We

will have updated US balance sheets on Monday reflecting revised supply and demand (SBO will be adjusted).

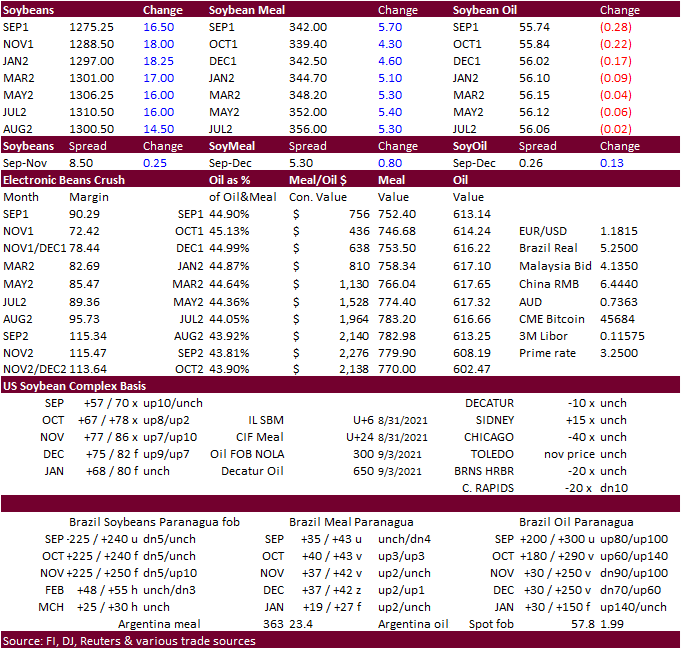

Very

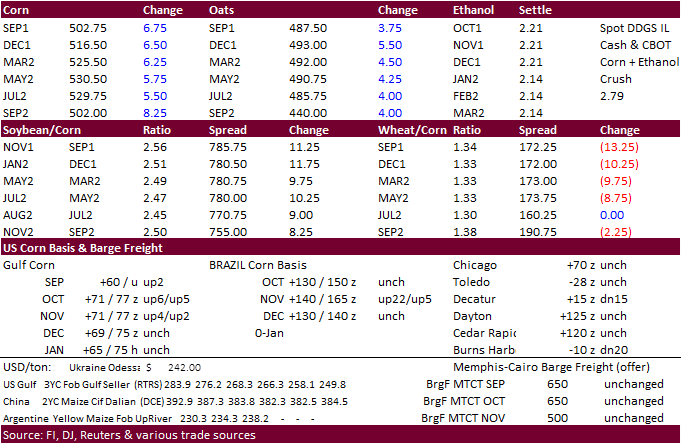

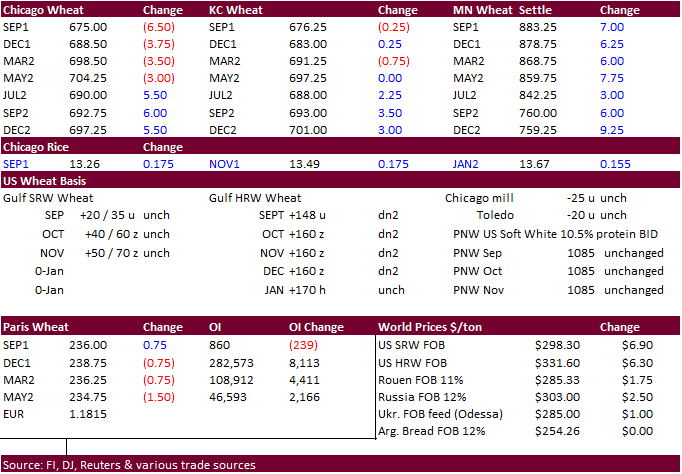

choppy trade with soybeans and meal leading corn higher. Soybean oil closed lower on weakness in palm oil and product spreading. Wheat saw bear spreading in Chicago and KC. Minneapolis rallied on concerns over global supply of high protein wheat.

WASHINGTON,

September 10, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

USDA

released their September supply and demand outlook

Reaction:

Initially

we were a little caught off guard USDA lowered the US soybean planted area, one factor that prompted buying in soybeans after prices dipped when the report was released. Overall US corn and soybean stocks for 2021-22 are still relatively tight, so traders

that faded or liquidated their long position this week headed into the report are coming back to the market. For example, many ethanol traders lifted positions and were back in buying it this afternoon after seeing a report that was not wildly bearish.

We

look for harvesting pressure to keep rallies limited going forward. Early corn yield reports suggest very good yields from Arkansas to Missouri, central IA, and southern IL.

USDA

OCE Secretary Briefing

https://www.usda.gov/sites/default/files/documents/september-2021-wasde-lockup-briefing.pdf

USDA

NASS Recap

https://www.nass.usda.gov/Newsroom/Executive_Briefings/2021/09-10-2021.pdf

USDA

update.

