PDF Attached

WASHINGTON,

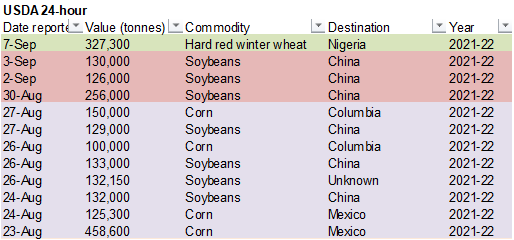

Sept. 7, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 327,300 metric tons of hard red winter wheat for delivery to Nigeria during the 2021/2022 marketing year.

Lower

trade on a higher USD, Gulf grain operations reopening, and expectations for USDA to report upward revisions to US corn and soybean crop production. Australia is expected to produce a very large wheat and canola crop. US corn conditions declined 1 point

to 59 (trade 60) and soybeans improved one point to 57 (trade 57).

MOST

IMPORTANT WEATHER OF THE DAY

- India

is still facing two monsoon depressions and waves of heavy rain associated with each over the next ten days - Heavy

rain already occurred during the extended weekend from northeastern Andhra Pradesh to parts of Maharashtra where rainfall varied from 2.00 to more than 8.00 inches - Some

flooding may already be under way - The

greatest rainfall the remainder of this workweek will occur from Maharashtra to Gujarat and southern Rajasthan where 2.00 to 6.00 inches and local totals of 8.00 to more than 12.00 inches will result in flooding

- Gujarat

and northern Maharashtra will be wettest - Some

crop damage will be possible because of flooding - Monsoon

depression number two will move over the Odisha border from the Bay of Bengal early next week and move to eastern Gujarat and southern Rajasthan with rainfall of 2.00 to more than 6.00 inches occurring once again from northeastern Andhra Pradesh, southern

Odisha and southern Chhattisgarh to Gujarat and southern Rajasthan - A

few days of drying will occur between each of the monsoon depressions to help flood water recede a bit, but flooding is possible from both events causing some damage to summer crops; including rice, soybeans, groundnuts, cotton, corn, sorghum, pulses and others - Australia

needs greater rain in northern New South Wales, Queensland and northern parts of Western Australia to improve reproductive conditions for wheat and barley - Southern

Australia soil moisture is still rated favorably with little change likely

- Australia

rainfall was greatest in central and eastern Victoria crop areas and near the Great Dividing range during the weekend - Most

areas reported 0.05 to 0.79 inch with a few totals of 1.00 to 2.50 inches from central Victoria to south-central New South Wales - Eastern

Queensland rainfall was minimal - Western

Australia and parts of South Australia rainfall was minimal as well - Weekend

temperatures were warm in the east and seasonably mild elsewhere. - Europe

weather will be very good for harvest and early season winter crop planting over the next ten days - Eastern

Europe will dry out most for the next ten days and some winter crop areas in the Balkan Countries will continue in need of greater soil moisture, despite some relief in the past week or two

- Some

southern CIS winter crop areas will need significant rain soon to support wheat, rye and barley germination, emergence and establishment - Cool

weather during the weekend had little impact on recently planted winter crops and may have slowed summer crop maturation - Drying

recently has been supportive of quick summer crop maturation and harvest progress - Precipitation

over the next couple of weeks will be greatest in norther n and some central parts of the CIS - Additional

cool weather is expected for a while which may induce more frost and freezes - Weekend

frost and freezes in Russia and neighboring areas of Belarus and the Baltic States had no lasting impact on winter or summer crops - None

of the cold reached down into the more important summer crop areas where corn, soybeans and other crops are still finishing out their development - China

reported another weekend of excessive rain in northeastern Sichuan, Shaanxi, southern Shanxi, northern and eastern Henan, Shandong and northern Jiangsu

- Rain

totals since Friday in these areas ranged from 3.50 to more than 7.00 inches and local amounts reached up to 18.23 inches in northeastern Sichuan - Flooding

was serious in northeastern Sichuan - Rain

elsewhere in the Yellow River Basin and North China Plain was less than 2.50 inches.

- Net

drying occurred in the Northeast Provinces and in the interior southern parts of China through Sunday, although a few thunderstorms did occur south of the Yangtze River in pockets producing 0.30 to 1.25 inches

- One

location reported 3.70 inches of rain - Showers

increased in both the northeast and southern parts of China Monday, although no excessive amounts were noted

- Heilongjiang

was mostly dry during much of the weekend along with some areas near and south of the Yangtze River - Temperatures

were very warm in the drier areas of the south and seasonable elsewhere - East-central

China will be driest over the next ten days; including the middle and lower Yellow River Basin - Rainfall

in the Yangtze River Valley will be light and erratic as well, although some rain will fall in that region - Northeastern

China will get periods of rain over the next ten days and may be excessively wet at times - Drying

will be needed soon to protect summer crop quality and to induce better drying conditions ahead of the harvest season - Some

delay in early season fieldwork is expected because of rain - Tropical

Storm Conson was located 184 miles southeast of Manila at 0900 GMT today near 12.7 north, 123.0 east moving west northwesterly at 13 mph and producing maximum sustained wind speeds of 52 mph near its center.

- Rainfall

to more than 6.00 inches has already occurred in association with the storm in the central Philippines and more will fall through Wednesday before the storm exits from the region.

