PDF Attached

USDA

export sales will be out Thursday and includes data for the previous 4 weeks. NOPA crush will be out at 11 am CT.

USDA:

-Data

for weeks ending on August 18 and August 25 will be combined and released under week ending August 25;

-Data

for weeks ending on September 1 and September 8 will be listed individually;

-Links

will be provided to the August 25 and September 1 reports. The ESR homepage will default to the current September 8 release.

Weekly

Highlights text will be included only for the weeks ending periods September 1 and September 8.

Soybeans

traded sharply lower along with soybean oil. Soybean meal ended mixed. Corn was lower (bear spreading). Wheat was higher from a lower USD and technical buying by the investment funds.

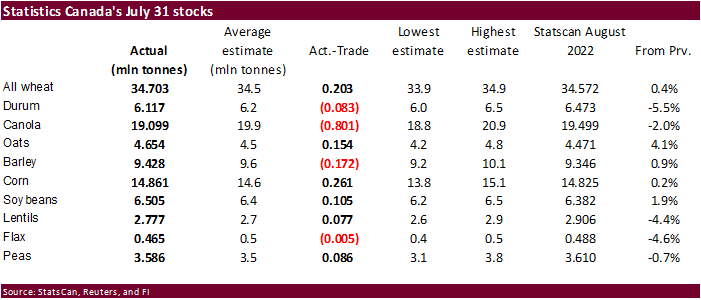

Statistics

Canada crop production was released, and largest surprise was canola coming in 800,000 tons below expectations. Durum production fell 5.5% from StatsCan August estimate. Soybeans and corn were reported above expectations. The production numbers are model based

driven. https://www150.statcan.gc.ca/n1/daily-quotidien/220914/dq220914b-eng.htm

US

rail strike concerns continue. Some large unions were still holding out while others were making progress with negotiations. Grain shipments slowed as early as today. We hear some rail movement was suspended in the south, an area where poultry producers depend

on daily shipments. Reuters noted railroads originate 24% of U.S. grain shipments, of which approximately half (691,000 carloads) is corn. Long distance passenger carrier Amtrak said it will cancel all long-distance trains routes on Wednesday. Here in the

Chicago area, several passenger UP trains were suspended, forcing tens of thousands of passengers to seek alternative routes to work.

Some

weather models this morning reduced precipitation for the US hard red winter wheat areas and the western Corn Belt for next week. The US lower Midwest, Delta and southeastern states will continue to dry out next ten days. The southern Plains will see restricted

precipitation for a while.

![]()

World

Weather, INC.

WEATHER

EVENTS AND FEATURES TO WATCH

-

Typhoon

Muifa was located 167 miles south southeast of Shanghai, China at 0900 GMT today moving north northwesterly at 9 mph and producing maximum sustained wind speeds near 98 mph -

Tropical

storm force wind was occurring out 120 miles from the storm while typhoon force wind was occurring out 30 miles -

A

steady weakening trend is expected with landfall likely over Shanghai around 1800 GMT today -

Wind

speeds at the time of landfall will vary between 75 and 95 mph -

Port

closures should have already occurred, and they may not open again until Thursday, but damage to the ports and infrastructure is not expected to be very serious -

The

storm will produce strong wind speeds and heavy rain along the coast in Jiangsu and eastern Shandong over the next few days with some flood damage expected to personal property and a few minor crop areas -

Muifa

is not likely to have a huge impact on agriculture -

Tropical

Storm Nanmadol is much farther to the southeast of Muifa in the western Pacific Ocean, but it will track toward Kyushu, Japan over the balance of this week. The storm may bring heavy rain and strong wind speeds to Kyushu and the northernmost Ryukyu Islands

of Japan this weekend and next Monday. -

A

tropical depression may evolve in the Atlantic Ocean southeast of the Leeward Islands over the next couple of days -

The

system may not survive passing over the Greater Antilles late this week and into the weekend, but it could bring some heavy rain to Puerto Rico, Hispaniola and the Lesser Antilles -

European

model has increased rainfall in parts of center west and center south Brazil overnight further raising the potential for some increase in topsoil moisture for Mato Grosso and possibly in a few Minas Gerais locations -

World

Weather, Inc. does not believe rainfall will be great enough in Sul de Minas, Cerrado Mineiro or Zona de Mata to induce coffee flowering of significance – at least not yet – but a pocket or two of flowering may be possible -

Greater

rain in Parana and southwestern Sao Paulo will support previously flowered coffee and developing sugarcane

-

Argentina

is still advertised to receive restricted rainfall during the next ten days, but some rain is still possible for a little while late this weekend into early next week -

Greater

rain will still be needed to induce a serious change in winter crop development, but any moisture will be welcome.

