PDF Attached

WASHINGTON,

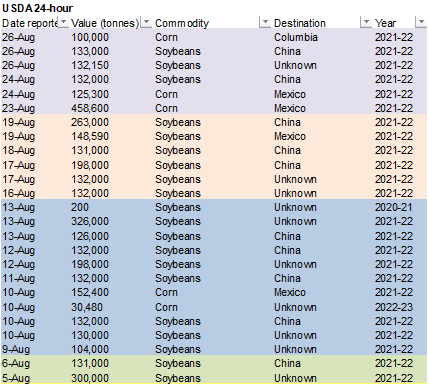

August 26, 2021—Private exporters reported to the U.S. Department of Agriculture the follow activity:

- Export

sales of 100,000 metric tons of corn for delivery to Colombia during the 2021/2022 marketing year; - Export

sales of 133,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year; and - Export

sales of 132,150 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

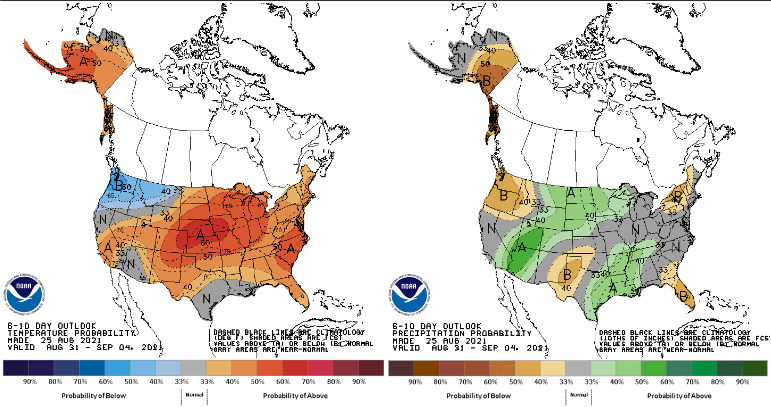

US

weather outlook looks good over the near term with precipitation falling across the north central and eastern areas through Friday, then the northern Midwest Saturday and central and eastern areas Sunday through Monday. Northeastern NE will see rain through

Saturday before rain expands to other parts of NE into KS and northern OK over the weekend. North Dakota, Minnesota, Wisconsin, and Iowa over next three days will see heavy rain.

![]()

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

- U.S.

National Hurricane Center made some strong comments about the potential for a significant tropical cyclone to threaten the north-central Gulf of Mexico Coast Sunday and Monday of next week - Most

computer forecast models are in agreement that a hurricane is likely and it may have some significant wind, rain and flood potentials - Landfall

is targeted on southeastern Louisiana for Sunday or Monday, but the forecast models have been shifting the storm track a little more to the east each day this week - The

system needs to be closely monitored - Southwestern

U.S. Corn Belt will likely see a limited amount of rainfall for a while which may deplete soil moisture and increase crop moisture stress - Most

U.S. Midwest crop areas outside of the southwest will experience a good mix of rain and sunshine along with warm temperatures to promote favorable crop conditions during the next two weeks

- Texas

cotton, corn, sorghum, rice and peanuts are no longer being threatened by next week’s tropical cyclone and favorable weather will continue to promote late season crop development and harvest progress - However,

some computer forecast models have suggested another tropical system may threaten the lower Texas coast Sep. 7-8 - Confidence

in this event is low because it occurs too far out in the forecast - U.S.

southeastern states will continue to experience a good mix of rain and sunshine during the next couple of weeks, although the weekend tropical cyclone will need to be closely monitored for a possible shift to the east that would bring heavy rain and strong

wind to Mississippi and/or Alabama - Far

western U.S. weather will continue quite dry and warm from California to the Pacific Northwest for at least the next ten days - Southwest

U.S. monsoon moisture may increase in the Arizona, New Mexico and the southern Rocky Mountain region next week - The

monsoon usually begins to withdraw in the second week of September - Canada’s

Prairies are still advertised to receive multiple waves of rain during the next two weeks offering further improvements to soil moisture and crop conditions - Southern

Alberta may be one of the last areas to get relief - Ontario

and Quebec, Canada soil moisture is decreasing, but summer crop conditions remain very good - Wheat

harvesting has and will continue to advance favorably - U.S.

northwestern Plains will also have a chance for rain, but Montana and Wyoming may be left in a very dry model for a while longer - These

areas will see greater than usual winter precipitation this year - Argentina

is still expected to see waves of rain next week that will help improve topsoil moisture for southern and eastern winter crop areas - Showers

in the west will be welcome, but may be a little too light for a serious improvement to soil moisture especially in Cordoba - Brazil

rainfall potentials were reduced in center west and center south crop areas for the second half of next week and into the following weekend - The

reduction in rain was needed - Coffee,

citrus and sugarcane areas now do not get much moisture and concern over coffee flowering has been reduced

- Rain

is still needed to help freeze damaged crops recover before the growing season begins in late September and October - Colombia,

Venezuela, Central America and western and southern parts of Mexico will be plenty wet over the coming week to ten days - Tropical

Depression 14E off the southwestern Mexico coast promises to bring torrential rainfall to Guerrero and Michoacan this weekend and next week - Rainfall

could vary from 10.00 to 20.00 inches resulting in serious flooding in coastal areas and some potential damage to personal property, infrastructure and some crops. - Western

