PDF Attached

Lower

trade on US shipping concerns and fund selling. Money managers are short Chicago wheat.

![]()

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

- Gujarat,

India is receiving some significant rain today, according to satellite imagery

o

Gujarat, like other areas in northwestern India and southern Pakistan, have been drier bias this summer and the moisture was needed to improve post monsoonal crop development potential for cotton, groundnuts and other crops

o

Rain will linger into Friday and some of it today and Thursday will be heavy

o

Another round of rain is expected during the middle to latter part of next week and it too will be significant

- Northern

India early season cotton is in the open boll stage of development with early harvesting expected soon

o

The withdrawal of the monsoon season should begin around mid-month to help induce a better harvest environment

- Most

of India’s grain, oilseeds and other crops away from the far northwest have seen an uneven distribution of rain this summer, but crops have managed the environment relatively well

o

More of the same is expected

- Cool

air will settle into western Russia, Belarus, the Baltic States and neighboring areas this weekend into next week

o

Drizzle and periods of light rain may occur in parts of the region resulting in slower harvest and planting progress

- Harvesting

of 2021 crops is already well under way, but will be slowed - Planting

of 2022 winter crops has also advanced and the moisture will ensure good establishment of crops planted in early August - Western

Alberta, Canada experienced very chilly weather periods of rain Tuesday and the same bias is expected today into Thursday - Southwestern

parts of Canada’s Prairies will continue dry biased over the next ten days - Northern

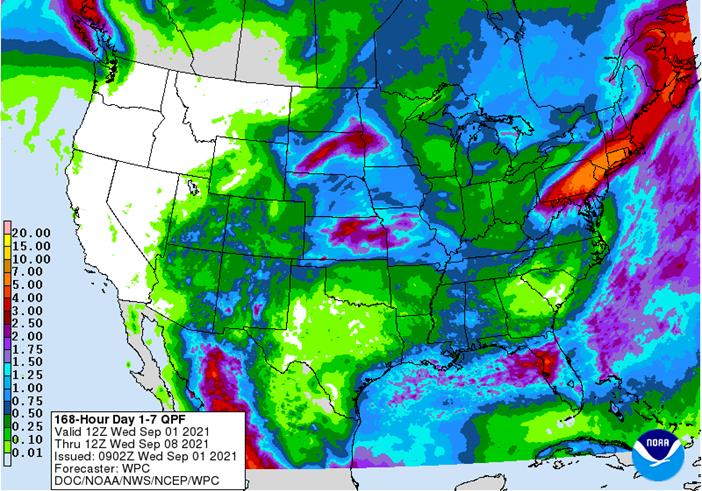

and eastern parts of Canada’s Prairies will experience improved harvest weather this weekend and next week as rain frequency decreases and greater sunshine begins to occur - U.S.

Midwest weather will be good for late season summer crop development maturation and early season harvesting during the next two weeks

o

Rain is expected in the northwestern Corn Belt tonight and Thursday after that rain in the Midwest is expected to be a little less frequent and less significant allowing the region to slowly dry down for a while

- U.S.

temperatures will be seasonable in the Midwest , Delta and southeastern states and warmer than usual from the Plains to the Pacific Coast - Tropical

Depression Ida continues to move through the eastern United States with today’s greatest rain occurring from Virginia to southern New England.

o

The system should finally exit the nation Friday into Saturday

o

Heavy rain will continue to impact a part of the region described

- Texas

and southwestern Oklahoma will experience net drying conditions over the next ten days and temperatures will be near to above average supporting good late season crop development and harvest progress - U.S.

Delta and southeastern states will see a good mix of rain and sunshine over the next two weeks, although flood water will continue to recede in southern Mississippi, southeastern Louisiana and southwestern Alabama from Hurricane Ida - Far

western U.S. will be dry or mostly dry during the next ten days along with the northwestern U.S. Plains - Western

Europe is expecting greater rainfall this weekend into next week which should help moisten the soil after recent net drying - Eastern

