PDF attached does not include daily estimate of funds

WASHINGTON,

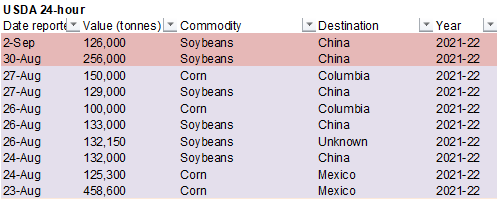

September 2, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 126,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

CME

decreases margins on lumber, corn, soybean oil and soybean meal futures, effective after the close of business on Thursday.

https://www.cmegroup.com/content/dam/cmegroup/notices/clearing/2021/09/Chadv21-303.pdf

https://www.cmegroup.com/notices/clearing/2021/09/Chadv21-304.xlsx

USDA

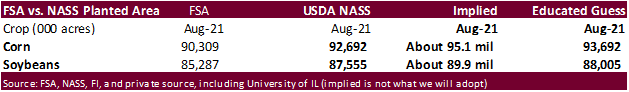

may review and incorporate data issued by the FSA office’s Prevented Planting report issued mid-August, in its September Crop Production report. We think corn and soybean acres could be revised higher. An upward revision of 500 to 1000 thousand acres for

corn and 200 to 450 thousand acres for soybeans could be bearish if USDA leaves unchanged or increases yields on September 10. Trade estimates may be out as early as Friday afternoon.

![]()

WORLD

WEATHER HIGHLIGHTS FOR SEP. 2, 2021

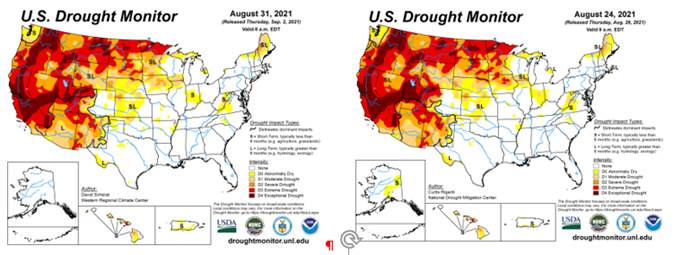

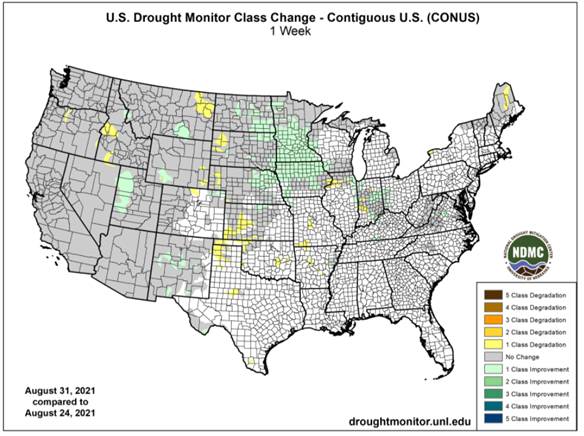

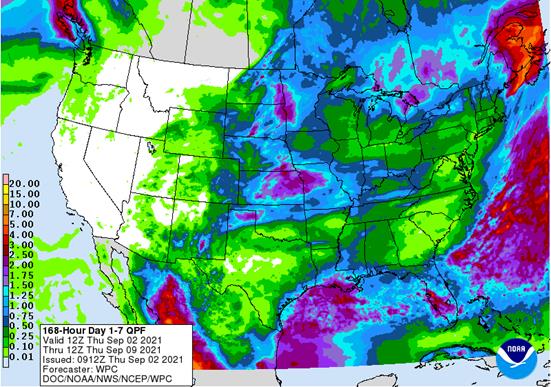

- Rain

will fall in the U.S. Dakotas, Nebraska and western parts of Minnesota today and Friday as remnants of Tropical Cyclone Nora reach the area.

- Remnants

of Tropical Depression Ida produced some heavy rain in the northeastern U.S.

- Many

U.S. Midwest and Great Plains crop areas along with some in the Delta and southeastern states will experience net drying after this weekend for much of next week.

- A

tropical disturbance may reach the Gulf of Mexico late next week and will be closely monitored for influence on the central Gulf coast in the following weekend.