-

Lower

U.S. Midwest, Delta and southeastern states will experience little to no rain over the coming week and possibly the next ten days -

Good

summer crop maturation and harvest conditions will result -

Rain

was removed from the U.S. hard red winter wheat outlook overnight -

Both

the GFS and ECMWF models are reducing rainfall advertised for next week and this change was needed and should verify well -

A

tropical cyclone evolving off the southwest coast of Mexico is predicted to move more to the west than north reducing the risk of bringing moisture into the southwestern U.S. and eventually into the central and southwestern U.S. Plains next week -

Northern

U.S. Plains weather is expected to be mixed with a few showers and some periods of sunshine during the next two weeks -

Eastern

Canada’s Prairies will get some rain today and Thursday and then drier weather will follow for a couple of days before a few more showers evolve ahead of cooler air -

Western

U.S. Corn Belt crop areas will get some rain Thursday into the weekend followed by some drier weather -

No

significant drought relief is expected in California or the U.S. Pacific Northwest through the next two weeks -

Significant

frost and freezes will be possible next week in parts of Canada’s Prairies -

Drought

continues in China’s central Yangtze River Basin where more damage continues to unirrigated rice and other crops -

No

change is expected for the next ten days -

Recent

drying in North China Plain and interior northeastern China has been ideal in speeding along summer crop maturation and supporting some early season harvesting -

Central

and eastern Heilongjiang, southeastern Jilin and southeastern Liaoning are still rated too wet on, but should be drying down

-

Moisture

from Typhoon Muifa could re-saturate the ground with moisture again possibly leading to some flooding and fieldwork delay late this week into the weekend -

China’s

weather will change little over the next ten days; however, Typhoon Muifa will move along the central China coast today into Friday producing some very heavy rain and strong wind speeds from northeastern Zhejiang to eastern Shandong -

Most

interior areas of eastern China and a large part of the northeastern provinces will continue to dry out over this forecast period.

-

Drought

conditions will prevail in the heart of the Yangtze River Basin -

Beneficial

drying will continue in portions of the Northeast Provinces as well as western parts of the North China Plain, although remnant moisture from Muifa will impact parts of Liaoning and southern Jilin late this week and into the weekend -

Typhoon

Muifa will induce flooding rainfall from northeastern Zhejiang to Shandong today and Thursday and from eastern Shandong to southeastern Heilongjiang Friday into the weekend

-

Rain

totals will vary from 3.00 to more than 8.00 inches above that which has already occurred -

China’s

weather bottom line will be good for the start of winter wheat planting in the Yellow River Basin and North China Plain and for the maturation and early harvest of summer crops in interior parts of the northeast. Flooding rain could impact a part of the central

east coast as Typhoon Muifa impacts those areas into Friday. Not much crop damage is expected because of the tropical cyclone, but some port closures are possible in the Shanghai area today into early Thursday. Heavy rain in southern Liaoning to southeastern

Heilongjiang will delay farming activity. -

Xinjiang,

China weather is expected to be mild to warm with rain mostly impacting the far northeast periodically -

This

pattern will be very good for cotton and corn maturation as well as early harvesting in most areas, but there will be some disruption due to the showers in the far northeast

-

India

will continue plenty wet across the central and eastern parts of the nation during the next ten days -

Some

Local flooding is possible especially in parts of Gujarat, northern Maharashtra and Madhya Pradesh as well as areas from northern Chhattisgarh to Bangladesh, West Bengal and northeastern Odisha

-

Net

drying will occur in the far northern and southernmost parts of the nation, despite some light showers -

Temperatures

will continue quite warm to hot in northwestern India and Pakistan -

Pakistan

has benefited from drier weather recently and it should remain mostly dry for the next ten days along with neighboring areas of far northwestern India -

Improved

cotton, rice and sugarcane conditions are expected, but production losses in Sindh because of late August flooding will not be reversible in many areas -

CIS

weather over the next ten days will spread rain from western Russia, Belarus and Ukraine into the remainder of Russia west of the Ural Mountains

-

Some

rain totals will vary from 0.50 to 1.50 inches in Russia’s Southern Region -

Sufficient

rain will fall to improve winter wheat and rye emergence and establishment -

Some

delay to summer crop maturation and harvest progress is expected as a result of the predicted rain.

