PDF Attached

2:33 PM CT: USDA SAYS RETRACTING WEEKLY EXPORT SALES DATA DISSEMINATED EARLIER THURSDAY – Reuters News

USDA rolled out a new export sales platform and data was initially questioned by traders. Unfortunately, the data is not easily available to scrape unlike the previous reports, so between the delay in the release of the report and conflicting information, traders and newswires were confused. The uncertainty in the USDA export sales data sent longs running, and CBOT prices traded lower. Hopefully going forward there will be an easier way to pull together a summary table. In our opinion, USDA should run both report sites side by side for several months instead of blindly rolling out a platform unfamiliar to the trade.

Pro Farmer crop tour continues to suggest lower yields relative to USDA and that limited losses for corn. The US Midwest will see rain across the central Corn Belt today, northwest Saturday and western areas Sunday. Parts of HRW wheat country will see rain on and off bias the southwestern areas over the next ten days.

![]()

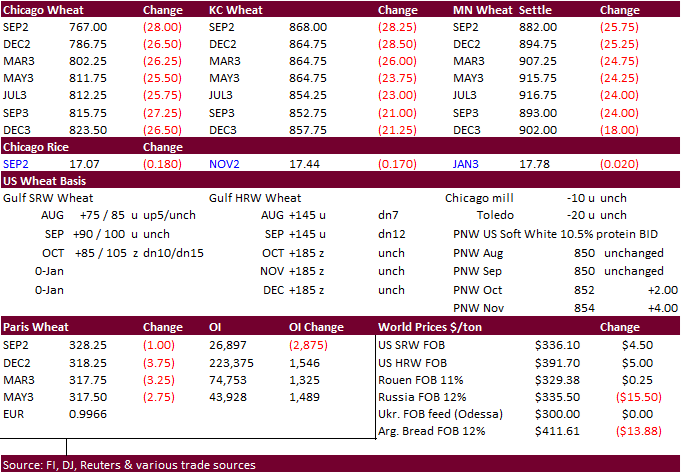

Earlier USDA export sales data

WEATHER EVENTS AND FEATURES TO WATCH

- Tropical Storm Ma-On moved into Guangdong, China overnight producing heavy rain and windy conditions, but the impact on crops and property should be relatively low

- Some flooding will occur in rice and sugarcane areas from western Guangdong into Yunnan with a few other crops impacted as well

- China’s Yangtze River Basin will see the excessive heat and dryness that has occurred this month slowly abate in the next ten days

- Showers will begin to pop up this weekend and temperatures will ease down a bit from the recent hot readings

- Not all of the basins will get relief during the coming ten days and there will be need for additional rainfall, but this will be a start toward some improvement

- Portions of northeastern China and a part of the North China Plain will see less frequent and less significant rain during the next two weeks translating into better late summer crop development conditions after a long summer of wet weather

- Xinjiang, China weather is expected to remain a little milder than usual with a few showers periodically, but summer crop conditions have been seriously altered by the pattern which has been relatively persistent in recent weeks

- Russia has one more week of dry and warm weather ahead

- Some relief is expected in the Baltic States, Belarus, far western Russia and western Ukraine this weekend into next week, but Russia’s Southern Region will likely stay quite dry for a full ten days and perhaps longer

- Rain is needed in winter wheat production areas to ensure a good emerged and established crop

- There is concern over the potential for a colder winter in 2023 across western Russia and any winter crops that are not well established by November could run a higher risk of winterkill if the winter cold outlook verifies

- India’s weather has improved and will continue more favorable for crop development over the next week to ten days

- Totally dry weather is not expected, but rain frequency and intensity will be lighter in areas that were excessively wet in recent weeks and that should bring on the improvement

- A moisture boost in southern India will be ideal for summer crops there after recent weeks of drier biased conditions

- Less rain in Pakistan and northern India in the next couple of weeks will be important in protecting early season cotton quality

- The early crops should be opening bolls and maturing with harvesting normally starting in mid-September.

- Too much rain has occurred recently in a part of Pakistan and in a few areas in central and northwestern India

- Western Europe will experience some scattered showers in the coming week, but the greatest frequency and significance of showers will hold off until the middle to latter part of next week

- The moisture will ease dryness, but not end it a more generalized soaking rain will still be needed

- Eastern Europe has been experiencing more frequent rain recently and that trend may continue for a while

- Areas from the western half of the Balkan Countries into western Poland and eastern Germany have been wettest and the trend will continue for a while

- Most of the significant rain in the southern U.S. is abating, but this past week’s heavy rainfall has raised some crop quality concerns from Texas into the Delta

- Soybean, rice and cotton quality compromises have likely occurred, although drier weather could change the situation

- Additional rain is expected periodically over the coming week which may add to the concern over crop conditions