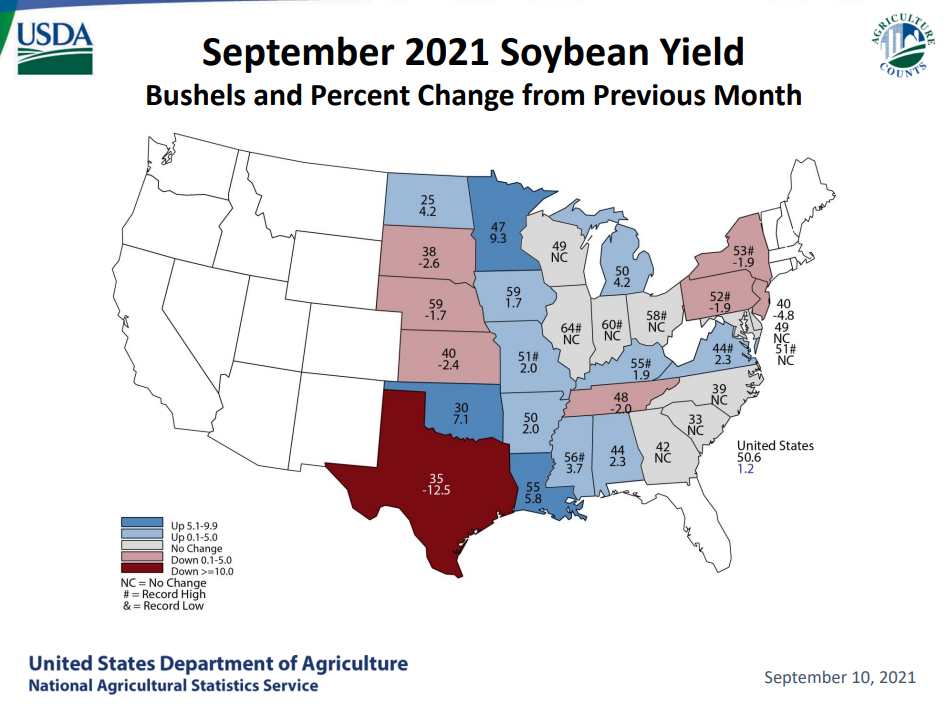

USDA’s

estimate for the US soybean yield was 50.6, 0.2 above trade expectations and 0.6/bu above the August estimate. The harvested area was lowered 284,000 acres from a downward revision of 320,000 acres to the planted area to 87.235 million. This is a clear example

why FSA prevented planting numbers should be only a consideration. They used all available data, including satellite and operator surveys. Note the planted area increased for IL, IA, MN, and NE. US production of 4.374 billion was 35 million above August,

which was 3 million below trade expectations, and but still 239 million above 2020. The higher supply left USDA the ability to make proper adjustments to demand, starting with old crop. USDA took old crop crush down 15 million bushels, as expected, resulting

in a 15 million bushel increase in the 2020-21 carryout. With the 2021-22 soybean carry in 15 million bushels higher and production 35 million higher, USDA lowered new-crop imports by 10 million and increased exports by 35 million, despite shipping concerns

for the month of September out of the Gulf. They unexpectedly chopped new-crop crush by 25 million bushels, forcing them to reduce new-crop soybean oil domestic use by 200 million pounds and soybean meal domestic use by 650,000 short tons. US new-crop soybean

meal production was reduced by the same amount, 650,000 short tons. 2021-22 US soybean oil production was reduced 290 million pounds. They took new-crop soybean oil imports down 150 million. Soybean oil for biodiesel for old crop was taken down 300 million

pounds, more than expected, and new-crop soybean oil for biodiesel was lowed 500 million pounds. USDA’s new-crop soybean carryout was raised 30 million bushels, 5 million below an average trade guess. 2021-22 world soybean production fell 800,000 tons to

384.4 million, nearly 6 percent above 2020, China new-crop soybean imports were lowered 1 million tons to 101 million tons. New-crop ending stocks were raised 4.4 million tons to 98.9 million, 4 percent above 2020-21, in large part to an upward revision

to 2020-21 global soybean stocks. Note USDA took current crop-year China imports of soybeans up 1 million tons to 99 million.

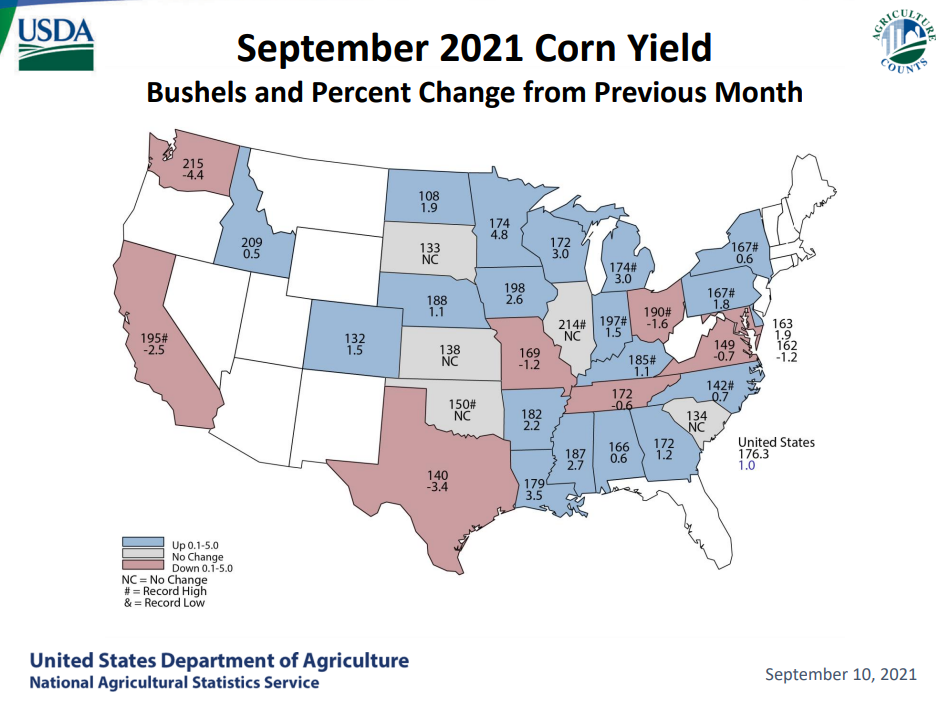

The

US corn yield was taken up 1.7 bushel/acre to 176.3 bushels, 0.5 bushel above an average trade guess. The planted area was taken up 612,000 acres to 93.304 million, and harvested area upward revised by 590,000 acres to 85.085 million. US corn production was

14.996 billion, 54 million above the trade and 246 million above August. US old crop corn ending stocks were 1.187 billion, 70 million above August and 18 million above the trade guess. New-crop US corn stocks were 1.408 billion, 166 million above last month

and 26 million above the trade guess. USDA lowered corn use for 2020-21 ethanol by 40 million bushels (remember last month it was taken up 25) and took exports down 30 million, resulting in a 70 million boost in the carry out. With US new-crop supply 316

million bushels higher, USDA raised feed use by 75 million and exports by 75 million. New crop stocks of 1.408 billion may sound comfortable, but the stocks to use ratio sits at 11.4%, well below out pivot comfort level of 15%. 2020-21 Brazil corn production

was slashed 7 million tons to 86 million, still about 4 million tons above some trade estimate. New-crop global production was upward revised 3 million tons and stocks were revised higher by 6.4 million. USDA took new-crop Argentina production up 2.0 million

tons.

