PDF Attached

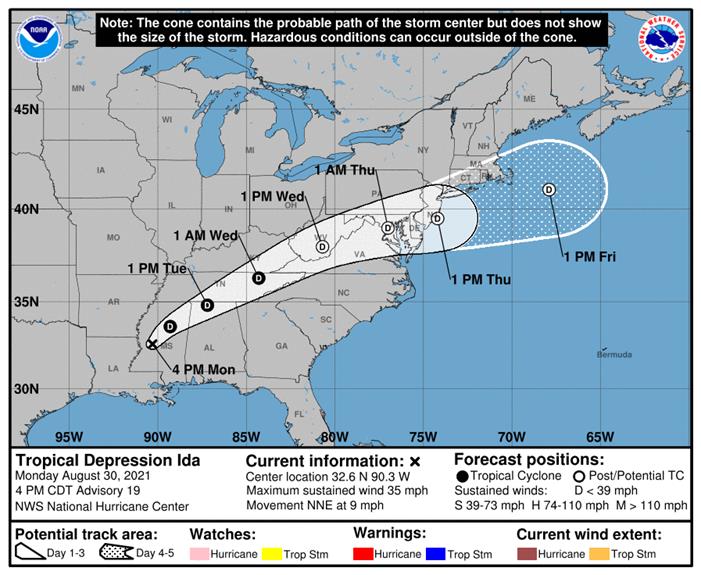

Hurricane

Ida left more than 1 million customers without power. It will take some time to get an idea on damage. Some grain facilities could be without power for weeks.

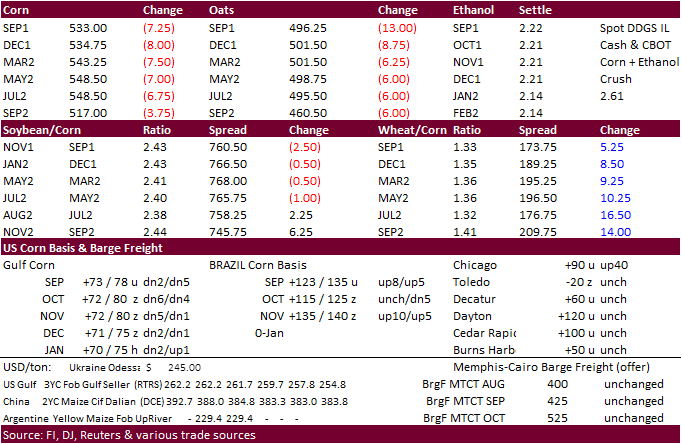

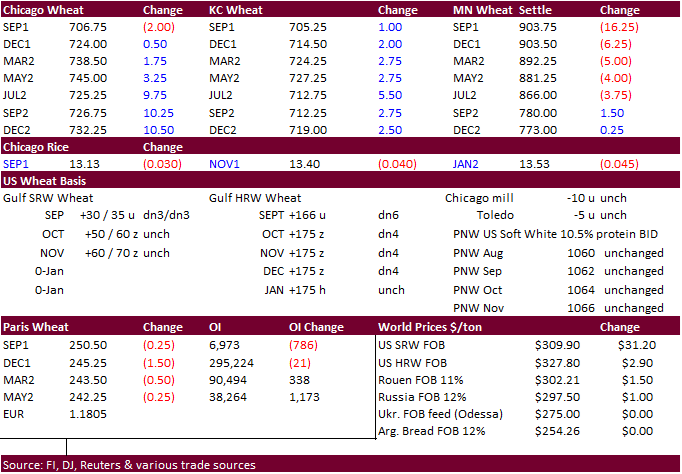

Corn and soybean prices were generally lower on concerns over a slowdown in grain/oilseed exports. Wheat was mixed.

