PDF Attached

Grains and oilseeds in a sideways trade today following yesterday’s macro flush. Traders are eyeing Friday’s USDA WASDE data as yield expectations vary.

WASHINGTON,

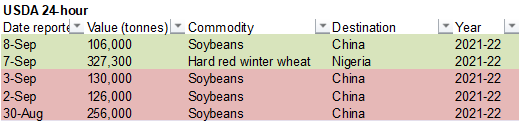

September 8, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 106,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

![]()

StatsCan

reported bearish stocks for July 31 Canadian canola and all-wheat.

1-7

day QPF total precipitation total

MOST

IMPORTANT WEATHER OF THE DAY

- Heavy

rain will begin impacting Gujarat today and many areas from that state into northwestern Madhya Pradesh, southern Rajasthan and parts of Maharashtra are facing frequent rain during the next ten days with some of it to be excessive

- Flooding

is a strong possibility and some damage to a few crops is possible - Flooding

rain is also expected this weekend through the first half of next week in southwestern Chhattisgarh, southwestern Odisha, northeastern Andhra Pradesh, northeastern Telangana and parts of eastern Maharashtra as a new monsoon depression evolves and comes inland

from the Bay of Bengal - Much

needed drying is under way in portions of the North China Plain, Yellow River Valley and areas southward to the Yangtze River - These

areas have been quite wet recently with serious flooding from northeastern Sichuan and southern Shaanxi to Shandong and northern Jiangsu during the weekend and Monday - Northeastern

China will continue to receive frequent rain during the coming week to ten days maintaining wet field conditions in areas where summer crops should be filling, maturing and beginning to be harvested - Tropical

Storm Conson was still in the central Philippines today, but will move across southwestern Luzon Island and enter the South China Sea as a small tropical storm - The

storm produced another 5.00 inches of rain on southern Luzon Tuesday - Conson

will move across the South China Sea for the next few days while intensifying

- The

storm may be a weak typhoon before impacting Hainan, China early next week.

- Super

Typhoon Chanthu turned on a path that will bring the storm closer to the Philippines recently - The

center of the storm was 613 miles east northeast of Manila and 563 miles southeast of the northeastern most tip of Luzon Island, Philippines at 15.5 north, 130.8 east moving west southwesterly at 12 mph and producing maximum sustained wind speeds of 161 mph - Chanthu

will weaken somewhat, but will remain a major typhoon as it move more westerly later today and Thursday - The

storm will turn to the northwest late Thursday and Friday with the storm center passing very near to the northeastern tip of Luzon Island around 0600 GMT Friday.

- The

storm center may be just far enough off the coast of Luzon to minimizing the impact, but damaging wind, flooding rain and rough seas will precede and accompany the storm - Chanthu

will then move toward eastern Guangdong and southwestern Fujian, China with landfall early next week as a weak typhoon or strong tropical storm - Hurricane

Larry remains a strong hurricane and will pass Bermuda to the east Friday and then impact Newfoundland, Canada during the weekend. - The

storm will induce some rough seas, strong wind and heavy rain briefly over Bermuda and more significantly over Newfoundland - Tropical

disturbance in the Gulf of Mexico is already spreading rain across the Florida Panhandle and into southwestern Georgia and southeastern Alabama this morning

- The

disturbance may become better organized later today as it moves more significantly into the southeastern U.S.

- However,

the system may not succeed in becoming a tropical depression until after it moves off the lower east coast of the U.S. late Thursday and Friday - The

storm will then move away from the U.S. and remain over open water - Tropical

wave over Central America this week will possibly emerge over the Bay of Campeche this weekend and spread its rain into northeastern Mexico, Texas and a part of Louisiana during the weekend and early part of next week - This

system will need to be monitored for possible development, although conditions do not appear to be very supportive of that – at least not based on the latest data - U.S.

weather will be very good for summer crop maturation and harvest progress in the central and northern Plains, Midwest, Delta and interior parts of the southeastern states - Rain

will fall in the southeastern states over the next few days due to the tropical disturbance that will move moving through northern Florida and southern Georgia later today into Friday - Winter

wheat planting should advance favorably in areas that recently received rain in the central Plains - West

