PDF Attached

StatsCan

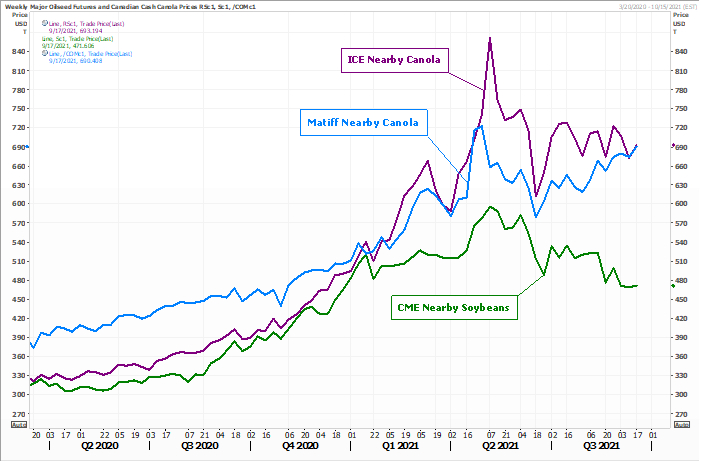

Canadian production estimates are viewed as supportive for wheat and canola, but soybean prices fell on light technical selling and oil/meal spreading. US Gulf shipments are starting to increase. Corn and wheat rallied in part to wheat production concerns.

World

Weather Inc.

MOST

IMPORTANT WEATHER OF THE DAY

-

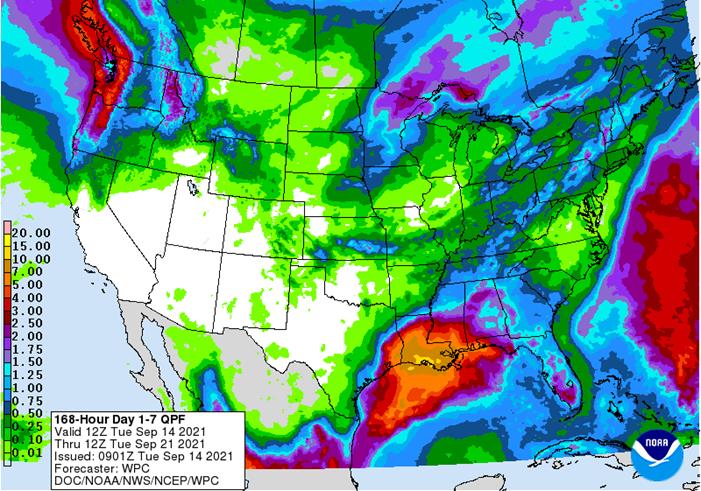

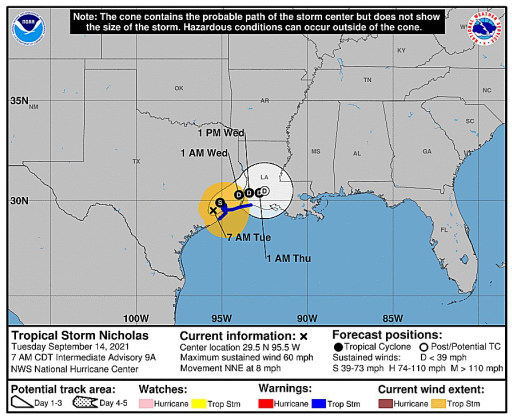

Tropical

Storm Nicholas has produced heavy rain and strong wind along the middle and upper Texas coast and some heavy rain in southwestern Louisiana

o

Wind speeds of 30 to 60 mph were noted in many Texas coastal areas Monday and overnight with peak wind speeds officially reported reaching 66 mph near Galveston

o

Rainfall through dawn today varied up to 7.00 inches along the upper Texas coast with 3.00 to 6.00 inches common

o

Very little rain or adverse weather impacted crop areas in Texas or Louisiana so far

-

Tropical

Storm Nicholas will produce excessive rain across southern Louisiana over the next few days resulting in some flooding

o

Flooding is also expected along the upper Texas coast

o

Additional rainfall of 4.00 to 10.00 inches will result in these areas with local totals to 13.00 inches in southern Louisiana

o

Sugarcane is vulnerable to a fall in sucrose because of the wet weather at harvest time

o

Early season harvesting will be delayed because of this rain event as well with fieldwork beginning in October rather than late September because of this excessive rain event

-

U.S.