- Conson

will regain intensity as it moves out over open water in the South China Sea Thursday into the weekend - The

storm will ultimately move toward Hainan, China reaching there Saturday and Sunday and it may continue to move toward northern Vietnam with landfall there possible early next week - The

storm may become a typhoon again prior to reaching Hainan and if the storm misses Hainan it could reach Vietnam as a typhoon as well - Very

heavy rain and flooding will occur in parts of the Philippines and especially over Hainan, China where some damage may occur to sugarcane and rice in both countries - Damage

in the Philippines will be relatively light, but some loss to crops and property is possible - Typhoon

Chanthu was located 1142 miles southeast of the southern tip of Taipei, Taiwan near 16.2 north, 135.3 east moving west northwesterly at 12 mph and producing maximum sustained wind speeds of 74 mph - Tropical

Storm force wind was occurring out 50 miles from the center of the storm while typhoon force wind (greater than 74 mph) was occurring out 15 miles - Typhoon

Chanthu will move toward southern Taiwan over the next few days and could become a strong typhoon as the week progresses - The

storm will need to be closely monitored because of its potential impact on Taiwan and southeastern China - Landfall

in Taiwan will occur no sooner than Saturday, but the storm could begin influencing the island sooner than that - There

is some potential the storm will only skirt southern Taiwan and then move into Fujian China later in the weekend or early next week as a strong storm. - Damaging

wind and flooding rain will impact Taiwan as the storm passes to the south.

- Major

Hurricane Larry was located 830 miles southeast of Bermuda near 23.8 north, 55.1 west at 0900 GMT today. The storm was moving northwesterly at 10 mph producing maximum sustained wind speeds of 120 mph.

- Hurricane

force wind was occurring out 70 miles out from the center of the storm while tropical storm force wind speeds were occurring out 185 miles

- Larry

should pass to the east of Bermuda Thursday, but the storm will be large enough to produce some rough seas, strong wind and rain over Bermuda - The

weather in Bermuda is not likely to reach damaging proportions - Larry

will eventually move to Newfoundland, Canada Friday into the weekend - A

region of disturbed tropical weather continues to move away from the Yucatan Peninsula and toward the central Gulf of Mexico

- This

disturbance will bring some heavy rain and thunderstorm activity to the U.S. Florida upper coast and the Florida Panhandle later this week possibly resulting in some flooding - The

system is being closely monitored for additional development, but the environment may not be very supportive of an organized tropical cyclone – at least not based on the latest data until after the system crosses the southeastern United States later this week

and reaches the Atlantic Ocean - The

center of this disturbance was located 671 miles south southwest of Apalachicola, Florida at 0800 EDT today.

- U.S.

weather over the next seven days will be very good for Midwest, Delta and Great Plains summer crop filling, maturation and harvesting - Rain

is expected in the Great Lakes region only with 0.50 to 1.50 inches of rain expected from two weather disturbances that pass across the region - A

couple of frontal systems are expected to push through the Midwest during the second week of the forecast offer a little more rainfall, but most of the precipitation will be brief and light for the northern and central Plains and Midwest

- U.S.

temperatures in this coming week will be very warm to hot in the western U.S. from the high Plains region to the Pacific Coast excepting the Columbia River Basin where temperatures will be closer to normal - Temperatures

will be closer to normal in the Midwest, Delta and southeastern states with a few areas slightly cooler than usual - U.S.

temperatures next week will be warmer than usual in the Plains and interior western U.S. while seasonably warm to the east - The

bottom line for much of the U.S. key grain and oilseed production areas during the next two weeks will be favorable for late season crop development, crop maturation and harvesting, despite some greater rain potential next week. Wheat planting in the southwestern

Plains should advance well with quick emergence for areas that just received rain this weekend.

- U.S.

weekend rainfall was most significant from Colorado and parts of the Texas Panhandle to the lower Midwest and a few areas in the Delta - Rain

was greatest in parts of Kansas and Missouri where local flooding occurred Friday into Saturday

- Lighter

rain fell in the lower Midwest, but amounts in most of these areas ranged from 1.00 to 3.00 inches with local amounts of 3.00 to 6.64 inches with the interior southeastern parts of Kansas and west-central Missouri wettest

- Some

local totals of 1.00 to 4.00 inches also occurred in southeastern Missouri and 1.00 to 3.00 inches in interior southern Illinois - Rain

totals in most other areas was rarely more than 1.00 inch with many areas reporting less than 0.50 inch - Rainfall

in the northern Plains and upper Midwest was minimal and amounts in the Delta were erratic and light, although more than 1.00 inch fell in a few areas - The

southeastern states were dry from southern Alabama to North Carolina and West Virginia while Florida received some locally heavy rainfall

- West

Texas reported scattered showers with erratic rainfall and a few amounts of up to 1.40 inches. Most of the rainfall was too light and sporadic to seriously change soil moisture - Weekend

temperatures were warm in much of the nation, especially in the west and south-central states, though, where extremes in the 90s a few readings above 100 were noted - Drought

will continue in the northwestern Plains - California

and the interior Pacific Northwest will remain dry - Canada’s

Prairies received a restricted amount of rain during the weekend during the weekend favoring crop maturation and harvest progress - Temperatures

were mild to warm with many highs in the 70s and 80s Fahrenheit and lows in the upper 30s and 40s with a few lower 50s as well - Southern