Europe should begin drying down for a while and the change will be good after recent wet and cool biased conditions - A

region of disturbed tropical weather in the western Caribbean Sea is still being closely monitored for possible development this weekend or next week, but the latest model forecasts send the system into Central America where development is not nearly as likely

as it was suggested to be earlier this week - Tropical

Storm Larry evolved in the eastern tropical Atlantic Tuesday and it will quickly intensify to a major hurricane by the weekend

o

The storm will remain over open water as it turns to the central Atlantic Ocean and there is very little potential for the storm to turn toward North America

- Tropical

Storm Kate remains in the central Atlantic Ocean and poses no threat to land

o

The storm should steadily diminish over the next few days

- Mexico’s

west and southern crop areas will be a little too wet over the coming week resulting in some flooding and concern over crop conditions

o

Flooding is already a problem in southwestern and west-central coastal states of Mexico following Tropical Storm Nora’s onslaught of heavy rainfall during the weekend and Monday.

o

Drier weather is needed in many areas

o

Northeastern Mexico will remain drier, but will receive some scattered showers and thunderstorms in the coming week

- Ontario

and Quebec, Canada weather will be well mixed, although rainfall will be lighter than usual; temperatures will be near normal

o

Wheat harvesting will advance well on the drier days

o

Corn and soybean filling and maturing conditions will be good, but late season crops will need additional moisture over time

- Argentina

received some welcome rain Tuesday, and more is expected

o

The precipitation was greatest in Buenos Aires and La Pampa where some improvement in winter crop conditions resulted

o

Areas to the north and especially in Cordoba, Santa Fe and Santiago del Estero need rain to support winter crops and to improve soil moisture for early season planting of spring crops

o

Wheat in Argentina needs rain especially in the west where is has been driest since the planting season ended

- Brazil

weather will be dry in most center west and center south crop areas during the next ten days, but showers may begin to evolve briefly during the middle part of September.

o

Some rain will fall in coastal areas of Bahia and Espirito Santo and periodic rain is predicted for areas in central Parana southward where wheat development should advance well along with some early season corn planting.

- Rain

along the central Atlantic Coast could benefit a few coffee trees - Australia

crop weather will continue to include timely rainfall in southern parts of the nation during the next two weeks. Northern production areas will need some greater rain as winter wheat, barley and canola begin to reproduce in early September

o

Rain will fall in Queensland and northern New South Wales this weekend into early next week, but confidence in its significance is low

- Temperatures

will be seasonable - China

weather is expected to remain active during the next two weeks with some moderate rain expected in the coming ten days between the Yellow and Yangtze Rivers possibly inducing some new flooding and possible late season crop damage

o

A part of eastern Inner Mongolia, northern Jilin, Liaoning and northwestern Heilongjiang will also get a little too much rain, although flooding is not likely to be a problem

o

China needs drier weather to protect late summer crop development and crop quality

o

Temperatures will be seasonable

- Southeast

Asia rainfall is expected to be frequent and sufficient to maintain favorable crop and soil conditions

o

Some timely rain fell in Thailand during the weekend

o

Most all crop areas will get rain multiple times over the next two weeks and sufficient amounts will occur to support better long term development potentials

- Pakistan

rainfall will remain restricted, but some showers will occur in the next ten days - North

Africa showers in the next two weeks will occur while temperatures are hot maintaining seasonably dry biased conditions - Colombia,

Venezuela and Central America will be plenty wet over the coming week to ten days - West-central

Africa rainfall over the next ten days will be near to above average

o

Recent rain benefited many areas, although Ghana would still benefit from more rain

o

Cameroon and southeastern Nigeria have been drier biased in recent weeks, although no critical problem with dryness is suspected

o

Coffee, cocoa, rice, sugarcane and cotton development has been and will continue to be good this year

- East-central

Africa showers and thunderstorms have been and will continue to be timely and beneficial resulting in a good outlook for coffee, cocoa, rice, sugarcane and other crops that are produced from Ethiopia into Uganda and southwestern Kenya.

- Showers

in South Africa will be erratic and mostly very light over the coming week

o

Net drying is expected, although temperatures are seasonably mild limiting evaporative moisture losses

- Southern

Oscillation Index was +4.76 today and the index should move a little higher for a while this week - New

Zealand weather will include near to below average rainfall during the next week except in western parts of South Island where rainfall will be more significant

o

Temperatures will be seasonable to slightly cooler biased

Source:

World Weather Inc.