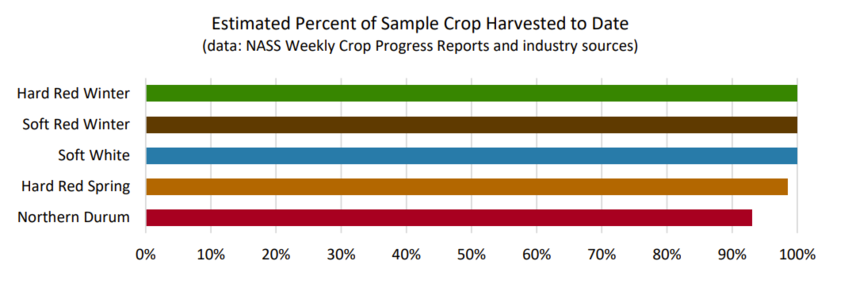

US

all wheat production was unchanged as they are currently surveying for the upcoming Small Grains Summary. USDA took 2021-22 US all-wheat ending stocks down 12 million bushels to 615 million by lowering imports by 10 million and raising food use by 2 million.

There were minimal changes in the wheat by class balances. HRS and soft red stocks were taken down 5 million bushels, each. We view changes to the US wheat balance sheet as noneventful. 2021-22 Russian wheat production was taken down 12.5 million tons to

72.5 million and Canada was lowered 8.5 million tons to 23 million. USDA took Australia production up 3 million tons to 31.5 million. World wheat production was lowered 12.1 million tons and stocks revised down 8.5 million. The cut in Russian and Canadian

production proves to bullish high protein wheat.

Japan’s

weather bureau estimated a 70% chance of no El Nino or La Nina occurring from now through the northern hemisphere winter.

World

Weather Inc.

MOST

IMPORTANT WEATHER OF THE DAY

- Super

Typhoon Chanthu’s was passing to the northeast of Luzon Island, Philippines this morning and will move dangerously close to Taiwan during the late weekend and early part of next week

- The

storm has potential to impact eastern China, South Korea and Japan - The

system stalls for a little while over the East China Sea and it could have influence on any one of these nations next week

- Eventually,

the storm will impact western Japan and southern South Korea, but it could also impact shipping to and from Shanghai, China - At

0900 GMT today the storm was 445 miles south southeast of Taipei, Taiwan at 18.3 north, 123.1 east moving northwesterly at 11 mph and producing maximum sustained wind speeds of nearly 166 mph - Tropical

storm force wind was occurring out 80 miles from the center of the storm while typhoon force wind was occurring out 45 miles - Chanthu’s

intensity will diminish over time and it will not be nearly as intense as it is today after reaching the East China Sea - The

storm should stay just far enough off the coast of Luzon Island, Philippines to minimize its impact, although heavy rain, rough seas, flooding and excessive wind will impact both areas - Taiwan

may be more impacted by the storm with torrential rain and excessive wind and coastal flooding expected. The storm will lose intensity as it moves along the Taiwan coast - Tropical

Storm Conson was located 215 miles east of Da Nang, Vietnam near 15.6 north, 111.7 east moving westerly at 9 mph and producing maximum sustained wind speeds of 46 mph - Tropical

storm force wind was occurring out 110 miles from the storm center - Conson

will move westerly through the weekend and will move inland near Da Nang, Vietnam around 0600 GMT Sunday

- The

storm will slowly weaken and that should help minimize the potential for significant wind damage when the storm comes inland.

- Heavy

rain is expected, though, and some flooding will result in central Vietnam and southern Laos - Very

little crop damage is expected - Tropical

Depression Mindy became a mid-latitude low pressure center overnight and will continue move away from the U.S.

- Hurricane

Larry will reach southeastern Newfoundland, Canada this weekend - The

storm will produce some excessive wind, rain and flooding in southeastern Newfoundland where property damage is likely - Hurricane

Olaf was located 35 miles west southwest of La Paz, Mexico located in the far southern part of Baja California moving northwesterly at 10 mph and producing maximum sustained wind speeds of 80 mph.

- The

storm will follow the lower west coast of Baja California for a while today and then turn to the west Saturday and then to southwest Sunday while steadily weakening - Damage

to fruit and vegetable crops will result along with a few tree crops and personal property in southern Baja California - All

of the damaging weather will occur today and early Saturday and then the system will move away from North America

- A

tropical weather disturbance in Central America will likely shift northward over the next few days and will stay mostly over land until Saturday when it will emerge over the western Bay of Campeche - The

system “may” evolve into a tropical depression during the weekend while continuing to move northward off the east coast of Mexico - The

system will bring rain to eastern Mexico, the Texas coast and parts of Louisiana from the weekend into early next week - No

damaging wind is currently expected, but some brief periods of heavy rainfall are possible in each of the areas noted above - U.S.

weather will be very good for summer crop maturation and harvest progress in the central and northern Plains, Midwest, Delta and interior parts of the southeastern states during much of the next two weeks - Not

much rain will fall through Monday - Periodic

frontal systems are expected that will produce “some” rain, but disruptions to fieldwork should be brief

- The

best weather for crop maturation and harvesting will occur through Sunday with little to no rain and mild to warm temperatures - Showers

will develop in the northern Plains and upper Midwest Monday at the same time tropical moisture reaches the central Gulf of Mexico coast - These

two weather features will merge over the eastern Midwest and Delta resulting in some enhanced rainfall during mid-week next week

- The

precipitation will shift to the southeastern states late next week - Rainfall

will be greatest in the lower and eastern Midwest, Delta and a parts of eastern Texas - Crop

quality concerns may evolve for open boll cotton in Coastal Bend areas of Texas, but the impact should be low - In

the meantime, restricted rain will fall in the Great Plains and some temperatures will be hot periodically

- Extreme

highs over 100 Fahrenheit will occur in the central wheat areas of the hard red winter wheat country today and Saturday with 90s likely Sunday and Monday - Winter

wheat planting should advance favorably in areas that recently received rain in the central Plains - West