Texas rainfall will be minimal until late next week when some rain is possible, but confidence is low - Temperatures

will be warm enough to induce better crop maturation conditions late this week and into the weekend when some 90-degree highs are expected - Drought

concerns remain in the U.S. Pacific Northwest, California and the interior western states, the northwestern U.S. Plains and southwestern Canada’s Prairies - No

change in this status is expected for a while - U.S.

temperatures in this coming week will be very warm to hot in the western U.S. from the high Plains region to the Pacific Coast excepting the Columbia River Basin where temperatures will be closer to normal - Temperatures

will be closer to normal in the Midwest, Delta and southeastern states with a few areas slightly cooler than usual - U.S.

temperatures next week will be warmer than usual in the Plains and interior western U.S. while seasonably warm to the east - The

bottom line for much of the U.S. key grain and oilseed production areas during the next two weeks will be favorable for late season crop development, crop maturation and harvesting, despite some greater rain potential next week. Wheat planting in the southwestern

Plains should advance well with quick emergence for areas that just received rain this weekend.

- Good

harvest weather is expected in Canada’s Prairies for a while with only a few brief bouts of rain expected in a part of the region that would disrupt fieldwork for any significant period of time. - Ontario

and Quebec weather will continue favorably mixed over the next two weeks for late season farming activity and harvesting of summer crops - Australia

experienced more frost and light freezes this morning in southeastern Queensland and northeastern New South Wales

- The

cool conditions recently may have had some negative impact on production potentials - Dryness

is also a concern in Queensland where winter crops should be reproducing - Australia

needs greater rain in northern New South Wales, Queensland and northern parts of Western Australia to improve reproductive conditions for wheat and barley - Southern

Australia soil moisture is still rated favorably with little change likely

- Eastern

Europe weather will be very good for harvest and early season winter crop planting over the next ten days - Some

winter crop areas in the Balkan Countries will continue in need of greater soil moisture, despite some dryness relief in the past week or two

- Western

Europe will get some beneficial rain soon easing recent drying that has firmed up the ground in France - Rain

will be good for future winter crop planting, but it will disrupt farming activity including the maturation and harvest of summer crops - Some

southern CIS winter crop areas will need significant rain soon to support wheat, rye and barley germination, emergence and establishment - The

dry weather will be good for summer crop maturation and harvesting - Very

little rain is expected from Ukraine into the middle and lower Volga River Basin or Kazakhstan over the next ten days - Waves

of rain will impact northern Russia during the next ten days with the greater amounts expected in the New Lands - Some

delay in harvest progress is possible and there may be a little concern over small grain and sunseed crop quality if the rain prevails too long - Recent

cool weather in northern Russia did not have much impact on crops - Additional

cool weather is expected for a while which may induce more frost and freezes - Frost

and freezes will impact Russia’s eastern New Lands and a part of northern Kazakhstan early next week that will end the growing season, but have little impact on crops - U.S.

rainfall Tuesday was most significant in the eastern Midwest with a few totals over 1.00 inch in southeastern Illinois, west-central Indiana and parts of Michigan - Not

much other rain occurred in key crop areas, although erratic rainfall occurred in the southeastern states - Heavy

rain fell in northern Georgia and in east-central Florida where more than 3.00 and 2.00 inches occurred respectively - Central

America and southern and eastern Mexico will remain wet biased during the next ten days with near to above normal rainfall - A

tropical disturbance in the western Caribbean Sea late this week may move across the Yucatan Peninsula during the weekend and could become a tropical cyclone in the western Bay of Campeche during the weekend before impacting northeastern Mexico and southern

Texas later next week - Confidence

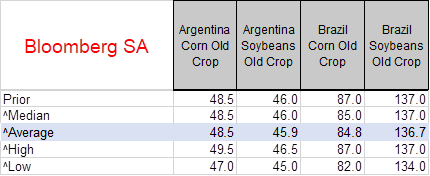

is very low - Argentina

will get some lingering rain in the southeast and then trend drier for a while - Recent

moisture was good for wheat and for future planting of early corn and sunseed - Rain