- Northwestern

India received rain this week and it will get more next week with Gujarat the primary recipient.

- Not

much change in the rest of the world overnight. - Eastern

Australia will get some rain this weekend and early next week - many

areas in the CIS from the Ural Mountain region into far eastern Europe will get some periodic rainfall over the coming week.

- Western

Europe will turn wetter this weekend especially next week. - China

will remain wet through the weekend, but next week looks drier

Source:

World Weather Inc.

Friday,

Sept. 3:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

Vietnam

Source:

Bloomberg and FI

USDA

export Sales

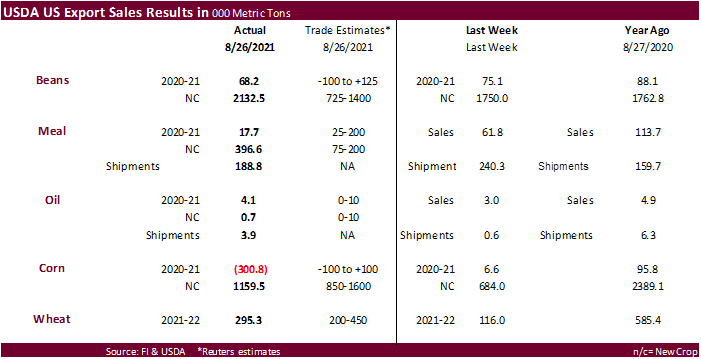

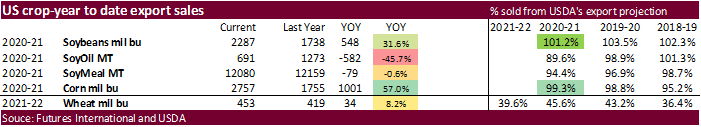

USDA

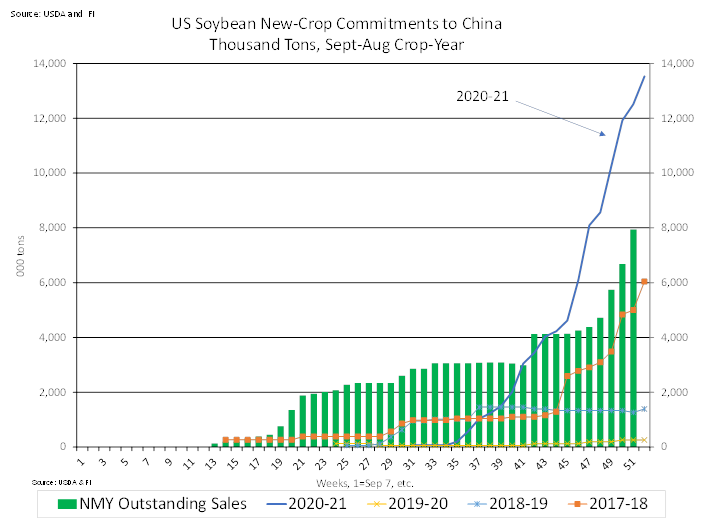

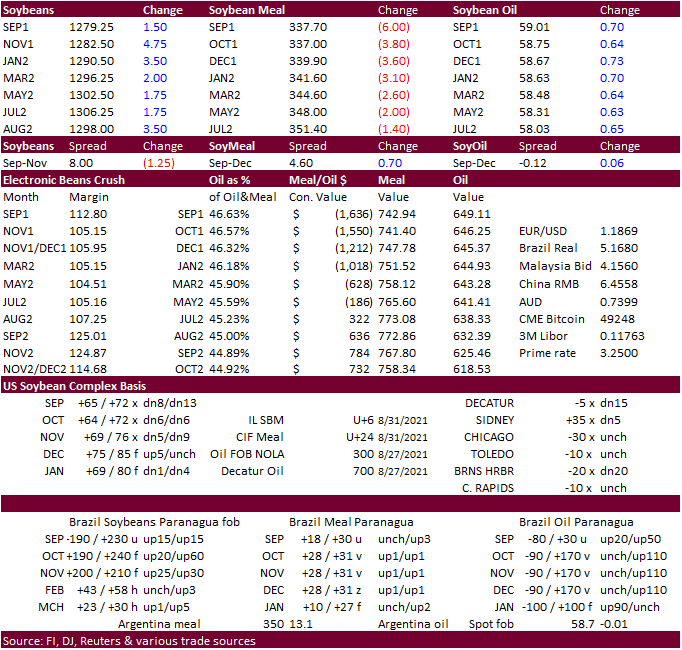

export sales for new-crop soybeans were better than expected at 2.133 million tons that included 1.264 million tons for China, 654,000 tons for unknown and 88,700 tons for Mexico. Old crop sales were positive 68,200 tons. Soybean meal sales were very good

