PDF Attached

CFTC

data will be out over the weekend.

WASHINGTON,

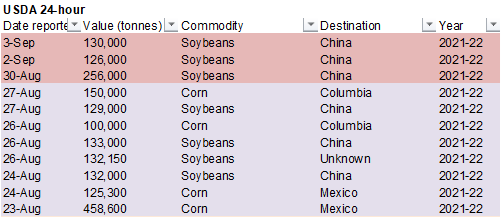

September 3, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 130,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

Higher

trade in the US soybean complex prices continue to rebound. Corn was lower on lack of fresh news and plummeting spot corn basis offers out of the Gulf. Wheat was higher on expectations for Russia to slow wheat sales next week. Holiday in the US Monday.

MOST

IMPORTANT WEATHER OF THE DAY

-

India

will likely turn too wet over the next ten days with flooding rainfall possible in some central parts of the nation

o

The wetter bias will be good for Gujarat and some neighboring areas of Rajasthan where soil moisture has been limited at times this summer

o

Northwestern Rajasthan will remain too dry

o

India’s overall production this year will be favorable, despite an uneven rainfall distribution at times

-

A

tropical cyclone will develop near Guam this weekend and move slowly toward the Ryukyu Islands. The storm will eventually turn toward South Korea and Japan, but not for at least a week -

Hurricane

Larry in the central Atlantic Ocean will become an impressive Category 4 hurricane this weekend, but it will remain far from major landmasses

o

The storm will eventually threaten Bermuda, but should pass to the east and then it may threaten Newfoundland Canada late next week

-

With

luck the storm will miss both areas -

A

new tropical disturbance may evolve in the western Gulf of Mexico early next week that could pose a threat to the U.S. coast.

o

The European forecast model suggests a tropical cyclone will evolve and move inland over the upper Texas coast.

o

The GFS model run suggests a much weaker storm that might threaten the Louisiana coast.

o

Landfall would not occur before mid-week next week and it might be more likely in the latter part of the week

-

Frost

and freezes occurred this morning in northern wheat and barley areas of Western Australia possibly impacting some of the crop as it moves toward reproduction.

o

Damage was not suspected of being serious enough to harm production

-

Rain

will fall in a part of northern New South Wales and Queensland, Australia late this weekend and early next week

o

The moisture is needed, but amounts will be limited and more will be needed

o

Southern parts of the nation will continue to get periodic rain events to maintain very good wheat, barley and canola production potentials

-

China

weather will be improving slowly, but additional wet weather will still impact many areas during the coming week with some heavy rain possible

o

The second week of the outlook should trend drier

-

Frost

and freezes could impact a part Xinjiang, China during the middle part of this month, but the coming week will likely turn drier and warmer

o

Some of the cotton in northeastern Xinjiang may still be a little immature for frost and freezes, but more detailed information is needed from the region to fully assess the potential impact if cold

arrives as advertised today

-

Frost

and freezes will also impact a part of western Russia early next week.

o

The impact on most crops will be minimal

-

There

is some concern over immature corn.

o

No damaging cold is expected in Ukraine or Russia’s Southern Region

o

Weather conditions may be too cloudy for hard freezes to occur in much of the region

-

South

Africa will get some showers in the coming week with the greatest rain possible in Free State where winter crops will benefit most from the moisture -

Europe

weather will be good for late summer crops to mature and for fieldwork of all kinds

o

Rainfall will be limited, although completely absent

o

Planting of early winter crops for 2022 has begun in the northeast part of the continent

