PDF Attached

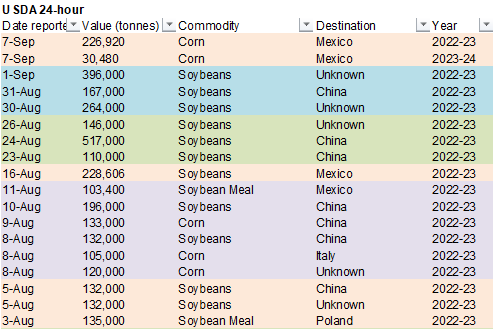

USDA: Private exporters reported sales of 257,400 tons of corn for delivery to Mexico. Of the total, 226,920 tons is for delivery during the 2022/2023 marketing year and 30,480 tons is for delivery during the 2023/2024 marketing year.

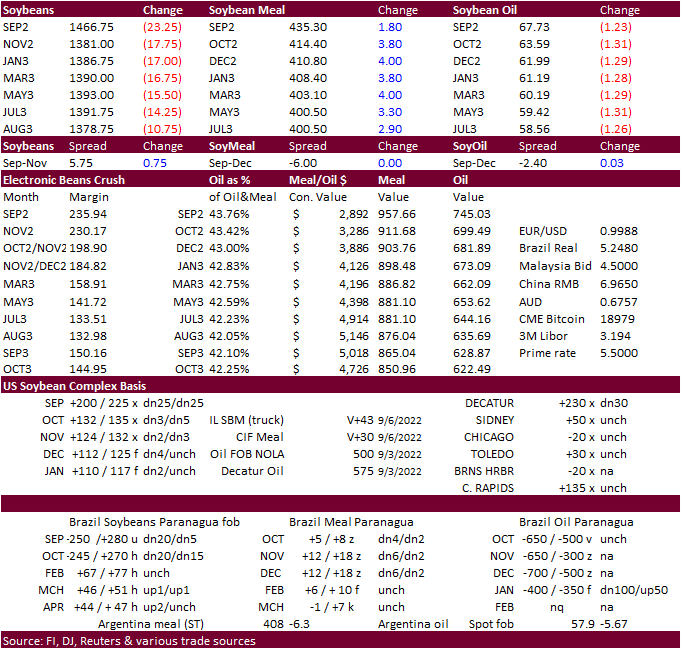

USD hit a new 20-year against the euro earlier but was lower by the time the ags closed. WTI crude oil traded sharply lower, and US equities higher. Moscow is threatening to not renew or renegotiate the Black Sea grain safe passage agreement set to expire in November. CBOT wheat prices were sharply higher, but prices settled well off highs. Corn ended lower and soybeans found pressure from an unchanged US crop rating, increase in Argentina producer & crush product selling, and fresh China covid lockdowns.

Look for light precipitation, if any, to develop across the northern Great Plains and some of the west central areas Thursday through Saturday. Precipitation will fall across parts of the northern Corn Belt Friday, west central and southeast areas Saturday before moving into the central/southern areas Sunday. The US southeast areas will see rain, slowing harvest progress and drying rates for corn. Europe will see additional rain this week.

World Weather, INC.

WEATHER EVENTS AND FEATURES TO WATCH

- India will continue plenty wet across the central, southern and eastern parts of the nation this week

- Some forecast models are still suggesting more rain in Gujarat, India for next week and if that occurs there could be some threat to maturing and open boll cotton; however, Gujarat crops are planted later than those in Pakistan, Rajasthan and Parana which should spare the state from much, if any, damage

- Pakistan has benefited from drier weather recently and if rain develops again next week across parts of the nation there may be more damage done to cotton and rice after flooding in late August

- The latest forecast data suggests less of a threat for damaging rainfall next week, but the situation will be closely monitored

- Europe will receive dryness easing rainfall over the coming week, but more will be needed to fully restore soil moisture to normal

- Spain and Portugal will not get much of the moisture, but remnants of Hurricane Danielle may bring greater rain to those areas late next week

- Confidence is very low over this though

- Russia and Ukraine precipitation is expected to slowly ramp up over the next couple of weeks with Russia’s Southern Region last to get rain in the middle to latter part of next week

- Moisture is needed for winter crop emergence and establishment

- Recent frost and light freezes in parts of Russia have had a minimal impact on crops and additional bouts of cool weather will continue to have a low impact.