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

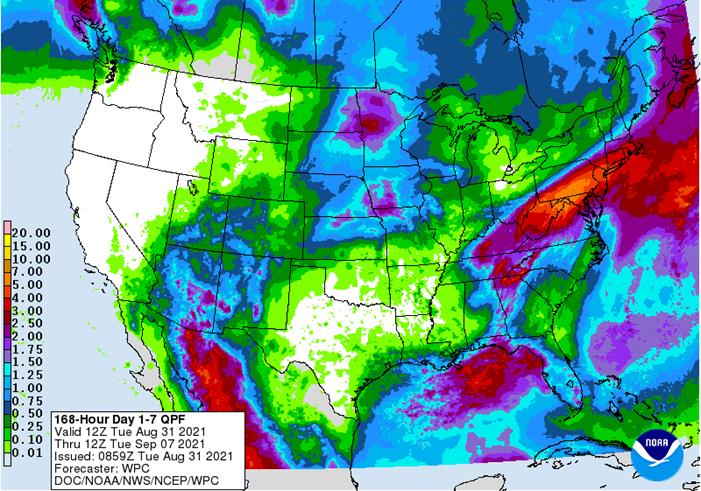

- Tropical

Depression Ida produced 2.00 to 6.00 inches of rain across Mississippi and western Alabama Monday and overnight with up to 8.11 inches in southwestern Alabama

o

Flooding has been widespread from southeastern Louisiana into southern Mississippi and southwestern Alabama causing some damage to property and some agricultural areas

o

Overall, though U.S. crop damage from the storm was kept relatively low

- Depression

Ida will move northeast through West Virginia and New Jersey over the next couple of days producing 1.00 to 4.00 inches of rain except in Pennsylvania where up to 6 inches will be possible - U.S.

Midwest, northeast and central Plains, Delta and southeastern states will experience a good mix of weather during the next ten days promoting favorable crop development and allowing some fieldwork and crop maturation to advance well

o

Drying is needed in the eastern Delta and in western Alabama after recent flooding rain

- Texas

will receive restricted rainfall and experience seasonable temperatures during the coming week

o

Some increase in shower activity is possible next week, but no heavy rain is currently expected

- Northwestern

U.S. Plains and southwestern Canada’s Prairies will be dry over the next ten days along with the U.S. Pacific Northwest and much of California

- U.S.

temperatures will be warmer than usual in the western half of the nation over this coming week and to a large degree in the following week, as well.

o

Eastern U.S. temperatures will be close to normal

- U.S.

rainfall Monday was greatest in central Iowa and in the Ohio River Basin where several areas reported 0.40 to nearly 2.00 inches

o

Temperatures were warm in much of nation, but not excessively hot

o

Central and southern Plains temperatures were still in the 90s Fahrenheit

- A

region of disturbed tropical weather in the western Caribbean Sea is being closely monitored for possible development this weekend or next weeks

o

The system could produce some locally heavy rainfall in parts of Central America and/or the Yucatan Peninsula during the next week

o

The GFS model tries to bring this system into the Bay of Campeche next week with landfall in northeastern Mexico, but confidence is very low

- A

tropical wave coming off West Africa today will become well organized and should become the next tropical cyclone in the Atlantic Ocean Basin, but the system is predicted to move into the central Atlantic and be of little to no threat to land – based on today’s

forecast model runs - Tropical

Storm Kate in the central Atlantic Ocean poses no threat to land - Northwestern

India is advertised to receive a few waves of rain during the next two weeks

o

Rain is possible today into Thursday and again during mid-week next week in Gujarat , far southeastern Pakistan and in a few southern and eastern Rajasthan locations

- The

moisture will be ideal in improving soil moisture for cotton, groundnuts and all other crops produced in Gujarat and immediate neighboring areas - Some

heavy rain is expected, and local flooding is possible in each of these two predicted waves of rain - Much

improved crop conditions should result

o

Northwestern Rajasthan and Punjab remain driest and in need of rain in unirrigated fields

- India’s

other crop areas will be favorably moist except some areas in the far south and in parts of Punjab and those areas may have to be closely monitored

- Frost

and a few freezes occurred again this morning in Russia’s northern New Lands

o

The impact of frost and freezes this morning and those that occurred in northwestern Russia Monday should have been low since normal first freeze dates are in the first week of September for some of these areas and crops were

sufficiently mature to handle the cold.

- Mexico’s

west and southern crop areas will be a little too wet over the coming week resulting in some flooding and concern over crop conditions

o

Flooding is already a problem in southwestern and west-central coastal states of Mexico following Tropical Storm Nora’s onslaught of heavy rainfall during the weekend and Monday.

o

Drier weather is needed in many areas

o

Northeastern Mexico will remain in a drier than usual mode this week, but could be impacted by a new tropical system next week, although confidence is low

- Canada’s

Prairies will be wettest in the west, north and east, but not in the southwest

o

Most of the precipitation will help improve soil moisture, but it will disrupt farming activity

- Heavy

rain will fall in western Alberta causing the ground to saturate and induce some flooding

o

The rain will not be welcome in areas trying to harvest and there will be some concern over the quality of unharvested grain and oilseeds, but a sufficient break from the dry bias is expected in another week.