-

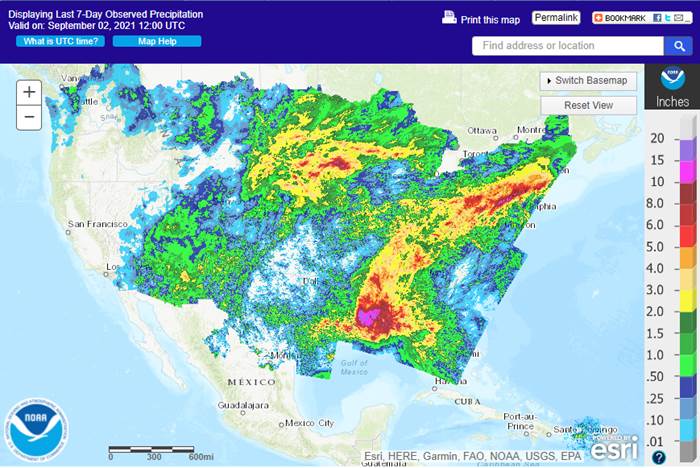

U.S.

rainfall Thursday and early today was greatest from the eastern Dakotas and Minnesota to Kansas and western Missouri

o

The rain event resulted from the remnants of Hurricane Nora that impacted western Mexico last weekend

o

This storm represents the last in a long series of beneficial rain events in the western Corn Belt

-

A

big improvement in soil moisture has occurred in the past couple of weeks in the northwestern Corn and Soybean Belt improving late season soybean development -

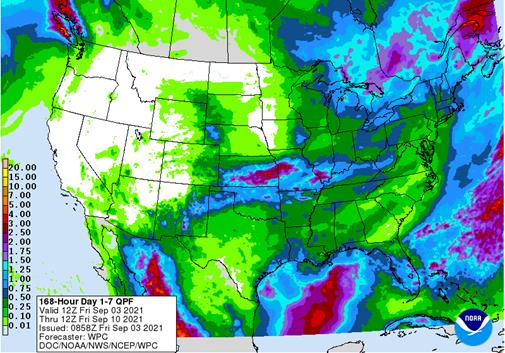

U.S.

weather will trend a little drier in the Midwest and Great Plains later this weekend and next week to help expedite summer crop maturation and some harvest progress -

West

Texas will receive a few showers this weekend into Monday followed by some brief cooling that may slow down crop maturation briefly

o

Additional dry and warm weather is needed and should evolve later next week

-

Very

warm to hot temperatures may evolve in the central United States late next week and into the following weekend

o

That event will help to expedite summer crop maturation and some harvesting

-

U.S.

hard red winter wheat production areas benefited from rain during overnight and more benefit is expected from showers and thunderstorms that advance to the south this weekend

o

Early season planting of 2022 crops has begun and this moisture will be ideal for inducing better planting and emergence conditions

o

The bulk of wheat planting will occur in October and more rain will be needed at that time

-

U.S.

Delta and southeastern states will experience a good mix of weather over the next week supporting aggressive crop development

o

A close watch will be made on the Gulf of Mexico next week to determine what the potential is for a land-falling tropical cyclone in either the Delta or southeastern states

-

U.S.

Northwestern Plains and southwestern Canada’s Prairies will be dry through the next ten days at least -

Most

of the far western U.S. will continue dry for the next ten days as well -

La

Nina will not start influencing the world until the end of September and more notably in October -

Western

Canada’s Prairies have been a little too wet this week and very cool; the region needs to see dry and warm weather

o

Some of that needed change should occur soon

o

Frost and freezes occurred this morning along the front range of the Canadian Rocky Mountains ending the growing season for only a few areas

o

Colder weather is expected near and beyond mid-month to induce the first widespread freeze event

-

Northern

and eastern parts of Canada’s Prairies will experience improved harvest weather this weekend and next week as rain frequency decreases and greater sunshine begins to occur

o

Some frosty weather may evolve late this weekend and again Tuesday and/or Wednesday mornings in the eastern Prairies

-

Ontario

and Quebec, Canada weather will be well mixed, although rainfall will be lighter than usual; temperatures will be near normal

o

Corn and soybean filling and maturing conditions will be good, but late season crops will need additional moisture over time