Cuba will be impacted with torrential rainfall and strong wind speeds Friday as an intensifying tropical cyclone passes over the region - Some

threat of damage to citrus and especially sugarcane is expected - India’s

forecast today remains a little wetter for Gujarat and neighboring areas during the middle to latter part of next week - The

change was needed and if the rain falls as advertised some short term improvements to cotton, groundnut and other crop development potential will result - Western

and northern Rajasthan and Pakistan remain in a dry weather mode with little change likely for the next week to ten days - Weather

conditions elsewhere in India are quite favorable and summer crop production is expected to be good - Australia’s

winter crops remain favorably rated with little change likely in the next ten days - The

only exception is in Queensland and a few neighboring areas where there is need for rain especially with reproduction of wheat and barley coming soon - China

has been reporting localized pockets of heavy rainfall recently, but no widespread excessive rain event has occurred - Rainfall

this month has been greater than desired for many crops in the nation and that could have some impact on production - Flooding

has occurred periodically and some of it may have damaged a few crops - A

part of northeastern China’s small grain crop is probably too wet and may be suffering a quality decline, but corn, soybeans, rice, sugarbeets and other crops are likely in favorable condition - China

needs to dry down, but is unlikely to do so for a while - Parts

of Western Europe will be dry through Tuesday - Some

showers will evolve briefly in central and southern France during the middle to latter part of the week and then another period of drying is likely

- The

drier weather may stress a few late season crops in France and the U.K., but it will be good for fieldwork and for expediting early season crop maturation - Northern

France and the U.K. will be driest, but some areas in Germany, Belgium, Netherlands, Denmark and Norway will also be impacted - Eastern

Europe will experience frequent rainfall and milder than usual temperatures over the next week and then experience a short term bout of drier weather - Some

rain will fall in the Balkan Countries where dryness has been a threat to unirrigated summer crop production in recent weeks - Russia’s

New Lands and Kazakhstan have been drier biased this month. - Crop

conditions have been favorable except in and north of Kazakhstan where too much heat and dryness hurt wheat and sunseed production

- Net

drying will continue for one more week and then some rain will be possible - Western

Russia summer crop conditions have been good and little change is expected - Harvesting

2021 crops and the planting of 2022 crops is occurring, but a little slower than desired in some of the wetter areas in western and northern Russia and neighboring areas.

- Southeast

Asia crop areas will receive periodic showers and thunderstorms over the next two weeks - West-central

Africa rainfall over the next ten days will be sufficient to support most crops - Coffee,

cocoa, rice, sugarcane and cotton development has been and will continue to be good this year - East-central

Africa showers and thunderstorms have been and will continue to be timely and beneficial resulting in a good outlook for coffee, cocoa, rice, sugarcane and other crops that are produced from Ethiopia into Uganda and southwestern Kenya.

- Showers

in South Africa will be erratic and light over the coming week - The

precipitation will benefit many wheat, barley and canola crops - Southern

Oscillation Index was +3.11 Sunday and the index should move in a narrow range over the next week to ten days with some upward movement

- New

Zealand weather will include near to below average rainfall during the next week with greater rain likely in the western parts of South Island in the first week of September - Temperatures

will be seasonable

Source:

World Weather Inc.