- Ontario

and Quebec weather will be well mixed, although rainfall will be lighter than usual; temperatures will be near to above average

o

Wheat harvesting will advance well on the drier days

o

Corn and soybean filling and maturing conditions will be good, but late season crops will need additional moisture over time

- Argentina

will receive some rain during mid-week this week, briefly in parts of the nation during the weekend and again erratically next week

o

If all three rain events verify there would be some beneficial improvement in topsoil moisture in at least some wheat and other crop production areas; however, some of the advertised rain is overdone and follow up rain will still

be needed to ensure a good start to spring wheat development

o

Wheat in Argentina needs rain especially in the west where is has been driest since the planting season ended

- Brazil

weather will be dry in most center west and center south crop areas during the next ten days, but showers may begin to evolve briefly during the middle part of September.

o

Some rain will fall in coastal areas of Bahia and Espirito Santo and periodic rain is predicted for areas in central Parana southward where wheat development should advance well along with some early season corn planting.

- Rain

along the central Atlantic Coast could benefit a few coffee trees - Australia

crop weather will continue to include timely rainfall in southern parts of the nation during the next two weeks. Northern production areas will need some greater rain as winter wheat, barley and canola begin to reproduce in early September

o

Both the GFS and European model runs have suggested rain may fall in Queensland and northern New South Wales this weekend into early next week, but confidence in its significance is low

- Some

of the rain advertised by the GFS model is overdone - Temperatures

will be seasonable - China

weather is expected to remain active during the next two weeks with heavy rain expected in the coming ten days between the Yellow and Yangtze Rivers possibly inducing some new flooding and possible late season crop damage

o

Rain amounts are advertised to vary from 3.00 to more than 8.00 inches with a few locations to get more than 10.00 inches

o

A part of eastern Inner Mongolia, northern Jilin, Liaoning and northwestern Heilongjiang will also get a little too much rain, although flooding is not likely to be a problem

o

China needs drier weather to protect late summer crop development and crop quality

o

Temperatures will be seasonable

- Southeast

Asia rainfall is expected to be frequent and sufficient to maintain favorable crop and soil conditions

o

Some timely rain fell in Thailand during the weekend

o

Most all crop areas will get rain multiple times over the next two weeks and sufficient amounts will occur to support better long term development potentials

- Pakistan

rainfall will remain restricted, but some showers will occur in the next ten days - Russia’s

Southern Region, eastern Ukraine and Volga River Basin will get some welcome rain during the middle to latter part of this week

o

The moisture will slow late season crop moisture stress, but it may not seriously change the bottom line on production because or previous dryness

o

Most of Kazakhstan and neighboring areas of Russia’s southern New Lands will not receive much rain until possibly next week when some showers are likely

o

Dryness has cut into some potential yields

- The

lateness of the season will also limit further declines in late season crop production potentials - Losses

to sunseed and spring wheat production occurred in a part of this region and a few soybean crops have recently been stressed by dryness from eastern Ukraine into the lower Volga River Basin - Cooler

air will impact portions of northern Russia during the next couple of weeks beginning in the northeastern New Lands this week and then developing in the northwestern part of Russia during the weekend and next week

o

Any frost or freezes that might occur would be seasonable if confined to mostly the far north.

- Northwestern

Europe will continue dry through the end of this workweek

o

Rain is expected in much of western Europe this weekend into next week bolstering topsoil moisture and slowing summer crop maturation and any fieldwork that is under way

- Southeast

Europe’s dryness has been eased by recent rain and more showers are expected over the coming week to perpetuate the improving trend

o

Greater rain may be needed to more substantially ease long-term dryness

- North

Africa showers in the next two weeks will occur while temperatures are hot maintaining seasonably dry biased conditions - Colombia,

Venezuela and Central America will be plenty wet over the coming week to ten days - West-central

Africa rainfall over the next ten days will be near to above average

o

Recent rain benefited many areas, although Ghana would still benefit from more rain

o

Cameroon and southeastern Nigeria have been drier biased in recent weeks, although no critical problem with dryness is suspected

o

Coffee, cocoa, rice, sugarcane and cotton development has been and will continue to be good this year

- East-central

Africa showers and thunderstorms have been and will continue to be timely and beneficial resulting in a good outlook for coffee, cocoa, rice, sugarcane and other crops that are produced from Ethiopia into Uganda and southwestern Kenya.