-

Mexico’s

west and southern crop areas will be a little too wet over the coming week resulting in some flooding and concern over crop conditions

o

Flooding was already a problem in southwestern and west-central coastal states of Mexico following Tropical Storm Nora’s onslaught of heavy rainfall last weekend, but most of that has probably come

to an end

o

Drier weather is needed in many areas

o

Northeastern Mexico will remain drier, but will receive some scattered showers and thunderstorms in the coming week

-

Argentina

received some welcome rain overnight in northern and eastern parts of the province

o

Western parts of the nation still need significant rain

-

Argentina

will continue to see periodic rainfall during the coming week and that should benefit many areas; including some of the western wheat areas that have been driest

o

However, a part of central and northern Cordoba will likely be missed by the greatest rainfall

-

Brazil

will see waves of rain in the south through the next ten days maintaining good crop weather from Rio Grande do Sul into Santa Catarina and a few southern Parana locations

o

Center west and center south crop areas will be dry until late next week when a few showers of light intensity are expected that may continue erratically into the following weekend

-

Resulting

rainfall will be light, but any moisture would be welcome after months of dryness

o

Early spring planting of corn is already under way in the south part of Brazil, but planting of corn and soybeans farther the north may not occur until late this month – at the earliest

-

A

tropical cyclone will evolve near Guam Monday and will intensify while moving toward the southern Ryukyu Islands of Japan during the week next week

o

The storm will be closely monitored for influence on Japan and/or South Korea

-

Southeast

Asia rainfall is expected to be frequent and sufficient to maintain favorable crop and soil conditions

o

Most all crop areas will get rain multiple times over the next two weeks and sufficient amounts will occur to support better long term development potentials

-

Pakistan

rainfall will remain restricted, but some showers will occur in the next ten days -

North

Africa showers in the next two weeks will occur briefly and lightly while temperatures are warmer biased leading to very little impact -

Colombia,

Venezuela and Central America will continue to receive frequent rainfall, but the intensity should be light -

West-central

Africa rainfall over the next ten days will be near to above average

o

Recent rain benefited many areas, although Ghana would still benefit from more rain

o

Cameroon and southeastern Nigeria have been drier biased in recent weeks, although no critical problem with dryness is suspected

o

Coffee, cocoa, rice, sugarcane and cotton development has been and will continue to be good this year

-

East-central

Africa showers and thunderstorms have been and will continue to be timely and beneficial resulting in a good outlook for coffee, cocoa, rice, sugarcane and other crops that are produced from Ethiopia into Uganda and southwestern Kenya.

-

Showers

in South Africa will be erratic and mostly very light over the coming week

o

Net drying is expected, although temperatures are seasonably mild limiting evaporative moisture losses

-

Southern

Oscillation Index was +5.31 today and the index should move erratically over the next week -

New

Zealand weather will include near to below average rainfall during the next week except in western parts of South Island where rainfall will be more significant

o

Temperatures will be seasonable to slightly cooler biased

o

Some frost and freezes were noted this morning

Source:

World Weather Inc.

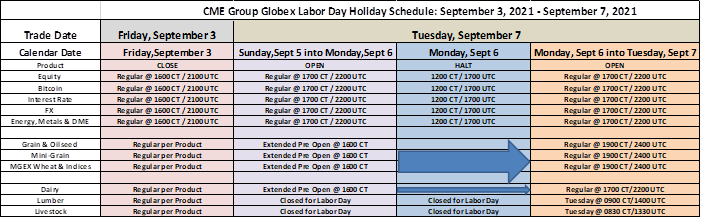

Monday,

Sept. 6:

- CNGOIC

monthly report on Chinese grains & oilseeds - Malaysia

Sept. 1-5 palm oil exports - New

Zealand Commodity Price - Ivory

Coast cocoa arrivals - HOLIDAY:

U.S., Canada

Tuesday,

Sept. 7:

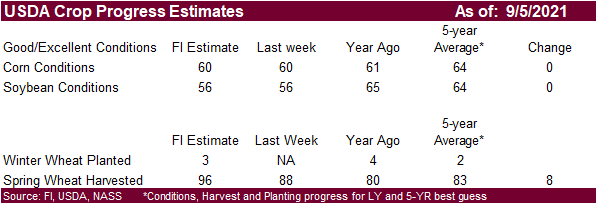

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn, cotton, soybeans; spring wheat harvest, 4pm - China’s

first batch of August trade data, including imports of soy, meat and edible oils - New

Zealand global dairy trade auction - Australia’s

September crop report - U.S.