Thursday,

Aug. 26:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports

Friday,

Aug. 27:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

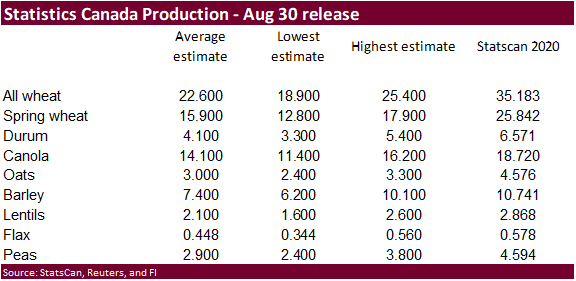

StatsCan

is due out with Canadian production on Monday

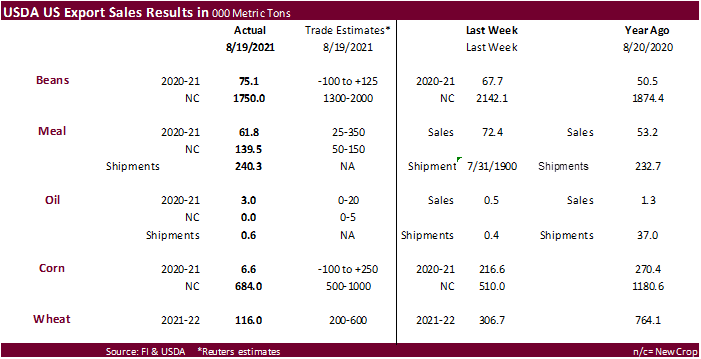

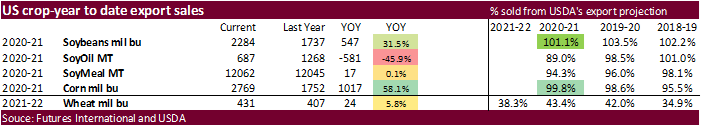

USDA

export Sales

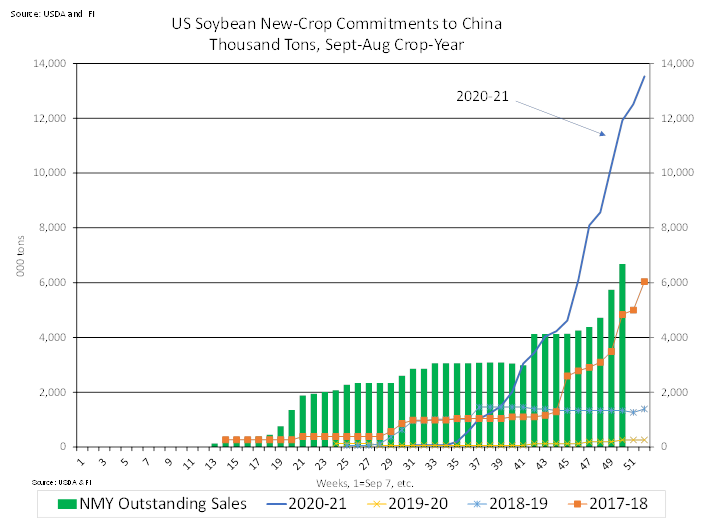

USDA

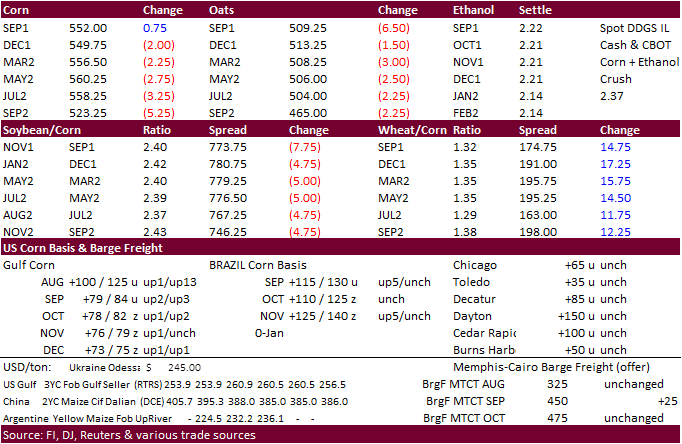

export sales were within expectations for new-crop soybeans at 1.750 million tons that included China (934,500 MT), unknown destinations (587,900), and Mexico (148,600 MT). There was a small amount of old crop sales for China. Soybean meal combined old and

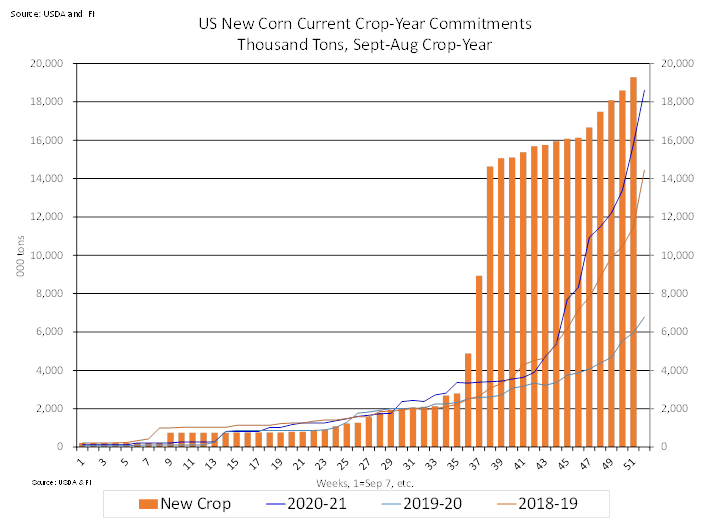

new-crop export sales were within expectations and shipments were good at 240,300 tons. Soybean oil sales and shipments were low, as expected. New-crop corn export sales of 684,00 tons were above the 510,000 tons reported last week and included Mexico (492,000MT),

Japan (93,000 MT), and Colombia (51,500 MT). All-wheat sales were a poor 116,000 tons, a marketing year low, and down from 306,700 tons previous week. Pork sales were 24,100 tons.

76

Counterparties Take $1091.792 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1147.089 Bln, 77 Bidders)

US

Initial Jobless Claims Aug 21: 353K (est 350K; prevR 349K; prev 348K)

US

Continuing Claims Aug 14: 2862K (est 2772K; prevR 2865K; prev 2820K)

US

GDP Annualized (Q/Q) Q2 S: 6.6% (est 6.7%; prev 6.5%)

US

Core PCE (Q/Q) Q2 S: 6.1% (est 6.1%; prev 6.1%)

US

Personal Consumption Q2 S: 11.9% (est 12.2%; prev 11.8%)

US

GDP Price Index Q2 S: 6.1% (est 6.0%; prev 6.0%)

·

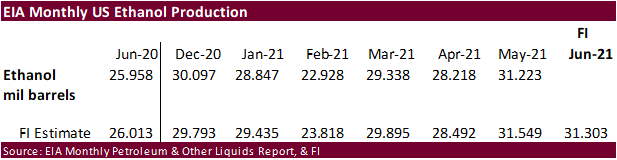

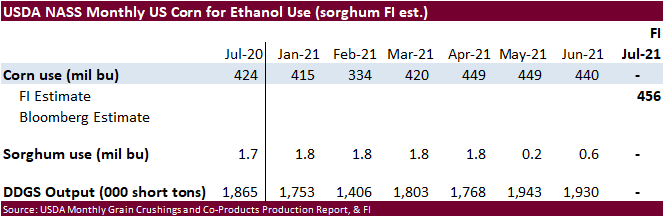

In a narrow range, corn futures are lower on lack of bullish news. USDA export sales were reported at the lower end of expectations for new-crop corn.