- Showers

in South Africa will be erratic and mostly very light over the coming week

o

Net drying is expected, although temperatures are seasonably mild limiting evaporative moisture losses

- Southern

Oscillation Index was +4.63 today and the index should move higher for a while this week - New

Zealand weather will include near to below average rainfall during the next week except in western parts of South Island where rainfall will be more significant

o

Temperatures will be seasonable to slightly cooler biased

Source:

World Weather Inc.

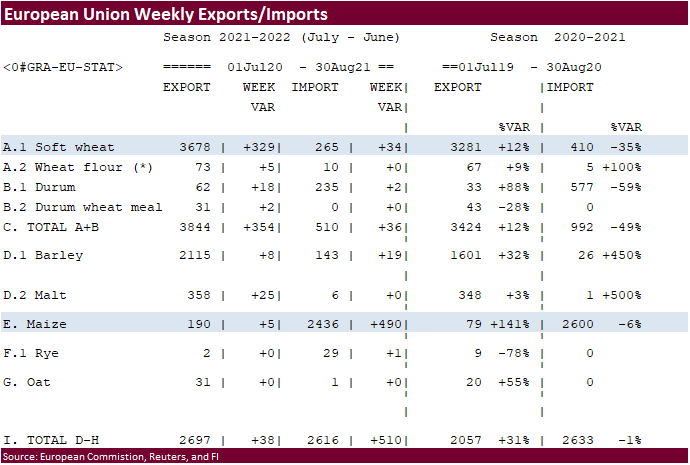

Tuesday,

Aug. 31:

- U.S.

agricultural prices paid and received - EU

weekly grain, oilseed import and export data - HOLIDAY:

Malaysia

Wednesday,

Sept. 1:

- EIA

weekly U.S. ethanol inventories, production - Australia

Commodity Index - U.S.

DDGS production, corn for ethanol, 3pm - Malaysia

August palm oil export data (tentative) - USDA

soybean crush, 3pm

Thursday,

Sept. 2:

- FAO

World Food Price Index - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Vietnam

Friday,

Sept. 3:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

Vietnam

Source:

Bloomberg and FI

FND

delivery

(Reuters)

– A Farm Futures magazine survey of U.S. planting intentions for 2022 indicated that producers expect to expand their plantings of corn, soybean and wheat acres in the coming crop year, aiming to capitalize on elevated prices.

-

Corn

plantings for 2022 were forecast at 94.3 million acres, up 1.7% from the U.S. Department of Agriculture’s 2021 estimate -

Soybean

plantings seen at 90.8 million acres, up 3.7% -

All-wheat

seedings seen at 49.7 million acres, up 6.3% -

Winter

wheat seedings seen at 35.4 million acres, up 5.1% -

Spring

wheat plantings (including durum) seen at 14.3 million acres, up 9.5% -

Farm

Futures surveyed 737 producers from July 13 to Aug. 1 via an email questionnaire

82

Counterparties Take $1189.616 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1140.711 Bln, 79 Bidders)

China

official PMIs for August: Manufacturing 50.1 (expected 50.1) & Services 47.5 (expected 52.0) . Services were 2nd worst non-PMI figure on record, according to one source.

Brent

Crude Oil Seen Averaging USD68.02/Barrel In 2021 Versus USD68.76/Barrel In July – RTRS

US

Crude Oil Seen Averaging $65.63/Barrel In 2021 Versus $66.13/Barrel In July Poll

Canadian

GDP (M/M) Jun: 0.7% (est 0.7%; prev -0.3%)

Canadian

GDP (Y/Y) Jun: 8.0% (est 8.8%; prev 14.6%)

Canadian

Quarterly GDP Annualized Q2: -1.2% (est 2.5%; prev 5.6%)

Canada

July GDP Most Likely Fell 0.4% – StatsCan Flash Estimate

·

End of month trade. Corn traded lower after USDA left US crop conditions unchanged and growing concerns over short-term US Gulf grain export logistical problems. Some companies are reporting significant damage to facilities and

others not. Companies with no significant damage are going to provide a timeline when they might be back and running after power is restored. Harvesting pressure may have also pressured prices. 9% of the corn crop is mature and we think corn harvesting

will ramp up over the next ten days across the south. .