for new-crop at 396,600 tons and shipment were 188,800 tons. New-crop meal sales included Colombia (104,000 MT),the Philippines (90,000 MT), unknown destinations (48,200 MT), and Romania(45,000 MT). SBO net sales were 4,100 tons old crop and 700 tons new.

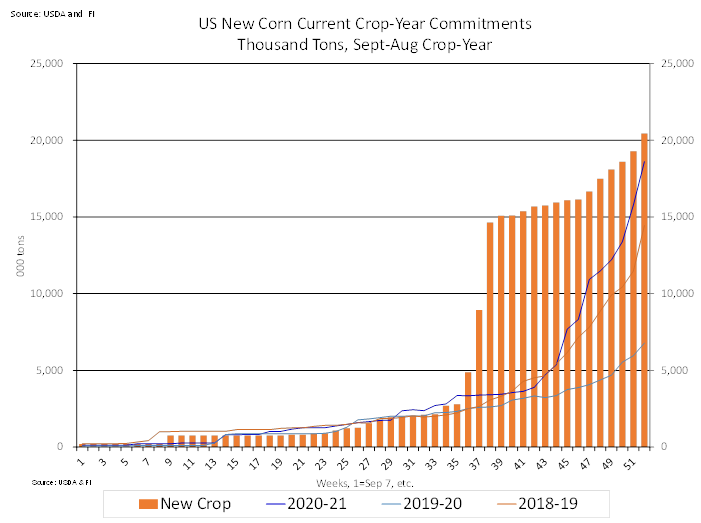

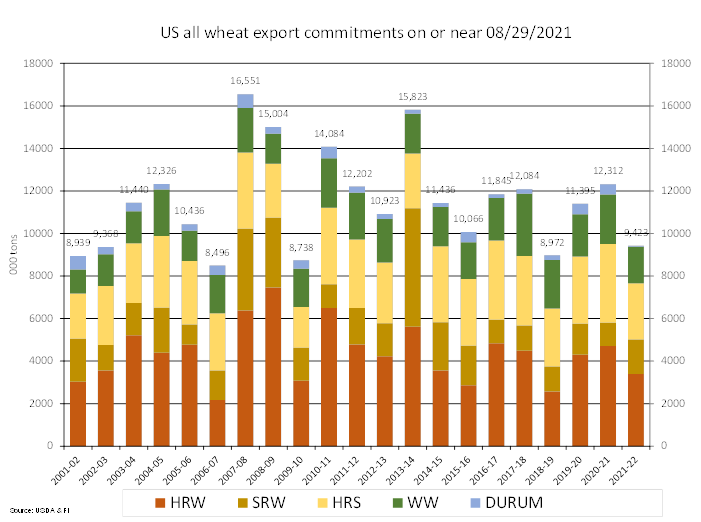

Corn sales of negative 300,800 tons are not uncommon for this late in the crop year for 2020-21. New-crop corn of 1.160 million tons were within expectations and included Mexico(464,500 MT), Colombia (352,000 MT), and Canada (292,600 MT). All-wheat sales

rebounded from the marketing low reported last week to 295,300 tons. Pork sales were a large 33,500 tons.

