PDF Attached

includes

updated US S&D’s

US

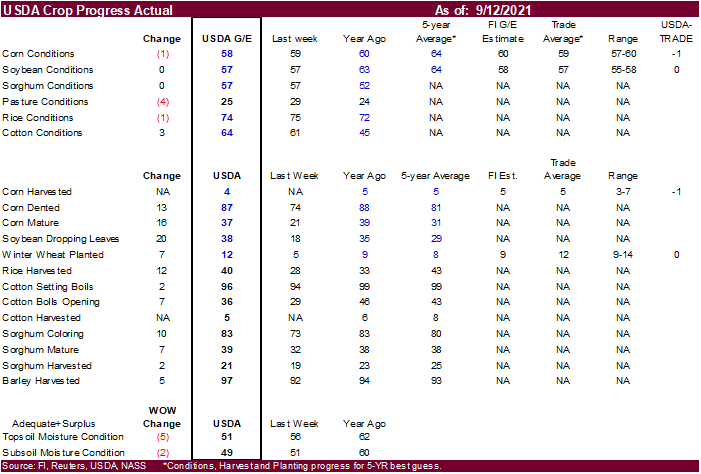

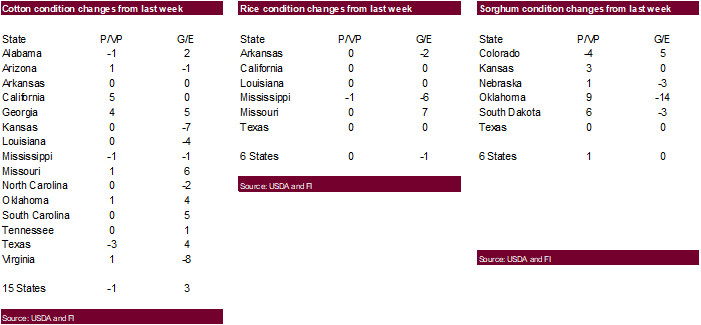

CORN – 58 PCT CONDITION GOOD/EXCELLENT VS 59 PCT WK AGO (60 PCT YR AGO) -USDA

US

SOYBEAN – 57 PCT CONDITION GOOD/EXCELLENT VS 57 PCT WK AGO (63 PCT YR AGO) -USDA

Trade

was at looking for unchanged for both corn and soybeans.

US

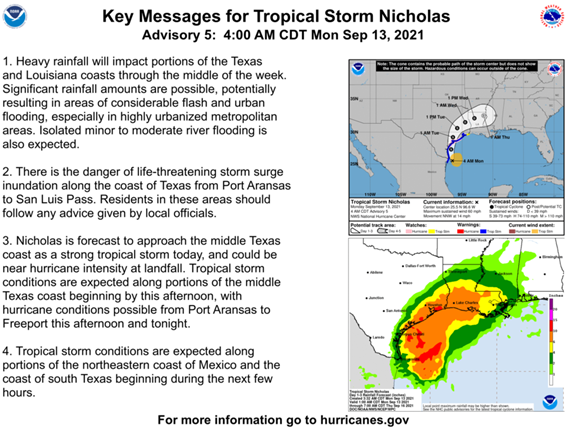

WINTER WHEAT – 12 PCT PLANTED VS 5 PCT WK AGO (8 PCT 5-YR AVG) -USDA (Trade was at 12)

US

CORN – 4 PCT HARVESTED (5 PCT YR) (5 PCT 5-YR AVG) -USDA (Trade was at 5)

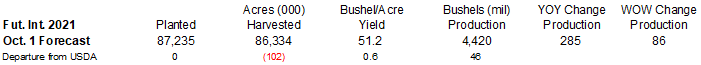

We

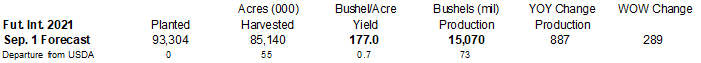

booted our US corn and soybean production estimates based on October USDA yields versus trend, higher US harvested area, and steady to improved conditions from late August.