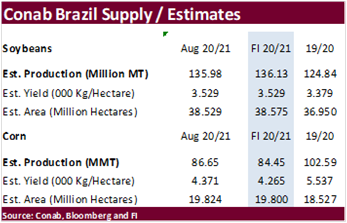

will still be needed in Cordoba, parts of Santa Fe and Santiago del Estero where dryness will remain significant - Brazil

rainfall will be greatest again Monday into Tuesday in Rio Grande do Sul where some flooding will be possible in some of its rice and corn production region areas - Rainfall

elsewhere in Brazil will be more restricted; however, Northern Mato Grosso may experience some periodic showers over the next ten days - Initial

rainfall in Mato Grosso will be too light for early autumn soybean planting, but the environment may improve next week and later this month - Coffee,

citrus and sugarcane areas will stay mostly dry for another week to ten days, although some showers will occur in Sul de Minas Friday and Saturday - Southeast

Asia rainfall will remain sufficient to carry on favorable crop development from the mainland areas into the Philippines and Indonesia and Malaysia during the next ten days - There

is some potential for excessive rain and flooding in a part of mainland Southeast Asia - Northeastern

Luzon Island could experience flooding rain from Typhoon Chanthu later this week - Rainfall

will be lightest in parts of Sumatra and Peninsular Malaysia where some net drying is possible and the region will need to be closely monitored - Temperatures

will be a little cooler than usual - New

Zealand will be extra wet this week while temperature are little cooler than usual - The

entire nation will be wetter than usual especially in South Island - Frost

and freezes were noted during the weekend, but there should not have been any negative impact on crops - Southern

Oscillation Index was +7.68 today and the index has been steady rising over the past week.

- This

week’s index will likely move a little more erratically and may drift lower for a little while - South

Africa rainfall should be mostly confined to the southeast early to mid-week this week with Natal most favored.

- West-Central

Africa will get sufficient rainfall during the next ten days to support its coffee, cocoa, rice sugarcane and other crops - Cotton

in west-central Africa is rated favorable and has likely yielded well this year

Source:

World Weather Inc.

Wednesday,

Sept. 8:

- Meat

Atlas 2021 – facts and figures about the animals people eat - Canada’s

StatsCan releases data on wheat, barley, canola and durum stockpiles

Thursday,

Sept. 9:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - EIA

weekly U.S. ethanol inventories, production - Brazil’s

Conab report on yield, area and output of corn and soybeans - Port

of Rouen data on French grain exports - UkrAgroConsult

Black Sea oilseed conference

Friday,

Sept. 10:

- USDA’s

monthly World Agricultural Supply and Demand Estimates (WASDE) report, noon - China

farm ministry’s CASDE outlook report - ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

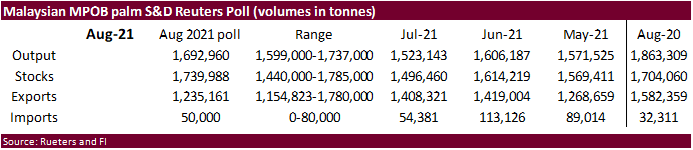

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysian

Palm Oil Board data on August stockpiles, output and exports - FranceAgriMer

weekly update on crop conditions - Malaysia

Sept. 1-10 palm oil export data - HOLIDAY:

India

Source:

Bloomberg and FI

US

inventories (Reuters)

US

production (Reuters)

World

inventories (Reuters)

FSA

data for September was released after the bell following an inadvertent earlier release.

·

Farmers enrolled 91.218 million acres corn in US crop subsidy programs including failed acres for 2021 as of September 1

·

Farmers enrolled 49.323 million acres wheat in US crop subsidy programs including failed acres for 2021 as of September 1

·

Farmers enrolled 86.184 million acres soybeans in US crop subsidy programs including failed acres for 2021 as of September 1

·

US farmers report prevented plantings of 637,805 acres corn for 2021 as of September 1

·

US farmers report prevented plantings of 336,563 acres soybeans for 2021 as of September 1

·

US farmers report prevented plantings of 291,881 acres wheat for 2021 as of September 1

