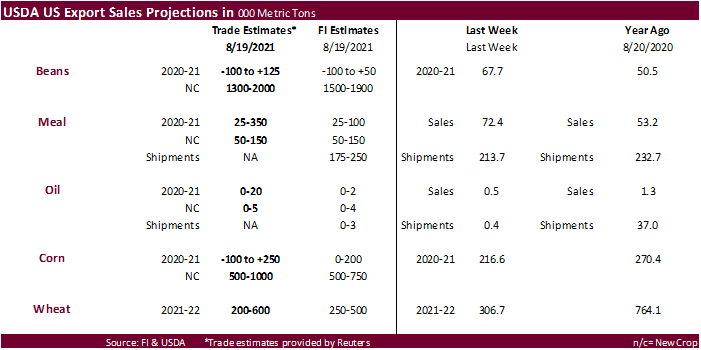

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- International Grains Council monthly report

- Port of Rouen data on French grain exports

Friday, Aug. 27:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

Source: Bloomberg and FI

Schnitkey, G., C. Zulauf, K. Swanson and N. Paulson. “Stress Test of 2022 Crop Returns.” farmdoc daily (11):124, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 24, 2021.

Macros

77 Counterparties Take $1147.089 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1129.737 Bln, 77 Bidders)

US Durable Goods Orders Jul P: -0.1% (est -0.3%; prevR 0.8%; prev 0.9%)

US Durable Goods Ex-Transportation Jul P: 0.7% (est 0.5%; prevR 0.6%; prev 0.5%)

US Cap Goods Orders Nondef Ex-Air Jul P: 0.0% (est 0.5%; prevR 1.0%; prev 0.7%)

US Cap Goods Ship Nondef Ex-Air Jul P: 1.0% (est 0.7%; prev 0.6%)

Canada July Wholesale Trade Most Likely Fell 2.0% – StatsCan Flash Estimate

US DoE Crude Oil Inventories (W/W) 20-Aug: -2980kK (est -2000K; prev -3233K)

– Distillate: 645kK (est -900K; prev -2697K)

– Cushing Crude: 70K (prev -980K)

– Gasoline: -2241K (est -1500K; prev 696K)

– Refinery Utilization: 0.20% (est -0.05%; prev 0.40%)

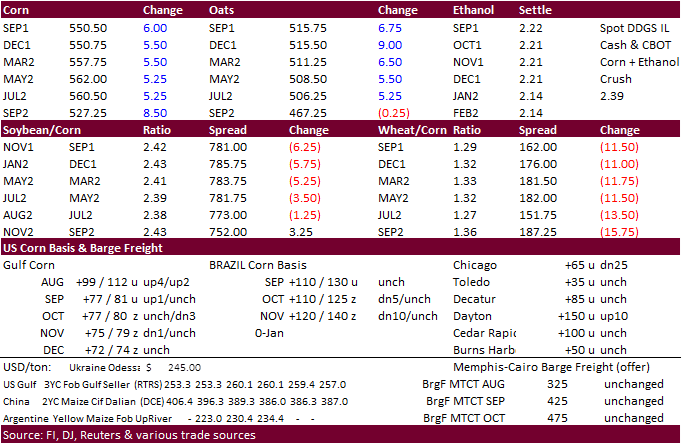

Corn

· Corn futures ended higher on unwinding of soybean/corn spreading, tight US domestic supplies, talk of Chinese buying interest and a USD that was slightly lower by 2 pm CT. Lack of fresh news should be noted. WTI was up $0.96.

· Funds bought an estimated net 5,000 corn contracts.

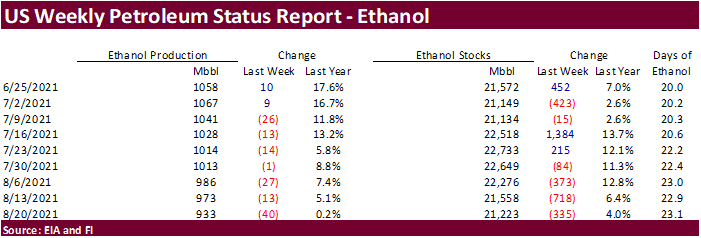

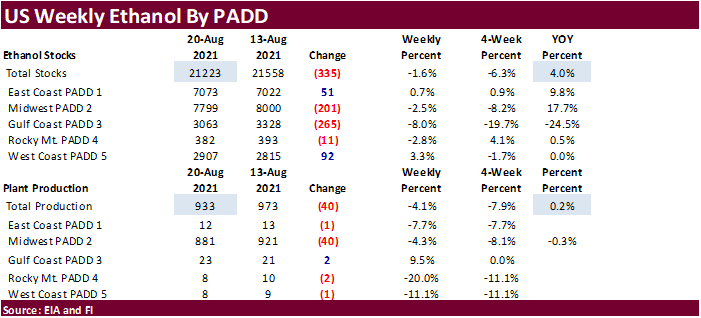

· US weekly ethanol production dropped by a large 40,000 barrels per day and some think that tight US domestic supplies were supportive for nearby futures. We are hearing a good amount of ethanol plant downtime/maintenance as interior spot cash prices are high. With new-crop coming online for the upper Delta soon, we should see production pickup.