·

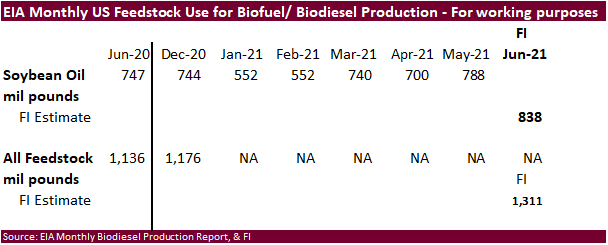

Details of the EPA proposal could be out as early as this Friday. The EPA

on

Thursday sent the annual biofuel blending mandates to the White House’s Office of Management and Budget for review.

·

The funds were flat on the day.

·

US weather outlook looks good over the near term with precipitation falling across the north central and eastern areas through Friday, then the northern Midwest Saturday and central and eastern areas Sunday through Monday. North

Dakota, Minnesota, Wisconsin, and Iowa over next three days will see heavy rain.

·

WTI is lower and USD higher.

·

IGC estimated global corn production at 1.202 billion tons, unchanged from their previous forecast.

·

China pork prices fell 2.6% for the week ending Aug 20 to 20.21 yuan ($3.12) per kilo and are down 57.6% from a year ago.

·

South Korea reported another African Swine Fever case from a local farm in Gangwon Province.

·

The EU Commission lowered its EU corn production estimate to 71 million tons from 72.8 million previously.

Export

developments.

- Under

the 24-hour announcement system, USDA reported 100,000 tons of new-crop corn to Columbia.

- South

Korea’s NOFI group bought 135,000 tons of corn. - 68,000

tons was bought at an estimated 265 cents a bushel c&f over the December for arrival in South Korea around Nov. 21.

- 67,000

tons was bought at an estimated 266 cents a bushel c&f over the December for arrival in South Korea around Dec. 1.

Updated

8/20/21

December

corn is seen in a $4.75-$6.00 range

·

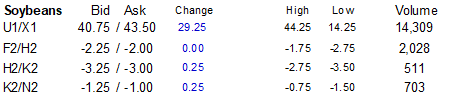

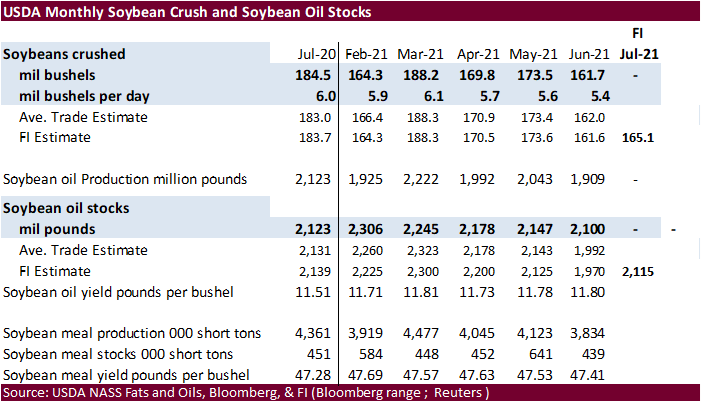

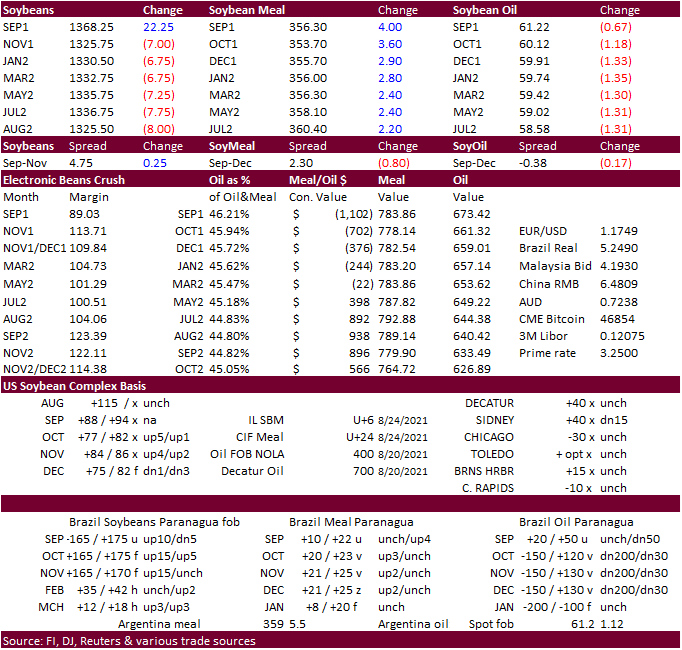

The September soybean contract surged over new-crop contracts, ending 21.50 cents higher. Spot supplies are tight and to add to the headaches, a tropical storm is expected to hit the Delta that could temporarily slow harvesting

and shipments. Note Louisiana was 2% complete as of Sunday.

·

November soybeans finished 6.50 cents lower. Rainfall across key parts of the US soybean growing areas this week should benefit crop development. USDA export sales were ok for soybeans. SBO was low while meal shipments were

good. Renewed concern over the EPA proposing to lower biofuel mandates and lower WTI crude pressured soybean oil. Meal ended higher on product spreading.

·

The funds sold an estimated net 3,000 soybeans, bought 2,000 an estimated net 2,000 soybean meal, and sold 1,000 soybean oil.

·

There were no surprises in this week’s USDA export sales.

·

Indonesia plans to raise its palm oil-based biodiesel blend to 40% from a mandatory 30%. No set time was given for the increase but it’s unlikely it will be increased over the next year.

