PDF Attached includes CFTC, daily estimate of funds, and some Pro Farmer charts.

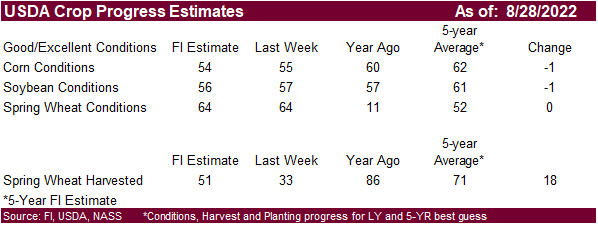

USDA

24-H: Private exporters reported sales of 146,000 metric tons of soybeans for delivery to unknown destinations during the 2022/2023 marketing year.

US

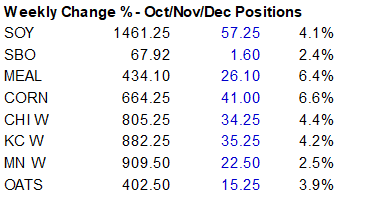

equities traded sharply lower (Dow down 1008 points) from Fed Chairman Jerome Powell comments over inflation and warning that the Feb could roll out an economic plan. CBOT ag markets rallied on crop concerns. US weather forecast was unchanged. The US Midwest

will see rain northwest Saturday and western areas Sunday. Parts of HRW wheat country will see rain on and off bias the southwestern areas over the next 7 days. Delta saw too much rain.

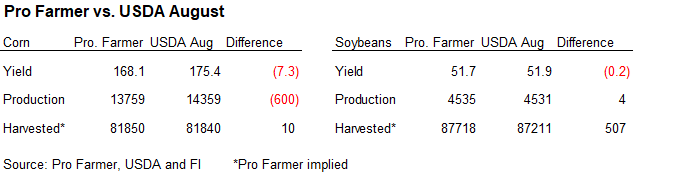

Pro

Farmer crop tour was viewed bullish corn and neutral and bearish soybeans.

Pro

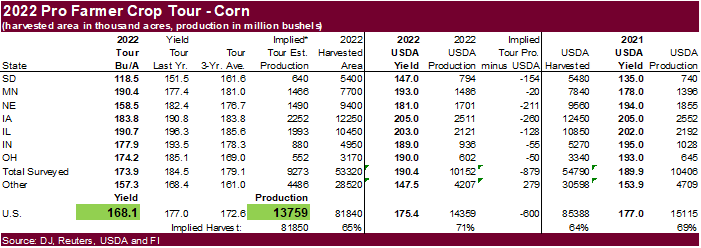

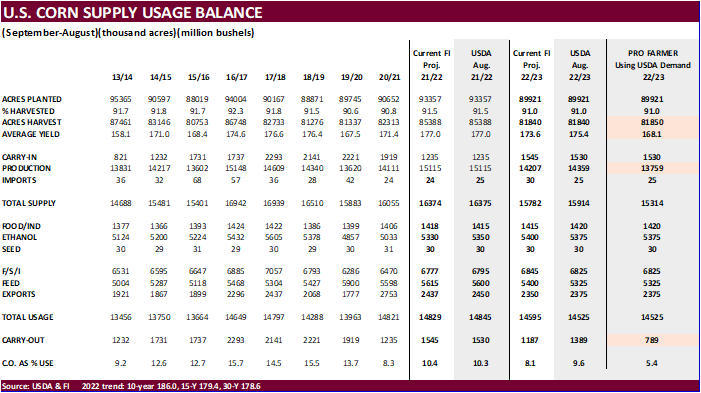

Farmer crop tour reported the US corn yield at 168.1, well below USDA’s 175.4 bu/ac. Production was pegged at 13.759 billion, below USDA’s 14.359 billion and compares to 15.115 billion a year ago. Trade expectations before the release of the report for the

Pro Farmer yield was 172 to 174 bushels per acre. Implied harvested area is near USDA. Using Pro Farmer’s supply and USDA’s demand, 2022-23 US corn ending stocks would fall 600 million bushels to 789 million. Demand destruction would prevent that, in our opinion.

Pro

Farmer crop tour reported the US soybean yield at 51.7, below USDA’s 51.9 bu/ac. Production was pegged at 4.535 billion, slightly above USDA’s 4.531 billion and compares to 4.435 billion a year ago. We were hearing around 50 bushels per acre estimate before

the release of the report. This implies a crop tour harvested area well above USDA. The yield was likely above trade expectations.