Midwest weather will be favorably mixed over the next ten days supporting late season summer crops finish out favorably and allowing some harvest progress to advance on the drier days -

West

Texas weather will be mostly good for the next ten days with only a few showers expected later this week

o

Temperatures will be warm enough to promote quick crop development

-

U.S.

southeastern states will experience a good mix of weather

o

Rainfall may be a little more abundant than desired, but no serious impact is expected other than slowing crop maturity and some fieldwork

-

U.S.

Great Plains weather will be mostly favorable for summer crop maturation, harvesting and some winter crop planting; however, rain is needed in the northwestern Plains and in many other winter wheat production areas to adequately prepare the soil for planting,

germination and emergence -

Frost

and freezes coming up later this week and early next week in the Canadian Prairies will have no negative impact on summer crops because of their faster than usual maturation this year -

Frost

and freezes will also impact a part of the northern U.S. Plains early next week and that, too, should have a low impact on crops because of their advanced state this year -

Another

bout of rain is expected in the U.S. Pacific Northwest this weekend, but the moisture will be mostly confined to the Cascade Mountains and the northern Rocky Mountains with very little moisture in the Yakima, Snake or Columbia River Basins.

-

California

weather will continue mostly dry for the next ten days -

Most

of the southwestern U.S. monsoon rainfall has ended -

Canada’s

Prairies and the northwestern U.S. Plains will receive minimal amounts of rain in the next ten days

o

The exceptions will be in western Alberta and in a few Manitoba locations where some rain is expected

o

Good crop maturation and harvest weather is expected

o

Planting of winter crops will advance, too, although some areas are still too dry for quick germination and plant emergence

-

Rain

will also fall from South Dakota into Minnesota and southeastern North Dakota later this week and during the late weekend ahead the two cool fronts expected in the region -

Strong

wind speeds will impact a part of the U.S. Plains and Canada Prairies periodically over the next week to ten days as autumn weather systems come and go

-

Mexico

precipitation will continue greater than usual in some western and interior southern parts of the nation during the coming week and the precipitation may continue abundantly in central and southern areas next week -

Argentina

rainfall will continue lacking significance in the driest areas of the west and north for at least another ten days -

Southern

Brazil received significant rain Monday and early today

o

Waves of additional rain are expected in southern Brazil over the next ten days, but rain in center west and center south crop areas will be minimal for a while

o

Rain is still needed in all coffee, citrus and sugarcane production areas and it would be good for soybean and corn areas in center west and center south

-

The

earliest that these areas will get rain is in about ten days and confidence is very low -

South

Africa crop areas will continue to receive periodic rainfall near the coast and rain would be welcome in many winter wheat areas to support aggressive spring crop development -

Australia

rainfall will continue limited in Queensland, northern New South Wales and northern parts of Western Australia through the weekend stressing some reproductive crops that do not have much subsoil moisture

o

Queensland winter wheat and barley yields are likely to slip lower this year because of frost, freezes and dryness in unirrigated areas

o

The remainder of Australia’s winter crops are still poised to perform quite favorably

-

Tropical

Storm Chanthu will move away from China’s Shanghai and Hangzhou Bay ports today and Wednesday allowing shipping to resume -

Tropical

Storm Chanthu will impact western Japan and a part of far southern South Korea later this week and into the weekend as it moves off to the east northeast from near the Shanghai area of the East China Sea today -

Eastern

China crop areas will see a good mix of weather over the next two weeks

o

Recent drying was welcome, and more is needed to support summer crop maturation and harvest progress

-

India’s

monsoon will continue to last longer than usual

o

Another ten days of frequent rainfall will occur in the central and north parts of the nation raising some concern over the condition of early maturating crops