US

Initial Jobless Claims Aug 28: 340K (est 345K; prevR 354K; prev 353K)

US

Continuing Claims Aug 21: 2748K (est 2808K; prevR 2908K; prev 2862K)

US

Nonfarm Productivity Q2 F: 2.1% (est 2.5%; prev 2.3%)

US

Unit Labour Costs Q2 F: 1.3% (est 0.9%; prev 1.0%)

US

Trade Balance (USD) Jul: -70.1B (est -70.9B; prev -75.7B)

Canadian

Building Permits (M/M) Jul: -3.9% (est 1.5%; prevR 7.2%; prev 6.9%)

Canadian

International Merchandise Trade Jul: 0.78B (est 1.70B; prevR 2.56B; prev 3.20B)

Crude-oil

production from OPEC members increased by 290,000 barrels per day in Aug., according to the latest Bloomberg survey

US

Factory Orders (M/M) Jul: 0.4% (est 0.3%; prev 1.5%)

–

Factory Orders Ex Trans (M/M) Jul: 0.8% (est 0.5%; prev 1.4%)

–

Durable Goods Orders (M/M) Jul F: -0.1% (est -0.1%; prev -0.1%)

–

Durables Ex Transportation (M/M) Jul F: 0.8% (est 0.7%; prev 0.7%)

–

Cap Goods Orders Nondef Ex-Air (M/M Jul F): 0.1% (est 0.0%; prev 0.0%)

–

Cap Goods Ship Nondef Ex-Air (M/M) Jul F: 0.9% (prev 1.0%)

·

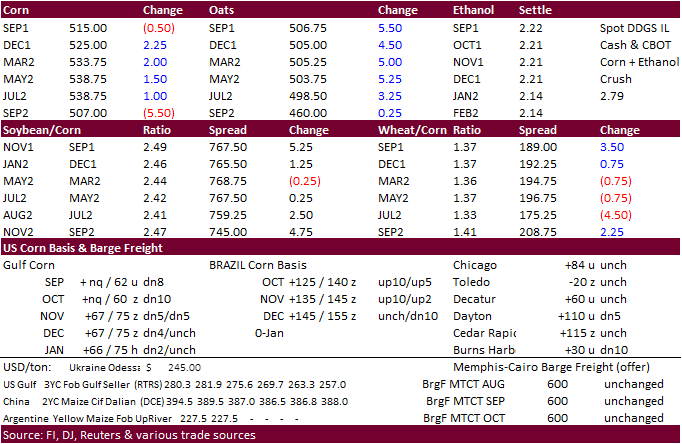

Corn ended 1.75-2.75 higher for the December through July 2022 contracts on good export sales and technical buying. Some traders were shoring up recent (new) short positions ahead of the long holiday weekend.

·

This morning we heard there were at least two Ukraine corn cargoes washed out that were destined to China. FOB premiums jumped yesterday on EU interest for Ukrainian corn, but it’s unknown how much corn was purchased.

·

Brazil is investigating a possible mad cow case.

·

NOLA is slowly reopening. But some companies might not be able to restore grain service for weeks because of damage. CHS mentioned they may shift demand to the PNW over the short term.

Export

developments.

·

China will auction off 111,321 tons of imported US corn and 13,180 tons of imported Ukrainian corn on September 3.

Updated

8/20/21

December

corn is seen in a $4.75-$6.00 range

Soybeans

·

China may have bought a couple cargoes of soybeans overnight, but these purchases are seen as “one offs.” Later this morning USDA reported private exporters sold 126,000 tons of soybean to China.

·

China crush margins have improved over the past three weeks and they are starting to stabilize somewhat and are near levels that should increase import interest.

·

Brazilian basis is firming rather quickly. We are hearing Brazil exporters are scrambling to boost exports as US Gulf export supplies are thin, and Brazilian domestic crushers are paying more for soybeans than exporters to secure

supplies.

·

Argentina’s farming associates are exploring a potential strike over the government extending limits on beef exports.

·

Egypt said they have enough vegetable oil reserves until February 2022.

·

Chevron plans to invest $600 million in two Bunge soybean crushing facilities to secure feedstock for renewable fuels. The 50/50 joint venture will include the facilities in Destrehan, Louisiana, and Cairo, Illinois.

Export

Developments

- USDA

reported private exporters sold 126,000 tons of soybean to China. - Egypt’s

GASC bought 10,000 tons of soyoil and 19,000 tons of sunflower for arrival between Oct. 20 and Nov. 5. The soyoil was purchased at $1,310 a ton c&f. The sunflower oil was purchased at $1,240 a ton c&f. In a separate local tender, they bought 34,000 ton

of Egyptian-produced soyoil (20,550 Egyptian pounds) and passed on local of sunflower oil for delivery in the same period.