Canada’s Prairies are not likely to receive much rain over the next ten days - Rain

will fall in southwestern and west-central Alberta and across some central Saskatchewan and Manitoba locations, but the resulting rain will be light - Drought

conditions will prevail in the southwestern Prairies - Ontario

and Quebec, Canada will experience a good mix of weather over the next two weeks supporting late season filling and maturation of summer crops - Central

America and southern and eastern Mexico will remain wet biased during the next ten days with near to above normal rainfall - A

tropical disturbance in the western Caribbean Sea late this week may move across the Yucatan Peninsula during the weekend and could become a tropical cyclone in the western Bay of Campeche during the weekend before impacting northeastern Mexico and southern

Texas later next week - Confidence

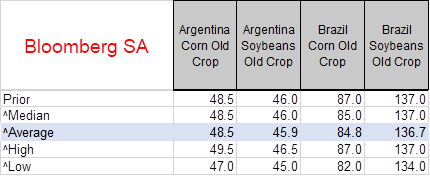

is very low - Argentina

rainfall through Wednesday will be greatest in Buenos Aires and La Pampa as well as from Uruguay to parts of Santa Fe, but rainfall elsewhere will be more limited for the next ten days

- The

moisture will be good for wheat and for future planting of early corn and sunseed - Rain

will still be needed in Cordoba, parts of Santa Fe and Santiago del Estero where dryness will remain significant - Most

of western Argentina still needs a general soaking rain - Brazil

rainfall will be heavy early today and again Sunday into Monday in Rio Grande do Sul where some flooding will be possible in some of its rice and corn production region areas - Rainfall

elsewhere in Brazil will be more restricted; however, Northern Mato Grosso may experience some periodic showers over the next ten days - Initial

rainfall in Mato Grosso will be too light for early autumn soybean planting, but the environment may improve next week and later this month - Flooding

in Rio Grande do Sul this week, could threaten some of the wheat crop, but only a small amount of spring planting has likely occurred so far and if there is any damage to those crops there would be plenty of time to replant - Coffee,

citrus and sugarcane areas will stay mostly dry for another week to ten days, although some showers will occur in Sul de Minas Friday and Saturday - South

America rain was mostly significant in interior southern Argentina and southern Brazil during the weekend - Rainfall

in Argentina through dawn Monday varied from 0.10 to 0.62 inch with a few amounts of 1.00 to 1.58 inches

- Most

of the rain occurred from southernmost Cordoba and La Pampa into Buenos Aires - Rainfall

in southern Cordoba ranged from 0.05 to 0.88 inch with most areas reporting less than 0.20 inch - Rainfall

in southern Brazil varied from 0.05 to 0.72 inch with most of that occurring from Rio Grande do Sul to western and southern Parana and southern Mato Grosso do Sul as well as southern Paraguay - Dry

weather occurred elsewhere - Brazil

temperatures heated up to the 90s and over 100 degrees Fahrenheit Friday through Sunday with extremes of 100 to 106 occurring in Mato Grosso and western Goias

- Argentina

temperatures were mild in the south and very warm in the north contrasting with highest afternoon temperatures in the upper 50s and 60s in the far south to the 80s and some 90s in the far north - Europe

weather during the weekend included limited rainfall and warm temperatures - Weather

this week is expected to continue warm with the greatest rain falling in France and Germany while other areas slowly dry out

- The

environment should be very good for late season summer crop development, maturation and harvest progress - CIS

weekend precipitation occurred from Belarus into western Russia and in the Ural Mountains region Friday through this morning - The

precipitation was mostly light, although a few 1.00 to 2.00-inch totals were noted - Net

drying occurred farther to the south in Ukraine, Russia’s Southern Region and the middle and lower Volga River Basin favoring summer crop maturation and harvest progress - Frost

and freezes occurred in portions of west-central and northwestern Russia during the weekend, but no serious harm was suspected to its unharvested crops or recently planted winter cereals - Cool

weather will continue in the western CIS this week with additional bouts of frost and a few freezes mostly in Russia - No

serious damage to crops will occur - Summer

crops in the south will not get cold enough for frost or freezes and no harm will come to the region - Spring

wheat and sunseed crops in the New Lands will also be subjected to frost and freezes for during the coming week to ten days, but crops should be mature enough to avoid any negative impact - Precipitation

in the CIS will be periodic, but light enough to have a limited impact on crops soil conditions during the next ten days - Some

disruption to harvesting is expected, but progress will be made - Winter

grain planting will also advance around the precipitation - Southeast

Asia rainfall will remain sufficient to carry on favorable crop development from the mainland areas into the Philippines and Indonesia and Malaysia during the next ten days - There

is some potential for excessive rain and flooding in a part of the Philippines and possibly in a few areas of mainland Southeast Asia - Flooding

rain is expected in Taiwan from Typhoon Chanthu - Rainfall

will be lightest in parts of Sumatra and Peninsular Malaysia where some net drying is possible and the region will need to be closely monitored - Temperatures

will be a little cooler than usual - New

Zealand will be extra wet this week while temperature are little cooler than usual - The

entire nation will be wetter than usual especially in South Island - Frost

and freezes were noted during the weekend, but there should not have been any negative impact on crops - Southern

Oscillation Index was +7.70 today and the index has been steady rising over the past week.