· December corn traded above a few key MA’s, but settled 6.50 cents higher at $5.5175, below its 100-day MA of $5.54. .

· Romania’s corn production was estimated at 13.7 million tons, up from 10.2 million last year.

· The weekly USDA Broiler Report showed eggs set in the United States up 3 percent and chicks placed up 1 percent. Cumulative placements from the week ending January 9, 2021, through August 21, 2021, for the United States were 6.17 billion. Cumulative placements were up 1 percent from the same period a year earlier.

Weekly US ethanol production last week was off 40,000 barrels to 933,000 barrels (trade was looking up 2,000) and stocks were down 335,000 barrels to 21.223 million barrels (trade looking for a 39,000 decrease) from the previous week. Ethanol production have fallen seven consecutive weeks and for the week ending 8/20 production posted its largest weekly decline since June 11 and was lowest since January 22, 2021. Stocks are lowest since 7/9/21. Early September to date ethanol production is running 3.4 percent below the same period a year ago. We are using 5.056 billion bushels, below USDA’s estimate of 5.075 billion. For 2021-22, we have 5.250 billion, 50 million below USDA. US gasoline stocks decreased 2.24 million barrels to 225.92 million. US gasoline demand was up from the previous week but overall running 4.5 percent above a year ago and off 3.3 percent from around this time in 2019.

Export developments.

- None reported

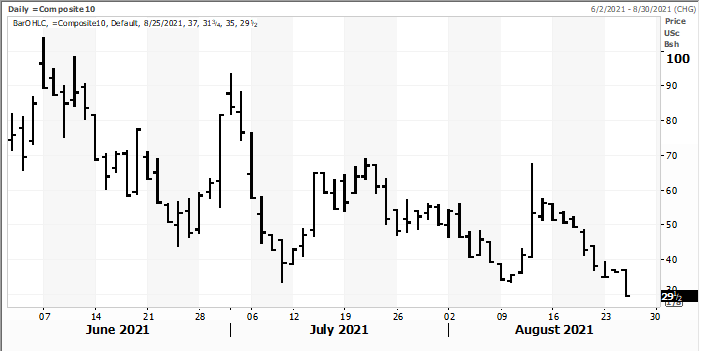

CZ1-CZ2 (December 2021 corn @ a premium)

Source: Reuters and FI

United States and Canadian Cattle

- United States and Canadian Cattle Inventory Down 1 Percent

- All cattle and calves in the United States and Canada combined totaled 113 million head on July 1, 2021, down 1 percent from the 114 million head on

- July 1, 2020. All cows and heifers that have calved, at 45.4 million head, were down 1 percent from a year ago.

- All cattle and calves in the United States as of July 1, 2021, totaled 101 million head, down 1 percent from July 1, 2020. All cows and heifers that have calved, at 40.9 million head, were down 1 percent from a year ago.

- All cattle and calves in Canada as of July 1, 2021, totaled 12.3 million head, up slightly from the 12.3 million head on July 1, 2020. All cows and heifers that have calved, at 4.54 million head, were down 1 percent from a year ago.

United States and Canadian Hogs

- United States and Canadian Hog Inventory Down 2 Percent United States and Canadian inventory of all hogs and pigs for June 2021 was 89.9 million head. This was down 2 percent from June 2020, but up slightly from June 2019. The breeding inventory, at 7.49 million head, was down 1 percent from a year ago and down 2 percent from 2019. Market hog inventory, at 82.4 million head, was down 2 percent from last year and up slightly from 2019. The semi-annual pig crop, at 82.2 million head, was down 1 percent from 2020 but up 1 percent from 2019. Sows farrowing during this period totaled 7.38 million head, down 1 percent from last year and down 1 percent from 2019.