Updated

8/31/21

Soybeans

– November $11.75-$14.50 range

Soybean

meal – December $320-$395

Soybean

oil – December 52-65 cent range

·

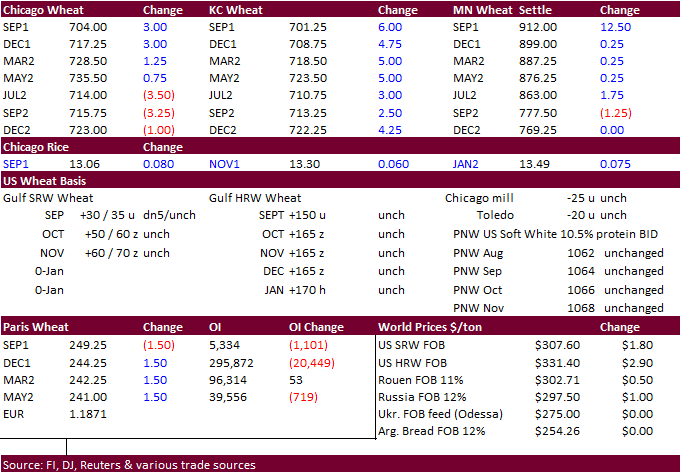

US wheat was mixed early this morning but ended mostly higher led by the KC market. Dry weather over the past month across the central Great Plains is getting traders nervous that the US winter wheat planting season will start

later than normal this year. Algeria bought more wheat than initially than reported.

·

The USD was down 22 points as of 22 pm CT.

·

Argentina saw very good rains over the past day across the heart of the wheat belt, benefiting the crop.

·

December Paris wheat was up 1.50 euros at 244.25.

·

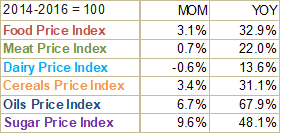

The FAO Food Price Index averaged 127.4 points in August, up 3.1 percent from July and 32.9 percent from the same month in 2020.

Export

Developments.

·

Jordan bought 60,000 tons of feed barley at $317/ton c&f for LH October through FH December shipment.

·

Jordan issued a new import tender for 120,000 tons of wheat, set to close September 8 for late December through February 14 shipment.

·

Yesterday it was reported Algeria bought around 460,000 to 490,000 tons of wheat and prices were reported at $353-$356.60/ton c&f. They are in for October shipment.

·

Results awaited: Bangladesh seeks 50,000 tons wheat.

·

Taiwan weeks 48,875 tons of US wheat on September 3 for October 15-Novmeber 1 shipment. They last bought US wheat on August 6, various classes at various prices.

·

Turkey seeks 245,000 tons of animal feed barley on September 7 for Sep 15-Oct 8 shipment.

·

Pakistan seeks 550,000 tons of wheat on September 7 for October through November shipment.

·

Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

Rice/Other

- South

Korea seeks 42,200 tons of rice for arrival in South Korea between February 28 and April 2022. 20,000 tons of that is of US origin, rest optional .