- This

week’s index will likely move a little more erratically and may drift lower for a little while - South

Africa rainfall should be mostly confined to the southeast early to mid-week this week with Natal most favored.

- West-Central

Africa will get sufficient rainfall during the next ten days to support its coffee, cocoa, rice sugarcane and other crops - Cotton

in west-central Africa is rated favorable and has likely yielded well this year

Source:

World Weather Inc.

Tuesday,

Sept. 7:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn, cotton, soybeans; spring wheat harvest, 4pm - China’s

first batch of August trade data, including imports of soy, meat and edible oils - New

Zealand global dairy trade auction - Australia’s

September crop report - U.S.

Purdue Agriculture Sentiment - EU

weekly grain, oilseed import and export data - HOLIDAY:

Brazil

Wednesday,

Sept. 8:

- Meat

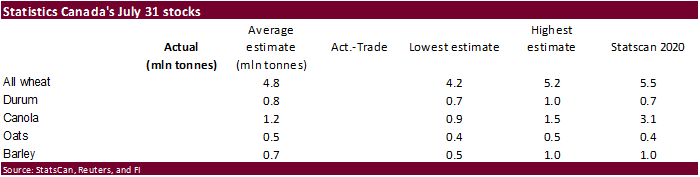

Atlas 2021 – facts and figures about the animals people eat - Canada’s

StatsCan releases data on wheat, barley, canola and durum stockpiles

Thursday,

Sept. 9:

- USDA

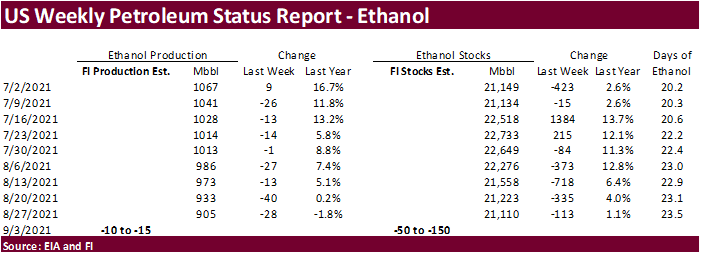

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - EIA

weekly U.S. ethanol inventories, production - Brazil’s

Conab report on yield, area and output of corn and soybeans - Port

of Rouen data on French grain exports - UkrAgroConsult

Black Sea oilseed conference

Friday,

Sept. 10:

- USDA’s

monthly World Agricultural Supply and Demand Estimates (WASDE) report, noon - China

farm ministry’s CASDE outlook report - ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

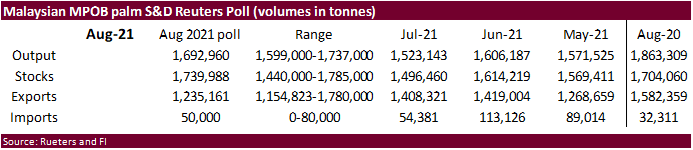

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysian

Palm Oil Board data on August stockpiles, output and exports - FranceAgriMer

weekly update on crop conditions - Malaysia

Sept. 1-10 palm oil export data - HOLIDAY:

India

Source:

Bloomberg and FI

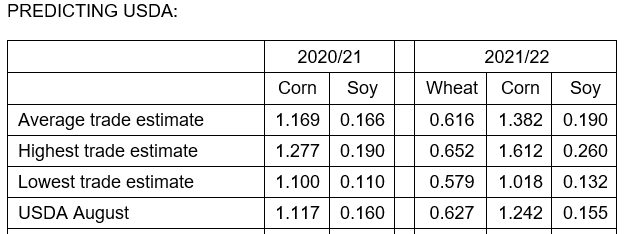

US

inventories (Reuters)

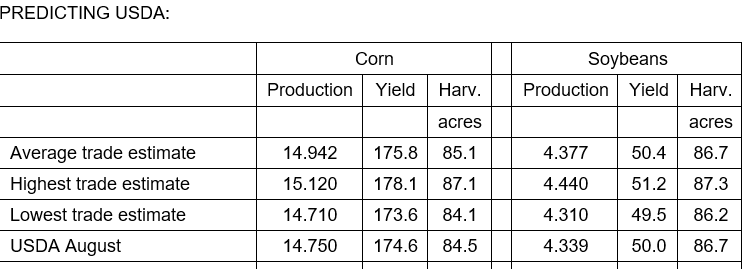

US

production (Reuters)

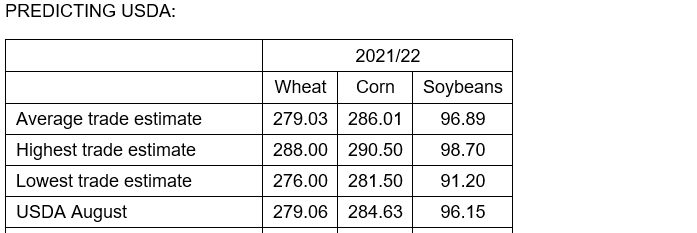

World

inventories (Reuters)

|

USDA |

||||

|

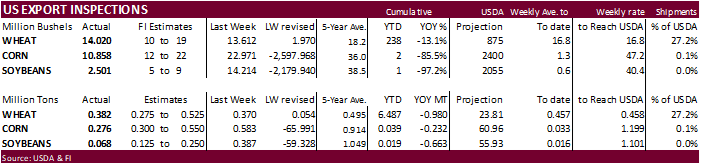

Wheat |

381,551 |

versus |

150000-525000 |

range |

|

Corn |

275,799 |

versus |

125000-550000 |

range |

|

Soybeans |

68,059 |

versus |

50000-250000 |

range |

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING SEP 02, 2021

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 09/02/2021 08/26/2021 09/03/2020 TO DATE TO DATE