Purdue Agriculture Sentiment - EU

weekly grain, oilseed import and export data - HOLIDAY:

Brazil

Wednesday,

Sept. 8:

- Meat

Atlas 2021 – facts and figures about the animals people eat - Canada’s

StatsCan releases data on wheat, barley, canola and durum stockpiles

Thursday,

Sept. 9:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - EIA

weekly U.S. ethanol inventories, production - Brazil’s

Conab report on yield, area and output of corn and soybeans - Port

of Rouen data on French grain exports - UkrAgroConsult

Black Sea oilseed conference

Friday,

Sept. 10:

- USDA’s

monthly World Agricultural Supply and Demand Estimates (WASDE) report, noon - China

farm ministry’s CASDE outlook report - ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

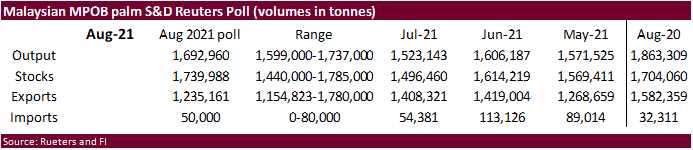

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysian

Palm Oil Board data on August stockpiles, output and exports - FranceAgriMer

weekly update on crop conditions - Malaysia

Sept. 1-10 palm oil export data - HOLIDAY:

India

Source:

Bloomberg and FI

StoneX

Crop Survey Results

Corn

Production 14998

Yield

177.5

Soybean

Production 4409

Soybean

yield 50.8

IHS

Markit Sep US production

Corn

15.091 vs. 14.750 USDA

Soybeans

4.358 vs. 4.339 USDA

Cotton

17.732 vs. 17.264 USDA

74

Counterparties Take $1074.707 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1066.987 Bln, 70 Bidders)

US

Change In Nonfarm Payrolls Aug: 235K (est 733K; prevR 1053K; prev 943K)

US

Unemployment Rate Aug: 5.2% (est 5.2%; prev 5.4%)

US

Average Hourly Earnings (M/M) Aug: 0.6% (est 0.3%; prevR 0.4%)

US

Average Hourly Earnings (Y/Y) Aug: 4.3% (est 3.9%; prevR 4.1%; prev 4.0%)

US

Change In Private Payrolls Aug: 243K (est 610K; prevR 798K; prev 703K)

US

Change In Manufacturing Payrolls Aug: 37K (est 25K; prevR 52K; prev 27K)

US

Average Weekly Hourly All Employees Aug: 34.7 (est 34.8; prevR 34.7; prev 34.8)

US

Labor Force Participation Rate Aug: 61.7% (est 61.8%; prev 61.7%)

US

Underemployment Rate Aug: 8.8% (prev 9.2%)

Canadian

Labor Productivity (Q/Q) Q2: 0.6% (est 1.6%; prev -1.7%)

·

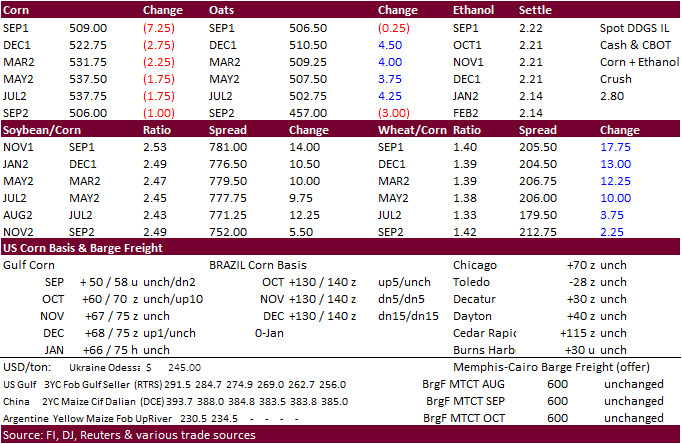

Corn opened and ended lower on lack of fresh news and plummeting spot corn basis offers out of the Gulf. Overall news is light. Expect positioning today ahead of the long holiday weekend.