Updated 8/31/21

December Chicago wheat is seen in a $6.80‐$8.00

range

December KC wheat is seen in a $6.60‐$7.80

December MN wheat is seen in a $8.45‐$9.50

U.S. EXPORT SALES FOR WEEK ENDING 8/26/21

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

146.7 |

1,494.1 |

1,863.1 |

125.5 |

1,904.3 |

2,849.5 |

0.0 |

0.0 |

|

SRW |

12.7 |

738.2 |

626.8 |

116.1 |

873.9 |

461.8 |

0.0 |

0.0 |

|

HRS |

64.3 |

1,072.8 |

1,984.5 |

113.3 |

1,574.6 |

1,718.8 |

0.0 |

0.0 |

|

WHITE |

71.6 |

682.5 |

1,182.4 |

62.2 |

1,032.3 |

1,138.5 |

0.0 |

0.0 |

|

DURUM |

0.0 |

7.4 |

273.9 |

0.0 |

43.2 |

213.3 |

0.0 |

0.0 |

|

TOTAL |

295.3 |

3,995.0 |

5,930.7 |

417.1 |

5,428.3 |

6,381.8 |

0.0 |

0.0 |

|

BARLEY |

-0.1 |

21.4 |

30.8 |

0.0 |

3.9 |

8.4 |

0.0 |

0.0 |

|

CORN |

-300.8 |

3,321.4 |

1,965.3 |

529.3 |

66,701.9 |

42,622.2 |

1,159.5 |

20,442.2 |

|

SORGHUM |

2.4 |

226.1 |

107.9 |

72.4 |

6,910.9 |

4,529.2 |

0.0 |

1,594.9 |

|

SOYBEANS |

68.2 |

1,940.7 |

3,517.5 |

324.0 |

60,287.4 |

43,785.1 |

2,132.5 |

17,747.5 |

|

SOY MEAL |

17.7 |

1,235.7 |

1,238.6 |

188.8 |

10,844.2 |

10,920.3 |

396.6 |

2,058.1 |

|

SOY OIL |

4.1 |

20.3 |

138.3 |

3.9 |

670.3 |

1,134.6 |

0.7 |

1.4 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

15.0 |

221.2 |

169.3 |

3.7 |

90.6 |

50.6 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

8.6 |

27.5 |

0.2 |

0.5 |

1.4 |

0.0 |

0.0 |

|

L G BRN |

0.2 |

1.4 |

8.1 |

0.6 |

11.5 |

2.6 |

0.0 |

0.0 |

|

M&S BR |

13.3 |

22.3 |

22.3 |

13.3 |

13.6 |

9.7 |

0.0 |

0.0 |

|

L G MLD |

19.8 |

168.6 |

69.3 |

18.6 |

71.5 |

16.4 |

0.0 |

0.0 |

|

M S MLD |

1.2 |

55.3 |

39.5 |

2.1 |

29.4 |

49.1 |

0.0 |

0.0 |

|

TOTAL |

49.5 |

477.5 |

336.0 |

38.6 |

217.2 |

129.8 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

105.2 |

4,787.1 |

5,731.7 |

168.6 |

782.1 |

1,251.5 |

23.8 |

667.3 |

|

PIMA |

14.5 |

129.0 |

188.8 |

4.7 |

24.1 |

36.4 |

0.0 |

0.0 |

This

summary is based on reports from exporters for the period August 20-26, 2021.

Wheat: Net

sales of 295,300 metric tons (MT) for 2021/2022 were up noticeably from the previous week and up 15 percent from the prior 4-week average. Increases primarily for Mexico (103,900 MT, including decreases of 600 MT), Japan (92,400 MT, including decreases of

600 MT), Nigeria (70,000 MT, including 30,000 MT switched from unknown destinations), China (58,000 MT, including 60,000 MT switched from unknown destinations and decreases of 2,000 MT), and the Philippines (45,800 MT), were offset by reductions for unknown

destinations (100,000 MT) and Brazil (50,000 MT). Exports of 417,100 MT were down 38 percent from the previous week and 27 percent from the prior 4-week average. The destinations were primarily to Mexico (146,900 MT), the Philippines (63,800 MT), China (58,500

MT), Thailand (33,500 MT), and Nigeria (32,000 MT).

Corn:

Net sales reductions of 300,800 MT for 2020/2021–a marketing-year low–were greater than the previous week, but down noticeably from the prior 4-week average. Increases primarily for Mexico (33,000 MT, including decreases of 7,700 MT), Guatemala (27,100

MT, including 22,500 MT switched from El Salvador, 7,500 MT switched from Costa Rica, and decreases of 2,900 MT), Taiwan (8,800 MT), South Korea (1,900 MT), and Colombia (1,400 MT, including decreases of 26,000 MT), were more than offset by reductions primarily

for Canada (209,800 MT) and China (133,200 MT). For 2021/2022, net sales of 1,159,500 MT primarily for Mexico (464,500 MT), Colombia (352,000 MT), Canada (292,600 MT), Japan (40,000 MT), and Taiwan (7,400 MT), were offset by reductions for unknown destinations

(1,900 MT). Exports of 529,300 MT were down 30 percent from the previous week and 48 percent from the prior 4-week average. The destinations were primarily to Mexico (258,700 MT), China (138,700 MT), Guatemala (34,600 MT), Colombia (30,400 MT), and Costa

Rica (29,600 MT).