Texas rainfall will be minimal for a while favoring crop development - Temperatures

will be warm enough to induce better crop maturation conditions late this week and into the weekend when some 90-degree highs are expected - Drought

concerns remain in the U.S. Pacific Northwest, California and the interior western states, the northwestern U.S. Plains and southwestern Canada’s Prairies - No

change in this status is expected for a while - U.S.

temperatures in this coming week will be very warm to hot in the western U.S. from the high Plains region to the Pacific Coast excepting the Columbia River Basin where temperatures will be closer to normal - Temperatures

will be closer to normal in the Midwest, Delta and southeastern states with a few areas slightly cooler than usual - U.S.

temperatures Sep. 17-20 will be warmer than usual in the Plains and interior western U.S. while seasonably warm to the east - Cooling

is likely in the Pacific Northwest and western Canada - The

bottom line for much of the U.S. key grain and oilseed production areas during the next two weeks will be favorable for late season crop development, crop maturation and harvesting, despite some greater rain potential next week in the eastern Midwest. Wheat

planting in the southwestern Plains should advance well with quick emergence for areas that received last weekend.

- Moderate

to heavy rain will impact Gujarat, India periodically along with many areas in northwestern Madhya Pradesh, southern Rajasthan and parts of Maharashtra during the next ten days with some of it to be excessive

- Flooding

is a possibility and some damage to a few crops is also possible - Some

flooding is also possible this weekend through the first half of next week in Chhattisgarh, Odisha, Madhya Pradesh and some areas nearby in India due to a new monsoon depression evolves and comes inland from the Bay of Bengal - This

storm is predicted to move on a path farther northeast from where it was advertised to move earlier this week

- This

change reduces rain from Maharashtra, Andhra Pradesh and parts of Telangana - Much

needed drying is under way in southern portions of the North China Plain, Yellow River Valley and areas southward into the Yangtze River Basin - This

region will continue to dry out for the next seven days - Northern

parts of this region have been quite wet recently with serious flooding from northeastern Sichuan and southern Shaanxi to Shandong and northern Jiangsu during the weekend and Monday - Northeastern

China will continue to receive some periodic rain during the coming week to ten days maintaining wet field conditions in areas where summer crops should be filling, maturing and beginning to be harvested - Harvest

weather in Canada’s Prairies may deteriorate for a while due to a boost in rainfall in western and northern parts of the region during the coming week.

- The

moisture will be great for winter crop use and for lifting topsoil moisture before winter arrives - Much

needed rain is expected in southern Alberta and southwestern most Saskatchewan briefly this weekend with 0.20 to 0.80 inch of moisture resulting and locally more - Ontario

and Quebec weather will continue favorably mixed over the next two weeks for late season farming activity and harvesting of summer crops - Australia

needs greater rain in northern New South Wales, Queensland and northern parts of Western Australia to improve reproductive conditions for wheat and barley - Southern

Australia soil moisture is still rated favorably with little change likely

- Eastern

Europe weather will be very good for harvest and early season winter crop planting over the next ten days - Some

winter crop areas in the Balkan Countries will continue in need of greater soil moisture, despite some dryness relief in the past week or two

- Western

Europe will get some beneficial rain over the coming week easing recent drying that has firmed up the ground in France - Rain

will be good for future winter crop planting, but it will disrupt farming activity including the maturation and harvest of summer crops - Some

southern CIS winter crop areas will need significant rain soon to support wheat, rye and barley germination, emergence and establishment - The

dry weather will be good for summer crop maturation and harvesting - Very

little rain is expected from Ukraine into the middle and lower Volga River Basin or Kazakhstan over the next ten days - Waves

of rain will impact northern Russia during the next ten days with the greater amounts expected in the New Lands - Some

delay in harvest progress is possible and there may be a little concern over small grain and sunseed crop quality if the rain prevails too long - Recent

cool weather in northern Russia did not have much impact on crops - Additional

cool weather is expected for a while which may induce more frost and freezes - Frost

and freezes will impact Russia’s New Lands and a part of northern Kazakhstan early next week that will end the growing season, but have little impact on crops

- Central

America and southern and eastern Mexico will remain wet biased during the next ten days with near to above normal rainfall - A

tropical disturbance in the western Caribbean Sea will move across the Yucatan Peninsula during the weekend and could become a tropical depression in the western Bay of Campeche during the weekend before impacting northeastern Mexico and southern Texas later

next week - Confidence

is very low - Argentina

will trend drier for a while, but more rain will evolve late in the weekend and early next week in eastern parts of the nation - Recent

moisture was good for wheat and for future planting of early corn and sunseed - Rain

will still be needed in Cordoba, parts of Santa Fe and Santiago del Estero where dryness will remain significant - Western

Argentina may be dry for ten days before rain chances improve again - Brazil

rainfall will be greatest again Monday into Tuesday in Rio Grande do Sul where some flooding will be possible in some of its rice and corn production region areas - Rainfall

elsewhere in Brazil will be more restricted; however, Northern Mato Grosso may experience some periodic showers over the next ten days - Initial

rainfall in Mato Grosso will be too light for early autumn soybean planting, but the environment may improve next week and later this month - Coffee,

citrus and sugarcane areas will stay mostly dry for another week to ten days, although some showers will occur in Sul de Minas Friday and Saturday - Showers

will also occur in interior southern Brazil periodically in the coming week benefiting early corn planting and winter wheat - Southeast

Asia rainfall will remain sufficient to carry on favorable crop development from the mainland areas into the Philippines and Indonesia and Malaysia during the next ten days - There

is some potential for excessive rain and flooding in a part of mainland Southeast Asia - Northeastern

Luzon Island could experience flooding rain from Typhoon Chanthu later this week - Rainfall

will be lightest in parts of Sumatra and Peninsular Malaysia where some net drying is possible and the region will need to be closely monitored - Temperatures

will be a little cooler than usual - New

Zealand will be extra wet this week while temperature are little cooler than usual - The

entire nation will be wetter than usual - Southern

Oscillation Index was +6.96 today and the index has been moving in a narrow range this week - The

index will drift aimlessly for a while - South

Africa rainfall should be mostly confined to the southeast early to mid-week this week with Natal most favored.

- West-Central

Africa will get sufficient rainfall during the next ten days to support its coffee, cocoa, rice sugarcane and other crops - Cotton

in west-central Africa is rated favorable and has likely yielded well this year

Source:

World Weather Inc.