BARLEY

0 0 1,996 6,550 5,727

CORN

275,799 583,498 887,889 39,453 271,920

FLAXSEED

0 0 72 24 389

MIXED

0 0 0 0 0

OATS

0 0 48 100 948

RYE

0 0 0 0 0

SORGHUM

3,831 74,186 33,144 1,317 33,096

SOYBEANS

68,059 386,839 1,512,819 18,778 682,227

SUNFLOWER

0 0 0 0 0

WHEAT

381,551 370,461 699,386 6,487,016 7,467,467

Total

729,240 1,414,984 3,135,354 6,553,238 8,461,774

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Due

out Wednesday morning

77

Counterparties Take $1079.945 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1074.707 Bln, 74 Bidders)

·

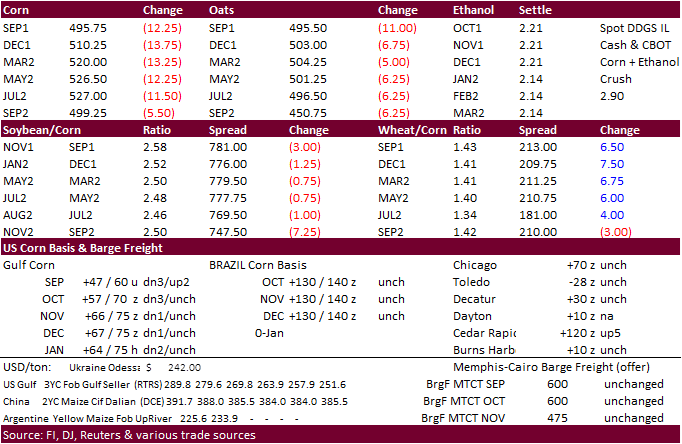

Corn ended lower from the strength in the USD, bearish technical signals (head and shoulders), and US harvest pressure. It will be drier this week for the US than that of last week, especially in the south. We hear harvesting

activity for corn, rice and milo is at full steam in Arkansas near Memphis, TN.

·

We see support in December corn at $5.0350, then $4.90.

·

There was talk the US corn crop could improve after rains fell over the past week. Traders are already looking for higher corn harvested area to be reported by USDA on Friday.

·

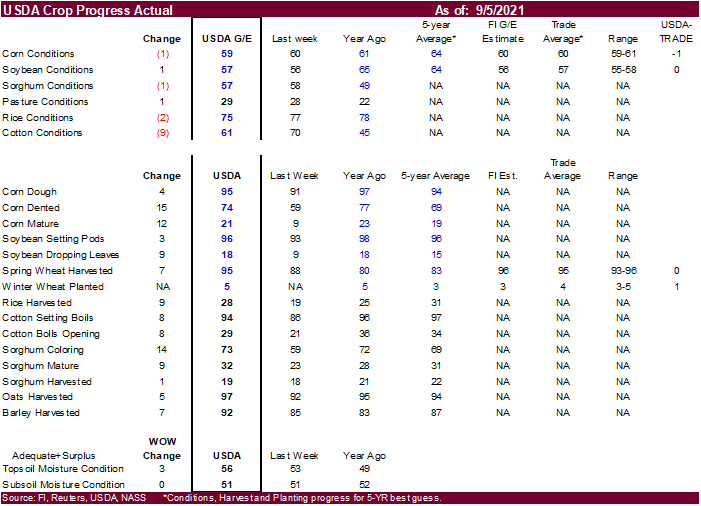

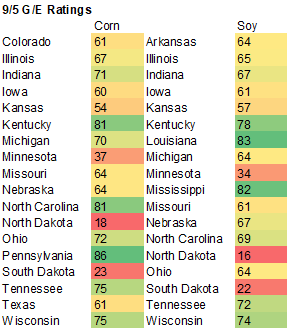

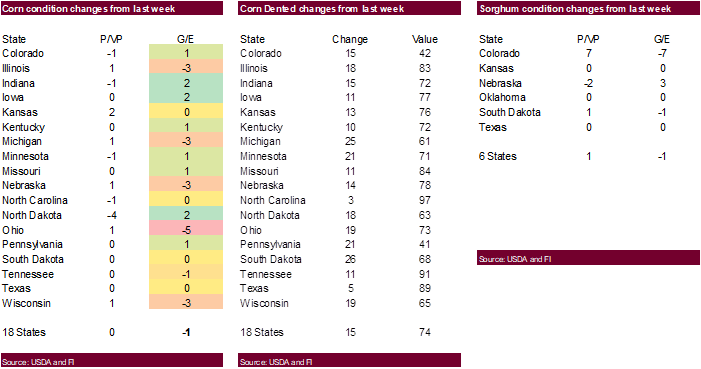

US corn conditions declined 1 point to 59 (trade 60) and soybeans improved one point to 57 (trade 57). US corn conditions for the G/E categories of 59 compares to 61 year ago and 64 average. IL declined 3 points. NE was off