·

Spot Gulf corn and soybean basis tanked this week in large part from hurricane Ida.

·

Ukraine started their corn harvest and they are off to a very good start.

·

France reported corn conditions as of Aug. 30 steady at 91% good or excellent.

·

Brazil is investigating a possible mad cow case.

Export

developments.

·

China auctioned off only 9,063 tons or 9% of the 111,321 tons of imported US corn offered and was unable to sell any of the 13,180 tons of imported Ukrainian corn on Friday.

U

of I: Using Preliminary August FSA Data to Project Final 2021 Planted Acreage for Corn and Soybeans

Irwin,

S. “Using Preliminary August FSA Data to Project Final 2021 Planted Acreage for Corn and Soybeans.” farmdoc daily (11):128, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 2, 2021.

CIF

barge corn and soybean basis

Updated

8/20/21

December

corn is seen in a $4.75-$6.00 range

Soybeans

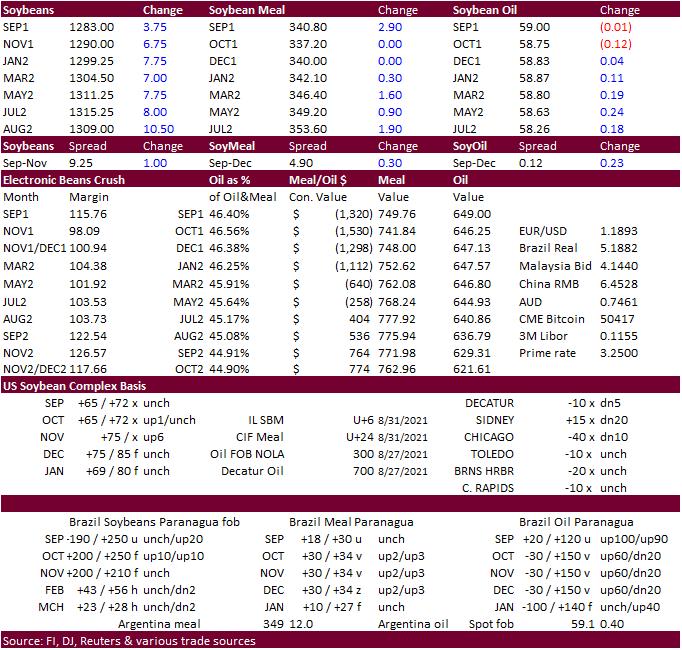

·

Brazil 2022 soybean forward sales reached 26 percent or 36.3 million tons of the Safras projected new-crop crop production of 142.2 million tons, well down from 49 percent at this time a year ago. 2020-21 soybean crop was 86

percent sold (Safras).

·

Russia’s export tax for sunflower oil will increase to $227.2 per ton for October, up from $169.9 per ton in September. The October tax is based on an indicative price of $1,324.7 per ton.

·

On Thursday, Bunge (Decatur, IN) cancelled 98 soybean oil registrations. SBO registrations stand at 300.

·

Argentina’s farming associates are exploring a potential strike over the government extending limits on beef exports.

Export

Developments

- USDA

reported private exporters sold 130,000 tons of soybean to China.