Friday,

Sept. 10:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- USDA’s

monthly World Agricultural Supply and Demand Estimates (WASDE) report, noon - China

farm ministry’s CASDE outlook report - ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysian

Palm Oil Board data on August stockpiles, output, and exports - FranceAgriMer

weekly update on crop conditions - Malaysia

Sept. 1-10 palm oil export data - HOLIDAY:

India

Monday,

Sept. 13:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn, cotton, soybeans; spring wheat harvest, 4pm - AB

Sugar trading update - Ivory

Coast cocoa arrivals - New

Zealand Food Prices

Tuesday,

Sept. 14:

- EU

weekly grain, oilseed import and export data - France

agricultural ministry crop production estimate - Ros

Agro capital markets day - Abares’

agricultural commodities — September quarter 2021

Wednesday,

Sept. 15:

- EIA

weekly U.S. ethanol inventories, production - FranceAgriMer

monthly grains report - Malaysia

Sept. 1-15 palm oil exports - Brazil’s

Unica releases cane crush and sugar output data (tentative)

Thursday,

Sept. 16:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Malaysia

Friday,

Sept. 17:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

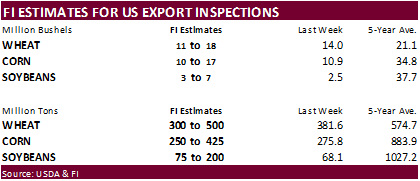

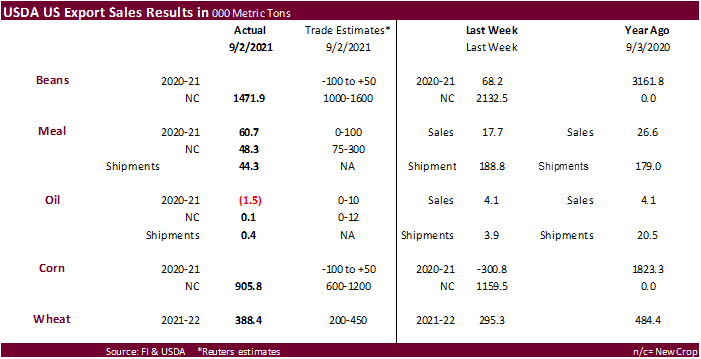

USDA

export sales

were within expectations for soybeans, corn, and wheat. Meal and soybean oil were near the lower end of expectations. Soybean meal shipments significantly slow, in part to the closure of Gulf terminals and barge movement, while soybean oil shipments remain

slow.

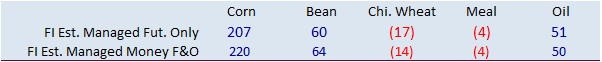

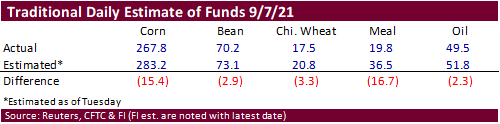

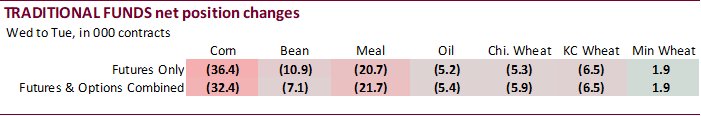

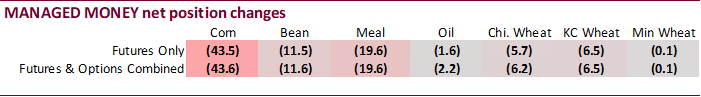

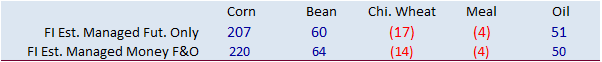

Commitment

of Traders

Funds

sold more than expected ag contracts for the week ending September 7, but positions were not that far off from trade expectations, with expectation to soybean meal, which could have been reflected in Friday’s (Sep 10) price reaction as funds added 3,000 contracts

with prices up $4.40-$5.50/short ton, mainly on spreading.

“On

Monday, OPEC is expected to decrease its forecast for oil demand growth in 2022” – chat source

US

Wholesale Inventories (M/M) Jul F: 0.6% (est 0.6%; prev 0.6%)

–

Wholesale Trade Sales (M/M) Jul: 2.0% (prev R 2.3%)

Commodity

group Louis Dreyfus completes stake sale to ADQ

·

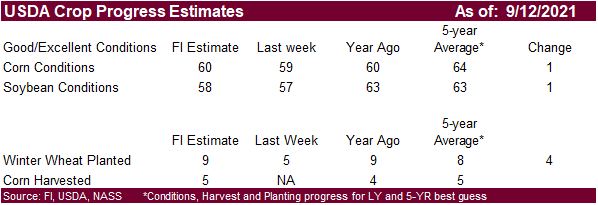

Corn futures chopped around before the USDA report and then chopped around thereafter until soybeans rallied, underpinning corn prices for the remainder of the day.

See

above page one for USDA comments. Other than USDA’s S&D report, news was light after the day session open. Several traders believe a short-term low is in. We are in the camp harvest pressure could test the Friday low based on field reports of excellent

yields. Its early to tell if the yield will increase next month, but if we had to guess we think it will be higher. On Monday we look for a one-point increase in crop conditions. Early corn field reports suggest very good yields from Arkansas to Missouri,

central IA, and southern IL. Problem for bears is that corn broke over the last few weeks and producers have become reluctant to sell.

·

Funds bought an estimated net 5,000 corn contracts.

·

Ukrainian grain traders union UGA estimated Ukraine’s corn crop could reach a record 38-40 million tons compared with 30 million tons harvested in 2020. AgMin is at 37.1 million tons and exports at 30.9 million.

·

China’s Sinograin sold 12,972 tons of imported genetically modified corn, or 10% of the total volume offered. They also sold 3,287 tons of imported non-GMO corn, or 40% of the volume offered. They plan to sell 99,339 tons of

corn from the United States.

·

In its monthly CASDE update, China lowered its 2021-22 corn consumption of corn by 3 million tons to 187 million tons from the previous month.