-

Cotton

in the open boll stage in the north needs to dry out for harvesting -

Too

much rain may harm its quality and could string some fiber out of open bolls

o

Southern India will continue dry biased for the next two weeks with rainfall well below average

o

Above normal rainfall in central and northern India will be good for some late season crops, but some drying will soon be needed

-

Interior

parts of mainland Southeast Asia will receive near to above normal precipitation over the next ten days resulting in an improvement in soil moisture and water supply which is needed for winter crops -

Philippines

rainfall will be greater than usual for a while and a new tropical cyclone could impact the nation next week -

Southwestern

Russia and parts of Ukraine will receive some needed rain this weekend into next week that will help improve soil moisture for winter wheat, rye and barley planting and emergence -

Northern

Russia will continue wet biased, but planting in those areas should be mostly complete -

Europe

weather Monday was very good for widespread fieldwork, although rain developed in Portugal and Spain

o

The moisture in the southwest will shift into France, northern Italy and parts of Germany over the next several days.

o

Temperatures will be warm biased

o

Eastern Europe will receive a more restricted precipitation pattern for a while and that will allow fieldwork to continue along with summer crop maturation

-

Rain

is needed to improve soil moisture for winter crops in the southeast -

North

Africa showers will be restricted over the next ten days, but some rain will fall -

West-central

Africa rain will continue to come and go favorably for coffee, sugarcane, rice, cocoa and other crops

o

Cotton production from the region has been better than last year in some areas especially Mali and Senegal

-

East-central

Africa coffee, cocoa and other crop development has advanced well due to timely rainfall that will continue lightly for a while -

A

tropical depression or tropical storm may evolve east of the Bahamas during the second half of this week that could evolve additionally while moving toward the North Carolina coast

o

The storm could impact North Carolina Thursday into Friday with some rain also occurring in Virginia

-

No

crop damaging rain, flooding or wind is expected

o

The tropical system should turn out to sea later this week and during the weekend

-

Today’s

Southern Oscillation Index was +9.17 and will rise over the next several days -

Ontario

and Quebec weather will continue favorably mixed over the next two weeks for late season farming activity and harvesting of summer crops -

New

Zealand will wetter than usual this week in North Island while more seasonable precipitation occurs farther to the south.

o

Next week will be wetter in western parts of South Island

Source:

World Weather Inc.

Tuesday,

Sept. 14:

- EU

weekly grain, oilseed import and export data - France

agricultural ministry crop production estimate - Ros

Agro capital markets day - Abares’

agricultural commodities — September quarter 2021

Wednesday,

Sept. 15:

- EIA

weekly U.S. ethanol inventories, production - FranceAgriMer

monthly grains report - Malaysia

Sept. 1-15 palm oil exports - Brazil’s

Unica releases cane crush and sugar output data (tentative)

Thursday,

Sept. 16:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Malaysia

Friday,

Sept. 17:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Macro

80

Counterparties Take $1169.28 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1087.108 Bln, 77 Bidders)

US

CPI (M/M) Aug: 0.3% (est 0.4%; prev 0.5%)

US

CPI Ex‐Food, Energy (M/M) Aug: 0.1% (est 0.3%; prev 0.3%)

US

CPI (Y/Y) Aug: 5.3% (est 5.3%; prev 5.4%)

US

CPI Ex‐Food, Energy (Y/Y) Aug: 4.0% (est 4.2%; prev 4.3%)

US

Real Avg Hourly Earnings (Y/Y) Aug: ‐0.9% (prev ‐1.2%)

US

Real Avg Weekly Earnings (Y/Y) Aug: ‐0.9% (prevR ‐0.9%; prev ‐0.7%)

Canadian

Manufacturing Sales (M/M) Jul: ‐1.5% (est ‐1.0%; prev 2.1%)