Wednesday,

Sept. 1:

- EIA

weekly U.S. ethanol inventories, production - Australia

Commodity Index - U.S.

DDGS production, corn for ethanol, 3pm - Malaysia

August palm oil export data (tentative) - USDA

soybean crush, 3pm

Thursday,

Sept. 2:

- FAO

World Food Price Index - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Vietnam

Friday,

Sept. 3:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

Vietnam

Source:

Bloomberg and FI

Farm

Futures

issued early 2022 US plantings and the corn area was estimated at 94.3 million acres, up 1.7% from USDA’s 2021 estimate. US soybeans were expected to expand 3.7% to 90.8 million acres. All-wheat was pegged at 49.7 million acres, up 6.3%, with winter at 35.4

million (up 5.1%), spring and durum at 14.3 million (up 5.1%). 737 producers were survey from July 13 to Aug. 1.

Selected

Brazil commodities exports:

Commodity

August 2021 August 2020

CRUDE

OIL (TNS) 6,968,531 5,258,498

IRON

ORE (TNS) 34,836,092 31,193,457

SOYBEANS

(TNS) 6,499,747 5,836,621

CORN

(TNS) 4,349,451 6,243,786

GREEN

COFFEE(TNS) 172,424 191,124

SUGAR

(TNS) 2,595,408 3,139,009

BEEF

(TNS) 181,605 163,220

POULTRY

(TNS) 351,137 340,469

PULP

(TNS) 1,347,636 1,260,327

US

ADP Employment Change Aug: 374K (est 638K; prevR 326K; prev 300K)

US

MBA Mortgage Applications Aug 27: -2.4% (prev 1.6%)

Canadian

Markit Manufacturing PMI Aug: 57.2 (prev 56.2)

US

ISM Manufacturing Aug: 59.9 (est 58.5; prev 59.5)

–

Prices Paid: 79.4 (est 84.0; prev 85.7)

–

New Orders: 66.7 (est 61.0; prev 64.9)

–

Employment: 49.0 (prev 52.9)

·

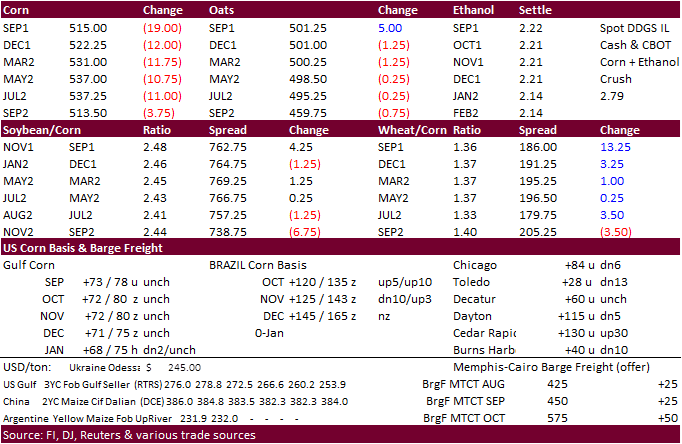

Corn ended lower for the third consecutive session on US export concerns. December traded below key technical levels and settled off 11.50 cents, lowest level since July 12. At least two out of six grain facilities located in

or around the NOLA Gulf area have confirmed elevator damage. One is down indefinitely. Cargill Inc said its Westwego, Louisiana, grain export terminal was damaged by Hurricane Ida, in addition to the grain export facility in Reserve, Louisiana.

·

This afternoon we heard the river is starting to reopen now that some of the power had been restored.

·

Funds sold an estimated net 11,000 corn contracts.

·

We heard China washed out about 500,000 tons of Ukraine corn commitments this week, and EU interest for Ukraine corn increased.

·

EU has a cap on Ukraine corn import volume. While likely not met yet this season, they tend to hit this yearly cap early in previous crop years. Ukraine had already sold forward around 20% of its corn export potential as of

early August, around 6-7MMT, according to AgriCensus. Ukraine started forward selling in January, mainly to China, and other Asian countries and Middle East also committed earlier this year.

·

StoneX estimated the 2021-22 Brazil first corn crop at 29.8 million tons (unchanged from prior) and second crop at 59.1 million (59.6 previously).