·

The

following are comparisons of farmer-reported plantings in September 2021, August 2021 and September 2020, based on a survey of farms (all figures in thousands of acres):

|

U.S. |

|||

|

Prevented (thousands |

|||

|

Crop |

Sept. |

Aug. |

Sept. |

|

Corn |

638 |

620 |

6,078 |

|

Soybeans |

337 |

316 |

1,451 |

|

Wheat |

292 |

292 |

1,268 |

|

U.S. |

|||

|

Crop |

Sept. |

Aug. |

Sept. |

|

Corn |

91,218 |

90,309 |

87,560 |

|

Soybeans |

86,184 |

85,287 |

81,455 |

|

Wheat |

49,323 |

48,808 |

45,947 |

Source:

USDA, Reuters and FI

·

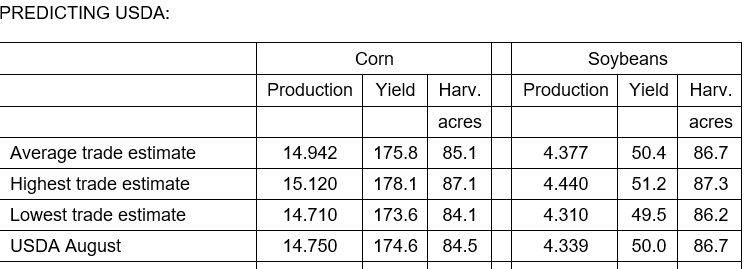

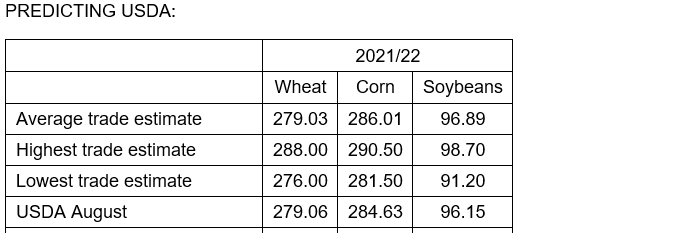

Corn reached the lowest level in two months this morning and managed to settle up a half-cent as traders weigh Friday’s USDA WASDE data.

·

Traders are looking for higher corn harvested area to be reported by USDA on Friday which pressed on the corn market today while yesterday’s worse-than-expected corn conditions underpinned the market.

·

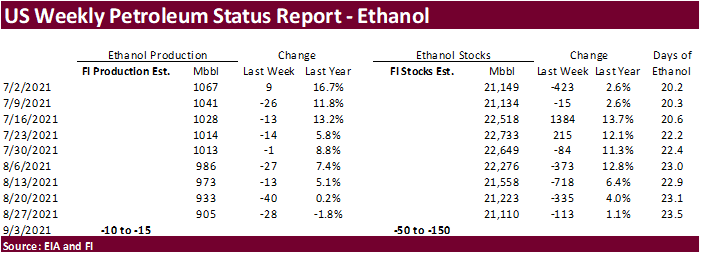

A Bloomberg poll looks for weekly US ethanol production to be up 4,000 barrels (856-950 range) from the previous week and stocks up 2,000 barrels to 21.112 million.

Export

developments.

·

South Korea’s NOFI rejected up to 69,000 tons of corn, 65,000 tons of feed wheat and 15,000 tons feed barley, due to high prices. The corn and wheat was for arrival in South Korea in December 2021, and the barley in January 2022.

Lowest price for the corn was $317.95 a ton.

·

China plans to sell 133,753 tons of US corn on September 10 and 8,277 tons from Ukraine.

Updated

8/20/21

December

corn is seen in a $4.75-$6.00 range

Soybeans

·

US soybeans closed higher on technical buying export demand. Traders noted position squaring ahead of Friday’s WASDE report.

·

Soymeal ended unchanged while soyoil traded lower on the session.

·

StatsCanada reported a bearish July 31 Canadian canola stocks of 1.767 million tons, 567,000 tons above trade expectations, but this seems to have little influence on US soybeans and ICE canola futures (November canola 9.10 @

7:50 am CT).