China

To Sell 7.38Mln Barrels Of Crude From Reserve September 24

·

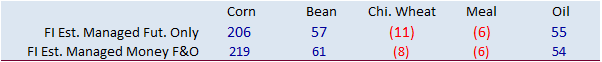

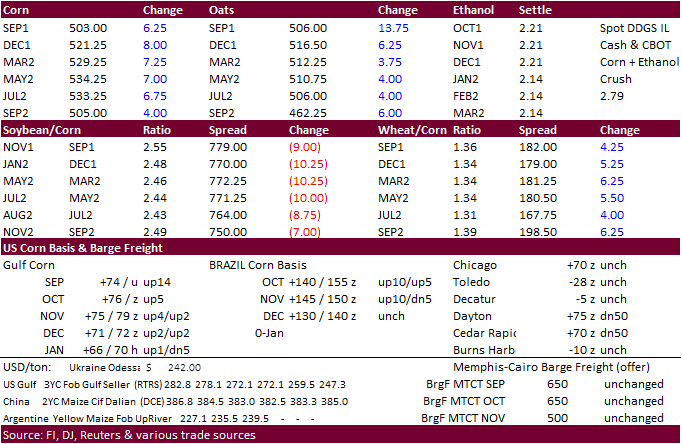

US corn futures ended 4.75-7.00 cents higher on technical buying and one point drop in US crop conditions to 58 percent. The rally in wheat, and corn/soybean spreading added to the upside movement. December ended back above

$5.20 at $5.2025/bu. Earlier this week both November soybeans and corn held above their 200-day MA’s.

·

Funds bought an estimated net 5,000 corn contracts.

·

US harvest progress could slow during the last half of this week from the tropical storm in the Gulf. 4 percent of the US corn crop had been harvested as of Sunday.

·

WTI crude oil traded in a wide two-sided range, ended mixed.

·

Argentina Buenos Aires grains exchange estimated the 2021-22 Argentina corn crop at 55 million tons, using a 7.1 million hectares area, up from 6.6 million hectares in 2020-21.

·

China corn futures hit a 12-mont low.

·

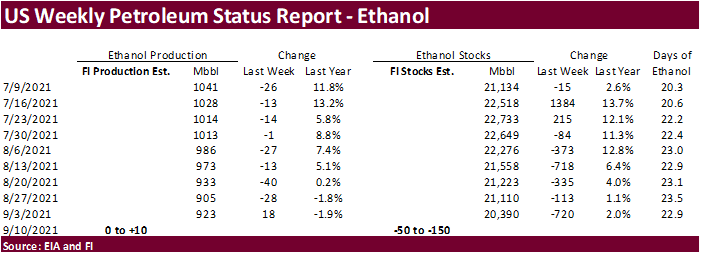

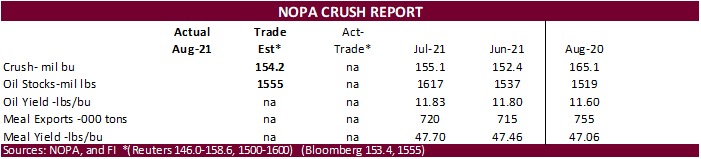

A Bloomberg poll looks for weekly US ethanol production to be up 3,000 barrels (905-950 range) from the previous week and stocks down 226,000 barrels to 20.164 million.

·

Bloomberg) — China’s national oil reserve center has announced the trading of 7.38m barrels of oil reserve on September 24, the National Food and Strategic Reserves Administration says in statement.

·

This week some of the filed reports are showing mixed yields for corn and soybeans, but most of the locations we read are above last year. One plot in central IL has poor stalk quality.

Export

developments.

·

None reported.

Updated

9/14/21

December

corn is seen in a $4.75-$5.75 range

(unch, down 25)