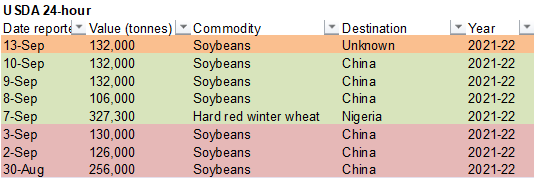

WASHINGTON,

September 13, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 132,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

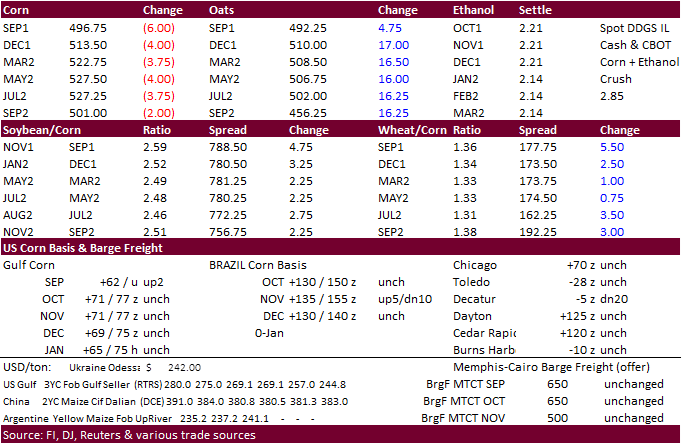

Many

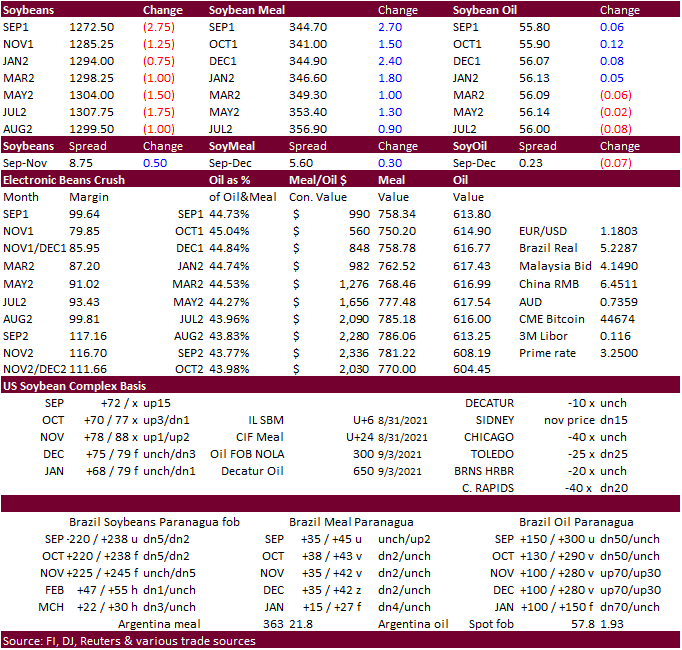

ag future contracts rebounded well off session lows. Soybean meal and nearby soybean oil closed higher, which supported crush. Corn was on the defensive for much of the session. Wheat was mixed.

World

Weather Inc.

BIGGEST

WEATHER ANOMALIES THREATENING CROP AREAS

- Shanghai

and the Hangzhou Ports will be shut down early this week because of typhoon Chanthu - Rain

is still needed in the Balkan Countries of southeastern Europe - Ukraine

the middle and lower Volga River Basin will get some needed rain this weekend into early next week and then dry again later next week…..this will leave a need for greater rain in winter crop areas - Kazakhstan

continues in need of moisture after long, dry, summer - Western

Argentina will continue in need of rain - Southern

Brazil will be wet early this week - Center

west and center south Brazil may begin to experience showers in the last ten days of this month, although resulting rainfall will be light leaving need for greater rain for spring planting - Canada’s

central and southwestern Prairies and northwestern U.S. Plains as well as all of the western U.S. still need significant moisture, despite weekend showers in a part of these areas - Frost

and freezes will evolve late this week and again next week in Canada - Northern

winter crop areas in Australia (Queensland, far northern New South Wales and northern parts of Western Australia) need rain to support the best winter crop yields during reproduction that is under way - Production

will still be good, but it could be better with some needed rain - Late

season India rainfall will continue greater than usual in the northwest and central parts of the nation while the interior south stays dry biased - The

monsoon will begin to withdraw around Sep. 20. - Southeastern

and east-central China will dry down this week and then get some more rain again next week

MOST

IMPORTANT WEATHER OF THE DAY

- Typhoon

Chanthu was 102 miles east southeast of Shanghai, China near 31.0 north, 123.3 east at 0900 GMT today.