- Eastern China will continue to dry out over the next ten days

- Areas from the Yangtze River Basin to the North China Plain will receive very little rain

- Drying in the northern part of this region will be good for summer crops after a long summer of frequent rain

- Drought in the Yangtze River Basin is prevailing and another ten days of drought could further damage rice and a few other crops in the heart of the basin where the worst conditions are prevailing

- Xinjiang, China weather is expected to be warm with very little rain in the next ten days

- This pattern will be very good for cotton and corn maturation as well as early harvesting

- Australia is still expected to see frequent bouts of rain over the next two weeks

- The moisture will be good for some crop areas in Queensland and South Australia, but New South Wales and Victoria may turn a little too wet over time

- Indian Ocean Dipole continues in its negative phase and will prevail there through November

- The combined impact of persistent La Nina and negative Indian Ocean Dipole is likely to lead to too much rain a part of eastern Australia later this year and that could threaten wheat and spring planting of some crops

- October will likely be wettest, but some of the wetter bias may already be evolving in late September

- This could threaten wheat, barley and canola later in the growing season

- Western and South Australia would not be impacted by too much moisture

- NOAA’s CFSv2 ENSO model has suggested earlier this week that La Nina will prevail through January, which is a 30-day extension over previous model runs

- Argentina rainfall is expected to be quite restricted over the next ten days raising concern very early summer crop planting prospects later this month and next

- Dryness will also be a concern for the nation’s wheat crop

- Brazil is expecting waves of rain in the southern part of the nation during the next ten days which should translate into ongoing good wheat development in the far south, but drier weather may soon be needed in wheat areas of Parana

- Showers advertised near mid-month in center west Brazil would be welcome if they verify, although early indications suggest the resulting rainfall will be sporadic and light

- The precipitation may offer some sign that seasonal rainfall will begin on time, but World Weather, Inc. urges a little caution because October rainfall is expected to be lighter and more sporadic and usual

- Canada’s Prairies will continue drier biased during the next ten days to two weeks favoring spring and summer crop maturation and harvest progress

- Soil moisture in the southeast is still favorable for late season crops

- Cooler air is expected in Canada and the north-central U.S. late this week and into the weekend

- Frost and a couple of light freezes may occur in parts of Canada’s Prairies, but no hard freezes are expected

- Friday and Saturday will be coldest

- U.S. upper Midwest and northeastern Plains temperatures will be no cooler than middle and upper 30s with no freeze expected, but a few patches of soft frost will be possible this weekend near the Canada border

- Much cooler air will slip in to Canada’s Prairies and the north-central United States late this week and into the weekend inducing high temperatures in the 50s and 60s Fahrenheit in Canada and in the 60s and lower 70s in the northern U.S. Plains and upper Midwest followed by lows in the middle and upper 30s and 40s in the U.S. and 30s and lower 40s in Canada

- Rain is possible late this week in a part of the western U.S. Corn and Soybean production areas, but most of the precipitation will be brief and light

- Pockets of soybean production areas may not get much precipitation over the next couple of weeks leading to some concern of poor filling conditions in a part of the western production areas

- U.S. weather will be dominated by a trough of low pressure over the southeastern United States during the coming week

- This pattern will restrict northbound moisture from the Gulf of Mexico from reaching into much of the western Midwest or Great Plains

- Moisture will also be restricted into Canada’s Prairies where net drying is likely

- Rain will fall frequently in the mid-south and especially the southeastern United States with some rain continuing periodically in the lower eastern Midwest

- Texas and Oklahoma weather is advertised drier this week than advertised last Friday

- Restricted rain will fall in the Great Plains over the next ten days allowing topsoil moisture in hard red winter wheat areas to become depleted

- South Africa precipitation is expected to be limited over the next five to seven days, but some forecast model runs today suggested rain might occur during mid- to late week next week

- winter crops are still semi-dormant and unlikely to develop aggressively until later this month leaving time for improved rainfall before the reproductive season arrives

- Winter crops are still poised to perform well this spring and if the rain occurs next week as advertised early season crop development should advance well

- Central America, Colombia and parts of Venezuela are expected to trend wetter than usual in the next few weeks due to the persistent La Nina influence on the region

- Hurricane Danielle was located far to the northwest of the Azores at 0500 EDT today.