Soybeans

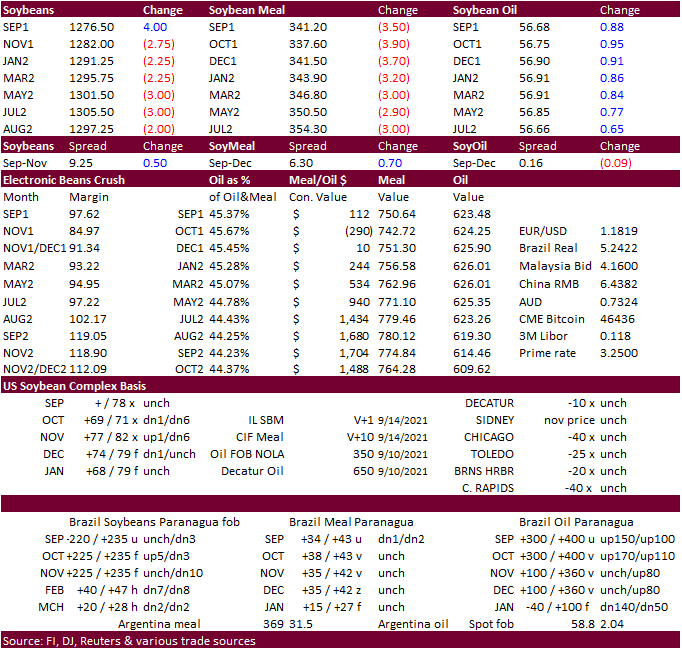

·

Soybeans opened higher on Chinese buying, a bullish Canadian canola production estimate, higher soybean oil, and strength in wheat and corn. But after fund buying dried, soybeans turned lower. The November contract ended 2.25

cents lower at $12.8250. US soybean conditions were unchanged last week at 57%. Soybean meal fell $2.50 to $3.50/short ton. December soybean oil rallied 196 points, ending 88 points higher. Other SBO contracts rallied 75 to 94 points. Note the 50% retracement

for December soybean oil is 59.51, looking back at low/high since early June.

·

Cargill noted their grain export terminal in Westwego, LA, restarted and barges began unloading on Monday.

·

Funds sold an estimated net 2,000 soybeans, sold 3,000 meal and bought 4,000 soybean oil.

·

There were reports that the $1.00 blender’s credit for biodiesel will remain in place for several years.

·

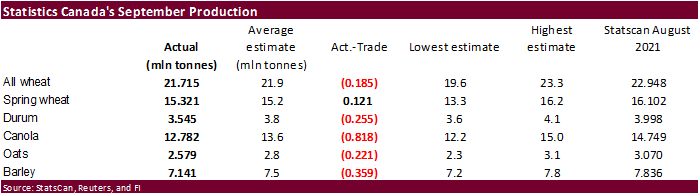

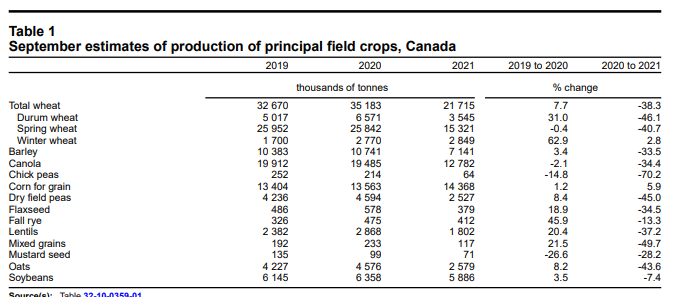

StatsCan reported the Canadian canola production at 12.782 million tons, 13% below their August survey and 34 percent below 2020. This rallied canola prices over $27/ton post report.

·

Argentina Buenos Aires grains exchange estimated the 2021-22 Argentina soybean crop at 44 million tons, from 43.1 million this year. The soybean area was estimated at 16.5 million hectares, down from the 16.9 million year earlier.

·

China was thought to have bought up 6-8 cargoes of soybeans from Brazil for October shipment and 2 off the PNW. Perhaps the USDA inspections report showing zero shipments out of the Gulf for two consecutive weeks caught their

eye. We heard they paid a hefty 425 over the November for the Brazilian soybeans.

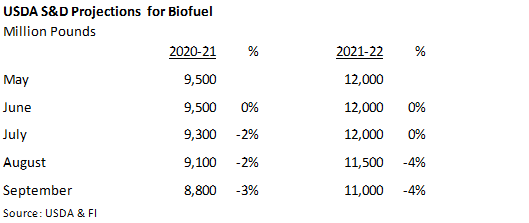

Soybean

oil for biodiesel oil use has fallen short of expectations so far in 2021, and USDA recognizes this.