·

USDA’s Broiler Report showed eggs type eggs set in the US up 2 percent and chicks placed down slightly. Cumulative placements from the week ending January 9, 2021 through August 28, 2021 for the United States were 6.35 billion.

Cumulative placements were up slightly from the same period a year earlier.

·

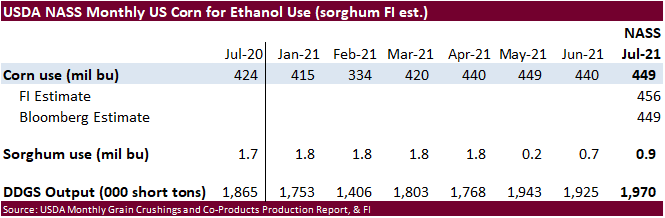

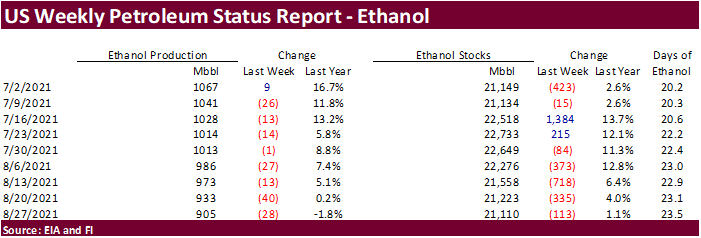

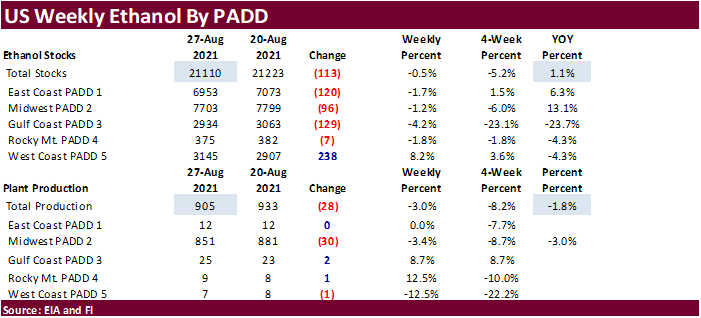

Weekly US ethanol production fell for the eighth consecutive week, longest streak since the pandemic. For the week ending August 27, it was off 28,000 barrels to 905,000 barrels (trade was looking down 7,000), lowest level since

2/26/21. 2020-21 US weekly ethanol production increased only 3.3% from the 2019-20 crop year. Ethanol stocks fell for the fifth consecutive week by 113,000 barrels to 21.110 million barrels (trade was looking for a 77,000 barrel decrease). US gasoline stocks

increased 1.3 million barrels to 227.2 million. Rolling 4-week average US gasoline demand increased from the previous week and running 8 percent above around this time a year ago but 2.6% below the comparable period a year ago.

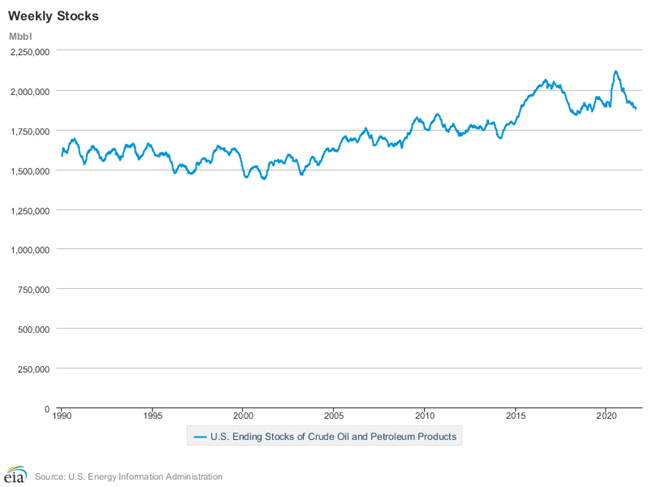

US

DoE Crude Oil Inventories (W/W) 27-Aug: -7169K (est -2500K; prev -2980K)

–

Distillate Inventories: -1732K (est -550K; prev 645K)

–

Cushing OK Crude Inventories: 836K (prev 70K)

–

Gasoline Inventories: 1290K (est -1600K; prev -2241K)

–

Refinery Utilization: -1.10% (est 0.35%; prev 0.20%)

Crude

Oil weekly Stocks

Export

developments.