·

(Bloomberg) — Indonesia’s weather agency forecasts early rainy season in almost half of the country’s weather zones, starting Sept.-Oct.

Agency

expects rainy season to last until March with normal intensity of rainfall in most of the zones, said Dwikorita Karnawati, head of the weather agency that is locally known as BMKG, on Thursday

Only

26% of the zones to see higher intensity

Export

Developments

·

India bought spot Argentina soybean meal. A least a couple cargoes were bought and they are in for more today.

- Under

the 24-hour announcement system, USDA reported 133,000 tons of new-crop soybeans to China and 132,150 tons to unknown.

Updated

8/24/21

Soybeans

– November $11.75-$15.00

Soybean

meal – December $320-$425

Soybean

oil – December 48-67 cent range

·

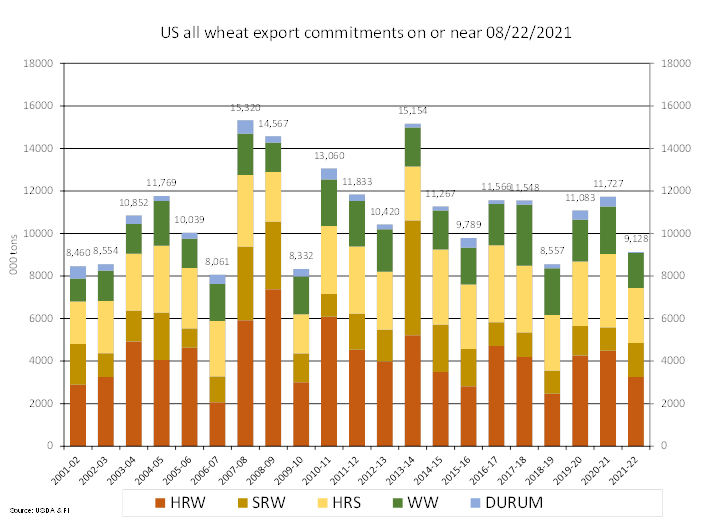

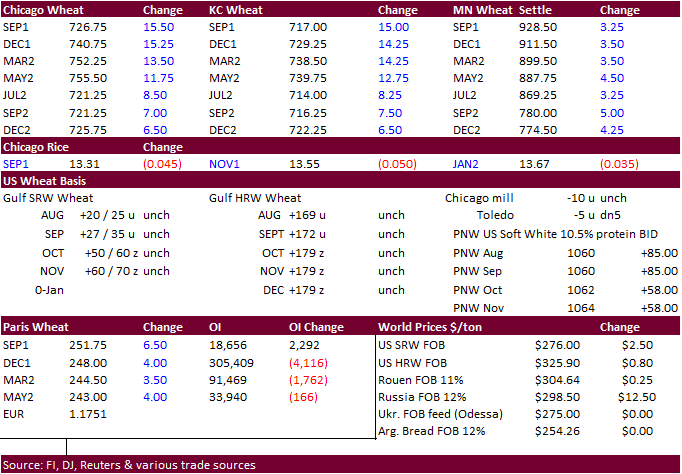

Chicago wheat futures ended higher led by KC and Chicago contracts on renewed global crop concerns. Gains in MN were limited on harvest pressure.

·

Funds bought an estimated net 7,000 Chicago wheat contracts.

·

All wheat export sales fell from the previous week and were a marketing year low.

·

IGC estimated global world wheat production at 782 tons, down 6 million tons from their previous forecast.

·

The European Commission lowered its estimate for the soft wheat crop for the EU to 127.2 million tons from 127.7 million, up from 117.2 million tons from 2020. Exports are seen at 30 million tons, up from 27.3 million tons in

2020-21.

·

December Paris wheat was up 4.00 euros at 247.50. September was 6.50 higher at 251.00, a 2.65% increase.

·

Belarus banned grain exports for six months to help keep domestic prices cool.

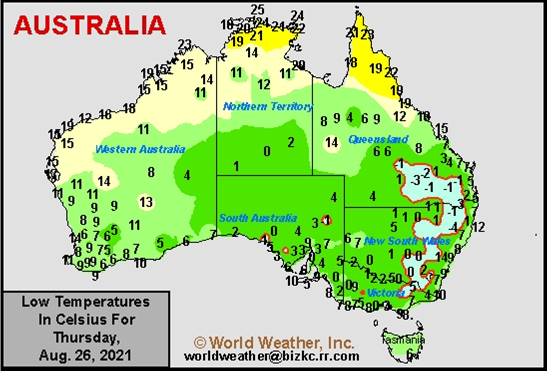

World

Weather Inc. “Wheat and barley in Queensland normally reproduces in the first two weeks of September which suggests the crop was likely in the late joint, boot and early heading stages this morning as the crop was impacted by low temperatures of -3 to +1

Celsius (26 to 34 Fahrenheit). Widespread frost likely occurred and many areas reported freezes. Most of the wheat and barley was not likely seriously harmed by the cold but a little production cut cannot be ruled out. “

Export

Developments.

·

Pakistan bought 160,000 tons of wheat out of 400,000 tons sought, at $355.95/ton c&f for Sep 15-Oct 31 shipment.

·

Tunisia bought 50,000 tons of soft wheat (100,000 sought) at$349.89/ton and $352.77/ton, c&f. They also bought 50,000 tons of barley (100,000 sought) at $319.50/ton and $322.98/ton c&f. Both were for Sep 20 through Oct 25 shipment.