Export

Developments

- Algeria’s

ONAB seeks up to 30,000 tons of soymeal on Wednesday, for shipment between Nov. 10-30 and Dec. 1-15.

Updated

9/14/21

Soybeans

– November $11.75-$13.75 range (unch, down 75)

Soybean

meal – December $310-$385 (down $10, down $10)

Soybean

oil – December 53-62 cent range

(down

100, down 300)

·

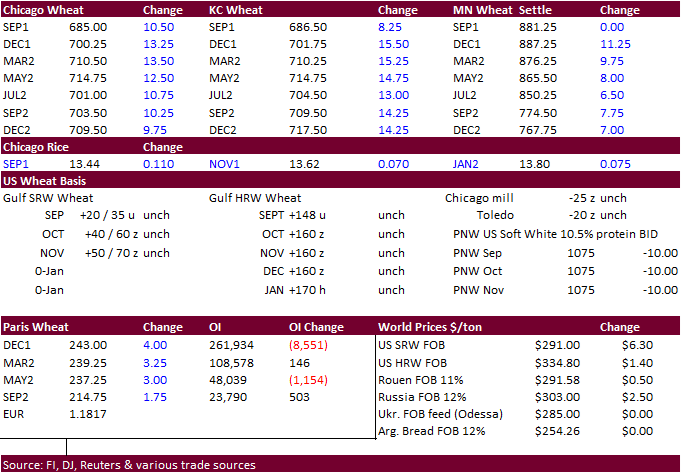

Wheat ended sharply higher led by KC type wheat from dry weather across the central Great Plains during early planting season. Downgrades for the Canadian and French wheat production estimates by each respected government supported

US and EU wheat futures in general.

·

Funds bought an estimated net 7,000 soft wheat contracts.

·

The drought in the Canadian Prairies during the late summer period was worse than what we expected, despite scattered rain events during August.

·

StatsCan reported the Canadian all-wheat production at 21.715 million tons, 5.4% below their August estimate and 38 percent below 2020. Spring wheat was 15.321 million tons, a 5% reduction from August and 41% below 2020. This

report incorporated satellite data.

·

Tropical storm Nicholas will dump more than 20 inches of rain as it reaches landfall in Texas. This is more of a wheat export problem, not as much for corn and soybeans.

·

Argentina Buenos Aires grains exchange estimated the Argentina wheat crop at 19.2 million tons, from 19 million tons previously.

·

Ukraine winter grain planting progress reached 5 percent complete on the expected 7.84 million hectares projected by the AgMin.

·

December Paris wheat was up 4.00 at 243.00 euros.

·

The USD was 33 points lower earlier this morning but by afternoon was moderately lower.

Export

Developments.

·

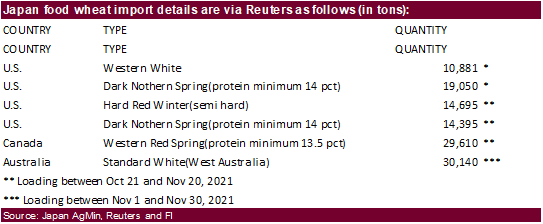

Japan seeks 118,771 tons of food wheat this week.

·

Turkey seeks 260,000 tons of feed barley on September 21 for October 8-October 31 shipment.

·

Jordan seeks 120,000 tons of wheat on September 15 for last half December through first half February shipment.

·

Japan’s Ministry in their regular SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival in Japan by Feb. 24, 2022, set to close on Sept. 15.

·

Bangladesh’s state grains buyer seeks another 50,000 tons of milling wheat on September 16.

·

Jordan seeks 120,000 tons of feed barley on September 16 for Dec/Jan/Feb shipment.

·

Pakistan issued a new import tender for 500,000 tons of wheat set to closed on September 20.

·

Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

·

Morocco seeks 363,000 tons of US wheat on September 21 for arrival by the end of the year.

Rice/Other

·

Bangladesh seeks 50,000 tons of rice on September 23.

Updated

9/9/21

December

Chicago wheat is seen in a $6.50‐$7.80 range

December

KC wheat is seen in a $6.40‐$8.00

December

MN wheat is seen in a $8.45‐$9.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.