-

Europe

rainfall Tuesday was scattered from Spain and Portugal into France where moisture totals varied from 0.05 to 0.60 inch with a few amounts over 1.00 inch -

Northern

Portugal and northeastern Spain were wettest -

Europe

rainfall will be greatest later this week through mid-week next week from Germany, Belgium and northeastern France to Ukraine, northern Romania, southern Belarus and parts of western Russia

-

Rainfall

will vary from 0.75 to 2.5 inches ensuring sufficient moisture for long term winter crop emergence and establishment -

There

is potential for 2.50 to more than 5.00 inches of rain in the western Balkan region, southwestern Ukraine and in a few northeastern Romania locations -

Rainfall

elsewhere will be more limited and net drying may occur more often than not -

Europe’s

bottom line looks good for improving soil moisture and long term winter crop emergence and establishment from northeastern France and Germany into Ukraine and far western Russia. Locally heavy rain in from Albania to northeastern Italy and Croatia could lead

to a little flooding and a minor amount of crop damage. In contrast, more rain will be needed in France, the United Kingdom and northern Germany as well as in the lower Danube River Basin where relief to dryness will only be partial.

-

Australia

is still expected to see periodic bouts of rain over the next two weeks -

Rainfall

may be a little too great in portions of Victoria and New South Wales, but no imminent problems are expected -

Australia’s

bottom line still looks very good for winter wheat, barley and canola development. As long as the crop region warms up a little more in coming weeks and rain frequency does not get excessive, this year’s production will be huge. There is some concern about

a wet bias in October and November that could harm the quality of some crops.

-

Argentina

rainfall is expected to erratic over the next ten days maintaining concern over early season crop planting prospects later this month and next -

Dryness

will also be a concern for the nation’s wheat crop – especially in the west -

Some

showers are expected Sunday into Monday, but they are not likely to be great enough for a lasting boost in soil moisture -

Southern

Brazil is expecting waves of rain during the next ten days which should translate into ongoing good wheat development in the far south, but drier weather may eventually be needed in wheat areas of Parana to protect grain quality -

Showers

advertised near and beyond mid-month in center west Brazil should be welcome -

The

middle to latter part of next week should be wettest and some early soybean planting should follow -

Brazil

coffee, citrus and sugarcane areas may get some rain periodically over the next ten days, but resulting rainfall is expected to be a little sporadic and light initially -

Ontario

and Quebec, Canada weather remains mostly good for corn and soybeans with little change likely -

Alternating

periods of rain and sunshine will continue along with seasonable temperatures -

the

environment will be good for late season crop development, maturation and early season harvesting -

South

Africa precipitation is expected to be limited over the next ten days -

Winter

crops are still semi-dormant in some areas and beginning to green up and resume development in other areas -

Showers

will be infrequent and light in the central and north while temperatures are warm which will stimulate some additional development -

Rain

will fall more significantly in Eastern and Western Cape and Natal this weekend into early next week -

Winter

crops are still poised to perform well this spring as long as timely rain evolves late this month and in October.

-

Central

America, Colombia and parts of Venezuela are expected to trend wetter than usual in the next few weeks due to the persistent La Nina influence on the region -

North

Africa showers at this time of year are always welcome, but have a minimal impact and that will be the case over the next ten days -

Mexico’s

drought in the northeast continues and will not likely end without the help from a tropical cyclone -

With

that said some significant rain has fallen over the past two weeks in portions of the dry region -

This

coming week’s rainfall will be trending lighter than usual once again -

Southern

and western Mexico will get some rain periodically through the next couple of weeks with sufficient amounts to maintain moisture abundance -

Southeast

Asia rainfall is expected to be frequent and significant during the next ten days to two weeks

-

All

areas are expected to be impacted and sufficient rain is expected to bolster soil moisture for long term crop development need

-

Local

flooding is expected -

West-Central

Africa showers and thunderstorms will continue frequently benefiting coffee and cocoa production areas during the next two weeks.

-

Some

rice, cotton and sugarcane will also benefit from this pattern -

Weekend

precipitation was minimal, but it will be increasing later this week and next week -

East-central

Africa rainfall will continue to occur most frequent and significantly in Ethiopia, Uganda and southwestern Kenya over the next two weeks -

Good

coffee, cocoa and other crop development conditions will prevail -

Today’s

Southern Oscillation Index was +10.09 and it will move erratically over the next few days.