- The

storm was moving northerly at 19 mph and producing maximum sustained wind speeds of 86 mph

- Tropical

storm force wind was occurring out 180 miles from the storm center while typhoon force wind (greater than 74mph) was occurring out 25 miles from the storm center - Typhoon

Chanthu be nearly stationary through Wednesday and then start moving to the east northeast Thursday and more rapidly in that same direction Friday and Saturday - The

typhoon will be downgraded to tropical storm status later today - The

storm will pass through southern most portions of South Korea as a tropical storm

- Heavy

rain has already occurred in the lower Yangtze River Basin due to the typhoon with rainfall to nearly 6.00 inches through dawn (China time) today - Much

of the storm’s greatest rainfall will stay out over water and impact some of the islands near to the Hangzhou Bay - The

storm will likely shut down much of the port activity for the next three days in the Hangzhou Bay area of China and then heavy rain and windy conditions will shift to southern South Korea and a part of western Japan during the middle to latter part of this

week - The

storm will be much weaker late this week and the impact on South Korea and Japan will be much less than that of China - Chanthu

may produce some additional rain in southeastern Jiangsu and northeastern Zhejiang, but the bulk of the storm’s flooding rain should stay out to sea.

- Chanthu

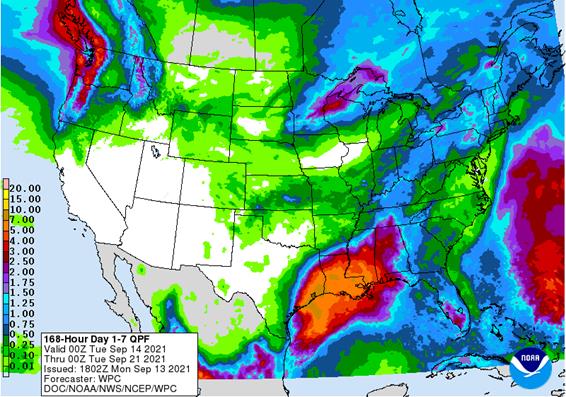

impacted eastern Taiwan with torrential rain, flooding and strong wind speeds during the weekend - Tropical

Storm Conson moved inland near Da Nang today (Sunday) and heavy rain fell in the area and west into southern Laos where 8.00 to 11.35 inches was common with 23.70 inches in Da Nang through dawn today

- Flooding

was most serious in the Da Nang area - Tropical

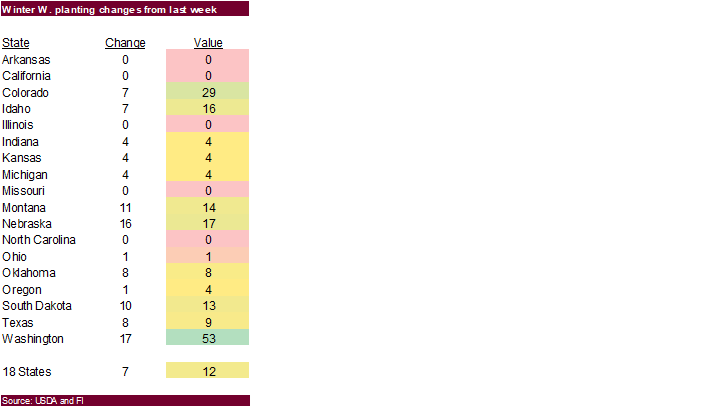

Storm Nicholas will bring heavy rain to the middle and upper Texas coast and parts of Louisiana during the coming week - Rainfall

of 5.00 to 10.00 inches and local amounts to nearly 13.00 inches will be possible along the middle and upper Texas coast while 4.00 to 8.00 inches occurs in Louisiana and 1.00 to 5.00 inches in interior eastern Texas and in the U.S. Delta - Flooding

will occur, but the impact will be greatest in urban areas and not in key agricultural areas - Louisiana

flooding may impact a few rice and sugarcane areas, but long term impacts on the crop should be low - A

tropical depression or tropical storm may evolve east of the Bahamas during mid-week this week that could evolve additionally while moving toward the North Carolina coast - The

storm could impact North Carolina Thursday into Friday with some rain also occurring in Virginia - No

crop damaging rain, flooding or wind is expected - The

tropical system should turn out to sea later this week and during the weekend - Tropical

Storm Olaf dissipated west of southern Baja California, Mexico during the weekend after producing some strong wind and rain over the southern tip of the Peninsula during the early weekend.