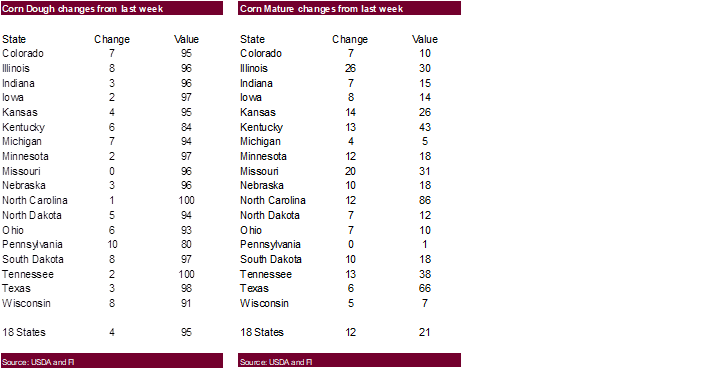

3 and OH was down 5. IN and IA improved 2 points. Corn dough was 95 percent versus 94 average, corn dented 74 percent, above 69 average, and corn mature 21 percent versus 19 percent average.

·

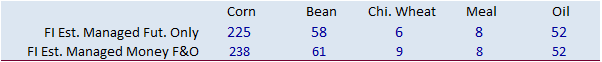

Funds sold an estimated net 11,000 corn contracts today.

·

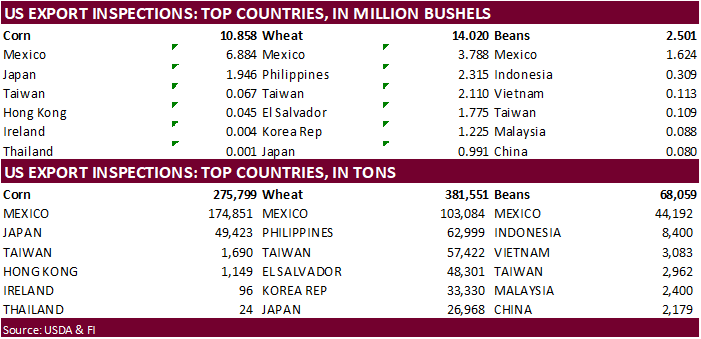

USDA US corn export inspections as of September 02, 2021 were 275,799 tons, within a range of trade expectations, below 583,498 tons previous week and compares to 887,889 tons year ago. Major countries included Mexico for 174,851

tons, Japan for 49,423 tons, and Taiwan for 1,690 tons.

·

AgRural sees Brazil corn crop at 81.9 million tons from 82.2 previously, more than 20 million tons below last year’s 102.6-million-ton harvest. AgRural estimated Brazil’s first corn crop to be planted in 2.973 million hectares,

up 0.6% from the previous season.

·

AgRural reported the summer corn planted area is 10 percent complete.

·

China’s state planner said on Monday several provinces have bought up pork for their reserves and others plan to buy the meat during September as well as the fourth quarter. (Reuters)

·

China is hopeful Brazil beef exports will resume after 2 cases of mad cow disease were reported in Brazil over the weekend.

·

China August meat imports fell 9 percent to 758,000 tons from year earlier and compares to 854,000 tons during July 2021. China has imported 6.69 million tons of meat for the first eight months of the year, up 1.7% from the same

period a year ago.

·

(Bloomberg) — China’s top agricultural think tank reduced its estimate for the country’s corn consumption in 2020-21 as high prices bolstered the use of substitutes in animal feed. The China National Grain & Oils Information

Center cut its forecast for domestic corn demand by 2 million tons to 276 million tons in the marketing year ending September.

Export

developments.

·

China plans to sell 133,753 tons of US corn on September 10 and 8,277 tons from Ukraine.

Updated

8/20/21

December

corn is seen in a $4.75-$6.00 range

·

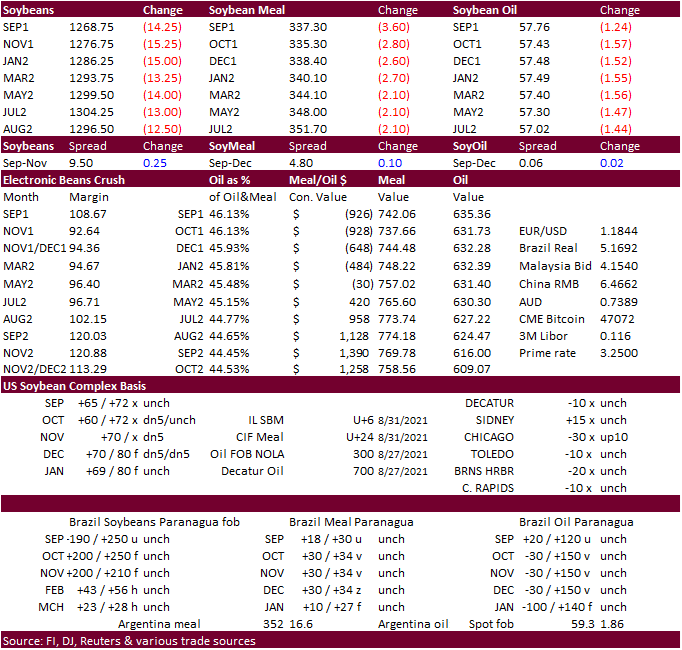

US soybean complex traded lower despite US Gulf loadings starting to resume. USDA export inspections were poor, as expected. We are hearing a cargo of soybeans is loading at Port Allen, and many more terminals are back up and

running. A

sharply higher USD added pressure to the soybean complex. Basis is starting to ease at the Gulf.

