PDF Attached

Calls:

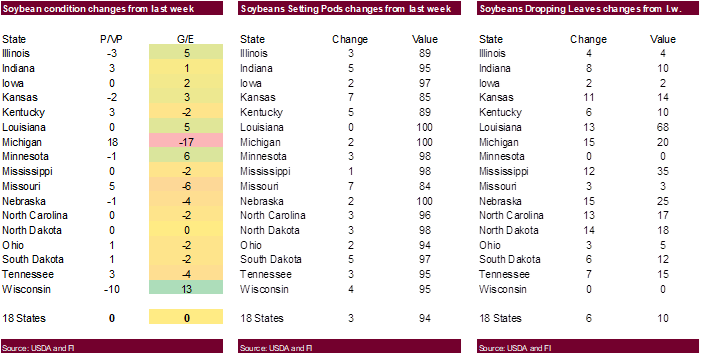

Soybeans

steady to 5 lower on follow through selling from Argentina producer selling

Meal

steady to $1.00 lower

Oil

steady to 40 points lower

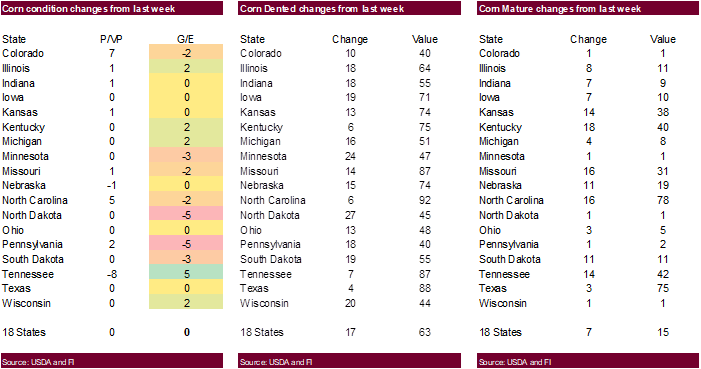

Corn

steady to 2 lower

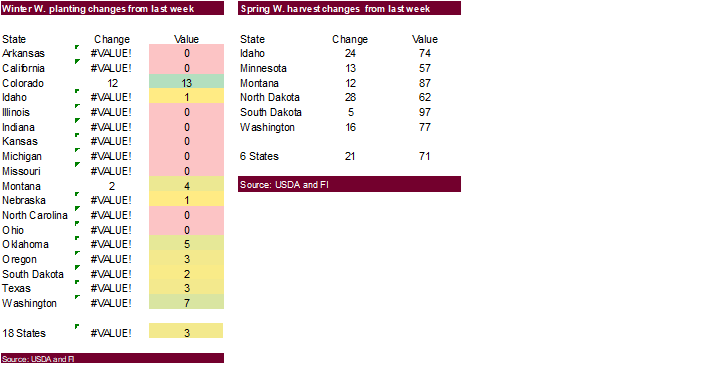

Wheat

steady to 3 lower

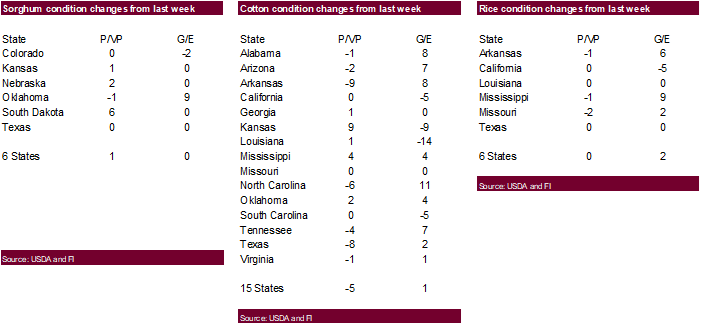

Look

for light precipitation, if any, to develop across the northern Great Plains and some of the west central areas through Saturday. This week rains are forecast drier in the northwest. SD, NE into KS. IA will see rain. Precipitation will also fall across other

parts of the northern Corn Belt. The US southeast areas will see rain, slowing harvest progress and drying rates for corn. Europe will see additional rain this week bias western growing areas, Poland and Romania.