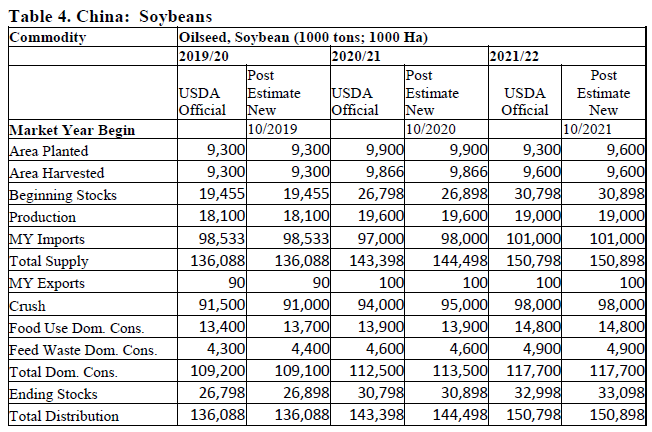

USDA Attaché on China soybeans

China soybean imports are forecast at 101 million metric tons (MMT) in marketing year (MY) 21/22, up 3 MMT from the previous year.

Export Developments

- Under the 24-hour announcement system, private exporters reported 106,000 tons of soybeans for delivery

to China during the 2021-22 marketing year.

Updated 8/31/21

Soybeans – November $11.75-$14.50 range

Soybean meal – December $320-$395

Soybean oil – December 52-65 cent range

·

US Wheat finished lower on the firmer USD hurting export demand. Harvest pressure for spring wheat and larger winter wheat sowings also weighed on the market. Global import demand is strong with Egypt, Algeria, and Pakistan in

for wheat but the US remains uncompetitive to cheaper EU and FSU wheat.

·

StatsCan reported a bearish July 31 all-wheat stocks of 5.705 million tons, 905,000 tons above an average trade guess and above 2020.

·

Ukraine exported 9.53 million tons of grain so far in the 2021-22 July-June season versus 8.86 million at the same point a year earlier. That included 5.33 million tons of wheat, 2.88 million tons of barley and 1.28 million tons

of corn.

·

India raised their purchase price for wheat they buy from farmers but there is backlash as it may not be enough of an increase to cover the cost of cultivation. New-crop wheat was seen increasing by 2% to 2,015 rupees ($27.39)

per 100 kg.

·

December Paris wheat settled down 0.25 at 242.00 euros.

Export

Developments.

–

60,000 tons Ukrainian at $310.25 plus $32.90 freight totaling $343.15/ton c&f

–

60,000 tons Russian at $316.50 plus $27.30 freight totaling $343.80/ton c&f

–

60,000 tons Ukrainian at $312.90 plus $32.90 freight totaling $345.80/ton c&f

–

60,000 tons Ukrainian at $312.90 plus $32.90 freight totaling $345.80/ton c&f

–

60,000 tons Ukrainian at $312.90 plus $33.65 freight totaling $346.55/ton c&f

·

Jordan passed on 120,000 tons of wheat for late December through February 14 shipment.

·

South Korea’s NOFI rejected up to 69,000 tons of corn, 65,000 tons of feed wheat and 15,000 tons feed barley, due to high prices. The corn and wheat was for arrival in South Korea in December 2021, and the barley in January 2022.

Lowest price for the feed wheat was $347.70 a ton c&f.

·

Algeria seeks at least 50,000 tons of barley for October shipment.

·

Japan’s Ministry in their regular SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival in Japan by Feb. 24, 2022, set to close on Sept. 15.

·

Pakistan is tendering for 550,000 tons of wheat. On Tuesday they were seeing offers at around $369.50/ton and $386.60/ton.

·

The Philippines seek 112,000 tons of animal feed wheat on Sept. 9 for shipment in September and October in two 56,000 tons consignments.

·

Jordan’s seeks 120,000 tons of animal feed barley on September 9 for Dec-Feb shipment.

·

Bangladesh’s state grains buyer seeks another 50,000 tons of milling wheat on September 16.

·

Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

Rice/Other

- (Bloomberg)

— U.S. 2021-22 cotton production seen at 17.69m bales, 428,000 bales above USDA’s previous est., according to the avg in a Bloomberg survey of nine analysts.

Estimates

range from 17m to 18.45m bales

U.S.

ending stocks seen increasing by the same amount

Global

ending stocks seen 438,000 bales higher at 87.67m bales

Updated 9/7/21

December Chicago wheat is seen in a $6.80‐$8.00 range

December KC wheat is seen in a $6.80‐$8.15

December MN wheat is seen in a $8.45‐$9.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.