- Hurricane

Larry dissipated during the weekend after impacting Newfoundland, Canada - A

tropical disturbance off the southwest Mexico coast will move inland this week generating some significant rain in Oaxaca, Michoacán, Colima and Jalisco - Flooding

will be greatest in Michoacan and Oaxaca - Very

little crop damage will occur to citrus or coffee - Some

sugarcane and rice areas might get a little too much rain - The

storm may re-emerge over the eastern Pacific Ocean later this week before moving westerly away from the nation - A

notable trend change in ENSO conditions has been advertised in the latest NOAA CFSv2 forecast model for La Nina during the past several days - The

model has been turning more aggressive with the development of La Nina over the next couple of months - La

Nina is advertised to develop over the next few weeks with a moderately strong La Nina possible in October through January.

- The

change is significant relative to that advertised earlier this month when the model was suggesting a weaker event - World

Weather, Inc. believes the model may be too aggressive with the development, but evolution toward La Nina is likely over the next few weeks.

- A

notable rise in the Southern Oscillation Index began during the weekend and this may continue for a while this week as the transition to La Nina begins - Southern

Oscillation Index was at +7.61 and the index should move higher over the next weeks - U.S.

weather during the weekend was nearly ideal for summer crop maturation and harvest progress - Little

to no rain fell in the Midwest, Delta or southeastern states - Some

welcome rain fell Friday into the weekend in the Pacific Northwest and a part of the U.S. northern Great Basin - No

heavy rain resulted, but the coverage of rain was the greatest seen in months and provides a little hope that dryness will be eased later this season - Rain

totals in the Colombia River Basin was no more than 0.58 inch which was not enough for a serious change in soil moisture

- Additional

rain is predicted in the Pacific Northwest during the weekend and into next week - U.S.

weather during the coming week will be well mixed with periods of rain and sunshine, but net drying is expected in the Great Plains, lower Midwest, interior southeastern states and a part of the northern most Delta - Totally

dry weather is not likely in these areas, but net drying will occur and that will be good for summer crop maturation and harvest progress for early season crops - Temperatures

will be well above average this week from the central and southern Rocky Mountain region through the central and northern Plains and Midwest to the middle and northern Atlantic Coast States - Quick

drying is expected in most of these warm areas - Cooling

is expected in the Pacific Northwest and far western Canada’s Prairies - U.S.

weather next week will be warmer than usual in the Midwest, Delta and most Atlantic Coast States next week while cooling expands in the western states - A

couple of cool fronts will pass through the Midwest producing light amounts of rain, but sufficient drying time will occur to support crop maturation and some harvest progress - West

Texas rainfall will be minimal for a while favoring crop development - A

few showers may occur briefly during mid-week this week, but resulting rainfall should not be great enough to seriously change crop or field conditions - Temperatures

have been warm enough to induce better crop maturation conditions - Cooling

is expected for a while this week - U.S.

hard red winter wheat production areas will receive restricted rainfall during the next ten days supporting summer crop maturation and harvest progress - Good

wheat planting progress is expected as well - Rain

will soon be needed to support better winter wheat emergence and establishment conditions - U.S.

Pacific Northwest showers next week will help lift topsoil moisture in some areas, but a more generalized rain will still be needed - Rain

in the eastern Midwest will be a little more widespread next week, but the impact on crops should be relatively low, although some fieldwork delay is anticipated - Canada’s

Prairies will continue to experience net drying this week favoring a faster than usual harvest pace across much of the region - Rain

is expected periodically in western and northern Alberta, northeastern Saskatchewan and in a few areas of Manitoba - No

heavy rain is expected and delays to farming activity should be brief - Weather

in Central America and the Greater Antilles this week will be frequent enough to maintain a relatively good environment for crops - Argentina

rainfall during the next ten days will be restricted in western parts of the nation maintaining concern about long term crop moisture in central and northern Cordoba, Santiago del Estero, western Santa Fe and parts of Chaco and western Formosa - Rain

will fall infrequent in far eastern Argentina through most of southern Brazil this week - Rain

will be greatest today through Wednesday from Rio Grande do Sul to southern Parana and southern Paraguay where 1.50 to more than 5.00 inches will result - Not

much other precipitation is expected over the coming week in center west, center south and northeastern Brazil