Source:

World Weather INC

Bloomberg

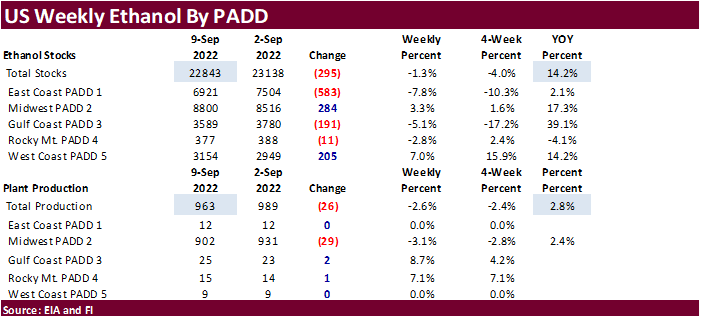

Ag Calendar

- EIA

weekly US ethanol inventories, production, 10:30am - France

AgriMer monthly grains outlook

Thursday,

Sept. 15:

- UkrAgroConsult’s

Agro&Food Security Forum, Warsaw - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Malaysia’s

Sept. 1-15 palm oil export data

Friday,

Sept. 16:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

Malaysia

99

Counterparties Take $2.226 Tln At Fed Reverse Repo Op (prev $2.203 Tln, 99 Bids)

US

PPI (M/M) Aug: -0.1% (est -0.1%; prev -0.5%)

US

Core PPI (M/M) Aug: 0.4% (est 0.3%; prev 0.2%)

US

PPI (Y/Y) Aug: 8.7% (est 8.8%; prev 9.8%)

US

Core PPI (Y/Y) Aug: 7.3% (est 7.0%; prev 7.6%)

Canadian

Manufacturing Sales (M/M) Jul: -0.9% (est -0.9%; prevR -0.1%)

US

DoE Crude Oil Inventories (W/W) 09-Sep: +2.442M (est +1.850M; prev +8.845M)

–

Distillate: +4.219M (est 0K; prev +95K)

–

Cushing: -135K (prev -501K)

–

Gasoline: -1.768M (est -1.600M; prev +333K)

–

Refinery: +0.60% (est -0.40%; prev -1.80%)

·

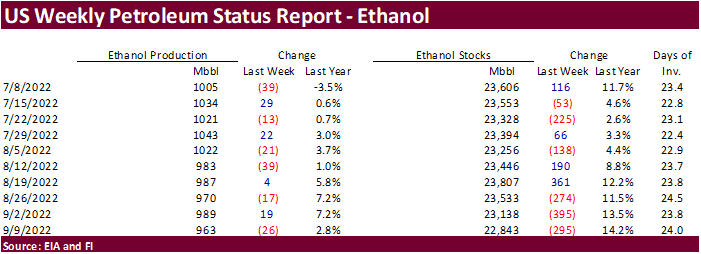

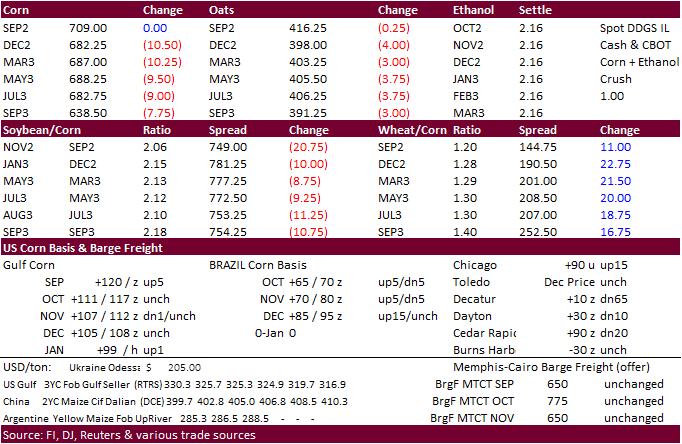

CBOT corn closed lower (bear spreading) on US economic concerns , commercial selling (after they bought Monday) and technical selling. A more than expected slowdown in US ethanol production was negative. Ethanol production could

continue to drop if plants run into problems with the potential rail strike (corn deliveries and ethanol transportation).

·

Funds sold an estimated net 9,000 corn contracts.

·

Agritel sees the Ukraine 2022 corn crop at 30.24 million tons, down nearly 12 million tons from the record set in 2021. Plantings were down to 4.28 million tons from 5.5 million.

·

The Baltic Dry index increased 13.3% to 1,595 points, after increasing 12.1 percent day before.

·

China plans to sell 15,000 tons of pork from reserves on September 17.

·

The USDA Broiler Report showed eggs set in the US up 5 percent and chicks placed up 5 percent. Cumulative placements from the week ending January 8, 2022 through September 10, 2022 for the United States were 6.78 billion. Cumulative

placements were up 1 percent from the same period a year earlier.

US

DoE Crude Oil Inventories (W/W) 09-Sep: +2.442M (est +1.850M; prev +8.845M)

–

Distillate: +4.219M (est 0K; prev +95K)

–

Cushing: -135K (prev -501K)

–

Gasoline: -1.768M (est -1.600M; prev +333K)

–

Refinery: +0.60% (est -0.40%; prev -1.80%)

Updated

9/7/22

December

corn is seen in a $6.00-$7.25 range.