·

Funds sold an estimated net 7,000 soybeans, 1,000 meal and 3,000 soybean oil.

·

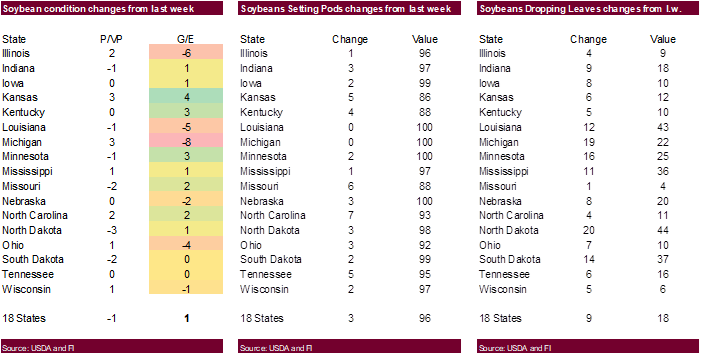

US corn conditions declined 1 point to 59 (trade 60) and soybeans improved one point to 57 (trade 57). US soybean conditions for the G/E categories of 57 compares to 65 year ago and 64 average. Il was down 6 points, LA down

5, MI down 8 and OH down 4. KS improved 4 points. Soybeans setting pods were 96 percent versus 96 average and soybeans dropping leaves were 18 percent versus 15 average.

·

USDA US soybean export inspections as of September 02, 2021 were 68,059 tons, within a range of trade expectations, below 386,839 tons previous week and compares to 1,512,819 tons year ago. Major countries included Mexico for

44,192 tons, Indonesia for 8,400 tons, and Vietnam for 3,083 tons.

·

Soybean inspections for the week ending September 2 out of the Gulf were zero. Corn was 108,444.

·

China August soybean imports were 9.49 million tons, slightly below 9.6 million tons during August 2020 and compares to 8.67 million in July.

·

Ukrainian sunflower oil exports totaled 5.277 million tons in 2020-21 (September to August), according to the national sunflower oil producers’ association, down from 6.684 million in 2019-20. 2021-22 exports are expected to

top 6 million tons.

·

Argentina raised their domestic prices for bioethanol and biodiesel that are mandatory to mix with gasoline and diesel. Bioethanol from sugar cane or corn was set at 59.35 pesos per liter (around $0.61), from a previous level

of 55.663 pesos per liter. Biodiesel was raised to 122,453 pesos per ton ($1,251) for September for mixture with diesel, rising to 124,900 pesos for October and 127,400 pesos in November. The previous price, set in July, was 112,000 pesos per ton. (Reuters)

·

Brazil was on holiday today.

·

Brazil 2022 soybean forward sales reached 26 percent or 36.3 million tons of the Safras projected new-crop crop production of 142.2 million tons, well down from 49 percent at this time a year ago. 2020-21 soybean crop was 86

percent sold (Safras).

·

ABARES estimated Australia’s canola crop at 5 million tons, up 20 percent from their June projection.

·

Strategie Grains reduced slightly its EU rapeseed production to 16.93 million tons from 17.03 million.

·

MPOB estimated the 2021 Malaysia palm oil at 18MMT vs 19.14 million for 2020. Exports were estimated at 16.3 vs 17.37 last year. Stocks were pegged at 1.7 million. The average palm oil prices was pegged at 4000 ringgit per

MT.

USDA

Attaché: European Union – Oilseeds and Products Semi-Annual Report

Export

Developments

- None

reported

Updated

8/31/21

Soybeans

– November $11.75-$14.50 range

Soybean

meal – December $320-$395

Soybean

oil – December 52-65 cent range

·

Wheat futures ended lower on a firm USD (+48 by 2 pm CT) and large Australian crop production estimate. Some of the US received rain across parts of the HRW wheat area over the weekend. This created a stir in KC/Chicago wheat

spreads but the December spread settled down to go out at 2.25 Chicago wheat premium. Australia sees their wheat crop to end up second largest on record. Global demand remains robust. After the close Egypt announced they seek wheat.

·

Some areas of the US HRW wheat area remain too dry to start plantings and we think KC December wheat has a chance to trade at a premium over Chicago if US Great Plains weather fails to improve. We raised our trading range for

KC wheat.

·

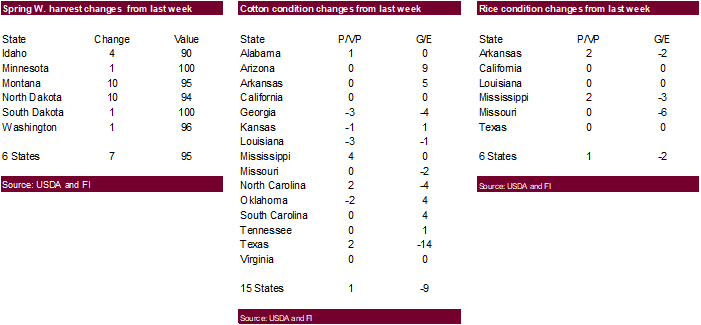

US winter wheat plantings were reported at 5 percent complete, one point above expectations and compares to 5 year ago and 3 percent average.