·

The Baltic Dry Index posted a 6 percent increase from the previous day to 3,864 points.

·

French corn conditions as of September 6 fell 2 points to 89% good or excellent and are well above a year ago of 60%.

·

France raised its bird flu alert level after highly contagious H5N8 strain of avian influenza was found this week among ducks, hens, turkeys, and pigeons belonging to a household in the Ardennes region. Belgium and Luxembourg

recently reported the cases. (Reuters)

Export

developments.

·

None reported.

Updated

8/20/21

December

corn is seen in a $4.75-$6.00 range

Soybeans

·

November soybeans today bounced off a 200-day MA, a bullish signal.

·

Funds bought an estimated net 10,000 soybeans, bought 5,000 meal and

bought 1,000 soybean oil. Note soybean oil fell 28 points basis October position.

·

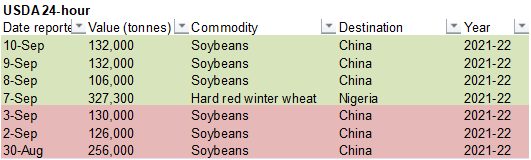

We are hearing China bought Brazilian soybeans for October shipment. Then at 8:00 am CT USDA announced another 132,000 ton soybean sale to China.

·

Argentina’s government signed a short-term deal with Belgian firm to dredge the Parana River. The Parana is at its lowest in 77 years.

·

China cash crush margins were last positive 139 cents on our analysis (133 previous) versus 115 cents late last week and 84 cents around a year ago.

·

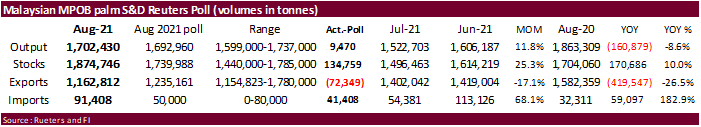

AmSpec reported Malaysian palm oil Sept. 1-10 exports rose 50.47% to 554,875 tons from 368,763 tons shipped during the first 10 days in the previous month.

·

Malaysia’s August palm oil stocks increased 25.3% from July to 1.87 million tons per MPOB data. Crude production was up 11.8% to 1.7 million tons, while palm oil exports fell 17.1% to 1.16 million. Production was up 11.2% to

1.7 million tons and exports fell 12.3% to 1.24 million tons.

Export

Developments

- Under

the USDA 24-hour announcement system, private exporters export sales of 132,000 tons of soybeans for delivery to China during the 2021-22 marketing year.

Updated

8/31/21

Soybeans

– November $11.75-$14.50 range

Soybean

meal – December $320-$395

Soybean

oil – December 52-65 cent range

·

Funds sold an estimated net 5,000 soft wheat contracts.

·

December Paris wheat was down 0.75 at 237.75 euros.

·

Russia’s wheat export duty will rise to $52.5 per ton as of September 15 from the current $46.5, which applies until September 14 (AgMin). Barley was set at $33.1 from $26.1, and corn will decrease to $49 per ton from $51.1.

·

MGEX announced that Thursday, September 9th, 2021, was the second-best volume (Minneapolis wheat contracts) day in history with a total of 35,979 contracts.

US

Wheat Associates weekly harvest report

“This

is the final weekly report for SW harvest and indicates a U.S. No. 2 SW wheat crop in 2021. The HRS harvest is winding down and northern durum harvest is more than 90% complete. HRS currently grades a U.S. No. 1 Dark Northern Spring (DNS) and northern durum

is grading at U.S. No. 1 Hard Amber Durum (HAD).”

Export

Developments.

·

Pakistan bought 405,000 tons of wheat (550k sought) at $369.50 a ton c&f. On Tuesday they were seeing offers at around $369.50/ton and $386.60/ton.

·

Pakistan issued a new import tender for 500,000 tons of wheat set to closed on September 20.

·

Results awaited: Saudi Arabia seeks 360,000 tons of wheat for arrival in November.

·

Jordan seeks 120,000 tons of wheat on September 15 for last half December through first half February shipment.

·

Japan’s Ministry in their regular SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival in Japan by Feb. 24, 2022, set to close on Sept. 15.

·

Bangladesh’s state grains buyer seeks another 50,000 tons of milling wheat on September 16.

·

Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

·

Morocco seeks 363,000 tons of US wheat on September 21 for arrival by the end of the year.

Rice/Other

- None

reported. - Cotton

prices were up Friday per USDA results.