$349.89/ton c&f. They last bought wheat on August 6 at $312.89/ton c&f.

·

Jordan bought 60,000 tons of feed barley out of 120,000 tons sought, at an estimated $317.00 a ton c&f for shipment in the first half of December.

·

The Philippines passed on 168,000 tons of feed wheat due to high prices. Origin was initially EU, Black Sea or Australian for Sep 17-Nov 18 shipment.

·

The Philippines seek 60,000 tons of feed wheat on August 27 for Sep/Oct shipment.

·

Jordan seeks 120,000 tons of wheat on September 1.

·

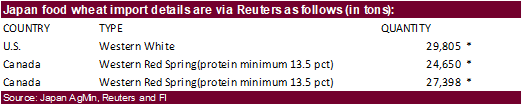

Japan bought 81,853 tons of food wheat from the US and Canada. Original details as follows:

·

Bangladesh seeks 50,000 tons wheat on September 1.

·

Turkey seeks 300,000 tons of milling wheat on September 2 for September 10 through October 10 shipment. They last bought 11.5% and 12.5% wheat on August 4 at $297.40-$308.90/ton c&f.

·

Taiwan weeks 48,875 tons of US wheat on September 3 for October 15-Novmeber 1 shipment. They last bought US wheat on August 6, various classes at various prices.

·

Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

Rice/Other

- South

Korea seeks 42,200 tons of rice for arrival in South Korea between February 28 and April 2022. 20,000 tons of that is of US origin, rest optional .

- China’s

National Bureau of Statistics (NBS) estimated early rice production increasing 2.7 to 28.02 million tons, up 723,000 tons from 2020. - Egypt

seeks 200,000 tons of raw sugar for Oct-Dec shipment on August 28.

Updated 8/17/21

December Chicago wheat is seen in a $6.80‐$8.25 range

December KC wheat is seen in a $6.60‐$8.00

December MN wheat is seen in a $8.45‐$9.80

USDA export Sales

U.S. EXPORT SALES FOR WEEK ENDING 8/19/21

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

90.5 |

1,472.8 |

1,856.3 |

248.3 |

1,778.8 |

2,636.9 |

0.0 |

0.0 |

|

SRW |

4.1 |

841.6 |

638.3 |

52.0 |

757.8 |

446.3 |

0.0 |

0.0 |

|

HRS |

21.1 |

1,121.8 |

1,882.5 |

170.3 |

1,461.3 |

1,572.8 |

0.0 |

0.0 |

|

WHITE |

0.2 |

673.1 |

1,200.7 |

204.1 |

970.1 |

1,029.1 |

0.0 |

0.0 |

|

DURUM |

0.1 |

7.4 |

250.9 |

1.1 |

43.2 |

213.3 |

0.0 |

0.0 |

|

TOTAL |

116.0 |

4,116.7 |

5,828.6 |

675.8 |

5,011.2 |

5,898.4 |

0.0 |

0.0 |

|

BARLEY |

0.4 |

21.4 |

30.8 |

1.0 |

3.9 |

8.4 |

0.0 |

0.0 |

|

CORN |

6.6 |

4,151.6 |

2,333.8 |

760.5 |

66,172.6 |

42,158.0 |

684.0 |

19,282.7 |

|

SORGHUM |

53.1 |

296.0 |

229.1 |

125.9 |

6,838.6 |

4,396.1 |

0.0 |

1,594.9 |

|

SOYBEANS |

75.1 |

2,196.5 |

4,308.3 |

260.1 |

59,963.4 |

42,975.8 |

1,750.0 |

15,615.0 |

|

SOY MEAL |

61.7 |

1,406.9 |

1,284.4 |

240.3 |

10,655.3 |

10,760.7 |

139.5 |

1,661.5 |

|

SOY OIL |

3.0 |

20.0 |

139.6 |

0.5 |

666.5 |

1,128.3 |

0.0 |

0.7 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

38.5 |

209.9 |

163.1 |

50.8 |

86.9 |

49.5 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

8.8 |

27.9 |

0.2 |

0.4 |

1.0 |

0.0 |

0.0 |

|

L G BRN |

0.1 |

1.8 |

8.7 |

0.4 |

10.9 |

2.0 |

0.0 |

0.0 |

|

M&S BR |

22.3 |

22.3 |

26.1 |

0.1 |

0.3 |

5.8 |

0.0 |

0.0 |

|

L G MLD |

17.2 |

167.5 |

69.4 |

26.0 |

52.9 |

11.9 |

0.0 |

0.0 |

|

M S MLD |

1.4 |

56.2 |

52.9 |

4.4 |

27.3 |

34.1 |

0.0 |

0.0 |

|

TOTAL |

79.5 |

466.6 |

348.0 |

81.9 |

178.6 |

104.3 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

245.1 |

4,850.5 |

5,874.1 |

201.7 |

613.4 |

977.7 |

67.9 |

643.5 |

|

PIMA |

14.3 |

119.2 |

183.6 |

8.0 |

19.3 |

24.3 |

0.0 |

0.0 |

This

summary is based on reports from exporters for the period August 13-19, 2021.