·

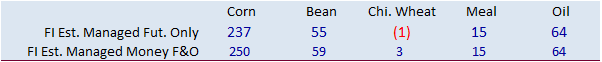

Funds sold an estimated net 13,000 corn contracts.

·

Ida left more than one million people without power.

·

US spot basis bids for corn and soybeans softened across the U.S. Midwest on the upcoming summer harvest season and post storm Ida grain facility assessments. Corn basis was down 10 cents for Davenport, Iowa, and down 5 cents

for Savanna, Illinois. Seneca, Illinois, was down 30 cents.

·

China will auction off 111,321 tons of imported US corn and 13,180 tons of imported Ukrainian corn on September 3.

·

Soybean and Corn Advisory lowered their estimate for Brazil 2020-21 corn production by 2MMT to 82 million tons. Brazil new-crop corn plantings should ramp up by end of next week after rains fell last week.

·

USDA Attaché: Brazil cattle on hog herds.

Post

forecasts that the cattle herd will grow four percent in 2021 and 2022, while beef production is forecast to decrease six percent in 2021.

·

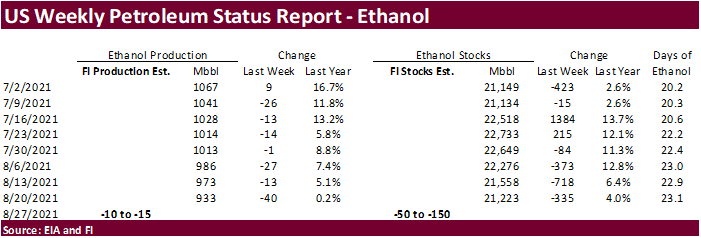

A Bloomberg poll looks for weekly US ethanol production to be down 7,000 barrels (890-945 range) from the previous week and stocks down 77,000 barrels to 21.146 million.

U

of I: US Animal and Product Production, 2018-2021

Zulauf,

C. and B. Brown. “US Animal and Product Production, 2018-2021.” farmdoc

daily

(11):126, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 30, 2021.

Bloomberg:

“Renewable Fuels Association calls on the U.S. EPA to allow fuel-terminal operators, blenders and marketers to increase use of ethanol to “fill the void in gasoline supplies created by refinery shutdowns in the Gulf Coast.” EPA action would allow many retailers

who don’t sell E15 blend to start offering it: RFA. Agency also should enable existing E15 retailers to keep selling the fuel through rest of summer season, RFA says in a letter to EPA chief Michael Regan. NOTE: Almost 12% of U.S. refining capacity has been

affected in wake of Hurricane Ida.”

Export

developments.

·

Taiwan’s MFIG bought 65,000 tons of corn from Argentina at a premium of 268.89/bu over the March futures, for around November/early Dec shipment.

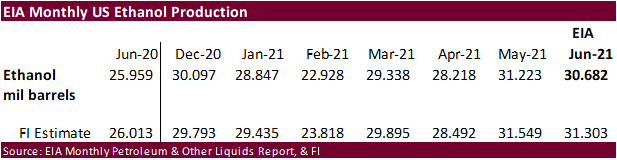

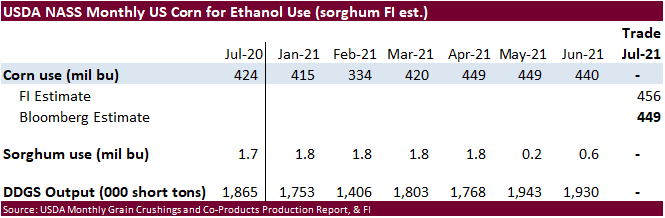

EIA

reported

June ethanol production at 30.682 million barrels, slightly below our expectations, and well above year ago. We left our 5.056 billion corn for ethanol use unchanged and for next year have 5.145 billion. NASS is due out with corn for ethanol use for July

on Wednesday.