- Dryness

is not unusual for this time of year in these areas, but pre-monsoonal showers and thunderstorms should evolve soon across portions of center west and center south Brazil late this month and during October - Initial

rainfall is expected to be lighter than usual because of developing La Nina conditions, but fieldwork should advance better than in 2020 - Temperatures

in Brazil over the coming two weeks will be warmer than usual in center west and center south parts of the nation while a little closer to normal elsewhere - Argentina

temperatures during the coming week will be seasonable with a slight warmer bias this week and then a little cooler next week - South

America weekend precipitation was limited to interior southern Brazil with few areas away from the coast getting more than 0.25 inch of moisture - Temperatures

were seasonable with a slight warmer bias - Europe

and CIS precipitation during the weekend was erratic and mostly light while temperatures were seasonable resulting in a good environment for fieldwork in areas that did not receive rain - Europe

temperatures during the coming week will be warmer than usual especially in the southeast and east-central crop areas - Temperatures

will be cooler than usual in north-central parts of Russia during the coming week and a little cooler next week - Not

much precipitation will fall this week in Kazakhstan and the eastern CIS New Lands

- Periodic

light precipitation will occur from the Ural Mountains westward, but the precipitation will be a little erratic leaving need for more rain in the middle and lower Volga River Basin and parts of Ukraine - Moisture

is needed in some of these winter wheat, rye and barley production areas to bolster soil moisture for planting, emergence and establishment - Week

two precipitation is advertised to be minimal in central and southwestern Russia, Ukraine and Belarus allowing autumn planting and establishment to advance favorably, although there will be some ongoing need for greater rain in the winter wheat production

areas - Europe

precipitation this week will occur from Portugal and Spain into France and Italy

- A

few areas in the western Balkan Countries will also receive some welcome rain - Net

drying is expected elsewhere - North

Africa showers in the next two weeks will mostly be too light to counter evaporation - India

rainfall will continue lighter than usual in the interior southern parts of the nation for the next couple of weeks - India

rainfall will continue abundant and frequent in central through interior northern parts of the nation for the next ten days - Monsoonal

precipitation will begin to withdraw after Sep. 20 which is later than usual - The

moisture may raise some concern over the quality of open boll cotton, but rain frequency in the most mature crop areas should be low enough to minimize the impact - Rainfall

will be heavy at times in central and northwestern India; including Gujarat and parts of Madhya Pradesh as well as northeastern Maharashtra - Crop

conditions may deteriorate in some of these areas until drier weather evolves - Weekend

rainfall in India greatest in Punjab where heavy rain may have damaged early season cotton in the open boll stage - Rainfall

varied up to 6.77 inches - Neighboring

areas of Rajasthan, Haryana and other neighboring areas ranged from 1.00 to slightly more than 3.50 inches - Rain

also fell moderately in Chhattisgarh, Odisha and neighboring areas where 1.00 to 3.00 inches were common, but central Odisha reported 8.00 to 13.97 inches resulting in some flooding

- Southern

India was dry - Light

rain fell in Gujarat and the middle Ganges River Basin - Heavy

rain fell in western and northern Luzon Island as Super Typhoon Chanthu departed from the region - Rainfall

varied from 4.00 to 11.85 inches - Flooding

may have negatively impacted some rice and sugarcane in the region - No

damaging wind occurred in key crop areas - Chanthu

producing excessive wind off the northeast coast of Luzon Island Friday - Other

areas in Southeast Asia received some periodic showers during the weekend, but parts of Sumatra, Indonesia and peninsular Malaysia were left mostly dry - Flooding

rain fell in central Vietnam and southern Laos from Tropical Storm Conson where 8.00 to 11.35 inches resulted - Da

Nang reported 23.70 inches of rain for the weekend and flooding was horrific - Southeast

Asia rainfall over the next two weeks will be abundant to locally excessive resulting in some pockets of flooding - The

moisture will help improve runoff and water supply for the long dry season that is approaching - A

favorable distribution of rain will occur in Indonesia and Malaysia during the next two weeks; however, parts of Sumatra will continue to report less than usual rain - Australia

rainfall during the weekend was minimal favoring a few showers areas - Australia

precipitation will remain restricted for the next ten days to two weeks especially in northern production areas; including Queensland, northern New South Wales and northern parts of Western Australia where winter crops are in the midst of reproduction.