Updated

8/31/21

Soybeans

– November $11.75-$14.50 range

Soybean

meal – December $320-$395

Soybean

oil – December 52-65 cent range

·

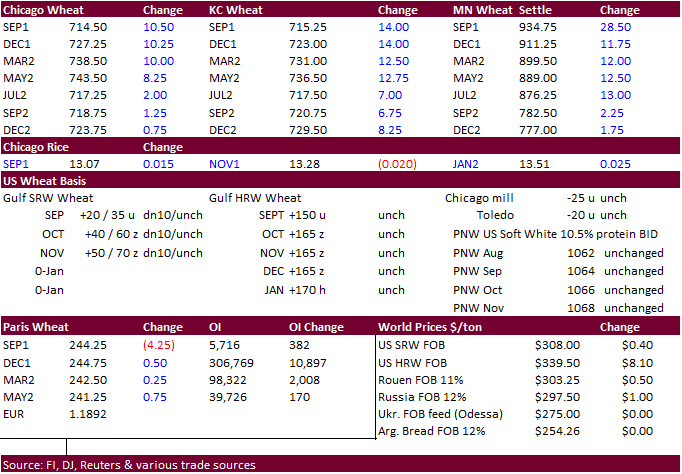

Wheat ended higher on Friday on expectations for Russia to slow wheat sales next week.

·

The USD was 23 points lower as of 1:15 pm CT.

·

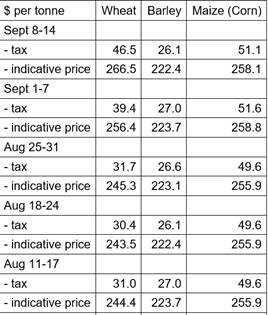

Russia increased their export tax on wheat to 46.5 USD/ton for the September 8-14 period from 39.40/ton September 1-7, highest weekly tax since at least early June.

·

French wheat test weights are weak in quality. Only 39% of the crop was estimated to surpass the 76 kg per hectoliter (kg/hl) minimum per reported from Reuters citing the AgMin.

·

France harvested 99% of the soft wheat crop by Aug. 30 compared with 96% the previous week.

·

December Paris wheat settled up 0.25 euros, or 0.1%, at 244.50 euros ($290.61) a ton.

·

Ukraine exported 9.14 million tons of grain so far in the 2021-22 July-June season versus 8.04 million at the same point a year earlier, according to the AgMin. This includes nearly 5 million tons of wheat, 2.84 million tons

of barley and 1.27 million tons of corn.

·

Kazakhstan is about 50 percent harvested for summer grains.

Russian

export taxes via Reuters

US

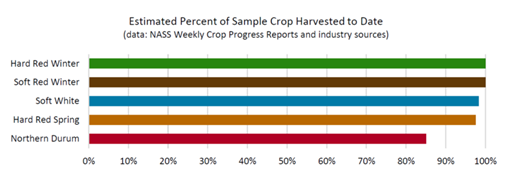

Wheat Associates:

“With

harvest complete, this is the final weekly report for HRW harvest; sample analysis continues. SW harvest is winding down and data still reflect a stressed crop. HRS harvest is nearing completion and this year’s crop currently grades at U.S. No. 1 Dark Northern

Spring. The northern durum samples are in with the current grade a U.S. No. 2 Hard Amber Durum.”

Export

Developments.

·

Taiwan bought 48,875 tons of various class US wheat for October 15-Novmeber 1 shipment.

·

Turkey seeks 245,000 tons of animal feed barley on September 7 for Sep 15-Oct 8 shipment.

·

Pakistan seeks 550,000 tons of wheat on September 7 for October through November shipment.

·

Jordan seeks 120,000 tons of wheat, set to close September 8 for late December through February 14 shipment.

·

Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

Rice/Other

- South

Korea seeks 42,200 tons of rice for arrival in South Korea between February 28 and April 2022. 20,000 tons of that is of US origin, rest optional .

Updated 8/31/21

December Chicago wheat is seen in a $6.80‐$8.00

range

December KC wheat is seen in a $6.60‐$7.80

December MN wheat is seen in a $8.45‐$9.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.