Updated

9/9/21

December

Chicago wheat is seen in a $6.50‐$7.80 range

December

KC wheat is seen in a $6.40‐$8.00

December

MN wheat is seen in a $8.45‐$9.50

U.S. EXPORT SALES FOR WEEK ENDING 09/02/21

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

|||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

WHEAT |

THOUSAND METRIC TONS |

|||||||

|

HRW |

227.4 |

1,507.4 |

1,856.1 |

214.0 |

2,118.3 |

3,000.5 |

0.0 |

0.0 |

|

SRW |

34.1 |

760.3 |

517.5 |

12.0 |

885.9 |

568.1 |

0.0 |

0.0 |

|

HRS |

77.7 |

1,049.3 |

1,831.7 |

101.1 |

1,675.8 |

1,973.7 |

0.0 |

0.0 |

|

WHITE |

49.2 |

668.8 |

1,226.0 |

62.9 |

1,095.2 |

1,334.9 |

0.0 |

0.0 |

|

DURUM |

0.0 |

7.4 |

256.8 |

0.0 |

43.2 |

231.6 |

0.0 |

0.0 |

|

TOTAL |

388.4 |

3,993.3 |

5,688.2 |

390.1 |

5,818.4 |

7,108.7 |

0.0 |

0.0 |

|

BARLEY |

-0.1 |

21.3 |

30.8 |

0.0 |

3.9 |

8.4 |

0.0 |

0.0 |

|

CORN |

905.8 |

24,158.2 |

18,601.2 |

167.9 |

167.9 |

245.7 |

0.0 |

331.0 |

|

SORGHUM |

126.4 |

1,944.9 |

2,415.0 |

0.0 |

0.0 |

33.0 |

0.0 |

0.0 |

|

SOYBEANS |

1,471.9 |

21,011.4 |

29,359.7 |

13.8 |

13.8 |

468.7 |

0.0 |

0.0 |

|

SOY MEAL |

60.7 |

1,252.1 |

1,086.2 |

44.3 |

10,888.5 |

11,099.3 |

48.3 |

2,106.4 |

|

SOY OIL |

-1.6 |

18.3 |

121.8 |

0.4 |

670.7 |

1,155.1 |

0.1 |

1.5 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

27.5 |

241.9 |

186.9 |

6.9 |

97.5 |

50.8 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

8.1 |

27.4 |

0.5 |

1.0 |

1.5 |

0.0 |

0.0 |

|

L G BRN |

0.2 |

1.1 |

8.3 |

0.5 |

12.0 |

2.7 |

0.0 |

0.0 |

|

M&S BR |

0.0 |

22.3 |

19.1 |

0.0 |

13.7 |

13.9 |

0.0 |

0.0 |

|

L G MLD |

4.0 |

167.1 |

68.5 |

5.5 |

77.0 |

20.2 |

0.0 |

0.0 |

|

M S MLD |

2.2 |

42.0 |

42.6 |

15.5 |

44.8 |

52.8 |

0.0 |

0.0 |

|

TOTAL |

34.0 |

482.6 |

352.9 |

28.9 |

246.0 |

141.7 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

|

|||||

|

UPLAND |

453.0 |

5,084.8 |

5,627.9 |

155.3 |

937.3 |

1,482.1 |

19.5 |

686.8 |

|

PIMA |

12.1 |

129.1 |

195.5 |

12.0 |

36.0 |

47.1 |

0.0 |

0.0 |

|

FINAL 2020/21 MARKETING YEAR |

||||

|

COMMODITY |

NET SALES |

CARRYOVER

SALES 1/ |

08/31/2021

EXPORTS |

ACCUMULATED

EXPORTS |

|

CORN |

-87.4 |

2,978.1 |

256.0 |

66,957.9 |

|

SORGHUM |

0.0 |

223.6 |

2.5 |

6,913.4 |

|

SOYBEANS |

148.2 |

1,805.8 |

283.1 |

60,570.5 |

|

|

|

|

|

|

This summary is based on reports from exporters for the period August 27-September 2, 2021.

Wheat: Net sales of 388,400 metric tons (MT) for 2021/2022 were up 32 percent from the previous week and 54 percent from the prior 4-week average. Increases primarily for

Mexico (128,100 MT, including decreases of 12,500 MT), the Philippines (63,000 MT), Japan (54,800 MT), Thailand (50,000 MT), and Venezuela (30,100 MT, including 29,300 MT switched from unknown destinations), were offset by reductions primarily for unknown

destinations (20,800 MT). Exports of 390,100 MT were down 7 percent from the previous week and 33 percent from the prior 4-week average. The destinations were primarily to Mexico (106,600 MT), the Philippines (63,000 MT), Taiwan (57,200 MT), Guatemala (33,500

MT), and South Korea (33,300 MT).

Corn: Net sales for the 2021/2022 marketing year, which began September 1, totaled 905,800 MT. Increases

were primarily for Mexico (334,100 MT, including decreases of 1,800 MT), unknown destinations (234,900 MT), Canada (176,200 MT, including decreases of 2,500 MT), Colombia (63,500 MT), and Japan (60,300 MT, including decreases of 10,200 MT), were offset by

reductions for Costa Rica (1,000 MT). A total of 2,978,100 MT in sales were carried over from the 2020/2021 marketing year, which ended August 31. Exports for the period ending August 31 of 256,000 MT brought accumulated exports to 66,957,900 MT, up 55 percent

from the prior year’s total of 43,273,800 MT. The primary destinations were to Mexico (117,000 MT), Japan (90,200 MT), Venezuela (19,100 MT), Canada (17,100 MT), and Guyana (8,000 MT). Exports for September 1-2 totaled 167,900 MT, with Mexico (140,100 MT),

Canada (27,500 MT), and Hong Kong (200 MT) being the primary destinations.

Optional Origin Sales: For 2021/2022, options were exercised to export 30,500 MT to

unknown destinations from other than the United States. The current outstanding balance of 110,000 MT is for unknown destinations.

Barley: Total net sales reductions for 2021/2022 of 100 MT were for Canada. No exports

were reported for the week.

Sorghum: Net sales

for the 2021/2022 marketing year, which began September 1, totaled 126,400 MT. Increases were reported for China (68,600 MT), unknown destinations (55,000 MT), and Mexico (2,800 MT). A total of 223,600 MT in sales were carried over from the 2020/2021 marketing

year, which ended August 31. Exports for the period ending August 31 of 2,500 MT brought accumulated exports to 6,913,400 MT, up 53 percent from the prior year’s total of 4,529,300 MT. The destination was Mexico. There were no exports for September 1-2.

Rice:

Net sales of 34,000 MT for 2021/2022 were primarily for Costa Rica (22,000 MT), Honduras (5,500 MT), Saudi Arabia (2,800 MT), Canada (2,200 MT), and Hong Kong

(900 MT). Exports of 28,900 MT were primarily to Japan (12,000 MT), Mexico (7,700 MT), Saudi Arabia (3,900 MT), Canada (2,400 MT), and the Dominican Republic (1,900 MT).

Soybeans: Net sales for the 2021/2022 marketing year, which began September 1, totaled

1,471,900 MT. Increases were primarily for China (764,000 MT), unknown destinations (453,600 MT), Mexico (79,100 MT, including decreases of 400 MT), Turkey (55,000 MT), and Egypt (55,000 MT). A total of 1,805,800 MT in sales were carried over from the 2020/2021

marketing year, which ended August 31. Exports for the period ending August 31 of 283,100 MT brought accumulated exports to 60,570,500 MT, up 35 percent from the prior year’s total of 44,934,500 MT. The primary destinations were Germany (152,200 MT), Japan

(58,100 MT), Mexico (42,700 MT), Indonesia (9,200 MT), and Taiwan (8,100 MT). Exports for September 1-2 totaled 13,800 MT, with Mexico (10,500 MT), Malaysia (2,200 MT), the Philippines (600 MT), Japan (300 MT), and Indonesia (200 MT) being the destinations.