Wheat: Net

sales of 116,000 metric tons (MT) for 2021/2022–a marketing-year low–were down 62 percent from the previous week and 67 percent from the prior 4-week average. Increases primarily for Peru (80,200 MT, including 70,000 MT switched from unknown destinations),

the Philippines (47,800 MT, including 42,700 MT switched from unknown destinations and decreases of 800 MT), Thailand (47,000 MT), Nigeria (38,000 MT switched from unknown destinations), and Guatemala (31,200 MT switched from unknown destinations), were offset

by reductions primarily for unknown destinations (176,400 MT). Exports of 675,800 MT–a marketing-year high–were up 14 percent from the previous week and 39 percent from the prior 4-week average. The destinations were primarily to China (169,100 MT), the

Philippines (107,800 MT), Mexico (93,300 MT), South Korea (81,400 MT), and Japan (63,500 MT).

Corn:

Net sales of 6,600 MT for 2020/2021 were down 97 percent from the previous week and 95 percent from the prior 4-week average. Increases primarily for Mexico (132,000 MT, including decreases of 11,900 MT), Canada (46,900 MT), Guatemala (12,300 MT, including

7,500 MT switched from Nicaragua and 1,100 switched from Costa Rica, and 2,000 MT switched from El Salvador), Taiwan (9,800 MT), and Honduras (7,300 MT, including 7,500 MT switched from Nicaragua, 5,100 MT switched from El Salvador, and decreases of 5,300

MT), were offset by reductions primarily for China (135,200 MT). For 2021/2022, net sales of 684,000 MT primarily for Mexico (492,000 MT), Japan (93,000 MT), Colombia (51,500 MT), Nicaragua (10,000 MT), and Jamaica (10,000 MT), were offset by reductions for

unknown destinations (3,500 MT). Exports of 760,500 MT were down 8 percent from the previous week and 35 percent from the prior 4-week average. The destinations were primarily to China (340,800 MT), Mexico (265,800 MT), Nicaragua (30,100 MT), Guatemala (28,100

MT), and Venezuela (25,000 MT).

Optional

Origin Sales:

For 2020/2021, the current outstanding balance of 30,500 MT is for unknown destinations. For 2021/2022, new optional origin sales of 60,000 MT were reported for unknown destinations. The current outstanding balance of 110,000 MT is for unknown destinations.

Barley:

Total net sales for 2021/2022 of 400 MT were for Taiwan. Exports of 1,000 MT were up 65 percent from the previous week and up noticeably from the prior 4-week average. The destination was to Japan.

Sorghum:

Net sales of 53,100 MT for 2020/2021 were down noticeably from the previous week and from the prior 4-week average. Increases were primarily for unknown destinations (30,000 MT) and China (16,800 MT, including decreases of 1,300 MT). Exports of 125,900 MT

were up noticeably from the previous week and from the prior 4-week average. The destination was primarily to China (124,800 MT).

Rice:

Net

sales of 79,500 MT for 2021/2022 primarily for Mexico (33,700 MT, including decreases of 1,300 MT), South Korea (22,200 MT), Guatemala (16,400 MT, including 3,000 MT switched from El Salvador), Canada (5,000 MT), and Costa Rica (2,500 MT), were offset by reductions

primarily for El Salvador (3,000 MT). Exports of 81,900 MT were primarily to Mexico (38,000 MT), Haiti (15,200 MT), Nicaragua (10,800 MT), Honduras (5,400 MT), and Guatemala (5,000 MT).

Exports

for Own Account:

For 2021/2022, the current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans:

Net sales of 75,100 MT for 2020/2021 were up 11 percent from the previous week and up noticeably from the prior 4-week average. Increases primarily for China (90,800 MT, including 68,000 MT switched from unknown destinations and decreases of 1,500 MT), the

Netherlands (66,000 MT, including 60,000 MT switched from unknown destinations), Taiwan (21,100 MT), Indonesia (19,700 MT, including decreases of 300 MT), and Vietnam (5,900 MT, including decreases of 100 MT), were offset by reductions primarily for unknown

destinations (131,000 MT). For 2021/2022, net sales of 1,750,000 MT were primarily for China (934,500 MT), unknown destinations (587,900), Mexico (148,600 MT), Taiwan (26,500 MT), and Indonesia (15,400 MT). Exports of 260,100 MT were up 1 percent from the

previous week and 23 percent from the prior 4-week average. The destinations were primarily to Mexico (76,600 MT), China (71,200 MT), the Netherlands (66,000 MT), Indonesia (12,000 MT), and Colombia (7,100 MT).

Exports

for Own Account:

For 2020/2021, the current exports for own account outstanding balance is 5,800 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 61,700 MT for 2020/2021–a marketing-year low–were down 14 percent from the previous week and 40 percent from the prior 4-week average. Increases primarily for Colombia (15,400 MT, including decreases of 10,800 MT), Canada (15,300 MT, including

decreases of 200 MT), Mexico (10,700 MT, including decrease of 7,600 MT), Turkey (6,400 MT, including 6,000 MT switched from the United Kingdom), and the Philippines (5,300 MT), were offset by reductions primarily for Honduras (9,500 MT) and the United Kingdom

(6,000 MT). For 2021/2022, net sales of 139,500 MT were primarily for the Philippines (90,000 MT), Canada (33,900 MT), and Colombia (12,000 MT). Exports of 240,300 MT were up 13 percent from the previous week and 7 percent from

the prior 4-week average. The destinations were primarily to Mexico (80,200 MT), the Philippines (45,300 MT), Colombia (26,400 MT), Turkey (21,400 MT), and Canada (19,300 MT).

Export

Adjustments:

Accumulated exports of soybean cake and meal to Canada were adjusted down 494 MT for the week ending August 12th. This shipment was reported in error.