Optional

Origin Sales:

For 2020/2021, the current outstanding balance of 30,500 MT is for unknown destinations. For 2021/2022, the current outstanding balance of 110,000 MT is for unknown destinations.

Barley:

Total net sales reductions for 2021/2022 of 100 MT were for Canada. There were no exports reported for the week.

Sorghum:

Total net sales of 2,400 MT for 2020/2021 were down 96 percent from the previous week and down noticeably from the prior 4-week average. The destination for China. Exports of 72,400 MT were down 43 percent from the previous week and 4 percent from the prior

4-week average. The destination was to China.

Rice:

Net

sales of 49,500 MT for 2021/2022 were primarily for Haiti (15,200 MT, including decreases of 100 MT), Honduras (15,000 MT), Japan (12,500 MT), Canada (2,500 MT), and Saudi Arabia (1,400 MT). Exports of 38,600 MT were primarily to Haiti (15,200 MT), Japan

(12,500 MT), Mexico (4,800 MT), Canada (2,200 MT), and Saudi Arabia (1,900 MT).

Exports

for Own Account:

For

2021/2022, exports for own account totaling 100 MT to Canada were applied to new or outstanding sales.

Soybeans:

Net sales of 68,200 MT for 2020/2021 were down 9 percent from the previous week, but up 9 percent from the prior 4-week average. Increases primarily for the Netherlands (86,200 MT, including 84,000 MT switched from unknown destinations and decreases of 3,800

MT), China (26,200 MT), Taiwan (17,200 MT), Indonesia (7,400 MT, including decreases of 100 MT), and Malaysia (5,800 MT, including decreases of 100 MT), were offset by reductions for unknown destinations (84,000 MT). For 2021/2022, net sales of 2,132,500

MT were primarily for China (1,264,000 MT), unknown destinations (654,000 MT), Mexico (88,700 MT), Egypt (50,000 MT), and Taiwan (32,000 MT). Exports of 324,000 MT were up 25 percent from the previous week and 50 percent from the prior 4-week average. The

destinations were primarily to Mexico (111,000 MT), the Netherlands (86,200 MT), China (71,600 MT), Costa Rica (16,800 MT), and Indonesia (9,800 MT).

Exports

for Own Account:

For 2020/2021, the current exports for own account outstanding balance is 5,800 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 17,700 MT for 2020/2021–a marketing-year low–were down 71 percent from the previous week and 82 percent from the prior 4-week average. Increases primarily for Mexico (19,600 MT), Canada (9,300 MT, including decreases of 700 MT), Taiwan (7,400

MT, including decreases of 100 MT), Guatemala (6,700 MT, including 6,100 MT switched from El Salvador), and Vietnam (5,600 MT), were offset by reductions primarily for Romania (45,000 MT).

For 2021/2022, net sales of 396,600 MT were primarily for Colombia (104,000 MT), the Philippines (90,000 MT), unknown destinations (48,200 MT), Romania (45,000 MT), and Ecuador (30,000 MT).

Exports of 188,800 MT were down 21 percent from the previous week and 15 percent from the prior 4-week average. The destinations were primarily to Vietnam (50,000 MT), Ecuador (32,500 MT), Canada (21,800 MT), Colombia (19,000 MT), and Mexico (18,300 MT).

Soybean

Oil:

Net sales of 4,100 MT for 2020/2021 were up 39 percent from the previous week and up noticeably from the prior 4-week average. Increases reported for Venezuela (3,000 MT), Honduras (1,000 MT), and Canada (100 MT). Total net sales for 2021/2022 of 700 MT

were for Canada. Exports of 3,900 MT were up noticeably from the previous week and from the prior 4-week average. The destinations were to Jamaica (3,500 MT), Canada (300 MT), and Mexico (100 MT).

Cotton:

Net sales of 105,200 RB for 2021/2022 were primarily for Pakistan (27,600 RB), Vietnam (17,200 RB, including decreases of 8,800 RB), Turkey (14,400 RB), Ecuador (8,800 RB), and China (8,400 RB). Total net sales for 2022/2023 of 23,800 RB were for Turkey.