- Danielle will change little over the next couple of days, but will gradually weaken back to tropical storm status

- The storm poses no threat to land

- Hurricane Earl was located well south of Bermuda at 0500 EDT today

- Earl will turn to the north northeast in the next couple of days and then to the northeast later in the week and during the weekend.

- The storm will intensify to major hurricane status in the next couple of days, but poses no threat to land.

- The system will pass to the east and southeast of Bermuda

- North Africa showers at this time of year are always welcome, but have a minimal impact and that will be the case over the next ten days

- Ontario and Quebec weather remains mostly good for corn and soybeans with little change likely

- the environment will be good for late season crop development, maturation and early season harvesting

- Mexico’s drought in the northeast continues and will not likely end without the help from a tropical cyclone

- With that said some significant rain fell during the past weekend in a few locations bringing some notable relief.

- This week’s weather will be trending drier

- Southern and western Mexico will get some rain periodically. through the next couple of week

- Central America rainfall has occurred routinely and will continue to do so favoring many crops

- Southeast Asia rainfall is expected to be frequent and significant during the next ten days to two weeks

- All areas are expected to be impacted and sufficient rain is expected to bolster soil moisture for long term crop development need

- Local flooding is expected

- Central Africa showers and thunderstorms have recently increased in some key coffee and cocoa production areas during the next two weeks.

- Recent rain in Ivory Coast and Ghana has brought relief to seasonal drying and will likely support mid-crop flowering if follow up rain occurs as needed

- Nigeria, Cameroon, Benin and other coffee and cocoa production areas should see relatively good crop weather over the next couple of weeks

- East-central Africa rainfall will continue to occur most frequent and significantly in Ethiopia, Uganda and southwestern Kenya over the next two weeks

- Good coffee, cocoa and other crop development conditions will prevail

- Today’s Southern Oscillation Index was +8.43 and it will move higher over the next few days

Source: World Weather INC

Bloomberg Ag Calendar

Wednesday, Sept. 7:

- China’s first batch of August trade data, including soybean, edible oil, rubber and meat imports

- Canada’s StatsCan releases wheat, durum, canola and barley stockpile data, 8:30am

- HOLIDAY: Brazil

Thursday, Sept. 8:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Black Sea Grain and Oilseeds conference, Rostov-on-Don, Russia

- EIA weekly US ethanol inventories, production, 11am

- Brazil’s Conab releases data on area, yield and output of corn and soybeans

Friday, Sept. 9:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

- Vietnam’s customs department releases August coffee, rice and rubber exports

- Brazil’s Unica to release cane crush and sugar output data (tentative)