- United States inventory of all hogs and pigs on June 1, 2021, was 75.7 million head. This was down 2 percent from June 1, 2020, but up 1 percent from March 1, 2021. The breeding inventory, at 6.23 million head, was down 2 percent from last year, but up slightly from the previous quarter. Market hog inventory, at 69.4 million head, was down 2 percent from last year, but up 1 percent from last quarter. The March to

- May 2021 pig crop, at 33.6 million head, was down 3 percent from 2020 and down 3 percent from 2019. Sows farrowing during this period totaled 3.07 million head, down 3 percent from 2020 and down 2 percent from 2019.

- Canadian inventory of all hogs and pigs on July 1, 2021, was 14.2 million head. This was up 1 percent from July 1, 2020, and up 2 percent from July 1, 2019. The breeding inventory, at 1.26 million head, was up 1 percent from last year and up 3 percent from 2019. Market hog inventory, at 13.0 million head, was up 1 percent from last year and up 2 percent from 2019. The semi-annual pig crop, at 15.3 million head, was up 5 percent from 2020 and up 9 percent from 2019. Sows farrowing during this period totaled 1.27 million head, up 2 percent from last year and up 4 percent from 2019.

Updated 8/20/21

December corn is seen in a $4.75-$6.00 range

· The soybean complex started lower on light profit but a rally in soybean oil and ongoing talk of Chinese demand for soybeans underpinned new-crop soy. Yesterday there was talk China bought at least eight US soybean cargoes this week. The September soybean contract settled 9.0 cents higher and November up 1.0 cent. Tight US supplies and short contract rolling to new-crop was noted. Soybean meal was once again under pressure as soybean oil ended sharply higher led by the soon expiring September contract. Last week’s selling was overdone, in our opinion.

· Funds bought an estimated net 1,000 soybeans, sold 1000 soybean meal and bought 3,000 soybean oil.

· Ongoing talk of long-term weather forecasts calling for a dry pattern for northern Argentina and southern Brazil is thought to be supportive for soybeans, but it’s too early as plantings don’t ramp up until late September well into October.

· Argentina decided to create its own agency to control the shipping along the major waterways, creating speculation tolls (or taxes) could increase for agriculture shippers.

· Germany’s rapeseed crop was estimated at 3.52 million tons, a slight increase from 2020.

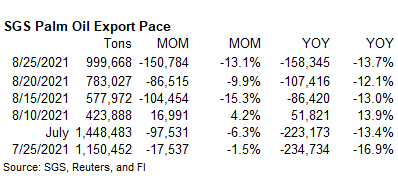

· Cargo surveyor SGS reported month to date August 25 Malaysian palm exports at 999,668 tons, 150,784 tons below the same period a month ago or down 13.1%, and 158,345 tons below the same period a year ago or down 13.7%. ITS reported August 1-25 palm oil exports fell 13.4% to 984,431 tons from 1.137 million shipped during the July 1-25 period. AmSpec: Malaysia’s Aug 1-25 palm oil exports 988,809 tons, down 12.3% from 988,809 tons previous period month ago.