Updated

8/20/21

December

corn is seen in a $4.75-$6.00 range

Soybeans

·

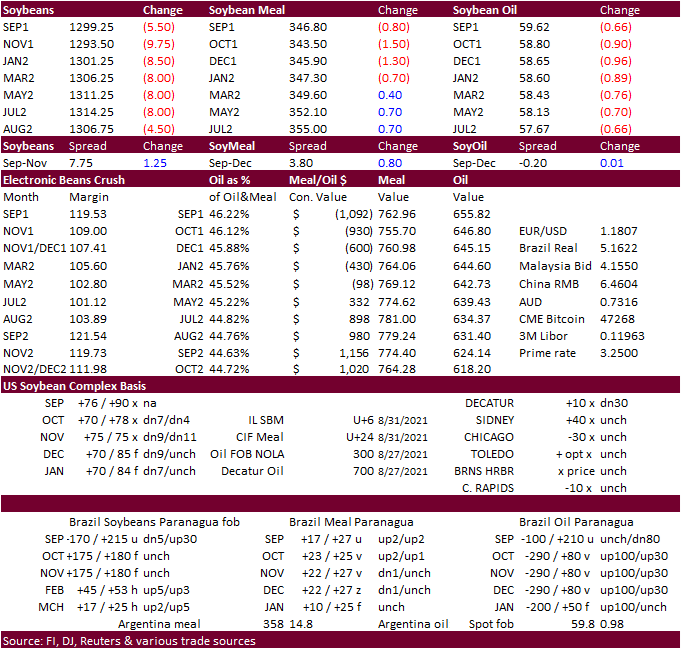

Soybeans ended lower led by the November contract. Soybean meal traded two-sided, ending lower. Soybean oil recovered some session losses but settled 57-92 points lower in part to lower energy prices.

·

Funds sold an estimated net 7,000 soybeans, 1,000 soybean meal and 3,000 soybean oil.

·

Soybean basis fell 10 cents at Davenport, Iowa, and was off 25 cents at Seneca, Illinois.

·

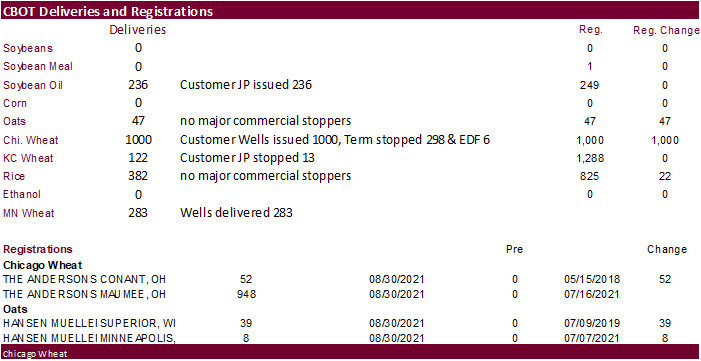

CBOT posted 236 soybean oil deliveries.

·

Malaysia was on holiday.

·

ITS: Malaysian Aug palm exports reached 1.213 million tons, a 15.8% decrease from July.

·

Bloomberg Intelligence: U.S.’s renewable diesel capacity will rise to 5.1 billion gallons per year by 2024, sufficient to replace 40% of current fossil diesel usage of 12.73 billion gallons if there is enough feedstock.

·

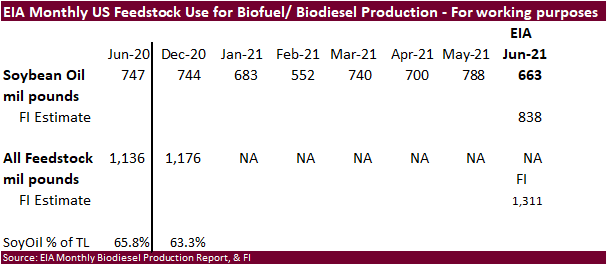

SBO feedstocks for biofuel use for the month of June was poor. (see below)

Export

Developments

- Egypt’s

GASC seeks at least 30,000 tons of soyoil and 10,000 tons of sunflower oil on Thursday for October 16 through November 2 shipment. At sight and 180-day letters of credit would be considered.