- HOLIDAY: Korea

Source: Bloomberg and FI

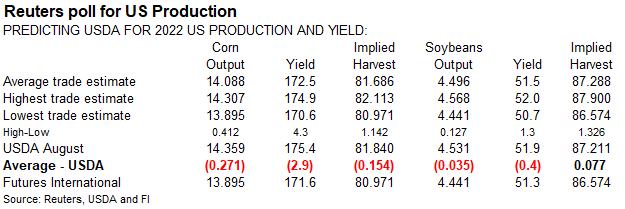

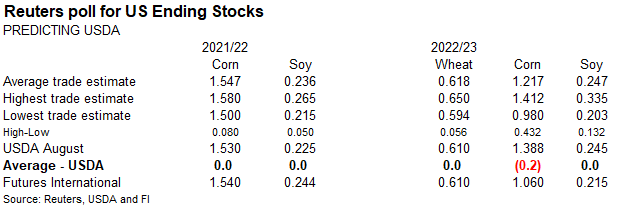

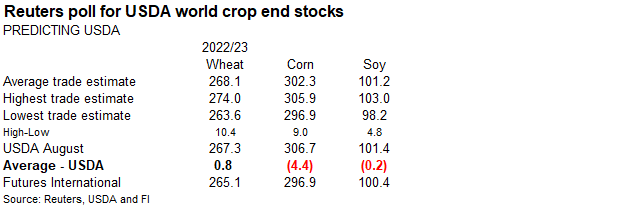

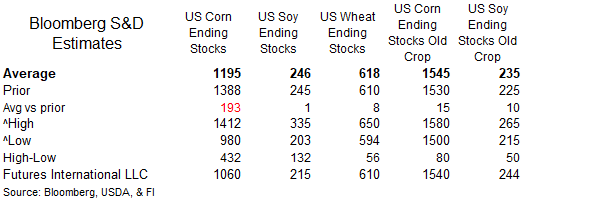

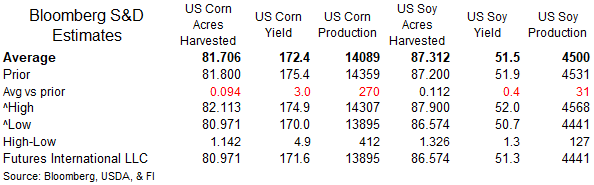

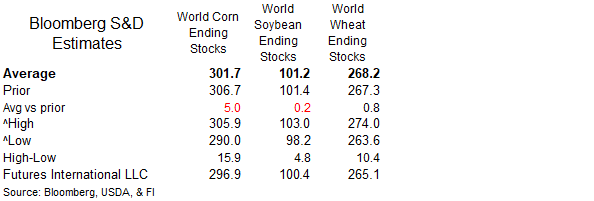

Bloomberg estimates for USDA

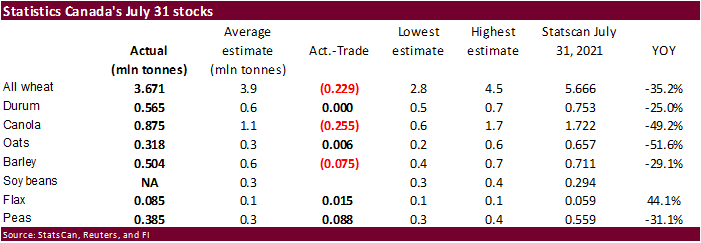

StatsCan July 31 grain and oilseed stocks.

103 Counterparties Take $2.207 Tln At Fed Reverse Repo Op (prev $2.189 Tln, 103 Bids)’

US MBA Mortgage Applications Sep 2: -0.8% (prev -3.2%)

US MBA 30 Year Mortgage Rate Sep 2: 5.94% (prev 5.80%)

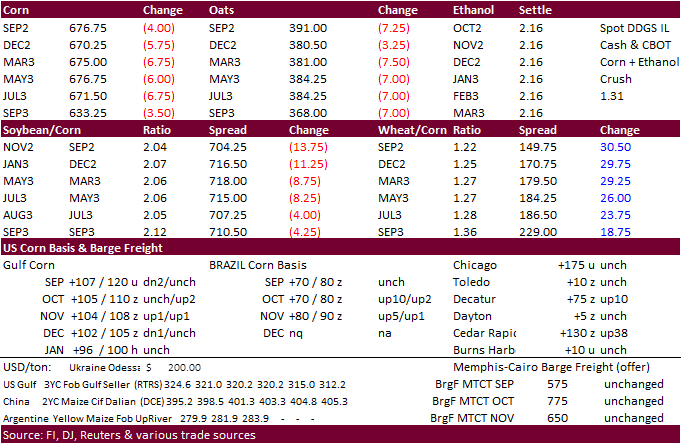

Corn

· CBOT corn traded two-sided. Prices found support earlier on Ukraine shipment concerns and strength in wheat. But when soybeans turned lower and crude oil extended losses, corn futures traded lower and settled down 5-6 cents through the July contracts.

· Funds sold an estimated net 3,000 corn contracts.

· October WTI crude fell below $82 for the first time since February 18.

· The USDA Broiler Report showed eggs set in the US up 4 percent and chicks placed up 5 percent. Cumulative placements from the week ending January 8, 2022 through September 3, 2022 for the United States were 6.59 billion. Cumulative placements were up 1 percent from the same period a year earlier.