Export Developments

· None reported

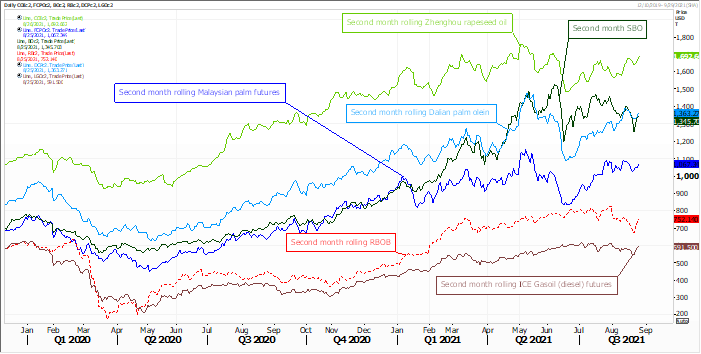

RBOB & gasoil versus selected vegetable oils

Source: Reuters and FI

Updated 8/24/21

Soybeans – November $11.75-$15.00

Soybean meal – December $320-$425

Soybean oil – December 48-67 cent range

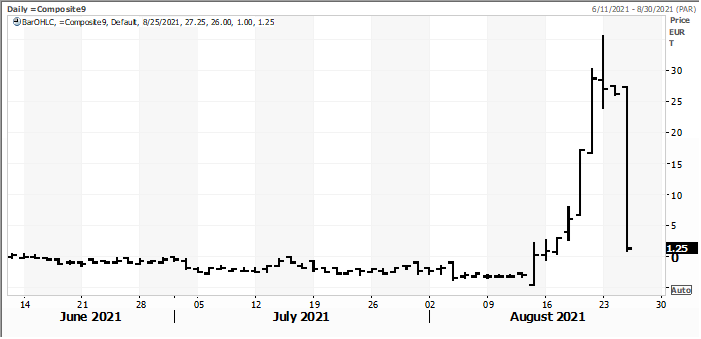

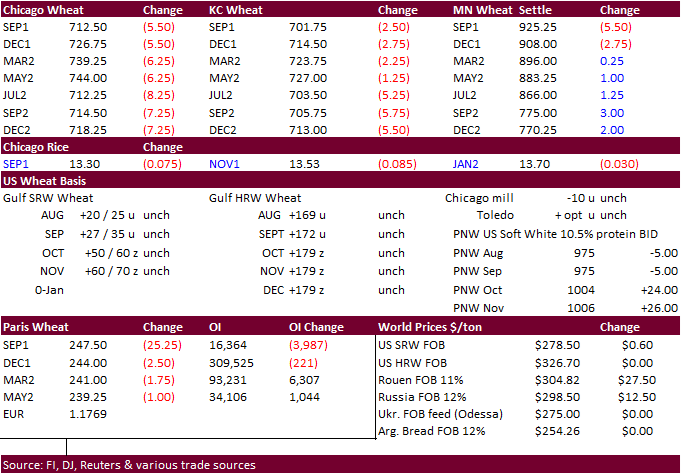

· Chicago wheat futures hit a two-week low before rebounding to end 6.75 cents lower basis the Sep through Mar positions. North American harvest pressure, lower Paris wheat and profit taking sent Chicago and KC lower along with nearby MN Sep and Dec positions. Back month MN contracts ended 0.25-3.0 cents higher. One of the reasons for the bear spreading was the collapse in the Paris Sep/Dec milling wheat spread. In addition, both Romania and Bulgaria reported large wheat production estimates for 2021.

· December Paris wheat was down 2.50 euros at 244.00. September was 25.25 lower at 245.25, a 9.3% decrease.

· Funds sold an estimated net 3,000 Chicago wheat contracts.

· Germany’s wheat harvest was estimated at 21.4 million tons, a 3.6% decline from 2020 due to adverse weather.

· We look for the Black Sea region to remain a dominant exporter of wheat this crop year.

· Romania collected a record 11.4-million-ton wheat crop after harvesting a very low 6.4 million tons in 2020.

· Bulgaria expects a 7.1-million-ton crop.

· Ukraine’s wheat harvest advanced to a record 32 million tons, about 5 million tons greater than what was collected at this time last year.

· Ukraine grain exports since July 1 total nearly 6.5 million tons from 6.4 million at this time last year.

September/December Paris milling wheat spread collapsed.

Source: Reuters and FI

Export Developments.

· Jordan bought 60,000 tons of wheat out of 120,000 tons sought, at an estimated $345/ton c&f for shipment in first half February 2022.

· Pakistan provisionally bought 160,000 tons of wheat out of 400,000 tons sought for Sep/Oct shipment. Price was thought to be believed at $355.95/ton.

· Turkey seeks 300,000 tons of milling wheat on September 2 for September 10 through October 10 shipment. They last bought 11.5% and 12.5% wheat on August 4 at $297.40-$308.90/ton c&f.

· Morocco saw no offers for 363,000 tons of US durum wheat under a tariff import quota for shipment by December 31.

· Tunisia seeks 100,000 tons of soft wheat and 100,000 tons of animal feed barley on August 26 for late Sep through October shipment. They last bought wheat on August 6 at $312.89/ton c&f.

· Taiwan weeks 48,875 tons of US wheat on September 3 for October 15-Novmeber 1 shipment. They last bought US wheat on August 6, various classes at various prices.

· The Philippines on August 26 seek 168,000 tons of feed wheat of EU, Black Sea or Australian origin for Sep 17-Nov 18 shipment. If shipped from Australia, shipment would be on the back end.

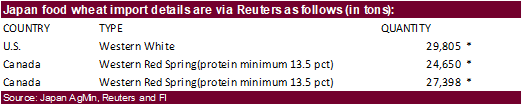

· Japan seeks 81,853 tons of food wheat from the US and Canada.

· Jordan seeks 120,000 tons of feed barley on August 26.

· Bangladesh seeks 50,000 tons wheat on September 1.

· Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

Rice/Other

- China’s National Bureau of Statistics (NBS) estimated early rice production increasing 2.7 to 28.02 million tons, up 723,000 tons from 2020.

- Egypt seeks 200,000 tons of raw sugar for Oct-Dec shipment on August 28.

Updated 8/17/21

December Chicago wheat is seen in a $6.80‐$8.25 range

December KC wheat is seen in a $6.60‐$8.00

December MN wheat is seen in a $8.45‐$9.80

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.