·

China will auction off 111,321 tons of imported US corn and 13,180 tons of imported Ukrainian corn on September 3.

Updated

8/20/21

December

corn is seen in a $4.75-$6.00 range

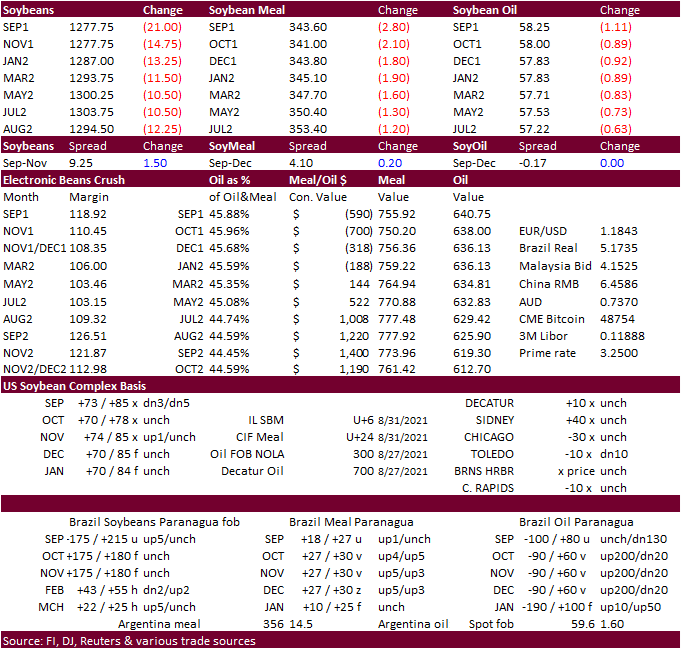

Soybeans

·

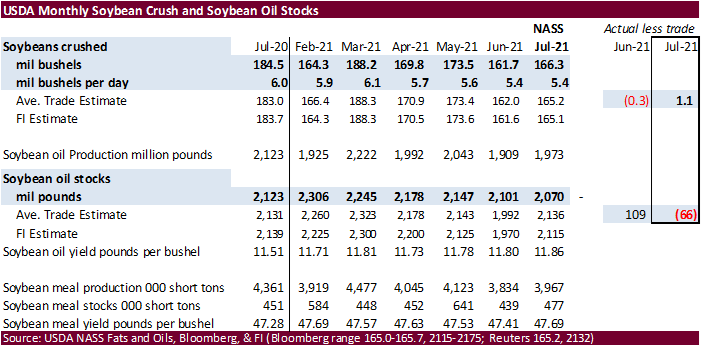

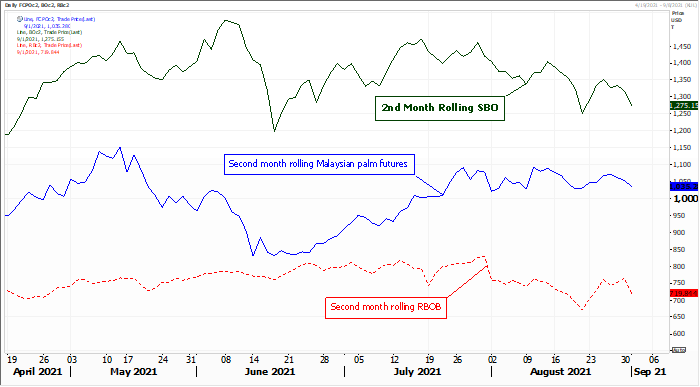

Soybeans traded sharply lower and are down for the fifth consecutive session on follow through selling over slowing US Gulf exports, favorable US weather and weaker soybean oil. Meal trended lower.

·

Funds sold an estimated net 9000 soybeans, 2000 meal and 3000 soybean oil.

·

We heard at least two US Gulf soybean cargoes for October shipment were switched to Brazil at an expensive price.

·

StoneX estimated the 2021-22 Brazil new-crop soybean production at 143.3 million tons (unchanged from prior).

·

Argentina producers sold 28.5 million tons of soybeans from the 2020-21 crop, up 568,600 tons from the previous week, and behind 30.3 million tons a year earlier.