Soybean

Oil:

Net sales of 3,000 MT for 2020/2021 were up noticeably from the previous week and up 90 percent from the prior 4-week average. Increases reported for Canada (3,200 MT), were offset by reductions for the Dominican Republic (300 MT). Exports of 500 MT were

up 15 percent from the previous week, but down 65 percent from the prior 4-week average. The destination was to Canada.

Cotton:

Net sales of 245,100 RB for 2021/2022 were primarily for El Salvador (67,100 RB), Turkey (61,100 RB), Pakistan (35,000 RB), Honduras (26,500 RB), and Vietnam (14,900 RB, including 5,200 RB switched from China, 300 RB switched from Japan, and decreases of 1,100

RB). For 2021/2022, net sales of 67,900 RB were primarily for El Salvador (48,000 RB) and Honduras (18,900 RB). Exports of 201,700 RB were primarily to Pakistan (42,700 RB), Turkey (29,700 RB), Vietnam (27,200 RB), China (26,000 RB), and Mexico (20,900 RB).

Net sales of Pima totaling 14,300 RB were primarily for India (7,600 RB), China (2,200 RB), Turkey (1,700 RB), Peru (1,400 RB), and Thailand (1,000 RB). Exports of 8,000 RB were primarily to China (1,800 RB), Peru (1,500 RB), Honduras (1,400 RB), India (1,200

RB), and Bangladesh (600 RB).

Optional

Origin Sales:

For 2021/2022, new optional origin sales of 8,800 RB were reported for Pakistan. The current outstanding balance of 8,800 RB is for Pakistan.

Exports

for Own Account:

For 2021/2022, the current exports for own account outstanding balance of 4,800 RB is for China (4,700 RB) and Vietnam (100 RB).

Hides

and Skins:

Net sales of 229,600 pieces for 2021 were up 21 percent from the previous week, but down 22 percent from the prior 4-week average. Increases primarily for China (80,800 whole cattle hides, including decreases of 19,200 pieces), South Korea (62,800 whole cattle

hides, including decreases of 1,100 pieces), Thailand (26,800 whole cattle hides, including decreases of 1,000 pieces), Taiwan (18,000 whole cattle hides, including decrease of 500 pieces), and Mexico (16,400 whole cattle hides, including decreases of 100

pieces), were offset by reductions for Turkey (100 whole cattle hides) and Japan (100 whole cattle hides). Total net sales of 1,300 kip skins were reported for China. Exports of 554,300 pieces were up 52 percent from the previous week and 46 percent from

the prior 4-week average. Whole cattle hides exports were primarily to China (403,700 pieces), South Korea (54,700 pieces), Mexico (24,900 pieces), Thailand (24,000 pieces), and Ethiopia (12,000 pieces). In addition, exports of 2,600 kip skins were to China.

Net

sales of 121,200 wet blues for 2021 were up 7 percent from the previous week and 39 percent from the prior 4-week average. Increases primarily for Vietnam (42,300 unsplit), China (30,100 unsplit), Italy (25,400 unsplit, including deceases of 200 unsplit and

100 grain splits), the Dominican Republic (8,800 unsplit and 7,200 grain splits), and Taiwan (6,000 unsplit), were offset by reductions for Mexico (900 unsplit). Total net sales reductions for 2022 of 16,000 pieces were for Italy. Exports of 210,800 wet

blues were up 43 percent

from the previous week and 57 percent from the prior 4-week average. The destinations were to China (89,900 unsplit), Vietnam (49,400 unsplit), Italy (31,500 unsplit and 7,400 grain splits), Taiwan (11,400 unsplit), and Mexico (8,600 grain splits and 2,500

unsplit). Net sales of 972,700 splits were reported for Vietnam (800,000 pounds), Taiwan (168,700 pounds), and China (4,000 pounds, including decreases of 1,100 pounds). Exports of 415,100 pounds were to China (250,400 pounds), Taiwan (84,700 pounds), and

Vietnam (80,000 pounds).

Beef:

Net

sales of 10,400 MT reported for 2021 were down 6 percent from the previous week and 33 percent from the prior 4-week average. Increases were primarily for Japan (3,800 MT, including decreases of 500 MT), South Korea (2,500 MT, including decreases of 500 MT),

China (1,500 MT, including decreases of 100 MT), Hong Kong (900 MT, including decreases of 200 MT), and Taiwan (600 MT, including 100 MT switched from the Philippines and decreases of 100 MT). Exports of 18,700 MT were down 5 percent from the previous week

and 4 percent from the prior 4-week average. The destinations were primarily to Japan (5,400 MT), South Korea (5,300 MT), China (3,500 MT), Mexico (1,200 MT), and Taiwan (1,100 MT).

Pork:

Net

sales of 24,100 MT reported for 2021 were up 21 percent from the previous week, but down 14 percent from the prior 4-week average. Increases primarily for Mexico (14,300 MT, including decreases of 600 MT), Japan (2,400 MT, including decreases of 400 MT),

Canada (2,200 MT, including decreases of 600 MT), Colombia (1,300 MT, including decreases of 100 MT), and China (1,300 MT, including decreases of 200 MT), were offset by reductions primarily for the Philippines (1,600 MT). Exports of 29,900 MT were up 4 percent

from the previous week and from the prior 4-week average. The destinations were primarily to Mexico (14,100 MT), China (4,600 MT), Japan (3,900 MT), South Korea (1,800 MT), and Canada (1,700 MT).

August

26, 2021 1 FOREIGN AGRICULTURAL SERVICE/USDA

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.