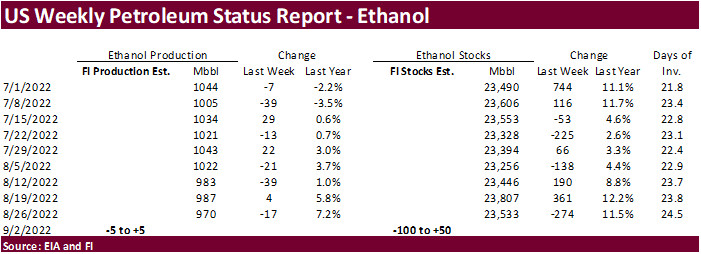

· A Bloomberg poll looks for weekly US ethanol production to be down 5,000 thousand (950-980 range) from the previous week and stocks down 207,000 barrels to 23.326 million.

University of Illinois: Margin Protection Revenue and Cost Components

Swanson, K., G. Schnitkey, C. Zulauf, N. Paulson and J. Coppess. “Margin Protection Revenue and Cost Components.” farmdoc daily (12):135, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 6, 2022.

https://farmdocdaily.illinois.edu/2022/09/margin-protection-revenue-and-cost-components.html

· USDA: Private exporters reported sales of 257,400 tons of corn for delivery to Mexico. Of the total, 226,920 tons is for delivery during the 2022/2023 marketing year and 30,480 tons is for delivery during the 2023/2024 marketing year.

· NOFI bought 68,000 tons of corn from SA or SAf at 174 cents c&f over the December for arrival around December 25.

· Results awaited: Taiwan’s MFIG group seek 65,000 tons of corn for November and/or early shipment from the US.

Updated 9/7/22

December corn is seen in a $6.00-$7.25 range.

· November soybeans fell to a three month low today from an unchanged US crop rating, increase in Argentina producer & crush product selling, and fresh China covid lockdowns.

· Funds sold 5,000 soybeans, bought 2,000 meal and sold 2,000 SBO.

· After the day session open, we heard 6-8 cargoes of US soybeans traded to China. Later we heard China also bought 15 cargoes of Argentina soybeans. China has been running behind on crop year soybean imports.

· China August soybean imports were 7.17 million tons, lowest for that month since 2014, and down 24.5 percent from a year earlier. Jan-Aug soybean imports were 61.33 million tons, down 8.6 percent from year earlier.

· Argentina producer soybean sales topped 2 million tons since Sunday and could end up 3.5-5.0 million tons by the end of the month. Official data showed producers registered 268,000 tons of soybean sales during the last week of August.

· The weakness in Argentina product prices on Tuesday, mainly vegetable oil, had some influence in CBOT meal prices over soybean oil.

· There are concerns USDA will trim both, US planted and harvested area for soybeans next week. Our projected area reduction for soybean plantings (USDA Sep S&D) is 400k for plantings and 638k for the harvested area.

· A Bloomberg article noted Louisiana State University Ag Center estimated 300,000 to 400,000 acres of soybeans were damaged by heavy rains late last month.

· Despite the loss in plantings/harvested area across selected part of the country, US soybean conditions were unchanged and US production may end up at a record.

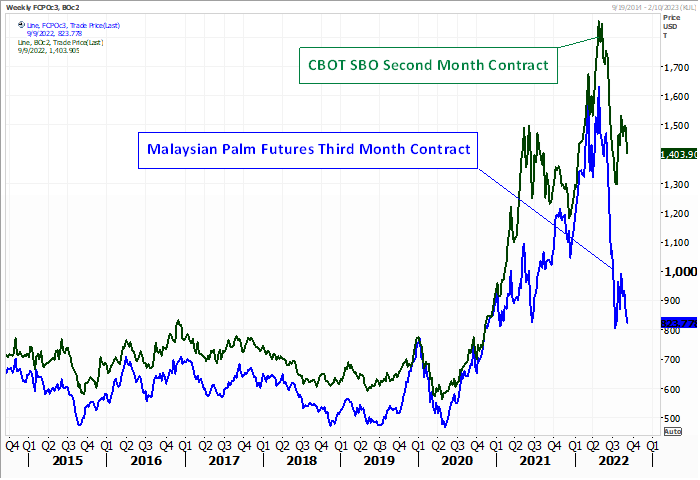

Soybean oil to a premium over palm oil

Source: Reuters and FI

· Today USDA’s AMS CCC seeks to sell 3,150 tons of vegetable oil for shipment for Oct 1-31 (Oct 16 to Nov 15 for plants at ports).