- Most of the U.S. Midwest and a large part of the eastern and southern Great Plains will receive rain in this coming week with the greatest amounts likely from Sunday through Thursday of next week wettest

- The wetter weather in the Midwest will be great for ensuring a good finish to summer crop development

- The Midwest will see drier weather in the second week of the forecast which will improve early season crop maturation conditions and maintain a good environment for late season crop growth

- Northwestern U.S. Plains and a part of Canada’s Prairies will get some rainfall in the next week, but resulting amounts in some areas will be a little too light and erratic for a serious change in soil conditions

- Early season crop harvest delays should be brief

- Late season crops will benefit from whatever rain falls, but more will be needed to support the best possible finish to the growing season

- U.S. Pacific Northwest and many areas in the heart of Canada’s Prairies will be dry biased for another ten days favoring crop maturation, but leaving some concern over soil moisture for winter crops and for use next spring

- The U.S. Pacific Northwest will have plenty of opportunity to get rain in the next few weeks, but central Canada’s Prairies will need moisture sooner than that to support winter crop planting and improved cover crop conditions

- Ontario and Quebec weather remains mostly good for corn and soybeans with little change likely

- Mexico’s drought in the northeast continues and will not likely end without the help of a tropical cyclone

- Western and southern Mexico rainfall is expected to be sufficient to support crop needs for a while, but summer monsoon has not been as good of a performer as predicted and greater rain is needed to prevent drought from being ongoing into 2023

- Central America rainfall has occurred routinely and will continue to do so favoring many crops

- Argentina’s two week forecast continues to promote lighter than usual rainfall in the west while eastern areas get a little more routine occurrence of rain to maintain a favorable winter crop outlook

- Southern Brazil weather is expected to continue favorably moist over the next two weeks

- Tropical waves in the Atlantic Ocean will be closely monitored over the next seven days for signs of tropical cyclone evolution, but no significant development is likely through the weekend.

- Typhoon Tokage is well to the southeast of Japan’s main islands and will stay to the east minimizing its potential impact on any part of eastern Asia through the next several days

- Rain in Australia is expected to become more limited for a while

- Western Australia will be driest for ten days and then showers will develop later in the second week of the outlook

- The bottom line still looks very good for most of the nation’s crops even though Western Australia will experience net drying for the next ten days

- Temperatures will be seasonable

- Southeast Asia rainfall is expected to be frequent and significant during the next ten days to two weeks

- All areas are expected to be impacted and sufficient rain is expected to bolster soil moisture for long term crop development need

- South Africa will receive periodic showers of limited significance in the south, west and east leaving north-central areas dry

- Most of the resulting rain is not likely to be great enough for a serious impact on soil moisture, but some southern areas will get enough to maintain favorable early spring crop development potential

- Central Africa showers and thunderstorms will continue most frequent and significant in the northern coffee, cocoa and cotton production areas, but over time the rainy pattern should shift to the south

- Southern coffee and cocoa areas are not likely to get significant rain for a while especially not in Ivory Coast or Ghana

- North Africa precipitation over the next two weeks will be sporadic and light having little to no impact on soil moisture

- Today’s Southern Oscillation Index was +9.45 and it will move erratically over the next few days

Source: World Weather INC

Bloomberg Ag Calendar

Thursday, Aug. 25:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Malaysia’s Aug. 1-25 palm oil export data

- USDA red meat production

Friday, Aug. 26:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

Source: Bloomberg and FI

Macros

97 Counterparties Take $2.188 Tln At Fed Reverse Repo Op (prev $2.237 Tln, 102 Bids)

US GDP Annualized (Q/Q) Q2 S: -0.6% (exp -0.7%; prev -0.9%)

US Initial Jobless Claims Aug-20: 243K (exp 252K; R prev 2545K)

– Continuing Claims Aug-13: 1415K (exp 1441K; R prev 1434K)

US Personal Consumption Q2 S: 1.5% (exp 1.5%; prev 1.0%)

– GDP Price Index Q2 S: 8.9% (exp 8.7%; prev 8.7%)

– Core PCE (Q/Q) Q2 S: 4.4% (exp 4.4%; prev 4.4%)

Canadian Payroll Employment Change Jun: 114.6K (prev -26.1K)

· Corn started higher after Pro Farmer suggested lower yields relative to USDA for IL and western IA, then turned lower post USDA export sales on uncertainty of the validity of the data after they rolled out a new platform. USDA later said they are retracting the USDA export sales data. Sharply lower wheat added to the negative sentiment but losses in corn were somewhat limited from concerns over the quality of the US corn crop.

· Funs sold an estimated net 5,000 corn.

· December corn ended near its session low, off 7.25 cents to $6.5000.