·

US spring wheat is 95 percent harvested at expectations and well above 83 percent average.

·

Funds sold an estimated net 4,000 Chicago SRW wheat contracts.

·

USDA US all-wheat export inspections as of September 02, 2021 were 381,551 tons, within a range of trade expectations, above 370,461 tons previous week and compares to 699,386 tons year ago. Major countries included Mexico for

103,084 tons, Philippines for 62,999 tons, and Taiwan for 57,422 tons.

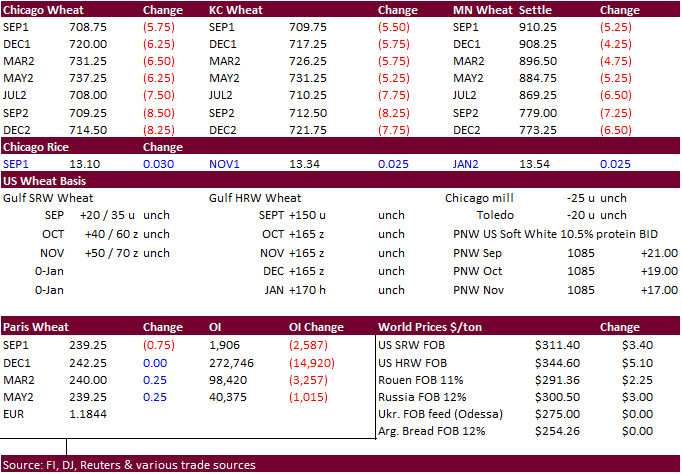

·

December Paris wheat was unchanged at 242.25 euros.

·

USDA reported private exporters sold 327,300 tons of hard red winter wheat to Nigeria. Last USDA sale of HRW wheat was on January 21 of 138,000 tons to the same country.

·

France sees their soft wheat crop at nearly 36 million tons, up 23 percent from last year. Quality remains very mixed after heavy rains fell during harvest season.

·

Australia is on track to harvest a near record wheat crop wheat this season, according to ABARES. They took wheat production up about 17% to 32.63 million tons (second largest on record and up from 27.8 million June estimate)

following recent favorable weather.

·

Australia’s western wheat crop saw frost over the weekend that may have an impact on production. This weekend frost event was compared to a 2016 event when the crop saw a 1-million-ton reduction, according to a Thomas Elder Markets

newsletter. https://www.thomaseldermarkets.com.au/grain/market-morsel-jack-frost-strikes-at-wa-crop/

·

Russian wheat export prices rose for the eighth consecutive week due to higher export tax and good domestic demand. IKAR showed 12.5% protein up 0.50/ton to $299.50 per ton and SovEcon reported wheat prices up $3.00/ton to $301/ton.

·

Russia’s AgMin noted grain exports during the July 1 to September 2 period fell to 6.7 million tons from 8.7 million a year earlier, led by an 18 percent decline in wheat shipments to 5.8 million tons.

·

Ukraine winter grain plantings started and the winter wheat area is off to a good start. A total of 7.8 million hectares of winter grains, including 6.68 million hectares of winter wheat, are expected to be sown, according to

the AgMin.

·

Kazakhstan’s president said it’s too early to set export duties on grains.

Export

Developments.

·

Egypt seeks wheat for October 25 through November 3 shipment.

·

Under the 24-hour USDA announcement system, private exporters sold 327,300 tons of hard red winter wheat for delivery to Nigeria during the 2021/2022 marketing year.

·

The Philippines seek 112,000 tons of animal feed wheat on Sept. 9 for shipment in September and October in two 56,000 tons consignments.

·

Pakistan is tendering for 550,000 tons of wheat and they are seeing offers at around $369.50/ton and $386.60/ton.

·

Turkey bought 245,000 tons of animal feed barley at between $294 and $306.90/ton for Sep 15-Oct 8 shipment.

·

Algeria seeks at least 50,000 tons of barley on September 8 for October shipment.

·

South Korea bought US and Australian and on Friday. An estimated 72,430 tons of milling wheat to be sourced from the United States and about 50,000 tons from Australia was noted.

·

Jordan seeks 120,000 tons of wheat, set to close September 8 for late December through February 14 shipment.

·

Jordan’s seeks 120,000 tons of animal feed barley on September 9 for Dec-Feb shipment.

·

Bangladesh’s state grains buyer seeks another 50,000 tons of milling wheat on September 16.

·

Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

Rice/Other

- South

Korea seeks 42,200 tons of rice for arrival in South Korea between February 28 and April 2022. 20,000 tons of that is of US origin, rest optional .

- (Bloomberg)

— U.S. 2021-22 cotton production seen at 17.69m bales, 428,000 bales above USDA’s previous est., according to the avg in a Bloomberg survey of nine analysts.

Estimates

range from 17m to 18.45m bales

U.S.

ending stocks seen increasing by the same amount

Global

ending stocks seen 438,000 bales higher at 87.67m bales

Updated 9/7/21

December Chicago wheat is seen in a $6.80‐$8.00

range

December KC wheat is seen in a $6.80‐$8.15

(up 20, up 35)

December MN wheat is seen in a $8.45‐$9.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.