Export for Own Account: For 2021/2022, new exports for own account totaling 5,800 MT

were carried over from the 2020/2021 marketing year, which ended August 31. The current exports for own account outstanding balance is 5,800 MT, all Canada.

Export Adjustments: Accumulated

export of soybeans to the Netherlands were adjusted down 65,966 MT for week ending August 19th, and 86,200 MT for week ending August 26th. The correct destination for these shipments is Germany.

Soybean Cake and Meal: Net sales of 60,700 MT for 2020/2021 were up noticeably from

the previous week, but down 9 percent from the prior 4-week average. Increases primarily for Mexico (24,100 MT, including decreases of 200 MT), Malaysia (8,500 MT), Canada (6,100 MT, including decreases of 200 MT), Taiwan (5,800 MT), and the Philippines (5,200

MT), were offset by reductions primarily for unknown destinations (8,300 MT).

For 2021/2022, net sales of 48,300 MT primarily for Japan (20,500 MT), the Dominican Republic (15,000 MT), Canada (9,100 MT), Colombia (8,600 MT), and Jamaica (8,000 MT), were offset by reductions primarily for unknown destinations (19,000 MT). Exports

of 44,300 MT were down 77 percent from the previous week and 80 percent from the prior 4-week average. The destinations were primarily to Canada (16,700 MT), Mexico (13,100 MT), Guyana (4,200 MT), Venezuela (3,100 MT), and Burma (2,400 MT).

Soybean Oil: Total net sales reductions for 2020/2021 of 1,600 MT, down noticeably

from the previous week and from the prior 4-week average, were for Canada (including decreases of 1,800 MT). Total net sales for 2021/2022 of 100 MT were for Canada. Exports of 400 MT were down 91 percent from the previous week and 73 percent from the prior

4-week average. The destination was primarily to Canada (300 MT).

Cotton:

Net sales of 453,000 RB for 2021/2022 primarily for China (261,500 RB, including decreases of 100 RB), Pakistan (36,500 RB), Indonesia (30,500 RB, including decreases of 100 RB), Guatemala (28,400 RB), and Turkey (25,400 RB, including decreases of 300 RB),

were offset by reductions for Japan (1,100 RB) and Bangladesh (200 RB). Total net sales for 2022/2023 of 19,500 RB were for Guatemala. Exports of 155,300 RB were primarily to Vietnam (48,600 RB), China (29,100 RB), Pakistan (16,600 RB), Mexico (16,000 RB),

and Turkey (14,300 RB). Net sales of Pima totaling 12,100 RB were primarily for India (5,500 RB, including decreases of 100 RB), Austria (2,600 RB), Honduras (2,200 RB), Pakistan (900 RB) and South Korea (700 RB). Exports of 12,000 RB were primarily to India

(7,700 RB), Pakistan (2,200 RB), China (1,000 RB), Peru (400 RB), and Thailand (400 RB).

Optional Origin Sales:

For 2021/2022, the current outstanding balance of 8,800 RB is for Pakistan.

Exports for Own Account: For 2021/2022, the current exports for own account outstanding balance of 4,800 RB is for China (4,700 RB) and Vietnam (100 RB).

Hides and Skins: Net sales

of 398,900 pieces for 2021 were up 23 percent from the previous week and 49 percent from the prior 4-week average. Increases primarily for China (285,600 whole cattle hides, including decreases of 28,400 pieces), South Korea (38,400 whole cattle hides, including

decreases of 1,200 pieces), Thailand (24,000 whole cattle hides, including decreases of 1,100 pieces), Mexico (19,300 whole cattle hides, including decreases of 600 pieces), and Italy (16,200 whole cattle hides), were offset by reductions for Ethiopia (100

pieces). Exports of 350,000 pieces were down 18 percent from the previous week and 20 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (226,400 pieces), South Korea (43,100 pieces), Mexico (30,600 pieces), Thailand

(15,800 pieces), and Taiwan (14,500 pieces).

Net sales of 2,100 wet blues for 2021 were down 99 percent from the previous week and from the prior

4-week average. Increases primarily for Brazil (6,000 unsplit), India (2,000 unsplit), Thailand (1,400 unsplit, including decreases of 400 unsplit), and Mexico (900 unsplit), were offset by reductions primarily for Italy (8,200 pieces).

Total net sales for 2022 of 8,000 wet blues were for Italy.

Exports of 64,500 wet blues were down 49

percent from the previous week and 60 percent from the prior 4-week average. The destinations were to Italy (23,300 unsplit), Vietnam (16,200 unsplit), Thailand (9,100 unsplit), China (6,600 unsplit), and Mexico (1,900

unsplit and 2,100 grain splits). Total net sales reductions of 2,100 splits were for China. Exports of 160,000 pounds were to Vietnam.

Beef:

Net sales of 12,400 MT reported for 2021 were down 20 percent from the previous week and 2 percent from the prior 4-week average. Increases were primarily for Japan

(4,600 MT, including decreases of 500 MT), China (2,700 MT, including decreases of 100 MT), South Korea (900 MT, including decreases 500 MT), Canada (800 MT), and Taiwan (700 MT, including 100 MT switched from the Philippines and decreases of 100 MT). Total

net sales for 2022 of 400 MT were for South Korea. Exports of 18,800 MT were up 4 percent from the previous week, but unchanged from the prior 4-week average. The destinations were primarily to Japan (4,900 MT), South Korea (4,700 MT), China (4,000 MT),

Taiwan (1,100 MT), and Mexico (1,000 MT).

Pork:

Net sales of 33,800 MT reported for 2021 were up 1 percent from the previous week and 47 percent from the prior 4-week average. Increases were primarily for China (15,000 MT, including decreases of 200 MT), Mexico (8,200

MT, including decreases of 700 MT), South Korea (3,600 MT, including decreases of 200 MT), Colombia (3,100 MT, including decreases of 100 MT), and Japan (1,600 MT, including decreases of 300 MT). Exports of 29,100 MT were up 3 percent from the previous week

and 2 percent from the prior 4-week average. The destinations were primarily to Mexico (13,800 MT), China (5,000 MT), Japan (3,700 MT), South Korea (1,400 MT), and Canada (1,400 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.