- Subsoil

moisture will carry on normal crop development for a while, but rain is needed to ensure the best yields outside of Queensland - Queensland

unirrigated crop areas need significant rain - South

Africa rain this week will be limited to coastal areas for the next week followed by drier weather next week - Winter

crops are still in favorable conditions and poised to perform well, but timely rain must evolve in the next few weeks to induce the best yields.

- Ontario

and Quebec weather will continue favorably mixed over the next two weeks for late season farming activity and harvesting of summer crops - New

Zealand will wetter than usual this week in North Island while more seasonable precipitation occurs farther to the south.

- Next

week will be wetter in western parts of South Island - West-Central

Africa will get sufficient rainfall during the next ten days to support its coffee, cocoa, rice sugarcane and other crops - Cotton

in west-central Africa is rated favorable and has likely yielded well this year - East-central

Africa showers and thunderstorms will continue over the next couple of weeks and the precipitation will be good for most of Ethiopia, Uruguay and southwestern Kenya

Monday,

Sept. 13:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn, cotton, soybeans; spring wheat harvest, 4pm - AB

Sugar trading update - Ivory

Coast cocoa arrivals - New

Zealand Food Prices

Tuesday,

Sept. 14:

- EU

weekly grain, oilseed import and export data - France

agricultural ministry crop production estimate - Ros

Agro capital markets day - Abares’

agricultural commodities — September quarter 2021

Wednesday,

Sept. 15:

- EIA

weekly U.S. ethanol inventories, production - FranceAgriMer

monthly grains report - Malaysia

Sept. 1-15 palm oil exports - Brazil’s

Unica releases cane crush and sugar output data (tentative)

Thursday,

Sept. 16:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Malaysia

Friday,

Sept. 17:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

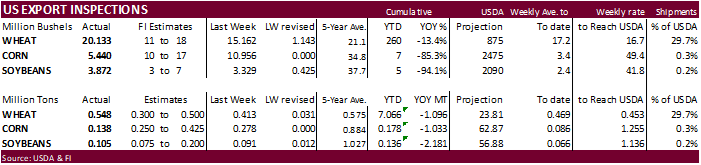

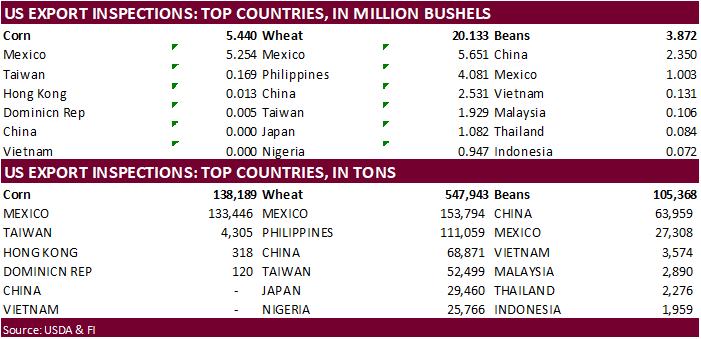

USDA

inspections versus Reuters trade range

Wheat

547,943 versus 200000-500000 range

Corn

138,189 versus 250000-600000 range

Soybeans

105,368 versus 75000-300000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING SEP 09, 2021

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 09/09/2021 09/02/2021 09/10/2020 TO DATE TO DATE

BARLEY

0 0 0 6,550 5,727

CORN

138,189 278,294 939,113 177,642 1,211,033

FLAXSEED

0 0 0 24 389

MIXED

0 0 0 0 0

OATS

100 0 0 200 948

RYE

0 0 0 0 0

SORGHUM

4,526 3,831 72,465 5,843 105,561

SOYBEANS

105,368 90,603 1,634,646 135,722 2,316,873

SUNFLOWER

0 0 0 0 0

WHEAT

547,943 412,649 694,154 7,066,057 8,161,621

Total

796,126 785,377 3,340,378 7,392,038 11,802,152

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

·

Favorable weekend US harvest weather pressured corn futures.