· December corn has the potential to trade up into the $6.90-$7.00 area soon unless we see better than expected yield results during the remainder of the crop tour.

· AgriCensus noted additional European firms plan to scale back on fertilizer production from the increase in costs for energy.

· The EU Commission cut its estimate for this year’s corn crop to 59.3 million tons from 65.8 million a month ago.

· The USD was lower this afternoon and crude oil lower.

· Heavy rain across the US Delta is seen delaying corn harvest progress and fieldwork activity for the balance of the week.

· None reported

Updated 8/23/22

December corn is seen in a $6.00-$7.00 range

· The soybean complex ended lower, with meal and soybean near their respected session lows, on speculative selling. Soybean oil was modularly lower in the back months. USDA reported a very large new-crop soybean export sales of 4.7 million tons but many questioned this figure as USDA rolled out a new format to report export sales. USDA later said they are retracting the USDA export sales data.

· Soybean meal basis for Frankfort, IN, fell $45 to 80 over the September. Most other US locations were unchanged.

· Funds sold 7,000 soybeans, sold 6,000 meal and were even in meal.

· Soybean pod development has a chance to improve across the US. The US Midwest will see rain across the central Corn Belt today, northwest Saturday and western areas Sunday.

· The Delta continues to see unwanted rain. We heard 25 inches fell in Winnsboro, LA.

· Argentina extended their 12.5% biodiesel blend rate to help limit fuel imports. They raised it from 5 percent back in June to “save foreign exchange” (reserves), according to Reuters.

· (Reuters) – Russia has set its export tax for sunflower oil at 8,621.3 roubles ($143.4) per ton for September, down from 15,987.1 roubles in August. The September tax is based on an indicative price of $1,583.0 a ton.

· Palm oil ended a 4-day winning streak.

· From the same period month ago, cargo surveyor ITS and AmSpec estimated exports of Malaysian palm oil products for Aug. 1-25 were up between 4.9% (966,655 tons) and 10% (906,470 tons), respectively, while cargo surveyor SGS reported exports fell 0.1% to 969,341 tons.

Export Developments

- None reported

Updated 8/23/22

Soybeans – November is seen in a $13.75-$16.00 range

Soybean meal – December $390-$445

Soybean oil – December 63.00-71.00

· US wheat futures ended lower, mainly on technical selling. Paris wheat was lower, in part to renewed export competition out of the Black Sea.

· Funds sold an estimated net 8,000 Chicago wheat contracts.

· Parts of HRW wheat country will see needed rain on and off bias the southwestern areas over the next ten days.

· Paris December wheat was down 3.75 euros at 317.25 per ton.

· The EU Commission increased its estimate for this year’s soft wheat crop to 126 million tons from 123.9 million a month ago.

· India will ban wheat flour exports to cool local prices. They banned wheat exports mid-May. India flour exports were up 200% during April-July 2022 from a year ago. Local wheat prices hit a record earlier this week (over $305 per ton).

· Reuters reported Egypt was believed to have passed on 240,000 tons of wheat on Wednesday and opening talks with direct suppliers for Russian wheat. Monday’s price was thought to be around $368 per ton.

· Egypt is expected to still be in for wheat.

· Russia is experiencing warm and dry weather, good for harvest, but rain will be needed prior to winter grain plantings.

· (Bloomberg) — Russian Ports Load Wheat for Iran, Egypt, Israel, Turkey. Russian ports also loaded barley for Iran, according to shipping lineups from Logistic OS for the week to Aug. 24.

· Taiwan bought 34,025 tons of US million wheat for shipment from the PNW between Oct. 12 and Oct. 26.

-9,675 tons of U.S. dark northern spring wheat, 14.5% protein content bought at $417.91 a ton FOB

-8,925 tons of hard red winter wheat, 12.5% protein content bought at $411.62 a ton

-5,425 tons of soft white wheat, 9.0% protein bought at $372.79 a ton.

· Reuters reported Egypt was believed to have passed on 240,000 tons of wheat on Wednesday and opening talks with direct suppliers for Russian wheat. Monday’s price was thought to be around $368 per ton.

· Japan bought 118,881 tons of food wheat from the United States, Canada and Australia, for Oct, Jan, and Feb loading.

· Jordan seeks 120,000 tons of barley on August 31 for Dec-Feb shipment.

· Jordan seeks 120,000 tons of wheat on August 30.

· Bangladesh seeks 50,000 tons of milling wheat on September 1, optional origin, for shipment within 40 days of contract signing.

Rice/Other

· Bangladesh seeks 50,000 tons of rice on September 6.

Updated 8/23/22

Chicago – December $7.25-$10.00

KC – December $8.00-$11.00

MN – December $8.00-$12.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.