· Yesterday Egypt bought 27,000 tons of sunflower oil. They are also in for soybean oil and local vegetable oils but passed. Lowest offer for soybean oil is $1,405/ton for 6k. Traders reported the following:

- 11,000 tons at $1,300 C&f for arrival Nov 11-30.

- 10,000 tons at $1,300 C&f for arrival Nov 11-30.

- 6,000 tons at $1,300 C&f for arrival Nov 11-30.

· Results awaited. South Korea’s Agro-Fisheries & Food Trade Corp. seeks 30,000 tons of GMO-free soybeans on September 6 for arrival in SK between November 12 and Dec 12, and another arrival period of October 30 and November 30.

USDA Attaché: China biofuel annual

Updated 9/6/22

Soybeans – November is seen in a $13.00-$15.50 range

Soybean meal – December $350-$440

Soybean oil – December 62.50-70.00

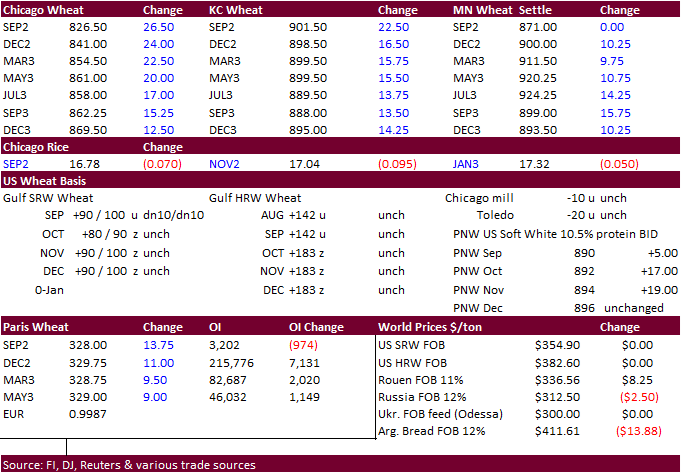

· CBOT wheat prices traded sharply higher on Black Sea shipping concerns but ended well off session highs. Chicago December hit a session high of $8.7350, highest since July 12th, and settled at $$8.4425.

· Funds bought an estimated net 10,000 Chicago wheat contracts.

· Paris December wheat was up 11 euros at 328.75 per ton.

· Moscow is threatening to not renew the Black Sea grain safe passage agreement set to expire in November. Several news outlets mentioned President Putin is not satisfied over the UN and Turkey brokered grain deal and may look to revise terms as western sanctions have expand against Russia since the agreement was struck in July. Russia noted only two out of 87 ships oof gran shipped from Ukraine made it to “poor” (developing) countries, although what lineup he referred to was not cited. Russia recently has been struggling to secure wheat shipments from logistical and payment problems. Russia demands payment in rubles instead of dollars, making it harder for banks to back grain and fertilizer deals.

· The UN reported 200 vessels were authorized to sail in/out of Ukraine ports since the safe passage agreement. “”As of 6 September, the total tonnage of grain and other foodstuffs exported from the three Ukrainian ports is 2,212,972 metric tons. A total of 204 voyages (108 inbound and 96 outbound) have been enabled so far,” (IFX)

· Russia could buy up to 3 million tons of grain for state stockpiles this season, most of it wheat.

· South Korea’s NOFI bought about 55,000 tons of feed wheat from Australia at an estimated $349.30 a ton c&f for shipment between January 10 and February 5.

· Japan in a SBS import tender seeks 70,000 tons of feed wheat and 40,000 tons of barley on September 14 for arrival in Japan by February 24.

· Jordan seeks 120,000 tons of barley on September 14 after passing September 7 for Feb-Mar shipment.

· Taiwan Flour Millers’ Association seeks 55,375 tons of US grade 1 milling wheat on Sept. 8 for shipment Nov. 2 and Nov. 16. Types sought include dark northern spring, hard red winter and white wheat.

· Jordan seeks 120,000 tons of wheat on September 13 for March and April shipment.

· Bangladesh seeks 50,000 tons of milling wheat on September 18. It’s for optional origin with shipment within 40 days of contract signing.

Rice/Other

· None reported

Updated 9/6/22

Chicago – December $7.25-$10.00

KC – December $7.50-$10.75

MN – December $8.00-$11.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.