·

Funds sold an estimated net 6,000 corn contracts.

·

USDA export inspections were lowest in 8-1/2 years.

·

USDA US corn export inspections as of September 09, 2021 were 138,189 tons, below a range of trade expectations, below 278,294 tons previous week and compares to 939,113 tons year ago. Major countries included Mexico for 133,446

tons, Taiwan for 4,305 tons, and Hong Kong for 318 tons.

·

News was light for corn. Traders should keep an eye on the December 200-day MA at $505.75. A close below this level could signal a potential leg down to the $4.90-$4.95 area.

·

We are hearing the EPA mandate may not be released until next week, at earliest.

·

Biden Administration plans to nominate Elaine Trevino to head the agriculture office of the US Trade Representative. Elaine Trevino is the president of the Almond Alliance of California.

·

Baltic Dry Index was up nearly 8 percent to 4,163 points.

·

We booted our corn and soybean production estimates based on October USDA yields versus trend, higher US harvested area, and steady to improved conditions from late August.

Export

developments.

·

None reported.

Updated

8/20/21

December

corn is seen in a $4.75-$6.00 range

Soybeans

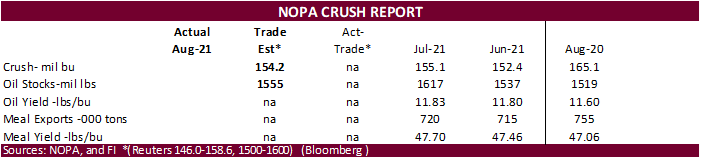

·

US soybeans and meal opened lower

in part to USDA’s upward revision to the US soybean yield and increasing concerns over the spread of Covid-19 variants. Meal rallied to close higher, trimming loses in soybeans. Soybean oil ended mixed. There is a new covid-19 outbreak in the province of

Fujian (Beijing Capital). China’s Fujian bans population from leaving the city & suspends bus, taxi, and train services.

·

Funds sold an estimated net 1,000 soybeans, bought 1,000 meal and were even in soybean oil.

·

USDA US soybean export inspections as of September 09, 2021 were 105,368 tons, within a range of trade expectations, above 90,603 tons previous week and compares to 1,634,646 tons year ago. Major countries included China for 63,959

tons, Mexico for 27,308 tons, and Vietnam for 3,574 tons.

·

Soybean oil initially found support from a snap in Malaysia’s losing streak after Malaysian September 1-10 palm exports were reported 29% higher form the same period last month by SGS at 548,420 tons. In addition, India lowered

their import taxes on crude palm oil to 2.5% from 10%, while the tax on crude soyoil and crude sunflower oil was reduced to 2.5% from 7.5%. The base import tax on refined grades of palm oil, soyoil and sunflower oil were lowered to 32.5% from 37.5%. Reuters

noted after the cuts, “crude palm oil, soyoil and sunflower oil imports will be subject to a 24.75% tax in total, including a 2.5% base import duty and other taxes, while refined grades of palm oil, soyoil and sunflower oil would carry a 35.75% tax in total.”

·

Bloomberg noted there is a House plant to introduce a credit of $1.25 to $1.75/gallon for sustainable aviation fuels. That would not include biodiesel producers. The draft might be marked up this week by the House Ways and Means

Committee.

Export

Developments

- Under

the USDA 24-hour announcement system, private exporters export sales of 132,000 tons of soybeans for delivery to unknown during the 2021-22 marketing year.