June

SBO use for biofuel

was a poor 663 million pounds versus 788 during May, also lowest for all of 2021.

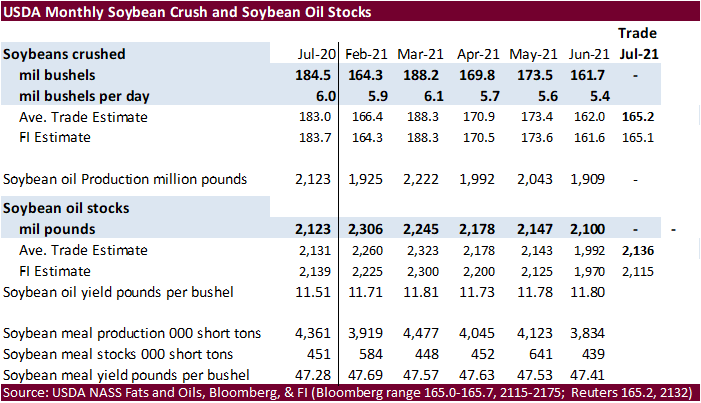

USDA

may leave SBO for biodiesel unchanged next month. We lowered our 2020-21 outlook by 50 million pounds for biofuel use and trimmed domestic consumption (food + industrial) by a like amount. Given the higher than expected soybean yields in the latest NASS

and NOPA crush reports, our yield was upward revised, adding about 125 million pounds to production. See updated annual and monthly S&D’s after the text.

Updated

8/31/21

Soybeans

– November $11.75-$14.50 range (unch, down 50 cents top end)

Soybean

meal – December $320-$395 (unch, down $30)

Soybean

oil – December 52-65 cent range

(unch,

down 200)

·

Chicago wheat opened mixed, traded much of the day lower, and ended lower in the nearby Chicago contracts while the 2020 positions ended higher. KC was mostly higher. Minneapolis wheat was lower from harvest pressure. KC and

Chicago saw bear spreading. US spring wheat harvest advanced to 88% complete vs. 71% average. Paris wheat fell to near a two-week low.

·

Funds sold an estimated net 3,000 Chicago SRW wheat contracts.

·

There were 1,000 Chicago wheat deliveries and 283 Minneapolis deliveries. KC were 122.

·

SovEcon lowered their Russia wheat crop estimate to 75.4 million tons from 76.2 million previously. Low spring wheat yields were noted. Some were looking for them to be around 73 million tons.

·

Ukraine AgMin: 2021 wheat harvest brought in 32.52 million tons from 99.4% of the sowing area, with a yield of 4.62 tons per hectare. The ministry said a total of 44.4 million tons of grain had been harvested as of Aug. 26.

·

Lebanon flour millers are seeing a fuel shortage threatening bread production.

·

The USD was 2 points higher as of 2:10 pm CT.

·

December Paris wheat was down 1.50 euros at 245.25 (down 0.6%).

Export

Developments.

·

Iran’s GTC bought 180,000-240,000 tons of Russian wheat over the past two weeks for October and beyond shipment.

·

Turkey seeks 245,000 tons of animal feed barley on September 7 for Sep 15-Oct 8 shipment.

·

Jordan seeks 120,000 tons of wheat on September 1.

·

Bangladesh seeks 50,000 tons wheat on September 1.

·

Jordan seeks 120,000 tons of feed barley on September 2 for LH October through FH December shipment.

·

Turkey seeks 300,000 tons of milling wheat on September 2 for September 10 through October 10 shipment. They last bought 11.5% and 12.5% wheat on August 4 at $297.40-$308.90/ton c&f.

·

Taiwan weeks 48,875 tons of US wheat on September 3 for October 15-Novmeber 1 shipment. They last bought US wheat on August 6, various classes at various prices.

·

Pakistan seeks 550,000 tons of wheat on September 7 for October through November shipment.

·

Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

Rice/Other

- South

Korea seeks 42,200 tons of rice for arrival in South Korea between February 28 and April 2022. 20,000 tons of that is of US origin, rest optional .

Updated 8/31/21

December Chicago wheat is seen in a $6.80‐$8.00

range (unch, down 20 cents top end)

December KC wheat is seen in a $6.60‐$7.80

(unch, down 20)

December MN wheat is seen in a $8.45‐$9.50

(unch, down 30)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.