·

Cargo surveyor SGS reported August Malaysian palm exports at 1,191,053 tons, 257,430 tons below the same period a month ago or down 17.8%, and 251,852 tons below the same period a year ago or down 17.5%. AmSpec reported 1.219

million tons, down from 1.428 million previous month. ITS: Malaysian Aug palm exports reached 1.213 million tons, a 15.8% decrease from July.

Export

Developments

- Egypt’s

GASC seeks at least 30,000 tons of soyoil and 10,000 tons of sunflower oil on Thursday for arrival between October 20-November 5. At sight and 180-day letters of credit would be considered.

- India

was estimated to have bought about 250,000 tons of soybeans meal, including 15,000 tons that as already shipped out a couple months ago but bought back at a higher price. Most of the soybean meal bought will originate from Argentina and some cargoes from

neighboring Asian countries.

Updated

8/31/21

Soybeans

– November $11.75-$14.50 range

Soybean

meal – December $320-$395

Soybean

oil – December 52-65 cent range

·

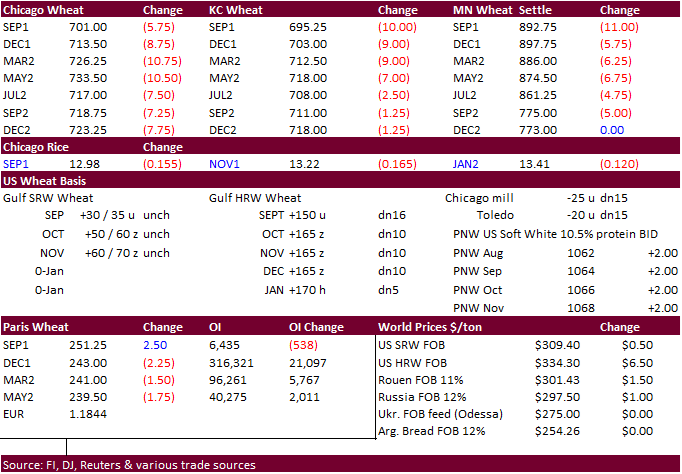

US wheat again started mixed on lack of direction but grinded lower after soybeans and corn hit sell stops. The downward trend this week in corn and soybeans is bearish for wheat futures but helping offset that is strong global

import wheat demand.

Algeria bought upwards to 460,000 tons of wheat.

·

Funds sold an estimated net 5,000 Chicago SRW wheat contracts.

·

December Paris wheat was off 2.25 euros at 242.75 euros/ton.

·

India monsoon rains are expected to be above normal for the month of September. June through August rainfall was about 9% deficient.

·

Ukraine AgMin: Grain exports for July-August totaled 8.6 million tons, up from 7.73 million year ago, including 4.6 million tons of wheat, 2.8 million tons of barley and 1.26 million tons of corn.

·

Russia AgMin: Farmers have already sown winter grains for next year’s crop on 2.4 million hectares, down from 3.5 million hectares at Sept 1, 2020.

Export

Developments.

·

Jordan passed on 120,000 tons of wheat.

·

Results awaited: Bangladesh seeks 50,000 tons wheat.

·

Jordan seeks 120,000 tons of feed barley on September 2 for LH October through FH December shipment.

·

Turkey seeks 300,000 tons of milling wheat on September 2 for September 10 through October 10 shipment. They last bought 11.5% and 12.5% wheat on August 4 at $297.40-$308.90/ton c&f.

·

Taiwan weeks 48,875 tons of US wheat on September 3 for October 15-Novmeber 1 shipment. They last bought US wheat on August 6, various classes at various prices.

·

Turkey seeks 245,000 tons of animal feed barley on September 7 for Sep 15-Oct 8 shipment.

·

Pakistan seeks 550,000 tons of wheat on September 7 for October through November shipment.

·

Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

Rice/Other

- South

Korea seeks 42,200 tons of rice for arrival in South Korea between February 28 and April 2022. 20,000 tons of that is of US origin, rest optional .

Updated 8/31/21

December Chicago wheat is seen in a $6.80‐$8.00

range

December KC wheat is seen in a $6.60‐$7.80

December MN wheat is seen in a $8.45‐$9.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.