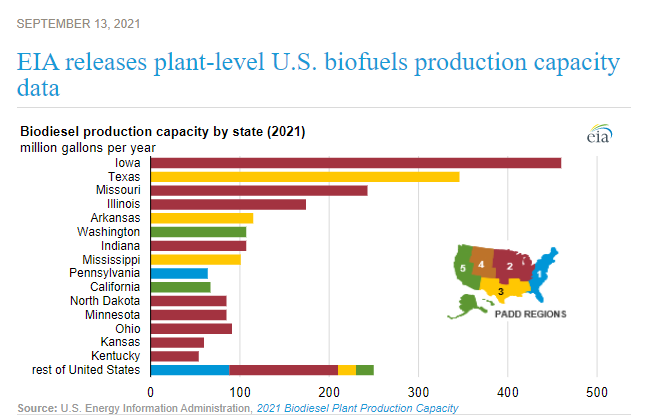

EIA

releases plant-level U.S. biofuels production capacity data

https://www.eia.gov/todayinenergy/detail.php?id=49516&src=email

Updated

8/31/21

Soybeans

– November $11.75-$14.50 range

Soybean

meal – December $320-$395

Soybean

oil – December 52-65 cent range

·

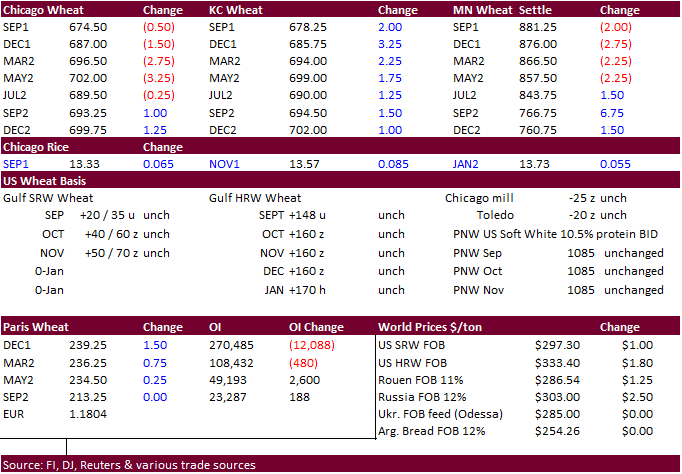

Wheat ended mixed on good global weather, higher USD, and steady import demand.

·

Funds sold an estimated net 1,000 soft wheat contracts.

·

USDA US all-wheat export inspections as of September 09, 2021 were 547,943 tons, above a range of trade expectations, above 412,649 tons previous week and compares to 694,154 tons year ago. Major countries included Mexico for

153,794 tons, Philippines for 111,059 tons, and China for 68,871 tons.

·

December Paris wheat was up 1.50 at 239.00 euros.

·

Tropical storm expected to impact TX and surrounding areas. This could slow wheat shipments.

·

Russia exported 7.7 million tons of grain so far this season, down nearly 26 percent from the previous season. Wheat exports fell 21.6% to 6.7 million tons, barley 43.7% to 0.9 million tons and corn 63.9% to 0.1 million tons.

·

Russian wheat prices appreciated for the ninth consecutive week to $300/ton for 12.5% protein, according to IKAR, up $0.50/ton previous week. SovEcon reported a $2.00 increase to $303/ton.

·

Morocco will suspend their import duty on soft wheat starting November 1.

·

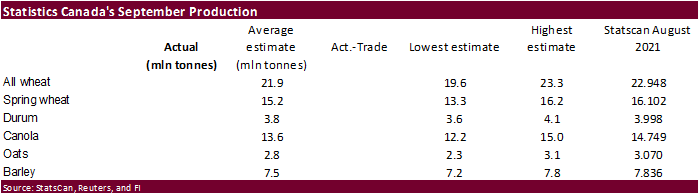

Next set of major reports will be quarterly stocks and small grains summary. We look for US wheat production to be upward revised by a small amount.

Export

Developments.

·

Algeria bought around 330,000 tons of feed barley, optional origin, at $307-$308/ton for October shipment.

·

Jordan seeks 120,000 tons of feed barley on September 16 for Dec/Jan/Feb shipment.

·

Pakistan issued a new import tender for 500,000 tons of wheat set to closed on September 20.

·

Jordan seeks 120,000 tons of wheat on September 15 for last half December through first half February shipment.

·

Japan’s Ministry in their regular SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival in Japan by Feb. 24, 2022, set to close on Sept. 15.

·

Bangladesh’s state grains buyer seeks another 50,000 tons of milling wheat on September 16.

·

Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

·

Morocco seeks 363,000 tons of US wheat on September 21 for arrival by the end of the year.

Rice/Other

·

Bangladesh seeks 50,000 tons of rice on September 23.

Updated

9/9/21

December

Chicago wheat is seen in a $6.50‐$7.80 range

December

KC wheat is seen in a $6.40‐$8.00

December

MN wheat is seen in a $8.45‐$9.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.