Exports of 168,600 RB were primarily to Turkey (33,400 RB), China (33,000 RB), Vietnam (25,000 RB), Pakistan (18,900 RB), and Bangladesh (17,400 RB). Net sales of Pima totaling 14,500 RB were primarily for Peru (6,300 RB), India (6,200 RB), Austria (500 RB),

Taiwan (400 RB), and Egypt (400 RB). Exports of 4,700 RB were primarily to India (2,200 RB), China (1,200 RB), Honduras (800 RB), Peru (300 RB), and Guatemala (100 RB).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 8,800 RB is for Pakistan.

Exports

for Own Account:

For 2021/2022, the current exports for own account outstanding balance of 4,800 RB is for China (4,700 RB) and Vietnam (100 RB).

Hides

and Skins:

Net sales of 324,500 pieces for 2021 were up 41 percent from the previous week and 28 percent from the prior 4-week average. Increases primarily for China (211,700 whole cattle hides, including decreases of 7,200 pieces), South Korea (34,400 whole cattle

hides, including of 1,600 pieces), Mexico (32,200 whole cattle hides, including decreases of 200 pieces), Brazil (19,500 whole cattle hides), and Thailand (16,900 whole cattle hides, including decreases of 500 pieces), were offset by reductions for Indonesia

(100 pieces). Exports of 425,700 pieces were down 22 percent from the previous week, but up 3 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (295,300 pieces), South Korea (70,000 pieces), Thailand (14,800 pieces),

Mexico (10,600 pieces), and Indonesia (10,200 pieces).

Net

sales of 206,400 wet blues for 2021 were up 70 percent from the previous week and 97 percent from the prior 4-week average. Increases were primarily for Italy (107,500 unsplit, 19,100 grain splits, including decreases of 200 unsplit and 100 grain splits),

China (23,300 unsplit, including decreases of 100 unsplit), Thailand (23,000 unsplit), Vietnam (16,300 unsplit), and Mexico (10,200 grain splits). Exports of 126,600 wet blues were down 40

percent

from the previous week and 14 percent from the prior 4-week average. The destinations were to China (34,500 unsplit and 4,700 grain splits), Italy (37,300 unsplit and 1,900 grain splits), Vietnam (22,100 unsplit), Taiwan (10,400 unsplit), and Thailand (8,900

unsplit). Net sales of 251,600 splits were reported primarily for Taiwan (210,700 pounds). Exports of 490,700 pounds were primarily to Taiwan (168,700 pounds) and China (161,900 pounds).

Beef:

Net

sales of 15,600 MT reported for 2021 were up 49 percent from the previous week and 24 percent from the prior 4-week average. Increases were primarily for South Korea (7,300 MT, including decreases 500 MT), Taiwan (3,100 MT, including decreases of 100 MT),

Japan (2,800 MT, including decreases of 500 MT), China (600 MT, including decreases of 800 MT), and Mexico (500 MT, including decreases of 100 MT). Exports of 18,100 MT were down 3 percent from the previous week and 6 percent from the prior 4-week average.

The destinations were primarily to South Korea (5,200 MT), Japan (4,600 MT), China (3,900 MT), Mexico (1,200 MT), and Taiwan (1,200 MT).

Pork:

Net

sales of 33,500 MT reported for 2021 were up 39 percent from the previous week and 38 percent from the prior 4-week average. Increases primarily for Mexico (21,200 MT, including decreases of 600 MT), Colombia (4,200 MT, including decreases of 300 MT), Japan

(3,000 MT, including decreases of 100 MT), China (2,000 MT, including decreases of 400 MT), and Canada (1,000 MT, including decreases of 400 MT), were offset by reductions for Vietnam (100 MT). Exports of 28,200 MT were down 6 percent from the previous week

and 2 percent from the prior 4-week average. The destinations were primarily to Mexico (13,200 MT), China (4,700 MT), Japan (3,900 MT), South Korea (1,500 MT), and Canada (1,200 MT).

September

2, 2021 1 FOREIGN AGRICULTURAL SERVICE/USDA

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.